Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Not a bad market reaction to Credit Corp’s FY2025 results, with shares up 20% at one stage.

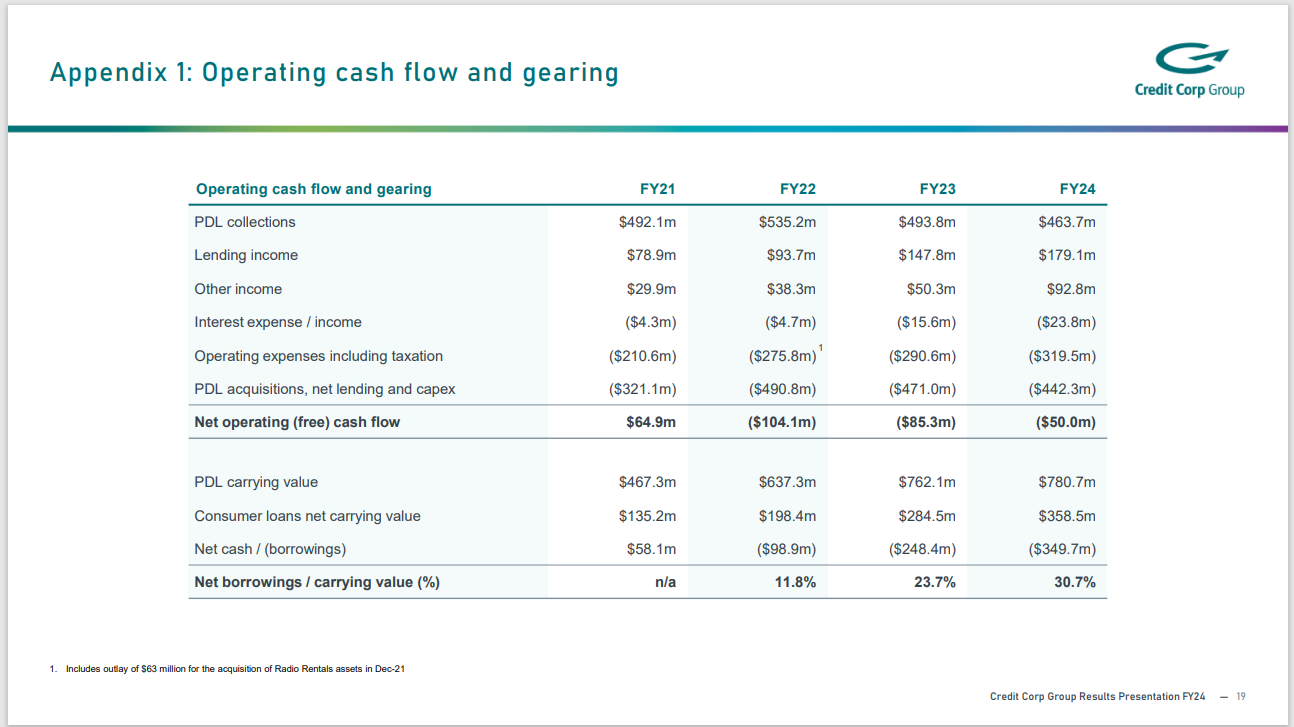

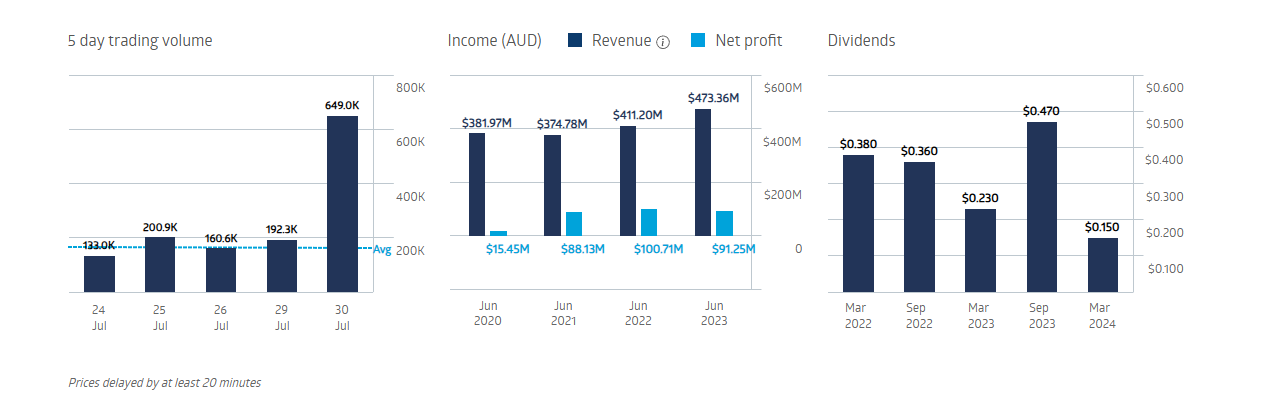

The numbers seem pretty good, at least at a surface level. NPAT came in 86% higher than last year, which was hit by impairments and accounting changes. Operating cash flow swung back into the black too (+$51 million vs -$50 million in FY24), and ROE nudged higher to 15.6 percent.

Last year’s result had a few red flags, as discussed at the time. Especially that change in PDL life cycle assumptions (from 6 to 8 years), which some here rightly questioned.

But this year things look a lot cleaner. It was also great to see growth in the US and lending segments. The FY26 outlook is for another 12% NPAT lift, and they have already secured 70 percent of their US PDL investment pipeline.

Given the heat CCP copped over US PDL accounting and impairments a couple years back, it is encouraging to see the business lean into operational improvements and (hopefully) more disciplined investment. It seems like a genuine course correction.

So it feels like they have stabilised things, which is good to see. No reason not to think they can keep trucking if they maintain that discipline.

Another year on from the Including staff acquired as part of the acquisition of Collection House during H1 FY23

Noted: Net Profit Margin 1 Year is down from: 19% to 9.37%

But

ROE: is rising

