Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

August 2018: LYL has already overtaken my previous price target. This ($5.45) is my new 6 month price target. They continue to perform well. . . .

Feb 2019: 12 month price target will depend on new contracts and commodity prices (esp. gold) which will in turn depend on what's happening in the world. Very hard to predict. . . .

Update: 31-Aug-19: Overtaken my updated PT. New PT = $6.77, based on quality management, quality company, and tailwind of higher gold price. . . .

29-Feb-2020: Update: Due to delays experienced across the industry with the timing of contract starts and new contract awards, it may take a bit longer for LYL to hit my latest $6.77 PT, so faced with new information, I'm reducing it back down to $5.80, which is a level I think they can reach over the next 6 months (by early September 2020) with a couple of reasonably sized new contract wins, and their usual outstanding performance on existing contracts.

29-Aug-2020: $5.80 is still fine for a 12-month PT. They went over $6 in Jan/Feb this year, and would have probably maintained those levels if it wasn't for the pandemic. LYL specialise in designing, building and optimising gold processing plants, and that's a great space to be at the minute. The downside is that they have traditionally done a lot of their work in Africa, South America, and other risky places to operate. Back here in Australia, GR Engineering (GNG) seem to get most of that work. Ideally I'd like to see the two companies merge, or LYL acquire GNG, but that may never happen. Would be good if it did tho... I hold both. GNG is a long term hold for me. LYL is a company I tend to buy when they look undervalued and sell when they look expensive. They look undervalued here (below $5) so I'm holding them.

LYL do a lot of other stuff also - not just gold plants. Have a look at their website for more on that.

They were originally (many moons ago) the engineering arm of Monadelphous (MND), which was spun out, and in recent years the two companies have formed a JV called Mondium which has been gaining traction, winning larger contracts each year. I also hold MND shares.

Update: 01-Mar-2021: This is another company that seems to be happy to sit at or around the price target that I set 12 months ago - $5.80 in this case, but I should acknowledge that prior to that it was $6.77 and I reduced it to $5.80. The $6.77 PT (in 2019) did not get taken out. $5.80 seems to be around the mark, and I would be raising it if gold was on a tear, but it ain't, so I won't. I think LYL will likely bounce around this level for a while, probably falling away on no news, then coming back up when new contracts are announced. I still hold LYL shares - and GNG shares. GNG had a corker of a day today, up another +5.84% to $1.45. Of the two, you'd have to say GNG has the far superior chart at this point - it's exactly what you want to see - all bottom left to top right at a very good clip. LYL is bouncing around their 12-month high but they don't have the same north-bound momentum that GNG currently do. I'm happy to be holding both, particularly GNG with their recently declared 5 cps fully franked interim dividend.

I'm leaving my PT for LYL at $5.80 for now, but will raise it if they break through $6 with any conviction. If they do that I think they're heading for around $6.70 by this time next year.

Update: 30-Aug-2021: Still happy with $5.80 for a PT for LYL, but that other former $6.70 PT for March 2022 might be a bridge too far from here (currently $4.75). LYL reported on 23-Aug-2021 and rose +4% on the day - from $4.61 to $4.80, but they haven't shot the lights out. GNG is looking better than LYL at this stage, and I do have significantly more invested in GNG than in LYL at this point. I have maintained a small RL position in LYL, but have a much larger one in GNG for their dividend - latest one is 7 cps (FF) for GNG, so their dividend yield is almost 6%, plus franking credits (12c/year FF). LYL have declared a 15 cps final div, so when added to their 10 cps interim dividend, they are on a 5.26% yield, plus franking, and LYL fully frank their divs also. Both do very similar work, however most of LYL's work is outside of Australia, and most of GNG's work is at home - within Australia, although not all. Both have liquidity issues due to being microcaps (LYL is < $200m, GNG is < $300m market cap) and having very high insider ownership. Holders are usually not interested in selling, so there can be precious little available to buy.

Their results can also be lumpy due to the shorter term nature of their EPC work, although GNG also have recurring revenue from their Upstream PS division - but check out GNG for further details on that - this is supposed to be about LYL. Both LYL and GNG have high quality management with heaps of skin in the game, both companies avoid debt and always maintain net cash on the balance sheet, both have excellent risk management strategies in place which clearly work, even when their clients get into financial difficulty occasionally and have trouble paying their bills. GNG & LYL have good track records of being conservative with their accounting and with their guidance, and collecting on their bad and doubtful debts more often than not.

LYL often work for larger companies on average than GNG do, although that is a generalisation and isn't always the case. I like them both, Two of my favourite engineering and construction companies. My other favourite in the space is MND - Monadelphous - but Mono's do other types of E&C to what Lycopodium and GR Engineering Services do. Mono's also have a variety of different divisions so they are much bigger with many more sources of revenue, including recurring revenue from multi-year operations and maintenance contracts. Of the three, currently GNG is performing the best, and MND is the safest, but LYL will have their day in the sun again one day. If they get back down to $4, I'll probably load up.

$7 is probably a good 5 year PT for LYL, so $7 by September 2026.

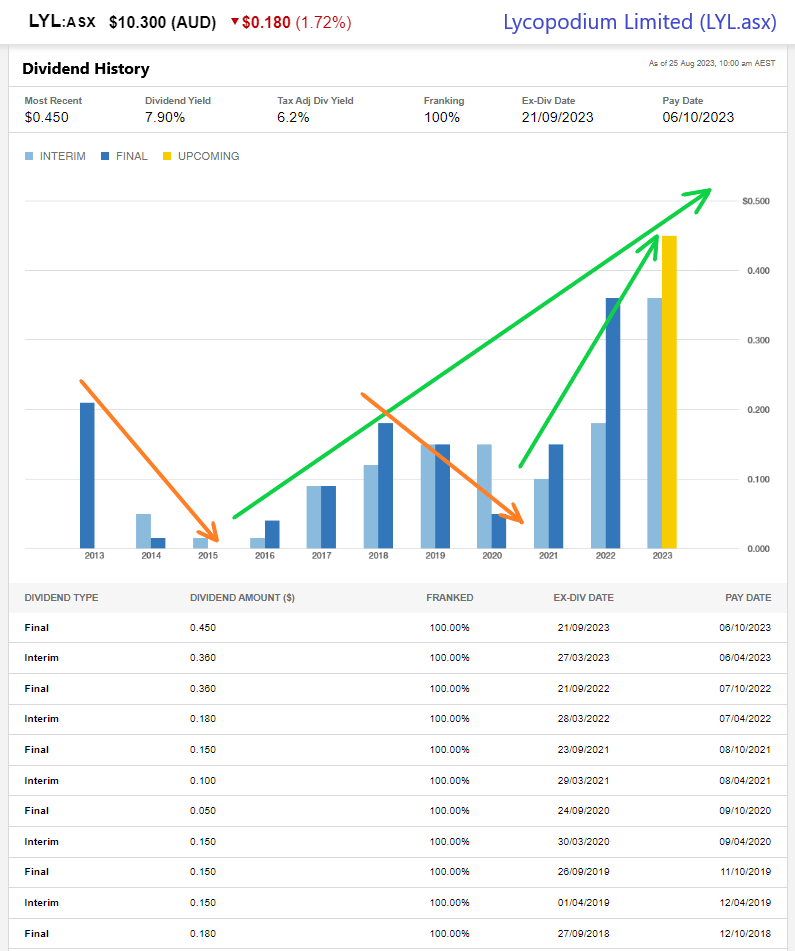

Update: 24-Aug-2022: LYL reported for FY22 today, and it was very good. All covered in various straws. They are now on a 9% dividend yield, or a 12.6% grossed-up yield (that includes the full value of their franking credits). Their FY22 dividends are more than double what they paid in FY21.

I am updating my valuation to $7.40 to reflect the significant growth the business has achieved in FY22 and the positive outlook they have for FY23.

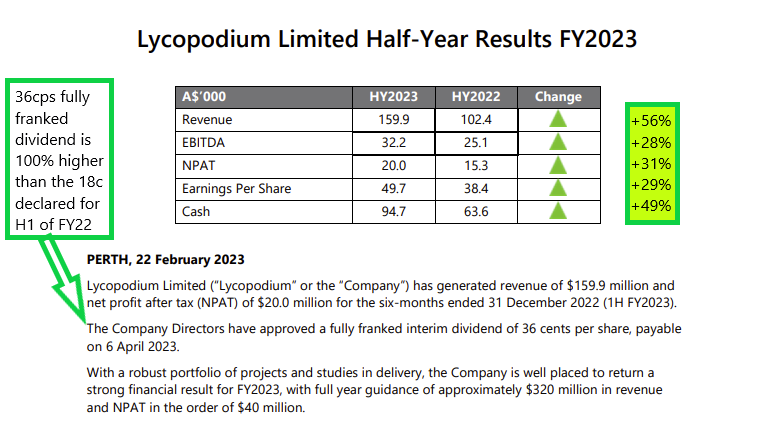

Update: 23-Feb-2023: Six months on, and LYL have released one of the best half year reports I've seen this year, perhaps THE best one. I won't talk about it too much because it's been well covered in the straws and valuations by @Scott (see here) and @Rick (see here). However, this latest half year report by Lycopodium is a cracker. Particularly given the industry headwinds, especially around the pandemic and the associated recruitment and staff retention challenges experienced across the sector.

FY2023 H1 Results Announcement

FY2023 H1 Results Presentation

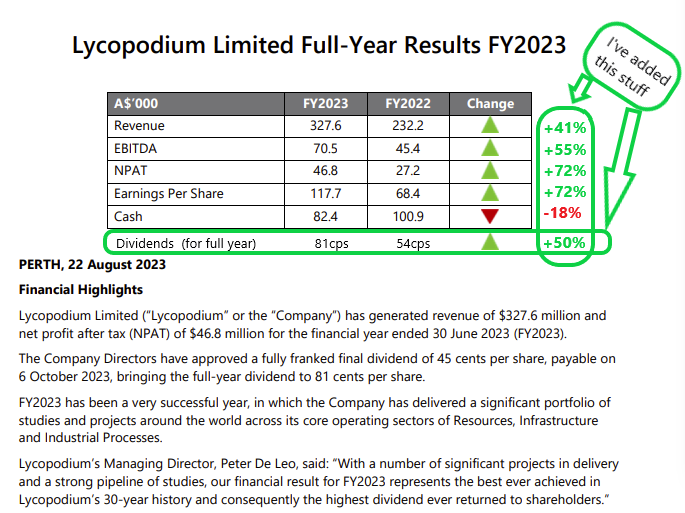

That's from page 1 of their announcement (link above) but I've added the percentage increases (in the green boxes, plus the green arrow) because they seem too shy and bashful to point out how well they've done. They're not big on blowing their own trumpet, this mob!

