Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

WTC is selling Expedient Software

Expedient, which operates in Australia and NZ, was owned by E2open, and the sale appears to be a move to appease the ACCC’s competition concerns.

As per the below, Expedient was projected to contribute less than 0.4% of WTC’s FY26 revenue.

All things considered re the events of the past year, I can see how keeping the ACCC sweet by divesting a small and apparently non-essential piece of the pie makes sense.

Discl: Held IRL

As I continue to digest and assess the content of last week’s $WTC Investor Day, while much of the press attention has focused on the implementation of the New Commercial Model, the session that impressed me most was the discussion on AI implementation.

I’ve decided to pull out a separate straw on this, because I think it may be of interest not only to those following $WTC, but also to the wider community interested in how firms are deriving value from AI.

$WTC’s AI philosophy

WiseTech’s AI strategy is built around narrow, specialised agentic AI, deeply embedded into CargoWise workflows, rather than broad, general-purpose models. Guardrails and human-in-the-loop verification are core design principles.

$WTC is scoping many potential AI agents. However, three are already “live” and can be accessed via the new Value Packs with 100% transaction-based pricing:

- Document ingestion (data entry automation)

- ComplianceWise – Export Controls

- Customs Classification Assistant

Each of these was described in detail at the Investor Day and provides evidence of how $WTC’s massive proprietary dataset, combined with LLMs’ ability to structure, process and reason over text-based data, can materially reduce the high labour content in existing freight forwarding, import and export processes.

Let’s look at each in turn.

1. Document ingestion

AI-native document ingestion replaces manual data entry and OCR-based bolt-on tools.

Example impact:

- Commercial invoice ingestion reduced from a ~5–6 minute manual task to near-zero

- At a global freight forwarder level, ~10 million commercial invoices per year equates to ~95 human years of data entry

Accuracy is high, driven by:

- Targeted models tuned to specific document types

- Uncertainty explicitly flagged to human operators

- Accuracy described as materially higher than OCR

From the Q&A discussion: accuracy is improving while labour is being removed, and this improvement is not being traded off against risk.

2. ComplianceWise – Export Controls

Across global jurisdictions, numerous controls restrict parties, locations and categories of goods.

AI agents assess export risk across:

- Parties (denied / sanctioned lists)

- Locations (embargoes, restricted destinations)

- Goods and end-use (dual-use items, munitions)

The AI effectively acts as a virtual compliance officer: jurisdiction-specific, always-on, and capable of scanning all available information against known restrictions and risk factors, flagging issues for human review.

Performance achieved:

- ~96% precision (low false positives)

- No missed red flags relative to expert human reviewers

3. Customs Classification Assistant

A core role of freight forwarders is ensuring goods are correctly classified. This task is exceptionally complex due to:

- The sheer number of codes

- Non-intuitive classification structures

- Jurisdictional differences

As a result, classification remains one of the most labour-intensive parts of the process.

$WTC’s AI agent is now able to complete ~90% of the classification work, leaving brokers to verify and submit (human in the loop).

Industry benchmarks:

- Human-based classification accuracy ranges from as low as ~20% to ~80%

- ~80% is typically considered a strong human benchmark

Pilot results: customers using the $WTC AI agent are reporting ~90% accuracy.

Importantly, narrow agent design and embedding regulatory data from $WTC databases (e.g. BorderWise) materially reduces the risk of AI hallucinations.

Richard White gave an illustrative example of a UPS business unit with 19 human classifiers and 1 supervisor. The AI agent is capable of performing the work of the 19 classifiers, leaving the supervisor to check and verify outputs as the only future required labour for this process.

Other AI applications

As with many enterprise software firms, $WTC is also developing AI-based customer service agents. The WiseTech agent is called ACE, supported by content from the WiseTech Academy.

Although ACE is only one month old (“a baby”, in management’s words), it is already being trained on ~20,000 historical support tickets where humans previously sent specific training materials to customers. Management estimates this could free up the equivalent of ~18 product managers currently involved in this work, allowing them to be redeployed into product development.

Finally, $WTC is also using AI internally to assist with code writing and testing.

These latter applications have quickly become ubiquitous across enterprise software, so there was little basis to assess whether $WTC is meaningfully ahead or behind peers in these areas.

Overall takeaways and management view

Richard White believes that rolling out AI agents within CargoWise and related products has the potential to reduce customer labour requirements by ~50% over two years. This is a bold claim - characteristic of RW’s visionary style - but the examples demonstrated so far lend it credibility. Time will tell.

It is difficult to overstate the complexity of freight classification and compliance. In another Investor Day session, Anthony Hardenburgh (Product Portfolio Leader, Global Trade Management) noted that across markets and products, $WTC handles ~73 million regulatory and data updates annually, all of which must be incorporated into its systems. This scale is far beyond what humans can manage alone and is precisely the type of problem suited to AI. It appears $WTC is leaning into this opportunity in earnest.

$WTC’s approach centres on carefully scoped, narrowly defined AI agents, tightly integrated into workflows. Management described a common AI agent architecture with an abstraction layer that allows A/B testing of different LLMs and rapid swapping as models improve and leap-frog each other.

Early labour reduction from AI is expected to occur primarily in lower-skill roles, many of which logistics firms have already offshored to shared-service centres. Remaining staff, employees of $WTC’s customers, will become more skilled and more valuable as supervisors of AI agents.

There was discussion around whether customers could build their own AI layers and bypass $WTC’s products. Management acknowledged this was possible and that some customers might see benefits. However, CEO Zubin emphasised that software development and workflow integration are WiseTech’s core expertise, and that embedding AI directly into CargoWise should deliver superior outcomes, because only $WTC has access to the source code and databases. That confidence seems reasonable, though real-world results will ultimately decide.

My assessment

AI adoption across large enterprise SaaS companies has become a central part of the investment thesis for my technology holdings over the past few years. The use cases showcased by $WTC are exactly the types of applications I was hoping to see, and it is encouraging that early solutions are now "live" with customers - particularly the 95% of largely small customers who have gone "live" on the new Value Packs, potentially a strong incentive for the LGFFs to follow quickly!

It will be particularly interesting to track adoption and realised benefits over the next one to two years.

This also underscores why $WTC had to move from “seat plus module” pricing to per-transaction pricing. Despite the noise surrounding the transition, there was really no alternative. Labour hours per shipment are about to be materially reduced, while shipments-per-seat should increase dramatically as these capabilities are adopted by customers. $WTC had to get ahead of that curve.

Overall, I was very impressed by the presentations, the examples, and indeed the presenters themselves. I was glad to see that $WTC are indeed doing what I expect them to be doing. It was good to learn the facts, rather than just hold the thesis!

Disc: Held

Just finished reading AFR article on WiseTech’s new pricing model. Early read: if you’re a customer actively using the product, you’re probably going to be paying more under the new structure.

I’m really interested to see how this plays out over the next 12–24 months. WiseTech has always had that mission-critical, sticky footprint. Once it’s in, it’s hard to rip out , so they’ve got the leverage to push pricing. But the flip side is whether customers start pushing back, especially larger ones who may suddenly see a step change in cost.

Could end up being a quiet tailwind for revenue… or spark some noise if the increases bite too hard. Worth watching!

Raelene Murphy will join the Board of $WTC from beginning 2026.

A seasoned ASX Non-Exec, Ms Murphy has significant experience chairing Audit and Risk Committees.

My guess is that she will likely succeed Andrew Harrison as Lead Independent Director, when the governance rebuild is complete. Andrew indicated at the AGM that he does not intend to serve his 3-year term, and will stand down once the goverance rebuild is done. The announcement says they have one more Independent Non-Exec left to appoint.

Ms Murphy adds experience and independence to the board, which is now starting to look like a more rounded and capable board (goverance, logistics industry experience, tech experience). From 2016-2022 she chaired the Audit & Risk Committee at Altium which, like $WTC, is a global enterprise SaaS player and leader in its industry.

From my perspective, this is a good appointment, and will hopefully sooth the nerves of some of the disgruntled insto. investors. I particularly like that, in addition to her Non-Exec experience, she has also had experience as a CEO / MD.

Interested if any other StrawPeople have views on Raelene from their exposure to her at other companies.

My BA has compiled the following resume for her. (Please note, I have not personally fact-checked it in detail, and so there may be some factual errors). From a quick look, it seems to align with her LinkedIn Profile.

Ms Raelene Murphy FCA GAICD

Independent Non-Executive Director

Incoming Director, WiseTech Global (effective 1 January 2026)

Profile

Highly experienced Australian public company director with more than 35 years’ leadership across governance, financial oversight, corporate restructuring, strategic transformation and complex transactions. Recognised specialist in audit and risk governance, frequently appointed as Chair of Audit & Risk Committees across ASX-listed companies. Brings deep expertise in turnaround situations, balance sheet discipline, enterprise risk management and board effectiveness across industrial, healthcare, FMCG, technology and regulated sectors.

