27-Aug-2023: Yesterday I highlighted GR Engineering Services (GRES, GNG.asx) and their income and growth history and future prospects. Today it's Lycopodium (LYL.asx).

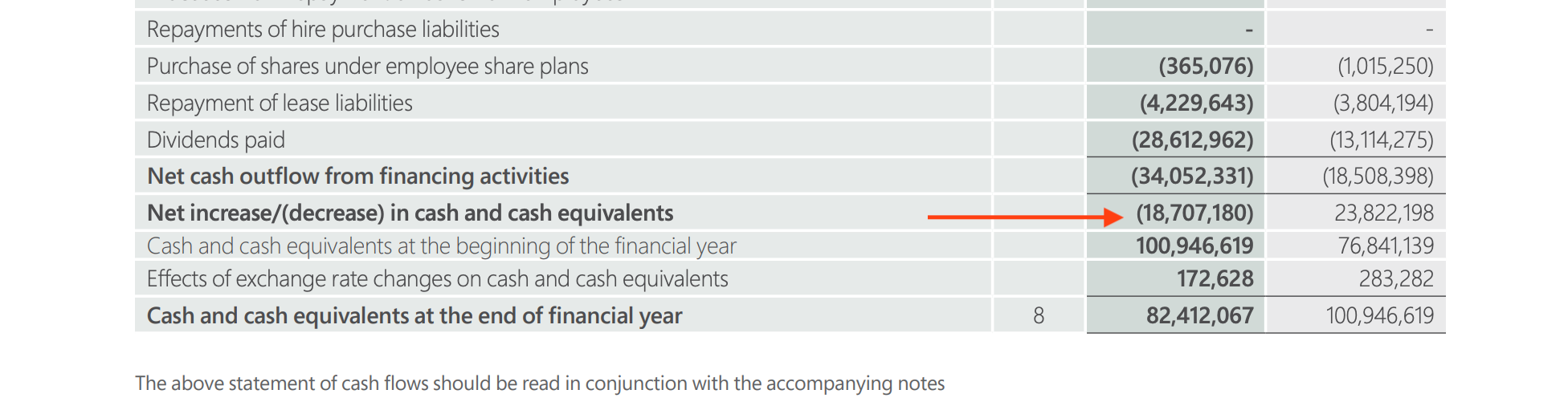

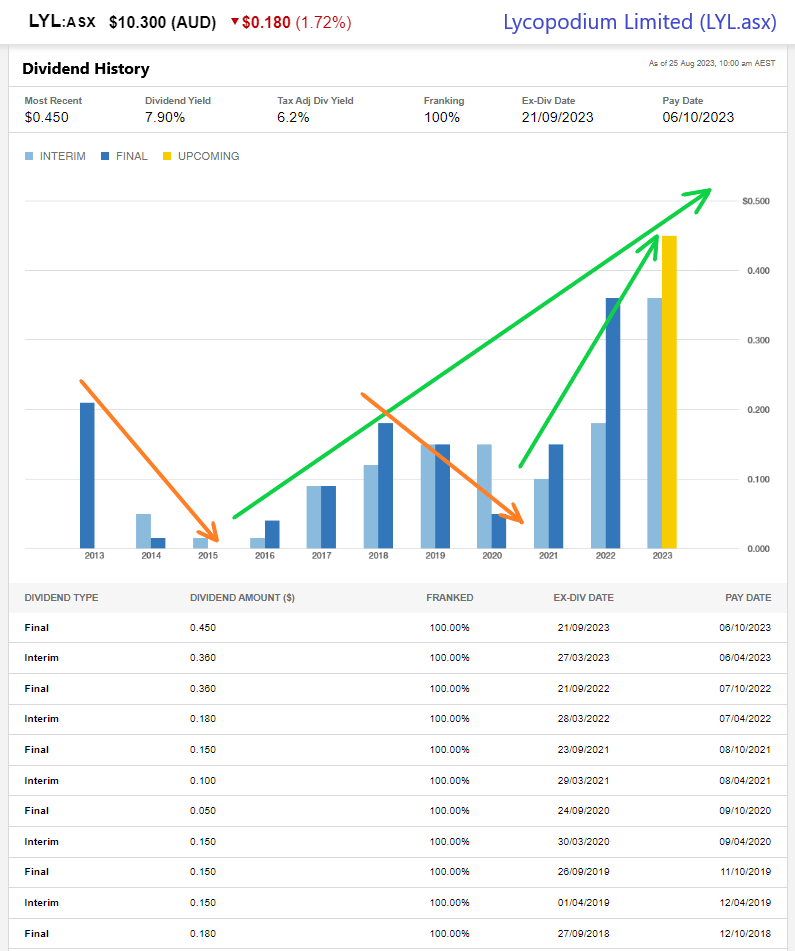

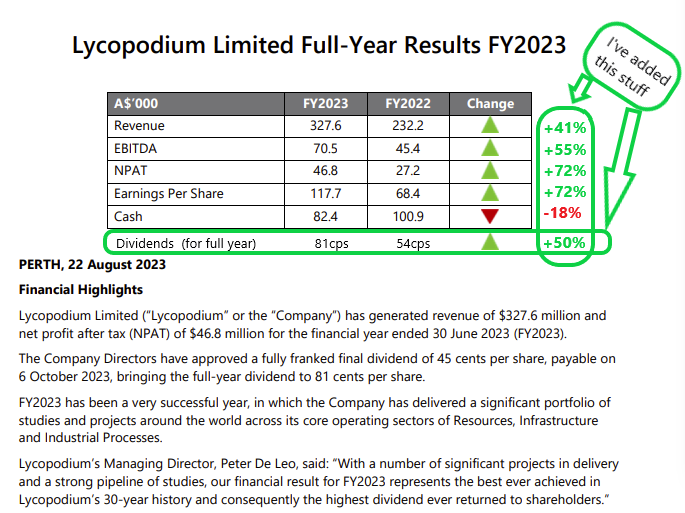

So there's the income - LYL's current 12m trailing dividend yield is 7.9% plus franking, and all of their dividends have been fully franked. That's a grossed-up trailing yield of 11.2% (including the full value of the franking credits). The trend here is also your friend. Their dividends are increasing along with their revenue and earnings. Their revenue and earnings can be lumpy due to the one-off nature of much of their project work, however their downtrends don't seem to last long, and the overall trend is up.

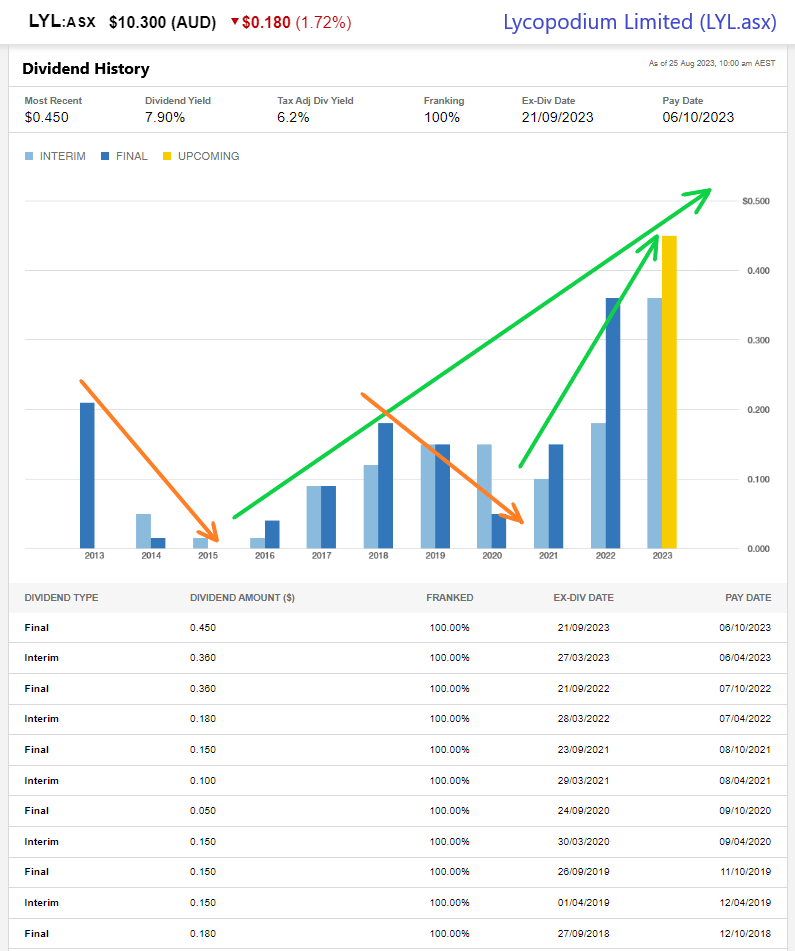

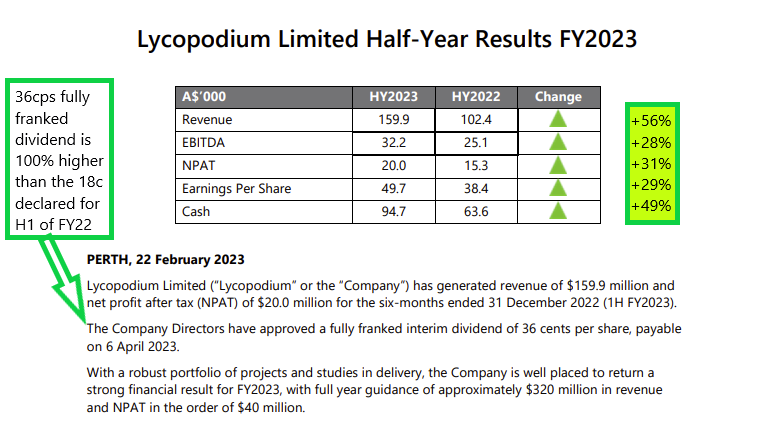

Here's their interim results summary released in Feb for the 6 months ending Dec 31st, 2022:

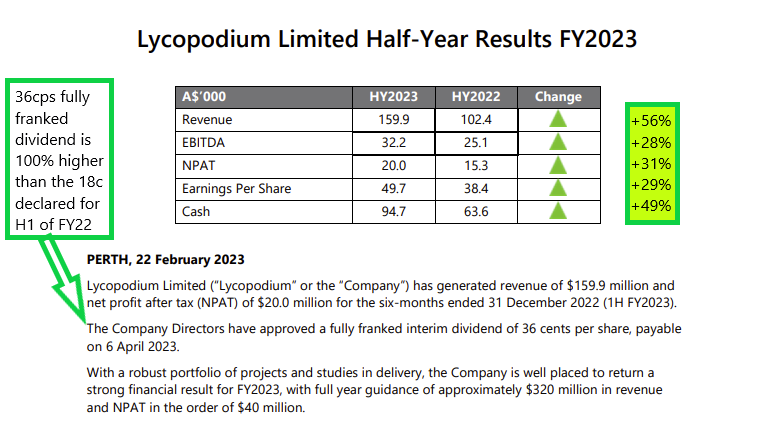

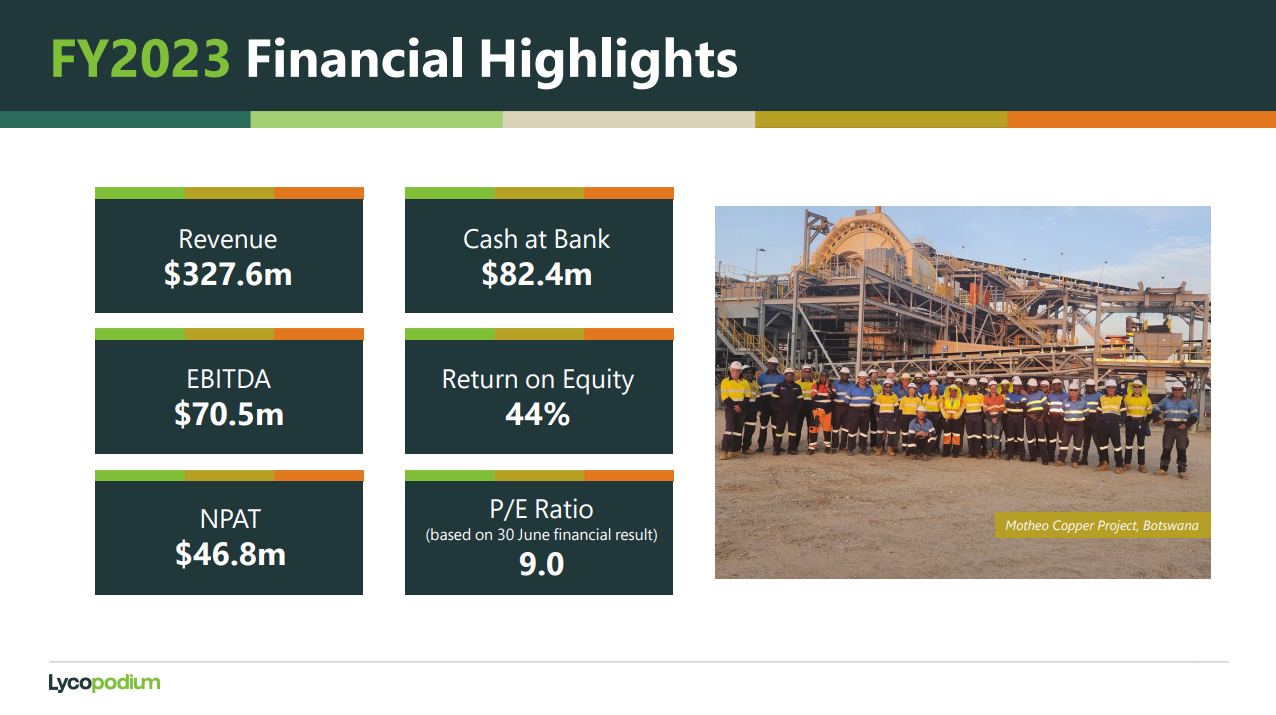

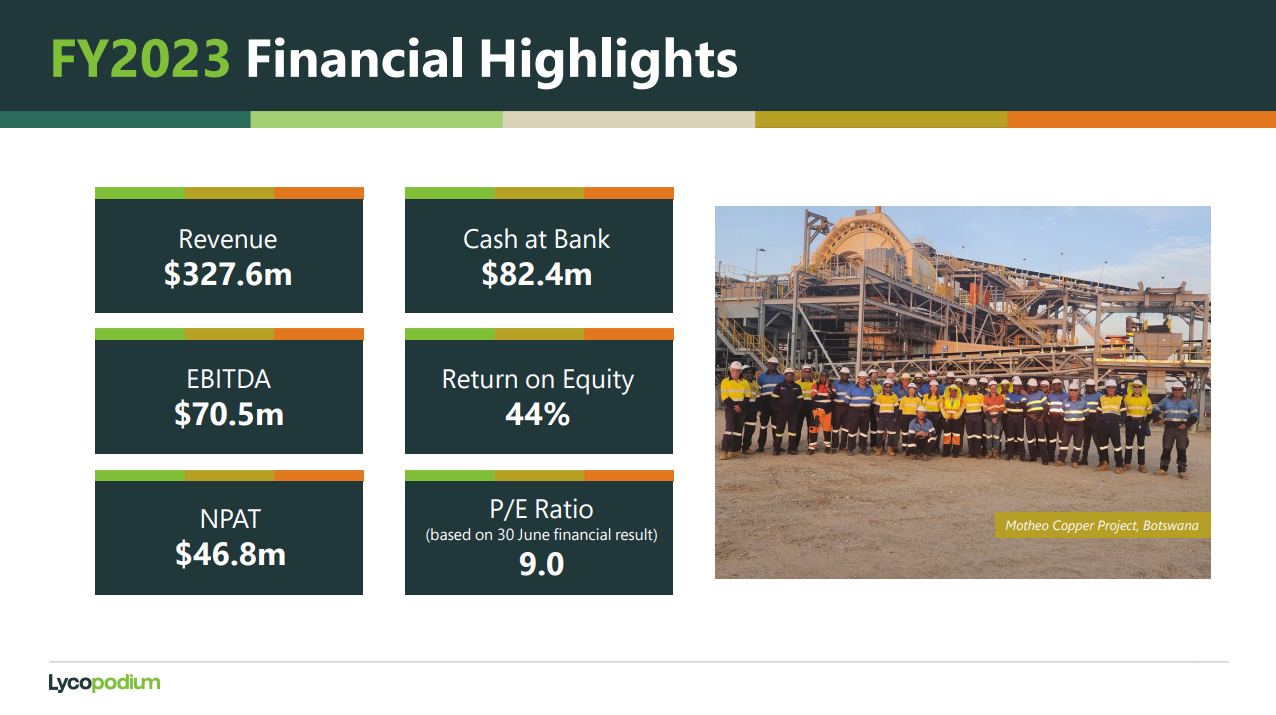

And here's their full year results published last week for the 12 months ending June 30, 2023:

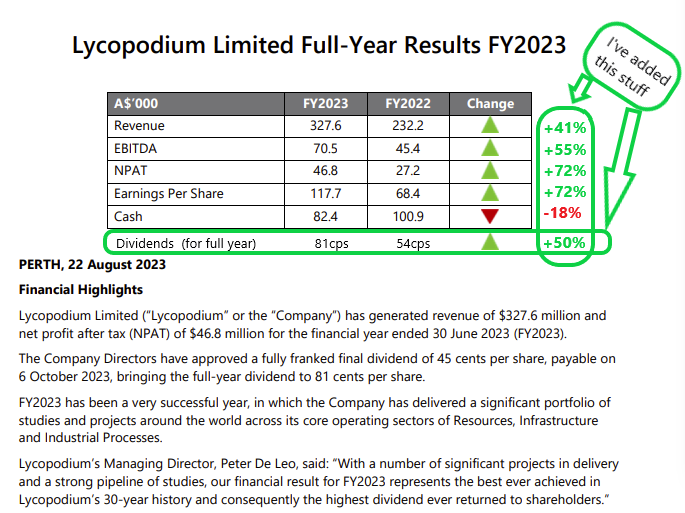

Source: LYL-FY2023-Full-Year-Results-Announcement-22-Aug-2023.PDF

See also: LYL-Investor-Presentation-FY2023-22-Aug-2023.PDF

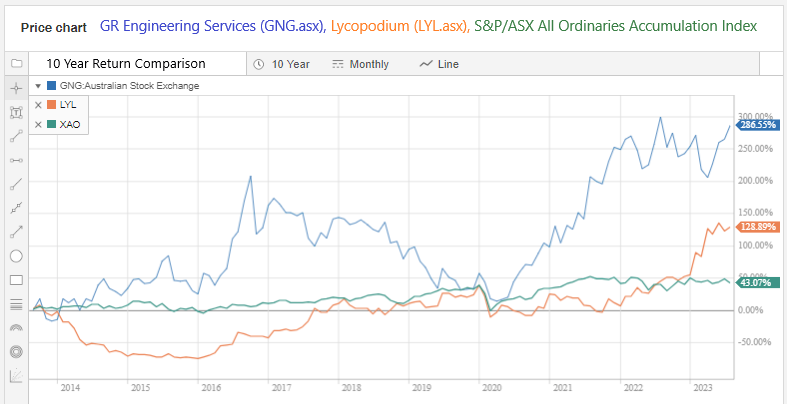

And we have share price growth as well:

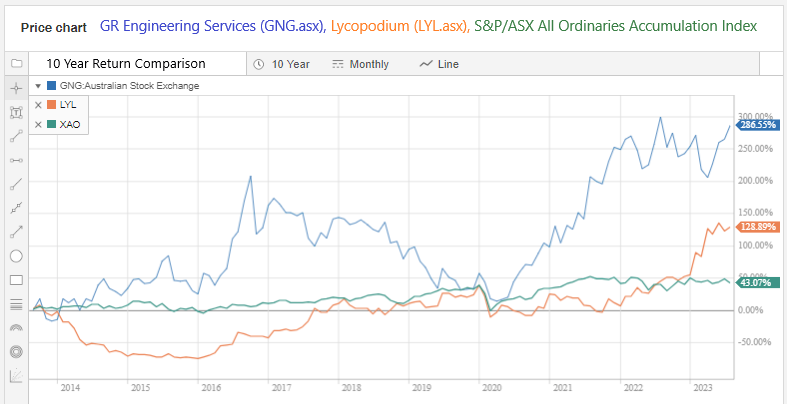

And here's that graph I showed yesterday in the straw on GNG that highlights the return from the same amount invested in GNG, LYL and the All Ords Index 10 years ago:

GNG has returned 6.6 x the All Ords Accumulation index, just in share price appreciation, with all the fully franked dividends on top of that. LYL has returned 3 x the All Ords return, plus dividends (dividends are already included in the green line coz the XAO is the All Ords Accumulation index which assumes all dividends are reinvested back into the underlying companies whereas the Blue and Orange lines for GNG and LYL do NOT include dividends).

The thing to note however is that LYL are really hitting their straps at this point in time, with rapid revenue and earnings growth, big dividend rises, and big share price movement to boot. GNG have done it more consistently, however LYL are catching up now.