CCP share price and company information for ASX:CCP

About CCP

The Company operates within the Australian debt collection and consumer lending industry.

Events

Directors / Senior management

- Mr Eric Dodd

- Chair, Non Exec. Director

- Mr Thomas Beregi

- Managing Director, CEO

- Mr Phillip Aris

- Non Exec. Director

- Mr Bradley John Cooper

- Non Exec. Director

- Ms Lyn McGrath

- Non Exec. Director

- Mr James Morrison Millar

- Non Exec. Director

- Ms Trudy Vonhoff

- Non Exec. Director

- Mr Matthew Angell

- Chief Op. Officer

- Mr Michael Eadie

- CFO

Secretaries

- Mr Michael Eadie

- Company Secretary

- Mr Thomas Beregi

- Company Secretary

CCP head office

Head office contact information

address

Level 15, 201 Kent Street, SYDNEY, NSW, AUSTRALIA, 2000

Telephone(02) 8651 5000

Fax1300 483 012

Web site

Share registry

Share registry contact information

share registry name

BOARDROOM PTY LIMITED

address

LEVEL 8, 210 GEORGE STREET, SYDNEY, NSW, AUSTRALIA, 2000

Telephone(02) 9290 9600

Sold my holdings on the day of the results. Like @lankypom, I’ve held for an extended period of time since Nov 2010. I also held it in a previous stint from Sep 2004 to Nov 2007.

Consumer Lending did a lot of heavily lifting in the result. The EBITDA return on the carry value of the three main segments - Consumer lending, ANZ PDLs, and US PDLs were 33%, 15.7% and 8.8%. Who would have thought 10 years ago that Consumer Lending would be the division that would be wildly more profitable than the core PDL businesses.