Current Board Appointments

WiseTech Global Limited (ASX:WTC)

Independent Non-Executive Director (from 1 January 2026)

Tabcorp Holdings Limited (ASX:TAH)

Non-Executive Director

Chair, Audit Committee

Bega Cheese Limited (ASX:BGA)

Non-Executive Director

Chair, Audit & Risk Committee

Member, People & Capability Committee; Risk & Sustainability Committee

Integral Diagnostics Limited (ASX:IDX)

Non-Executive Director

Chair, Audit Committee

Amotiv Limited (ASX:AOV)

Independent Non-Executive Director

Chair, Audit Committee

Member, Nomination, Remuneration and Risk / Safety / Sustainability Committees

Former Board Appointments

Altium Limited (ASX:ALU)

Non-Executive Director; Chair, Audit & Risk Committee (2016 – 2022)

Elders Limited (ASX:ELD)

Non-Executive Director (2020 – 2024)

Service Stream (ASX:SSM)

Non-Executive Director (2015 – 2019)

Executive Career Highlights

Managing Director – 333 Group / KordaMentha

Senior restructuring and turnaround leader, specialising in complex corporate recovery, strategic reviews and performance transformation. Involved in major government and enterprise restructures, including advisory work on the National Broadband Network (NBN).

Chief Executive Officer – Delta Group

Led a diversified industrial services and construction group, overseeing operational restructuring, financial stabilisation and strategic repositioning.

Senior Executive – Mars Group

Held senior finance and operational roles within global FMCG operations, gaining deep exposure to multinational governance, supply chain operations and performance management.

Partner – Horwath (now BDO)

Led corporate turnaround and restructuring advisory practice.

Core Expertise

- Board governance & ASX-listed company oversight

- Audit & Risk Committee leadership

- Financial reporting & capital management

- Corporate restructuring & turnaround management

- Mergers, acquisitions & integration

- Enterprise risk frameworks

- Cyber and digital risk oversight

- Strategic transformation & cost optimisation

- Crisis management & business continuity

Qualifications & Professional Memberships

- Bachelor of Business

- Fellow, Chartered Accountants Australia & New Zealand (FCA)

- Graduate, Australian Institute of Company Directors (GAICD)

- Member, Chief Executive Women

- Member, Australian Institute of Company Directors

Governance Profile (Summary)

Ms Murphy is widely regarded for her disciplined approach to financial governance, pragmatic oversight of management, and ability to guide organisations through structural change while maintaining strong risk discipline and shareholder alignment. Her appointment to WiseTech strengthens the board’s depth in audit, risk and large-scale transformation oversight.

Disc: Held

@Solvetheriddle ... sounds like neither of us got any insight from our AGM questions!

On CTO, I'll have another go at Investor Day.

This is enough for me to sell out today!

WiseTech Global Ltd Update WiseTech Global Ltd (ASX: WTC;

WiseTech; the Company) provides an update that officers of the Australian Securities and Investments Commission and the Australian Federal Police attended WiseTech’s Sydney office yesterday.

They executed a search warrant requiring the production of documents regarding alleged trading in WiseTech shares by Richard White and three WiseTech employees during the period from late 2024 to early 2025.

So far as WiseTech is aware, no charges have been laid against any person and there are no allegations against the Company itself. WiseTech intends to fully cooperate with any investigation.

Over the last 6 weeks or so RW has sold 3% of the company on market... (he still owns 35%). Is that odd? Surely a block trade of some kind would be less damaging to the share price...

Is anyone else seeing a decent margin of safety for Wisetech after recent share price drops? Currently $86 at 7/10.

My calculated fair value came to $110, with bear case around mid $80’s, base around $110, and bull around $130.

This was with fairly conservative assumptions around integration risks of e2open and relatively new management team.

WTC opened lower at open,

Total revenue $778.7m ↑ 13% organically

Underlying NPAT1 $241.8m ↑ 30% on FY24

Statutory NPAT $200.7m (↑ 17%) Underlying EPS 72.8 cps (↑ 30%)

https://hotcopper.com.au/threads/ann-wisetech-global-fy25-results-investor-presentation.8734516/

WiseTech will issue a dividend of 7.7 cents per share.

The company's "general and administration" costs skyrocketed nearly 50%, from US$97 million to US$142 million. R&D spend was up 10% to US$185 million, though sales and marketing costs decreased 15% to US$51 million.

What is included in the FY26 guidance:

• Retention of existing CargoWise customers consistent with historical levels • Overall supply chain volumes reflecting recent trends

• New customer growth consistent with historical levels

• New product and feature launches monetized

• Contractual increases in revenue from existing customers, including those reflecting the end of temporary pricing arrangements

• Standard price increases

• Inflation in staff and other costs

• Full year effect of FY25 acquisitions and a minor reduction for non-CargoWise revenue, as a group overall, from product exits, as expected

Outlook >>>>>>>>>

Voted down at open>>

Zubin Appoo has been appointed CEO of $WTC.

Here's his LinkedIn profile.

This is someone who will know RW and $WTC well, having been with $WTC from 2004 to 2018, as head of Innovation and Technology.

IMO, RW has decided to prioritise someone he knows and presumably trusts over an experienced CEO who has run a global tech firm. And given everything that has transpired in the last year, I can't say I am surprised.

But this is a big step up for Zubin. As far as I can see he hasn't run anything of the scale and complexity of $WTC over the seven years he has been away. And $WTC is a much larger and more complex firm that when he was last there.

An important appointment, this allows Andrew Cartledge to set sail and retire, having supported RW through a tricky time as Acting CEO.

Clearly, the Executive Chairman will continue to make the big calls, and that will give time for Zubin to grow into the role. So, I am OK with the appointment. Let's see how they go.

Disc: Held in RL only

WiseTech flags redundancies as it restructures to double down on AI

WiseTech Global has told employees it is increasing the use of artificial intelligence across the business as part of a broad restructure of the ASX-listed logistics software giant that will result in redundancies.

In a note on Tuesday, WiseTech chief of staff Zubin Appoo said the company had made the decision after “a deep assessment of our operating model, teams, roles, skills and processes”.

“The result of the assessment means we will conduct a phased restructure program across all functions of the business and all regions. There will likely be several phases across the business, and we will communicate these as soon as possible,” Appoo wrote in the email to staff.

WiseTech employs about 3500 people around the world. The first phase of restructure will focus on the product development and customer service divisions, and the WiseTech Academy in Australia, India, the United States and China. WiseTech Academy offers certification and training for using the company’s products such as CargoWise, which helps co-ordinate freight.

It is unclear how many roles will be made redundant.

Fundie View - ECP Growth manger:

Wisetech (WTC) outperformed in May following the speculation & confirmation of an acquisition offer for US listed peer E2open, on a significantly lower earnings multiple. While E2open hasn't shown standalone growth, and comprises a number of acquisitions historically accumulated by the listed prior listed entity, we think the value can be enhanced in WTC's hands over time, primarily due to the data assets E2open comprises. One simple example is its ownership of Avantida (part of its INTTRA platform acquired in 2018) which has a 21% share in global ocean freight bookings plus a container reuse platform used by 13 ocean carriers in 37 countries. Ownership and control could enhance the rollout of Wisetech’s key project Container Transport Optimisation in major markets, owing to the additional container-related movement data

follow up article from MS

this sounds credible to me. I don’t expect any magic for many years, but I think WTC has become a bottom drawer investment for me. Will continue to monitor periodically but reckon this is one of the best Quality stocks on the ASX now

WiseTech (WTC) plans to acquire publicly listed e2open for USD 3.30 per share in cash, an enterprise value of USD 2.1 billion. Funding is from a new fully underwritten USD 3 billion debt facility, from a nine-bank syndicate.

The transformative acquisition is larger than WiseTech’s prior 55 combined. It expands from the software from freight forwarders and carriers now to their customers, the beneficial cargo owners.

E2open is faltering. It struggled to create synergies through its many acquisitions, especially between its products for freight forwarders—such as BluJay—and the beneficial cargo owners. High debt created further pressure.

We view the acquisition as opportunistic given e2open’s falling share price. We also expect integration to be challenging, requiring significant future financial and management resources.

WiseTech expanding in every direction

We believe acquiring BluJay, CargoWise’s closest global competitor, consolidates the freight-forwarding software market. It also prevents a downstream competitor, such as Descartes, from acquiring the business.

However, further evidence is needed to conclude that WiseTech will win beneficial cargo owners and efficiently merge the new software with the existing freight-forwarding solutions.

WiseTech is now expanding in force in every direction from its core freight-forwarding solution. This includes downstream software for land-based transportation and upstream software for cargo owners, and software for carriers.

The acquisition should close in the second half of calendar 2025, post-approvals. Sufficient shareholders have agreed to the deal. Fiscal 2025 guidance is unchanged, save a USD 40 million one-time cost related to the transaction.

The acquisition significantly expands WiseTech’s vision and addressable market. The company now aspires to also become the operating system for global trade, in addition to the previous vision of becoming the operating system for logistics.

