Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

The deed is done for all holders. DTC should have been swept off the brokerages, with the associated consideration paid out.

Overall, a weak and disappointing outcome for anyone that didn't gamble near the absolute bottom.

Looks like the acquisition of $DTC by Ideagen is progressing, with the market assuming the deal with likely complete based on today's announcement that the Deed has been signed.

At an acquisition price of $0.24 this deal looks very different depending on your perspective.

I held $DTC from July 2020 until June 2021, losing about half my capital when I concluded it was a cash incinerator that appeared unlikely to build a sustainable business. (Lots of historical threads on here). I got out at $0.87, and consider I dodged a bullet.

Of course, some clever (or lucky or both) souls bought shares earlier in 2023 at $0.065. Those who held are laughing all the way to the bank with a 3-bagger in less than a year. Good on ya.

Well, well, well...Mitratech has walked away after a couple of weeks due diligence (which is not a great sign).

Management is now entertaining a second bid that was received, at a lower price of 27c, from Ideagen. Given the precedent set by Mitratech, any prospects of a deal being consummated here have taken a blow. The market certainly doesn't seem to have any confidence in it, and got it right with the large spread between the market price and the now unsuccessful bid lobbed by Mitratech.

A long time coming this - the company apparently was approached by several parties with initial, conditional, non-binding and indicative offers.

It decided to grant exclusive DD to one of them - US-based Mitratech holdings. The offer is for 30c, and preferred settlement is via scheme of arrangement.

Shares are up big as expected, though there is a still a considerable gap to the offer price. For long-suffering holders, this may not be the worst exit - hopefully we get a bidding war with a much better final price, as we saw with IntelliHR (I sold on the first bid and left over 100% on the table with that one!).

Generally, it looks like Christian is finally willing to vend the company.

Nice news today as @mikebrisy pointed out. Of course there will be a jump as news like this comes in however I cant stress enough "patience is key". I'm seeing a lot of movement in the market from beaten up stocks as they pre-empting results. Of cousre you could play these as that what the market is, "market sentiment". In technical analysis there are set regions price should target. However if these arent alway met if the market is very bullish or bearish at the time. Right now Im feeling the market has been so uncertain and negative that if a direction is seen by the wider community then there thirst for good news causes them to jump in. FOMO. I dont worry about FOMO as there are always opportunities to be had. It was a nice push up today on DTC however Im still waiting for my targets. Ill update the chart for you all when I see opportunities. Anotherwords, todays move is not a high probability opportunity for myself.

$DTC annoucemed their 4C report this mornings.

Their Highlights

Cash Highlights

• Free cash flow $0.51 m vs pcp negative ($1.6m);

• Operating cashflow of $3m vs up 131% on pcp basis of $1.3m;

• 5th consecutive quarter of positive operating cashflow.

Financial Highlights

• Quarterly Revenue of $7.4m, same as prior quarter;

• EBITDA of $2.72 m, up 145% on pcp basis of $1.1m;

• EBITDA Margin of 37%, up 164% of pcp basis of 14%;

• Q4 Gross Margin 79%;

• Client churn 1.8%;