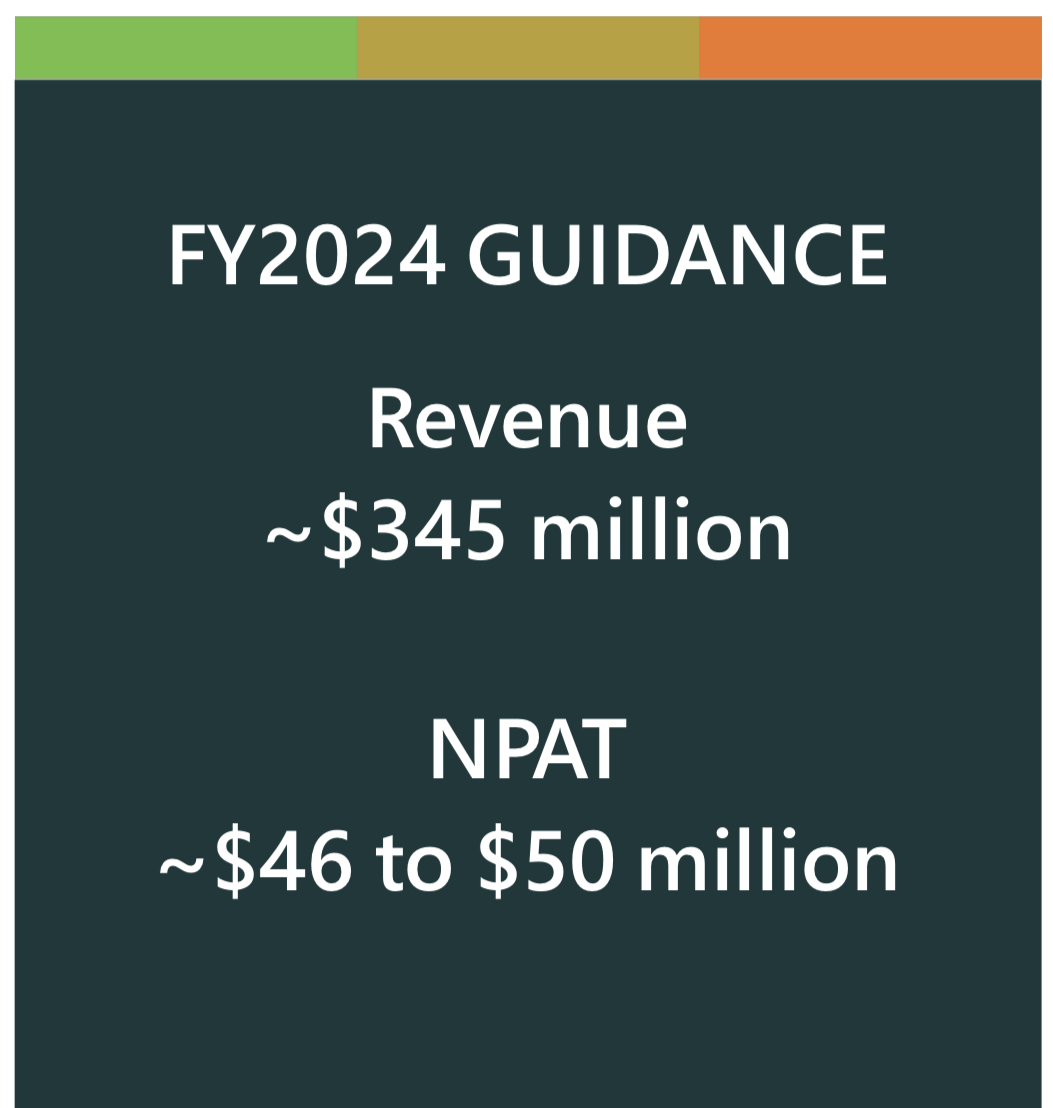

Their full year guidance of approx. $320m in revenue and $40m NPAT is simply double what they managed in the first half ($159.9m and $20m), so I have no doubt they will exceed those numbers, as they usually do. Underpromise and overdeliver. That's their MO. I hold LYL both here and in real life, and I always have high expectations of both LYL and GNG (who do the same stuff but with a more Australian focus, LYL specialise in West Africa and other risky places and they are very, very good at risk management), but LYL even beat my own high expectations sometimes. They are THAT good!

LYL closed at $7.64 on the 21-Feb-2023 (Tuesday), the day before they released these results, comfortably meeting my previous price target (set six months ago) of $7.40.

On Wednesday, on the back of these results, they rose +76 cents (+10%) to close at $8.40. Today (Thursday) they rose another 7 cents to close at $8.47. Based on their most recent full year dividend of 36 cps plus this one (another 36 cps), that's 72 cents per share per year now, which means their dividend yield is 8.5%pa based on today's price, and 9.4%pa based on Tuesday's closing price. Based on my average buy price (IRL) of $6.05 (yes, I've averaged up on this one), they're on an 11.9% yield, and that's not taking any of the franking credits into account. And their dividends are all fully franked. To get the grossed up yields (to include the full value of the franking credits, you can take those yields and multiply them by 1.42857 - or just add 43% more on.

That's a handy tip for anybody that wants to work out the franking credits they're going to get on a dividend. Work out the total amount you're going to get in the bank, and if that dividend is fully (100%) franked at the 30% corporate tax rate, you can use the following formula:

30 / 70 x X

where X is the full amount you're going to receive in the bank, "/" means "divided by" and "x" (the small x) means "multiplied by".

If the dividend is coming from a small LIC (like SNC) or any smaller company who qualifies for the lower 25% tax rate, you would use this formula:

25 / 75 x X

The first two numbers in the formula always need to add up to 100 for the formula to work. The first number is the corporate tax rate that applies and the second number is 100 minus the first number. The reason you can't just add 30% to the amount you're going to receive is that a fully franked dividend includes the tax payable on the entire value of the dividend and the franking credits, because the franking credits count as both income and a tax credit, so they have to cover the tax payable on the franking credits plus the amount you're going to get in the bank, which usually works out to 42.857142857% or 30 / 70.

That formula gives you the dollar value of the franking credits you're going to receive. If the dividend is only 85% franked, you would add "x 0.85" to the end of the formula, so for MFG's latest dividend the franking credits would be:

30 / 70 x X x 0.85

For Altium's latest dividend, which is 40% franked, you would change the 0.85 to 0.40 (or just 0.4 or even .4, as the extra zeroes in this case are superfluous).

30 / 70 x X x 0.40

So - if you held 8,000 LYL shares, you would get $2,880 (being 8000 x 0.36) in the bank on the 6th April, plus $1,234.28 in franking credits (or $1,234.29 if they round to the nearest cent instead of ignoring everything after the second decimal place). That $1,234.28 is:

30 / 70 x 2880

Anyway, sorry about the excruciating level of detail (helpful no doubt to some, very obvious to others), but that is all to say that LYL were on a VERY good dividend yield before these results, and they still are, even with the share price rise we've seen this week.

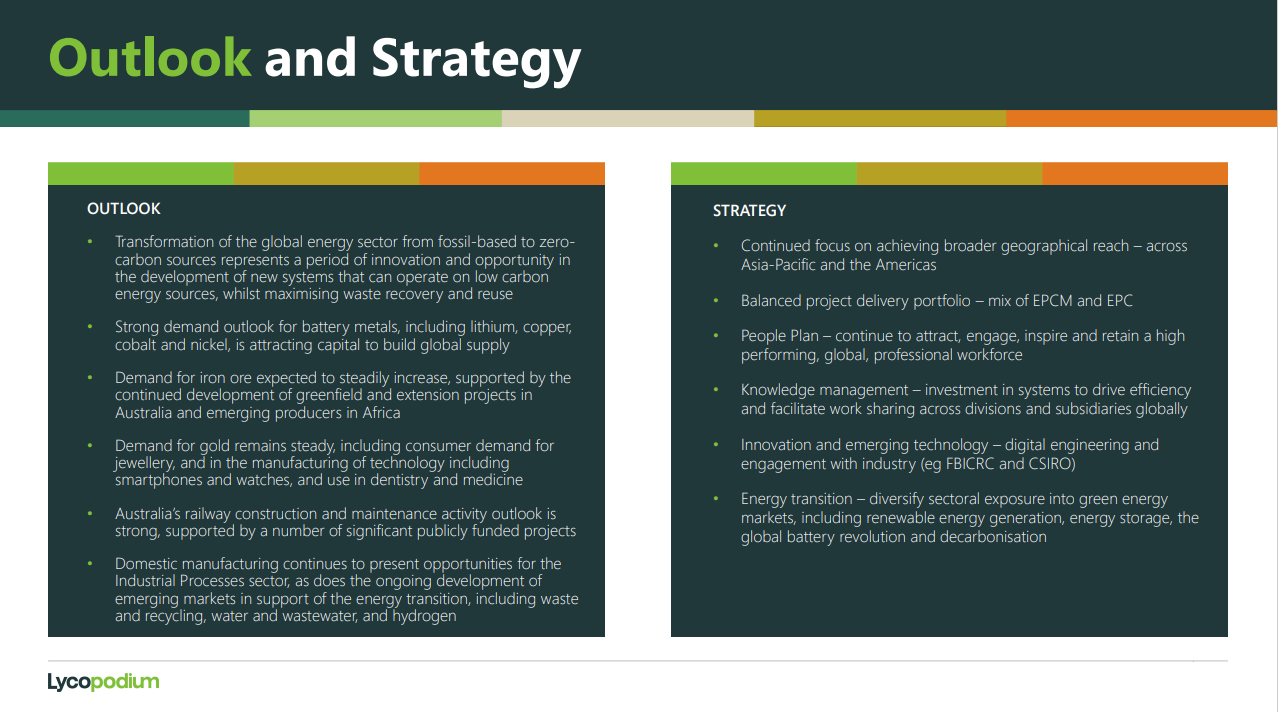

And while they are certainly a good income stock, they are also a growth stock. Their core revenue is lumpy by nature - being one off engineering, procurement and construction (EPC) contracts, often with an "M" tacked on - meaning that they manage the projects as well, but they keep winning more and more work. Some of their more recent work has not included the "C" - it's been "EPM" work, so Engineering, Procurement and Management of projects, especially some in West Africa. That, no doubt, is also part of their risk management. They will often let others do the actual boots-on-the-ground construction in these higher-risk areas of the world, and get paid very well for designing the plant, procuring all the parts and equipment and material required to build it, and managing the whole process.

But that better belongs in a Bull Case straw I suppose. Superior management who are exceptional at risk management in some of the more risky parts of the world to build gold plants.

