SDR's FY23 results had no surprises as most of it was revealed during the earlier 4Q Appendix 4C Release. However, these charts in the pack stood out for me as it provided a bit more "colour" on the performance.

It was a strong result and it is executing/delivering on the trajectory Sankar said it would. Will be interesting to see how much this holds up in the next 2Q's as global economies decelerate further, eating into discretionary travel demand.

Discl: Held IRL and in SM.

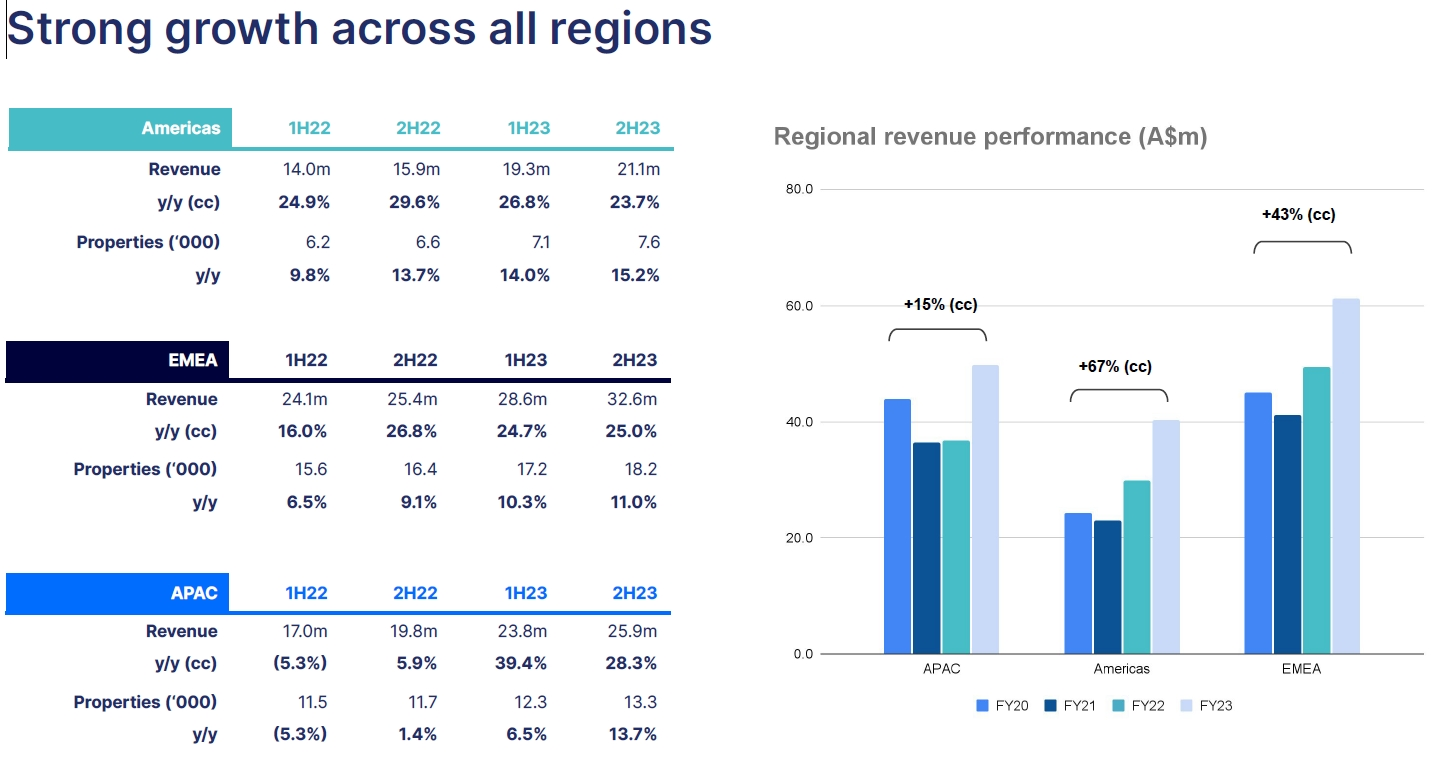

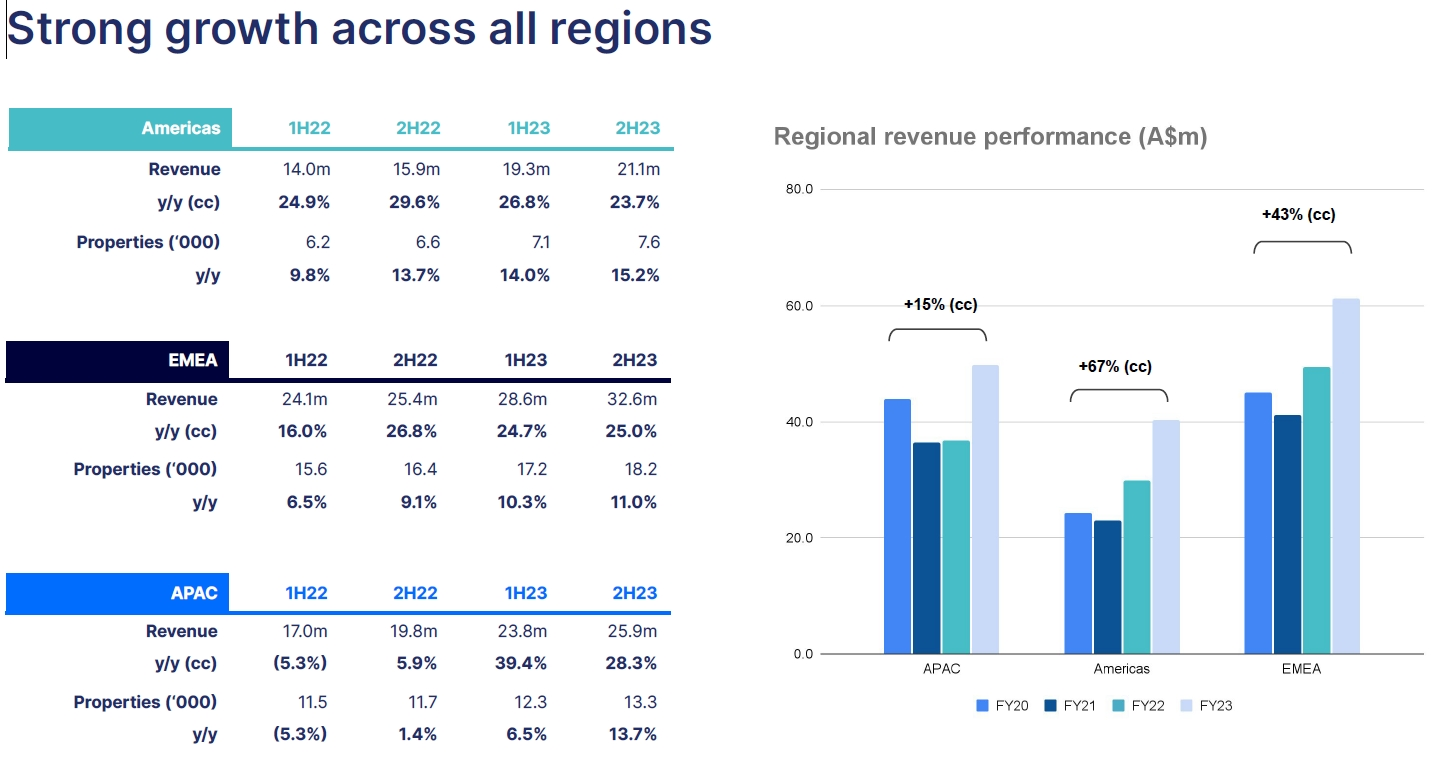

- Growth was strong across all regions in terms of revenue and property additions