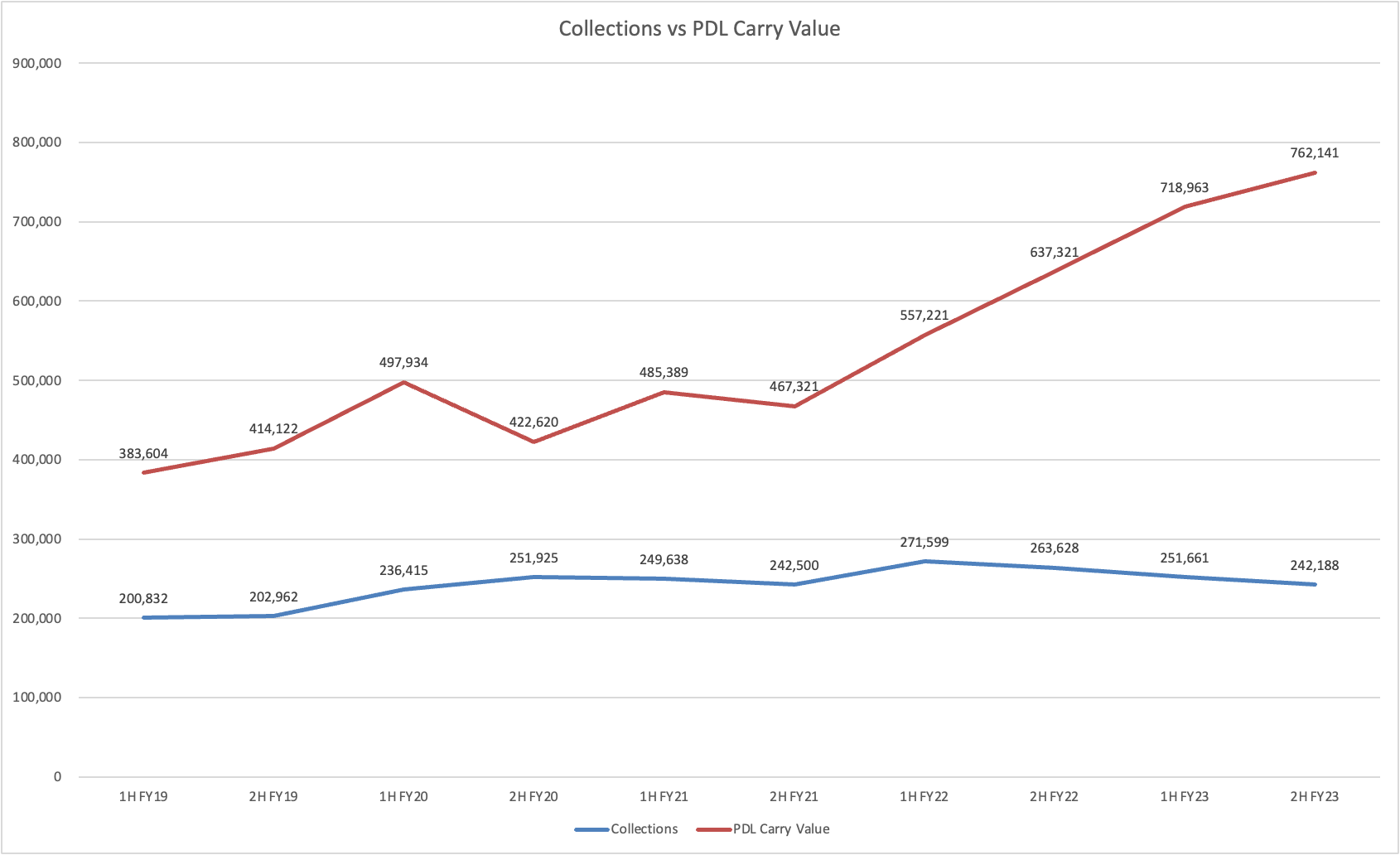

My main concern is the ballooning carry value of the PDL assets on the balance sheet.

Collections have been declining in the past 3 halves, yet the PDL carry value has been increasing. If one thinks that an asset is increasing in value, should it be yielding less? This doesn’t make a whole lot of sense, and shows that management have had a shift away from their ultra conservative accounting practices.

The ANZ PDL business is currently in run off as its not able to get the supply necessary to grow collections. The business collected $141m in 2H. Just for comparison, this is very similar to the collection level the group had in FY15 which was $288m for the full year. To highlight the shift in the company’s conservativeness, the carry values for FY15 vs Today is $164m vs $297m.

I’m harping on about PDL carry values because the amortisation of it affects every number from the revenue down. Revenue is in fact Collections minus PDL amortisation. And the shift to a less conservative stance has benefited the bottom line over the past couple of years.

In absolute terms, Credit Corp’s PDL carry value is still conservative vs its competitors. But that’s not saying much in an industry littered with blowups.

