Nick Scali isn't the only great retailer on the ASX. JB HiFi certainly seems to be holding its own, with full year results coming in above expectations.

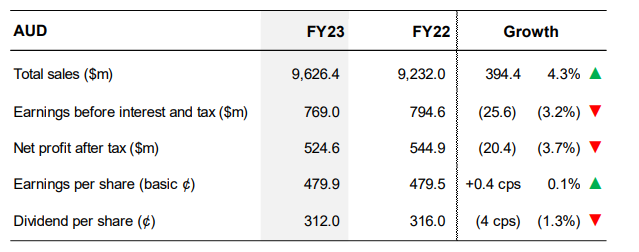

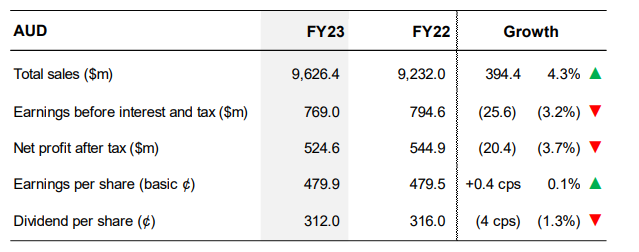

You can get all the details here, but the high level view is this:

Yes, it's essentially flat on a per share earnings basis (but still technically a record result), and given the much-touted difficulty in retail it aint half bad. Especially given that it's cycling off all that 'work from home' demand that we saw post covid. Related to this, online sales were down about 20%.

Gross margin was up, but operating margins were slightly weaker -- cost of doing business was up marginally (I'm assuming higher wages, but they don't spell this out). Still, the business is doing EBIT margins of 8% in aggregate, which is up there relative to global peers.

Balance sheet remains in rude good health -- the cash balance increased $52m over the year to $177m. Debt remains negligible, in fact it dropped 17% to $49.8m. They can meet their interest expense 170-times over.

Still, we know that a lot of the mortgage related pain is yet to wash through discretionary retail (as mikebrissy pointed out nicely elsewhere); July saw sales growth of -1.8% for JB Hi Fi Australia, and -12% for the Good Guys. JB Hi Fi NZ was actually strong up 10% (not exactly sure why, i need to dig deeper, but there were no new stores opened in FY23 in NZ). The good Guys actually saw a decline in sales of about 8% in the 4th quarter, so it looks like the weakest link at present.

No guidance was issued, but at present shares are on a yield of 6.5%, or almost 10% when accounting for franking. The PE is 10.

These metrics are right at the better end of the spectrum, historically speaking, again reflecting expectations for a tough 12 months. And, like with Nick Scali, investors need to be wary of the operating leverage (eg a 10% drop in sales would, assuming the same gross margins and CODB, would reduce pre-tax profit by about 35%).

Still, it doesnt seem too bad.

Disc: not held