I am posting below my 4C analysis for $DTC. 11 months ago I removed $DTC from my watch list on concerns about i) lack of strategic focus in its investment phase ii) cash burn with no evidence of emerging positive operating economics iii) better opportunities elsewhere. (Exited IRL on 28-06-21 taking a c. 50% loss but have never held on SM.)

@Chagsy's “Bull Case” post last week got my attention, so I took another look at the most recent results and also the recent contract announcements. I wont repeat info from @Chagsy's post, as it is a good summary. My reason for writing this post is that I always remain alert to the probability that I was wrong!

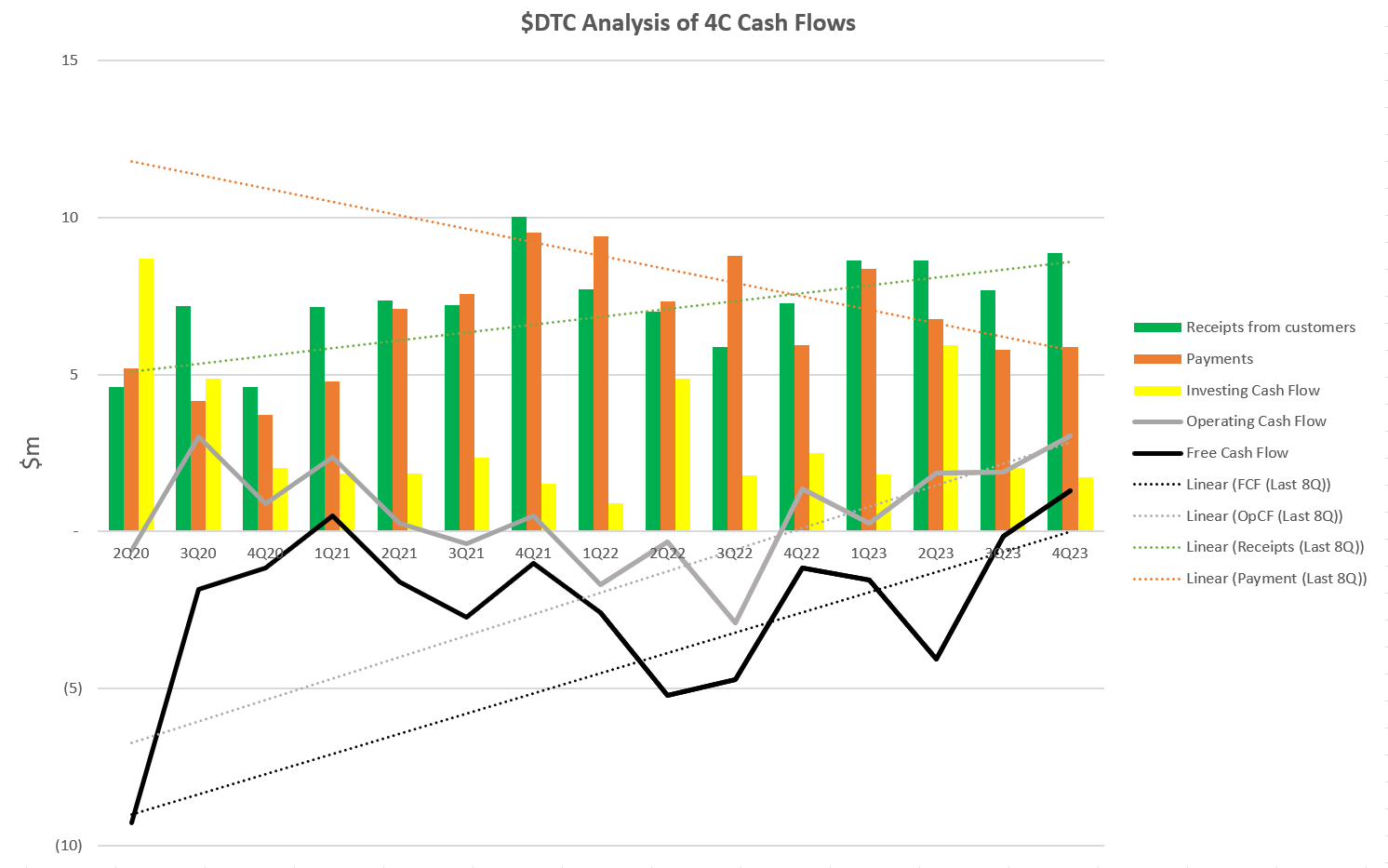

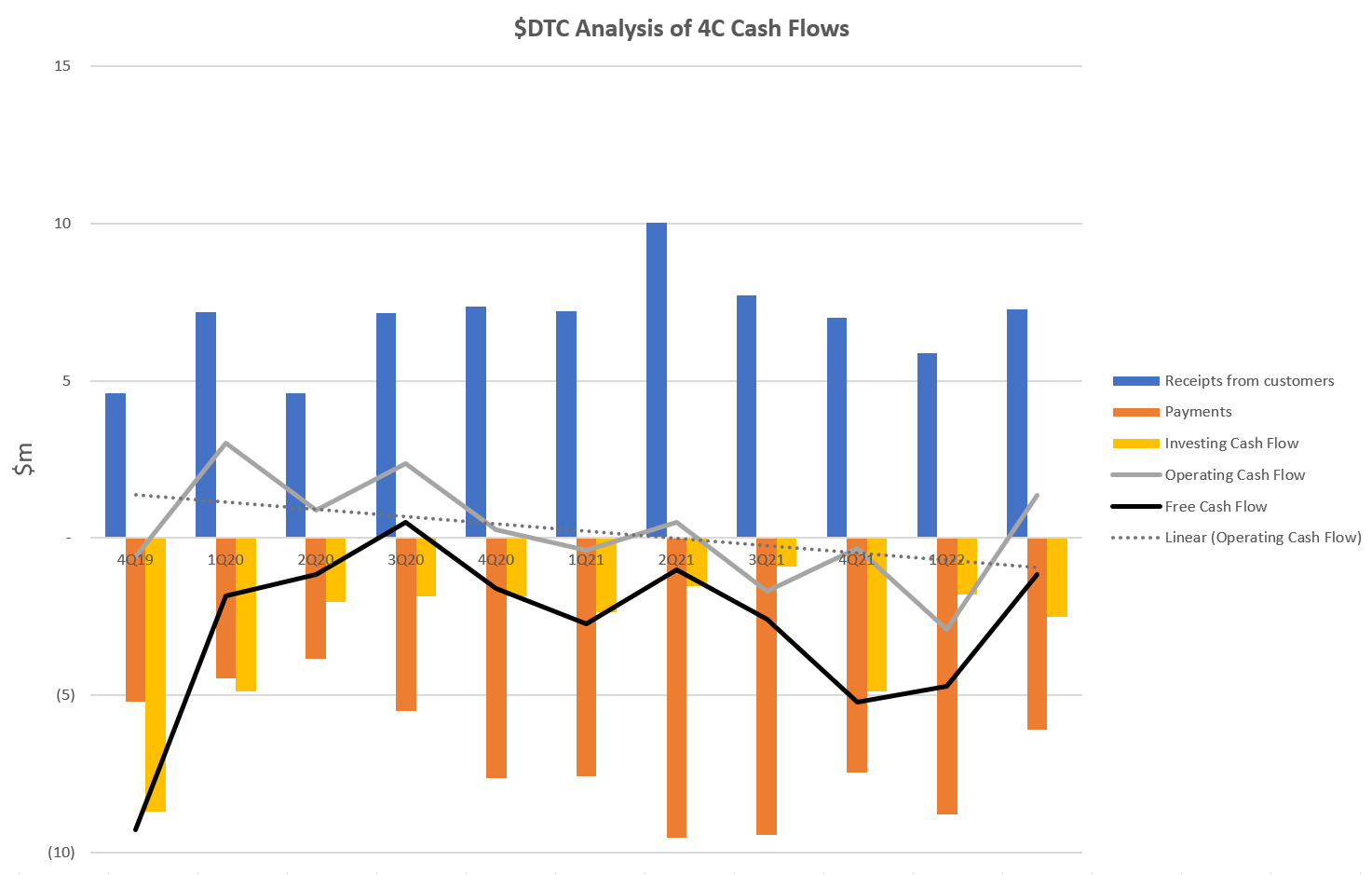

So, first the 4C analysis (below). The last Q is undoubtedly positive, but 1Q does not for me give evidence of a positive trend in operating economics, despite management assertions. However, should this continue for another couple of quarters, then looking at the more recent period (6Qs), you could argue the corner has been turned, which is what Christian Damstra is saying.

So, what of the future prospects? The 3 recently announced deals are all interesting:

· North East Link Project – Work Force Management modules

· Barrick – eLearning modules

· Capstone Copper – multiple modules across the whole Enterprise Project Platform

Collectively, in the context of annual revenues of $30m, the minimum spend in these deals is not material, but they do hold the prospect of significant upside if the clients find value in them and roll them out. (I’ve spent a good part of my career working on mega-projects and have had a lot of exposure to procurement of systems on them. There’s a big difference between signing up a customer and getting a strong system implementation, partly because mega-projects are themselves such chaotic environments.)

Furthermore, the 8th June announcement of “Update on new customer wins and material contracts” involved updates on items that were not actually material in the context of $30m annual revenue. (This is in contrast to another Strawman favourite, $ALC, where CEO Kate Quirk has made clear that they are going to stop updating on immaterial contracts and instead provide a one-slide summary of major developments in each quarterly briefing, in line with ASX rules, as done in the latest presentation.)