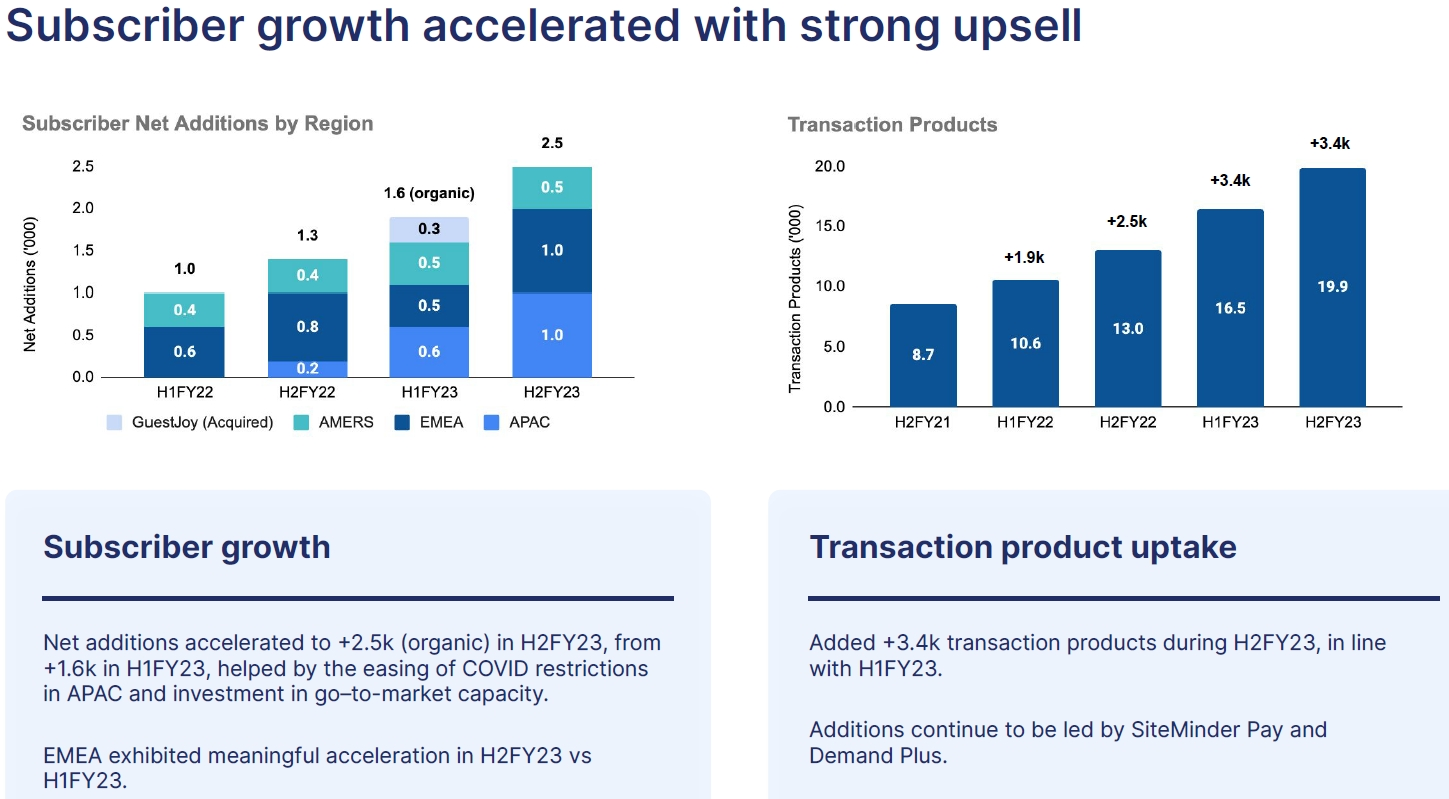

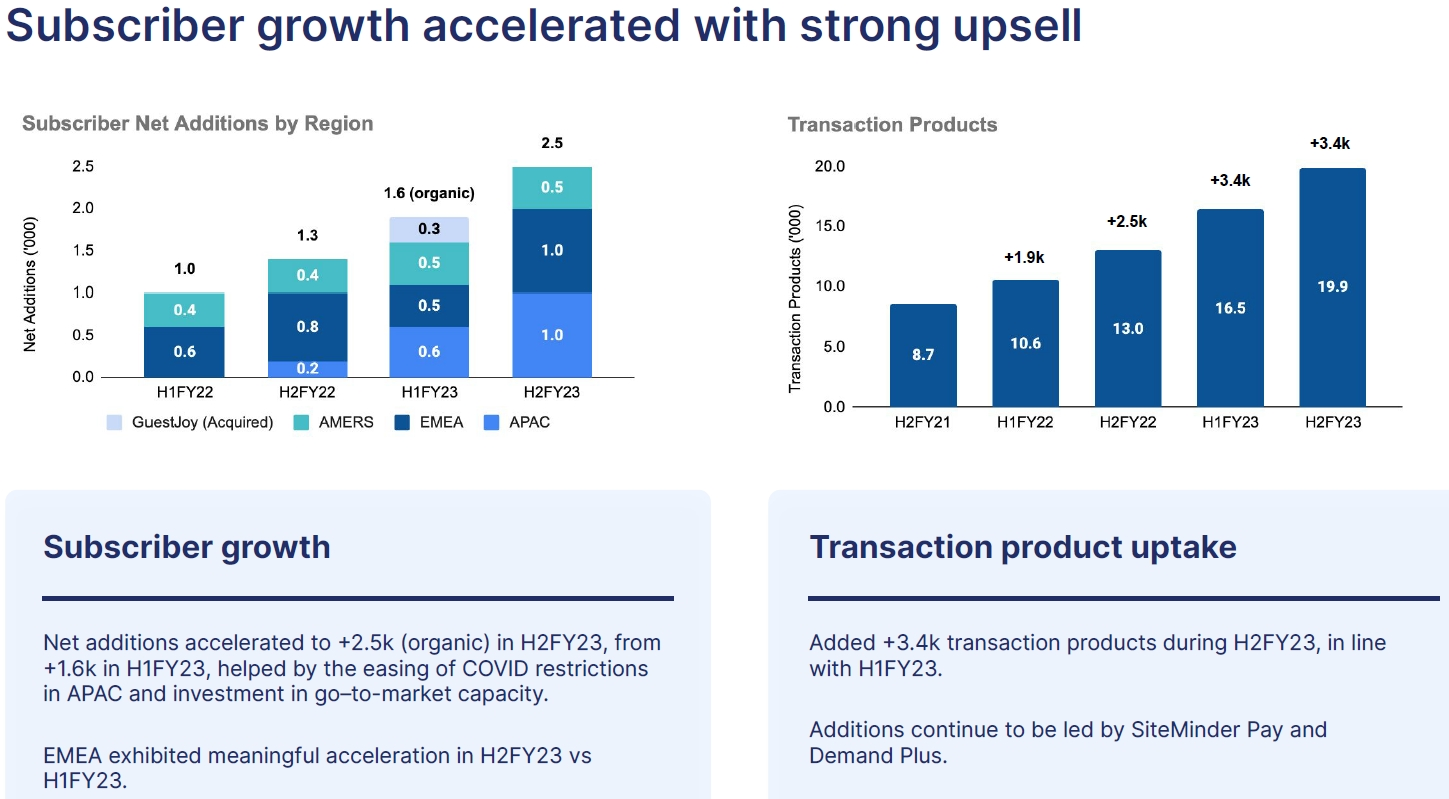

- Strong subscriber Net Additions, again across all regions, and strong uptake of transaction-based products