This means the company will now look to move further up the value chain into the procurement of supply chain services. Historically, WiseTech has primarily served freight forwarders, who work on behalf of cargo owners to co-ordinate the movements of goods, as these goods are moved along the supply chain by carriers, which own the physical assets like ships, airplanes, trucks, trains, and warehouses.

Beneficial cargo owners use different software to procure these services, which is where e2open plays. WiseTech now intends to bring together freight forwarders, carriers, and beneficial cargo owners into a single, multisided marketplace.

Easier said than done?

Although the vision is appealing, we believe it is easier said than done. WiseTech has previously tried to do something similar with CargoWise Neo. E2open itself has also tried to combine the same elements. Both have been unsuccessful so far.

In an ideal world, a cargo owner, such as a retailer, could easily compare freight forwarders and carriers on price and service for a certain shipment, select the parties they would like to work with, and the information related to the shipment would be seamlessly shared with the selected parties.

This means information would follow goods as they are moved all the way from the factory where the goods are produced to the final place of consumption, as goods are passed between trucks, trains, ships, airplanes, ports, and warehouses. But this requires dozens of different parties along the supply chain to be on the same system or to have systems communicating with each other, which is highly unlikely.

We therefore expect WiseTech to try to bring more of these parties together on the same platform. Although we rate WiseTech’s chances of success as higher than e2open’s, due to the strong position it occupies in international freight forwarding, at the center of the supply chain, we still view this as a multidecade journey.

Timing for expansion looks right

We do believe it is the right time for WiseTech to attempt such a large expansion.

Usually, companies try to expand their addressable market before properly locking in their existing markets. This often results in companies getting stretched too thin, as they’re fighting multifront wars. But WiseTech has essentially locked in the market for freight-forwarding software, in our view.

WiseTech now works with the majority of the Top 25 freight forwarders, as per the authoritative Armstrong & Associates rankings. These companies typically set the standards for the broader industry, meaning we expect WiseTech to continue acquiring additional freight forwarders as customers.

Additionally, given CargoWise customers consistently outperform their competitors because of the CargoWise platform, we see a second highly predictable route toward market dominance, namely through CargoWise customers taking further market share.

Moreover, with the acquisition, WiseTech is also acquiring its largest direct competitor in global freight forwarding, BluJay. We expect WiseTech will transition BluJay’s customers over to CargoWise over the coming years, thereby further consolidating the market and increasing the likelihood CargoWise becomes the default software for the industry.

Solid track record and sound balance sheet

There are other additional benefits which are readily foreseeable. The first is generic cost-optimization. WiseTech expects to generate over $50 million in annualized cost-savings at the end of the second year of ownership.

Given WiseTech’s track record with prior acquisitions, we believe these estimates are credible. These would consist of things like consolidating back-office functions and removing public market costs. However, given the majority of the e2open business consists of products that have little synergy with WiseTech’s current product suite, we don’t currently forecast further cost-optimizations beyond that point.

Despite the large debt raising, we believe WiseTech’s balance sheet remains sound. We calculate WiseTech’s EBIT/interest coverage ratio to be over 4 times in fiscal 2027, the first year of full-year ownership. Following the acquisition, WiseTech expects liquidity of around $700 million, from cash and undrawn debt

From Morningstar.

Seems to agree with pretty much your thoughts @mikebrisy !

WiseTech’s competitive position is incredibly strong and looks set to underpin formidable sales growth for the foreseeable future.

We have reviewed the competitive positioning of WiseTech (ASX: WTC), the global leader in logistics software for international freight forwarding. We increase our economic moat rating to wide from narrow, due to a better appreciation of the uniqueness of the company’s switching costs.

WiseTech’s CargoWise drives significant improvements in the efficiency and efficacy of its users, as compared with alternatives, which, in the cost-conscious logistics industry, leads to consistent market share gains. Switching away from CargoWise is therefore not a rational decision.

CargoWise’s switching costs are most clearly evidenced by its annual gross retention rates, which have stood over 99% per year since 2013, despite WiseTech pushing through notoriously steep price increases over this period. The score warrants close inspection because it is exceedingly rare for software companies to have such near-perfect retention scores.

For comparison, WiseTech’s closest peers are estimated to have 95% customer retention rates. Although such scores are still very impressive, implying a mere 5% annual churn, CargoWise’s churn is at least five times better, at under 1% annual churn.

This assumes the difficulty level for retaining customers scales linearly between 95% to 100%, while in reality, the closer a company gets to 100%, the more difficult each incremental percentage point of retention becomes.

WiseTech and its customers outpace the competition

We believe WiseTech’s CargoWise software helps its customers meaningfully outperform their competitors and thereby reduces business failure risk to close to zero. We see this evidenced in several revealing metrics.

The most striking among these is that every long-term CargoWise customer that is publicly listed has seen its share price outperform every one of its publicly listed peers over the past decade by a wide margin, with the average CargoWise customer delivering around 10 times the share price performance of the average peer.

My emphasis in the above paragraph - this would appear to be in incredibly powerful justification of the probability of increased adoption of their platform.

Figure 1: CargoWise’s publicly listed customers have outperformed peers. Source: PitchBook, Morningstar equity research, company filings, Armstrong & Associates Top 25 Freight Forwarders.

We believe this is because, by digitizing and automating processes, CargoWise makes its users materially more efficient (and effective) at their jobs. Anecdotally, we believe it is typical for freight forwarders using CargoWise to process twice the number of jobs per day, compared with the industry average.

But having twice the efficiency should result in half the staff, all else being equal. After all, as WiseTech’s CargoWise customers become proficient on the platform, they should be able to reduce staff and therefore have seat churn. This brings us to the second metric of customer outperformance.

We observe CargoWise customers have consistently gained market share, as they translate their lower cost base into lower prices for their respective customers, which, in a cost-conscious industry, results in significant improvements in their win rates at tenders. We believe the combination of a cost-conscious industry with an efficient market, and material efficiency improvements through CargoWise compared with all alternatives, means freight forwarders need CargoWise to be competitive in their industry.

This is different from almost all other software, which doesn’t significantly affect the success or failure of their customers – due to insignificant productivity gains compared with alternatives or because their customers don’t operate in industries which select as strongly for the lowest-cost provider. We have therefore described WiseTech as a “kingmaker” in its industry, as it essentially determines who succeeds or fails in the industry.

A different kind of switching cost

The kingmaker archetype of switching costs is different from most instances of switching costs. Usually, switching costs refer to a company incurring direct negative costs from switching to a different provider, such as having to train staff on a new system, integrating a new system with the company’s existing systems or risking disruption to mission-critical software.

CargoWise has those types of costs in spades. Customers typically take years to implement the mission-critical CargoWise software and we believe the same is true for subsequently switching away to another system. But we view the loss of benefits from higher productivity as far more significant in this case, as this affects a company’s core ability to remain competitive, and ultimately, to survive.

There are several important implications from WiseTech’s CargoWise customers consistently taking market share.

Most software companies primarily grow by increasing their number of customers, increasing user penetration within customers, increasing product penetration per user and increasing prices per product. However, WiseTech has an additional growth driver from helping its customers take market share and thereby growing their own businesses.

Moreover, whereas the traditional levers of software growth come with customer acquisition costs, customer success costs, product development costs or costs from increased churn, respectively, growth coming from customers taking market share comes with virtually no incremental costs in terms of sales and marketing, or research and development.

Still early days for market penetration

The market remains overly focused on the drama around the personal life of founder Richard White, which is distracting the market from the company’s large, and highly winnable market opportunity.

Although half of the world’s top 25 freight forwarders, and a quarter of the largest 200 freight forwarders use the software, we estimate still less than 10% of international freight forwarding volumes run through the CargoWise platform.

Moreover, this only refers to (air and ocean) port-to-port movements. WiseTech also has functionality for the next adjacent job, namely going through import/export customs and compliance, for which it is less penetrated. Given how tightly these two types of jobs are connected for freight forwarders’ workflows, we consider this opportunity as highly winnable.

The next job along the supply chain is typically the movement of a container between a port and a distribution center. Here the competitive intensity increases for WiseTech, as it starts to compete with the world’s many transport management system providers. But we do like WiseTech’s odds in this space over the long-term for two main reasons.

The first reason is sheer financial resources. WiseTech’s core international freight forwarding business generates large cash flows which the company can use to brute-force its way into the market, by either building or buying functionalities. The second is that these movements will increasingly have to pass through the CargoWise platform for the customs and compliance and air and ocean movements. Having an integrated system decreases the number of handoff points along the supply chain, which reduces costs and increases visibility.

We believe the next typical downstream movements of warehousing, and to-door and to-store are not logically adjacent enough in freight forwarders’ workflows to be winnable by WiseTech, as the supply chain typically has three distinct parts, moving goods from factory to a warehouse near the factory, moving goods from a warehouse near the factory to a warehouse near the consumer, and finally, moving goods from the warehouse near the consumer to the consumer (either to-door or to-store).

We believe WiseTech can also continue to expand along another dimension, namely toward the physical layer of the supply chain. We believe the company demonstrates network effects here.