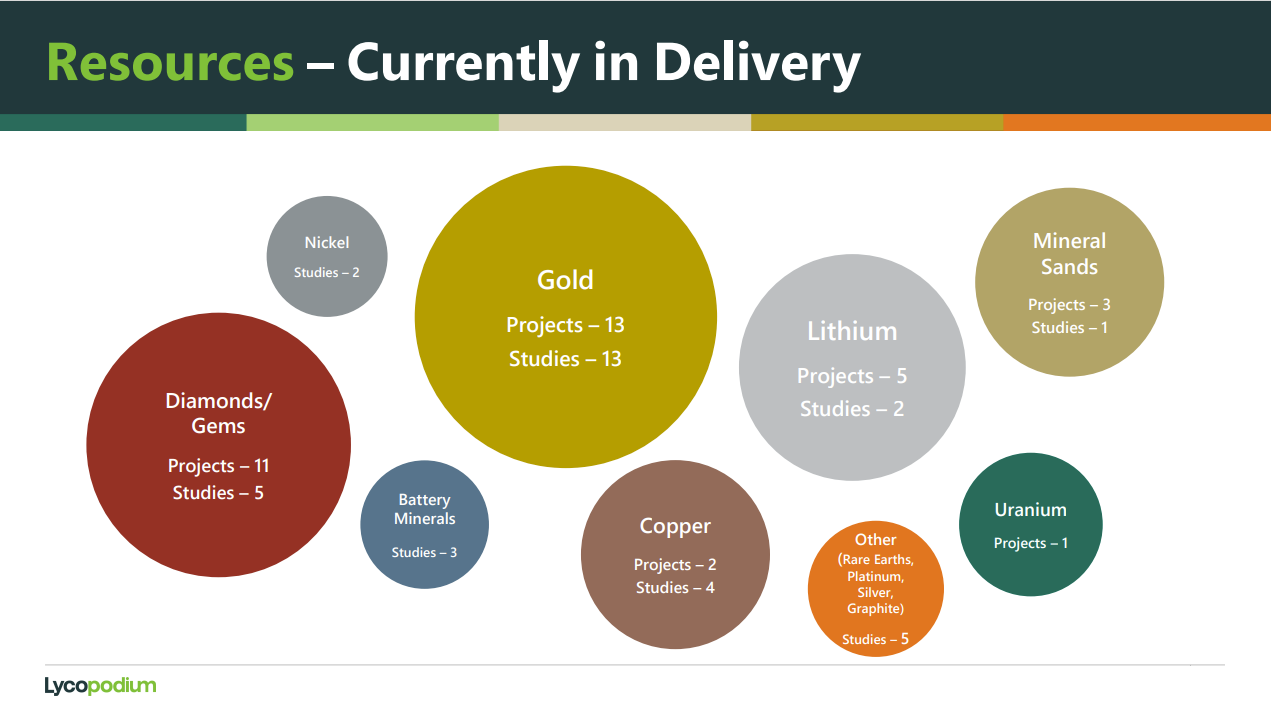

However, as their presso points out, they are active in a number of industries, they have more than one string (gold plants) to their bow, and they just keep on delivering for their shareholders. I plan to buy more soon once one or two of my other companies goes ex-div.

And they do a lot more than just gold plants of course, like Lithium...

https://www.lycopodium.com/case-studies/

https://www.lycopodium.com/what-we-do/

https://www.lycopodium.com/about-us/our-story/

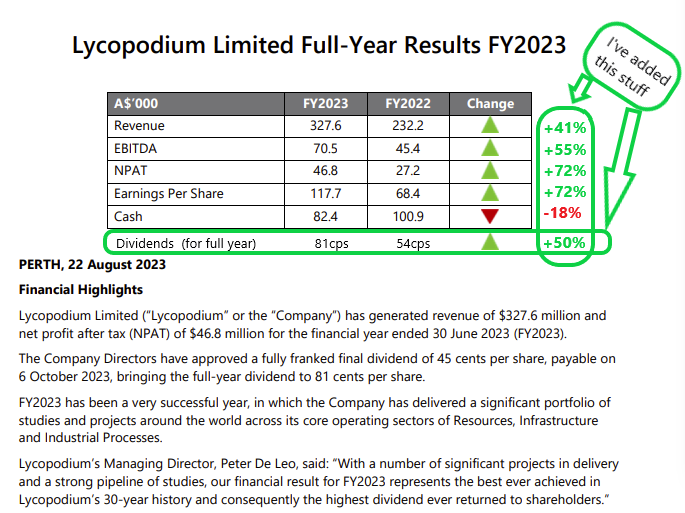

27-Aug-2023: Update: After FY23 full year results in August:

Raising my price target for LYL to $11.88 (from $9.70 - which they've already reached and passed).

Source: LYL-FY2023-Full-Year-Results-Announcement-22-Aug-2023.PDF

See also: LYL-Investor-Presentation-FY2023-22-Aug-2023.PDF

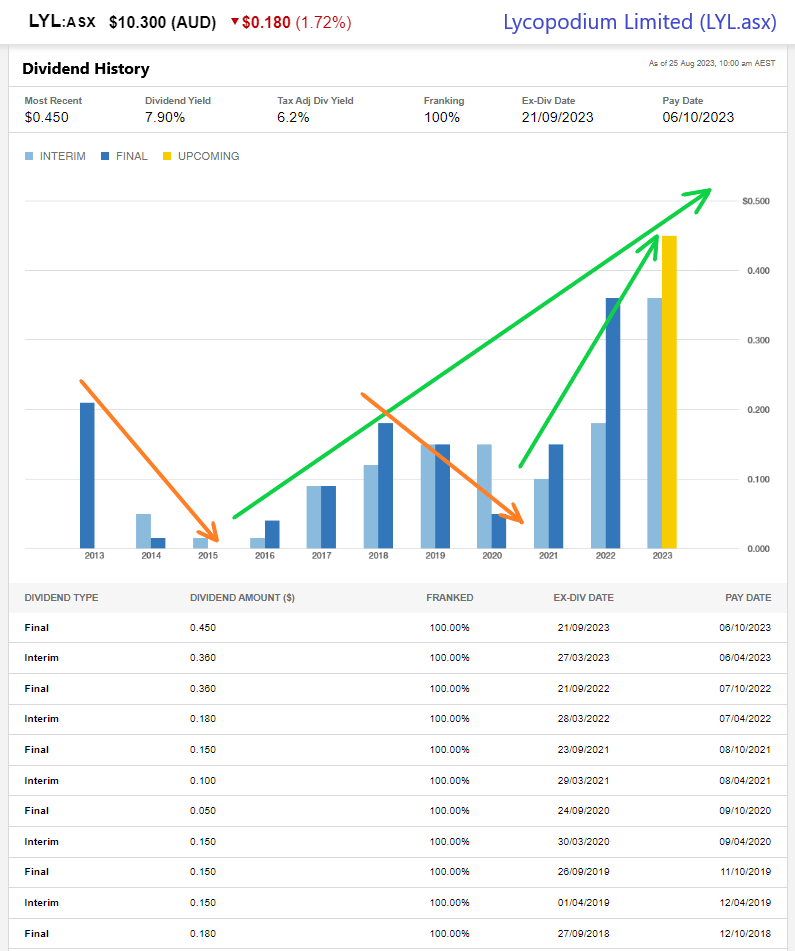

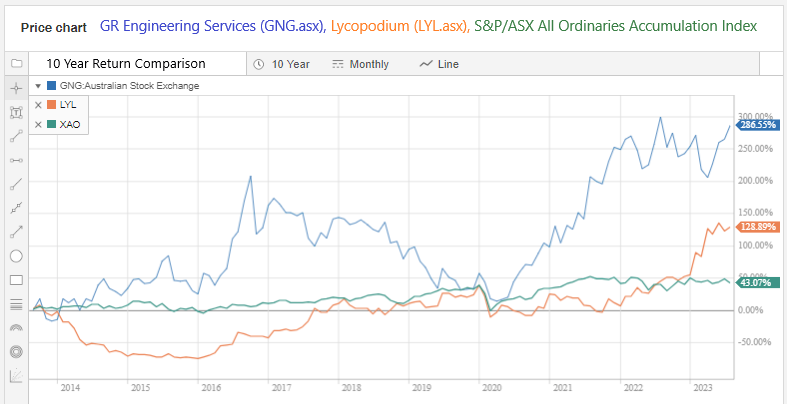

Souurce: Commsec (trend lines added by me).

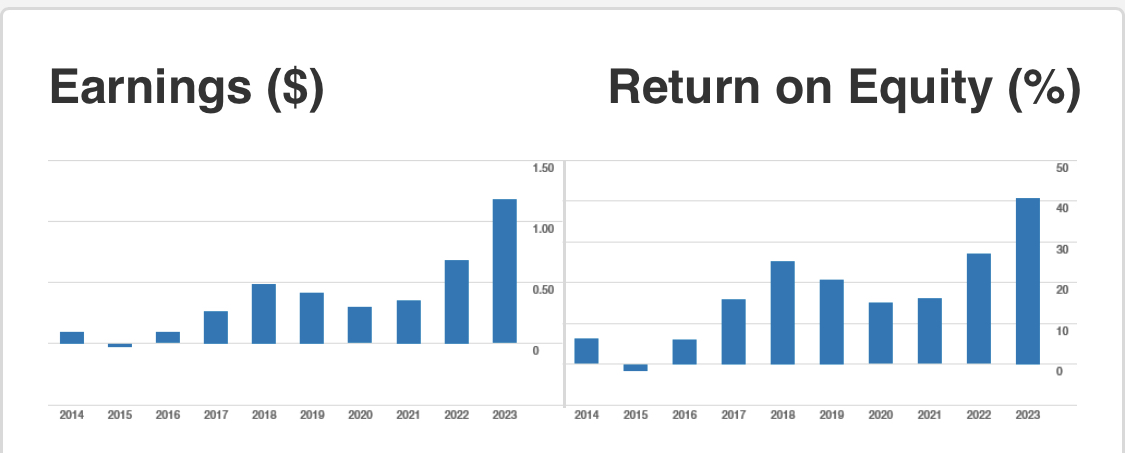

Not growing in a straight line all of the time, there are pullbacks, but the overall trend is up and the growth has been substantial.

Current 12m trailing dividend yield is 7.9% plus franking, and all of their dividends have been fully franked. That's a grossed-up trailing yield of 11.2% (including the full value of the franking credits).

And we have share price growth as well:

Source: Commsec (as at Friday 25th August 2023, showing Friday's price movement (-1.72%) at the top.

Disclosure: I continue to hold LYL shares (both here and IRL). Liquidity is still an issue, however it's a great place to park some patient money and watch it grow and produce income at the same time.

03-March-2024: Update: Raising my PT for LYL from $11.88 to $14.25, as they've already shot past my previous price target. They keep on underpromising and overdelivering. Here's their H1 of FY2024 results summary table:

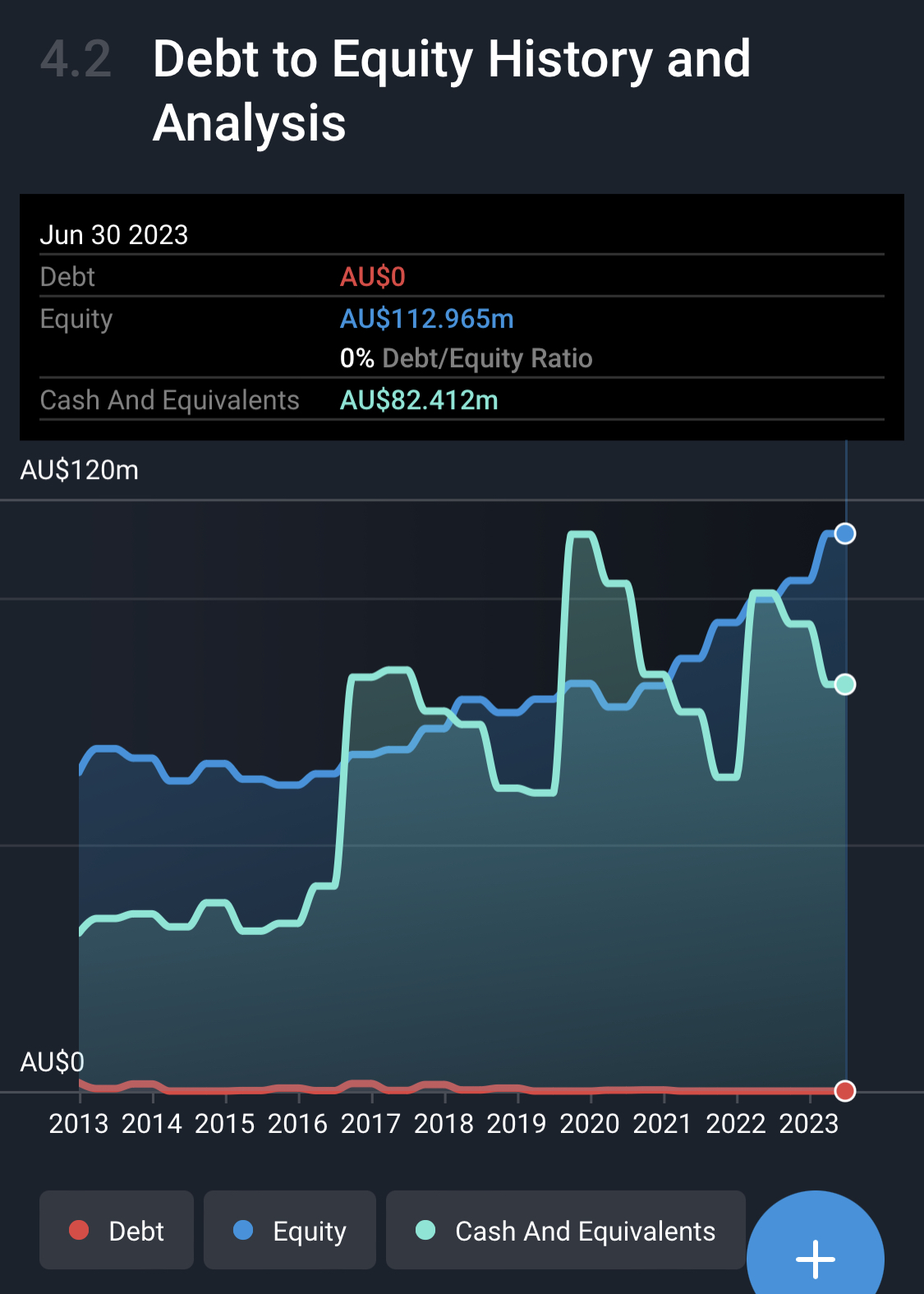

As usual, they did NOT provide any percentages - I've added those (above) on the right side of the table. The cash fluctuates depending on progress payments, completion payments, and so forth, so I'm not fussed about the cash levels - they move up and down a lot, but they always have plenty of spare cash - they are, after all, a small company with a sub-$500m market cap, so $69m of net cash is plenty.

Here's page 1 of that results announcement:

And here's a link to the full announcement: Lycopodium-Half-Year-Results-Announcement.PDF

And to their results presentation for the half: 1HFY2024-Investor-Presentation(LYL).PDF

And below is a share price comparison of LYL, GNG and MND against the S&P/ASX200 TR (total return) Index (XJO) - Lycopodium, GR Engineering and Monadelphous all being quality ASX-listed engineering and construction companies that I hold in real money portfolios (and I also hold two of them here on Strawman.com):

GNG has done OK, but LYL is powering ahead now. Happy to be holding. They're growing at a good clip, they are very profitable, they pay excellent fully franked dividends, they have high insider ownership (great alignment of interests between management and ordinary shareholders), they have superb industry position, they are very well run, and the management like to underpromise and then overdeliver. Not very much NOT to like! And LOTS to like!

21-Aug-2024: Update (post FY24 Full Year Results):

I've written about my thoughts on today's results and the market's reaction here (it may loop back to this valuation, so just scroll down and the straw will be below it).

I would have preferred a higher final dividend, but it's all good - I increased my exposure today both here and in my largest real-money portfolio where it is now my second largest position (10,000 shares worth $123.4 K based on today's $12.34 closing share price) and only $5K below my largest position, WLE (100,000 shares currently worth $128.5 K), so I'd expect LYL will become the largest position in that portfolio soon enough as we get a little bit of a recovery in the share price after today's -12% fall.

Interesting thing I found today on Strawman.com. The system kept telling me my buy order was too large and would exceed the 20% portfolio position limit (no single position can be more than 20% of your entire portfolio value here at the time of purchase or top-up, a rule that also applies in my super which is in an industry super fund). The trouble was that the system here was basing that on yesterday's closing price for LYL, which was $14.02, being $1.68 higher than where they closed today, so that meant that I couldn't move up to 20% of my portfolio here with a buy - I could only end up with 18.5%. Oh well, there's always tomorrow.

Here's a quick recap of today's results:

Dividend down -4.9% vs pcp, ROE down -4% from 44% in FY23 to 42.2% for FY24, Cash down -18% from $82.4 million to $67.6 million (and their cash always bounces around because of the timing of significant milestone payments with their larger projects - but they have net cash and no debt), and everything else up.

Record Revenue, Record Earnings, Record EPS, and on a single digit PE ratio now also.

My previous price target had already been achieved prior to today, so I'm moving it up again, this time to $14.85.

Disclosure: Yes, I hold Lycopodium shares.

Lycopodium replaced Monadelphous Group (MND) - a couple of years ago - as my favourite ASX-listed company. Other favourites include ARB Corporation (ARB) and GR Engineering Services (GNG) and a few gold producers (NST, GMD, RMS).

They can be very illiquid, because 33% of their shares are owned by their Board, Management, Founders, and their families, but worth taking the time to accumulate a position, IMO.

They're in the All Ords Index, and when they do finally get added to the ASX300 Index they will absolutely get added to my SMSF (where my direct share ownership is limited to ASX300 stocks because it's in an industry super fund).

For now I hold them outside of my super, and here on SM also where they are my largest position.

https://www.youtube.com/watch?app=desktop&v=-Mp5i9Zhqdg

21-March-2025: Update:

This one has been marked as stale (6 months old), but I don't have anything to add really, other than what I've already put into straws and forum posts. The $14.85 share price target that I set here in August (2024) is still good. The company is the same today as it was then, with the same upside potential and outlook. The main difference is that the share price is now lower, but that doesn't change my PT.

I don't think I gave a timeframe for that $14.85 PT in August, but I'll give one now - $14.85 by November 2027 - which will line up nicely with them being my pick in this thread: here: Highest conviction stock with great management you trust which had a 3 year timeframe from November 2024, so the finish line for that fantasy portfolio is November 2027.

I will make two other observations, the first being that $10 has recently proved to be a good downside resistance level, and that LYL can often have low liquidity as demonstrated by the gaps between the buys and the sells (price points) below:

So, they're best held by people who do have high conviction, because if you get shaken by the share price volatility and you lose your nerve and want to exit, there can be very few buyers and the price those few buyers are prepared to pay can be a lot lower than what you might consider to be fair value.

So fair warning about that low liquidity. The share price can and at times certainly WILL be volatile, but that is a good thing if you have high conviction and a fair idea of your buy zones and your sell zones.

Disclosure: Held. LYL is my largest position both here and in my real money portfolios. [I do have high conviction in this company]

19-Sept-2025: Update: No change

I've just posted a straw about them going ex-div yesterday and holding above that $12/share level that I think is shaping up to be a new downside resistance level (previously was $10/share), so I'll not repeat all that.

The TL;DR version: Back to higher dividends again now I reckon and they've got some good gold tailwinds too.

No change to my $14.85 price target. That and then some. Still happy to have this one as my largest real life (real money) position.

Thursday 5th Feb, 2026: Update:

Raising my price target again - they have already overtaken my old one of $14.85 - so I'm moving that PT up to $17.70 now.

I've explained a fair bit of why in a forum post I added here a couple of hours ago - click here for that - however there's also the gold price of around A$7,000 / around US$5,000/ounce, significantly higher than it was in September (see above in my previous update).

Here's where it was yesterday (4th Feb):

Gold and copper prices are currently providing good tailwinds for Lycopodium and they do deserve to trade at a higher P/E multiple than where they have traded in recent years as I explained yesterday in that post (link above).

Lycopodium is not the type of company I have any natural attraction for or interest in, but @Bear77 ’s constant banging on about it and enthusiasm for it (I very much respect his opinion in mining and mining services, where I lack understanding) warrants a look.

Investment Analysis:

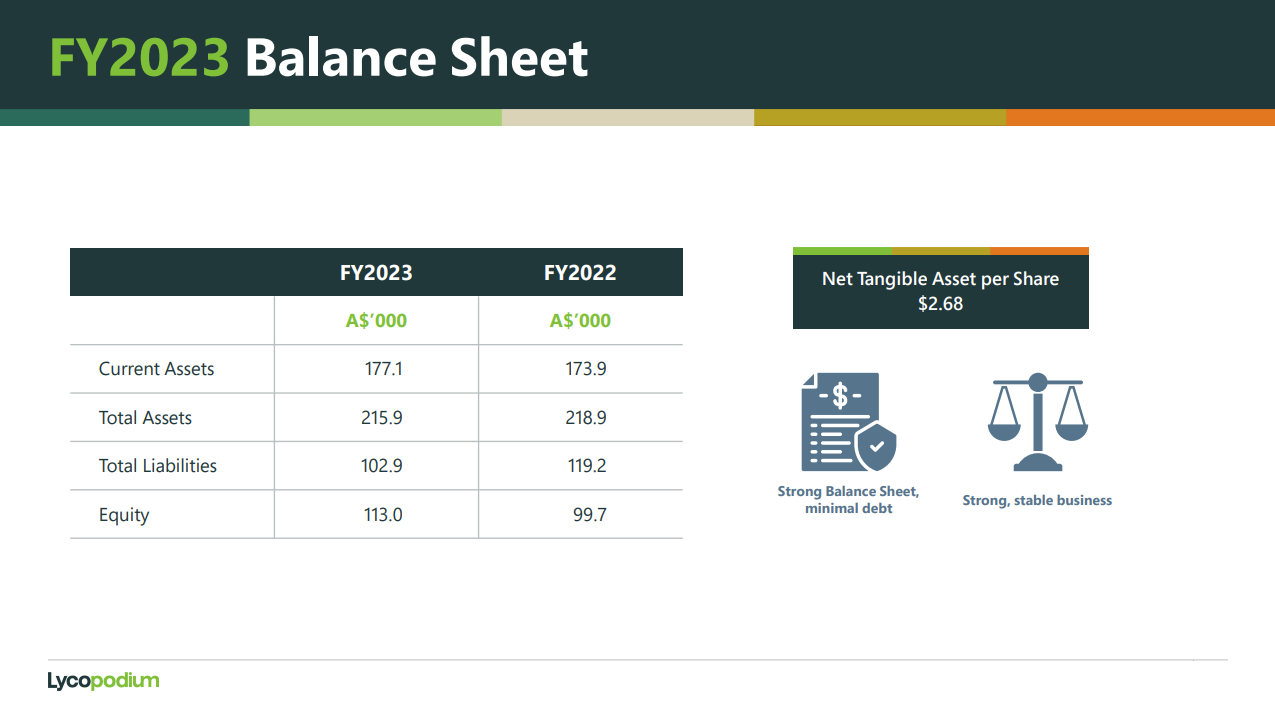

· Rock solid balance sheet, A$77m (FY25) cash (no debt) with only risk that the Trade Receivables balance is quite high at $115m (about a third of revenue) and customers are global.

