Sold my holdings on the day of the results. Like @lankypom, I’ve held for an extended period of time since Nov 2010. I also held it in a previous stint from Sep 2004 to Nov 2007.

Consumer Lending did a lot of heavily lifting in the result. The EBITDA return on the carry value of the three main segments - Consumer lending, ANZ PDLs, and US PDLs were 33%, 15.7% and 8.8%. Who would have thought 10 years ago that Consumer Lending would be the division that would be wildly more profitable than the core PDL businesses.

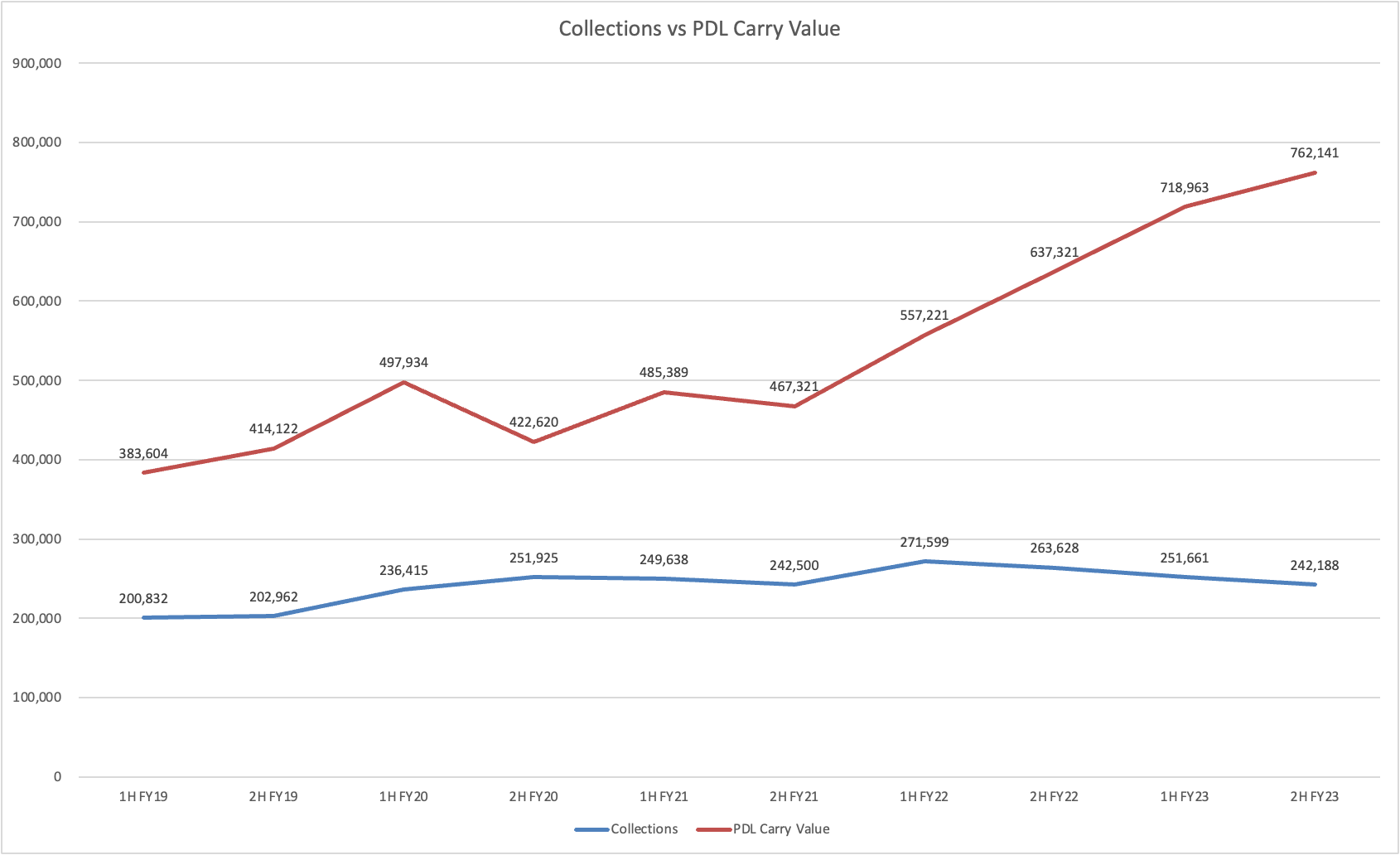

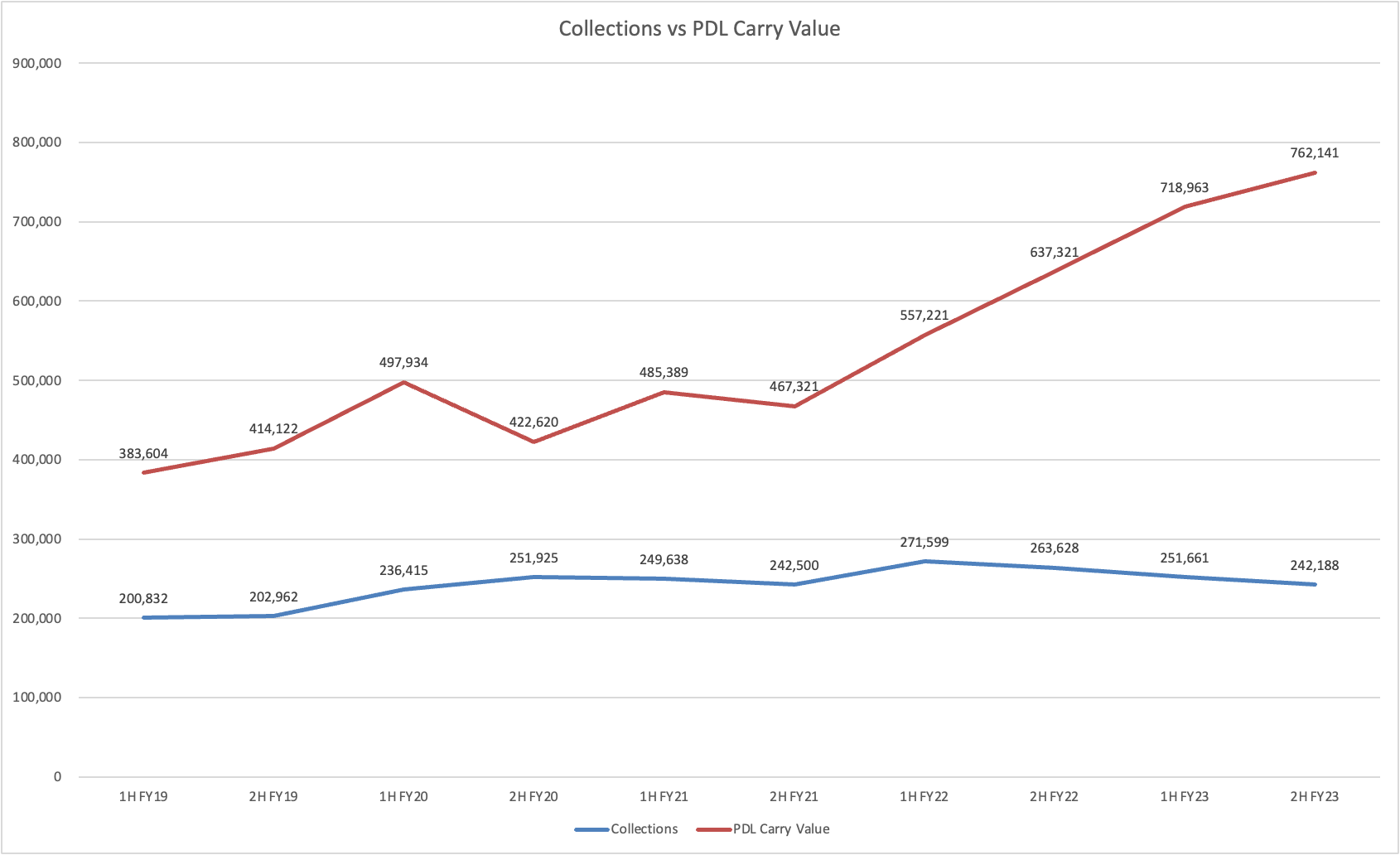

My main concern is the ballooning carry value of the PDL assets on the balance sheet.

Collections have been declining in the past 3 halves, yet the PDL carry value has been increasing. If one thinks that an asset is increasing in value, should it be yielding less? This doesn’t make a whole lot of sense, and shows that management have had a shift away from their ultra conservative accounting practices.

The ANZ PDL business is currently in run off as its not able to get the supply necessary to grow collections. The business collected $141m in 2H. Just for comparison, this is very similar to the collection level the group had in FY15 which was $288m for the full year. To highlight the shift in the company’s conservativeness, the carry values for FY15 vs Today is $164m vs $297m.