Freight forwarders select and coordinate the operators of physical assets, such as ships, airplanes, trains, trucks, and warehouses, to move goods. When such third-party logistics companies are integrated with CargoWise, freight forwarders can maintain visibility as goods move along the supply chain without freight forwarders having to manually track and trace these movements. This results in significant labor cost savings for both the freight forwarders and 3PLs.

Given the cost-focused nature of the industry, we believe this incentivizes freight forwarders, who operate as gatekeepers in the supply chain, to give selection preference to 3PLs that are integrated with the CargoWise platform. Hence, 3PLs are incentivized to integrate with CargoWise to win business. This in turn increases the pool of potential 3PLs that freight forwarders can work with in a highly efficient manner.

Fair Value increased, shares look undervalued

We raise our fair value estimate to AUD 130 per share, from AUD 115 previously. At current prices, shares screen as materially undervalued.

We assume revenue grows at a compound annual growth rate of 20% over the next decade, driven primarily by organic revenue growth in the CargoWise product suite. We forecast an increase in group EBIT margins to 51% by fiscal 2034 from 37% in fiscal 2024, as a result of across the board operating leverage.

They've done it! $WTC announces acquisition of E3Open for US$2.1bn funded by a new US$3.0bn debt facility with a large group of bank lenders.

My quick observation

I have previously explained my enthusiasm for the industrial logic of this complementary acquisition. While it moves $WTC to a leverage of 3.5x EBITDA, the new lending facility leaves the business with US$0.7bn of liquidity, and strong free cash flows of the business will see debt falling to <2.0 within 3 years, excluding any contribution from synergies (which $WTC have proven time and again they can extract over the 2-3 year timeframe).

It is far and away the largest of $WTC's 55 acquisitions over >10 years, and exceeds the value of all combined (US$1.2bn). So given that all acquisitions involve execution risk, this is of another order of scale to anything $WTC has done before. Therefore success is not a given.

Overall, at 10x adjusted EBITDA, the acquisition multiple is modest for this type of business, considering $WTC trades on a forward multiple of 53x! It no doubt reflects the difficulties E2Open has faced over recent years with declining sales and leadership changes. Clearly, RW has formed the view that the business will be stronger when combined with Cargowise and the recent investments in landside logistics. We'll see.

It certainly opens a new chapter in the evolution of $WTC. Does it help advance the Global OS strategy enabling $WTC to eventually come to dominate global logistics?? Or is it a case of strategic diworsification? In any event, it brings new capabilities into $WTC that would have taken a decade or more to build organically.

Invester call in 30 minutes!

Disc: Held in RL only

$WTC issued a late confirmation this evening that it is engaged in a strategic review of US supply chain and logistics provider E2Open ($ETWO).

While $WTC has confirmed it is looking at E2Open, it is making clear that a transaction might not evenutate.

E2Open is a complementary business to $WTC focused on supply chain planning, demand forecasting, supplier collaboration, and global trade compliance, whereas the Cargowise focus is more on logistics execution—freight forwarding, customs compliance, and transportation. That said, there are areas of overlap.

The timing could be fortuitous from the $WTC perspective. E2Open was pretty acquisitive in 2021 and 2022, and over the last two years has made major goodwill writedowns, as these acquisitions have not delivered the intended value. (Let that be a warning to RW!) See the SP chart below.

As a result, market cap is down from US$3.42bn in late 2021 to US$1.8bn in 2023 to US$611mn yesterday! What a fall from grace! (We might expect a bit of a pop overnight, given news of $WTC's interest.)

Despite the writedowns and forecast continuing NPAT losses - presumably due to continuing goodwill amortisation - E2Open is still valued on a EV/EBITDA of 6.75, with forecast EBIT of US171m, even though revenue growth looks pretty flatlined.

As an acquisition this lies totally within $WTC's current financial capacity, however, it would easily be the largest acquisition to date, with all the risk that entails.

I tasked my AI BA with putting together a "Strategic Rationale" for why $WTC might contemplate such an acquisition. Overall, it makes sense to me. IF they can execute sucessfully.

Still, counting chickens here. There might not even be a deal.

Strategic Rationale for Acquisition ((Prepared by ChatGPT4.0)

1. Expansion Across the Supply Chain

- WiseTech primarily focuses on logistics execution—freight forwarding, customs compliance, and transportation.

- E2open adds capabilities in supply chain planning, demand forecasting, supplier collaboration, and global trade compliance, creating a more end-to-end platform.

- The combination would span planning to execution, a rare full-stack integration in logistics tech.

2. Access to a Broad Customer Base

- E2open serves a wider array of large enterprise manufacturers, retailers, and brand owners.

- WiseTech could cross-sell CargoWise solutions into these accounts while upselling E2open's planning tools to freight forwarders.

3. Global Network Effects

- E2open claims over 400,000 connected partners in its multi-enterprise network.

- WiseTech’s CargoWise system links forwarders and customs brokers in over 165 countries.

- A merger would strengthen data visibility, tracking, and workflow automation across more legs of the global supply chain.

4. Cloud Platform and Architecture Alignment

- Both firms offer multi-tenant, cloud-native software.

- Their platforms are built for scalability and integration, enabling smoother consolidation and unified roadmaps post-acquisition.

5. Undervalued Asset Opportunity

- E2open has seen a sharp decline in valuation due to missed financial targets and goodwill impairments.

- For a disciplined acquirer like WiseTech (which typically buys profitable or strategic assets), this could represent a discounted strategic asset with long-term value.

My Conclusion

I don't know enough about E2Open to have a considered view about the potential combination.

There are some potential orange flags. While the large Blume and Envase landside logistics software deals appear to have progressed well, there have been delays to the launch of Container Optimisation, which presumably integrated some of their capabilities. We've not been given any insights into that, other than RW wanted to move slowly to get things right, starting with a small localised trial implementation.

E2Open is a significantly larger acquistion than anything $WTC has done before, and although $WTC has built a strong capability over the last deacde in successfully acquiring and integrating businesses. E2Open is a step up in scale, and itself includes two material recent acquisitions (Bluejay Solutions and Logistyx Technologies), which were part of E2Open's own growth story and scaling up. No doubt, RW and team are doing their due diligence on what precisely thay might be getting into.

I'm not going to second guess Richard and his management team. They've been pretty sure footed over the last decade in the acquisitions they've made and, when the time comes, they'll lay out the rationale. It will surely be something about accelerating by years the building of the Global Logistics OS. So, let's wait and see what happens, if anything.

However, given E2Opens recent fall from grace and sluggish outlook, the timing could be right to make this move if it brings complementary capabilities AND a large client based into which $WTC can cross-sell Cargowise.

Given $WTC's long term strategic goal, it is hardly surprising that the acquisitions they will consider will grow as they do. At just shy of A$1bn market cap, E2Open is still a minnow compared with $WTC's almost A$19bn!

Disc: I hold WTC in RL only

90% of the air time on $WTC has unfortunately recently been on governance issues, but it good to see the team have been progressing tuck-in acquisitions to build out the platform capability and reach.

There have been 4 small acquisitions in as many months, with two very small ones in Latin America that haven't even warranted ASX announcements, but that are on the company website:

- https://www.wisetechglobal.com/news/wisetech-global-to-acquire-opentecnologia-sa/

- https://www.wisetechglobal.com/news/wisetech-global-expands-global-customs-capability-in-chile-ecuador-panama-and-mexico-with-acquisition-of-editrade-sa/

Both are tiny acqusitions focused on customs software in Latin America, extending the Cargowise footprint.

Customs processes, rules and other knowledge are highly jurisdiction-specific, and these acquisitions are about bringing the people with the knowledge in the acquired companies into $WTC, as well as their software code (which get's rewritten into Cargowise), and the customers - who become cross-sell opportunities.

This has been a hallmark of the $WTC growth strategy over many years now, and they have demonstrated a strong integration capability, as well as the ability to retain key staff. This was evidenced by some of the acquired CEOs who presented at the last investor day.

Andrew C, Vlad and the team know what they are doing here. And it is good to see that strong efforts are afoot continuing to build out Global Logistics OS despite all the noise that dominates the headlines.

Over recent days $WTC has communicated continued progress in its work to re-establish/repair the governance organisation.

Yesterday it published the results from its Shareholder Engagement Survey

- Shareholders want a public summary of the Board Review into Executive Chair Richard White to help rebuild market confidence. (DONE)

- There is strong support for Richard White to remain involved, especially in product innovation and strategic growth.

- A clear CEO succession plan is expected, with emphasis on a candidate experienced in software, product development, and WiseTech’s business.

- Investors desire a gradual and well-managed CEO transition, ensuring continuity and innovation.

- Board independence needs strengthening, with a call for more independent non-executive directors (NEDs), especially those with logistics and global tech experience. (See Below)

- Shareholders want ongoing engagement with the Board and senior executives, with greater visibility of leadership beyond Investor Day events.

The Board's response is:

- A summary of the Board Review findings was released on 19 March 2025.

- Two new independent directors have been appointed, with a search underway for two more, including one with Audit and Risk expertise.

