$VHT CEO Teri Thomas provided an update on the progress of the company, its market position, industry trends and priorities. While she flew through the material very quickly and at a high level, there was a lot of great content. It was a very content-rich presentation, I learned a lot, and if a recording is made available I definitely recommend that you catch it.

While there were no new material disclosures, there was some very good material. In this straw I pick out key points on:

- Financial highlights

- Product and Strategy

- Markets and Customers

- New Products

- Q&A - I discussed with Teri recent developments in Scandinavia and I've written her response virutally verbatim

Financial highlights achieved

- Revenue growth “up 61%” over the last two years***

- 15% reduction in the cost base

- FCF positive since September 2022

- $12m+ cash on hand to fund growth – no need to raise new capital

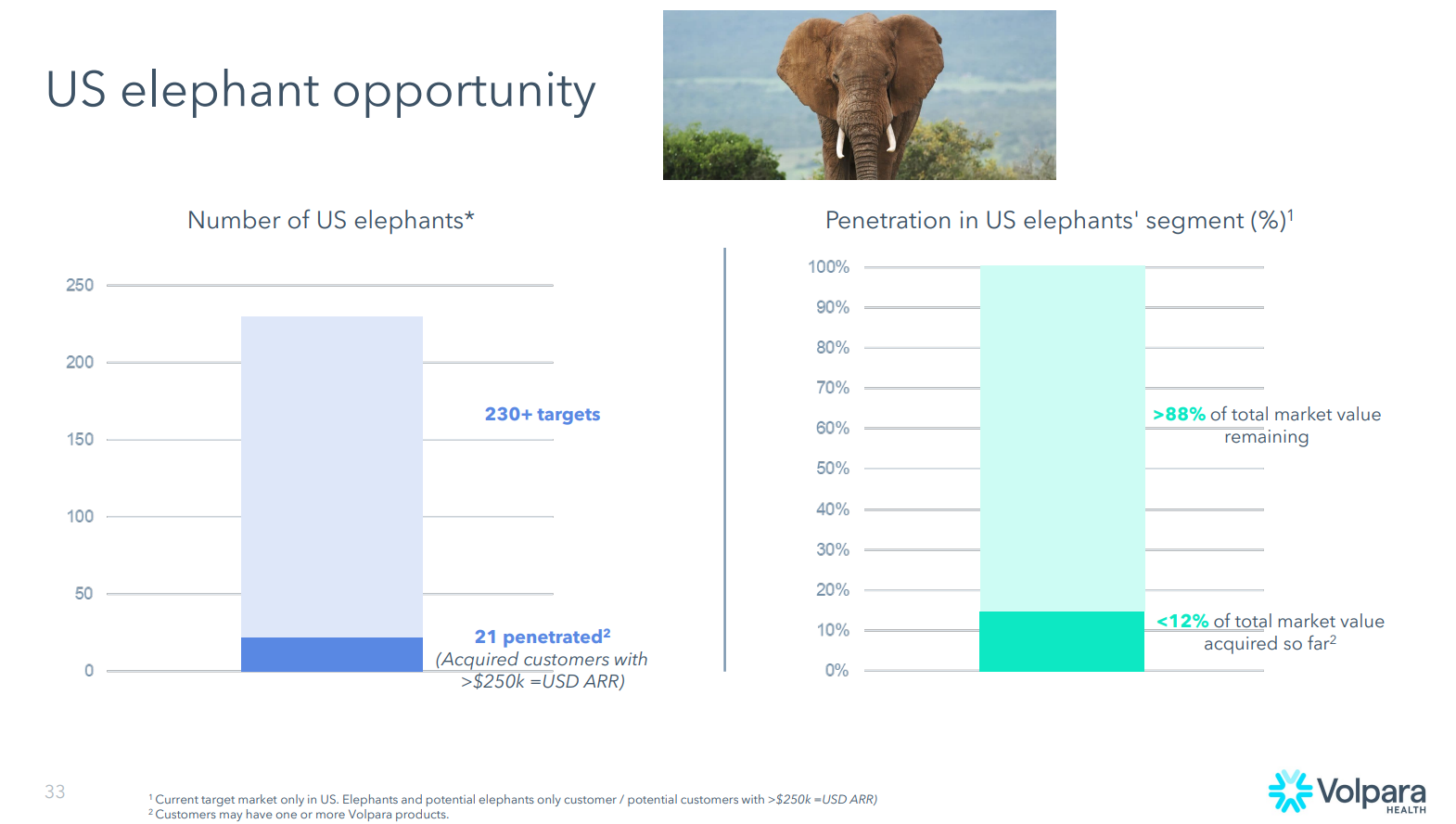

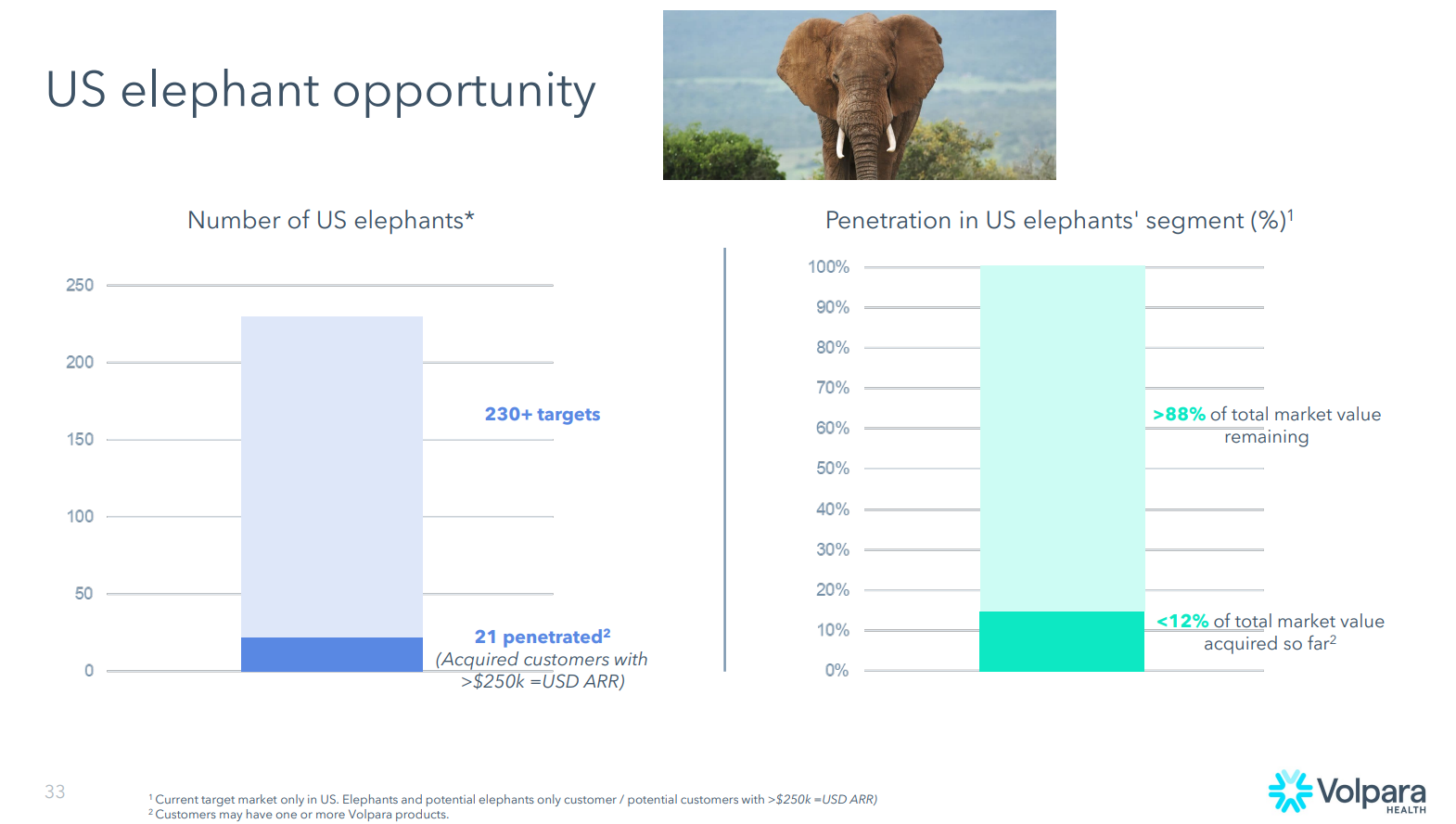

- “Elephants” up from 10 to 21, growing CARR by US$5m

*** I thought this was an odd statement, particularly since FY23 revenue of $35.01m is actually 77% higher than FY21 revenue of $19.75m. So I don’t know how it was derived (whether US$, NZ$ or A$, revenue added or something else. I cannot reconcile it).

Future Guidance – no change to previous messages

- Positive EBITDA forecast over next “12 to 18 months” (i.e. keeping wriggle room if they don't hit it this year?)

- 20% annual revenue growth

- High margins (%GM>90%)

- Low churn

- Stable cost base

- New product launch in <12months (see below)

- Major new products in innovation pipeline and growth outside of mammography (including to other cancers and beyond cancer, e.g., cardiovascular disease)

Product and Strategy

Teri emphasised the vision of the company “To become the global leader in software for the early detection and prevention of cancer and other devastating diseases.”

Upfront, she reminded everyone that $VHT is an analytics firm, neither competing with equipment vendors nor PACS vendors, but providing software that supports them.

She highlighted the growing incidence of cancer particularly in younger women (citing a recent article in JAMA) and recapped the recent shift by the US Government in recommending mammograms at age 40 instead of 50 as under-scoring the urgency of early detection, and how risk assessment can be used at even earlier ages. (In his introductory remarks Chair Paul Reid remarked that the risk product has been the fastest selling last year.)

Teri noted that Risk PathwaysTM grew at its fastest rate last year. She linked this to the US government ruling that risk programs are to be required by the national accreditation program for breast centres.