It was disappointing to see that the table in the Quarterly Performance section reported metrics excluding the ended Newmont contract to show positive churn and revenue retention. My objection is that there is no mention of the value of the metrics had the loss of the major contract been accounted for. (Some may recall that $NEA had to deal with a significant churn event in the USA 1-2 years back. In their case, they reported the bad numbers, but then added commentary on what the result would have been if the cases were excluded. This is a more honest approach in my opinion. The numbers are the numbers. Anything else raises questions of integrity for me.)

Finally, I am encouraged by the statement by CEO Christian Damstra that the investment phase is completed. (We heard similar from $ELO recently, another SaaS firm that has been through a costly investment phase building their platform over the last 3-5 years.) This is positive because it will mean than management attention is on customers and execution to implement the platform, rather than acquiring to build it. This should have both positive revenue and cost benefits.

My conclusions are as follows, stated in terms of what I need to see to consider investing in $DTC again:

1. 2 consecutive, further quarters of results to confirm positive operating economics.

2. Progress on the existing customers showing progressively increasing utilisation and rollout across multiple sites.

3. Evidence of a customer-led focus on which modules add most value and are being implemented. This should drive simplication/high-grading of the platform. (I am still worried that there are too many elements to maintain.)

4. Less management “spin” in results reporting. This is going to take a polite email to CEO Christian or the Chairman. (Several of us have learned the harsh lessons of $LVT.)

$DTC back on the watch list. Thanks @Chagsy !

Disc: Not held IRL or SM.