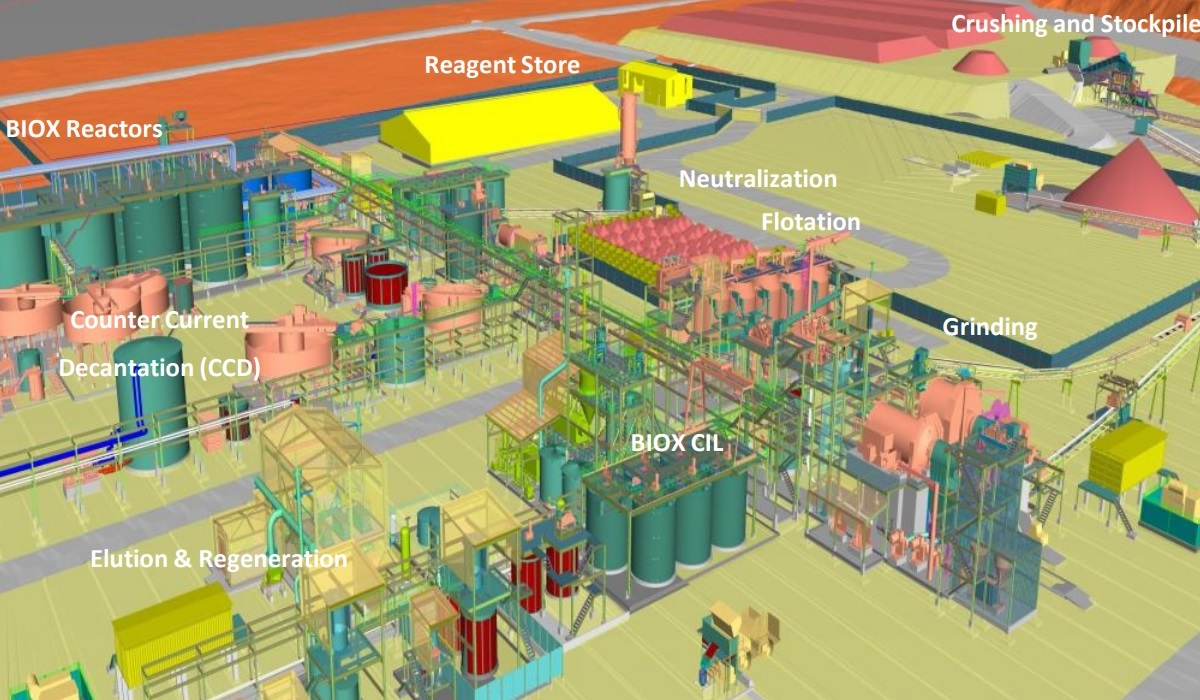

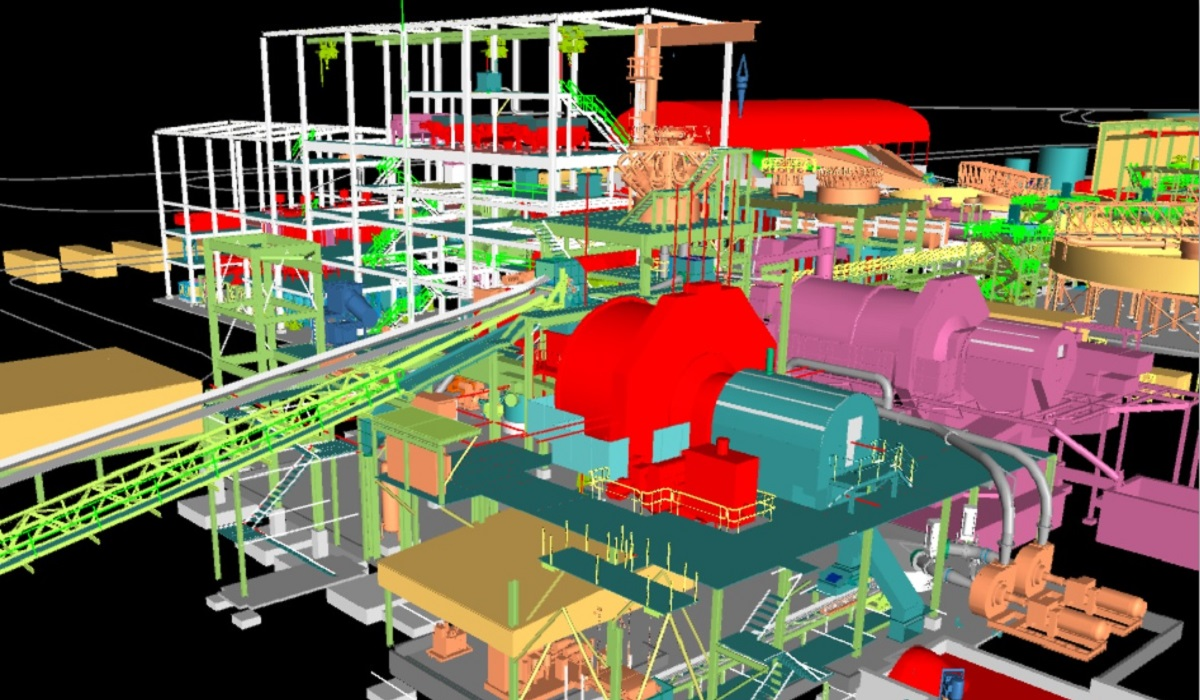

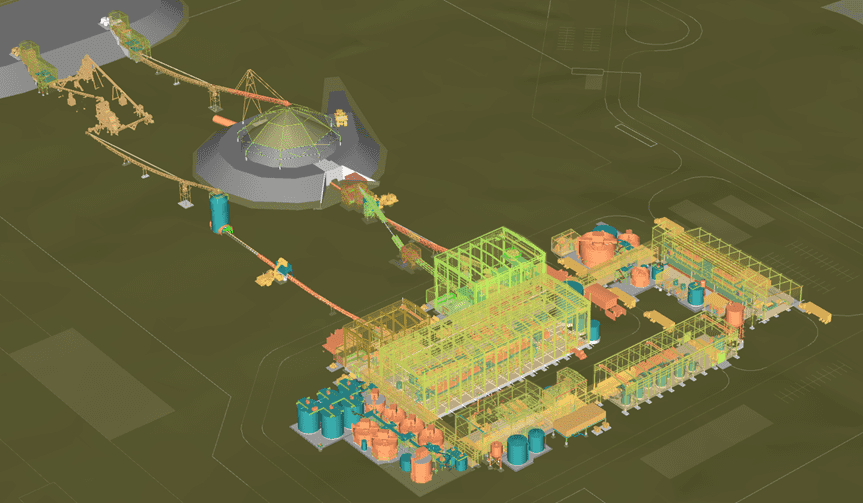

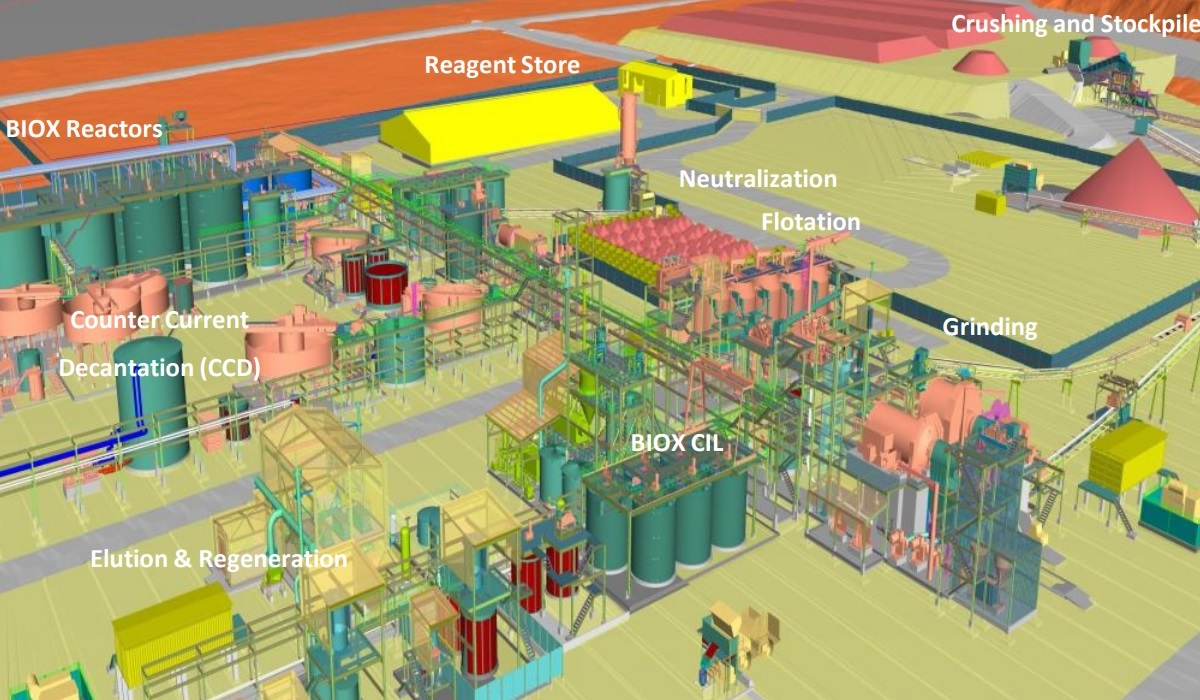

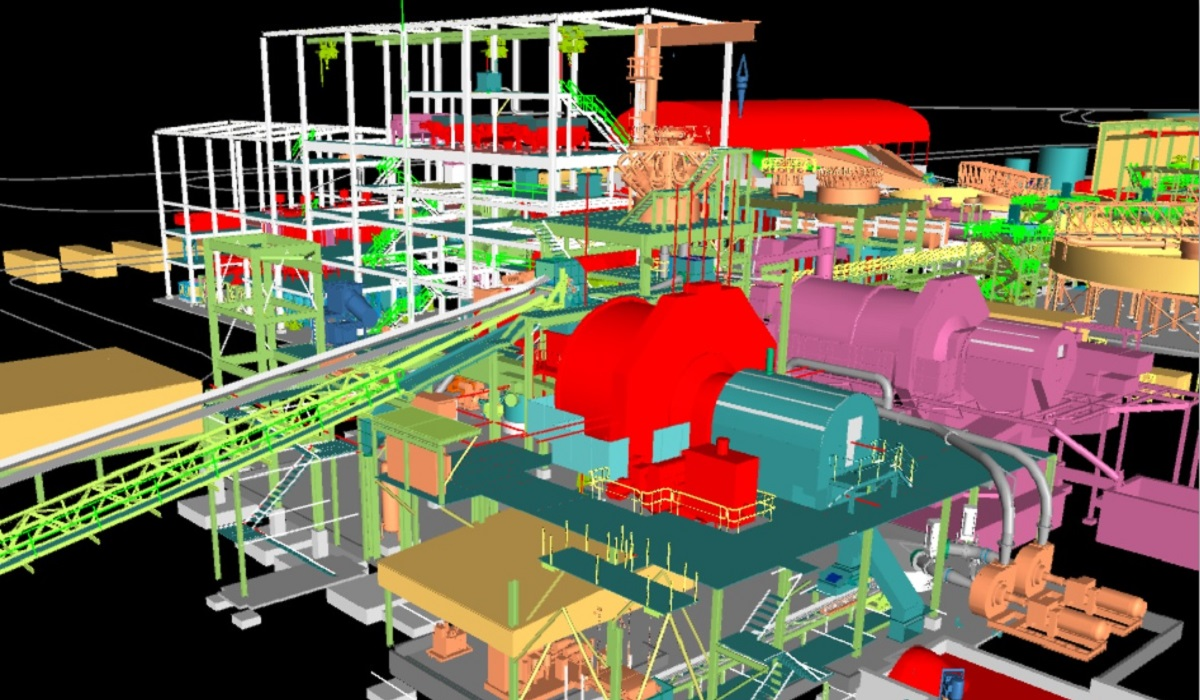

Both companies do similar work, with both specialising in the design and construction of gold processing plants (mills) and both also do other commodities as well as gold, and both have other divisions as well with their Mineral Processing Engineering & Construction division being their main revenue driver. That project work is lumpy, but they're both very good at it and they are usually busy. Both companies have very high insider ownership as well.

