Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

I think I have overestimated the quality of BCC as a business, while there are many positives, I think I have underestimated the amount of capital that needs to be deployed to maintain their sales cycles.

This quarter they slipped back into negative cashflow ($622k) and reduced the their $5m cash down to $3.2m, after capitalising product development costs. A lot of this will unwind next quarter as they sell the inventory they are now building, which is mostly to fill the Irridium Go Exec order. So the working capital will be recouped as these are contracted orders, but the ability for BCC to spit off cash is a lot less than I had initially expected. I still think it is a good buisness that is undervalued but I don't think the business will become significantly more profitable in the future.

The positives - Zoleo subscription royalty revenues have increased to $1m annualised, up from $711K at the end of June 23. They say this is high margin and flows largely straight to pre-tax profits so continuing to grow this will be important.

The negatives- They estimate the JV arbitration will cost $1m ($100K spent this quarter) and should be complete before June next year. They still think it is a binary outcome -either Roadpost gets it or they get it.. The JV did $40.6M revenue in 2023, which is the same as Beam did, so the arbitration decision will have a material effect. The big risk here is if it goes on longer or costs more, as Beam don't have large pockets to absorb these costs. They also want to deploy $3m for product development this year. Despite this, they are still guiding for cash to increase over FY24, above the $5m that ended 2023 with. For that to happen the next few quarters will need to be good.

Still happy to hold, but this year needs to deliver for my thesis to be maintained. However, I don't see a major catalyst for a SP re-rate until the JV arbitration is completed.

Just as Beam were starting to turn the corner and consolidate a good year with another solid one they announce that they are going to arbitration with their joint venture partner RoadPost. I am noticing an unfortunate habit of BCC, just as things are looking positive and interest is developing they manage to find somethng to knock the momentum out. Hopefully this one will be temporary. They expect an arbitration decision to occur in 2H 2024FY.

This was always a opaque JV, and details have been a bit scarce but at its heart the JV was distribution arrangement for N America, BCC made the units, sold for very low margin with the aim of getting high margin subscription revenue. Roadpost sold them in N America and the JV had the costs/profits that would then be distributed to each partner.

It looks like from the BCC version that Roadpost has brokern some of the contractual arrangements in the JV and Beam are now trying to get it terminated through a canadian arbitrator. Negotiation has failed and they are going to the umpire for a decision.

It looks like either Roadpost or BCC will end up owning the Zolio inc JV (or is it just a V now?).

Its not a great outcome but I don't know enough yet to really know long term whether this is potentially positive development or not.

The majority of th subscriber revenue is in the US, - total subscribers is now 80Kish (up from 71K at end of FY) and Aus has a bit over 6K currently. So full ownership of the JV would give them 80K subs of high margin revenue. Not really sure how they would pay for a buy out of Roadpost though and not totally sure how a contractual break, affects the price etc, presumerably their would be some kind of penalty. Lots of unknowns, which is never really great for the SP direction.

Also not really clear how a buyout from Roadpost would work as Beam being the manufacturer would surely then raise the margin on the units as they wouldn't be getting the subscriber money. So they would get a good injection of cash but it would seem like the Zoleo device would then become a bit problematic.

Hard to see how this works out but what I am looking to see over the next 6-9 months is an enterprise customer signed up, I get these are slow but I think if they don't manage to get one over this timeframe it means that its not that attractive to enterprise customers. I also want to see this arbitration resolved and then assess what it means. I think if the SP was closer to 25c I would be selling and probably will sell some if the SP goes for an unexpected run, but I think at the current level the longer term downside is minimal. Zoleo isn't the main driver of revenue or profit for BCC and its not hard to get a valuation on the 80K subscription revenue that is worth just as much as the current market cap of BCC.

As part of my interest in BCC I keep an alert going on Iridium in the US, as an early monitoring point for the health and condition of the satellite communications market.

