$IKE issued their 1Q FY24 Performance Report this morning.

In May, at the last quarterly update and again at the FY report, $IKE warned of a slowdown in transactions driven by two of their larger customers doing a fibre rollout in an area where the pole owning utility does not allow use of digital tools for the key engineering processes that $IKE delivers. Today we got to see how bad this was. And its bad. I go into this in further detail below.

Their Highlights

- Q1 FY24 revenue of ~$5.6m (-18% vs pcp).

- Subscription revenue of $2.5m (+36% vs pcp)

- Transaction revenue of $2.1m (-45% vs pcp)

- Q1 FY24 gross margin approximately of ~$3.4m (-12% vs pcp), with a gross margin percentage of ~61%. (up from pcp of ~56%)

- Total cash and receivables as at 30 June 2023 of $18.1m, comprised of $13.7m cash and $4.4m receivables, with payables of $1.1m and no debt.

Other key items in the report commentary

First, good news. $IKE continues to add about one enterprise customer per week, so the upward trend in number of customers is steady. Subscription revenue was up slightly over Q4 and +36% on the pcp. So steady growth.

The issue is that transactions and transaction revenue fell dramatically. We knew it would be a decline, but the decline is significant at -45% vs. pcp.

On a positive note, Glenn reports that forecasts coming from customers point to transactions building strongly through the rest of FY24 and that $IKE has not changed their growth outlook from a broader FY24 perspective.

The "soft launch" of next generation software is referred to as a "near term milestone" so it is still ahead of us. What's new is the information that the new features which have been developed in consultation with the customer council are expected to generate subscription revenues of "more than 5 times the level of revenue per annum per customer" than the legacy platform. Wow.

On cash, this is reported at $13.7m.