The US PDL carry value is the one I’m most concerned about. They’re carrying A$465m on the books, and collecting about $200m a year. Having seen repayment plan delinquencies creep up in Q4, collections have started to flatten after heavy investments PDL and big headcount increases. The carry value seems bloated and the Amortisation vs Carry Value ratio for the US business is at PNC’s levels of 0.21, having consistently trended down over the past few years.

I’m concerned about write downs. If not write downs, then the headwind the relaxation of the amortisation policy will have on the profits in future years.

NPAT fell by 5 per cent over the prior year to $91.3 million. While lending segment earnings grew strongly, the impact was offset by continued run-off in the core AU/NZ debt buying business and costs arising from increased US resourcing.

Conclusion:

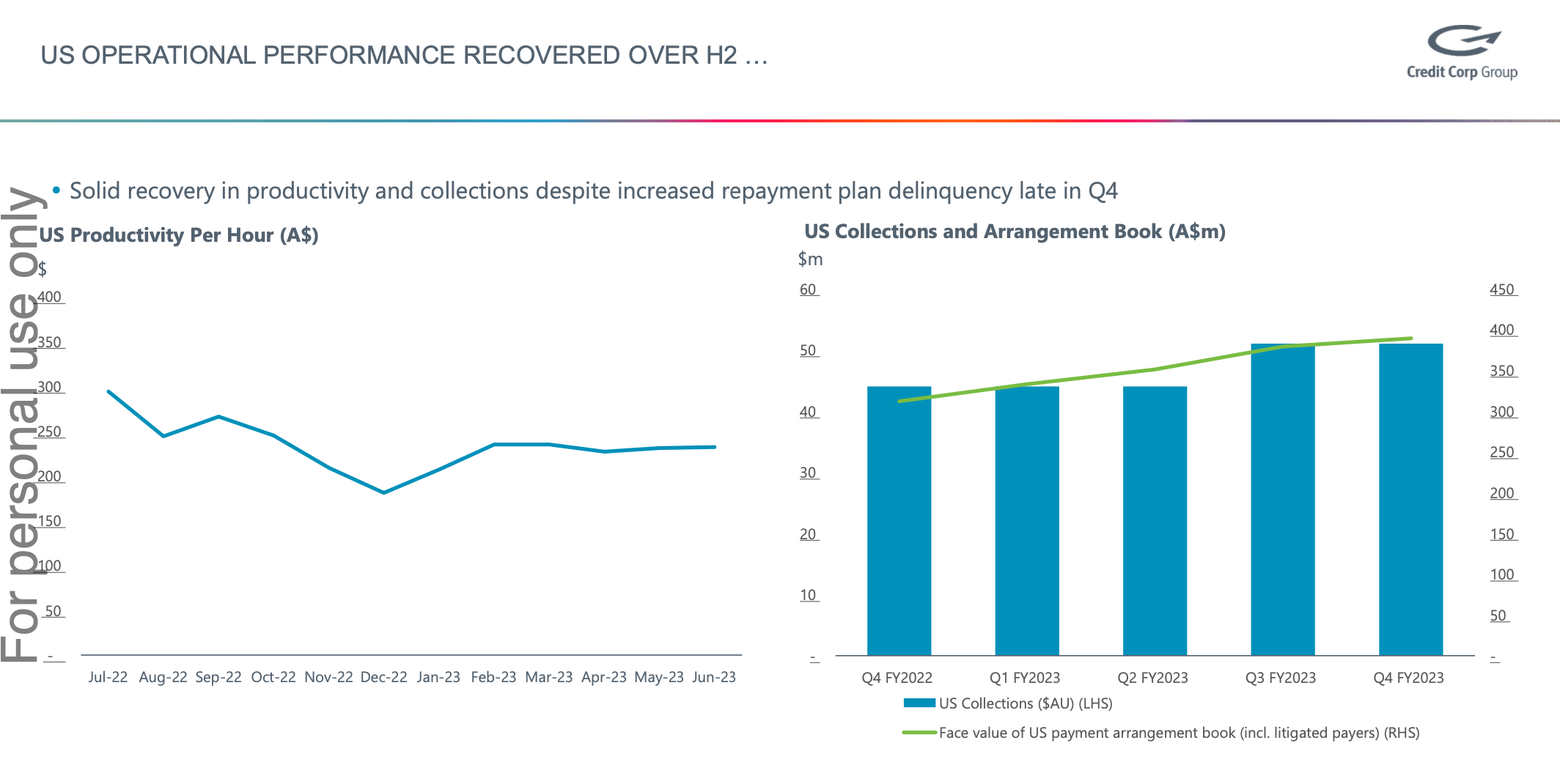

FY23 earnings were 5% lower on FY22, as rising wage costs and lower labour productivity more than offset a 15% growth in revenue. Nonetheless, the results were in line with consensus expectations. However, management's FY24 earnings guidance is ~10% below consensus expectation.