• Refinanced existing debt facilities, providing investor certainty

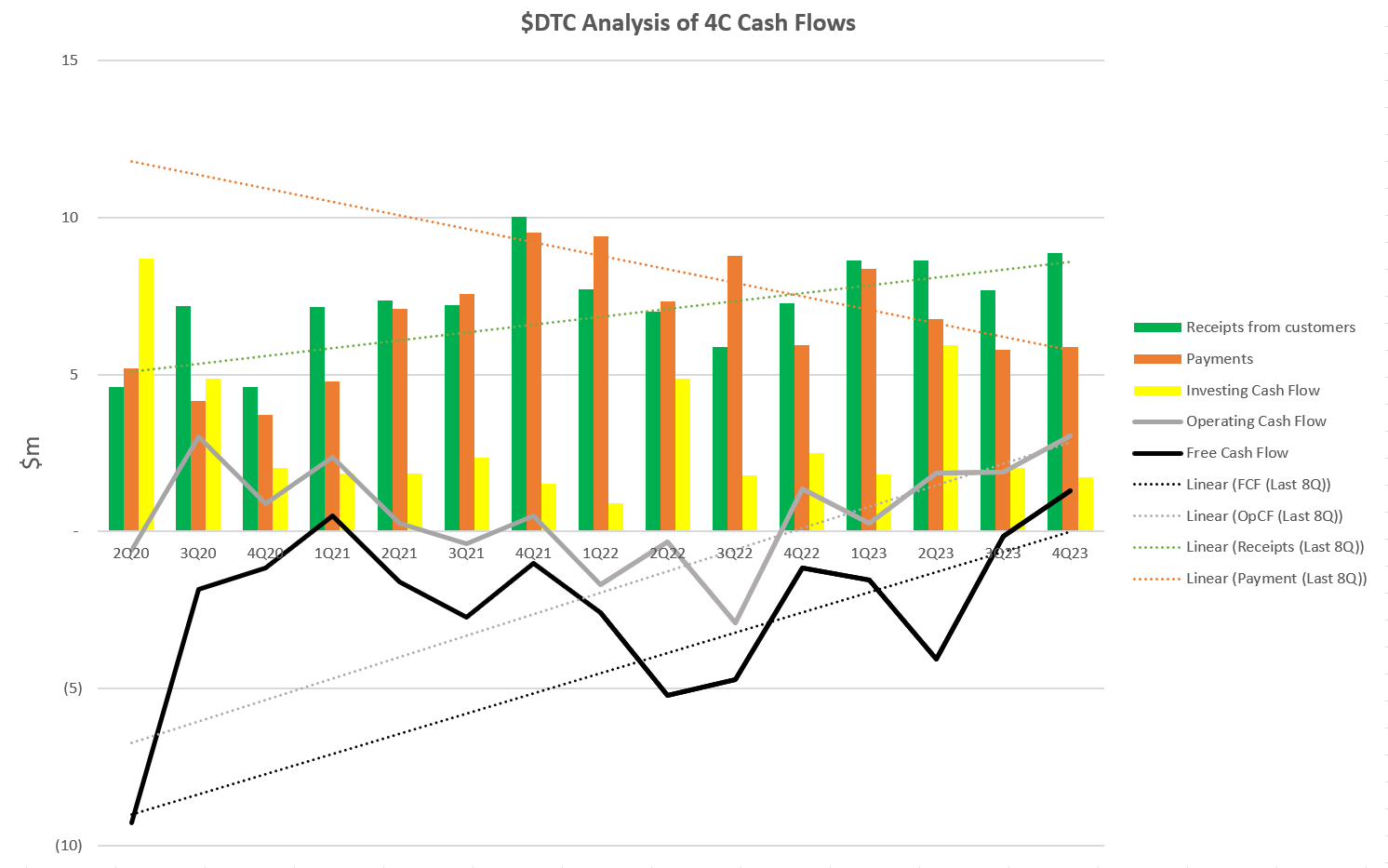

CF Trend Analysis

Below is my standard CF trend analysis. Note that the trendlines are plotted for the last 8Q only.

This is another former cash burner which has now successfully tackled costs to generate consistent positive Operating CF. However, the expense has been a slowing revenue growth.

My Key Takeways

$DTC appears to have succeeded in using the imperative of the changing market environment to turn from a cash burner to a cash generator. Certainly, on an operating cashflow basis, this is looking sustainable, with the 5th consecutive quarter of positive OpCF.

Topline growth is still there, looking at the 8Q trend, albeit slower than historically, and it remains to be seen what the continuing growth trajectory looks like.

Positively, churn was low, and a historical large churn event (which management excluded from their churn reporting to my irritation) is now outside the window, and so once again reported churn is a clean result.

I've historically criticised $DTC from being insufficiently focused "too many modules, too many verticals". That too seems to be improving with a reported focus on mining and civil construction.

On valuation, $DTC is on a modest 1.2 EV/EBITDA. Recently SP has been knocked down as it began to take on debt to see it through the "transformation" without having to raise cash.

If the market believes that the reported strong prospects ahead of it will convert into contracts, we could see $DTC re-rate quite quickly, now that it truly is at the inflection point.

I'm more sceptical, and want to see continued movement on the top line, while costs and investment levels are contained. I've no doubt I'll miss some of the re-rate, but Im not a trader and the long term thesis sin't yet restored.

All credit to management - they've done what I criticised them for not doing before - getting the firm to proftable growth.