Trend Analysis

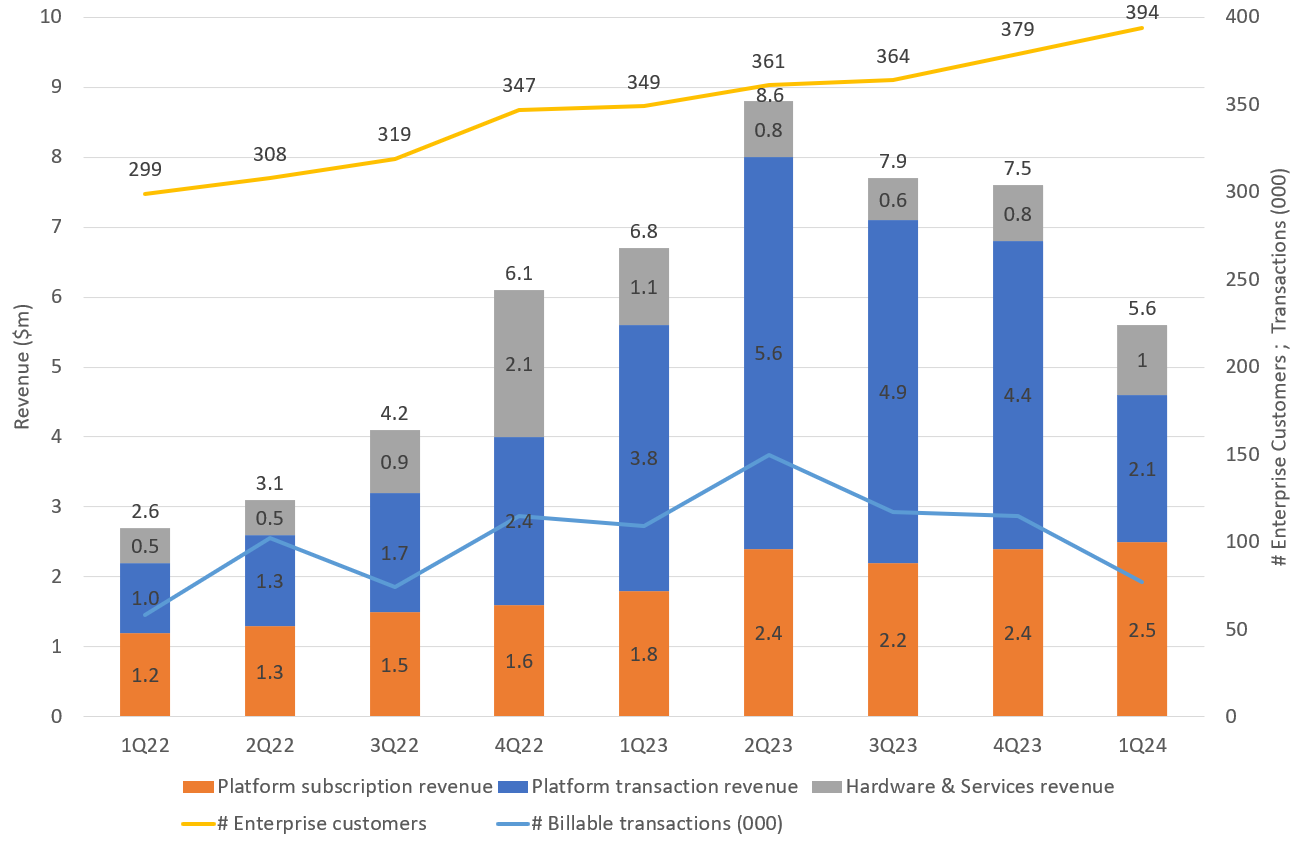

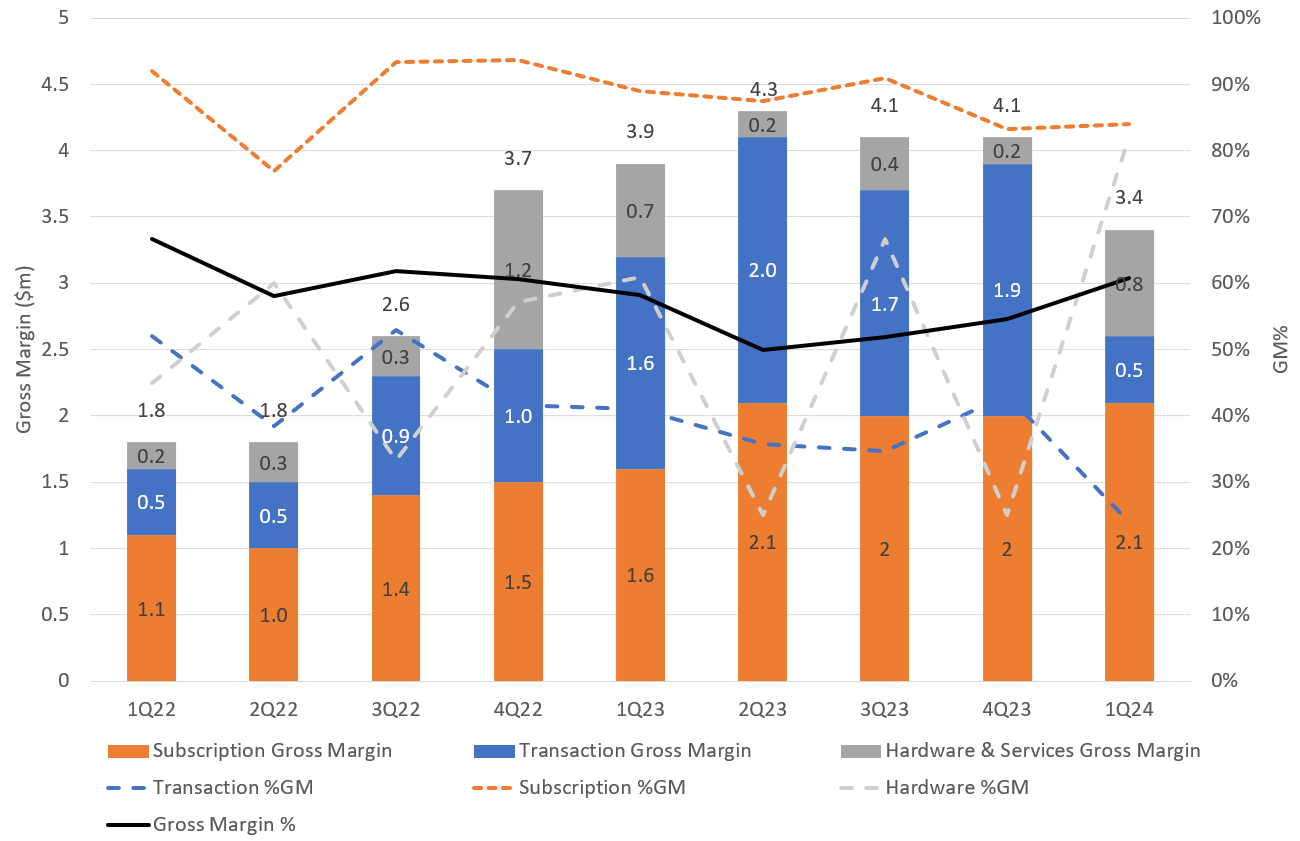

