IPG

IPG

FY23 Results Presen'

Pinned straw:

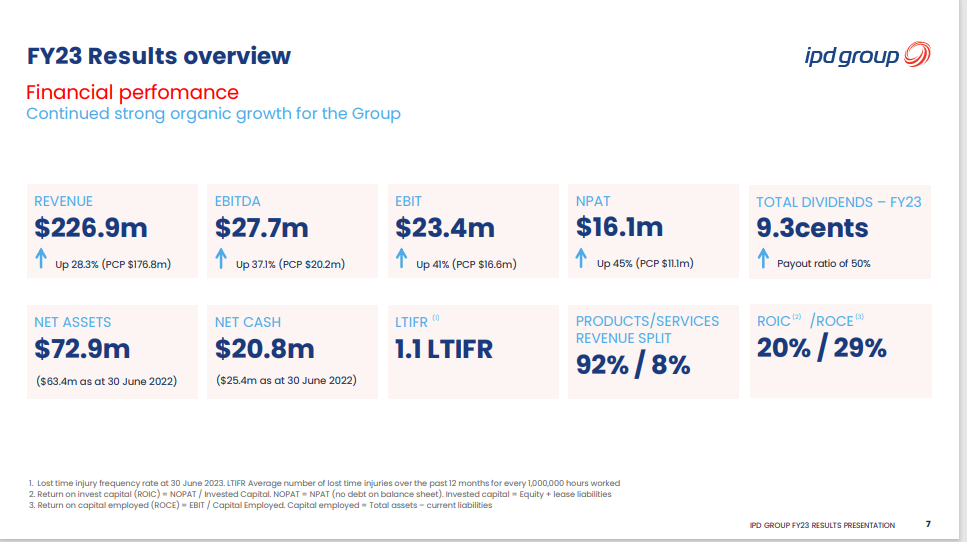

Earnings Per Share (0.19) was below Bell Potters estimate of 0.22.

Dividend Per Share (0.93) was also below the broker consensus of 0.11

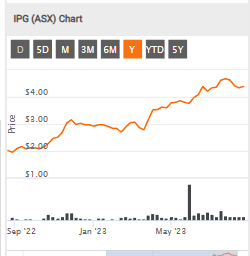

Explains the price weakness today.

Bell Potter looks like they are keeping the estimate and the 5.50 price target.

6