· Solid growth rate (Sales and NPAT) maybe a little lumpy, great ROE and ROC but trending down a little last year.

· Strong NPAT margin around 10% or above historically (and forecasted) with a capital light business model, but cash conversion lags due to the growing Trade Receivables.

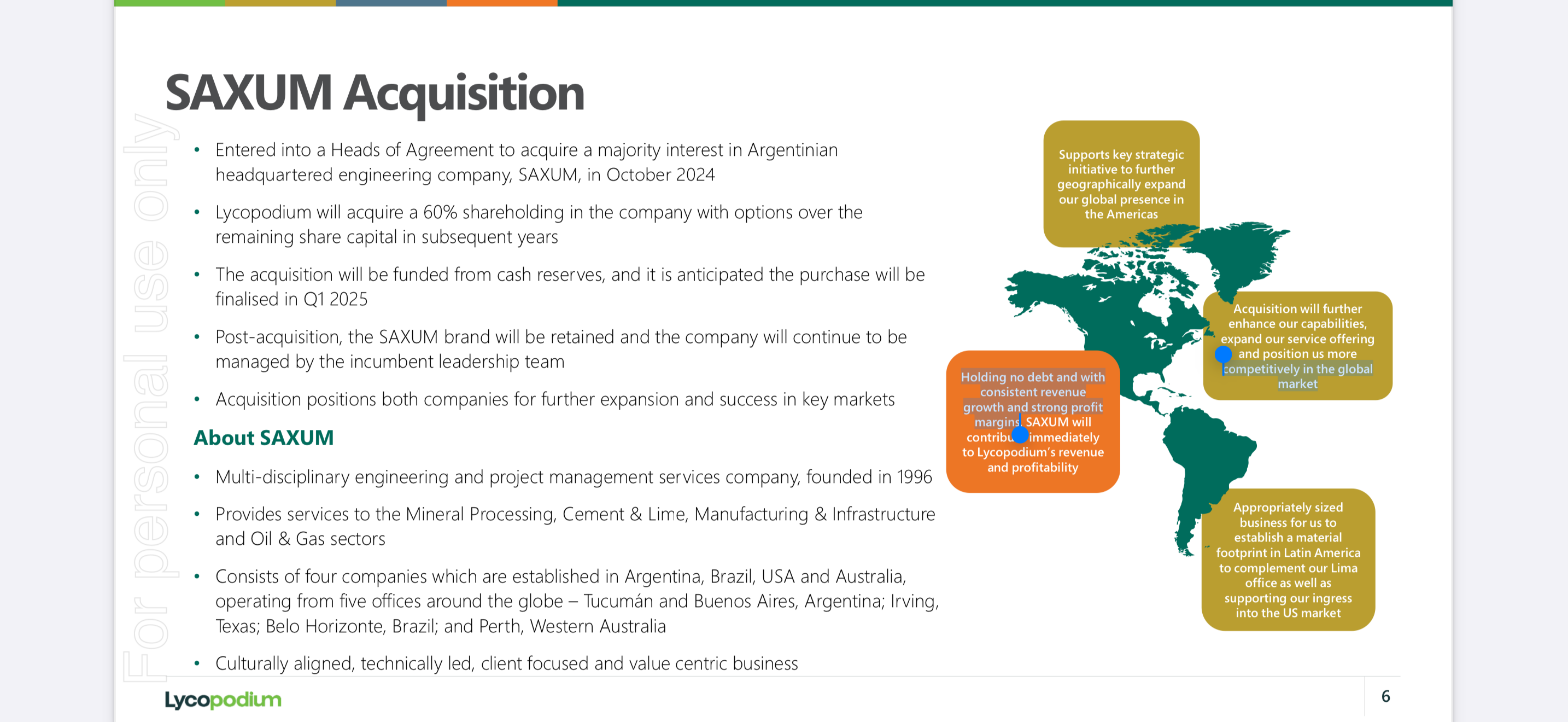

· Shown very conservative management over a long period, share count unchanged in 10 years and no debt. SAXUM acquisition shows caution and prudence on dilution and balance sheet.

· Expect it to continue to be well managed and to grow on a three year rolling average over 10%, unsure how much the current gold price rise and SAXUM will convert into growth, the market seems to be pricing in a lot of growth, I don’t have a strong enough understanding to price this in.

· Current PE around 15 is at the top of the range for the company, a PE around 10 has been the average over the last decade, so exceptional growth is needed.

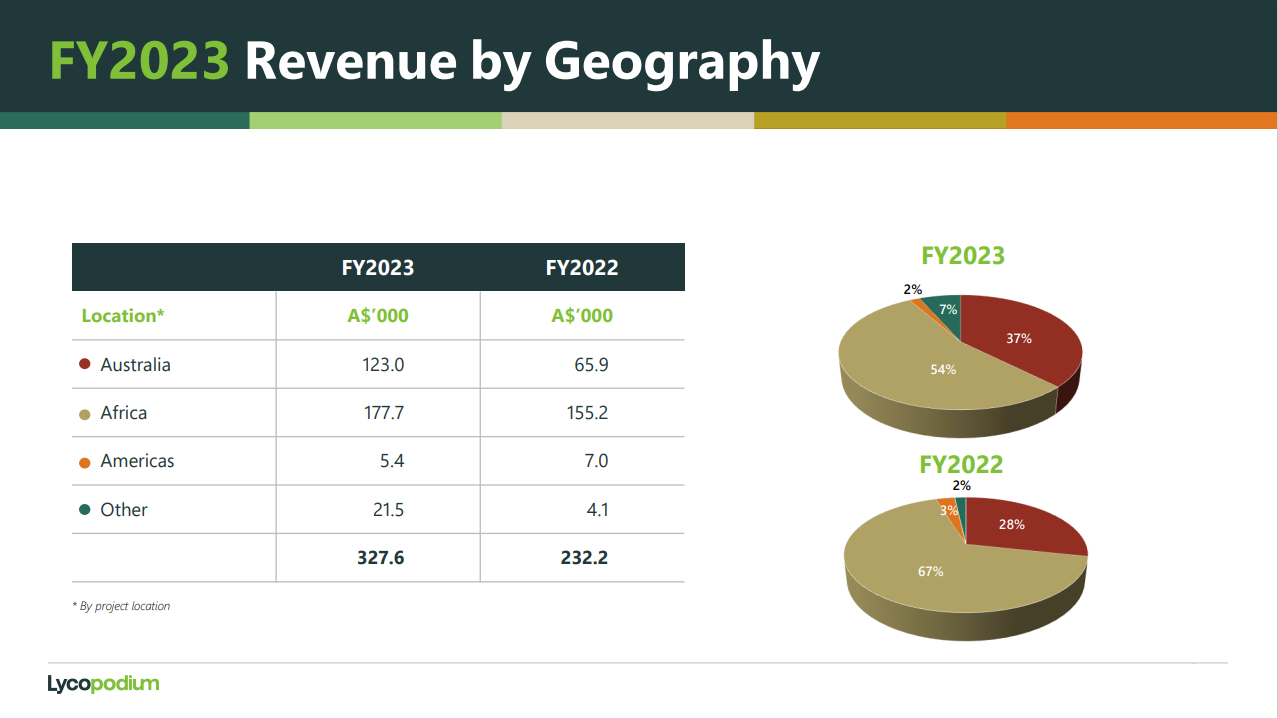

· Global operations, including in Africa (57% revenue) which brings risk that explains it’s low average PE, however as @Bear77 pointed out with the Reko Diq project, they may be cautious of risky sites or price in the risk. “Overall strategic commitment to prioritise high-quality work over high-risk work” per their presentation.

· Dividend yield is low due to current share price, but historically has been good.

· Good track record and prospects, offers strong long-term possibilities.

Conclusion:

It’s going on the watch list with a view that I would be interested sub $11 despite it being a bit outside my comfort zone, but under this price and with it’s track record I feel there is a fair margin of safety. The low liquidity my offer deep discounts in the case there is a large seller. I would be buying it as a steady long-term income hold, but would exit if it became over valued like I currently view it.

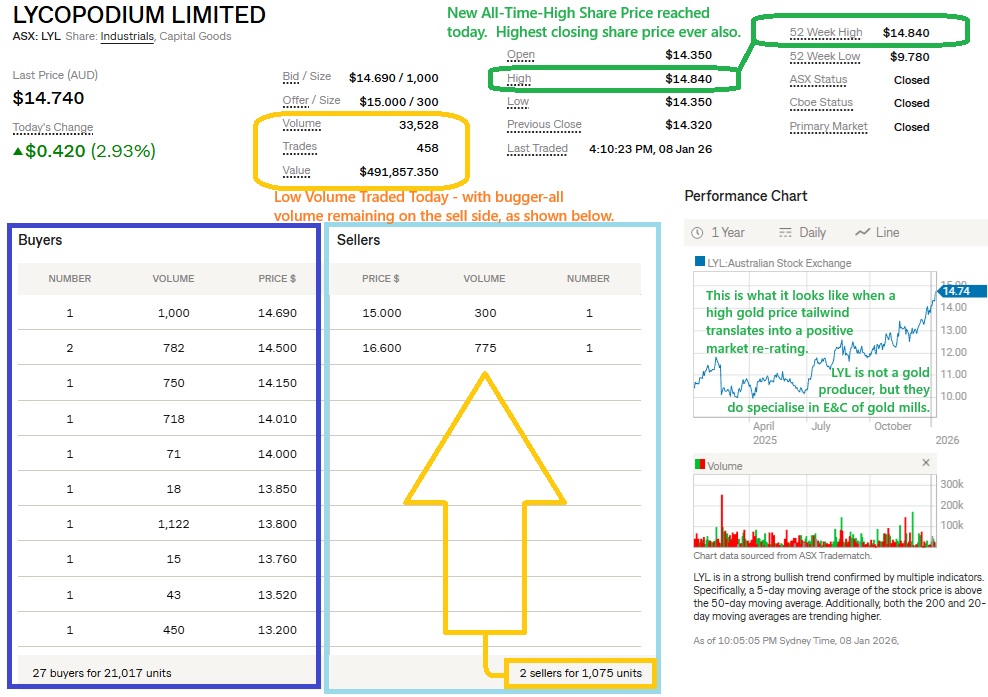

Thurs 8th Jan 2026:

Disclosure: Lycopodium is my largest position both here and in my real money portfolios.