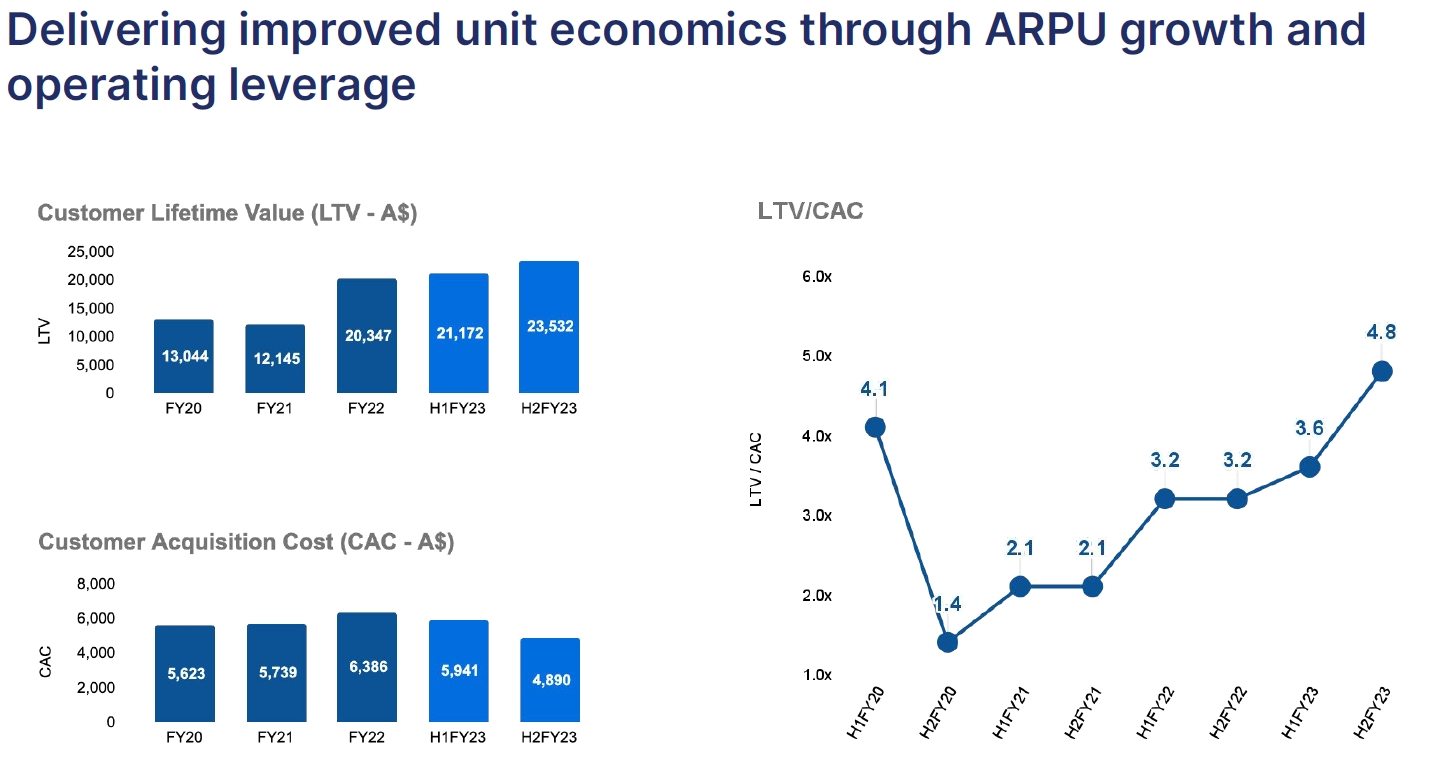

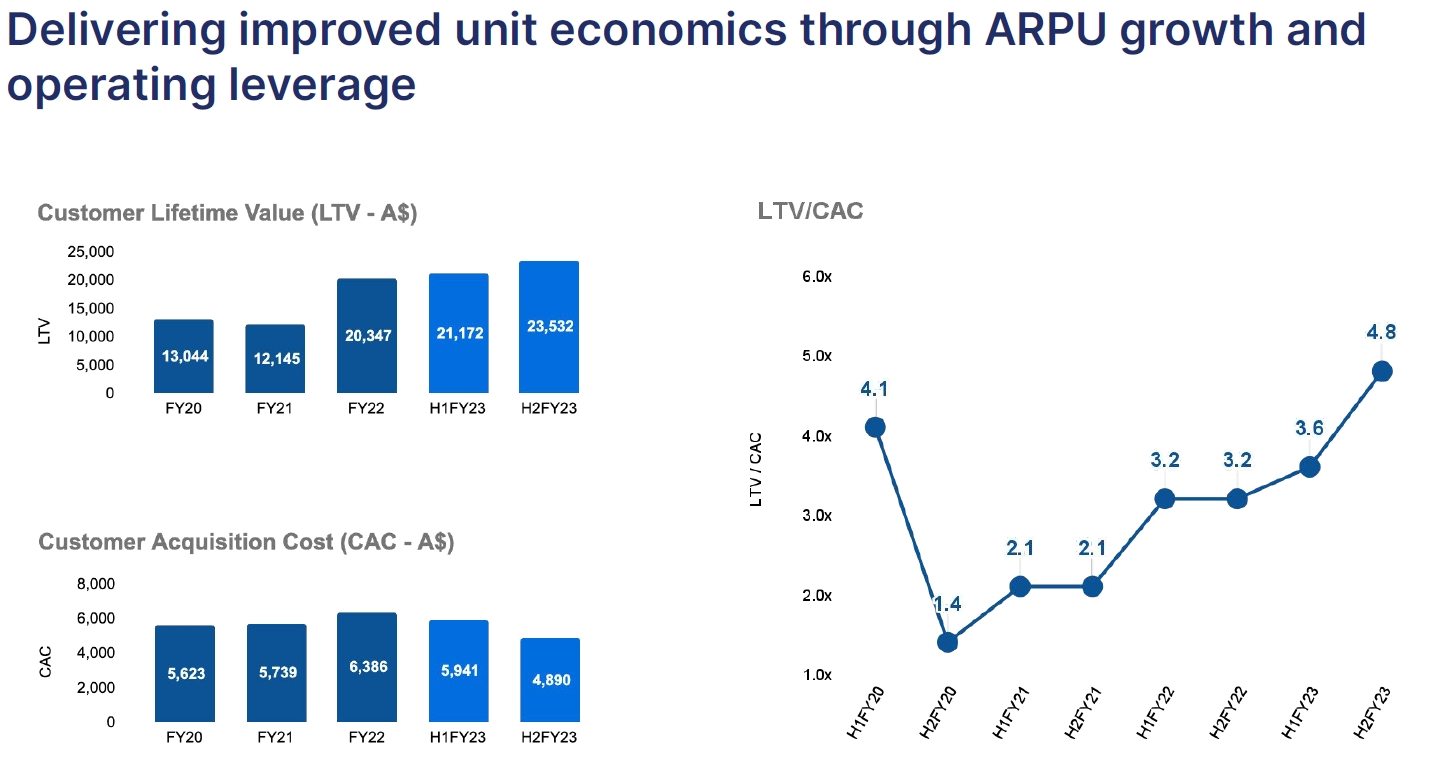

- LTV/CAC metric was missing in the 4C announcement - moved to 4.1x for FY23, but improved to 4.8x 2HFY23, HoH moves appear to be accelerating, as Sankar said it would

- LTV was up 9.7% to a record $23,212

- CAC improved 14% from $6,386 in FY22 to $5,469 in FY23, driven by operating leverage. CAC for H2FY23 was $4,890