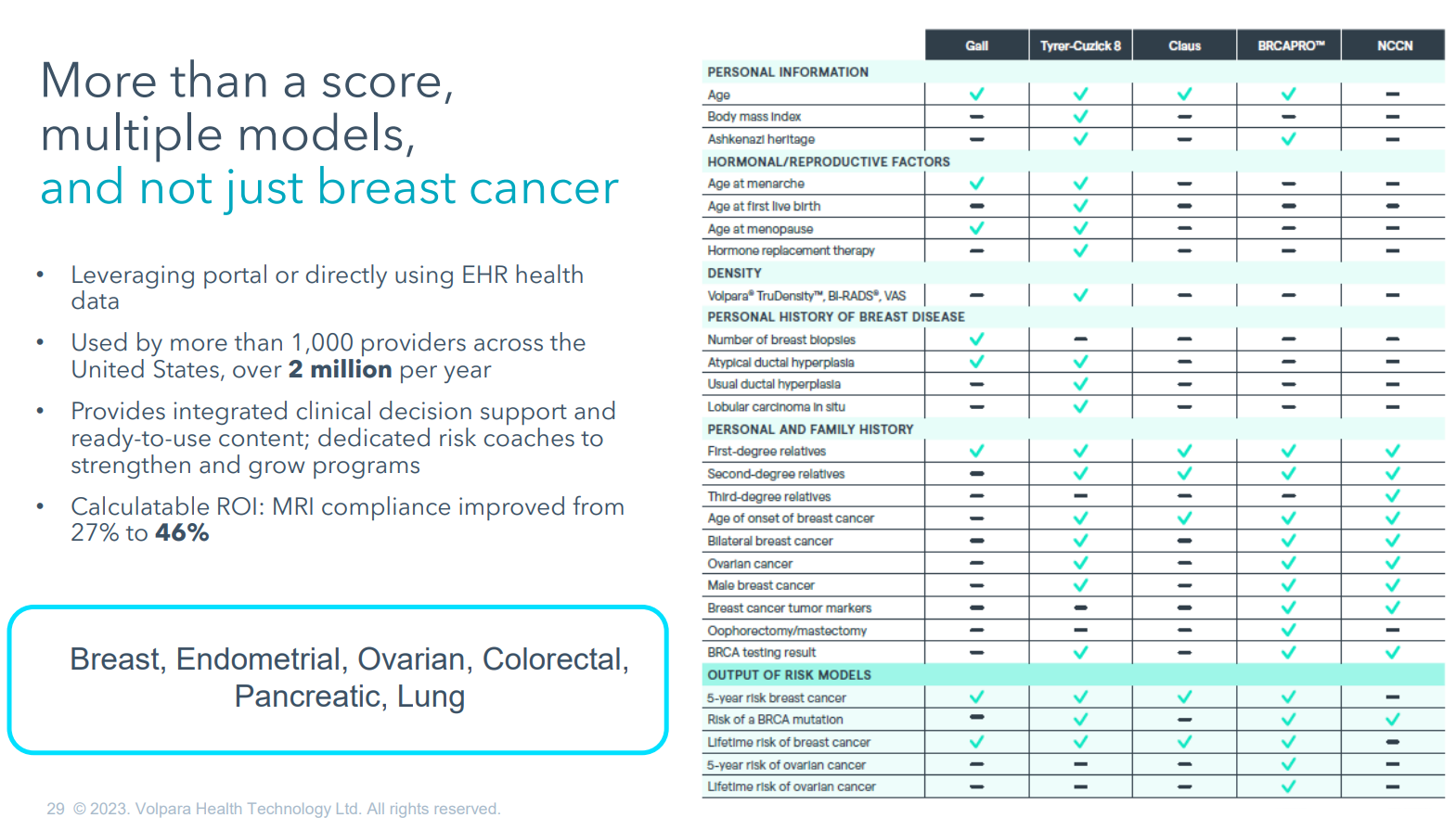

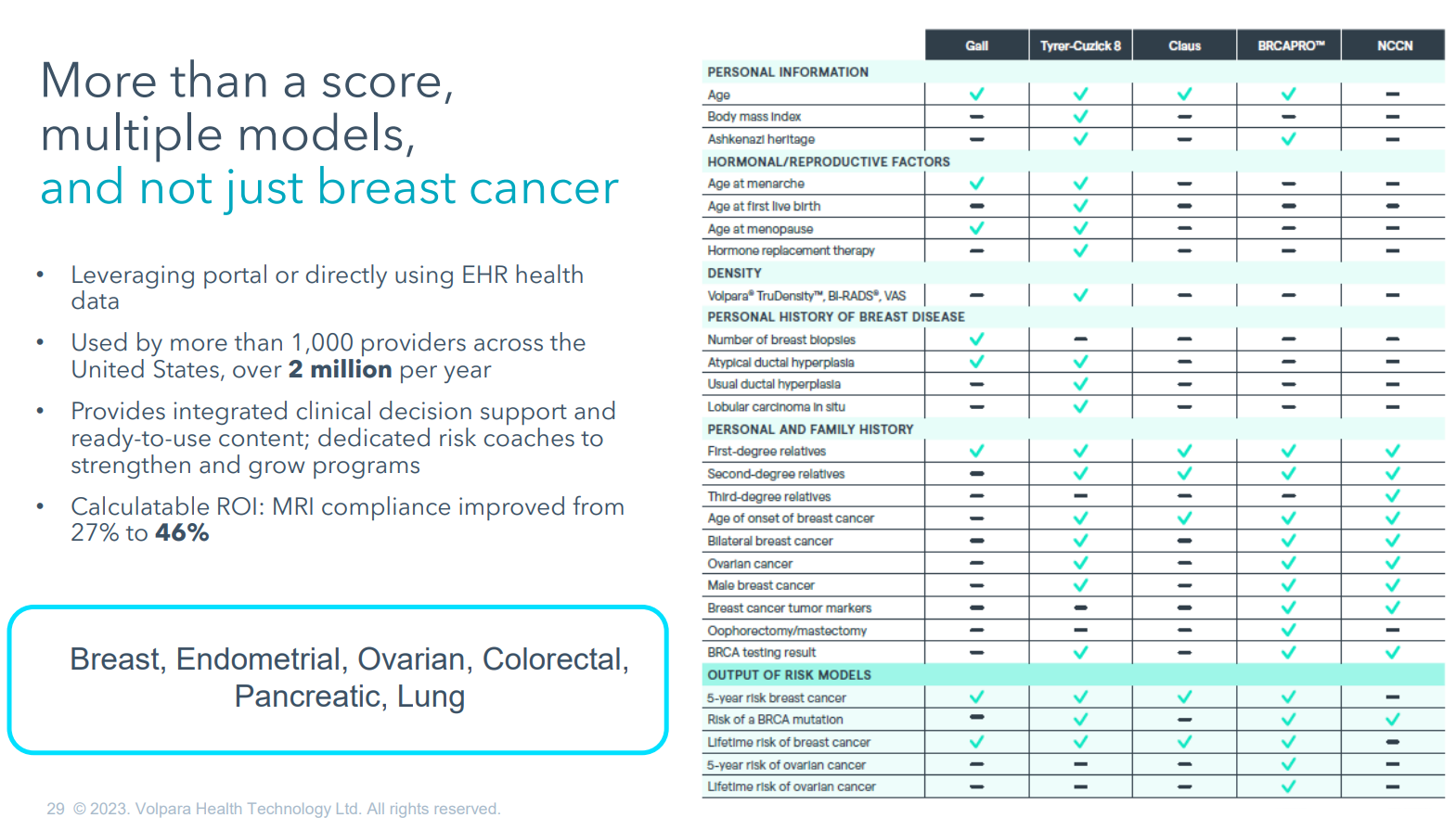

Risk PathwayTM also provides a platform for extension of risk assessment beyond mammography. Teri noted that the competitive advantage of $VHT’s product is that it incorporates more risk models than the competition. She said the platform is “poised for expansion into other pathways as well” with the slide showing “breast, endometrial, ovarian, colorectal, pancreatic and lung.” Clearly, they are working to develop this platform to support the growing trend towards personalised healthcare pathways based on risk assessment beyond breast cancer. (see slide)

