Yes, I thought so too! I’ve owned Metcash (MTS) in the past and back then it was boring with a capital B, but things have changed!

The Metrics

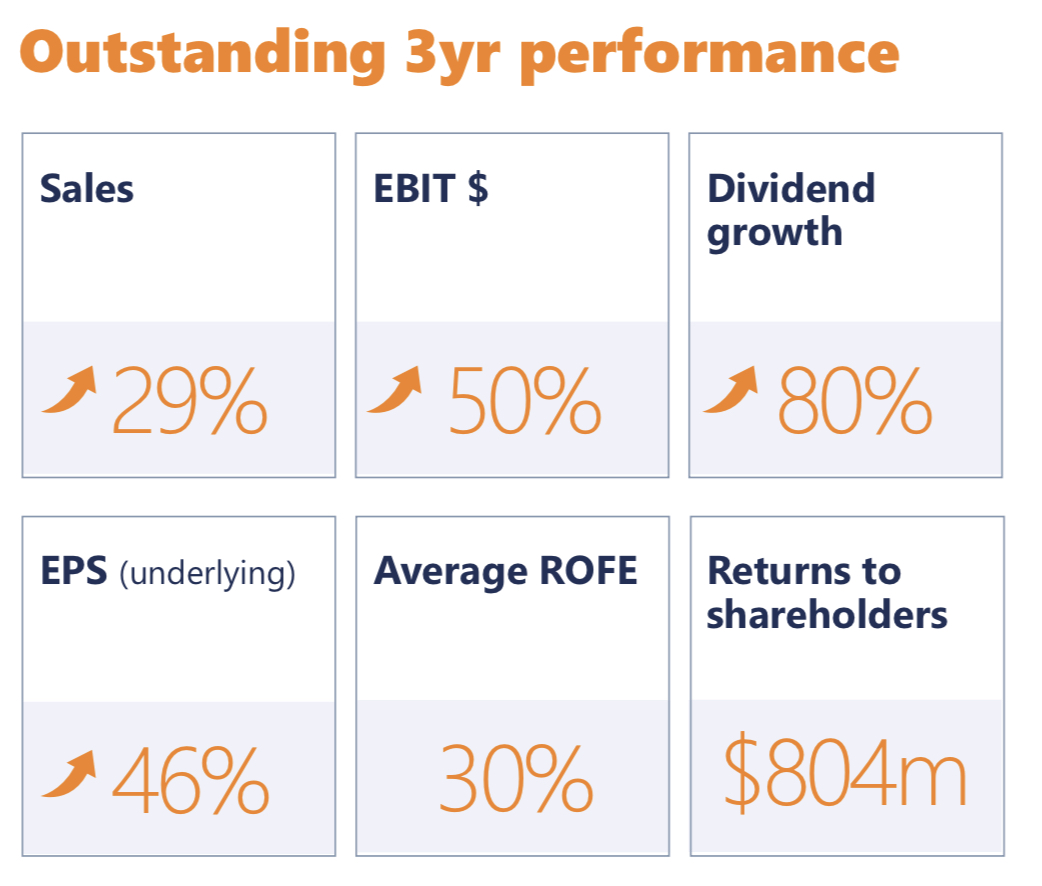

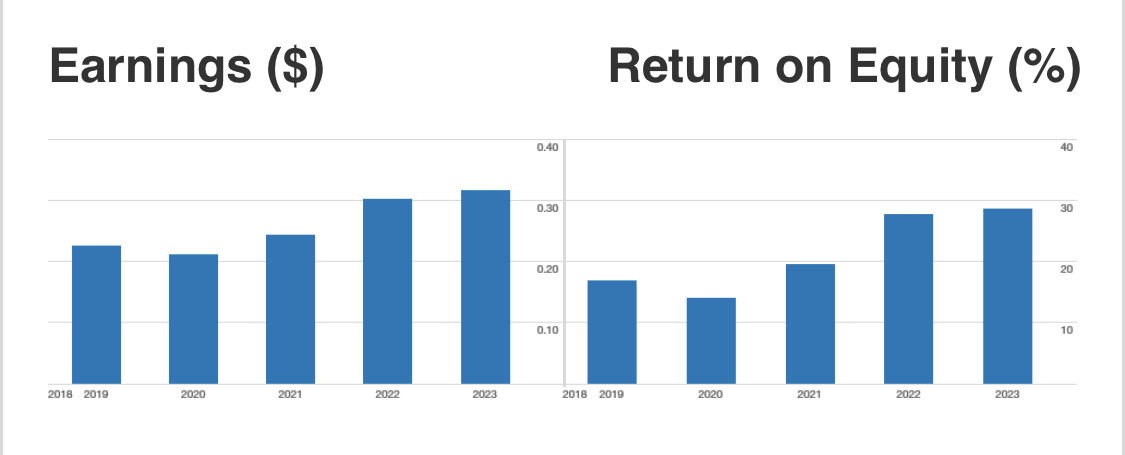

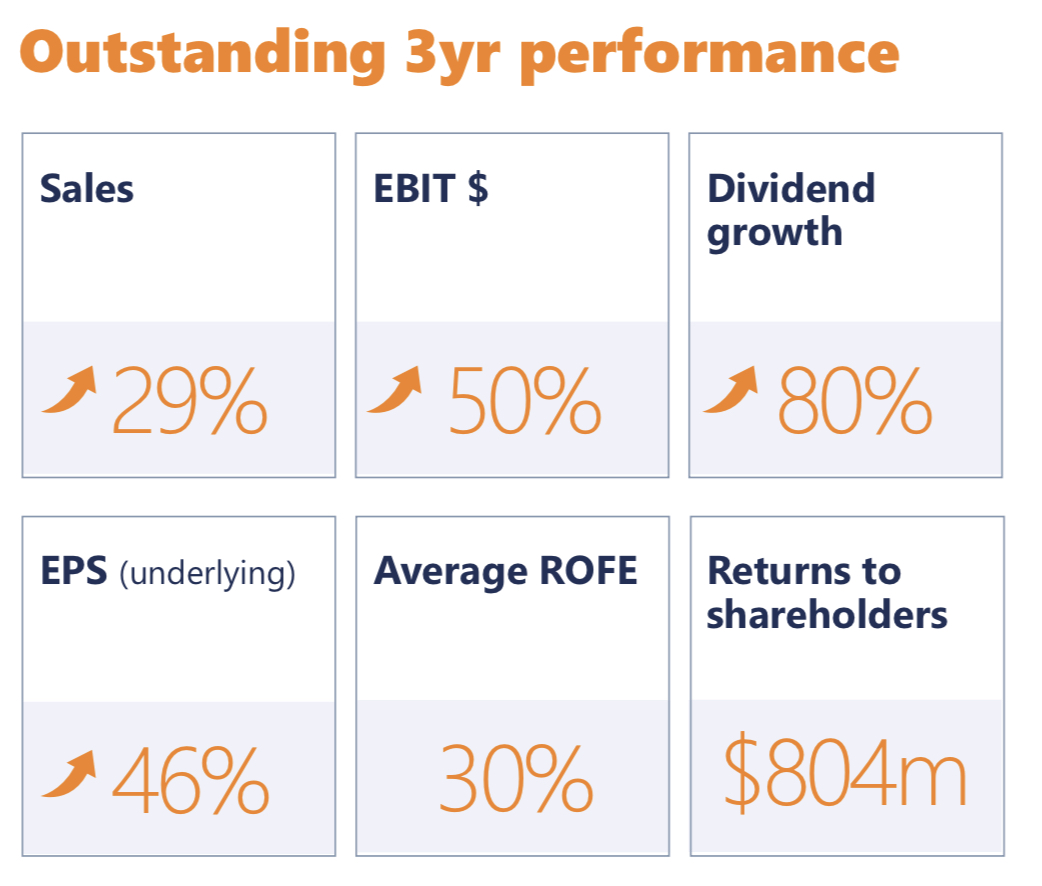

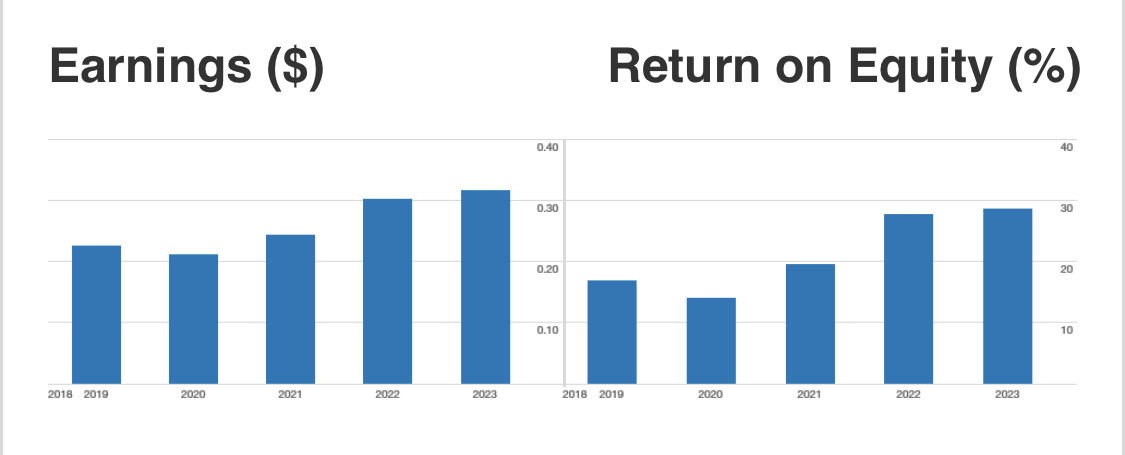

To be honest I was a bit surprised when I lifted the bonnet on Metcash last week. A lot more grunt than I expected. Metcash has been quietly supercharging their ROE over recent years. Underlying FY23 ROE was 28%, up from 14.1% in 2020. Underlying EPS has climbed from 21 cps in 2020 to 32 cps over the last 3 years (up 46% in 3 years).

Source: Commsec

I didn’t realise that Metcash was a dividend stock either. This year Metcash paid investors fully franked dividends of 22.5 cps (up 80% in 3 years). On the current share price ($3.60 on 26/07/23) that’s a yield of 6.3% fully franked, or 8.9% if you can take full advantage of the franking credits.

What about future growth? With a payout ratio of 84% this year that leaves only 16% to reinvest into growth. Over the last three years more earnings have been invested into growth: 38% in 2020, 25% in 2021 and 27% in 2022. We can expect earnings growth to steady a bit from here. Analyst consensus (9 analysts, Simply Wall Street data) have earnings growing of 5.4% per year over the next 3 years.

Margins are thin with gross margins at 11.5% and net profit margins a razor thin 1.64%.

