Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

JB Hi-Fi shares slip despite sales growth

Investors are bidding down JB Hi-Fi shares today despite the company reporting quarterly sales growth across all its businesses.

The ASX 200 retailer reported total sales growth of 6% for JB Hi-Fi Australia, with comparable sales growth of 5%.

And the company's New Zealand branch saw a major uptick in business, with total sales growth for JB Hi-Fi New Zealand of 39.3% and comparable sales growth of 24.3%.

At The Good Guys, total sales growth for the three months to 30 September came in at 2.5%, with comparable sales growth of 2.4%.

And JB Hi-Fi reported total sales growth for e&s of 4.1% with comparable sales growth of 0.7%.

Interesting interview on how important company culture is in investing here -

https://www.livewiremarkets.com/wires/qiao-ma-why-culture-should-be-key-to-your-investment-decision-making?utm_campaign=87365&utm_content=wrap_up_instant&utm_term=qiao-ma-why-culture-should-be-key-to-your-investment-decision-making&utm_medium=email&utm_source=campaign+monitor

As someone who has created a successful business as well as worked in others, I would put an authentic, appropriate and sustainable culture right at the top of the most important necessities you need to be successful as a business.

So reflecting on this in relation to companies I own or are following this year...

From the snippets I have seen in investor calls, meetings and up close at AGM's, in relation to how they view their shareholders (which is probably pretty similar to how they view staff and customers you'd guess) -

It's excellent at Codan, Nick Scali, Mainfreight, Silk Logistics and Jumbo Interactive.

It's good at Charter Hall relative to the property industry.

It's secretive at Data 3 but I'm not sure if thats ok or not.

It's bad at JB Hi-Fi and Paradigm Biopharmaceuticals.

And I don't know at Dicker Data, Duratec or Resmed as I haven't got up close with them yet.

As always, just my observations and opinions but I am guiding my capital around accordingly...

I attended the JB Hi-Fi AGM this morning. Nothing especially new or exciting business or strategy wise. However I was not impressed by the behaviour of a number of Board members and the Company Secretary in the meeting. In my opinion they came across as over confident, chuckled at legitimate shareholder questions and in one case were disinterested. For the $159 000 + we pay them in Board fees a year I expect a lot better than that at the one event a year they have to interact with their individual shareholders. One of the three Directors up for election today has too much on their plate and another has several black marks against her for significant risk failures at past ASX listed Directorships that destroyed shareholder value. So while I think JB has a dominant market position and structural advantages, I am not comfortable with the Board overseeing my investment at present. All just my opinions of course. Selling IRL and on Strawman.

$JBH Trading Update as part of today's AGM.

Overall LFL holding up pretty well and WOW, we are buying a lot more gadgets/higher value gadgets than pre-COVID.

The Good Guys are a bit of a drag on the show.

Disc: Not held in RL or SM

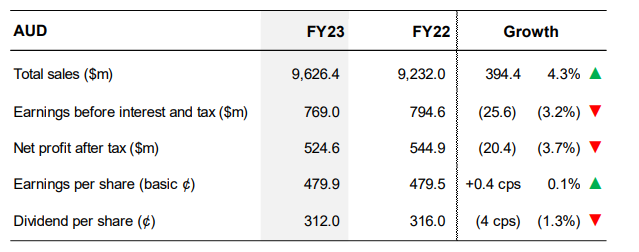

Nick Scali isn't the only great retailer on the ASX. JB HiFi certainly seems to be holding its own, with full year results coming in above expectations.

You can get all the details here, but the high level view is this:

Yes, it's essentially flat on a per share earnings basis (but still technically a record result), and given the much-touted difficulty in retail it aint half bad. Especially given that it's cycling off all that 'work from home' demand that we saw post covid. Related to this, online sales were down about 20%.

Gross margin was up, but operating margins were slightly weaker -- cost of doing business was up marginally (I'm assuming higher wages, but they don't spell this out). Still, the business is doing EBIT margins of 8% in aggregate, which is up there relative to global peers.

Balance sheet remains in rude good health -- the cash balance increased $52m over the year to $177m. Debt remains negligible, in fact it dropped 17% to $49.8m. They can meet their interest expense 170-times over.

Still, we know that a lot of the mortgage related pain is yet to wash through discretionary retail (as mikebrissy pointed out nicely elsewhere); July saw sales growth of -1.8% for JB Hi Fi Australia, and -12% for the Good Guys. JB Hi Fi NZ was actually strong up 10% (not exactly sure why, i need to dig deeper, but there were no new stores opened in FY23 in NZ). The good Guys actually saw a decline in sales of about 8% in the 4th quarter, so it looks like the weakest link at present.