On Scorecard, Teri highlighted that $VHT’s proprietary algorithms deliver AI analysis within the workflow of the mammogram analysis, and that this differentiates it. (At the moment, I should add!) She again referenced the collaboration with $MSFT on AI.

She expects to see increased use of ScorecardTM and Analytics as $VHT supports organisations in complying with the new US FDA requirement mandating density reporting for all women undergoing mammograms. The presentation provided some data (I had not seen before) showing that 75% of women lie in the B and C density categories, where it is important to decide in which group they lie to assess their risk, and that two human experts will agree on this assessment around 65% of the time.

Market & Customers

Teri noted that the customer focus has broadened from hospitals and imaging centres/networks to include large screening programs (US and Australia). She indicated that they are also engaging insurers and primary care doctors, with the first primary care doctors already using $VHT products to screen women for risk at younger ages.

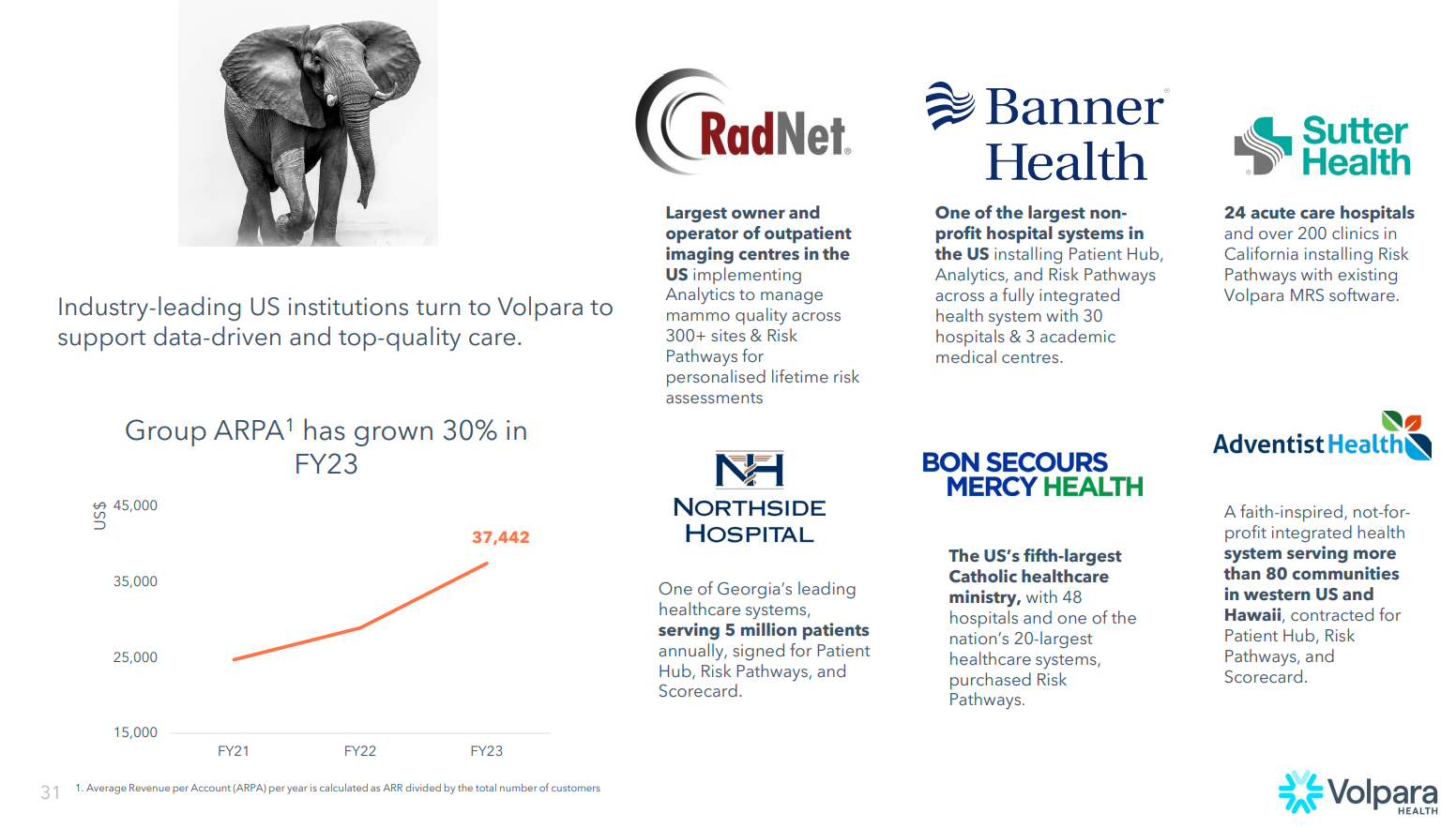

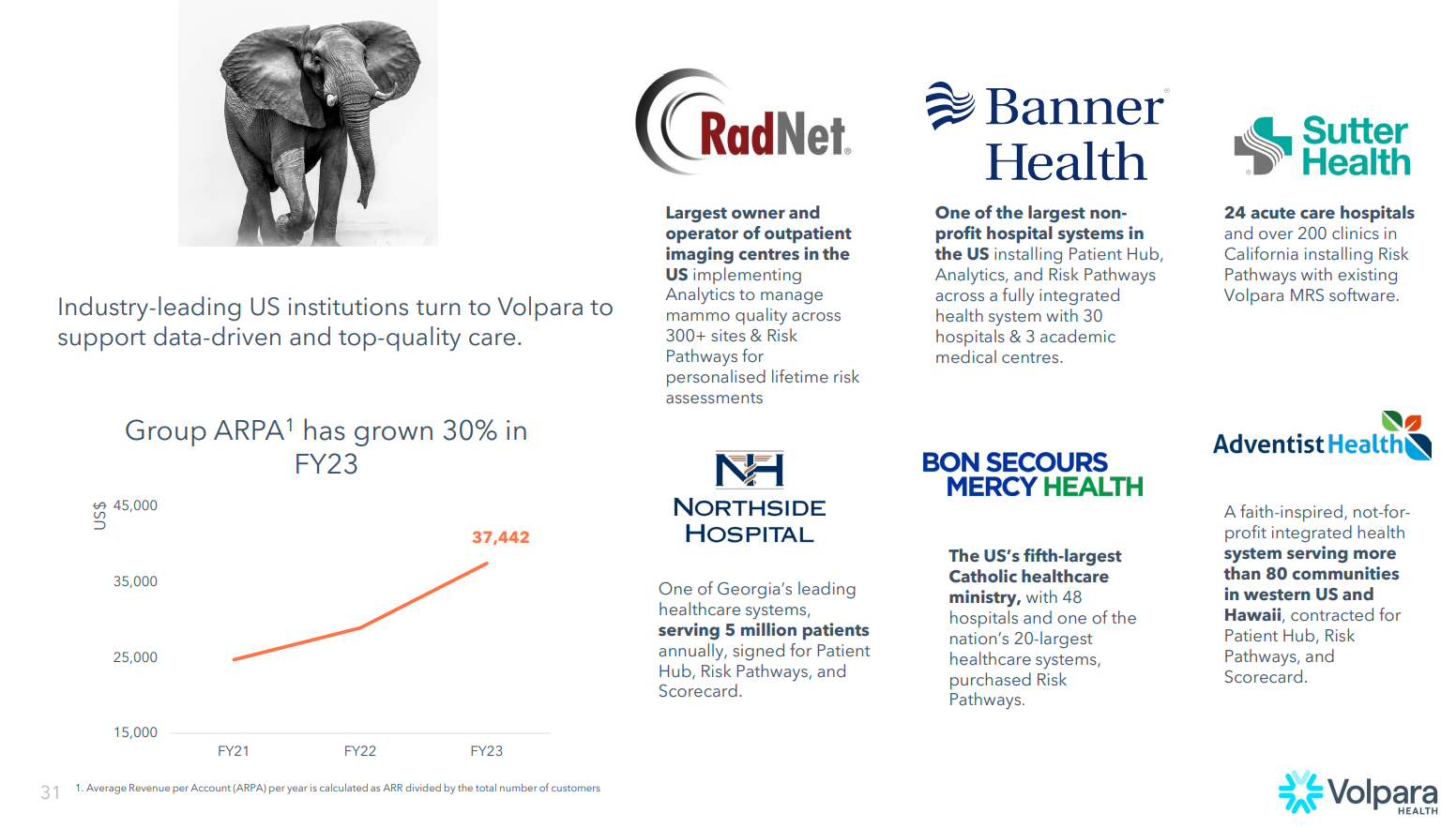

Under Teri, $VHT have shifted focus from ARPU (per user) to APRA (per account). ARPA increased 30% to US$37,442 in FY23, due to the focus on “Elephants”. Later, in the Q&A, CFO Craig commented that he saw this moving from $40k to $50k and even onwards to $100k.

Teri spent some time outlining the unique customer proposition of $VHT products, summarised in Slide 22 (“Uniqueness Defined”) much of which we have heard before, but it was good to see it pulled together.

$VHT estimate that their penetration into larger institutions is only 10-15%, with 21 “elephants” signed up out of a total of 230+ identifed targets. In her words “… a vast untapped market, with over 85% awaiting exploration”. She noted “a considerable proportion of these institutions” that lack comprehensive risk programs or analytics.