Disc: Not held in RL and SM (formerly held)

Damstra was also one I talked about 5 days ago. It has moved up nicely too completing its larger degree wave 1 up now looking for the bottom of wave 2 down before starting the strongest wave 3 of 5 up. This is the wave that I usually like to work on as its the longest wave and the strongest. (dont forget things can break though)

Good on the management @ Damstra. This could be a great turn around storey for this company. I still hold my position which is 90% down (oh well). I believed they have a good product just poorly rum (couple drinks last night) on the expense side. They have leaned the costs right back to cash flow pos and today just expanded 2 x contracts considerably. I will be playing this one on the way back up. Im a technical chart analyst so I will let you all know when Im jumping in and out as I go. (do as you please, im not your mum :) ).

Latest 4C from DTC:

First up, you have to congratulate them for the clarity of their reporting style and refreshing honesty. The metrics they had flagged in the last 4c have been diligently reported on again, no cherry picking. Though they have chosen to exclude the Newmont fail from their revenue, so maybe not that brilliant!

The good news is that they have definitely had a lot of success in reducing the cash burn: both from pcp and previous quarter to 570k. The EBTIDA margin has improved significantly to 19%. They have $8.1m in cash and predict FCF +ve in 2H FY23 if revenue targets are met.

They have increased prices to multiple customers without an increase in churn, and are looking at expanding this to the majority of their client base.

But.... they are still free cash flow -ve. There are no guarantees that revenue targets will be met and then they are looking at having to do another raise which will be highly destructive to existing shareholders.

Additionally, NRR is not brilliant at 103%. For a SaaS company to be really profitable they need to be upselling modules to existing customers consistently and have a NRR at least 10% points higher.

They have a shot at doing what they say they are going to do as the new Barrick contract looks like it could become a good earner, and old contracts roll onto a new pricing model, but it is not without significant risk.

Not Held, lost a lot on them already!

some positive news

Update on new customer wins and material contracts

• New contract wins with UGL Engineering, CBRE Group and Gamuda Australia

• Barrick Gold implementation has commenced with first payment of USD$278,000 processed

• North East Link Project commenced with additional A$655,000 implementation order placed

Damstra Holdings Limited (ASX:DTC) (Damstra or the Company), an Australian-based global provider of integrated workplace management solutions, is pleased to provide an update on a number of new customer wins and existing material contracts.

New contract wins

CBRE Group

Damstra has signed a global two year agreement with CBRE1, one of the world’s largest commercial real estate services and investment firms, to provide its EPP integrated work order and permit to work modules for one of CBRE’s global clients, Macquarie Group (ASX:MQG), across its ~110 offices in 30 countries. The solution for CBRE covers all third-party suppliers entering Macquarie Group locations and has been developed by combining the TIKS permit to work modules with Damstra’s EPP functionality, demonstrating the material cross-sell capability of both platforms. In securing this agreement we have displaced an international competitor.

The estimated annual revenue is A$350,000, implementation has now commenced. Discussions have also commenced with the client on program management and implementation of the offering which would be incremental professional services if provided.

UGL Engineering

Damstra has secured UGL Engineering as a new client, with a two-year agreement for A$150,000 to provide the EPP product suite for the Hunter Power Project for Snowy Hydro. The contract deepens Damstra’s existing relationship with CIMIC Group, the parent company of UGL and key Damstra construction client CPB Contractors.

Gamuda Australia

Damstra has been selected to provide its services to Gamuda Australia, as part of its consortium with Laing O’Rourke to complete stage one of the NSW Government’s A$2.16 billion Western Tunnelling Package (WTP) on the Sydney Metro West project, a new underground railway connecting Greater Parramatta and the Sydney CBD. Damstra has received payment of A$588,000 for the project implementation, future revenues are still to be determined.

1 Term is 24 months from date of execution. The schedule will be reviewed in 12 months (Jun 2023) to identify further opportunities to extend the service or review the existing commercial model. CBRE has the right to terminate schedule and the associated services at any time with 60 days’ notice to Damstra.

Update on material contracts

Barrick Gold

Following the master services agreement signed with Barrick Gold earlier this month 2 , Damstra has commenced implementation with Barrick at three mine sites in North America, Dominican Republic, and Republic of Congo. Damstra has now processed USD$278,000 of the USD$1.2m contract value. USD$158,400 has been received by Damstra and the remaining USD$120,000 will be received mid-June.