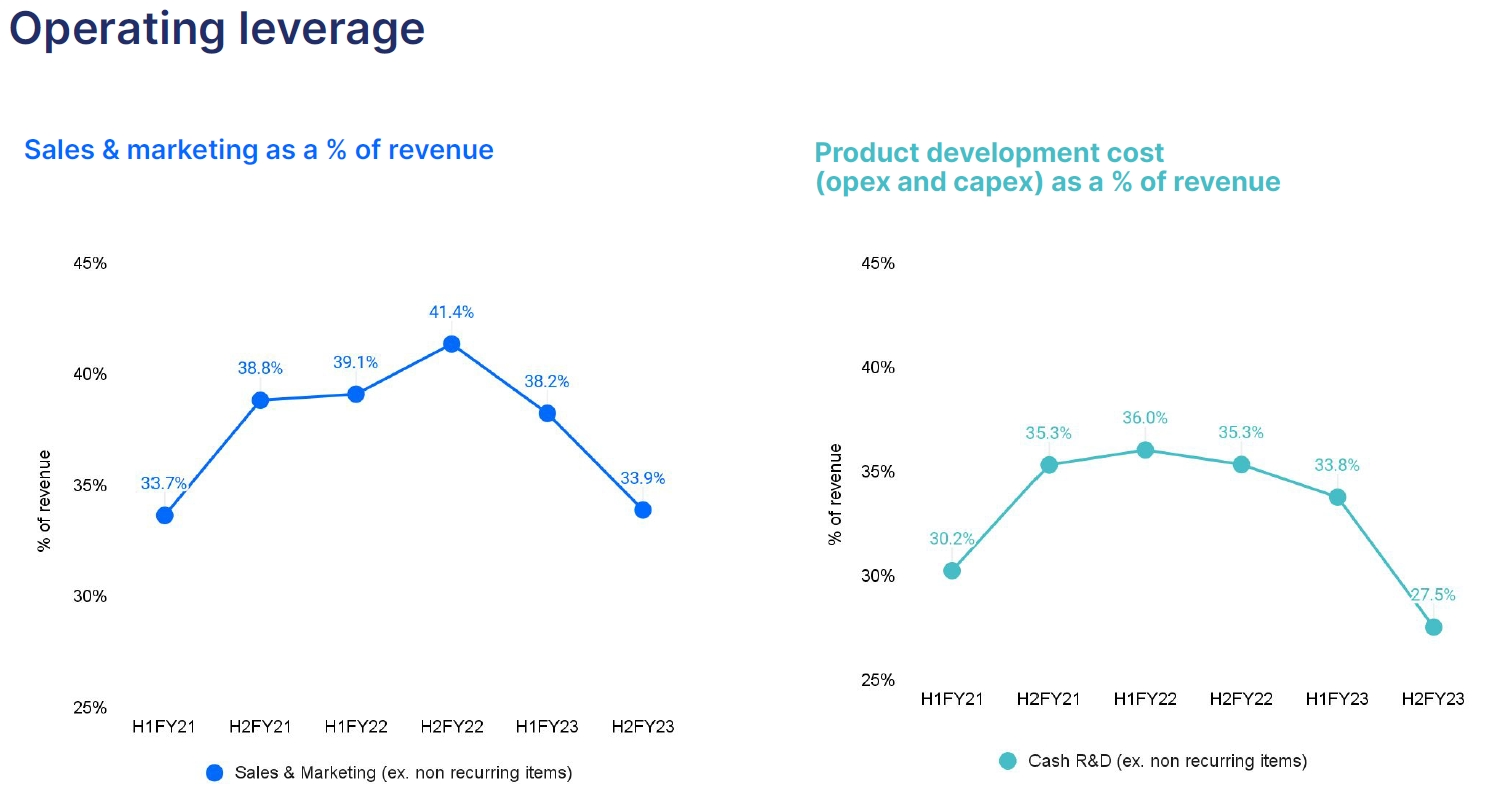

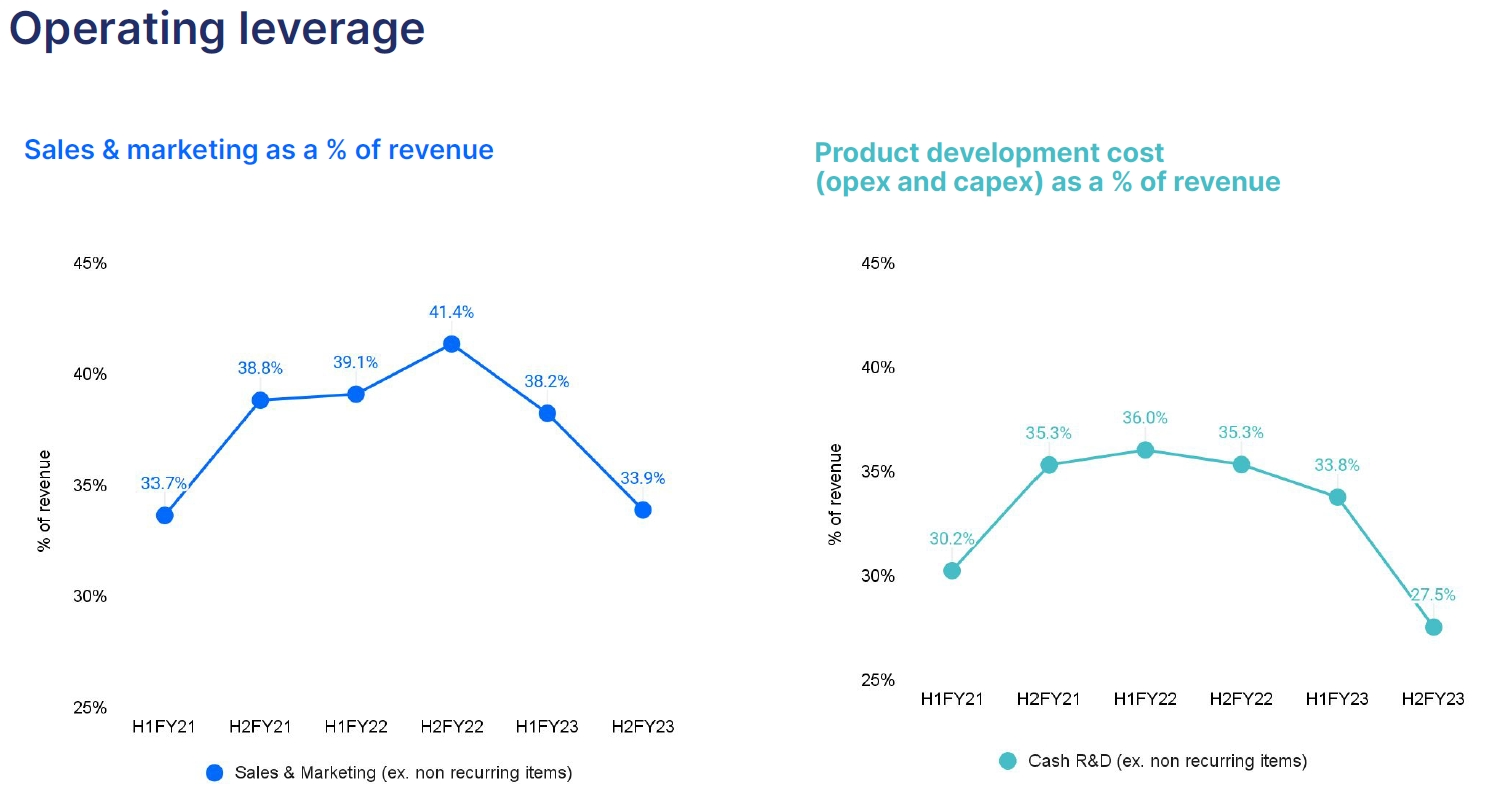

- Both Sales & Marketing and Product Development cost as a % of revenue are trending down rather decisively