No guidance was issued, but at present shares are on a yield of 6.5%, or almost 10% when accounting for franking. The PE is 10.

These metrics are right at the better end of the spectrum, historically speaking, again reflecting expectations for a tough 12 months. And, like with Nick Scali, investors need to be wary of the operating leverage (eg a 10% drop in sales would, assuming the same gross margins and CODB, would reduce pre-tax profit by about 35%).

Still, it doesnt seem too bad.

Disc: not held

JB Hi-Fi Finally Concede and Rebrand To JBEE Cause That’s What Everyone Calls Them Anyway

WENDELL HUSSEY | Cadet | CONTACT

The nation’s premier home entertainment and electronics retailer has today made a big move to fall in line with consumer perceptions.

JB Hi-Fi has reportedly finally decided to concede and rebrand their operation after extensive community consultation.

Moving forward, the famous yellow brand will simply be known as JBEE, rather than JB Hi-Fi.

“Look, it’s a move aimed at saving consumers all of 0.5 to 0.75 seconds worth of time when they pronounce our name,” laughed a spokesperson for the brand, who was seen rocking a triple lanyard and multiple tech tools dangling off his belt.

Rumours have also surfaced that the rebrand may have something to do with the release of Transformers: Rise of the Beasts, which features the revered Bumblebee.

The autobot, who has the ability to convert into a 1970s Chevrolet Camaro (notably one of the sickest cars to ever be made), has been a mainstay of the Transformers franchise – and now looks set to be a mainstay of the Australian retail scene.

“Haha look, Bumblebee might have something to do with our rebrand,” laughed the JBEE spokesperson, handwriting out one of those famous price labels with a giant red marker.

“But also, people are busy you know, and if we are being real, most people don’t use the Hi-Fi in common parlance.”

“Anyway, are you chasing a new sound system?”

Our reporter then confirmed he was, and seeing as he was at the home of home entertainment – he may as well kill two birds with one stone.

Recently I’ve been thinking about retail and the move to online. I mean when we run low of liquid soap, or dishwasher tabs, or two-minute noodles, I don’t bother putting it on a shopping list I just open the Amazon app and it arrives the next day. The fact they have managed to crack the 1B annual sales means I am not alone, even though this is well below their initial market expectations. Incidentally, Amazon Australian operations continue to be a loss proposition.

Amazon are not perfect; they don’t carry everything – shock – and the prices are not always competitive. That and sometimes you want to see the item or speak to a “knowledgeable” salesperson.

Prime, no pun intended, example being a few weeks ago I had made a lasagne which was about to go in the oven. The oven though didn’t heat up. Quick disassembly and hey presto spaghetti bolognese. Oven problem solved next day at Good Guys* The knowledgeable salesperson upsold me into a model I probably didn’t need, but I’m happy with the experience.

JB had close on 9B of sales in FY21 a figure which has been steadily growing over the last 5 years. Profit was up nearly 70% on pcp. Online is now above Australian retail market of 11% at 13.1% of sales.

There is a risk that these results are short term and there is a pull back in the next financial year although the market does not seem to think so with shares now well above pre 2020.

A thought about bricks and mortar stores is, possibly, they are not just about retail. US online spectacle retailer Warby Parker sees their stores as valuable marketing vehicle for introducing new customers to the brand. Shoe and apparel retailer have similar thinking, viewing stores as effective and profitable source of customer acquisition. I think the same could be said for the yellow JB stores.

Retail is hard, I don’t own any , but this one looks to be doing things right. Additionally, I don’t think Amazon is as much of a threat as many analysts originally expected. While they are a juggernaut, JB would be wise to continually look over their shoulder.

*acquired by JB Hi Fi in 2016

JB Hi-Fi Limited Half Year 2021 Results Update

JB Hi-Fi Limited (“Group”) today reports the following preliminary unaudited HY21 financial results (post the adoption of AASB 16) for the 6 months ending 31 December 2020.

Sales momentum was strong throughout the half, with continued elevated customer demand for consumer electronics and home appliance products.

This, combined with exceptional growth in online sales and a wellexecuted Black Friday promotional period, more than offset the impact of the government mandated temporary store closures during the half.

Online sales were up 161.7% to $678.8m, representing 13.7% of total sales. Gross margins were well managed with strong improvements in gross margins in key categories, particularly in The Good Guys, but offset by sales mix in JB HI-FI Australia and JB HI-FI New Zealand.