North East Link Project

Damstra advises that revenue from the North East Link Project, Victoria’s largest road project, has now commenced with first contractor inductions commenced from late April and ~500 staff and contractors across 15 companies having registered to date. Damstra is contracted to provide mobilisation systems via its EPP to approximately 15,000 users on the project, utilising the workforce management, Damstra Learning and digital forms modules. The project is expected to fully ramp up in Q2 FY23.

The North East Link consortium has confirmed the first stage of implementation services and associated 4G services and Hi-gain communications, with an initial purchase order for A$655,000 now placed. This is in addition to the A$4.9 million of expected revenue over six years (average A$816,000 p.a.) as previously disclosed3.

Damstra Chief Executive Officer, Christian Damstra, said:

“We are extremely pleased to announce a number of new client wins, we have signed UGL, Gamuda Australia and CBRE as new clients, with the global CBRE deployment providing us with a platform to expand our relationship over time. We are also pleased to have kicked off our engagements with Barrick Gold and the North East Link project, which has now commenced and will become our single largest construction project.”

Relatively good update this morning from Damstra. Revenue guidance was at least reaffirmed and not downgraded again...

They have guided for $30-34m revenue, so if we take a middle figure of $32m then top line growth is still around 20% compared to FY21.

They currently trade on a P/S of less than 3x. So if the market becomes a bit more generous and gives them a P/S of around 4x provided there are no more downgrades then that gives them a valuation of around $0.50.

Disc: Held IRL and on Strawman

Could the DTC management be any more hopeless.

Three downgrades in a row and now a cap raise at 15% discount to all time low sp.

I am a long term holder and can put up with a fair bit of volitity but this is too much even for me.

I'd sell right now but we are in a trading halt.

Updated 5yr DCF at 10% growth with 10% discount. Assume additional 10% dilution of shares on issue, from185m to 204m. Notes to self: DTC has history of 20%+ growth, but management decisions have weakened the thesis. RegTech = picks and shovels. SaaS = high margin tech company (withe some hardware sales) Patience required = down but not out. wait for the quarterly's. Management on watch. Looking for reasons to hold and not sell.

Given the price action of the past month I needed to update my valuation. My conclusion is that the price drop has gone way too far with a downside valuation of $0.76 updating my base case valuation of $2.70 done in March.

Compared to previous valuations this is a Bear view, but others may see it as a low-end Base view (take it as you like and DYOR). While I concerned with some recent updates, the optionality and scope of application of DTC’s product range across different industries and globally provides sufficient opportunity for this to remain a favorably asymmetric bet.

Significant adjustments made:

· Sales growth pulled back, sales by 2030 about half previous forecast

· Margins improved, creeping up 1% a year to reflect continued software and SAAS growth, this flowed into better EBITDA%

· Terminal value multiple dropped from 20 to 10 time EV/EBITDA is the most significant impact and reflects lower long term growth assumptions and higher risk.

Announcement: DAMSTRA SIGNS CONTRACT VARIATION WITH CPB CONTRACTORS

This just adds $550k pa (ARR +$550k) revenue to an existing customer (CPB Contractors, part of CIMIC) through to 2024...

Not sure why this is price sensitive info, adds 2% to revenue. Smells like desperation!

Disc: I own DTC (RL + SM)

Based on Lower end of guidance of $30m revenue given at the AGM. Large discount given my uncertainty/ confidence in business. Sadly held in RL and Strawman for moment.

100% sold out now. Why:

1) 2nd or it is 3rd consecutive guidance downgrade.

2) Management are poor capital allocators, as exemplified by the disastrous Vault Intelligence acquisition.

3) Software platform not as sticky as it seems, as exemplified by loss of key customer.

4) Failing to execute sales pipeline, as exemplified by "big deal" flagged to be landed by end of Q1 - We are still waiting.

Big fail on my part, I should of sold out at the previous downgrade - all the above issues were plain to see then.

Guidance downgrade in AGM today: ouch...