Cash Flows and Debt

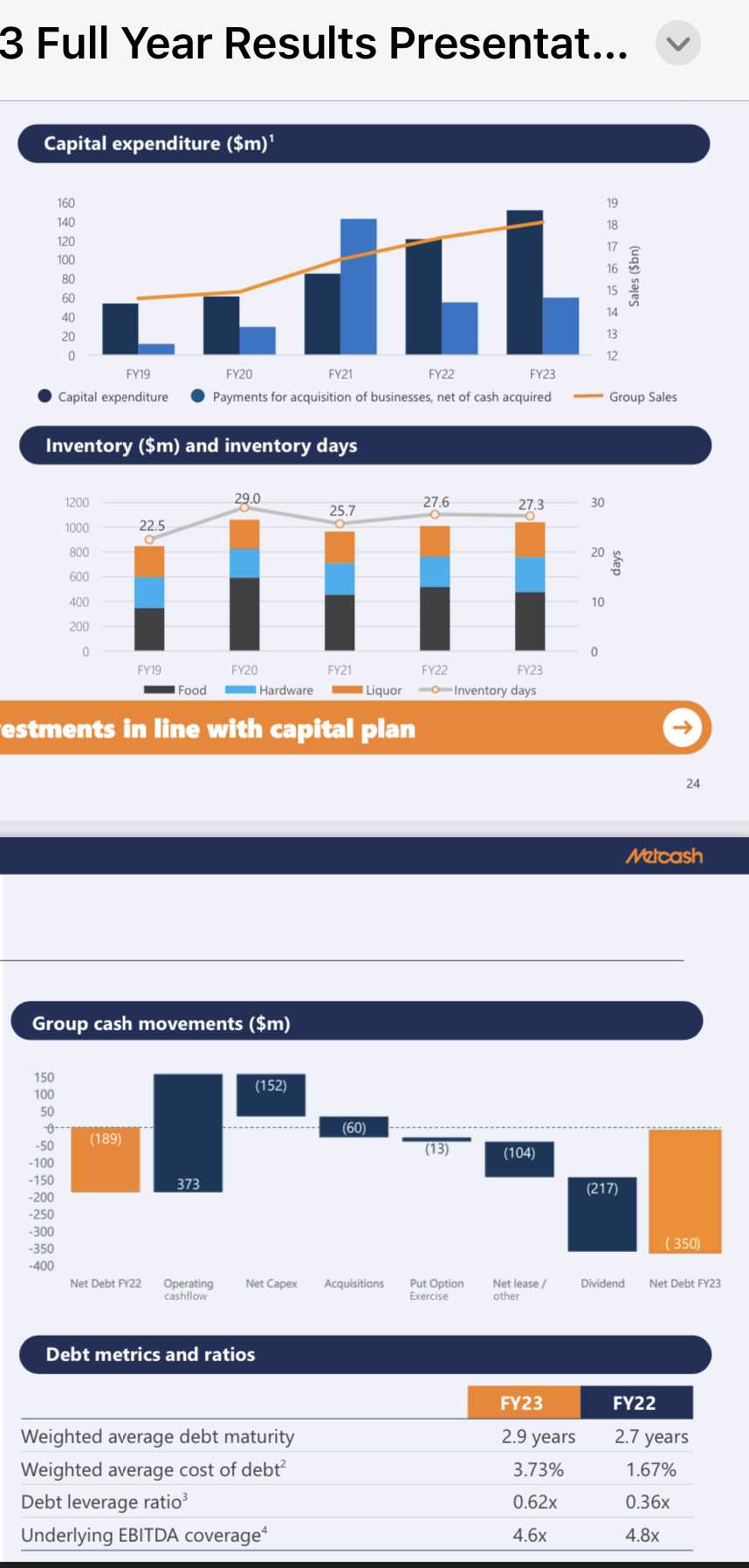

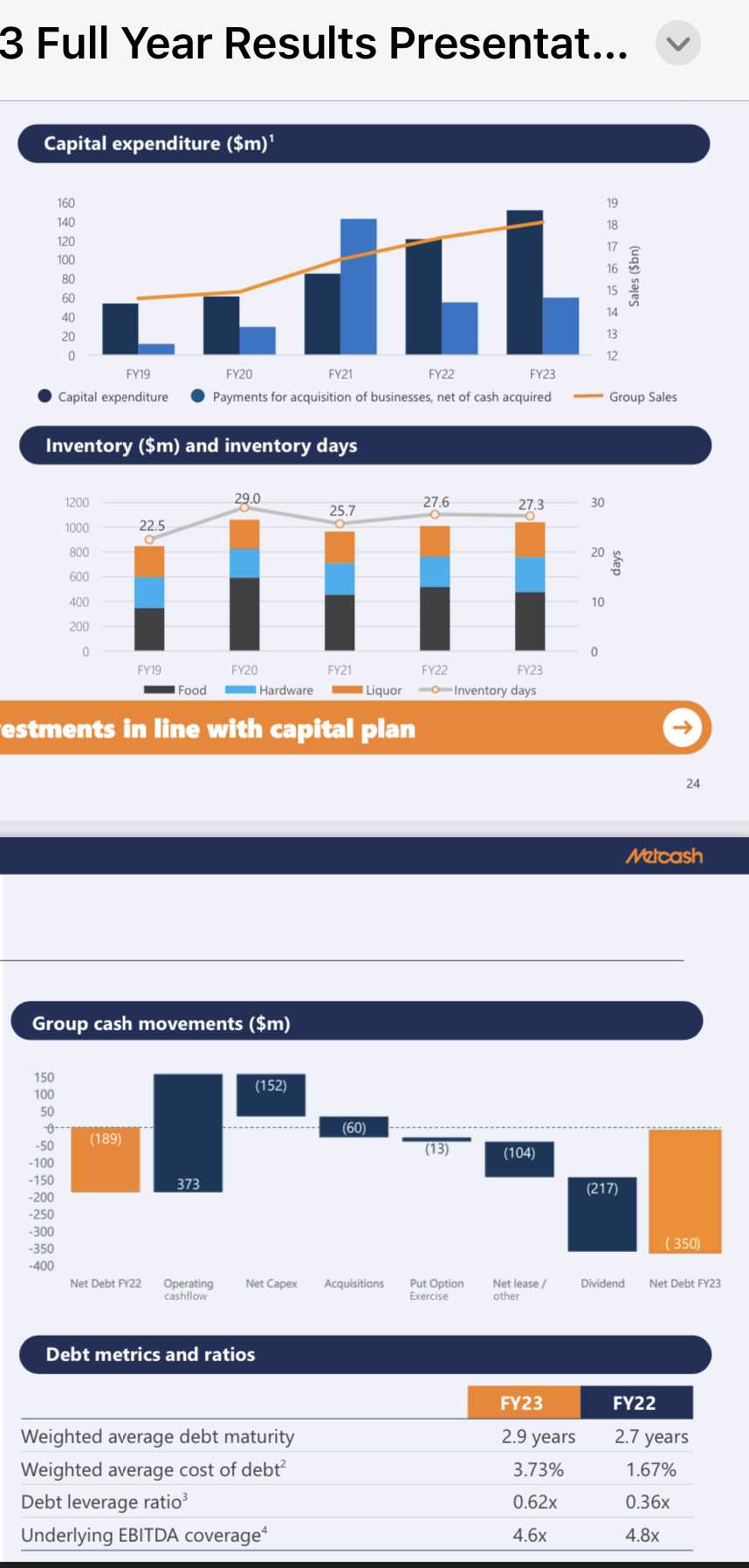

Net debt to equity is OK at 32.2% but this has increased significantly over 3 years. In January 2020 Metcash had more cash than debt.

This year net debt increased from $189 million to $350 million. Of the $161 million increase in net debt, $60 million went toward acquisitions. There was also $152 million on Capex this year.