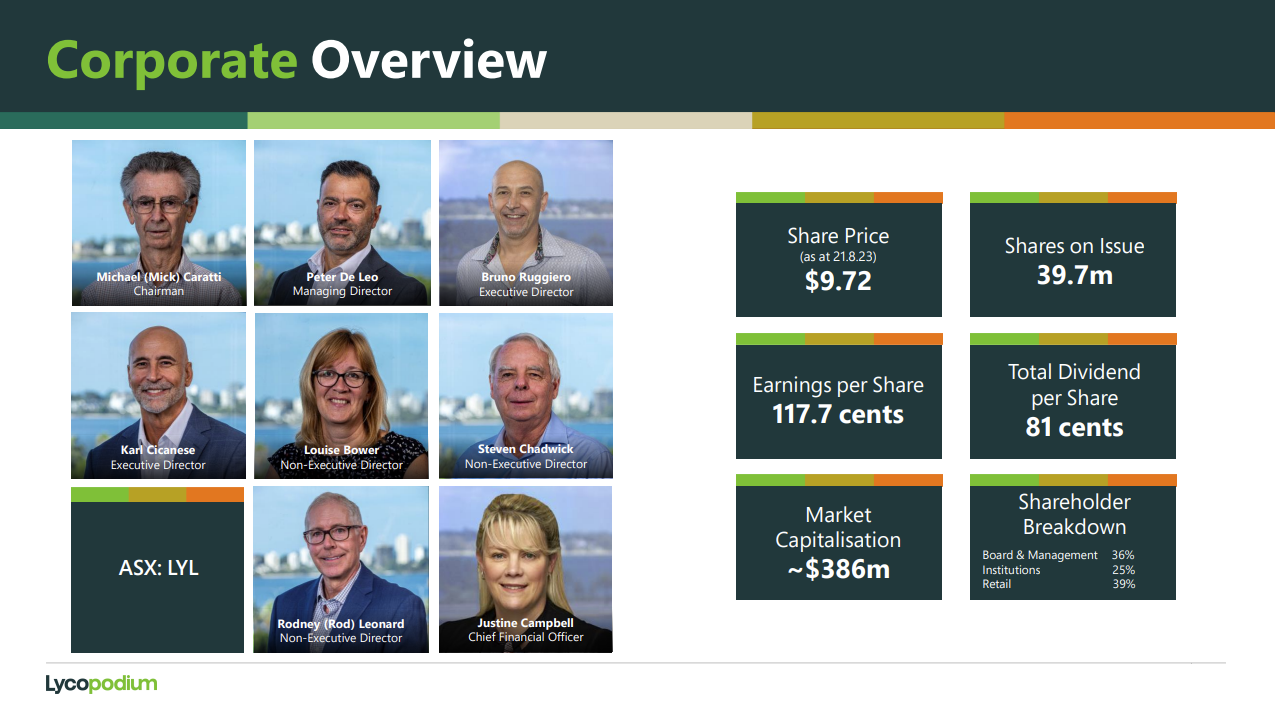

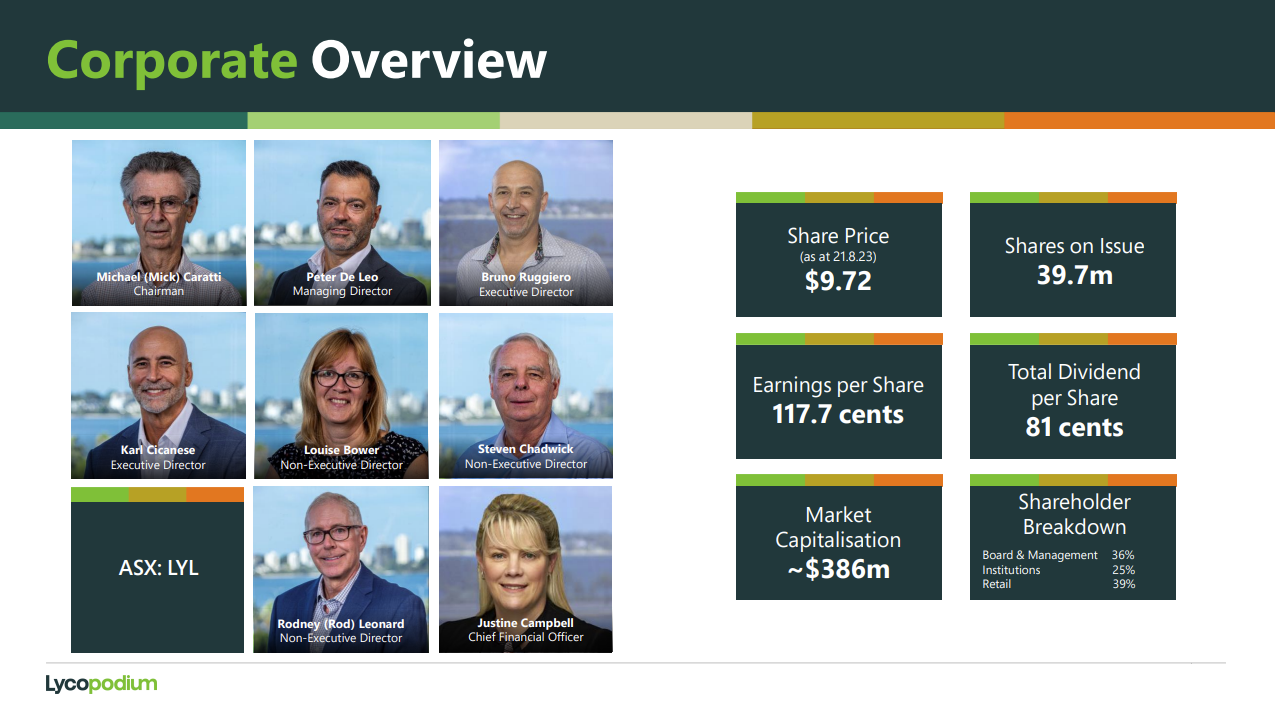

In LYL's case, it's 36% Board and Management ownership, and a notional 39% free float, but they're just as illiquid as GNG are, so selling a heap of shares in a hurry will almost certainly move the share price, and it could be by quite a bit, depending on how many you need to sell and how fast. Once again, suitable for patient money.