Share price reaction down ~ 11% ...Good for ones looking to purchase some more.

Credit Corp has released FY2023 results showing:

- 70% growth in lending segment net profit after tax (NPAT)

- 43% growth in the consumer loan book to a record gross closing balance of $358 million

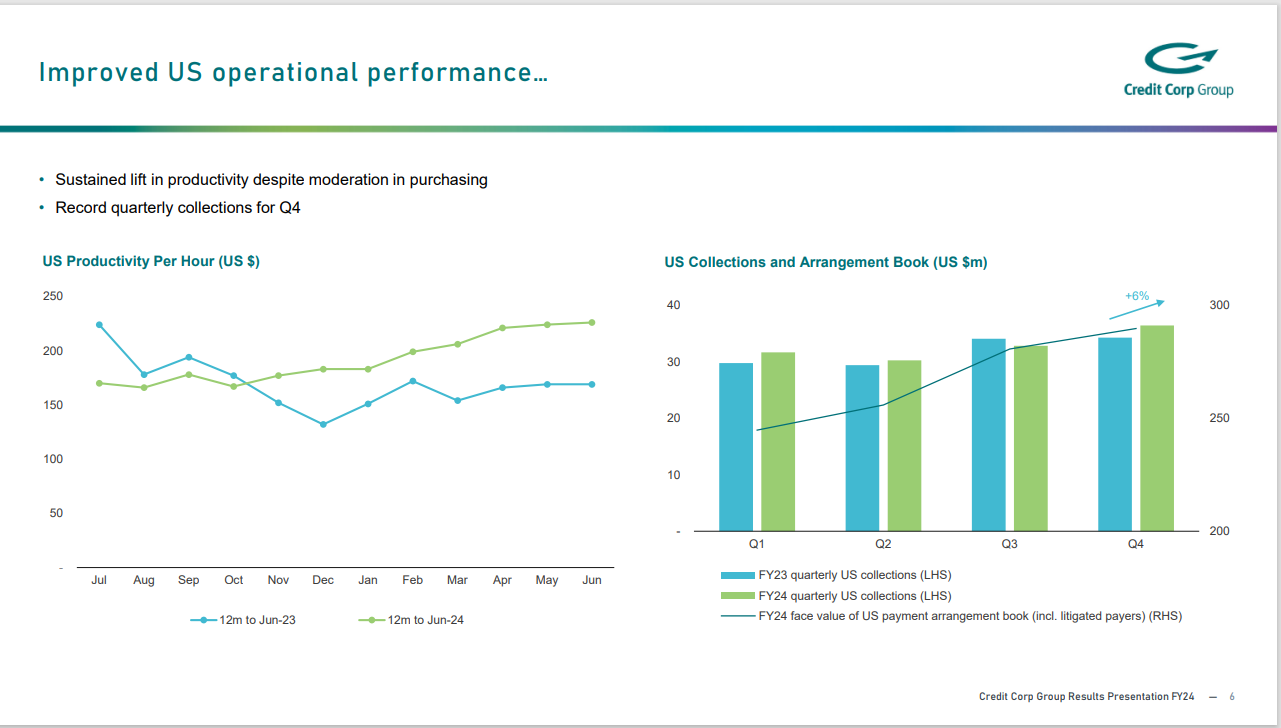

- Recovery in US operational performance over the second half

- Solid FY2024 US investment pipeline secured in improved pricing conditions

NPAT fell by 5 per cent over the prior year to $91.3 million.

And the market hated it, marking it down by 14%.