- A detailed succession plan has been developed and is under review, with market updates expected soon.

- The company will make the successful Investor Day an annual event to enhance investor access to Board members and senior leaders.

This was then followed by the announcement of two new Non-Executive Directors, as follows:

Chris Charlton:

- Background: Over 35 years in customs and international trade; most recently Vice President – Asia Pacific Customs Brokerage at UPS.

- Expertise: Deep experience in logistics, customs compliance, and product development.

- Board Contribution: Will enhance logistics and product insight, particularly for CargoWise Next and other innovations.

- Committee Role: Appointed to the People & Remuneration Committee.

Andrew Harrison

- Background: Chartered Accountant, former investment banker, ex-CFO (Seven Group, Hanson Australia), former Chair of WiseTech and Bapcor.

- Board Experience: Broad directorships in both public and private companies, including infrastructure, healthcare, IP, and tech sectors.

- Board Contribution: Offers deep continuity, governance, and strategic insight from prior WiseTech leadership.

- Committee Roles:

- Lead Independent Director (replacing Mike Gregg)

- Member of Audit & Risk Committee

- Chair of People & Remuneration Committee

Next Steps

The Board is actively recruiting two additional independent directors, including one with Audit & Risk Committee experience.

My Assessment

While $WTC clearly are engaging with shareholders and addressing the governance concerns, they are very much doing on their own terms.

Andrew Harrison was Chair of $WTC from June 2005 until April 2024. His absence of 1 year form the company does not pass the common standard whereby 3 years absence is (as I understand it) considered good practice in terms of justifying the claim to be independent. For many who are concerned about strict corporate governance standards, this will not be considered good enough. I expect we will hear challenges on this from Proxy Advisors and organisations like the ASA.

With Harrison now joinging Charles Gibbon, we have the two previous Chairs on the Board who have spanned $WTC public listing history, I think. So not a strong rating for independence, but a mark of continuity that has seen shareholder value grow from $3,35 at IPO in 2016 through to over $80, only 9 years later.

Chris Charlton. This is a good move, adding to the Board someone with deep experience in the logistics industry on the customer side. Chris has spent 35 years in the logistics indutry, of which 26 were spent at UPS - a major Cargowise Customer. Importantly, Chris's experience is customs and compliance, and important area of potential growth for $WTC, given some prominnence a couple of years ago when Kuhne-Nagel signed up to the Customs & Compliance module. Of course, in a world of increasing tariffs and trade protection, this part of the $WTC offereing becomes potentially increasingly important.

So Chris is the first Director who looks like he can claim to be Independent.

At one level, while I welcome Chris' experience and skillset, I am a little underwhelmed given that he only reached divisional VP level at UPS, and I believe a company of the scale and global reach of $WTC should have a heavier hitter for a Board renewal that will set up the company for the next decade of growth. That said, when I compare Chris' industry experience, it vastly outstrips the combined experience of the four directors who have departed, none of whom had industry credentials in global logistics as far as I could see. So, on paper, Chris is a solid "tick" from me.

The Board will be well aware that they do not pass any reasonable measure of indepedence, and so the last line of the release is important to me. They intend to appoint two additional independent directors. It will be interesting to see both the credentials and the degree of independence of these next two appointments. I imagine Richard and his co-directors will be all to well aware of that.

So, good progress, but more to do. But it appears that RW and the Board are taking this all seriously.

Disc: Held

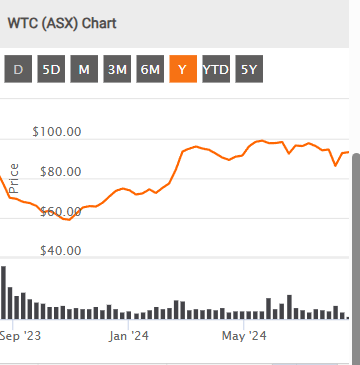

The chart of WTC is obviously broken and bearish after recent events, but there is an eerily interesting thing about today's low.

It is exactly the price reached at the bottom of the one-day yen carry trade panic (remember that?) on 06/08/2024, down to the cent!

So, is that the bottom? Only time will tell, but markets tend to exhibit an uncanny symmetry about them, so I wouldn't be surprised if it did turn out to be the case.

26 Feb 2025

More of a file note than a valuation update following 1H FY25.

Keeping valuation unchanged at $103 ($92 - $123).

Slower revenue growth in Cargowise, heading to lower end of guidance driven by slower new product releases, and a now later Aussie pilot approach to Container Optimisation is, in part, offset by significantly stronger margins.

Container Optimisation is such an important product that I'd much prefer it is throughly tested and proven before wider roll-out and so, in the grand scheme of things, I'm going to look past these delays for now.

With SP now just below my mid point, I have added some back this morning, taking my RL holding from 50% of my pre-goverance-drama allocation to c. 70%, Still cautious on how the goverance issue plays out, and how institutions react to the Board recomposition.

Howvever, overall, my thesis remain grounded on the long term view that $WTC is progressing towards its vision of building the operating system for global logistics.

Full valuation update after the FY25 Results.

22 August 2024

Update my valuation range to $103 ($92 - $123) based on full model update, anchored of 2024 result and FY25 guidance.

In this case I have dropped more highly leveraged scenarios on the basis that RW maintains a conservative balance sheet, as $WTC continues to invest heavily (organically and inorganically) as it seeks to build the operating system for global logistics.

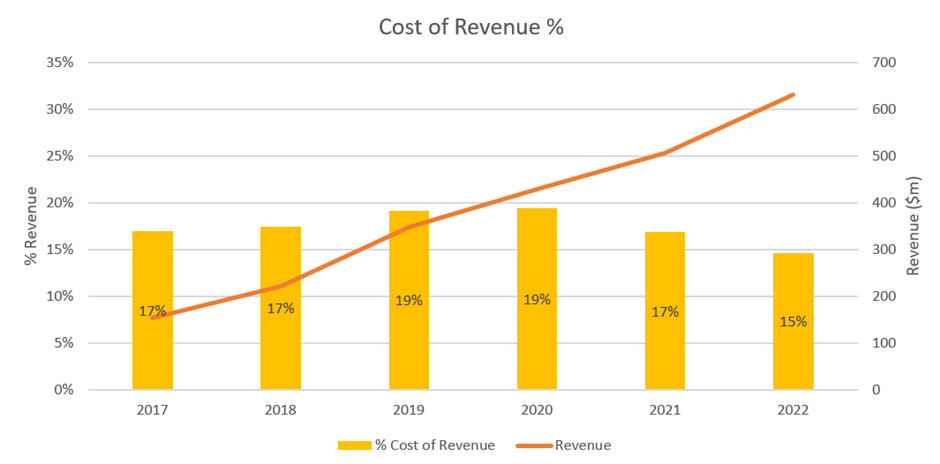

4 March 2024

Changing my valuation range to $80.00 ($62.00 - $96.00)

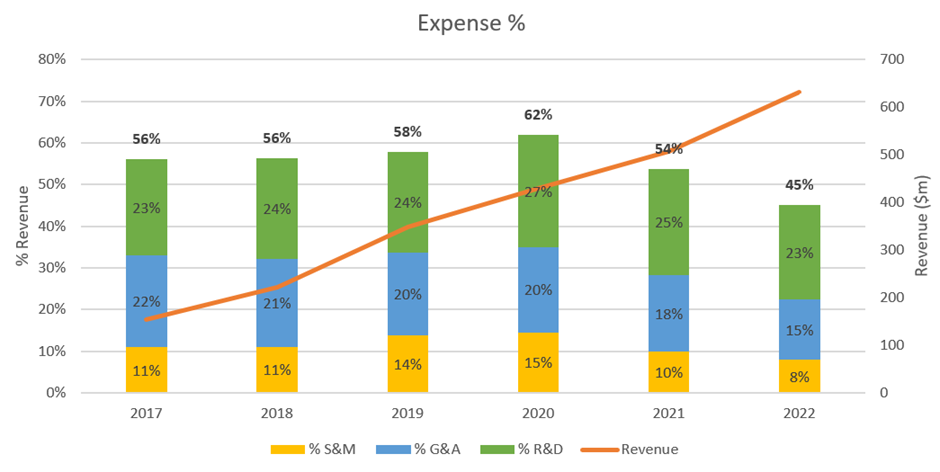

I'll try and keep a very long story short here: I know its only two weeks since I updated my $WTC valuation, But after watching the CommSec interview with Rickard White, I realised that with the major exapnsion into landside logistics, as well as AI exploitation, $WTC is significantly stepping up its rate of investment in the platform - both in absolute terms and as a % revenue. (see figure below) with capitalisaed development actually increasing 30% ove the PCP, I actually missed this last week, and was only prompted by the interview to go back and look at my model.

Graph from 1H FY24 Results

However, ORGANIC revenue for the half grew only 15% and organic revenue for Cargowise grew only 19%, and the delay of the new release of Cargowise means that we might reasonably expect this to flow through to H2.