I was interested in a recent press release by Iridium of a partnership with the US defence department-

“it has been awarded a five-year base Indefinite Delivery, Indefinite Quantity (IDIQ) contract with one five-year option by the U.S. Space Force for Iridium Certus® services. The multiple awardee contract is part of a U.S. Proliferated Low Earth Orbit (PLEO) Satellite-Based Services award and includes multiple Iridium partners.”

The award includes Iridium Certus™ terminals and service, which provide mission-critical broadband and midband capabilities to the modern warfighter. Iridium Certus terminals are low-profile and capable of maintaining broadband connectivity in fast-paced, unpredictable environments on land, at sea, and in the air — and can do so without landing communications in non-U.S. territories.”

As beam is the designer and manufacturer of the Certus devices and at the FY23 results they mentioned that they were designing a new certus device for launch next year, it’s possible that the new device is linked to this contract.

Early days and no contract value is ascribed to the 5yr iridium deal and indefinite delivery, indefinite quantity could range anywhere, from none to a lot, but overall I consider this a pretty positive development that should flow on the beam at some point.

Beam released a very good set of numbers this morning. A bit less NPAT than I was hoping for but they did achieved their guidance (Rev -$40m, NPAT >$2m), so I can't complain.

Revenue: $40m (+67%)

Total recurring revenue: $1.6m (Zoleo + Airtime)

EBITDA: $4.3m (+189%)

NPAT: $2.1 (vs 177K loss in FY22).

EPS:2.4c

Good FY 24 outlook commentary-

Forecast EBITDA to increase by double digits, with further increase in margins due to recurring revenue and changing product mix. As low margin Zoleo hardware sales are proportionally reduced and Iridium Go Exec and recurring revenue increase. In their words "The net result is that total revenue is likely to remain steady at around record highs in FY24 even as profitability continues to increase."

Forecasting $3m capex costs as they develop 2 new products. This is a surprise to me as I thought they might have had a period of lower reinvestment, but they have a history of good product development so this is potentially a good use of funds, but may be a slight drag on the numbers. Would be disapointed if they can't maintain and increase profitability during this next product development cycle.

The global sattelite communications market has forecast CAGR growth of 7% to a US$9.2 billion by 2030, providing a good tailwind for their products.

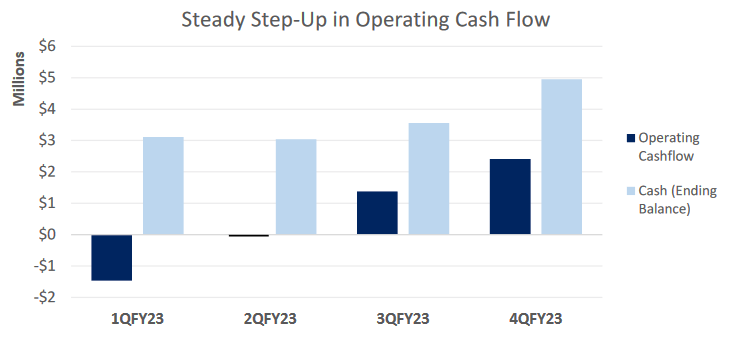

A couple of graphs that highlight the good numbers:

Product development costs are capitalised though.

Increasing Zoleo subscribers and the recurring revenue is one of the main drivers of continued profit growth. Commentary on subscriber growth numbers were that it is growing strongly and is expected to keep growing strongly. Also had an update that the JV revenue of ROW recurring revenue flows mostly to Beams pre-tax profit line. Also learnt that the 2nd phase of the European (50:50 revenue split) rollout is complete with Zoleo now available in all 30 European economic area countries. Was already available in UK.

Pretty happy to maintain my current valuation of 34c

Great result from Beam today. Nothing in the report for me not to like.

Generated $2.5M cash up 39% from Q3, total cash balance now $5M. Driven by the continued reduction in working capital and development costs. Importantly they expect positive cash flow to continue. "While it is normal for the level of cash flows to vary between quarters due to the timing of payments and receipts, the Company’s trend of positive operating cash flows is expected to continue, on current projections"

All segments of the business doing well. Equipment sales up 22% QoQ. The segment that has really surprised me over the last few quarters is the sustained growth in their Sat phone shop sales, up another 22% QoQ.