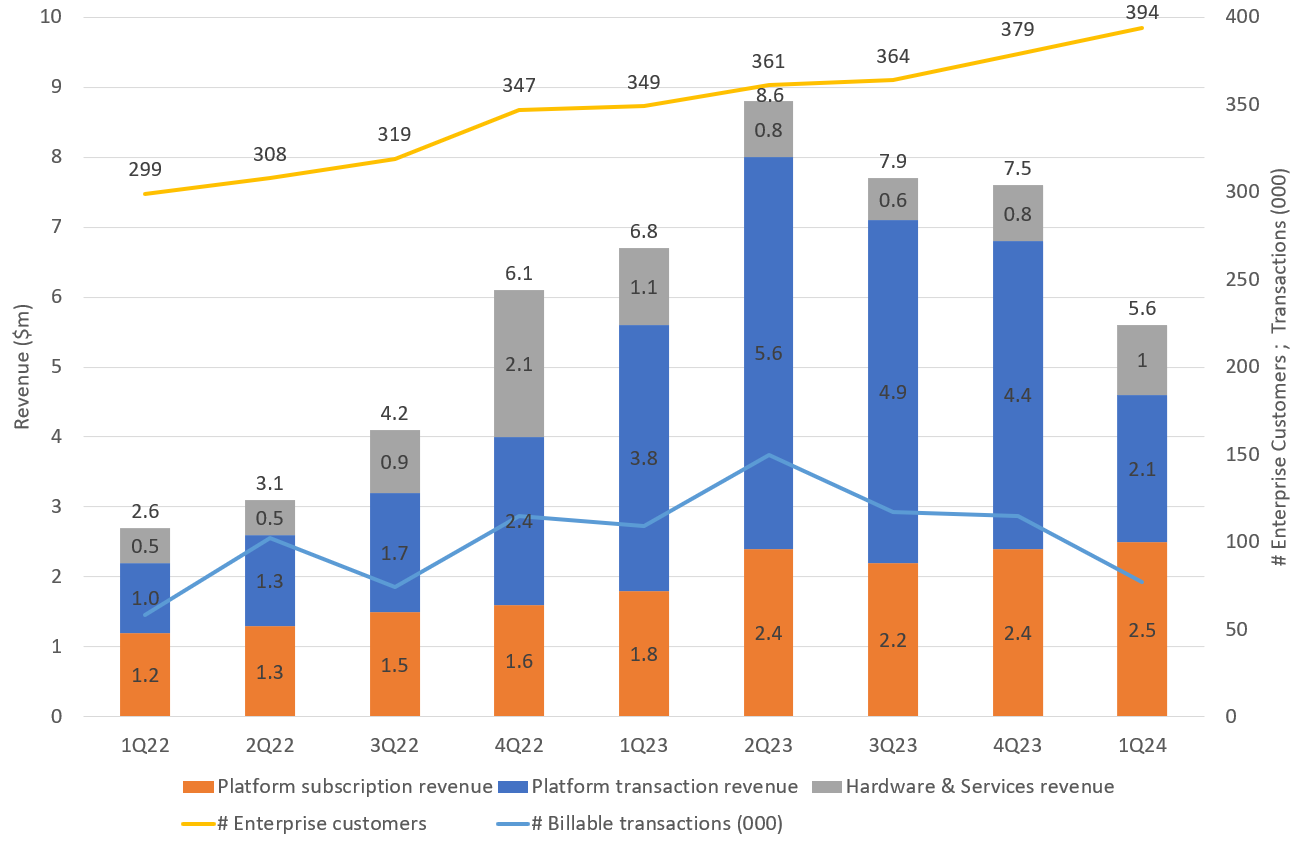

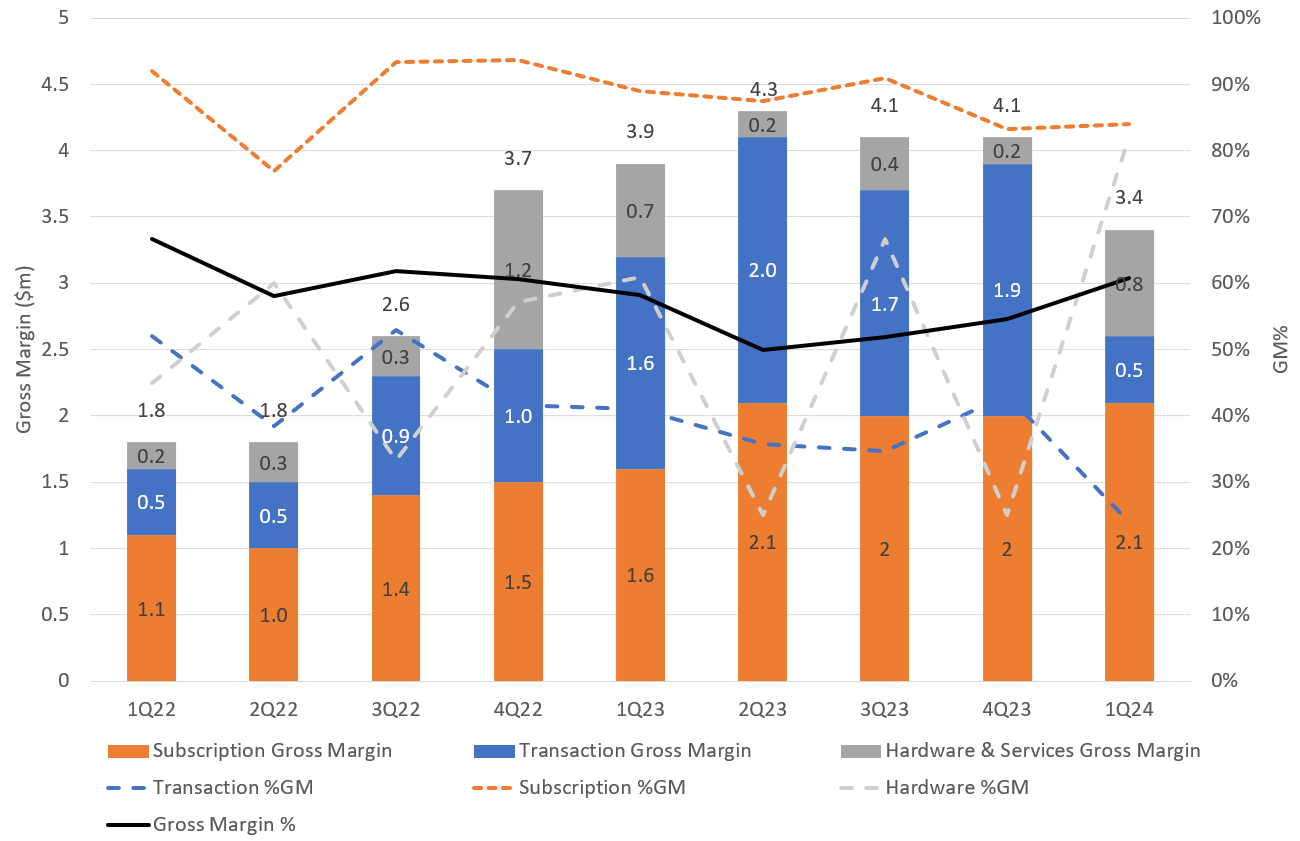

I include my two trend reports. Figure 1 for volumes and revenues and Figure 2 for Gross Margins ($ and %).

