Wilsons HTM provided the following via a broker note email:

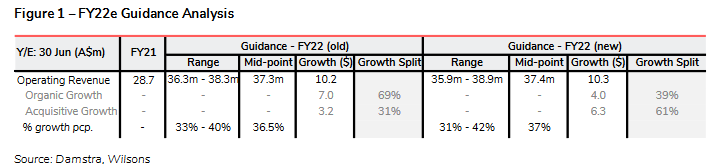

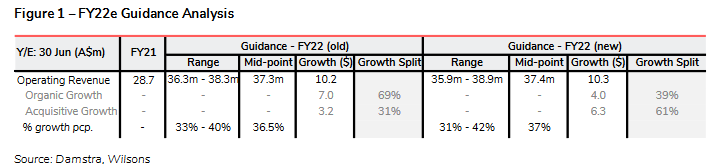

Damstra today reported a disappointing 1Q22 update, with ARR and guidance both challenging. ARR grew +$10.4m (+55%) vs. pcp but fell -$5.2m (-15%) vs. 4Q21 ARR of $34.5m. The fall was primarily attributed to the descoping of Damstra work by one of its biggest clients, Newmont (~$3m), and ongoing impacts from Covid-19 (~$2m). While the mid-point of the guidance range was basically unchanged, the mix is now skewed to acquisitive growth (previously: organic). These issues, coupled with ongoing ambiguity regarding expected large contract wins and achieving guidance arguably relying on those contract wins, see us downgrade Damstra to M/W, lower our FY22e revenue forecasts by -12% to below the low-end of guidance and reduce our target price by -58% to $0.75.

My opinion:

This is a 180 degree turn from Wilsons. All previous broker notes had DTC at >$1.50 TP. Be interesting to see if other brokers follow, as they are often all copy cats with very little independent thought! (hahaha jaded much?!)

Interesting observation that they assess it is now revenue by acquisition and not internal growth (table below), broadly a sign of an 'average' company, and not an 'above average' company. And average is fine. One can still see a reasonable outcome over twenty years of investing with an 'average company', but no monster she'll be.

I am not one to get cold feet easily. My thesis still has 3 years to run on DTC and given the macro environment, I am willing to wait longer to see what happens. Every company hits speed bumps and what we commonly forgot is it takes time to fix these things, aka 12 months minimum. I won't top up at the lows, but will maintain my current holdings.

Disc: Held in RL.