Reducing Exposure: Voting power back to 7.60%

6 signs you should sell | Wilson Asset Management

- Large investors exit

A shareholder owning more than 5% of a company must notify the market if they cease being a substantial shareholder.* We closely watch substantial shareholder notices announced on the ASX to identify if large investors are entering or exiting a company. When one of these large investors announces it is no longer a substantial shareholder, it may indicate they are planning to completely exit their holding. As large positions can take many weeks (or even months) to unwind, this may put downward pressure on the company’s share price in the short-term.

While we can only make inferences from substantial shareholder announcements, they can provide valuable insights which may feed into our investment decisions. Investors should note that when large shareholders announce they are no longer a substantial shareholder, they may only be temporarily exiting, or modestly reducing, their holding in the company.

For example, fund managers of open-ended investment vehicles may be forced to sell some of their shares in order to fund redemptions.

I’m actually surprised by the share price action post 1H FY23 Results. The market seems to have taken notice of the medium-long term improvements and discounted the short-term pain and what on the surface looks to be a terrible result.

The Bad

- Revenue for 1H FY23 is up 8% but NPAT is down 30% pcp and the dividend payout is down a whopping 40%.

- Aus/NZ PDL collections are in run off mode because Australian PDL supply is currently 60% lower than pre-covid. There’s just not enough debt to buy.

- US collections is slower than expectations due to the big influx in new staff and the ramp up time required. Management is probably 6-12 months behind where they expected to be on this front.

The Good

- Consumer lending book has grown rapidly - 66% over the past year. Some might view this as a negative going into a recessionary environment. However loss rates are still below pro-forma and pre-covid levels, and the loans are mostly short-term in duration so management believe expansion is currently the correct move. A larger lending book will post higher interest revenue into the future.

- US PDL supply is increasing significantly, and management believe the prices will moderate as a result. They’ll be letting all the forward-flow agreements lapse this financial year, keeping some dry powder and hopefully scooping up PDLs at lower prices.

The Nuance

- When the company writes a loan, it takes an upfront ~20% provision expense to anticipate the potential of future losses. However loss rates are currently only running at ~13% I believe. When these loans are completed, the difference is written back as profit. You have an interesting dynamic where the faster the company grows the loan book in a given period, the worse the statutory NPAT will be. This was a major reason the NPAT result for the half was poor. NPAT will rebound strongly next half as lending abates (demand peaks leading into Christmas).

- The management team is very savvy financially (as you need be in this business), and also very conservative. $3m in project costs for new consumer lending products was incurred in this half (will be piloted in 2H), but they don’t capitalise it or provide any adjusted numbers with this backed out. The CLH acquisition incurred $5m of restructuring cost this half, which they also didn’t call out. The company takes provisions (estimated future expenses that are expensed immediately) for the integration costs of the Baycorp and Collection House acquisitions. After 3 years (as of FY22 report), there’s still $5m of provisions on the balance sheet for the former. For whatever reason, Credit Corp has a propensity to take expenses early, and thereby downplaying the current level of success. This is a rarity in small cap land, and in particular the areas of debt buying and consumer lending - where adjusted EBITDA-alphabet-soup metrics are pushed to the limits.

I’ve had a long history with Credit Corp. It was my first ever purchase of my own volition all the way back in 2004. Back then, I liked the revenue growth, the ROE, and its P/E ratio at around 20 was reasonable. In retrospect, I had no clue what I was doing. And every year, I’m more and more of the opinion that financial services is an area that new comers should avoid completely.

Revenues, profits, and many of the conventional fundamental metrics are meaningless without understanding how loss rates or amortisation rates are calculated. And knowing the relative comparison with peers is not enough, but one needs to understand how it sits at an absolute level. For example Credit Corp was always much more conservative with amortisation vs its peers, but all its peers turned out to be abject failures - Repcol, Baycorp, Collection House, Pioneer Credit. So maybe CCP was not “conservative” at an absolute level, but just more “correct”.

In a recent Baby Giants episode, Claude spoke about how Redbubble, to some extent, can choose its sales number by its allocation on ad spend. I really like the comment because I feel lots of companies are in this position, but it’s not spoken about much. This is even more the case for debt buyers and consumer lenders. Debt buyers can buy more debt by bidding higher, and consumer lenders and lend more by relaxing lending standards. Both are not good things. I cringe whenever I hear these companies boasting about “gaining market share” with no reference to the trade-offs made. It’s like someone boasting about buying the most houses in Australia this week (“I’m taking market share”).