The Business

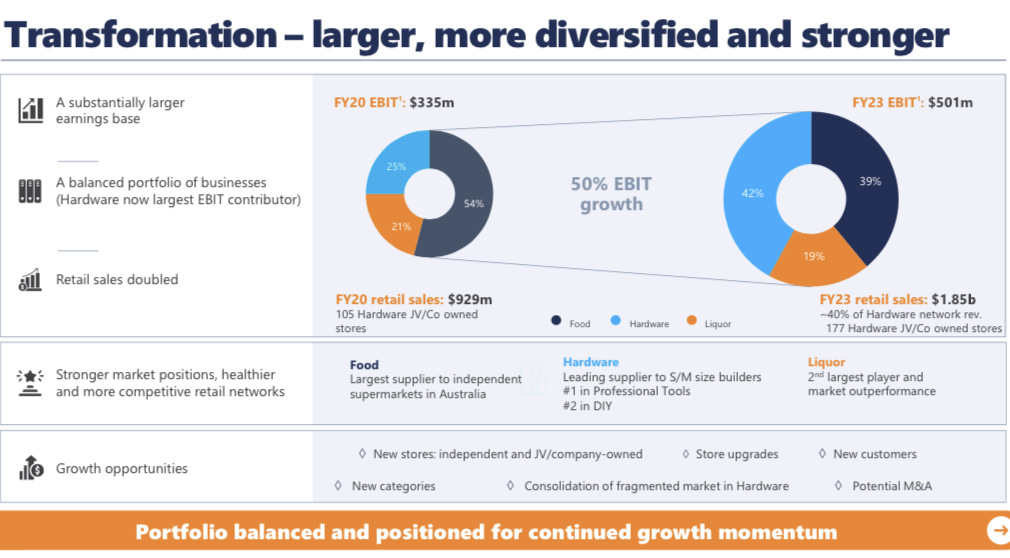

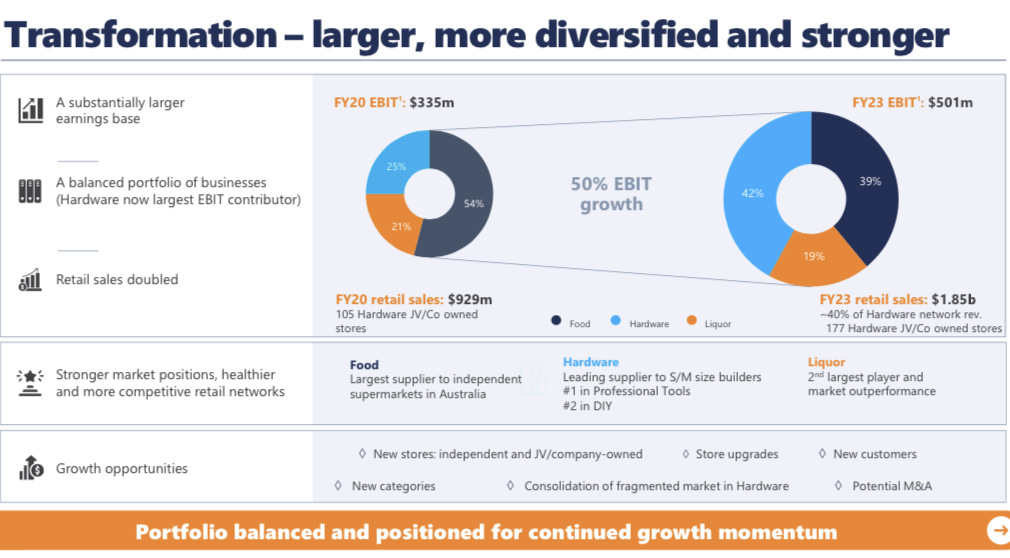

I was surprised to see how the business has changed since I looked at it last. The business still consists of 3 main categories, food, hardware and liquor. The biggest change has been the shift from food to hardware. Hardware is now king, increasing from 25% to 42% over the last 3 years.

Most investors, including myself, probably see Metcash playing second fiddle in hardware (Bunnings v. Mitre10 and Homeware), second fiddle in liquor (Endeavour v. other brands) second fiddle in food (Woolworths, Coles, Aldi v IGA) however, it seems to have carved out a niche here as the second fiddle. Mitre 10 even refer to themselves when advertising as ‘the other hardware store’.