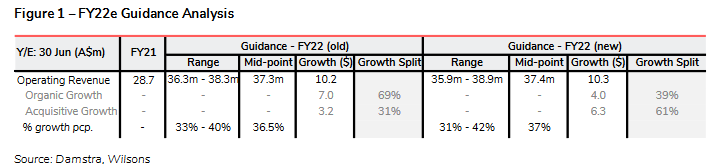

Wilsons HTM provided the following via a broker note email:

Damstra today reported a disappointing 1Q22 update, with ARR and guidance both challenging. ARR grew +$10.4m (+55%) vs. pcp but fell -$5.2m (-15%) vs. 4Q21 ARR of $34.5m. The fall was primarily attributed to the descoping of Damstra work by one of its biggest clients, Newmont (~$3m), and ongoing impacts from Covid-19 (~$2m). While the mid-point of the guidance range was basically unchanged, the mix is now skewed to acquisitive growth (previously: organic). These issues, coupled with ongoing ambiguity regarding expected large contract wins and achieving guidance arguably relying on those contract wins, see us downgrade Damstra to M/W, lower our FY22e revenue forecasts by -12% to below the low-end of guidance and reduce our target price by -58% to $0.75.

My opinion:

This is a 180 degree turn from Wilsons. All previous broker notes had DTC at >$1.50 TP. Be interesting to see if other brokers follow, as they are often all copy cats with very little independent thought! (hahaha jaded much?!)

Interesting observation that they assess it is now revenue by acquisition and not internal growth (table below), broadly a sign of an 'average' company, and not an 'above average' company. And average is fine. One can still see a reasonable outcome over twenty years of investing with an 'average company', but no monster she'll be.

I am not one to get cold feet easily. My thesis still has 3 years to run on DTC and given the macro environment, I am willing to wait longer to see what happens. Every company hits speed bumps and what we commonly forgot is it takes time to fix these things, aka 12 months minimum. I won't top up at the lows, but will maintain my current holdings.

Disc: Held in RL.

Disappointing result, impacted by the loss in revenue from Newmont. Key takeaways:

- Q1 churn 5.7%, due to Newmont ceasing, and in some cases cancelling roll out of Damstra platform. Newmont has advised they will no longer centrally manage mine sites, and allow individual mines to manage / implement their software applications.

- COVID impacting revenue, due to less site staff.

- 9 clients added - up 5% on previous quarter.

- Revenue of $6.3 million, up just 20% on PCP.

- ARR down from $35 M to $29.3 M due to loss of Newmont contracts.

- Still in the process of closing large customer deal - trial completed and undergoing negotiations.

DISC - I HOLD

Annual Results released, and interesting takeawys from earnings call:

1) Revenue for FY2021 of $27.4 M (excludes about $1.7 M of Vault revenue under contractual dispute).

2) Gross margin improvement to 79%, up form 69%.

3) ARR now $34.5M (vs $21.2 M pcp)

4) Churn is less than 1%, demonstrating how sticky Damstra's software / platform is.

5) 70 of 200 employees are engaged in R & D, including the development of the EPP (Enterprise Protection Platform), and AI driven protection development. Increasing US team to 30 people in FY2022, and seeking to grow team to 250-260 peoplei in FY 2022. Losts of development, including the development of intelligent workflows, digital forms (compliance streamlining).

6) 60% of revenue growth in FY2021 from new customers, 40% of revenue growth form existing customers.

7) EPP being sold as the equivalent to CRM and ERM platforms for workplace risk / safety, and this is getting broad acceptance in the US.

8) Pipeline: International miner (40 k employees) compelted tirals this month, with negotionns to commence in September, + 3 US gold miners, 1 diamond miner, 1 lage healthcare co, and 1 large Us construction co, initiating trials.

9) targeting free cashflow breakeven in FY2022.

10) Management report they don't like riasing cpaital & diluting shareholders, hence why they hav ethe $10 M debt facility in order to minimise / avoid further capital raisings.

11) Key learnings from FY2021. Damstra management have learnt they need to improve the visibility / deepening of their sales pipeline, and this is a key focus for FY2022.

DISC - I HOLD.