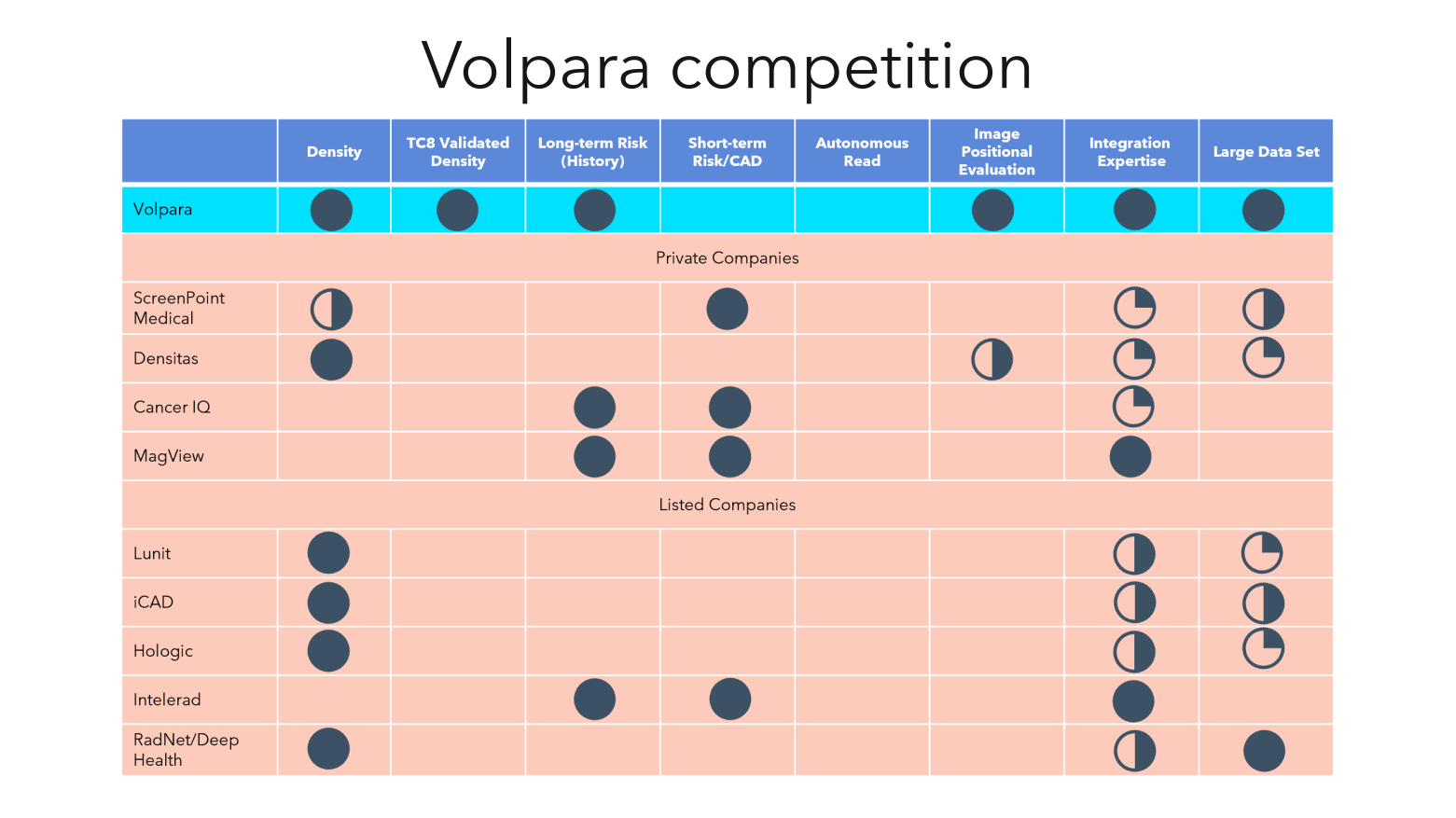

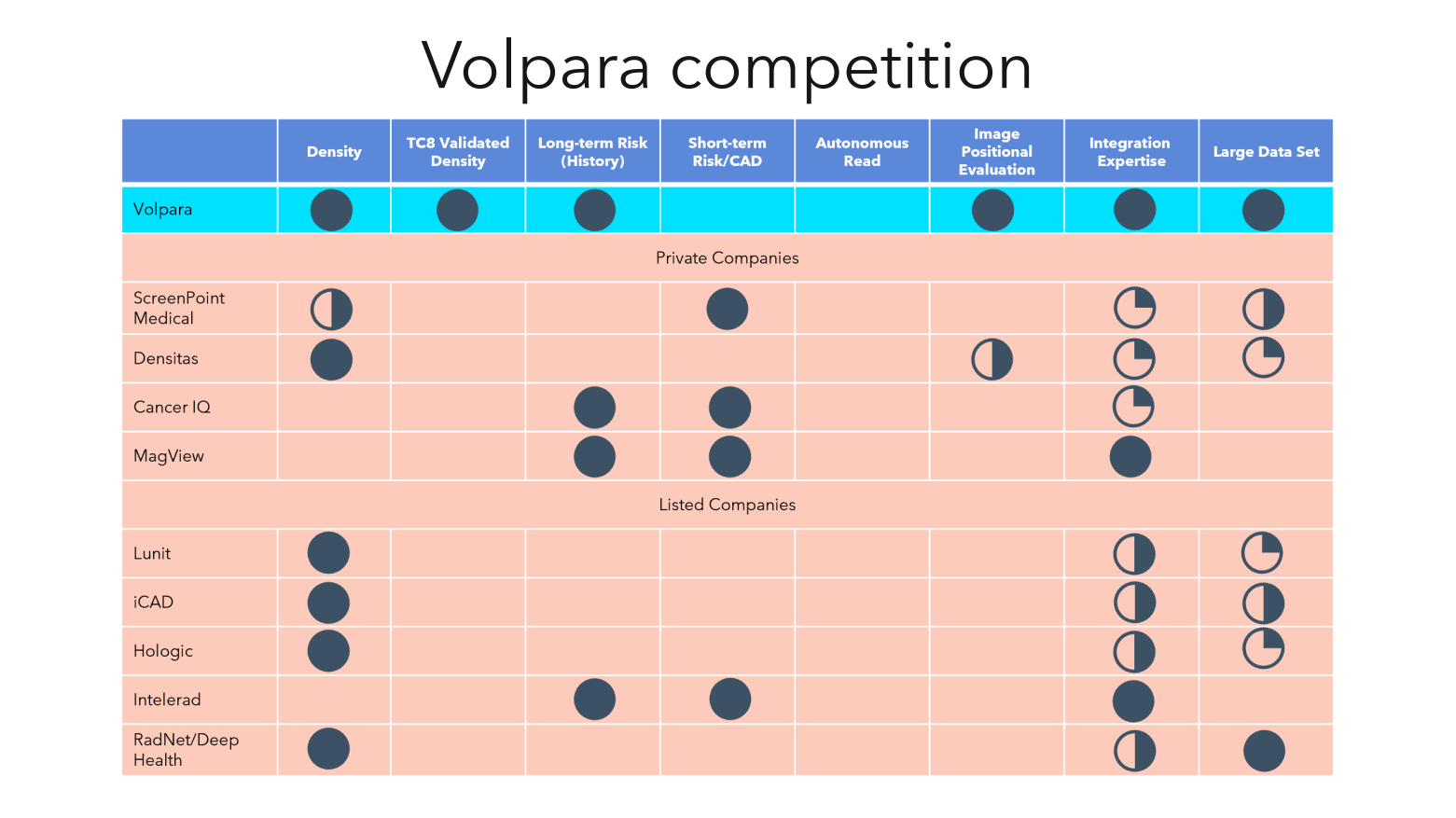

The competitive analysis (slide below- clearly, $VHT’s own view) was interesting. Teri did not discuss the significance of the gap in “Short Term Risk/CAD” and it was interesting to observe the currently blank “Autonomous Read” column. The latter is clearly the space that Transpera are working on. I missed the opportunity of asking Teri about the significance of these capability gaps, and what they mean for potential future $VHT technical (or commercial!) innovation. (I followed up with her on this after the meeting and will post the answer as a comment when I have digested it.)

