Pinned straw:

Nice work @mushroompanda

I've long had a weird fascination with these PDP businesses. Have owned both PNC and CCP and have dodged bullets on both. When they are on song they pump cash but they also blow themselves up from time to time.

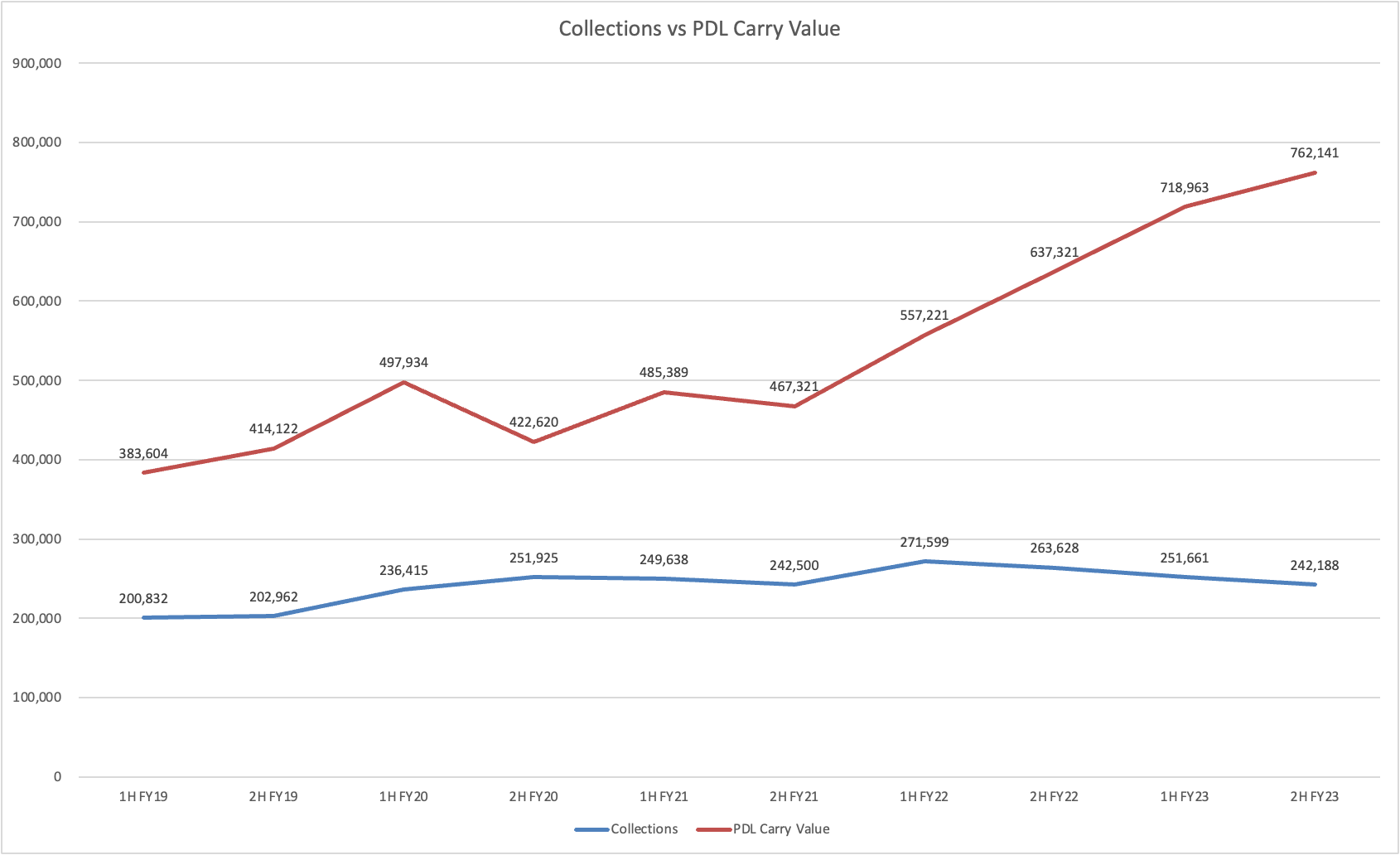

That strikes me as weird (unless I've done something wrong) that a $45m NPAT adjustment is ~$80m or so for a 14% write down which implies a book value for the US PDPs of something like $570m. Given the total PDP value in FY23 was $780m, 73% seems higher than I would have anticipated given the collections profile between the two geographies. That might explain @mushroompanda chart of rising PDPs but flat collections.

Obviously they have overpaid. The question is by how much and how it affects the US business over the next few years. It's probably worth pointing out their debt has an LVR covenant of 60% of the book value of the PDPs. Back of the envelope this would get them to around 45% so a lot would have to go wrong from here for them to breach that covenant, but in terms of access to funding another couple of write downs and the headroom could start to shrink to a point it affects PDP investment decisions. The cashflow profile of these PDPs is such that they can really be turbocharged by using debt (usually able to collect the investment within 12 months or so and can daisy chain the debt along to build a cf stream etc) Lack of funding has hampered PNC for a few years now.

Interesting times.

Watching from the sidelines.

Yes well done Panda. one of the strengths of SM is the record of your past comments, held to account both good and bad. i can see my comment above as well

re CCP, historically buying it on a bloodbath has been a profitable strategy and maybe that will be shown to work again this time. the bigger picture, imo, is that I once viewed this company as a quality LT grower, hard to see that thesis as holding true, It has evolved into an ordinary company, along with countless others. so of less interest to me LT.

@mushroompanda fair enough, maybe C19 largesse has killed off the debt book biz for a while. as i looked more at this result i was surprised by the biz mix changes, as more personal lending grows as well as the US, it deserves a lower multiple, imo. i understand what they are doing but not that thrilled by it all. too many play in personal lending.

at least they controlled their funding costs unlike SVR (MNY)

This is brilliant analysis @mushroompanda. Better than anything I've seen come out of the sell side brokers on CCP since the result.