$WTC reported its FY23 results this morning and I’ll be joining RW for the call at 10:00. But in advance of that here’s my quick take. Bottom line – keep on Truckin’.

Their Highlights

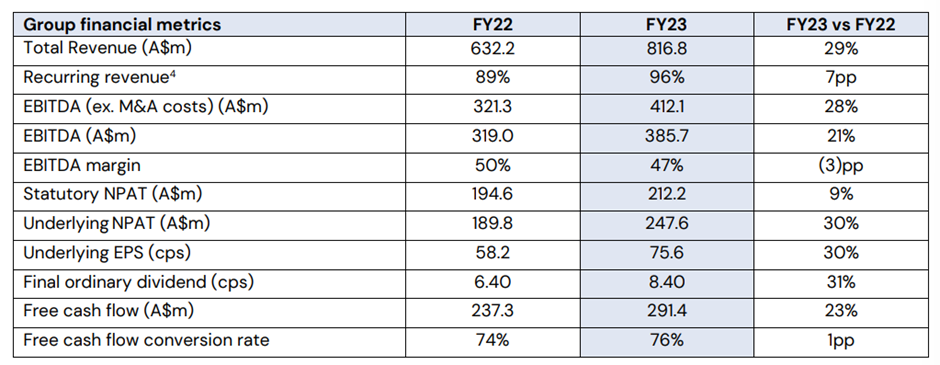

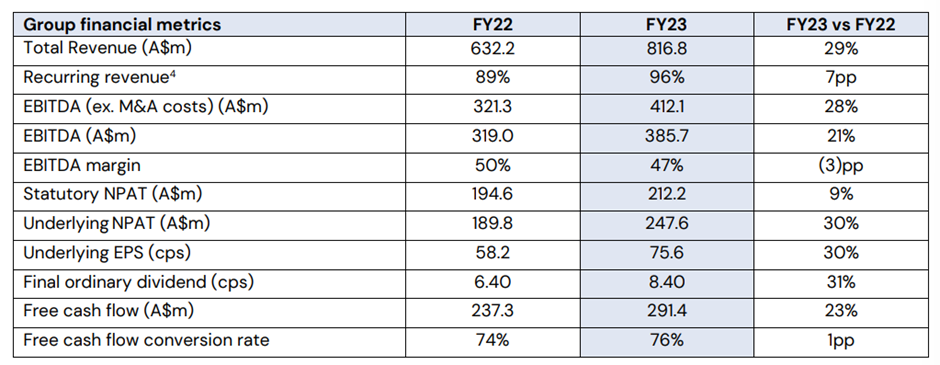

- FY23 Total Revenue of $816.8 million, up 29% (up 21% organically) on FY22

- CargoWise recurring revenue of $650.1 million, up 48% (up 37% organically) on FY22, driven by existing and new customer growth including new Large Global Freight Forwarder (LGFF) rollouts

- Executed a strategic move into North American landside logistics with acquisitions of Envase Technologies and Blume Global, extending and strengthening WiseTech’s position in one of its six key development priorities

- Signed first global customs rollout with world’s largest freight forwarder, Kuehne+Nagel (K+N); post year-end momentum with expansion of FedEx global rollout to include global customs

- EBITDA ex. M&A costs of $412.1 million up 28% on FY22. EBITDA of $385.7 million up 21% on FY22

- Organic EBITDA margin up 2 percentage points (pp) to 53%, reflecting enhanced operating leverage, new product releases, pricing and ongoing financial discipline. EBITDA margin of 47%, down 3pp on FY22 reflecting recent M&A

- Underlying NPAT 3 of $247.6 million, up 30% on FY22; with statutory NPAT of $212.2 million, up 9%

- Strong free cash flow of $291.4 million, up 23% on FY22

- Final dividend of 8.40 cents per share (cps), up 31% on FY22 and representing a payout ratio of 20% of Underlying NPAT

My Analysis

Everything said about $WTC has to be understood in the context that the market has priced it to perfection, with the SP having run up over 70% since the start of the year.

The numbers speak for themselves, so I don’t need to write much about them.

What I will focus on is that, after such a stellar FY21-FY-22 comparison, there is the potential for disappointment in today’s result. However, I am not disappointed and I believe the market consensus shows that many analysts are just not doing their jobs properly. There is no other way to explain it.

While organic revenue growth of 21% was a smidge below my model of 22%, EBITDA growth of +28% (excluding impacts of M&A) was stronger than I expected.

RW has signalled the big step up in R&D spend, and this is to be expected. With several tuck-in acquisitions and the larger Envase and Blume – leaders in North American landside logistics – total R&D (capitalised and non-capitalised) increased a whopping 45% to $261.9m. But I am glad $WTC is doing this, as they need to continue to invest heavily to achieve the long term vision.

Because of the impacts of the acquisitions, expenses are elevated and margins are reduced from EBITDA down to NPAT. There is also a healthy tax bill.

This is an established pattern for $WTC, and over the coming 2-3 years we will see margins grind back upwards as integration proceeds. Over the years, $WTC has achieved a core capability in integrating acquisitions. Envas eand Blume are at the larger scale, so their margin impacts are largers. This is not without risk, but I have a high level of confidence in the team.

There is always a lot to highlight in the $WTC disclosures. For me the standout one this year is that today, the $WTC portfolio covers territories and activity they estimate account for 55% of global manufactured tradeflow. With the developments in progress and the global rollouts under way, they expect that to expand to c. 70% over the coming years.

Another standout, is that the DHL rollout appears to have followed the K-N lead by including global customs as part of the scope. This was the big announcement last year, and the belief was that after K-N taking the plunge, other leaders would follow. So that appears to be playing out.

My Key Takeaways

A good result, but the market (which I say has behaved independent of newsflow through the year in driving up the SP, as funds have increased exposure to the ASX best quality larger cap tech play) has priced $WTC for perfection.

Earlier this year, after a deep dive, I valued $WTC at $71.00 (with a wide range of scenarios ranging from $49 to $84).

Presented recently with the opportunity to sell some at $88, I took the money, selling down one-third of my RL holding. Partly because I expect the market may well cool to this result. If we see a solid pullback over the coming weeks, which I think could happen, I’ll be waiting. ;-) (... but I'm not a trader!!)

A great company. A good result. But it is in the valuation in my view.

About to join RW for his call.

Disc: Held in RL