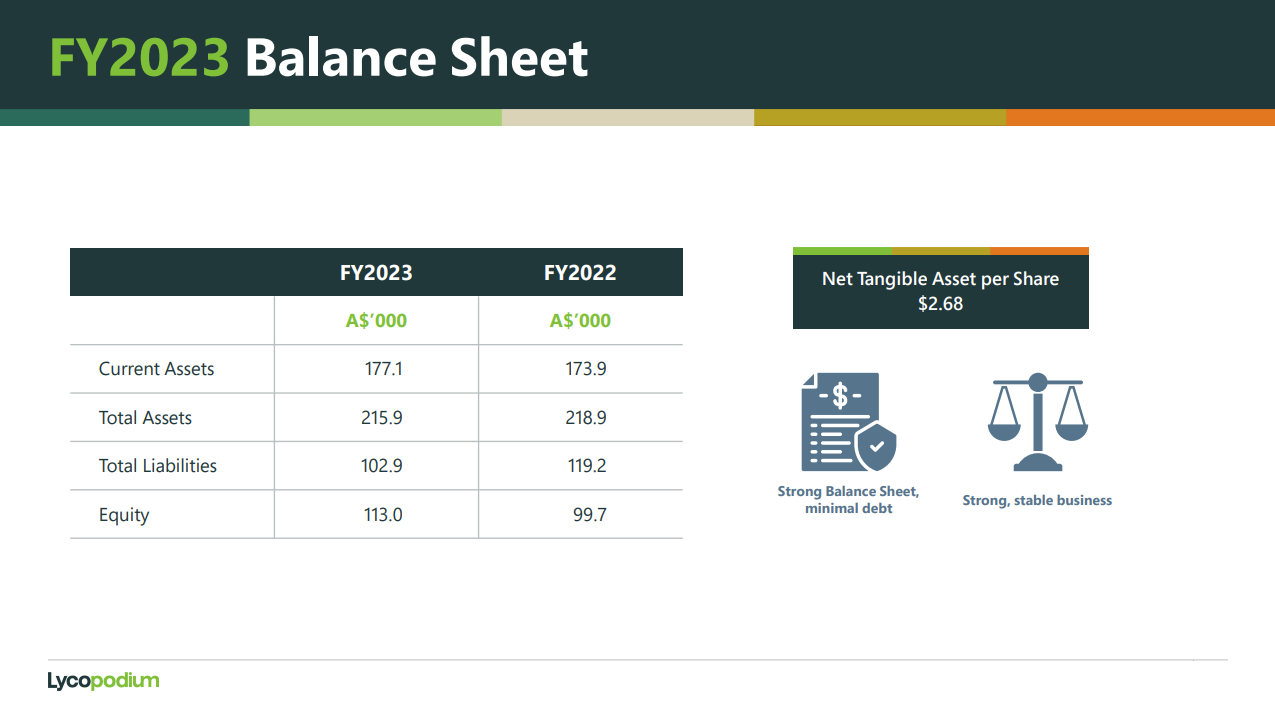

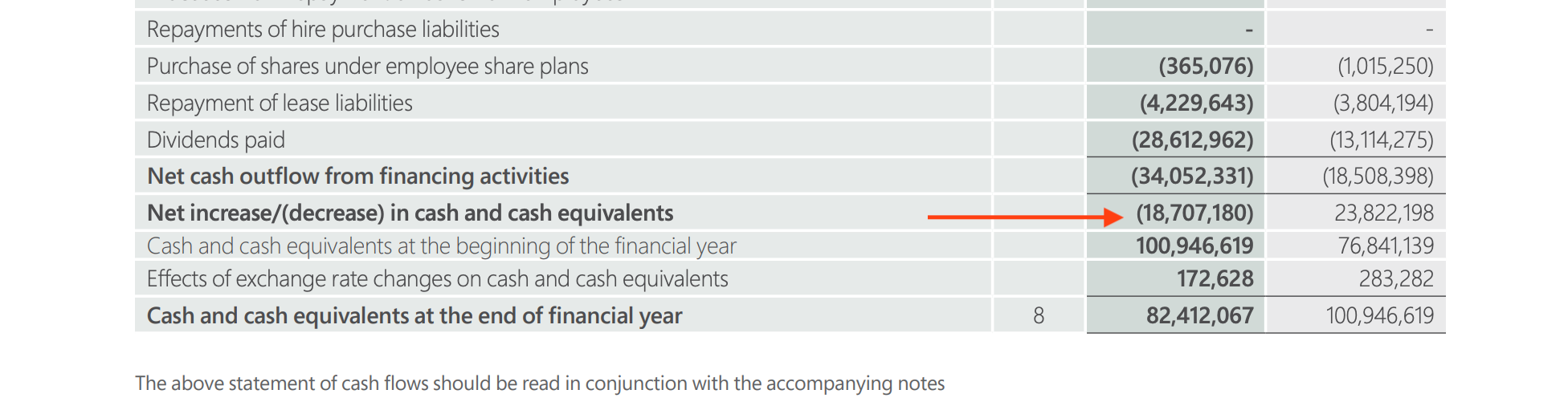

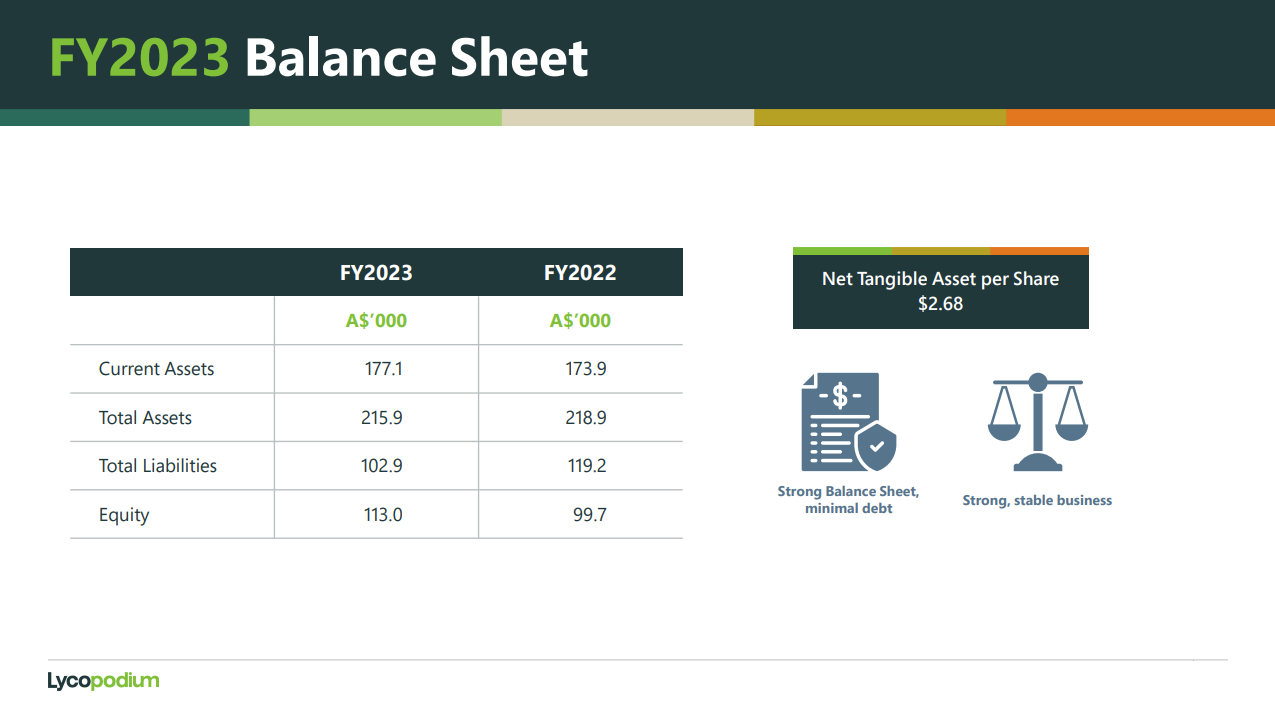

You can see there that their market cap is very similar to GNG and they actually have a similar amount of cash in the bank ($82.4m vs GNG's $86m at June 30th), however LYL, unlike GNG, do actually have some debt, and it's a trade-off, because while they have manageable debt, they are also growing faster and have a higher ROE (44%). They are more profitable than GNG are.