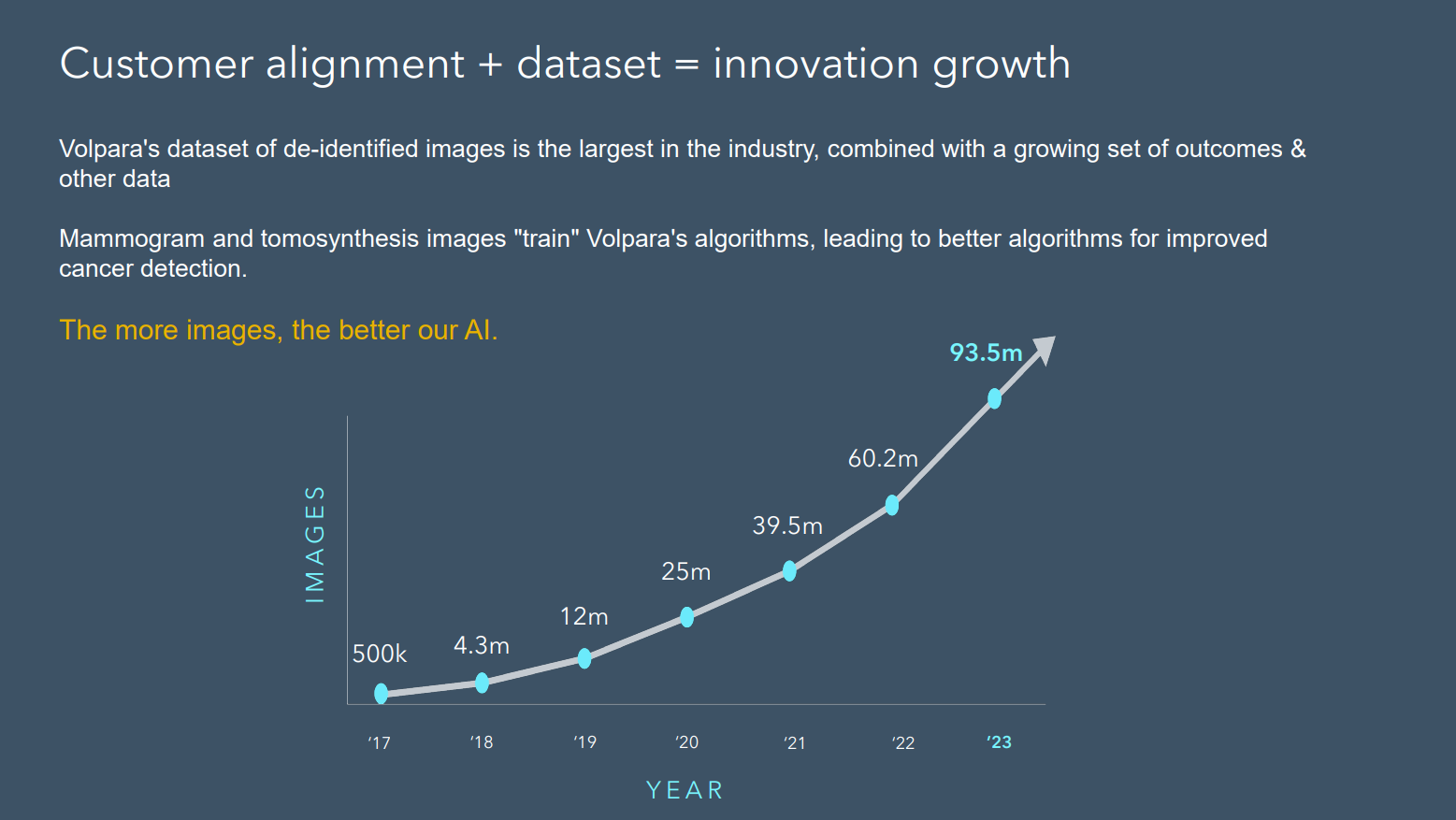

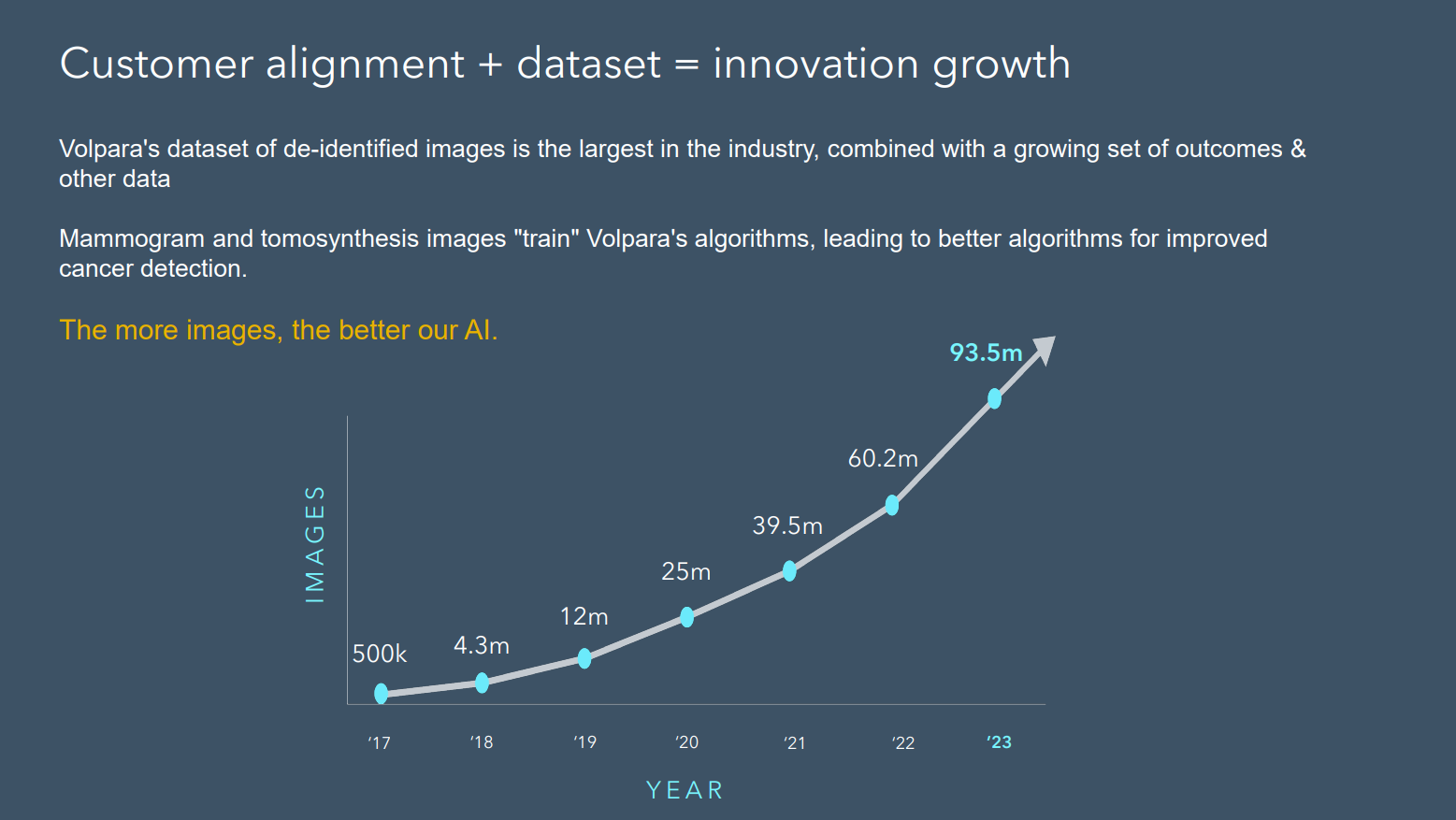

In addressing AI, Teri showed the following graph, highlighting the scale of the dataset on which $VHT’s algorithms are “trained” highlighting that some of the competitor efforts are training of dataset of hundreds or thousands of images. She was clear that this places $VHT at a strategic advantage, positioning them to improve the quality of their product offerings ahead of the competition.

New Products

Teri referred to the innovation pipeline, with efforts aligned closely with customers and key markets.

She gave a “sneak peak” of the next new product “Quiver”, which will be unveiled at RSNA (Radiology Society of North America Conference, November 2023). From the description, this appears to be a tool that streamlines mammography clinics operations (she says they refer to it internally as the “Binder Reduction Act” or BRA, ;-)), eliminating the need for "stacks of physical binders" and should save significant customer time. Teri says customers are “quite excited about this”. The product and other advanced modules are being incorporated into the overall code base, so it can be deployed across the existing customer base.

Quiver also has the advantage of “smoothing the onboarding of new customers to our analytics product”.

Teri summarised that not only are $VHT driving technical innovation, they are also focused on facilitating ease and efficiency for customers.

Overall, Volpara’s growth driver and product focus is aimed at mammography staff shortages, with some stats provided on this in the presentation.

On IP, the portfolio has 122 granted patents in 30+ countries with 26 applications in progress. There is copyright and 15 registered trademarks in addition. All this is a significant investment, if you peer into the accounts. All of this is in addition to the unparallel research validation in peer-reviewed journal citations.

An update was given on the public and private health screening in Australia, which is significant and growing, focusing on both density and risk. They plan to deploy the analytics capability they have been developing with $MSFT into Australia and NZ, so I expwect we will hear more about that in due course. Eventually, there will be a read-out from the QLD clinical trial, as well.