I missed the full implications of this in my re-run of my valuation model last week, and was probably lulled into a false sense of security by seeing all the broker vals. moving significantly upwards (Confirmation Bias?).

So, I took a harder look at my revenue growth and margin evolution scenarios, generating the following distribution of valuations.

In the valuation range quoted above,I've ignored the levered valulation in the higest growth scenario, because in this case the reinvestment rate is higher and management is more likely to run a more conservative balance sheet.

My Mean (p10% - p90%) ranges as shown is $80.00 ($62.00-$96.00)

Minor tweaks to other parameters, but model largely as below (WACC 9%; growth in CV is 3.5% from 2043)

21-Feb-2024

Updated DCF model following 1H FY24, with major revisions to my valuation posted 11 months ago $71.00 ($49 - $98)

Valuation scenarios combining two sets of scenarios:

a. Unlevered: ($70.30 to $99.50), with one higher scenario of $130, which is rejected as starting revenue growth of 22% is considered too high for now, given the lower report organic revenue growth today, albeit it is noted that Cargowise organic is still growing at 19%.

b. Levered at 1.0x EBIDTA (phased in to 2029): ($77.55 to $111.02) rejecting high value of $147, as above)

Revenue Growth: Range of scenarios for annual revenue growth of 20% and 17% in 2024 tapering down to 16% - 14.5% (2032) and 11% (2042)

Margin Evolution ($84.64 unlevered scenario) - see graph below

Other Model Updates

- Continuing Value growth rate 3.5% (unchanged)

- WACC = 9% (updated from review of sources. Note last valuation used 10%, so reduction in WACC in line with market is offset by reduced revenue growth scenarios). You really can get whatever you want!

Observations

- With $WTC having spent c. $800m in acquisitions since the last model update, the revenue profile is uplifted and flattened.

- Margins are eroded in the next next two years, but recover over time in line with guidance indicated today for FY25.

- Will recalibrate based on the FY24 result - should only require minor adjustments, given the guidance provided.

- Premium over analyst models appears mainly due to longer term model horizon, which is justifiable given the analysis performed in last year's $WTC deep dive, assuming $WTC succeeds in building the "operating system for global logistics).

Important Disclaimer:

Prepared for my personal use and information only. Not to be used as a basis for investment decisions. The underlying models are not validated to be free from error.

RW is back.

New Board Update

The new Board of WiseTech Global Limited (WiseTech, the Company, ASX:WTC) provides an update below. Board and Committee Composition Richard White has been appointed to the Board as Executive Chairman.

The Executive Chairman will, in conjunction with the Nomination Committee, oversee succession planning including completion of the internal and external search process for a permanent Chief Executive Officer.

The Executive Chairman will lead the Company’s product development and growth strategy. His remuneration is to be agreed but will not exceed his pre-October 2024 CEO salary.

Mike Gregg has now joined the Board, as announced on 24 February 2025. Mike Gregg has been appointed Lead Independent Director.

The People & Remuneration Committee is now made up of Charles Gibbon and Mike Gregg. Lead

Independent Director responsibilities

The Lead Independent Director will have carriage of governance related matters and the Board renewal process. He will also lead the Board (excluding Mr White) in overseeing the completion of the Board Review announced on 24 October 2024.

The Lead Independent Director will request a briefing from Seyfarth Shaw in the coming days as to the scope and status of their review and will seek to ensure all relevant parties are interviewed, and that a thorough approach with due process is followed. It is anticipated that an update as to the status of the report will be provided to the market in mid to late March.

Due to the resignation of four directors, the Company does not currently satisfy the ASX Listing Rules requirement that its Audit and Risk Committee comprise at least three non-executive directors. The Company intends to appoint additional independent directors as soon as practicable so that this rule can be complied with.

The Board expects that at least one appointment will occur within 4 weeks. As part of the Board renewal process a shareholder engagement process will commence in the following days to ascertain their views on the relevant skillset for the future Board composition.

Mr White in the headlines again.

More allegations against him.

Interestingly, it seems he has not signed the agreement that would see him take on his new role at the company.

"People close to Mr White said he had privately expressed frustration with the decision to remove him as chief executive and informally discussed moving WiseTech to the United States in the longer term."

If that were true, I guess he'd need to stay the head honcho, in order to make that happen.

See AFR article here: https://www.afr.com/technology/i-ve-been-too-trusting-richard-white-responds-to-new-allegations-20250209-p5lapv

I attended the $WTC Investor Day today, which focused on the new products: Compliance Wise, Cargowise Next, and Container Transport Optimisation (CTO). But, as importantly in the light of recent events, the day provided the opportunity to see key members of the broader management team.There was a lot to absorb today, and I don’t have the energy to summarise all the insights of the day. So will rather share a few top level impressions.

The $WTC bench of leaders are impressive, particularly in their longevity with the company and/or how leaders of historical acquisitions have integrated effectively into the business (and by this I mean not just as heads of their former businesses, which over time get full subsumed by Cargowise and related products, but as leaders of overall functions within $WTC).

We saw about 10 leaders across products, technology, sales, and finance. If I was to single one out, I was very impressed with Acting CFO Caroline Pham. She facilitated several of the sessions, demonstrated she was across all areas of the business, and is a phenomenally clear communicator. Very impressive. But then again Brett Shearer (CTO and Chief Architect, with $WTC since 1994), John Pritchard (Product Development, since 2019), and Vlad Bilanovsky (Chief Execution Officer) were all impressive. Too.

It is also clear that there is a powerful and high performing culture in $WTC ("Creedo" and "Mantras") that truly govern/shape how people behave and decisions are reached.

But it was the closing panel when Richard White came back on-stage and in some of the excellent questions, that clearly demonstrated that this is a company whose evolution is still being guided forward by his vision for the roadmap to creating the operating system for global logistics. And that’s not a just slogan, as it was clear in many of the questions and answers that this is a vision that the entire leadership team is focused on turning into a reality. It is a massive under-taking, and there are decades to run, but the belief that they will succeed and in their strategic differentiation is palpable.

At the very end of the session, I felt I got some insights into the delayed launch of CTO and the adjustment to guidance. When CTO goes live it will be with a limited scope – focused in the market around Sydney, with one optimisation (out of “10”) turned on, before being extended to the East Coast of Australia and then the West Coas of the US. In my view, this alone was never going to account for the adjustment in guidance that was recently announced. No way! Which leads me to conclude several things: 1) that $WTC got ahead of itself in issuing the initial FY25 (my hypothesis when I exited several months ago); 2) that there have been an accumulation of delays in new product launches over the last years; and 3) that the process of scoping what goes in the “go live” version has been progressively descoped to ensure that they launch a product that works.

The forces at work here were all set in train under RW’s watch, with at most a month or two of a drag on senior decision-making on key go-no-go decisions during the recent media circus. That was because these decisions involved descoping and delays – decisions which only the CEO can ultimately take.

Again, in my view, this is all a manifestation of the inevitable tension that exists between the visionary CEO, and the ability of the team to deliver. I’ve seen it before elsewhere, and after today’s sessions I am even more convinced than before the meeting that this is what’s at play at $WTC. Frankly, it would be better if they didn’t give guidance, because the tension in itself is not a negative thing. Not having guidance would leave the team free to work out these issues without having to recalibrate external expectations.

Having made these somewhat negative remarks, it is clear that the three new products will ultimately drive significant future value. If CTO gets traction in the market, it could be as big as Cargowise.

From today, Richard sees himself fully unleashed from management and governance tasks to develop the roadmap, the product, and key customers engagements to bring his vision to reality. If there is a risk, it is that without being accountable for promises made to the market, the tension between driving $WTC to implement his vision, and the reality of updating shareholders on guidance expectations may well be something that emerges from time to time. We should not be surprised when it does. That is the consequence of ambition.

Without seeing the specifics, we also got clear insights into the existence of work on material future product innovations, that will extend long into the future.

Valuation

I need to go away and look at my valuation.

I believe that there is a near term risk that an inevitable maturing of Cargowise revenue growth may coincide with a gap as delayed new products ramp up. This creates the possibility that if the market can’t see through this, that I will get a re-entry point for $WTC. i.e., the market recalibrates to a slightly softer FY25 projecting that forward, with then growth recharged in FY26 and FY27 and new product sales kick in. Something to mull over.

I haven't decided what this means for my reinvesting for $WTC. There is more work to do over the summer.