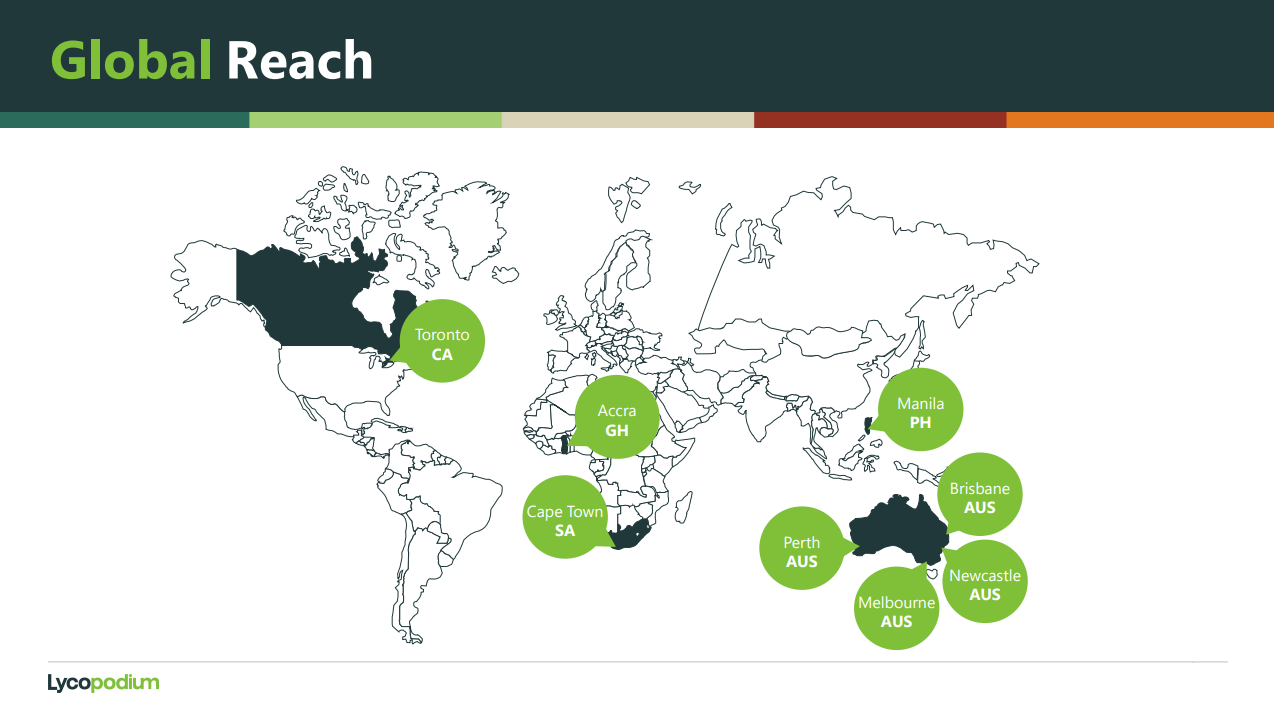

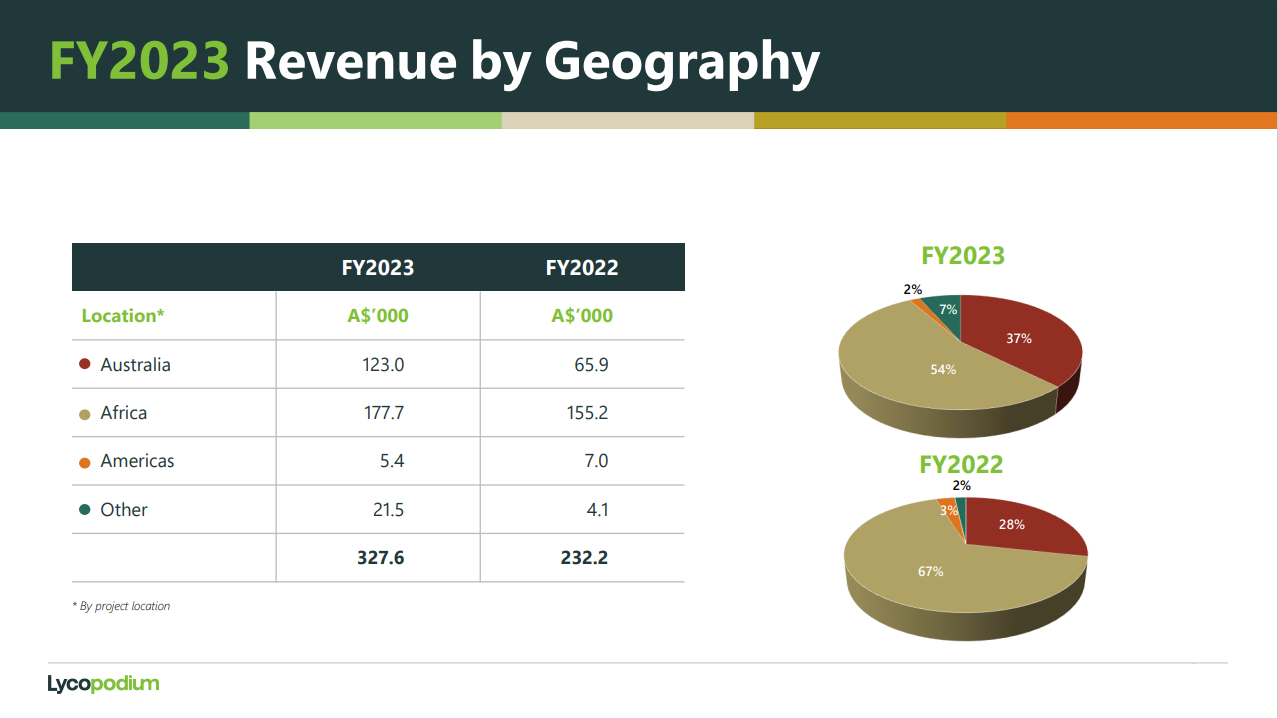

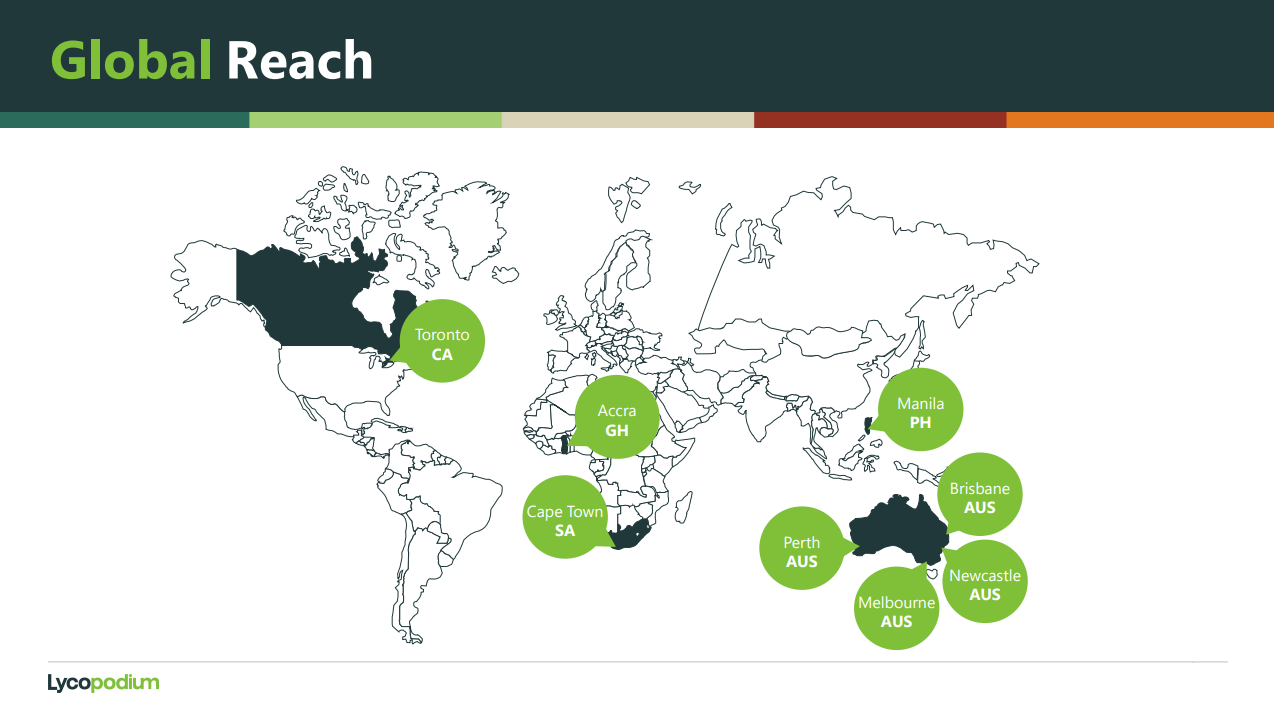

They are also more global, with more full-time employees than GNG and with more offices that they work out of. They do a lot of work overseas, especially in Africa, and particularly West Africa, where there are more risk factors to consider, but LYL have become very good at that. More on that in a minute.

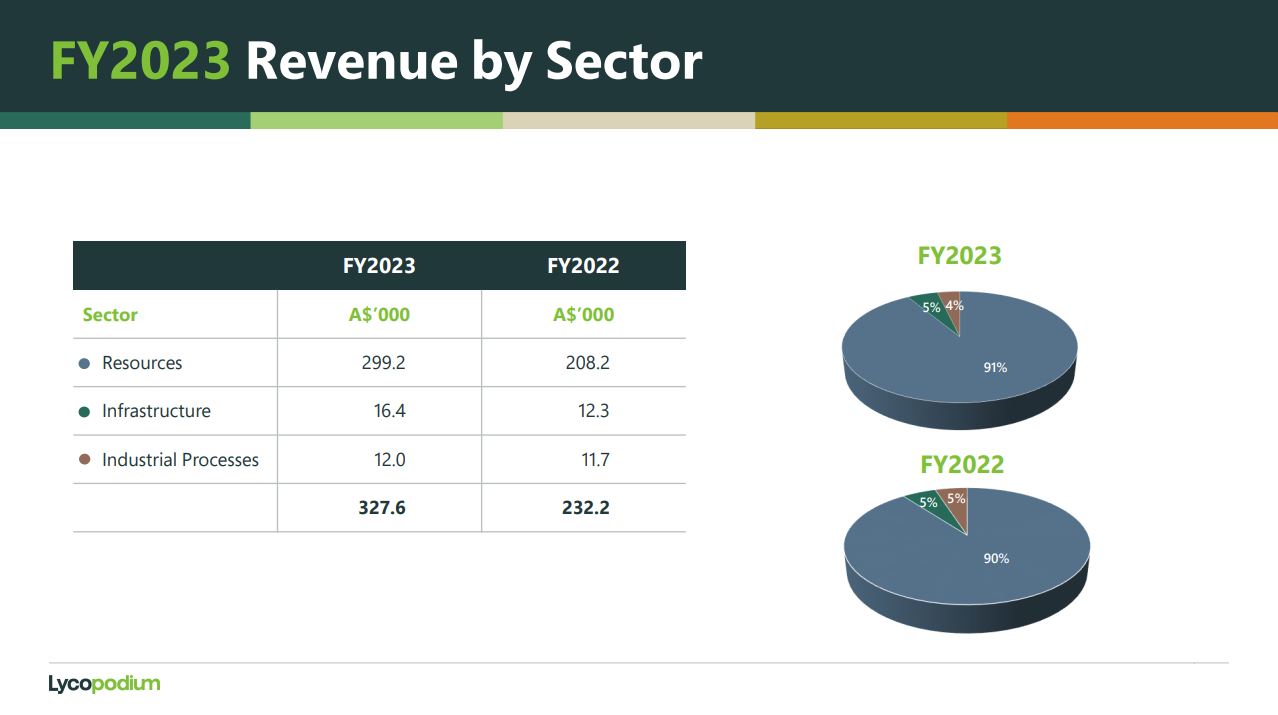

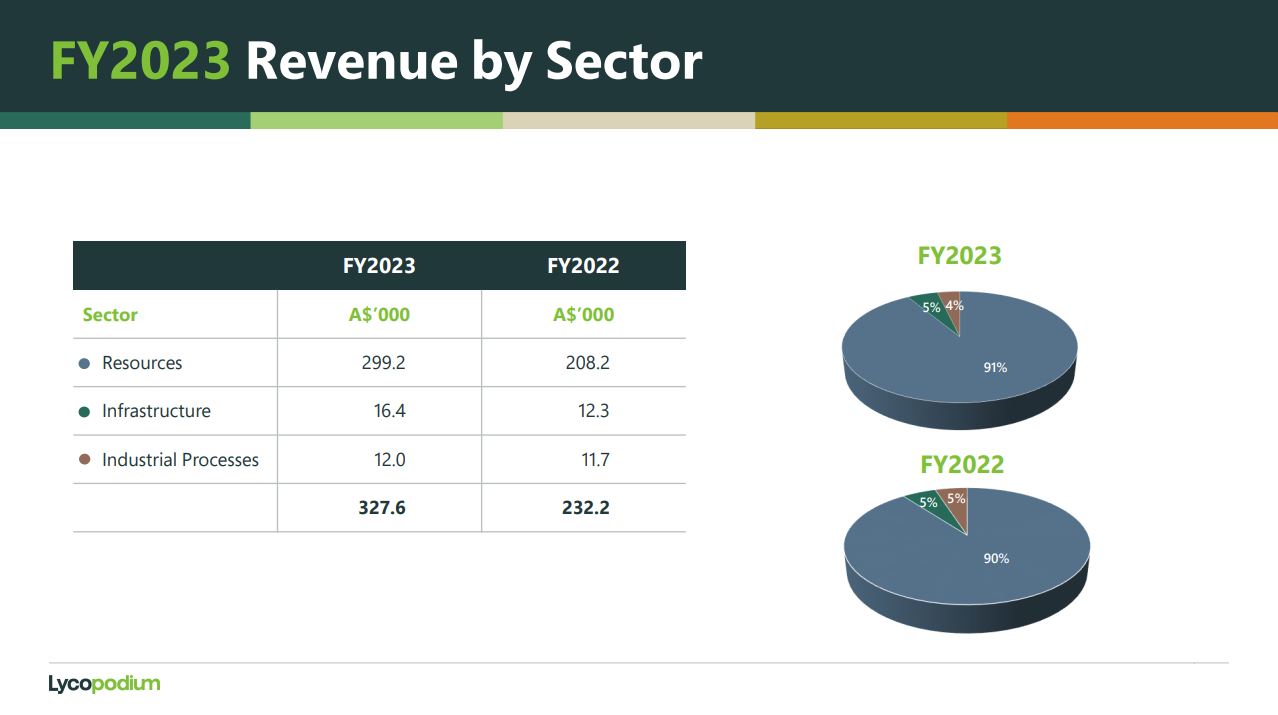

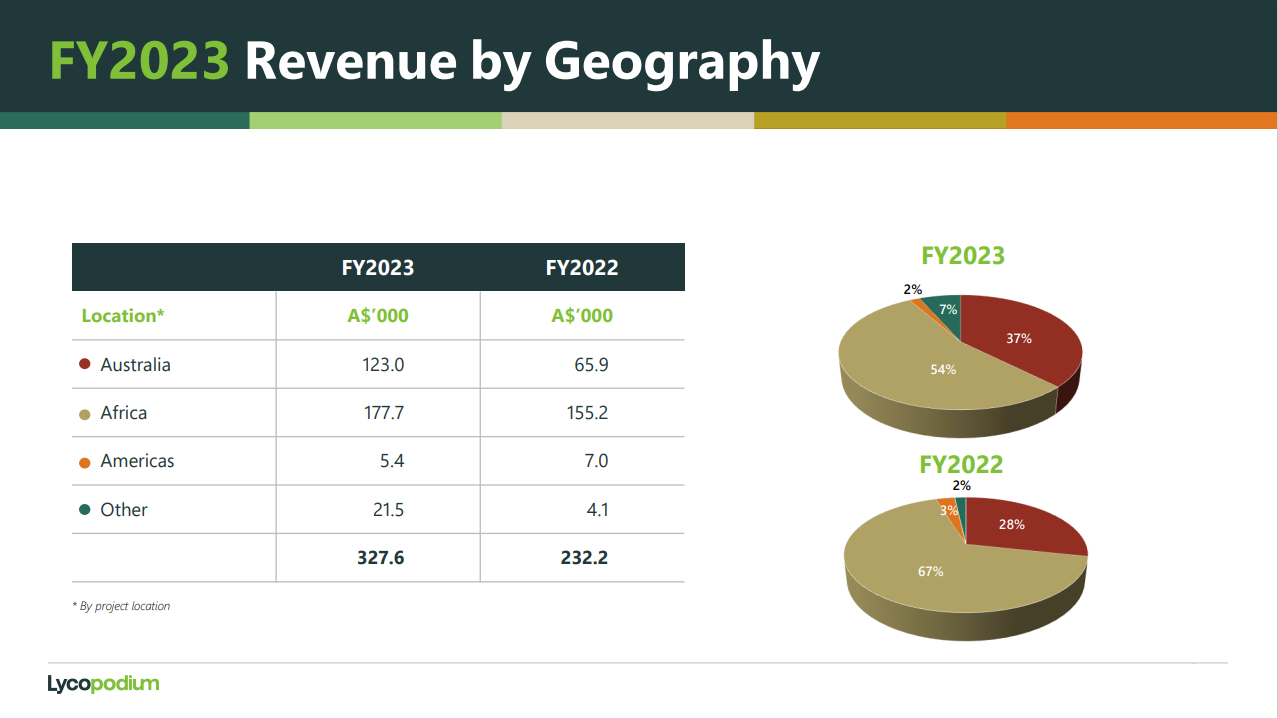

OK, now to their revenue sources, first by sector and then by geography:

The first slide shows little change from FY22 to FY23, however the "...by Geography" slide shows that they are relying less on Africa (in FY23 vs FY22) even though over half of their revenue is still derived from work done in Africa. Another way of looking at it is that they (Lycopodium) are now getting more work here in Australia.

