Another year on from the Including staff acquired as part of the acquisition of Collection House during H1 FY23

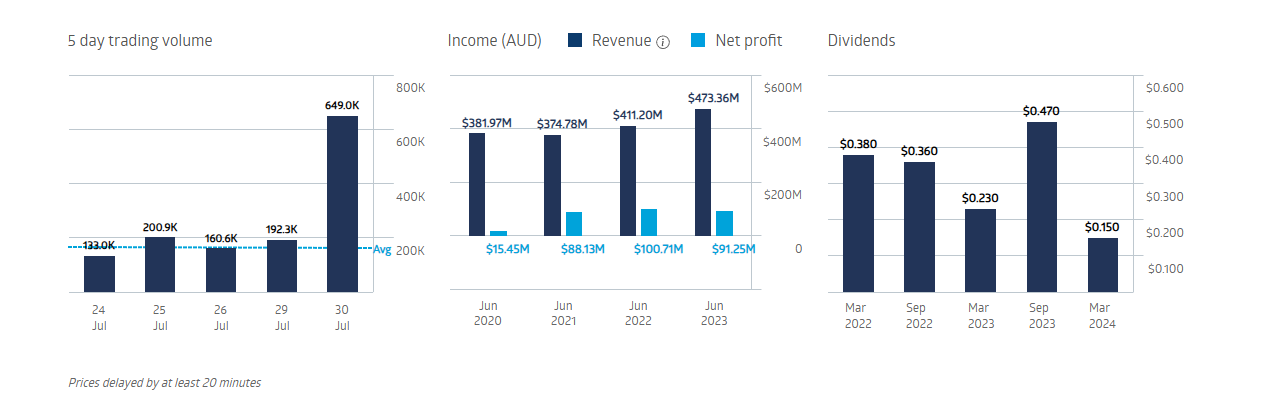

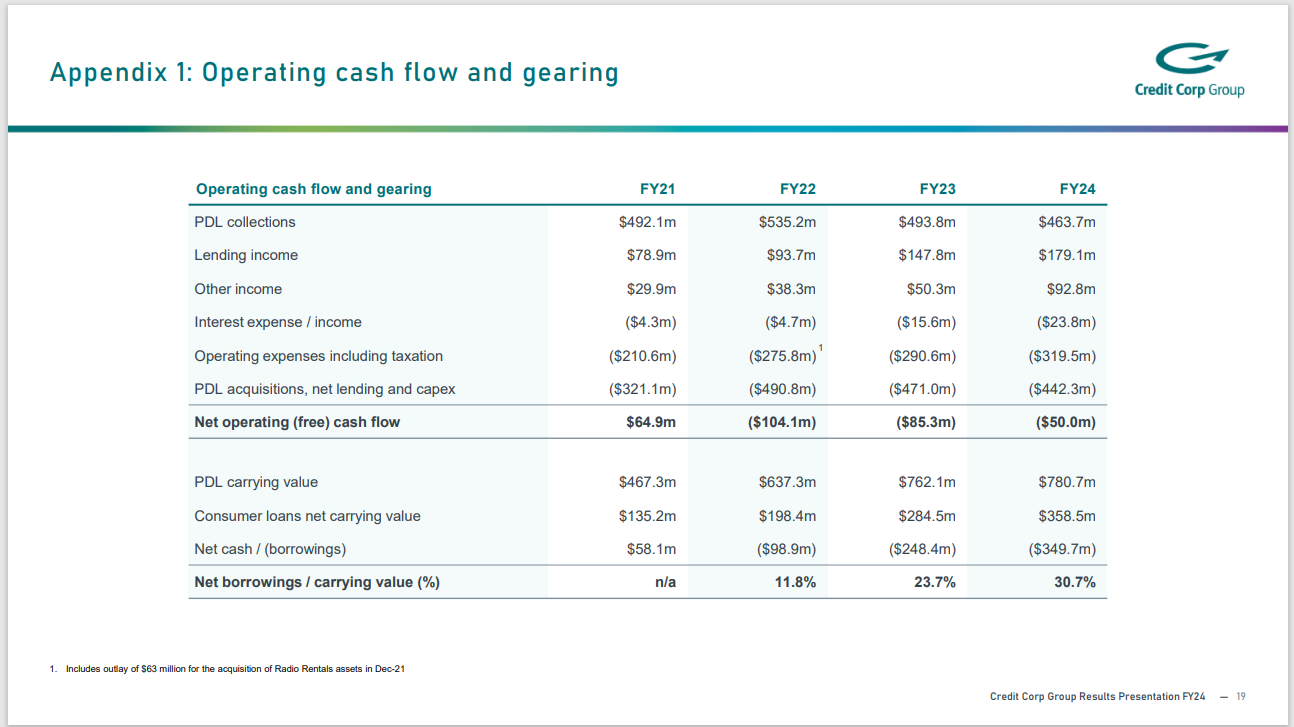

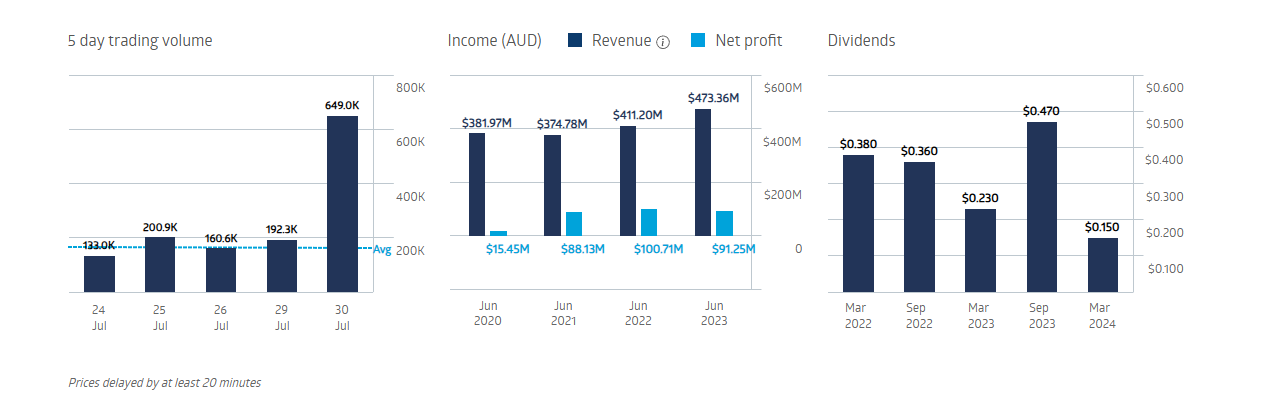

Noted: Net Profit Margin 1 Year is down from: 19% to 9.37%

But

ROE: is rising

@mushroompanda

CCP share price and company information for ASX:CCP

About CCP

The Company operates within the Australian debt collection and consumer lending industry.

Events

Directors / Senior management

- Mr Eric Dodd

- Chair, Non Exec. Director

- Mr Thomas Beregi

- Managing Director, CEO

- Mr Phillip Aris

- Non Exec. Director

- Mr Bradley John Cooper

- Non Exec. Director

- Ms Lyn McGrath

- Non Exec. Director

- Mr James Morrison Millar

- Non Exec. Director

- Ms Trudy Vonhoff

- Non Exec. Director

- Mr Matthew Angell

- Chief Op. Officer

- Mr Michael Eadie

- CFO

Secretaries

- Mr Michael Eadie

- Company Secretary

- Mr Thomas Beregi

- Company Secretary

CCP head office

Head office contact information

address

Level 15, 201 Kent Street, SYDNEY, NSW, AUSTRALIA, 2000

Telephone(02) 8651 5000

Fax1300 483 012

Web site

http://www.creditcorp.com.au

Share registry

Share registry contact information

share registry name

BOARDROOM PTY LIMITED

address

LEVEL 8, 210 GEORGE STREET, SYDNEY, NSW, AUSTRALIA, 2000

Telephone(02) 9290 9600