Q&A

There were few questions - nothing very insightful, apart from the one on ARPA, addressed above and ....

I asked my own question about the recent developments in Scandinavia (that we have been discussing here on SM), Teri replied:

"I'm gonna spend a lot of September in Europe and speak with some of the people that are running these programs. So we are in the research mode with the people that determine the standards in Scandinavia. It is a part of the world that everyone else is looking to as well, as they try to figure out some of the challenges with not enough radiologists and also not enough availability of MRIs for further scanning for people who have dense breasts. So the DENSE Trial and the SOBI recommendation was that for anyone who has dense breasts ought to get an MRI and that will save lives. But the next challenge was - OK, we don't have enought MRIs. So what we've been doing in Norway is studying what is the narrow band of density that is the most important for women to be able to go forward and get further testing including MRI. That will be concluding likely within the next year. So we will share publically when we can. But we are talking with some others about similar initiatives.

Part of the reason Teri is going to Europe is to figure out whether this is ready for a broader deployment versus still in the research phase. The key insight is that $VHT are directly involved with the actors at the cutting edge.

My Key Takeaways

I've seen every presentation since Teri took over as CEO, and this one deepened my understanding probably more than any.

I am encouraged that, in resetting the cost-base, Teri has maintained a strong innovation and product development engine, and that this is working hard at the cutting edge of research and AI exploitation. Both are essential if $VHT is to succeed in the long term.

Everything I heard today supports my investment thesis. I have a sense that patience here will be rewarded.

Held in RL (2.5%) and SM