The majority of GNG's revenue is derived from work here in Australia, although they do work overseas as well, just less than LYL do. Most of LYL's work is done overseas or else for clients who have mines/processing plants located overseas, and that's mostly still in Africa, and in West Africa in particular.

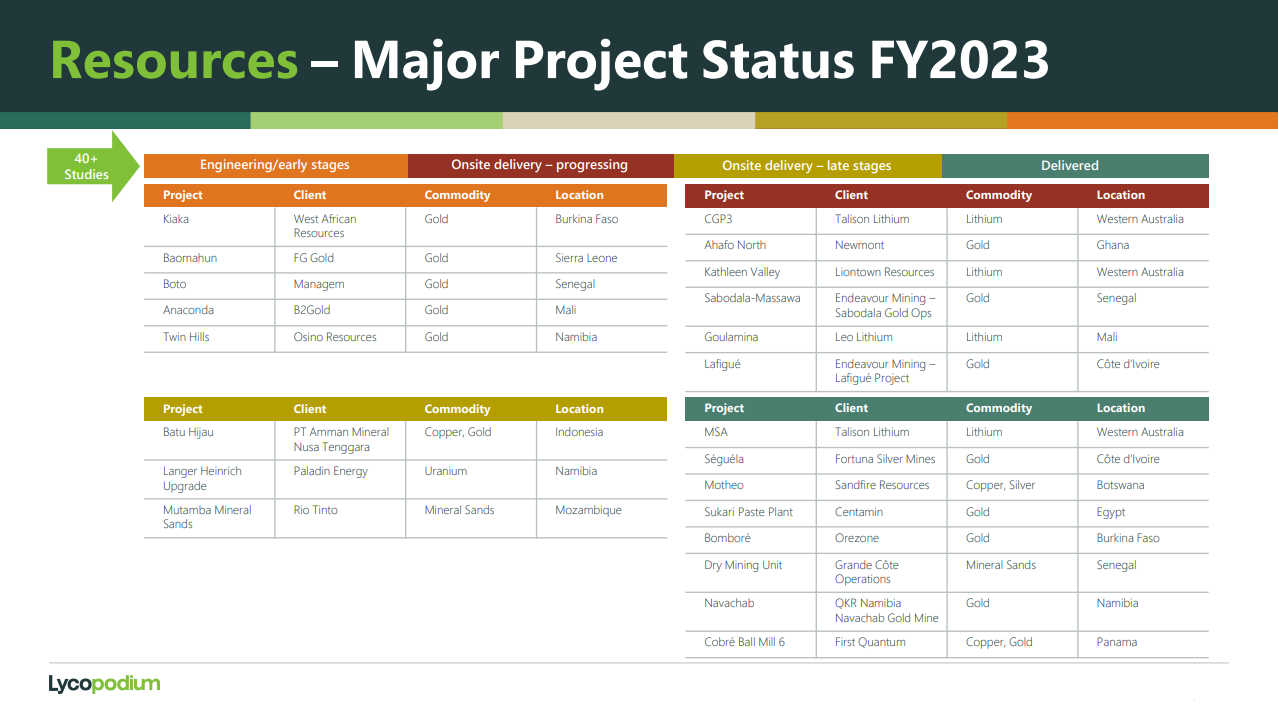

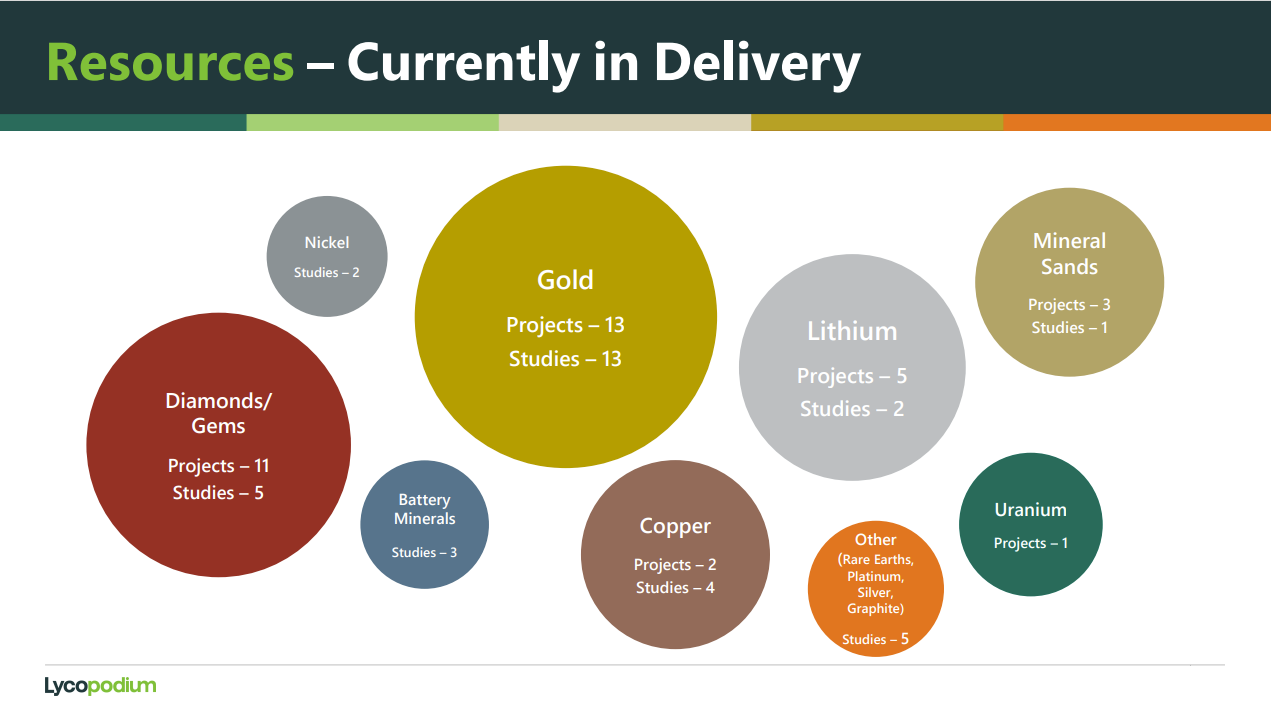

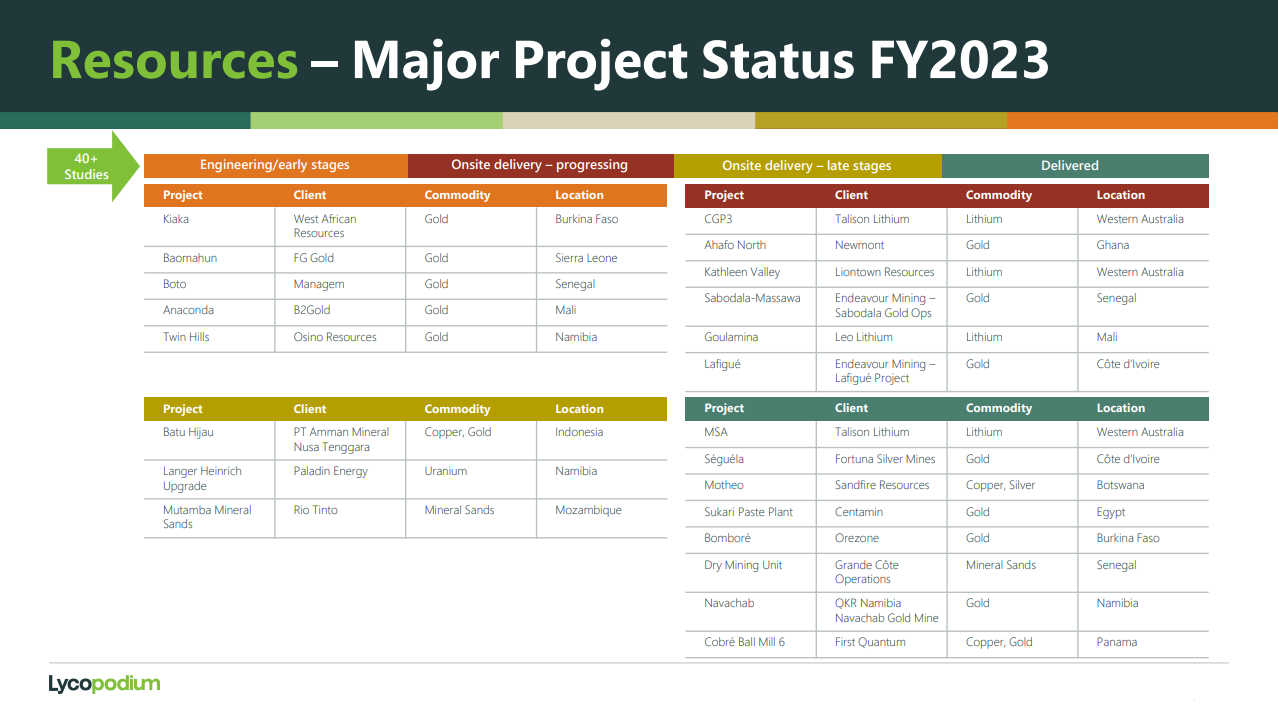

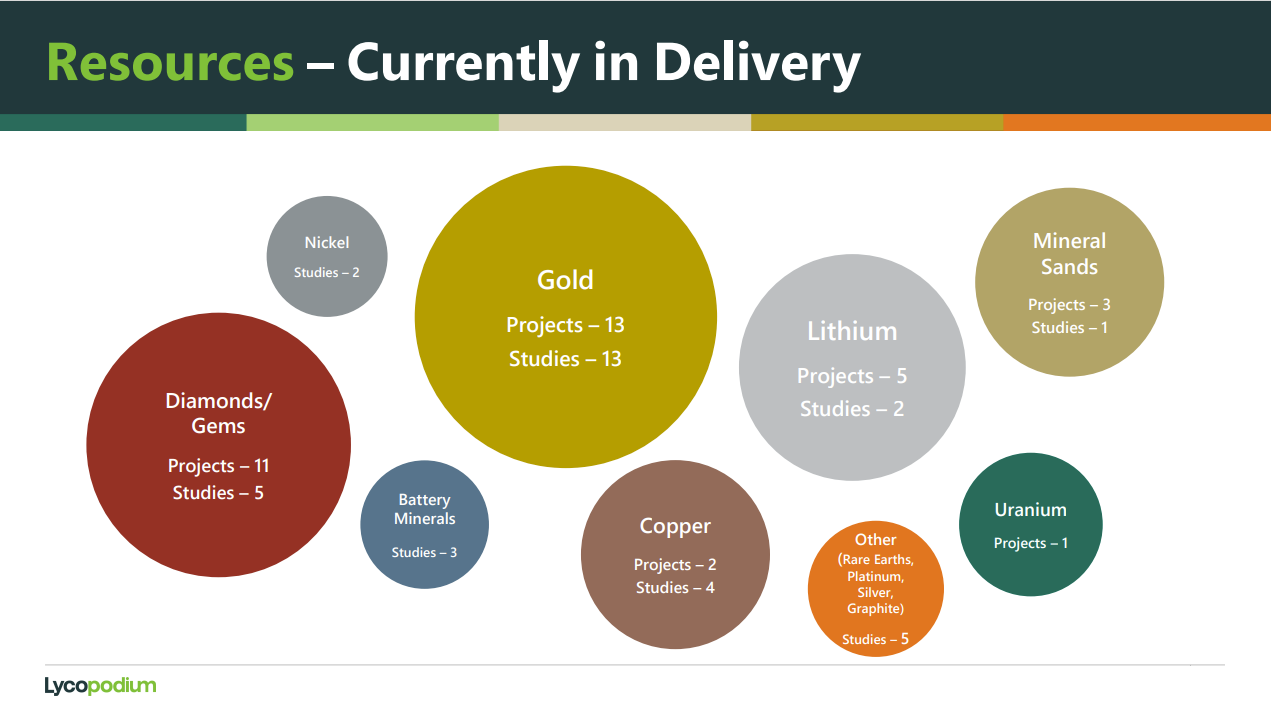

The next slide slows you the status of their major projects, and also gives you a fair idea of what commodities they are into; it's mostly lithium, gold and copper to a lesser extent, as well as mineral sands.

The next slide shows you the total of all projects and studies that LYL are working on currently, split into commodities, and we see that Diamonds/Gems feature now as well (below), although not in the previous slide - which was just their "Major" projects - so we can assume that those Diamonds/Gems Projects and Studies are smaller in nature. I do note that "De Beers Group" is listed as one of LYL's clients (two slides up from here).

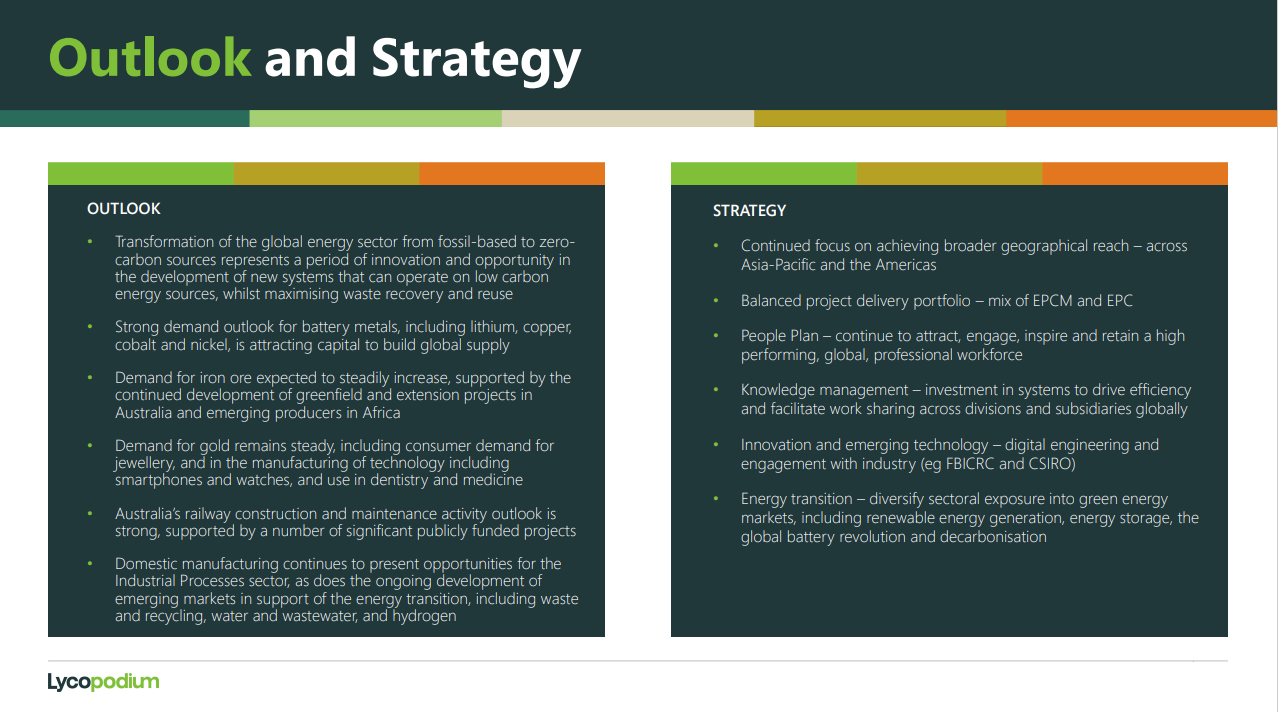

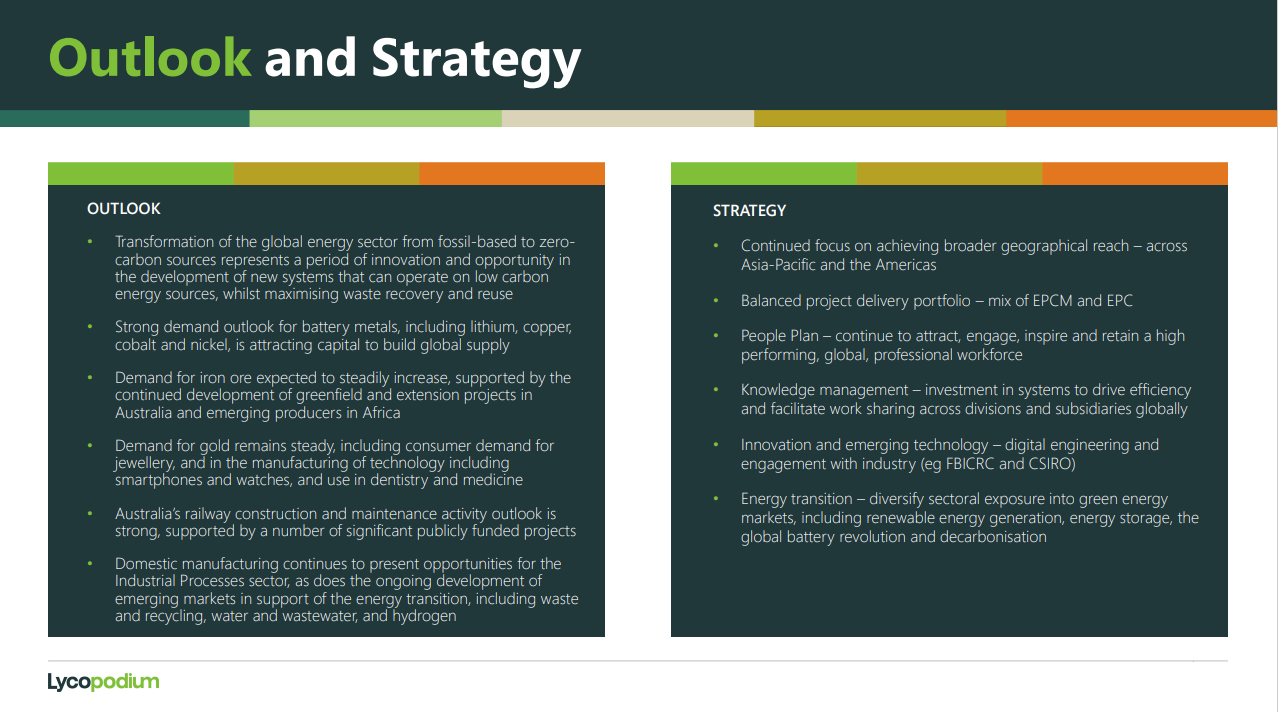

Finally, the Outlook and Strategy slide:

OK, so that's just 12 slides from the deck of 26 - you can view the entire deck here: LYL-Investor-Presentation-FY2023-22-Aug-2023.PDF

I recommend having a look at slides 16 through 18 on "Business Improvements" and "Innovative Thinking", and also slides 12 through 14 on Lycopodium's FY23 Operational Highlights Details.

If you're interested.

Summary: Lycopodium (LYL) is a microcap that has low liquidity (not too many buyers or sellers much of the time and often substantial gaps between the price points of both the bids and the offers, and more often than not a reasonable gap between the highest bid and the lowest offer) that is suitable for patient money that is looking for income plus growth. The company is highly profitable (ROE of 44%), paying very good dividends (which are growing), and the business is growing at a good clip, and is well managed by a Board and Management who own 36% of the company - which provides good shareholder alignment which usually results in positive shareholder-friendly outcomes (such as good total shareholder returns).