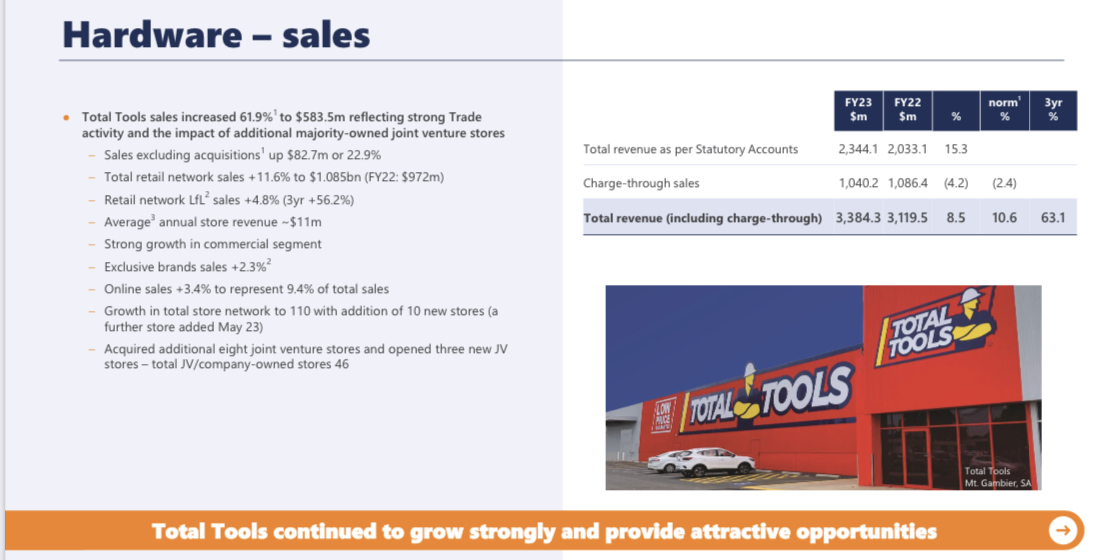

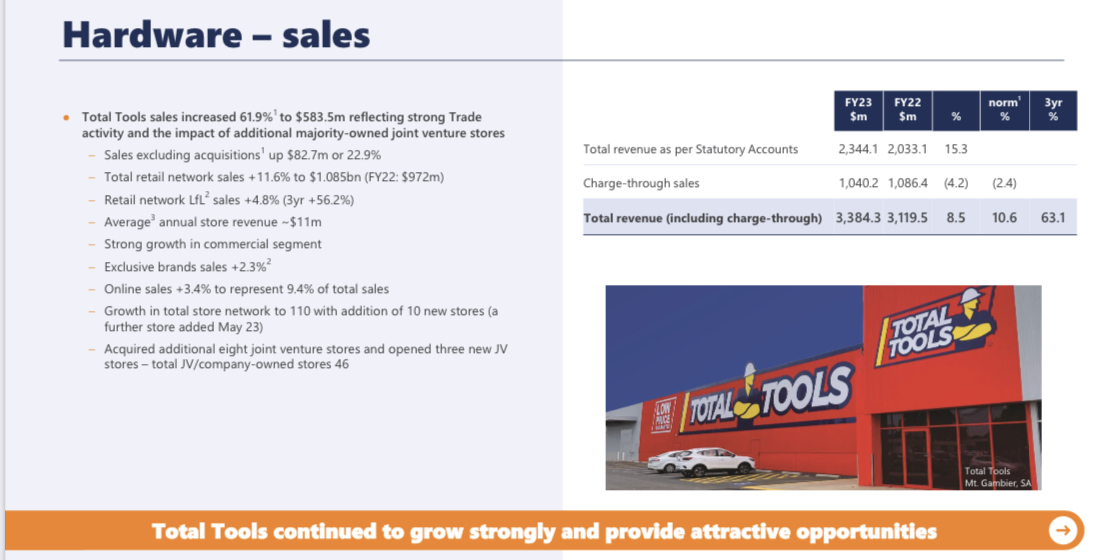

What most people are probably not aware of is Metcash is now #1 in professional tools. I wasn’t even aware they had a joint venture in Total Tools until a week ago, and this year Total Tools sales increased by 61.9%.

In the hardware division, total sales (including charge-through) increased by 10.6% normalised to $3.4bn.

