Great result from Beam today. Nothing in the report for me not to like.

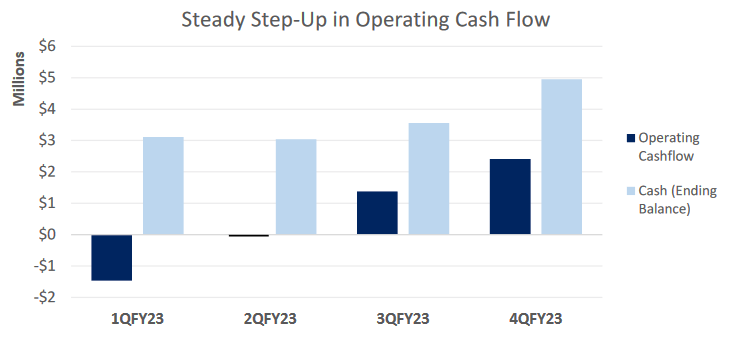

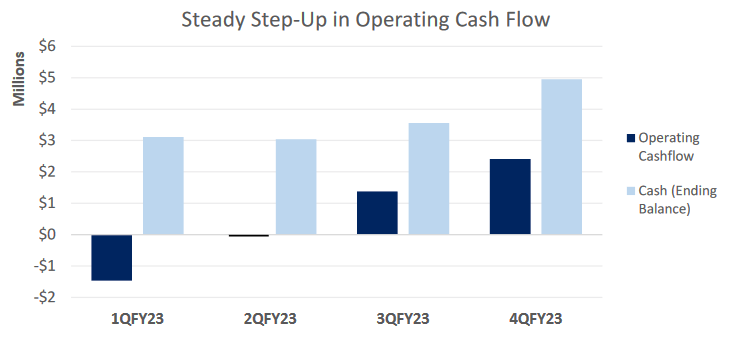

Generated $2.5M cash up 39% from Q3, total cash balance now $5M. Driven by the continued reduction in working capital and development costs. Importantly they expect positive cash flow to continue. "While it is normal for the level of cash flows to vary between quarters due to the timing of payments and receipts, the Company’s trend of positive operating cash flows is expected to continue, on current projections"

All segments of the business doing well. Equipment sales up 22% QoQ. The segment that has really surprised me over the last few quarters is the sustained growth in their Sat phone shop sales, up another 22% QoQ.

Annual royalties from Zoleo annualised at $870K, up 18% QoQ.

Total Zoleo subscriber numbers in ANZ (BCC high margin (85%revenue to BCC) segment) increased to 6200 users, up 23% QoQ, while global subscribers (15% revenue to Beam) increased to 71,000 users14% QoQ. Zoleo was looking a little shaky ther for a while but it looks like they are gaining penetration into the enterprise market with some of their recent improvements in tracking multple users from a central point. These users are where I see the long term value being created.

Confirmed that they have hit their 2023 guidance - $40M revenue, $4M EBITDA.

The JV with RoadPost (Beam owns 50%) is now material to the company so we finally get some optics around this--> JV will have total revenue of $27M of which $17M is high margin reoccurring subscription revenue.

Beam has a market cap of $15M is debt free and now has $5M cash on hand. They are also presenting at Coffee microcaps next Monday.