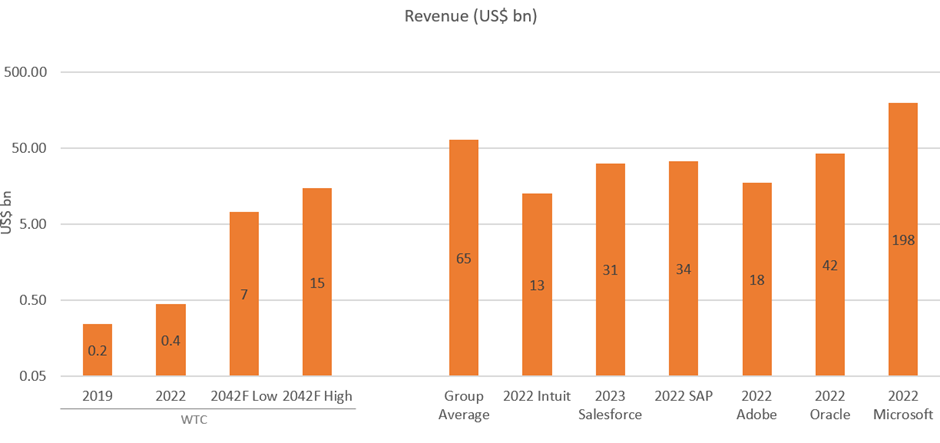

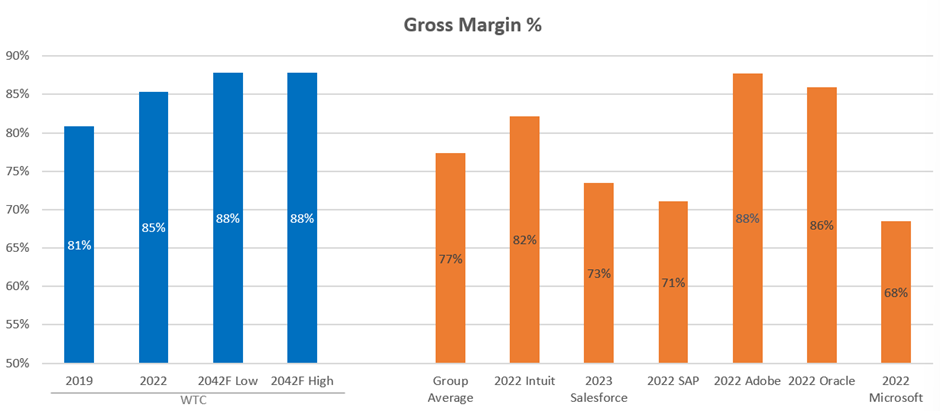

Looking back at the deep dive I did a couple of years ago, I estimated that $WTC in 2019 held about a 1% share of the global market for logistics and supply chain software. I also estimated that my valuations were based on this growing to between 6-9% by 2042.

I think I need to go back and look at some of those assumptions, following today’s presentation. I might be doing $WTC a disservice.

Disc: Not currently held, but that's likely only temporary

WTC aim to gain Governence stabilty.

Noted: WTC team 3,500 people vs PME team 120 people

some slides here-

If you want to see the webcast click on link / then letter see below :

Link to webcast https://cdn-api.markitdigital.com/apiman-gateway/ASX/asx-research/1.0/file/2924-02889672-2A1565954

6 month chart:

I love the AFR. But its recent "go for his nuts" approach to playing the man, not the ball (pun sort of intended ..) is starting to get to me a bit once the initial public service of raising unseen/unknown red flags outlives its usefulness. In my view, the relentless desire to find ANY fault with every and anything starts to dilute the importance of investigative journaling. I am feeling this way the more I read Joe Aston's book on Qantas, for example - it has got way, way too personal vs Joyce.

Unless of course, there is an angle to the announcement which I haven't quite seen, hence this post/question.

This was an extract of the AFR's take on the WTC announcement on Fri where Maree Isaacs sold a chunk of her shares to Richard with a somewhat funky deal stretching out 7 years.

I read the announcement and my immediate reaction was (1) good for Maree (2) Richard is committing himself to more holdings and a somewhat orderly drawdown vs flooding the market or selling a block to another investor who could cause turbulence in the WTC book (3) how Richard pays Maree is a matter for him/them. This is, for all intents and purposes, no different from how one fund sells a block to another fund and deals with the funding/settlement issue - the Board notes the change in shareholding, however the deal is structured, and everyone moves on.

So this AFR take surprised me. I am wondering why, as a shareholder, should I be concerned with this, beyond the above. Its a shareholder to shareholder sale, no doubt both are insiders. But it is still a matter for them and I can't quite see how the Board should be concerned with this. The fact that the numbers are big does not change it for me. Is the AFR, or specifically, Mark di Stefano, trying to make news where there is none to be made?

Wondering what everyone's take on this is and if I am missing something blatantly obvious here. Am doing this to try to sharpen my read of these sorts of announcements, particularly after the recent spate of corporate governance drama's.

Discl: Held IRL

Extract of AFR article only:

This statement is fascinating for its lack of detail. What’s with the indeterminate amount of time? Is there a nominal value? Is the volume-weighted average price calculated by the share price movements of the previous quarter, or for the entire preceding period? Does Isaacs get more money if WiseTech shares go up? Or down? Is White making a killing off this or isn’t he? Do either of them even know?

Shareholders may want to ask because the numbers underlying the deal are so damn big. Isaacs held 8.17 per cent of RealWise, which in turn owned 37.43 per cent of WiseTech’s shares.

Deducting the upfront cash Isaacs received, White should at current market prices owe her roughly $1 billion. To settle that debt, he’s committed to pay her quarterly instalments of an unfixed amount, for an unspecified period. Isaacs is effectively taking on White’s credit risk. Think of it as a loan. A mystery $1 billion vendor loan taken out by the LinkedIn Lecher.

The terms should be of paramount importance to anyone invested in WiseTech’s success. White isn’t the CEO any more, but he is still easily the largest shareholder and remains a salaried “consultant” reporting to the chairman. Now he has a $1 billion commercial arrangement with a board director, which will be paid off, presumably, by further share sales (White’s been a monumental seller of late, including to pay for his divorce). How has all this not been clearly enunciated by the company?

https://www.afr.com/technology/how-richard-white-s-humble-tech-nerd-image-came-undone-20241025-p5klcx?utm_medium=Social&utm_campaign=nc&utm_source=Facebook#Echobox=1729935459-1

And there it is. (25% to 100%)

RW has settled the court case.

I believe that, like a crash of thunder, that clears the air. Yes, there will be aftershocks and questions about key man risk and behaviour relevant to the business will remain. But I think this fundamentally resolves several questions.

I'm not condoing the behaviour. It's none of my business, And I don't know the full facts.

Accordingly, I have re-initiated a 5% RL positon at $106 and am leaving my p50% estimate of valuation at $103 unchanged until the next results.

Rock on.

Disc: Held in RL

P.S. Discussion with Board:

Dammery: Option 1 ..., Option 2 ..., or Option 3 - Just make it go away.

RW: Oh, Okay then, I'll take Option 3.

Ok WTC down heavily this morning on all that bad media. Is this over sold? I'd be interested in all Straw peoples thoughts here. The bull and bear case.

The Australian this morning commenting on reports that $WTC Board “confront tough choices with White” with reports of one option being considered in having White taking leave of absence.

Given all the salacious press of recent days/weeks, I’ve been waiting for this shoe to drop.

To be clear, I believe $WTC is currently overvalued, and I have exited my RL position after the FY results as reported here in earlier straws.

I wonder what this news is going to do to the SP?

It is on the top of my watch list to re-enter on a significant fall.

There’s little doubt that Richard’s personal issues will be a distraction for him, but $WTC is large enough that should he step back for a bit, it will be a good test of the bench below him as to whether performance continues without missing a beat. That is actually something I’d like to understand better.

Disc. Not held

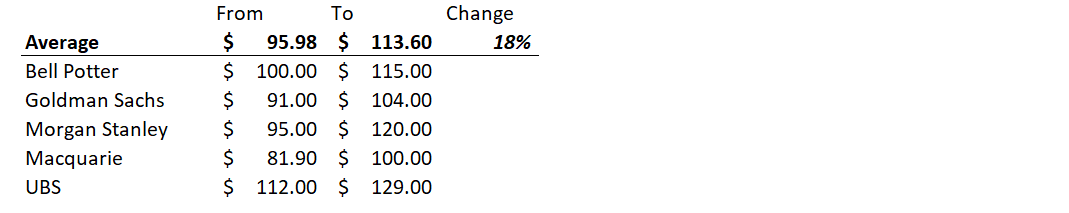

In this straw, I summarise the market response, analyst response, and my own valuation update, following the surprisingly good result/outlook yesterday for $WTC.

Suffice to say, its a pattern we've seen before.

Market Reponse

The market opened positively, yesterday up 20% with the day's volumes of 1.8m about 4x daily norms. Today has added another 9%+ (at time of writing) on another 1.7m shares, taking the cumulative uplift to around 29%. Just to be clear, that's about $9bn market cap added.

Analysts

Overnight, several analysts updated their valuations and TPs. (Remember there TP's are 12m targets)

Here's a snapshot of the individuals I've been able to track:

The more complete set on marketscreener.com has moved as follows:

Prior to result: Average $92.82 ($55-$115; n= 18)

Post result: Average $107.32 ($55-$129; n=18)

An average change of +16%, albeit not all have updated.

My Valuation

I have previously reported the details of my detailed, long-run DCF model, built a couple of years ago.