Annual royalties from Zoleo annualised at $870K, up 18% QoQ.

Total Zoleo subscriber numbers in ANZ (BCC high margin (85%revenue to BCC) segment) increased to 6200 users, up 23% QoQ, while global subscribers (15% revenue to Beam) increased to 71,000 users14% QoQ. Zoleo was looking a little shaky ther for a while but it looks like they are gaining penetration into the enterprise market with some of their recent improvements in tracking multple users from a central point. These users are where I see the long term value being created.

Confirmed that they have hit their 2023 guidance - $40M revenue, $4M EBITDA.

The JV with RoadPost (Beam owns 50%) is now material to the company so we finally get some optics around this--> JV will have total revenue of $27M of which $17M is high margin reoccurring subscription revenue.

Beam has a market cap of $15M is debt free and now has $5M cash on hand. They are also presenting at Coffee microcaps next Monday.

A good announcement by BCC on their new Iridium Go Exec product. They have now received their second order to build and ship this product to Iridium. This Go Exec contract was $12m over 5 years with minimum quantities. The exact details have been limited to date, but BCC were always fairly positive that the total value of this product would exceed the initial $12m contract. So now we know that they have achieved the first years minimum order commitment in 6 months and that they now expect that 80% of this contract will be realised by the end FY24. Its also now clearer on how much this product is driving their positive 2023 revenue numbers. They did $14m revenue in core beam products in H1 and this contract will contribute approx $4.8m to their FY23 revenue, so probably around 20-25% of 2023 revenue. This also aligns with my independant channel checks which seem to confirm that the product itself is high quality, in demand and generally has only positive reviews.

They have also not altered their guidance ffrom the last quarterly and are still on track to do around $4m EBIDTA and >$2m NPAT. I am expecting this one to surprise the market when they actually deliver these numbers. It seems like their is currently a lot of exhaustion in the SP, with low liquidity selling over the last few months dropping the price back to the covid lows, which is surprising given the newsflow has generally been quite positive in 2023.

The market cap is $16M and their EPS should be around 2-2.5c this FY. Their heavy investment in product development is now finished and they should have a couple of years of improving margins and good cash generation.

Based on the full year guidance of >$2m NPAT, which I think they should do closer to $2.5m, and start to accumalte cash on the balance sheet.

and a sharecount of 86.4m

gives an EPS of 2.9c

Apply a PE of 12 gives a fair value of $0.34

Beam Communications had a very good half and all of the headline numbers are much better than previous periods. Excitingly they are back to a solid profit making $1.16m for the half. Revenue for the half was $20.5m and EBITDA was $2.2m

All componenets of the buisness were up but the good result was really off the back of hardware sales which did $14m of revenue up 106% on pcp. This segment did have a decline in gross margin to 32%, not sure exactly why, employee costs have gone up a bit or inflation effects on components maybe. Some, but not all, of this revenue increase was due the initial $12m (min spend) over 5 year order for the recently launched, Irridium Go Exec device. Older models also sold well with commentary around demand remaining strong for these devices. These hardware devices do seem to sell well and have a long life with the initital Irridium Go now 8 years old and new orders still coming through. Core beam revenue is just sat phone hardware sales and excludes Zoleo ($5.1m) and Sat phone shop revenue ($1.1m).

Zoleo is startingt to get the recurring revenue coming through with $341K almost double the pcp. I am a bit disapointed in the ANZ segment which is where BCC get the high margin subscription revenue from. The devices have sold well in North America (>100K units) but BCC sell the initial unit for minimal margin and only get 15% of the Nth America subscription revenue as part of the original deal with Roadpost Inc. Subsciber growth in ANZ is really important and had slowed in the December quarter but commentary was that it has picked up again and sales are a bit seasonal in this area. Initially they had previously hoped to have 15K subscribers by June 23, but had dropped this target, they think it will be another 2 years before that target is achieved. New update was that 10% of the ANZ subscribers are now government and Enterprise customers. They have launced Zoleo API, which had been delayed, this programming interface lets Gov/Enterprise customers monitor the position of all of the Zoleo units they have and they think this will speed up the sales to these customers. They give a good explanation of why the direct to smartphone option isn't really a competitor, which I believe. It is worth looking at the recent investor webinars to see how they view this.