Here are the headlines from the release:

- Annualised Recurring Revenue (ARR) of $34.5 million, up 63% on the prior corresponding period (pcp)

- Strong revenue growth of 40% on pcp to $27.4 million1 , with 87% of this revenue being annually recurring

- Operating leverage drives continued gross margin expansion to 78.9% (FY20: 68.5%2 )

- Strong EBITDA result of $6.6 million, consistent with pcp following the acquisition of the previously loss-making Vault business

- EBITDA margin remains robust at 24.3%

- Cash receipts of $31.7 million, up 51% on pcp

- Key operating metrics:

- Users increased by 74% to 737k (FY20: 423k)

- Clients increased by 159% to 724 (FY20: 279)

- Churn remains minimal at ~1%

But here is some of what lies beneath:

- If you ignore government grants, operating cashflow was barely +$0.5m from receipts of $31.7m, which paints a slightly different picture from the GM expansion message and references to operating leverage

- In order to maintain a cash balance of c. $10m, borrowings of c. $10m have been taken on from the facility announced earlier

In Q&A from Chairman and CEO, there was quite a bit of discussion about the cash position and even a reference to seeing "positive free cash flow is the recent months".

I exited DTC earlier this year at a significant capital loss for two reasons:

- Strategy: I see the EPP strategy as too broad. Too many modules, too many verticals, too many countries. From my perspective the strategy lacks focus - a big red flag.

- Economics: with ARR of c$35m, I can't see how this is generating cash. I fully expect DTC will be back to the market for more cash or otherwise (given they said they won't do that) then we'll see a weakening balance sheet as they take on more debt.

Conclusion

- AVOID - I exited DTC based on concerns about cash burn and lack of a focused strategy

- Today's results reinforce my belief that the thesis is broken

- Removing from my watchlist today as there are too many high growth tech firms that have positive economics.

[Disc. Not Held in SM or IRL]

I contacted DTC regarding my favourite topic of SaaS metrics. I got this reply which I have posted for general info.

Some questions were answered, some were not, and there was a bit of extra info thrown in for free!

Dear Mr xxxxx

Thanks a lot for your enquiry and nice to meet a fellow shareholder!

In terms of LTV and CAC, we have actually previously struggled to understand how to communicate that. Our issue, and particularly in the workforce management product, is that we tend not to lose clients. Glencore, for example, was our first client in 2002 and is still with us today. So it is really hard to get a sensible number, as that will blow the percentages right out. To give you an idea:

- Sales team costs circa 28% of revenue currently (and this has been increasing, It was very low pre-listing);

- Our average contract with our Top clients is 3-5 years

- Client $ churn is less than 1%

- The top ones have all been clients for multiple renewals.

So, you can see how CAC would be really hard to get a sensible idea from.

FCF: we define as operating cash less capitalised software spend. That went slightly backwards this year at ($1.8m), which was a bit of an anomaly due to delayed receipts and higher spend in development. Last year, for example, it was $3m positive. I do aim to keep operating cash at 80% of EBITDA, and I do expect development costs to reduce as a percentage of revenue going forward, not that integration activities are winding down.

Hope this helps

Kind regards

??Chris Scholtz

Chief Financial Officer

Damstra has delivered a very strong Q4 (attached) and as Chagsy points out this is in contrast with a week H1 and ok Q3 which has seen the share price come off significantly. This has restored my faith in the company as I now expect it to exceed my FY21 forecast and underpin my current valuation of $2.70 which I will update once we get the annual report.

Q4 & FY Key Take Away:

· Revenue: $9.1m for Q4 (+32% QoQ, +75% PCP), giving a FY of $32m (+55% YoY) is exceptional, driven by User growth (7% QoQ, +76% YoY) and Client growth (+7% QoQ, +13% YoY if you exclude Vault acquisition, +122% if included).

· ARR: Now at $35m (+6% QoQ, +65% YoY) with 85% of revenue recuring which is down -2% YoY and down -7% QoQ, I expect the jump in total revenue in Q3 was in the Hardware and Implementation areas from new customers, so the %ARR will lift going forward as Licence fees come online. We will find out when the annual report is released.

· Gross Profit: 78.4% for Q4 (-7.1% QoQ but +7% PCP), as per ARR I think this is due to higher Hardware and Implementation revenue which is lower margin but necessary to tap into long term, high margin Licence fees. Full Year margin of 78.4% is up 10% from 68.4% last year, which validates the business model and high operating leverage it can achieve as it onboards customers and increases its proportion of Licence Fee ARR.

· EBITDA: $2.0m or 30% for Q4 is not a level I expected them to get to until 2024 and testament to the successful integration of Vault with $6.2m in synergies. It looks like full year EBITDA is going to be $5.7m or 17.9%, a hell of an improvement on FY20 $1.1m and 4.6%.