Today was the first day I updated it following the Blume and Envase acquisitions early last year, which always muddy the waters, and I find that I need a clear 12 months for things to stablise, which they appear to.

Based on my range of scenarios for revenue and margin evolution, I get the following:

P(exp.) = $103; Range ($92 - $123)

My Divestment Decision

Earlier this year I sold my full $WTC holding at c.$96, because at that time the SP had flown up towards the top of my valuation range. On 5th August, I bought the position back at a cost base of $87.37, ... courtesy I think of the unwinding of the Japanese carry trade.

Although $WTC is a quality business, its share price is fairly volatile, partly because the market continually misjudges the temporary impact of %GM compression following acquisitions (which are about acquiring capability and market footprint, to then fold into Cargowise). This time a further misreading was due to $WTC taking time to develop the next set of product enhancements, resulting in high R&D and capex, with organic revenue slower to respond.

But whenever the market gets behind the eight-ball on what's really going on, and the result surprises, there is an over-reaction. This most recent "over-reaction" has even caught me by surprise. Having realised a gain of almost 40% in less than three weeks, I have today sold down 50% of my RL position.

I know it can be dumb to sell your winners. Real dumb. But over the last 8 years I have consistently sold down $WTC when it hits the top of my valuation range and bought back when the SP moves to the low end of the band.

One measure I track is the EV/EBITDA(forward) mulitple. Historically, this moves around quite a bit within the band of 38 to 52. Today at my exit price, it hit around 58. I'm confident history will prove that's not sustainable.

Whether its P/E or EV/EBITDA or any other valuation multiple, $WTC moves around quite a lot. So even though it is probably my favourite stock, and the business on the ASX I understand well (second only to $PNV), I do tend to move in and out of it every 1 to 2 years.

I didn't sell my entire position because sometimes the market gets completely irrational about $WTC, and it is not uncommon for it to go even higher over the coming weeks. Worst case, scenario, I'll hold what is still a 5% position in my portfolio for the long term.

Happy Days.

Disc: Held in RL (5%)

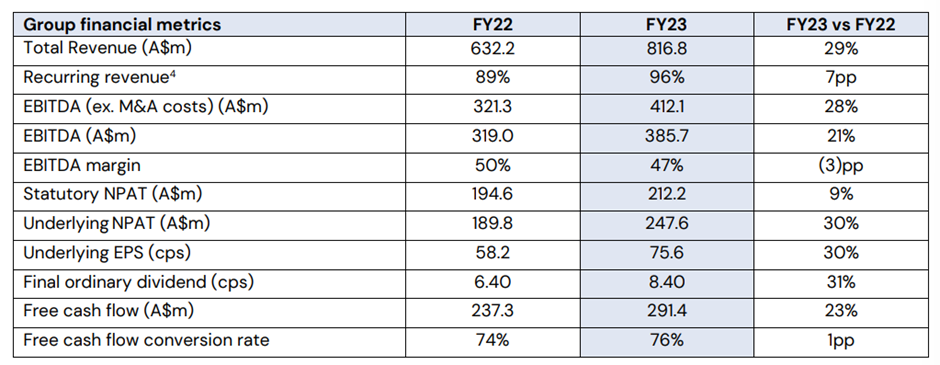

This Result looks ok at a glance:

21 August 2024 WiseTech delivers strong financial performance and outlook 33% CargoWise revenue growth, 28% total revenue growth 48% EBITDA margin, ahead of expectations WiseTech Global Limited (WiseTech or the Company) today announced its financial results for the twelve months ended 30 June 2024 (FY24). FY24 highlights

• Total revenue of $1,041.7 million, up 28% (up 15% organically1 ) on FY23

• CargoWise revenue of $880.3 million, up 33% (up 19% organically) on FY23, driven by full and part year effect of FY23/FY24 M&A and customer growth including new Large Global Freight Forwarder (LGFF) rollouts

• EBITDA of $495.6 million, up 28% on FY23; 48% EBITDA margin ahead of expectations and 4QFY24 EBITDA margin run rate at 50%

• Underlying NPAT2 of $283.5 million, up 15% on FY23; with statutory NPAT of $262.8 million, up 24%

• Strong free cash flow of $333.0 million, up 14% on FY23 • Final dividend of 9.2cps, up 10% on FY23; representing payout ratio of 20% of Underlying NPAT

• CargoWise customer penetration momentum continues with LGFF wins – Sinotrans (Top 25), APL Logistics, Yamato Transport, TIBA Tech and Grupo TLA Logistics. Nippon Express (Top 25) was secured post year-end

• Three breakthrough product releases announced for FY25 - CargoWise Next, Container Transport Optimization and ComplianceWise, with planned releases commencing 1H25

Final ordinary dividend (cps) 9.2cps up 10%

Transaction small % of their holdings - pay Tax?.. Why? No News.

Richard White Disposed: 208,239 Units or $18,697,690 Has balance of $10.831Billion

Name of Director Maree Isaacs Disposed: 18,519 Units or $1,662,821 ...Balance of $963.197Million

I’ll kick off by correcting the introductory remark in my straw this morning. Although revenue was a modest beat to consensus at (+3%), EBITDA and EPS were strong beats, with EBITDA +14% better than consensus. Hence the strong SP response, ending up over 11% on the day at the close.

As ever, it was a joy to hear Richard White talking about the business. So, rather than go through more detailed analysis of the results, I’ll focus on three big themes.

1. The Acquisitions and how they play into the strategy

2. Customer Value - proof?

3. Machine Learning/AI

1. The Acquisitions and how they play into the strategy

In one year, $WTC has taken a decisive set of steps in landside logistics, focused on North America.

The significant Blume and Envase acquisitions in early 2023 extend Cargowise capabilities from the port into import/export container haulage and rail. Blume is a leader in North America in internodal rail and Envase covers all aspects of container movements including trucking companies, port, depots and warehouses. These acquisitions further penetrate the supply chain, stepping beyond the original focus of the freight-forwarder and customs clearing, providing more of the solution onwards to end customers.

Later in the year, the smaller acquisition of Matchbox, complemented these capabilities. Matchbox allows operators working on the platform to swap container assets, thus significantly reducing the haulage from destination back to the base depot, yielding potentially significant cost savings to customers.

The next piece is the November acquisition of Sistemas Casa, the Mexican customs and international freight software solutions provider.

Richard briefly pointed out the growing importance of Mexico as a major trade partner to the US. What he didn’t dwell on, is that with increase risk perception around China, a lot of manufacturing investment is now heading into Mexico. So the time is right for $WTC to be building out its capabilities in landside logistics, to position itself for the growth in tradeflows within North America.

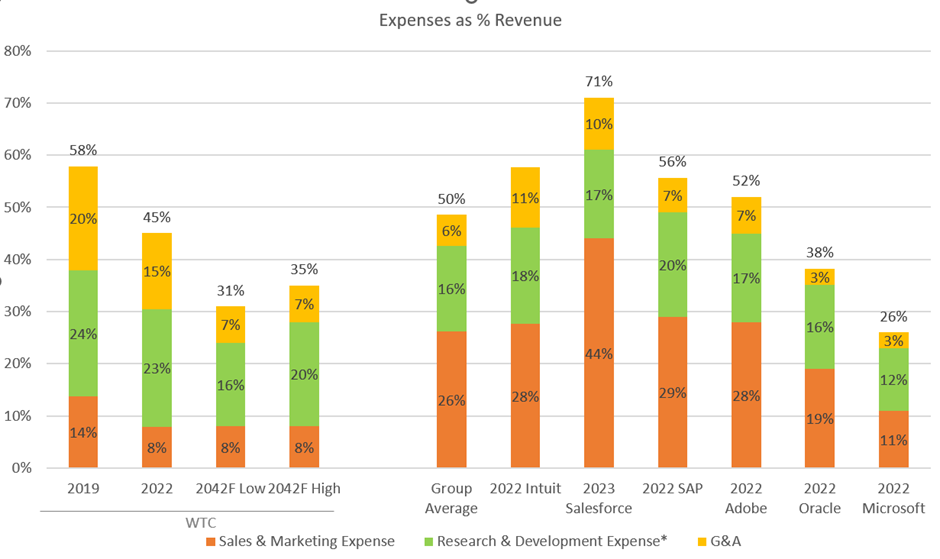

With this step change in capability, it is hardly surprising that $WTC is ramping up its R&D spending – now at 35% of revenue. Product development is 62% of $WTC’s headcount! This, added to the margin compression resulting from including the lower margin acquired businesses. I am curious to understand whether the deep integration of Blume and Envase is underway, given that the initial plan was to run them alongside Cargowise for a period until the understood better how to integrate. (I didn’t get the chance to ask this today, as I was in listen-only mode. One for next time)

There was a clue that serious integration is happening, because of the discussion about delays to the next release of Cargowise into FY25. This would make sense if there was serious effort underway to incorporate deeper landside capabilities in the next release. It also explains the lower revenue growth reported for Envase and Blume, as staff will have been focused on integration into cargowise, and not selling the legacy platform (Hey, Bucephulus, feel like round 2?).