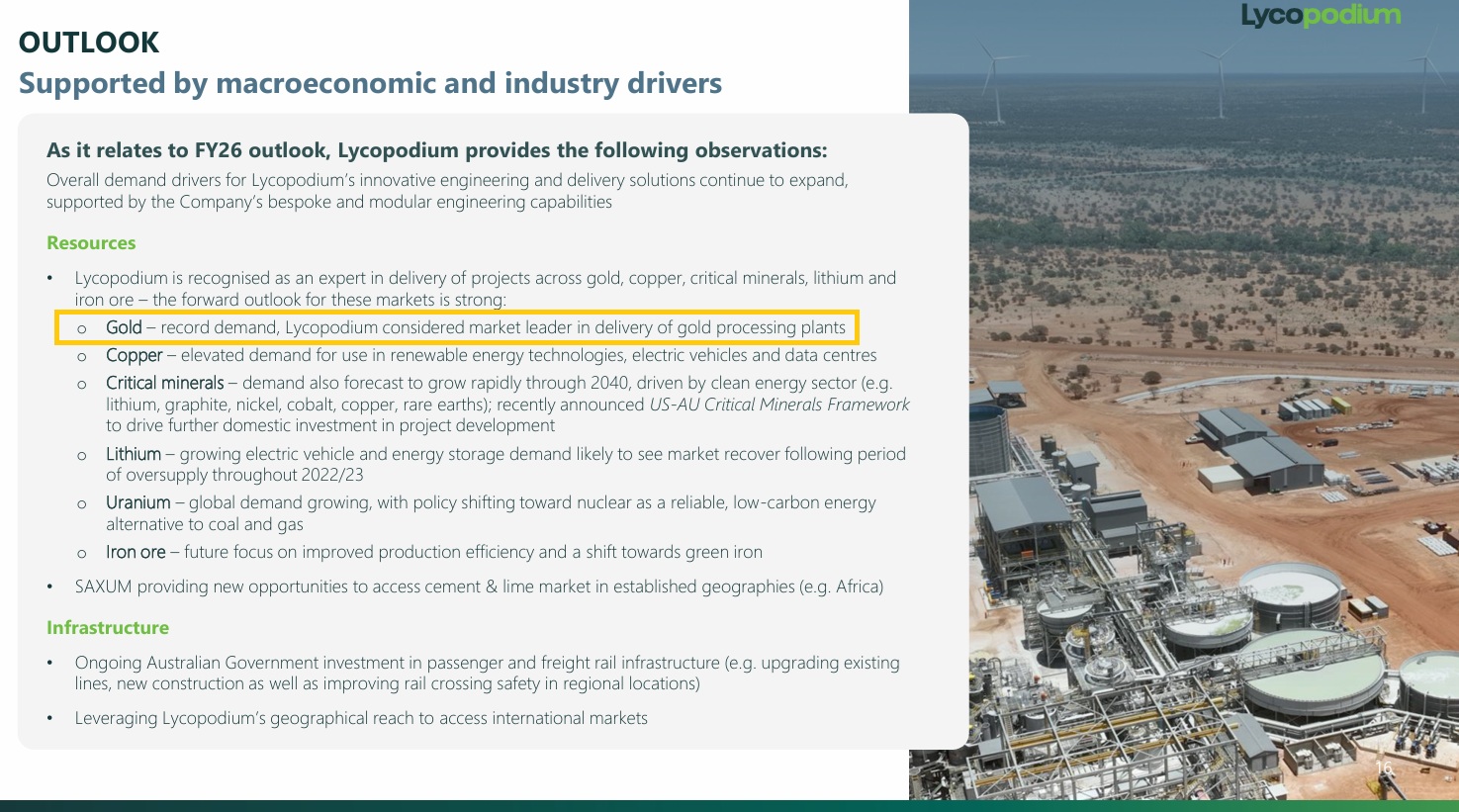

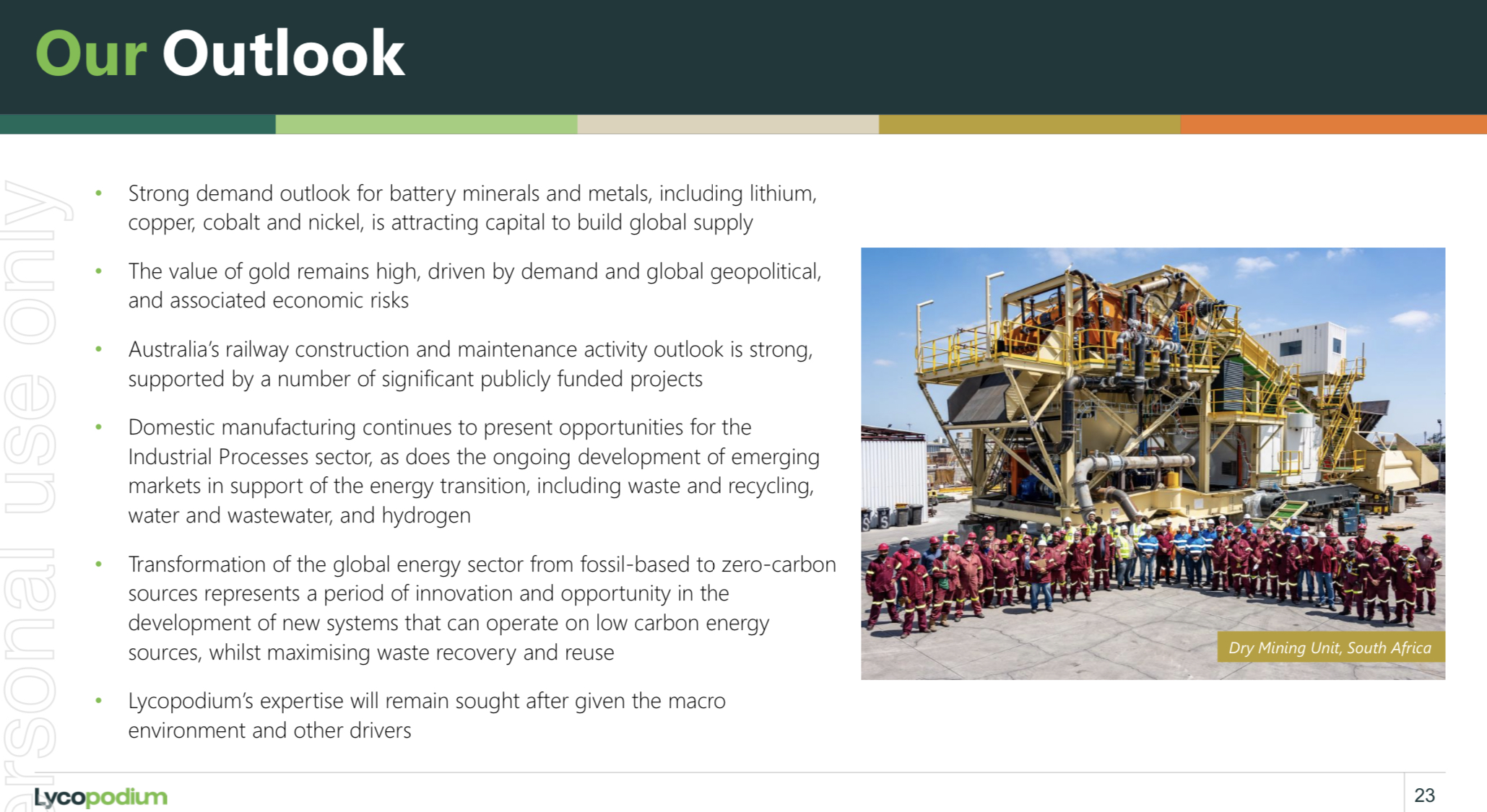

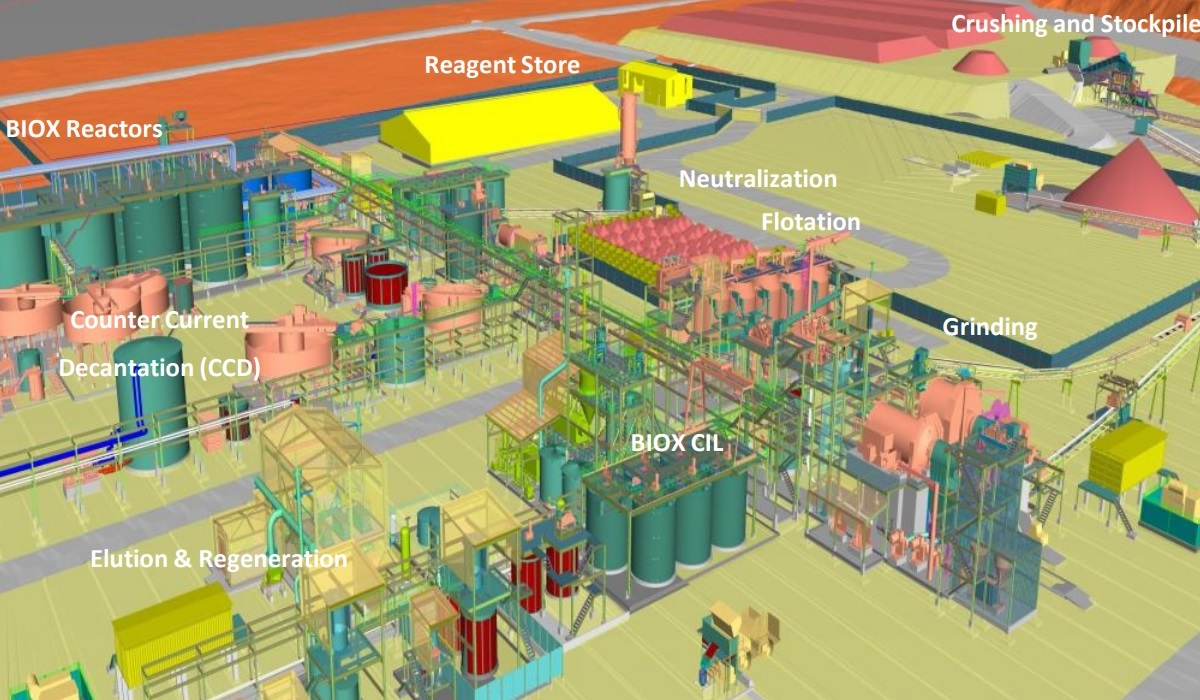

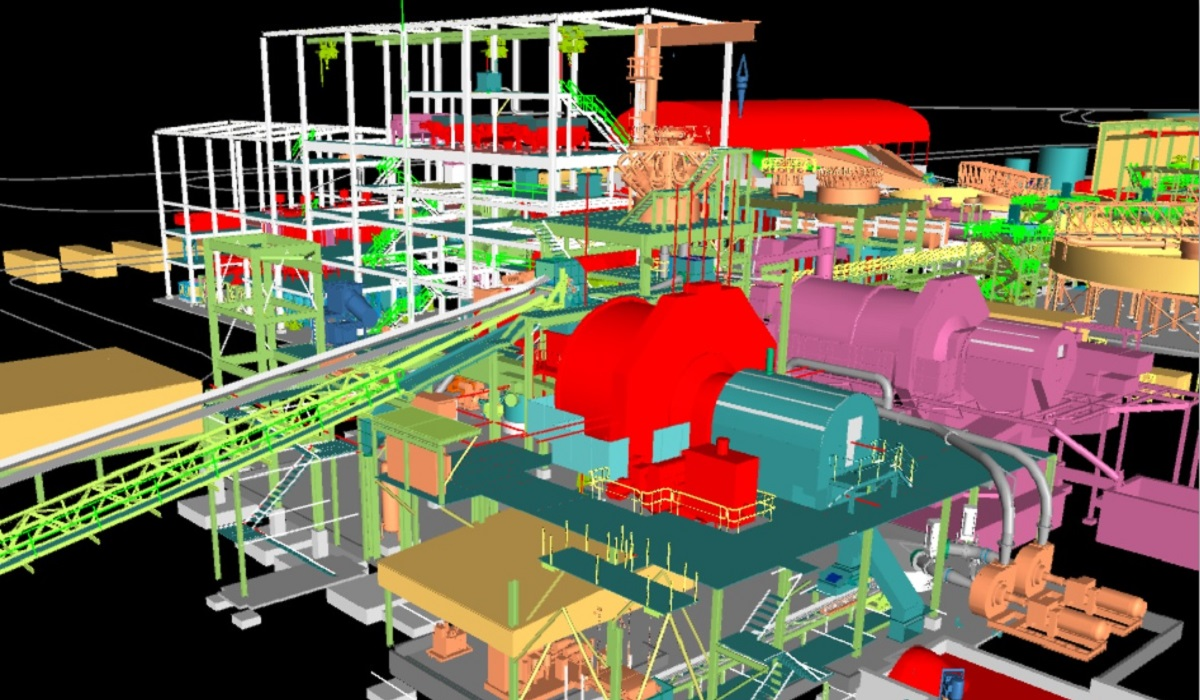

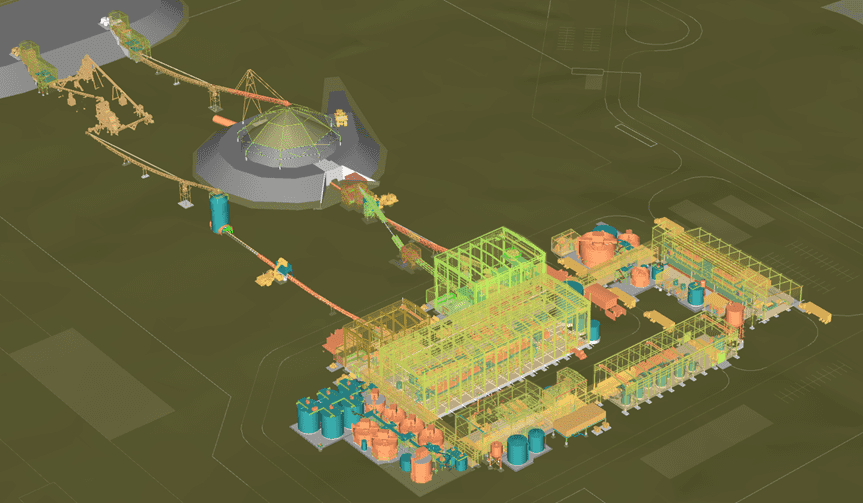

My analysis today: This is not a company in a bubble of any sort, it's a good old-fashioned engineering and construction (E&C) company that specialises in the engineering (/design) and construction of gold processing plants (gold mills). That's certainly not all they do, but it's what they are best known for, and they are enjoying a positive market re-rating as the liklihood of further work across the gold and copper sectors in particular - and in other commodities also - becomes more and more likely.

Many gold projects that were not economically viable two years ago are certainly positioned to make big profits now if those projects can be brought into production within a reasonable period of time while the gold price is still high. And that's what LYL do globally (and GNG do mostly here in Australia, LYL is my largest position IRL and GNG is my second largest).

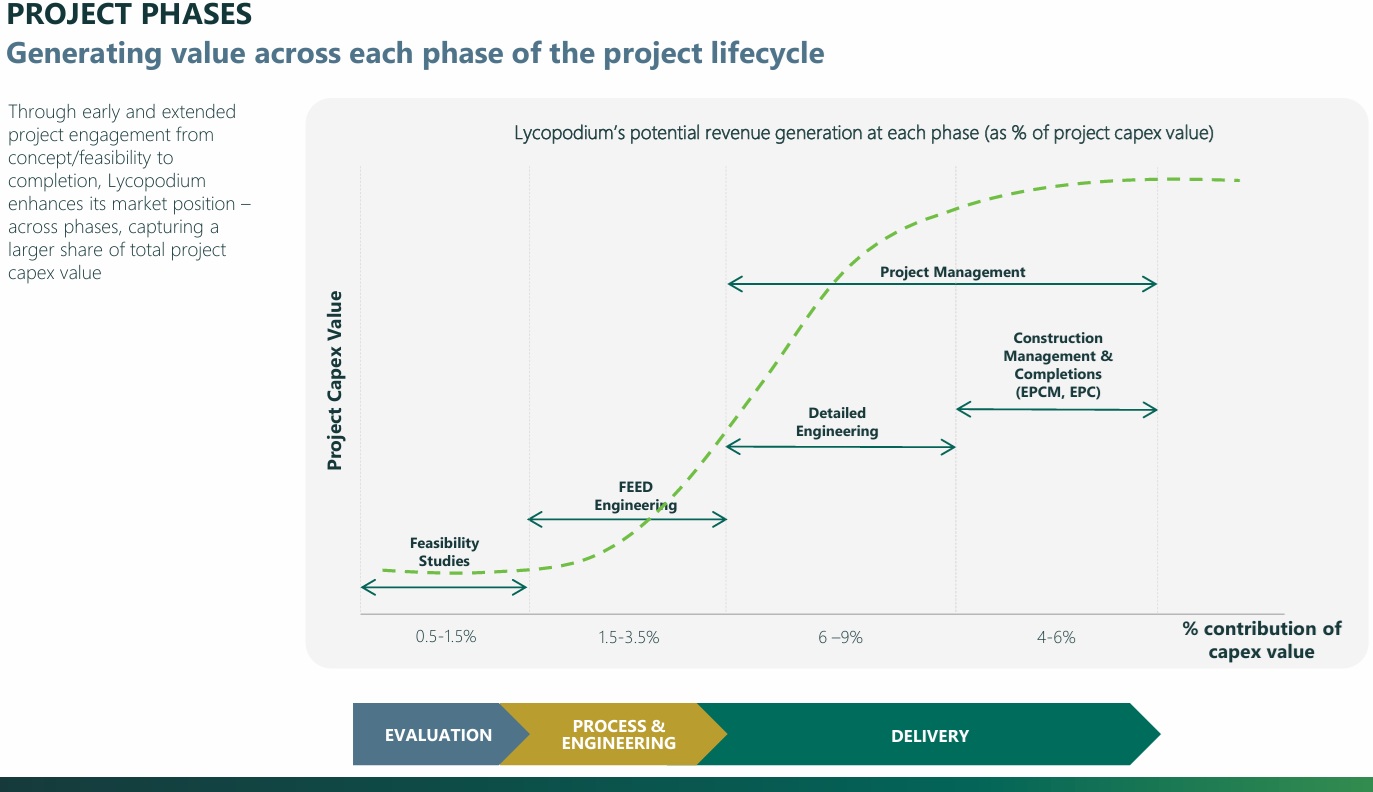

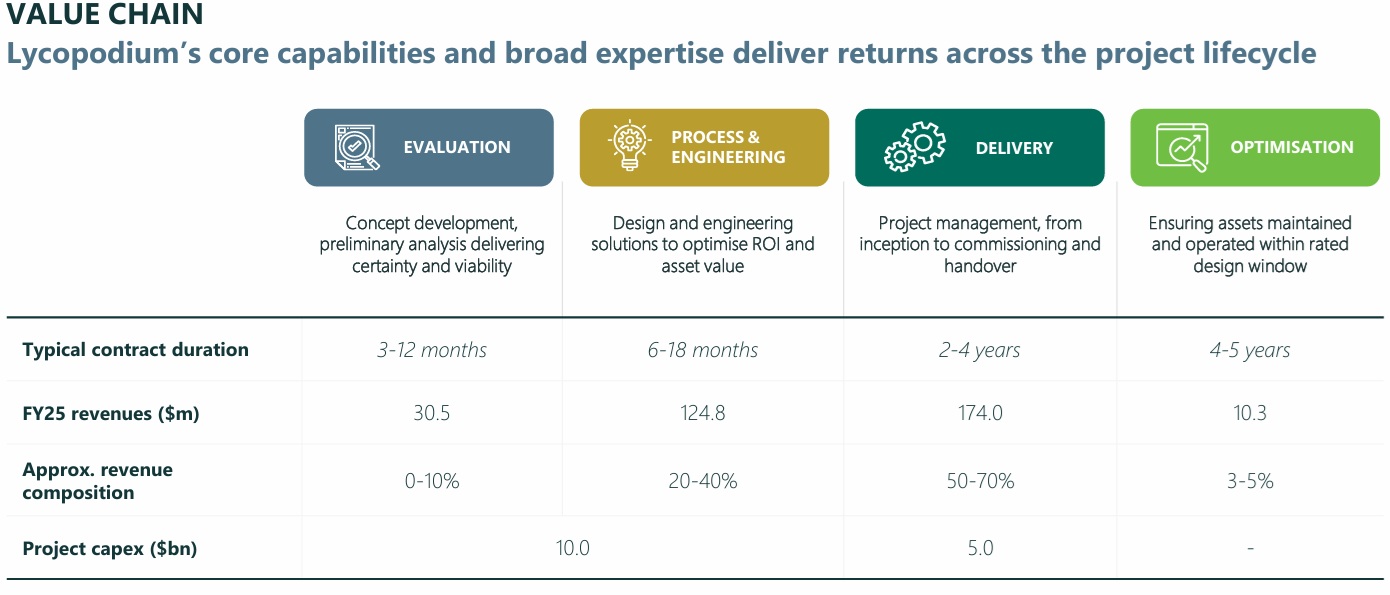

LYL and GNG do scoping studies (SS), pre-feasibility studies (PFS), feasibility studies (FS, also known as BFS and DFS - bankable/definitive feasibility studies), front-end engineering and design (FEED), and they are EPC / EPCM / EP&PM contractors as well and that's where they make the big dollars.

- EPC = Engineering, Procurement and Construction.

- EPCM has Management (Project Management) tacked on as well.

- EP&PM (sometimes called EPM) means Engineering, Procurement and Project Management, so not the actual construction.