Their revenue is diversified across commodities and across geographies, and they are expanding their offering beyond traditional engineering and construction project work.

One feature I have noticed is that a couple of recent contracts (in the past year) have been EPM contracts rather than the traditional EPC or EPCM contracts. E=Engineering. P=Procurement (sourcing everything needed for the project to be constructed and commissioned). C=Construction. M or PM=(Project) Management. So with an EPM contract (sometimes called an EP and PM contract), LYL do the design (E), procurement (P) and they manage (M) the project, but another company does the actual construction work, usually a local company that is based (HQ'd) in the country where the project is being constructed. This is likely another form of risk management. Use a local company to do the actual construction work, employing locals, and LYL manage the whole process and clip the ticket on everything. One example of where they have done this is with the Goulamina Lithium Project in Mali - see here: Award-of-Contract-for-the-Goulamina-Lithium-Project.PDF [14-Nov-2022]

Anyway, while a lot of their work is one-off project work, so their revenue and earnings will be lumpy at times, they are very good at what they do, and the industries that they work in recognise that, so I have good reason to think they'll stay busy and keep growing.

They don't overpromise and then undeliver; they give conservative guidance and then try to beat it, often positively upgrading their guidance as the year progresses and then still beating it on at least one metric.

Disclosure: Of course I do hold LYL (and GNG) in my real life portfolios as well as here on SM.

Further Reading:

https://www.lycopodium.com/

Our Story | Lycopodium Limited

What We Do | Lycopodium Limited

Our Engineering and Project Management Principles | Lycopodium

Where We Work | Lycopodium Limited

Case Studies (lycopodium.com)

Investor Relations | Lycopodium