I’m harping on about PDL carry values because the amortisation of it affects every number from the revenue down. Revenue is in fact Collections minus PDL amortisation. And the shift to a less conservative stance has benefited the bottom line over the past couple of years.

In absolute terms, Credit Corp’s PDL carry value is still conservative vs its competitors. But that’s not saying much in an industry littered with blowups.

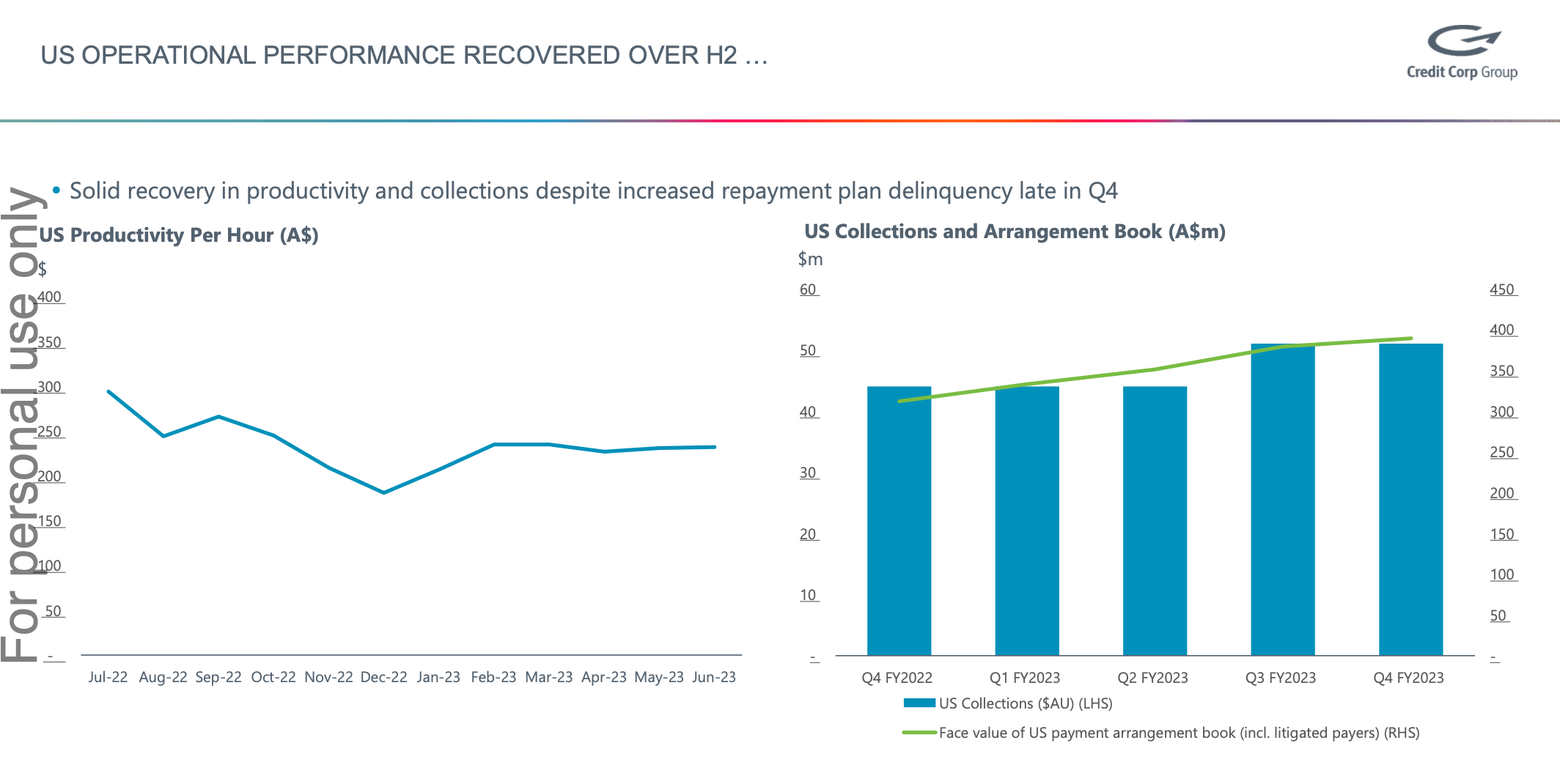

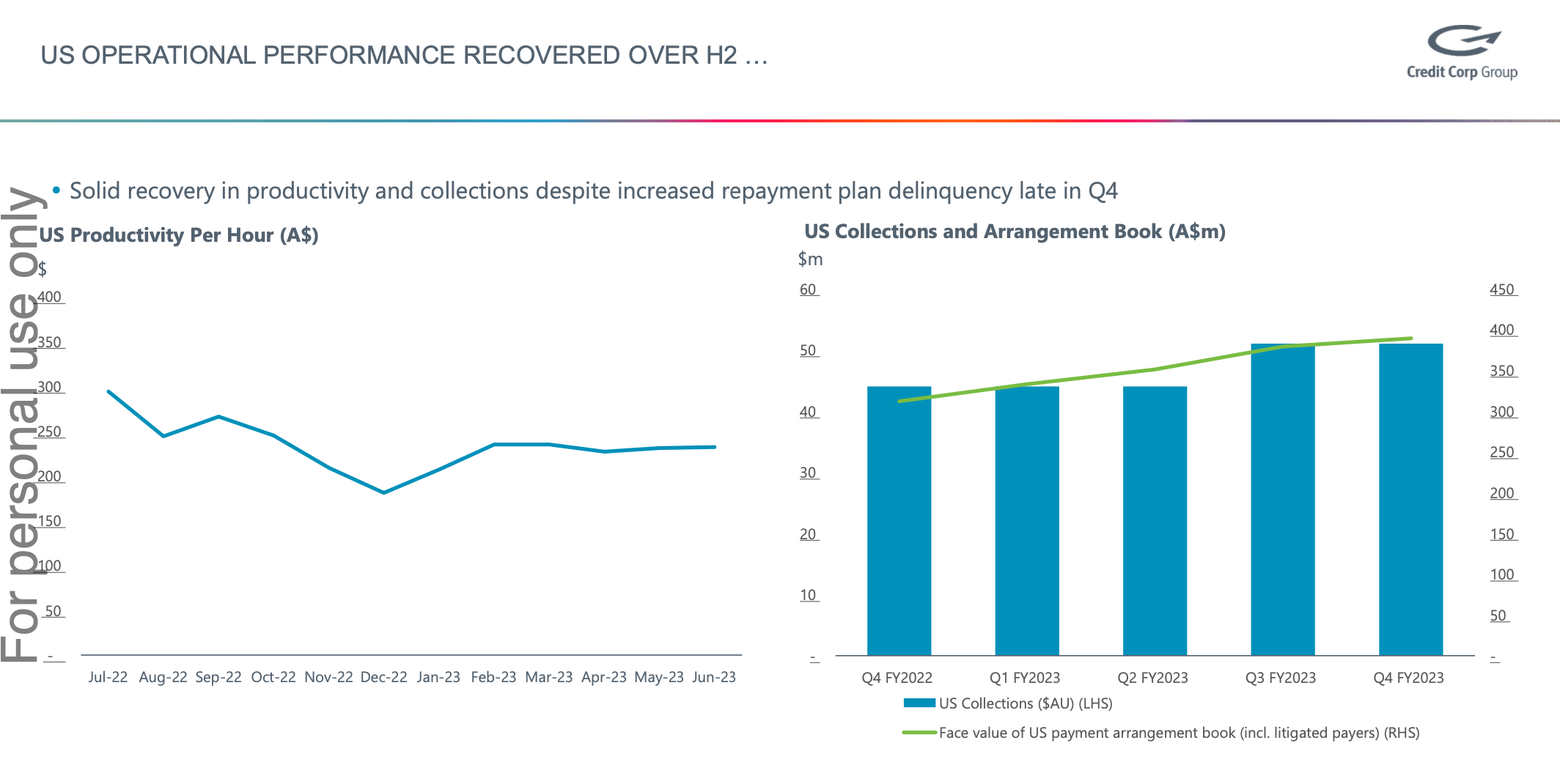

The US PDL carry value is the one I’m most concerned about. They’re carrying A$465m on the books, and collecting about $200m a year. Having seen repayment plan delinquencies creep up in Q4, collections have started to flatten after heavy investments PDL and big headcount increases. The carry value seems bloated and the Amortisation vs Carry Value ratio for the US business is at PNC’s levels of 0.21, having consistently trended down over the past few years.

I’m concerned about write downs. If not write downs, then the headwind the relaxation of the amortisation policy will have on the profits in future years.