LYL do not usually do the actual construction, however they mostly manage that construction on behalf of their clients. LYL operate mostly overseas and they usually use in-country construction companies to do the actual boots-on-the-ground construction work and they (LYL) manage that construction with minimal boots on the ground themselves. They have excellent risk management that has worked for them very well for decades and has allowed them to work very profitably in West Africa and other places that are generally considered higher risk.

In the past 18 months two things have happened that I think are noteworthy. The first is that LYL withdrew from the bidding process for two large, higher-risk projects for Barrick Gold - the world's second largest gold mining company who are also diversifying into copper and other commodities now. Those projects that LYL have walked away from are Barrick's Reko Diq in Ballochistan, Western Pakistan (wedged between Iran and Afghanistan - see map below) and Barrick's Lumwana copper mine expansion project in Zambia.

Reko Diq (shown above) in particular is likely to be one of the most dangerous places to build and operate a copper/gold mine in the world today and it's unclear whether Lycopodium withdrew from the bidding process (after delivering studies for both projects to Barrick) because of the risks or because Barrick were not prepared to compensate LYL adequately for those risks; but either way it's a net positive in my view that Lycopodium have the discipline to walk away from a project like Reko Diq which would have been LYL's largest contract ever if they had bid for it and had been awarded it.

I note that Fluor Corporation, a company headquartered in Irving, Texas, has been awarded the EPCM contract for Reko Diq, with final notice to proceed given to them by Barrick in late July 2025 - see here: https://newsroom.fluor.com/news-releases/news-details/2025/Fluor-Receives-Final-Notice-to-Proceed-from-Barrick-on-Reko-Diq-Copper-Project-in-Pakistan/default.aspx

So it's safe to assume that LYL are no longer involved in Reko Diq in any capacity now, which is likely for the best.