Figure 1 Volumes and Revenues

Figure 2 Gross Margin ($ LHS and % RHS)

My Analysis of the Results

Volumes

While we were prepared to expect the decline in transactions, the fall is quite dramatic. It this is down to a loss of activity as two larger customers traversed a "no-go" utility area in their fibrerollout, it points to very high concentration in the subscription revenue.

But what is also clear from Figure 1, is that this wasn't just a one quarter phenomenon. 1Q represents the third consecutive quarter of declining transaction volume. So even though we were given the "heads-up" in May, it looks like this has been a longer time coming, so I have a question as to whether Glenn was being transparent with investors, or only telling us when it became obvious to him that there was no way we were not going to find out.

We are told to now expect growth again moving forward. I'm not surprised that the two engineering customer likely took 3-4 quaters to traverse a State in their fibre rollout (I'll assert this, even though Glenn hasn't said this - just to be clear), what is disappointing is that this implies that growth in the use of the platform across the other almost 400 customers hasn't rapidly compensated for the decline. That says to me that the "super-users" of the platform are highly concentrated.

Reporting the number of customers is an almost meaningless metric. A customer could be a small enginering firm with a handful of engineers, or it could be a large cap utility with 100s or even 1000s of engineers. $IKE would do better by shareholders to report the "number of seats" in the way that $ALU does.

Disappointing though this is, it is not thesis-breaking from my perspective for two reasons. First, in the short term, the two super-user customers will move to other juridictions and begin to use the $IKE tools again. This appears to be forecast. Secondly, and more importantly, provided that other customers are rolling out the use of the $IKE tools, then over time, this lumpiness will smooth out.

As ever, we can either choose to accept Glenn at his word or not, that growth will resume for the rest of FY24. Historically, Glenn has a good track record on forward-looking statements, so I will give benefit of the doubt.

Margins

Margins collpased in transactions. It is unclear how costs are allocated to transactions. Unlike normal SaaS where the incremental transaction cost is $0, we know that $IKE provides services in support of the use of the tools. Given the collapse in volumes, some of these support resources are potentially being recovered over a smaller volume.

More generally, margins appear to not be a concern, as the overall % GM has continued the postive trend up over the last 3 quarters getting back to where is was in 2022.

Cash

Cash has fallen from $18.0m at the end of FY23 to $13.7m at the end of Q1, and Glenn has dropped the use of the term "fortress balance sheet". From my perspective, that puts $IKE on a "negative watch" because, were this rate of burn to continue, $IKE would be only two or three quarters away from raising cash. However, if growth resumes through the rest of FY24, then the propsect of a raising might be averted.

Outlook

The forward guidance is clear about a return to growth, both from transactions and with the propsect of strong subscription revenue growth as the next generation software is released and progressively adopted through the rest of FY24. This will be a key proving point for $IKE. If customers value the new product and adopt it, subscription revenue will grow strongly and - given the value to customers - you'd expect transaction volumes to follow. If not, $IKE could face the prospect of supporting customer on mutliple platforms, which could potentially drive costs. So it will be an interesting year or two ahead!

My Key Takeaways

The result is disappointing and it raises (or rather strengthens) questions over the longer term trajectory for $IKE. Frankly, it is worse than I feared, but it is not inconsistent with what Glenn has said. I believe we could have been warned earlier and you could debate whether Glenn should have done this, if he could.

In May, given the negative outlook and my concern about customer concentration risk, I cut my $IKE position in half, as I was too overweight for such a high-risk proposition.

The $IKE SP can be volatile given illiquidity. So if any shareholders weren't paying attention in May and June, they might get a nasty shock this morning. We'll see as the day unfolds.

Unless anything material transpires in the call at midday, I intend to sit tight with my current position. Indeed, if $IKE can maintain subscription growth and restore strong transaction growth, then given all the reasons I've written about before, I'd like to hold more of this stock. It is possible an adverse market reaction could give me an opportunity to pick up more cheaply in the near term. However, I have to be honest and say I do have questionmarks now, and my conviction in the thesis is not as strong as a year ago.

For now, I'll sit tight whatever Mr Market decides.

Disc. Held in RL (1.3%) and SM