They will also start to get revenue in H2 from the contract with Mobile tracking and data ($1.2m/yr) that they signed last year

While the headline numbers were good a few disapointments was the increase in working capital and negative operating cash flow of $1.5m for the half. They do a good job of breaking this apart and explaining why it will unwind over the next few months and revert to cash. They still have 3m cash and I expect this will probably double to $6m after the full year results.

They have guided to FY23 numbers of EBITDA of approx $4m and NPAT of >$2m. If they do this and have the cash accumulating again then I think they will definately get a rerate as the few years of higher development spend should now consistently convert to increasing profit or thats the plan anyway!

Currently it is on FY23 PE of 10 so undemanding but not crazy cheap either.

Previous guidance for FY23 was to materially exceed $2.1m in EBITDA and today they have upgraded H1 to be around $2m EBITDA on $20m revenue. Last quarter they did $8m rev so had a very good xmas trading period. So should be a cracker of a full year result and bring them back into profitability.

The commentary on the upgrade was that the new Certus device (sold through Irridium) and Zoleo are selling well and that the momentum is continuing into the 2nd half. FY22 was disapoointing in terms of numbers as there was a lot of development and inventory costs that were obscuring the headline numbers, but todays announcement is a good indication that these are now moving into revenue.

I like this buisness as they have a steady production of long life hardware devices (Sat phones- sold through Irridium network) and also now have Zoleo and Certus devices which are at the front of the pack in their categories and enable them to start capturing a subscription revenue. This is the revenue that I think will start to become more meaningful into 24 and provide them with a step change.

Garmin released a new product this week, Garmin messenger which sits between their Garmin mini inreach and the full on Garmin map/gps-messenger products. This product puts it in direct competition with the Zoleo.

Biggest advantage over the Zoleo, no need for a phone app to use it and can reverse charge.

Biggest negative, cost is greater.

For more detail this podcast has a good overview comparing the two.

https://backpackinglight.com/podcast-68-unpacking-garmin-inreach-messenger/

Apple have announced an emergency SOS call via satellite on their new phone. I’ve been wondering when this would happen. Information on the feature is scant, it appears it is just an emergency SOS at this point, no tracking, messaging etc, but that would be easy to expand on. Plus, its free for the next 2 years, all emergency sat devices are currently subscription based. I also saw a mention of apple tackling Garmin head on with their new watch, Garmin is currently the clear leader in the gps/emergency/watch space, IMO.

I looked at the Zoleo product over a year ago when I was looking to upgrade my tracking/emergency device. (Would I have even known about this product if not for hearing about it on some investment platform?) It’s features and cost fell well short of the Garmin.

When I compared the Zoleo product to the Garmin, 3 big advantages stuck out.

1. A monthly sub was available, which meant you could activate the device when needed.

2. The mapping/gps function

3. Different models to choose from, size, weight, features, battery life

Spot also have 1st mover advantage in certain activities. For example, in paragliding they were adopted and became the sports standard. Everyone was trackable on the same platform, a game changer in improving safety for pilots and retrievals. This mass adoption within a user group makes it difficult. If not impossible to use a different product.

Currently we have a spot, about $300 pa (I think without looking it up) because of paragliding. I do take it on hikes/mtb as a backup or I’m with someone who has a Garmin. I’m looking at a remote solo hike next year and have a Garmin on my buy list, as it has better functionality than the Spot.

Finally in the past the iridium sat phones that Beam had were used by serious 4wd’s. (The size and weight are irrelevant when you are in a car.) Recently I heard from a friend about the “wifi” nomads in the outback are using starlink sat’s to work from their camp setups. So, it appears the sat phone may have had its days too. I’m guessing one day I’ll be able to use my iphone as a sat phone.