If you got down this far. Thanks for reading :D

Hi @BoredSaint - there are some reasons I think to be cautious about Credit Corp's valuation. The Purchased Debt Ledger (PDL) business is a difficult business and I'm not sure the economics of the industry will be good for investors. The problem is that the money in this business is either won or lost on purchases of debt ledgers. Of recent times there has been little supply of PDLs (as banks, utilities and other sellers have pulled away from selling down their old, bad debts) and high demand, pushing prices up. Unfortunately, in this industry if someone overpays and has a problem, it doesn't emerge for quite a while, sometimes years. Because the debt books are always being wound down, anyone in a listed environment has to keep buying ledgers to show growth (as CCP has done in the last few years). So limited supply, high demand and institutional imperative to keep buying, means to me that these businesses will at some point struggle to show returns. This has been a factor in this industry for some years now and CCP as the biggest isn't unfortunately immune from it either.

I don't own CCP IRL or SM, nor any other debt collection/PDL businesses for this reason.

Update 01/02/23

Update following 1HFY23 results

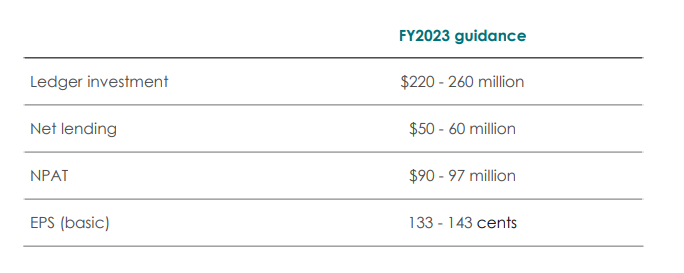

Guidance remains unchanged for full year NPAT of $90-97m

15x PE on mid point of guidance ($93.5m) would give valuation of $20.59

Update 02/08/22

Updating based on FY22 results.

15x PE on $96.2m NPAT gives a valuation of $21.28.

Original Valuation

More of a price target (buy target) than an actual valuation.

Based on forecast FY22 NPAT of $92m (low end of guidance) and applying a 15x PE (approximately the avg PE prior to 2020) gives a target of around $20.35.

Disc: Held IRL, not held on Strawman.

Credit Corp (CCP) released their first half results for FY23 this morning. From their release:

CCP attributed the decrease in NPAT (compared to CCP) to:

- up-front loss provisioning and marketing expense from rapid loan book growth;

- costs arising from increased US resourcing; and

- run-off in the core AU/NZ debt buying segment.

I think overall it was a poor half on the surface for CCP but this could be laying the foundation for future growth especially in the US. Just on the lending side, they are expecting 2HFY23 NPAT to be $25-30m (up from $4.3m in 1HFY23).

Guidance remains unchanged:

Will continue to hold but will need to see their investments pay off especially in the second half of this year.

Full presentation here

Disc: Held IRL. Not held on Strawman.

As previously advised, the DOCA includes the transfer of all shares of CLH to Credit Corp (or its nominee), subject to the Deed Administrators obtaining an order from the Court pursuant to section 444GA of the Corporations Act 2001 (Cth) (“444GA Order

Credit Corp Group (CCP) today announced its FY22 results. From their release:

- 9% increase in net profit after tax (NPAT) to $96.2 million

- Record annual investment:

- US purchased debt ledger (PDL) outlay 80% above previous peak (FY2020)

- Gross lending volume 24% above prior record (FY2019)

- 16% increase in US segment NPAT

- Recovery in lending segment earnings and loan book

Management also provided guidance for FY23:

Overall a fairly good result for CCP. I see this business as counter-cyclical given their business of debt collections. Management did flag that overall AU/NZ debt purchasing has not recovered to pre-covid levels and thus most of the growth in the business has been through the increase in US debt purchasing. This has also run into issues in regards to staffing in a tight labour market although management have made the move to use offshore (Philippines) staff to make up the numbers.

Free cash flow was negative as a result of acquisitions (Radio Rentals in particular) although management do expect FCF next year to exceed $100m providing them with sufficient cash for potential acquisitions.

Outlook implies not a lot of growth for the coming year although I feel management are always quite conservative in their guidance.

Disc: Held IRL, not held on Strawman.