· Cash & FCF: Cash receipts of $10m are up 39% QoQ, Operating cash flow of +$513k is good but continued IP investment leaves FCF negative at -1,019k. They have drawn down 12m on the loan facility so have $9.8m cash on hand, but net cash is negative -$2.2m. The takeaway is they have a good cash run way to grow to positive FCF and are spending to grow and develop products such as Damstra Digital Forms and Damstra Solo products.

· Outlook: there is a pipeline of large UK and North American customer additions in the offering and a contract extension with the NBN (worth about $1m per year for 7 yrs). Also, several partner wins including achieved Partner status with Amazon Web Services (AWS).

Up 18% as I write this to 0.94 and now at my average buy price (RL) it seems the market liked the announcement as well. I had been a little concerned about how the business was going over the last 6 months, but my fears have been wiped away by this update and I look forward to continuing to hold DTC long term, seeing it break into the UK and US markets is the critical next step

DTC has just announced (can't attach for some reason!!!) the refinancing of it’s $20m 2 year facility with Westpac which was only announced in April with “Partners for Growth VI, L.P. (PFG), a well-known San Francisco Bay Area-headquartered specialist provider of growth funding solutions to technology companies”.

The first tranche will be to pay off the $3.7m currently drawn down from the Westpac facility at a fixed rate of 7.85% (3 yr) which is higher than the Westpac rate of 6.5% (2 yr). In addition PFG will get Warrants to buy shares at various exercise prices shown below. One set on the initial tranche draw down then next on a second and final tranche.

The Warrants have a weighted average exercise price of $1.22 with a 7 year duration which requires a 5.6% compound growth in share price from yesterdays closing price of $0.83 to be in the money. Not a particularly demanding hurdle, but the market likes it has given the first years required growth of 6% to the share price today…

Total dilution is less than 1% at 1,603,884 ordinary shares covered by the warrants on 186m shares currently on market.

The debt is more expensive, but longer in duration and probably better placed with PFG than Westpac in terms of having a debt provider that is aligned to a growth business, so pro’s and con’s leaves me neutral on this announcement with little to no change in my valuation of the company.

Warrants Issued: Expire 30/6/28

2 x 34,564 shares at $1.05

2 x 31,905 shares at $1.14

2 x 59,252 shares at $1.23

2 x 73736 shares at $1.32

I own and continue to hold DTC

Strong update today (27/4/21) from Damstra (full detail attached), YOY growth for the quarter includes a lot of inorganic growth from the Vault acquisition, but still very strong and on track in terms of organic growth. My key takeaways from the activities report and investor presentation are:

· Growth back on track, both customer numbers and sales growth are solid.

· Gross Margins at 81% is very impressive, above what I have valued for.

· Vault integration successful, synergies $6m Vs $4m anticipated at acquisition.

· FCF still negative, but introduction of $20m debt facility provides a long cash runway as they focus on growth.

· Growth focus is very welcomed, as is the moved to ARR reporting. I hope they will look at LTV soon, which should be very high based on ultra low churn and high margins. This also will provide a justification for investment in growth.

· Development of Enterprise Protection Platform (EPP) last quarter provides a strong customer proposition to sell the vast array of functions and products Damstra offers.

· US market growth strategy is focused and calculated. This is critical to long term growth and upside share price value, if done well this is a 10x opportunity.

· Outlook: Damstra is now forecasting for FY21, revenue of between $28.5 - $30.5m.

“The Company is focused on executing its long-term growth strategy and continuing to develop its EPP platform, while continuing client acquisition and converting opportunities in South East Asia and North America.”

I will continue to hold DTC and see my last valuation as potentially a little light, but will not update until full year results are available. I am most interested in seeing traction in the US market but also ROW growth is important, leadership is looking solid so far on this, so just a case of watching and waiting.

Updating my valuation for the H1 FY21 result and also with a format change and methodology enhancements incorporating learnings from Aswath Damodran’s (check it out: (43) Session 1: Introduction to Valuation - YouTube).

H1 FY21 results had higher operating cost base than I was expecting with the Vault acquisition. I expect this to improve and be compensated by faster top line growth as customer acquisition improves post Covid and the benefits of Damstras products and services have more relevance in a post Covid world.

The valuation has increased from $2.21 to $2.70, the principal driver of the change is extending the growth out to 2030 from 2027 previously which increased the PV of the terminal value. My view of the company’s future is little changed, I see a lot of opportunity.