Outlook

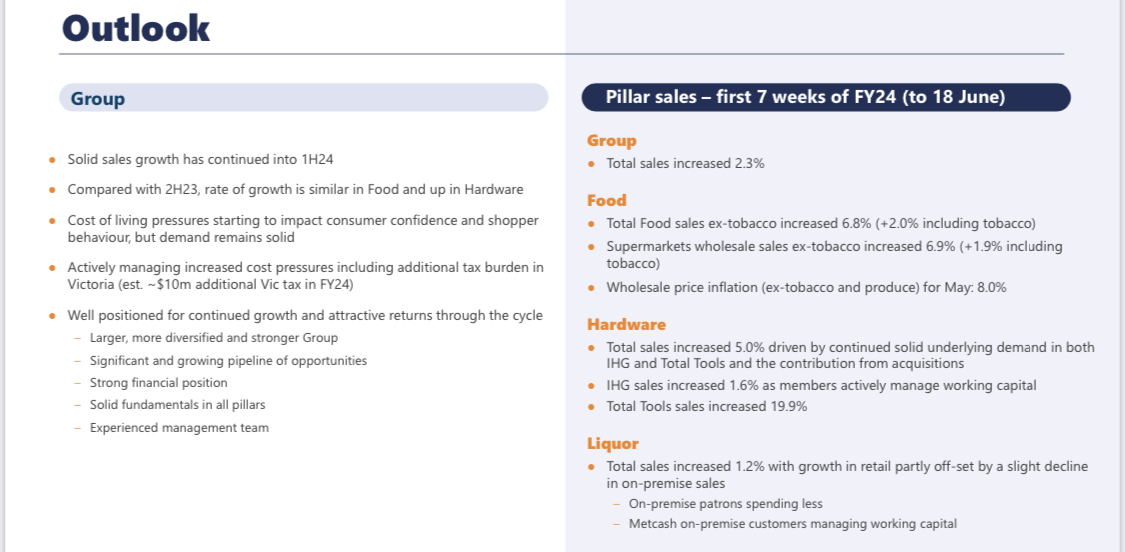

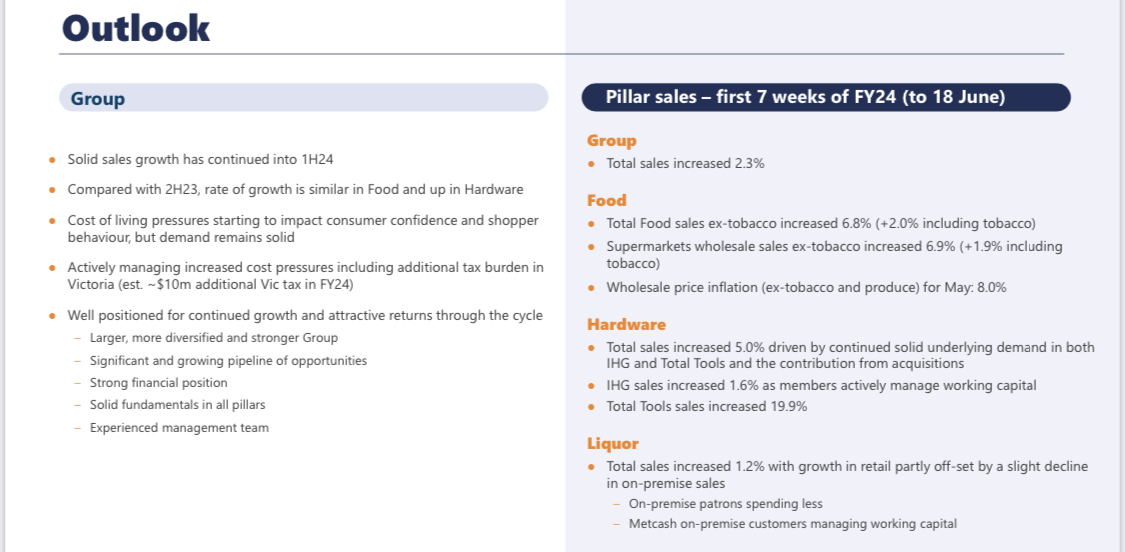

In the first 7 weeks of FY24 total group sales have grown 2.3%. It’s not outstanding, but given many retailers have been reporting negative growth, it’s a reasonable start to FY24.

My Take

I like what I see at Metcash. I think the business has a good balance of growth and defensiveness. I like the Strong ROE of 28% and the current gross yield of 8.9% which is very attractive in the superfund.

Using McNivens StockVal formula, projecting underlying ROE of 28%, equity of $1.12 per share and 16% reinvested earnings into growth, I get a total return of c.13% per year including franking credits over the next few years.

Metcash has just earned a small position in our portfolio with the possibility of adding more if our conviction builds.

Disc: Added IRL yesterday (1%)