Credit Corp Group (CCP) today announced its FY22 results. From their release:

- 9% increase in net profit after tax (NPAT) to $96.2 million

- Record annual investment:

- US purchased debt ledger (PDL) outlay 80% above previous peak (FY2020)

- Gross lending volume 24% above prior record (FY2019)

- 16% increase in US segment NPAT

- Recovery in lending segment earnings and loan book

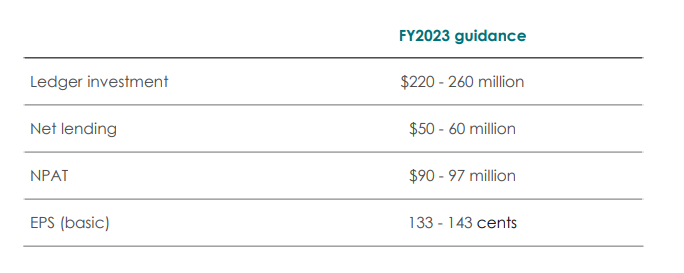

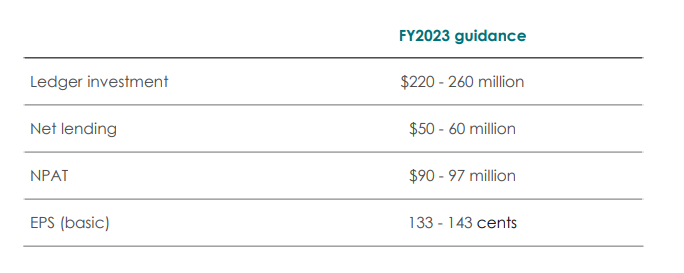

Management also provided guidance for FY23:

Overall a fairly good result for CCP. I see this business as counter-cyclical given their business of debt collections. Management did flag that overall AU/NZ debt purchasing has not recovered to pre-covid levels and thus most of the growth in the business has been through the increase in US debt purchasing. This has also run into issues in regards to staffing in a tight labour market although management have made the move to use offshore (Philippines) staff to make up the numbers.

Free cash flow was negative as a result of acquisitions (Radio Rentals in particular) although management do expect FCF next year to exceed $100m providing them with sufficient cash for potential acquisitions.

Outlook implies not a lot of growth for the coming year although I feel management are always quite conservative in their guidance.

Disc: Held IRL, not held on Strawman.