As a long-term user of these products, I don’t see the beam product as having any serious uptake in recreational users. There may be a market there in commercial applications, but I haven’t looked into that.

This info is based on my research over a year ago and the Zoleo product may have changed since then. I just thought my user experience may be of value to anyone watching this stock.

After a couple of quarters of higher cash spends -- mainly on prepurchase of material to fulfill orders and product development costs, this one is looking a lot better. I must admit I was starting to wonder if their model for selling Zoleo at unit costs to generate a longer tail of recurring subscription revenue was going to work or whether they were just buying negative revenue. Its still not entirely settled but this quarterly and the commentary over the last couple of years does suggest it is moving in the right direction.

The good news -

- Total revenue up 8.7m for the quarter up 79% pcp. $28m for the FY22 up from 18.5m FY21

- Positive operating cashflow of 0.5m but after investment in new product development they were -0.4m but I am ok with this as investing in the development of the Iridium Certus device will drive sales in the future - launch scheduled this year.

- Sales of non-Zoleo devices increased by 58% compared to last quarter. These are lumpy but they do consistently sell these other devices so happy to see this quarter as a good one but I dont expect next quarter to match it. A lot of these sales went through their SatPhone shop -- which is having a very good year.

- Australian & NZ Zoleo subscribers up to 3739 up 46% from Q3 and 191% from the pcp. The Aus/NZ sales are very important to my valuation as this is the high margin subcription revenue that they keep 85% of, while the Roadpost JV gets 15%.

- Uk and Europe (scandinavia) launch going well (they get 50% of profits)

- Prepurchase of material should be largely complete and the numbers in the next few quarterlies should improve.

- Still plenty of cash - 5.8m

The bad news -

- No commentary on this but they had previously guided for 15K aus/nz subscribers by end of FY23. The Covid interruptions last year had really slowed the speed of the zoleo uptake and I can't see them hitting 15K and I will be happy if they can add another 7500 in FY23. So this does push the subscription revenue out a bit, but I am still backing them to deliver on this target but it will probably be in FY24.

As a back of the envelope calculation their subscription plans range from $32 (basic, 25 sattelite messages/ month -$80 (unlimited messages), there is also a location track add on for $7.95/month. There is a $40 activation fee, and after 3 months you can pause the subscription so I think they have tailored these to be pretty appealing to their target markets. I am thinking the margin on this should be around the 60% area but this has not been disclosed

At 10K subscribers on the basic plan is $3.8m revenue of which they will get 85% ($3.2m). (not including churn-1-2%, activation fee ($40) or subscription pauses). If the margin is 60% then around $1.9m drops to the bottomline. This is overly simple but illustrates why I like this opportunity.

Beam has sold 91K Zoleo units to the Roadpost JV, but they will only get 15% of the net profits from these units sold in US/Canada. They have not given a lot of detail on the numbers of the JV but we should get some in the annual report and hopefully they are paying out a dividend to Beam this year. I think it is safe to say that Zoleo is a product that is appealing and will keep selling and now it is just getting clarity on how much money they will actually make from it.

***

Not much response to this announcement at the open this morning despite the fact this feels like one of the more positive announcements this company has released in a while. That is saying something because Beam does tend to release a lot as price sensitive. That's probably at the core of why I'm wary of Beam. There seems to be a lot of releases in regards to orders, that never seem to convert into sales or revenue, or at least are very slow to do so. I'd be happy for holders to show me how I'm wrong though.

[Not held]

I have also purchased a small holding in this recently. Zoleo appears to be a great product (4-5* on amazon/catch/myer), with ease of use being a key positively reviewed feature. I am interested to see how the government trial is going in the NT as these could be decent recurring contracts if rolled out across all remote emergency services etc.

I am also attracted to the fact that the legacy business is already profitable, and management have skin in the game. I don't like that r&d is capitalised, something to keep an eye on.

The stock appears to be undervalued with the market not pricing in the potential upside from a successful Zoloe rollout. As someone else mentioned the risk-reward seems to be to the upside at this stage