Barrick's planned major expansion of their Lumwana copper mine in Zambia is still going ahead apparently - see here: https://www.barrick.com/English/news/news-details/2025/lumwana-expansion-in-full-swing-as-barrick-builds-tier-one-copper-mine/default.aspx [July 10, 2025] - However LYL do not appear to have continued their involvement with that project after delivering the feasibility study (FS) and basic engineering for it in 2024. Again, it's not clear if there are project-specific reasons for this or whether it's just a Barrick thing - or more likely a Mark Bristow thing.

Bristow announced his resignation as Barrick's CEO and President on September 29th, 2025, departing the company immediately, with Mark Hill appointed interim CEO the same day. His exit was sudden and without a stated reason from Barrick, though sources later pointed to issues with Mali operations as a contributing factor, say The Globe and Mail.

Bristow was a hard man to deal with by all acoounts, very stubborn and not prepared to admit when he had made a mistake, and not at all sympathetic to major shareholder concerns about his taking the world's second largest gold producer away from gold into copper and other commodities and moving into much riskier jurisdictions without developing the required positive relationships with those countries governments (at all levels), regulatory authorities or local communities where Barrick either operated or wanted to operate.

Bristow took a hard line approach to dealing with the military Junta running Mali and in the process managed to lose control of their (Barrick's) gold mines in Mali and also had an arrest warrant issued for him (Bristow) in Mali, which apparently still stands if he ever makes the mistake of returning to Mali.

Australian company Resolute Mining (RSG) also had major issues in Mali - Terence Holohan, the CEO and MD of RSG was detained in Mali for 10 days in November 2024. He and two other employees were held in the capital, Bamako, over a tax dispute with the Malian military government and Holohan quit RSG after he was released.

Lycopodium is likely to have a list of countries that they will NOT work in, such as Mali at this point in time, and that list would be fluid as situations change, and Lycopodium would also have companies that they would prefer not to have as clients, often because of the company's management and the way they go about things, and that could be the case with Barrick, I don't know, but LYL don't often walk away from large projects after doing all the studies and a fair bit of FEED work, yet they have walked away from two large projects both owned by Barrick in the past 18 months.

My take on that is that it is a real positive because it highlights to me that Lycopodium's risk management processes are robust and they won't chase work that is too risky, or where they are not being adequately compensated for risk where they believe they can manage that risk.

In relation to Lumwana, Google tells me that Zambia presents mixed risks for mining: it's historically stable but faces significant challenges like severe environmental pollution (lead, heavy metals), high safety risks (accidents, poor conditions), and governance issues (taxation, local benefit sharing), alongside recent major environmental disasters (like the 2025 Chinese-owned mine tailings dam collapse) that strain investor confidence and community relations. So not sure whether Lumwana was considered too high risk or a project for which Barrick did not want to adequately compensate Lycopodium for the risk in Lycopodium's view.

China and Russia (Russia mostly through the organisation formerly known as Wagner Group) are both becoming more and more involved in Africa, both central and western Africa, and that also brings various new risks to the countries in Africa where China and Russia are most active.

This is interesting: Zambia Mining Disaster May Have Been 30-Times Worse Than Estimated [Aug 15, 2025, Bloomberg Television, on YouTube]

Plain text link: https://www.youtube.com/watch?v=4IMLHxiyTXM

OK, so that's the first thing I've noticed over the last 18 months, clear examples of risk management in action at Lycopodium.

The second thing is their acquisition of 60% of SAXUM - which has been covered here in straws and forum posts. I like that a lot. I like the measured way they are expanding into Central and South America using SAXUM and that they have the option to acquire the remaining 40% of SAXUM at a future date - the deal is designed to keep all of the SAXUM founders and employees in place and incentivised to continue to grow the company and do well.

I also like that instead of issuing new shares when they believed they were undervalued (at around $10/share then - now over $14/share) or borrowing money, they simply used their own cash and replenished that cash by reducing one dividend. LYL remain debt free and they've had a stable share count for over a decade now.

So evidence of risk management in action, and evidence of a growth strategy into new geographies and new areas of construction, e.g. SAXUM is big in cement and lime in Latin America, and that side of their business is growing at a good clip, so there's geographic expansion opportunities as well as cross-selling opportunities.

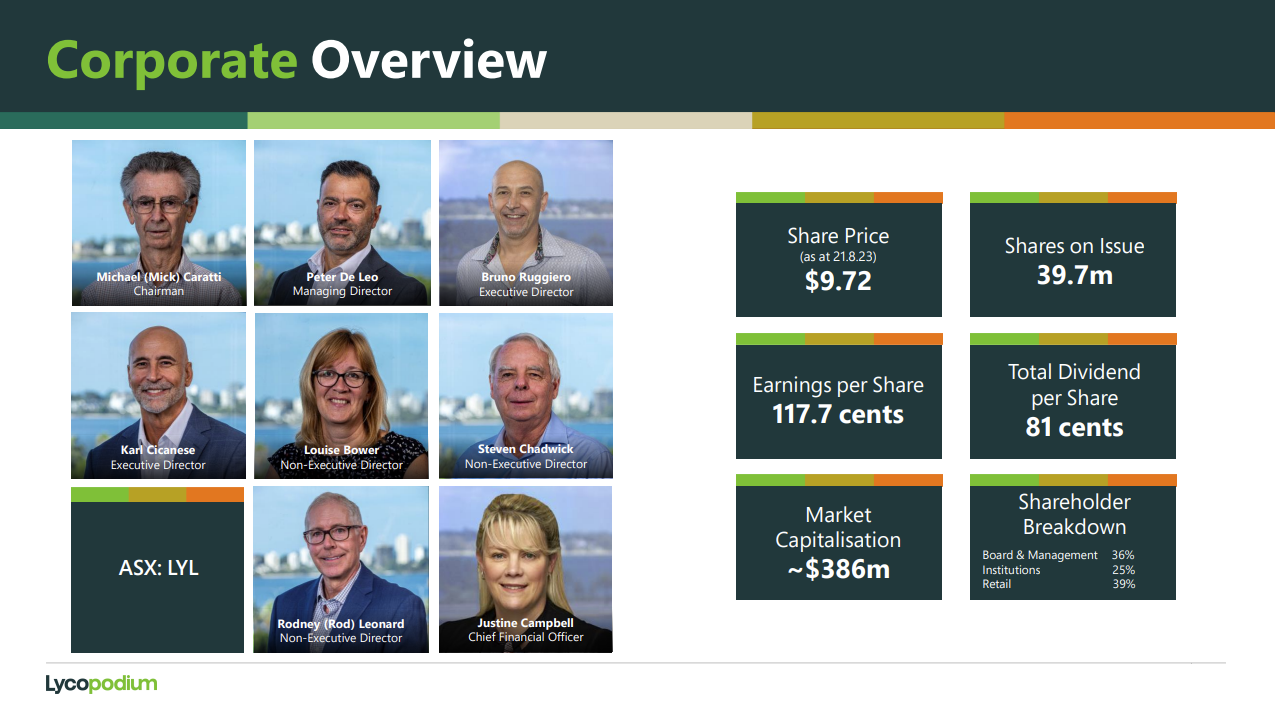

Lycopodium is a very well managed company under Peter De Leo's leadership - and there's heaps of insider ownership with around 35% to 40% of the company owned by their Board, Management and the company's founders, with some of those founders still working within the company in Management and Board roles.

This high insider ownership reduces the free float, and shareholders like me who tend to aggregate a larger position rather than sell shares also tends to reduce the liquidity even further, as I've highlighted at the top of this post with just 2 remaining sell orders left in the market after the close today, being 300 shares for sale at $15 and 775 shares @ $16.60 - and that's it. More sell volume will surely emerge during trading tomorrow, but even during the trading day the volume is usually thin with this one.

What that lack of liquidity means is that you probably want to get in when the share price is depressed, like the 7 months between November 2024 and June 2025 (inclusive) where the LYL share price traded mostly between $10 and $11 and kept dropping back to $10 regularly, because when they get a positive re-rating - as they have recently - there just aren't the sellers there to enable you to build a half decent position.

On the flip side that's good if you already hold a decent position (I do), because while the demand to buy them continues, the share price is more likely to rise further than to fall because of that lack of volume on the sell side.

It's certainly a nice graph now! As Colonel John "Hannibal" Smith, the leader of The A-Team, used to say, "I love it when a plan comes together."

Further Reading: FY2025 AGM Presentation: https://www.lycopodium.com/wp-content/uploads/2025/11/FY2025-AGM-Presentation-1.pdf [13-Nov-2025]

Further Viewing: Peter De Leo presenting at ASX SMIDcaps 2025: https://www.lycopodium.com/wp-content/uploads/2025/10/ASX-SMIDcaps-2025-Presentation.mp4 [09-Oct-2025]

So, are they a buy today? They were at below $12/share and I was not shy about that at the time. Up here near $15/share there's obviously now less upside, but I still reckon a buy up here wouldn't be a bad thing when you look back in 5 and 10 years time from now, but no, I'm personally NOT buying up here - They are already my largest position - I hold 10,000 LYL in one portfolio - currently worth $147 K, and some more in a second portfolio that holds my kids' investments - and that kids' portfolio only has one company in it, LYL. So no, I'm not buying more up here myself, but I'd consider buying more if they pulled back to near $10/share again.

23-Dec-2025: LYL are certainly back in a solid uptrend now:

LYL reached a new 52-week high of $13.81 during this morning's trading; the only time they've been this high before was briefly in August 2024 when they went over $14. It's hardly surprising because they're a very profitable company with a rock solid balance sheet (no net debt and plenty of cash) and they have strong tailwinds. They specialise in the design, engineering and construction of gold processing plants (gold mills), and the gold price is reaching new all time highs yet again:

Source: goldprice.org 5 minutes ago.

It's a nice Christmas present. LYL is my largest real life position (13%) and it's also my largest position here on Strawman.com, and has been for a while. On top of the welcome share price uptrend I expect higher dividends from Lycopodium in calendar 2026 for the reasons I have previously outlined here.

Rather than issue new shares or take on debt, LYL's M.O. is to pay for acquisitions using their own cash, and that's what they did when the purchased 60% of SAXUM in February this year, and they reduced their dividends to replenish that cash balance. That's all done now, so I can't see why they won't return to paying out well-above-market-average dividends again now. I've always liked them because of their high quality and excellent management, and also because they provide growth plus income.

SAXUM provides Lycopodium with additional growth opportunities in the Americas as we've previously discussed, and I expect them to exercise their option to buy the remaining 40% of SAXUM when the time comes.

My wife finally got out of ICU yesterday after her open heart surgery on the 10th of this month, so she's in the cardiac ward and improving her strength and mobility every day. While she will almost certainly still be in hospital over Christmas, that's OK, the surgery was successful, she has two new mechanical heart valves and she doesn't have the lung fluid issues any more that caused breathing issues, so she is off the oxygen. We have our 30th Wedding Anniversary on New Year's Eve, so hopefully she'll be home by then, otherwise we'll celebrate that in hospital also. There's heaps to be very thankful for.

Wishing everyone in the Strawman community a very happy and peaceful Christmas and a Rockin' New Year! Stay safe, enjoy good times, family, friends, everything we are blessed with, and for those of us here in Australia, be thankful also that we live in the best country in the world!

Merry Christmas and a Happy New Year everybody!!

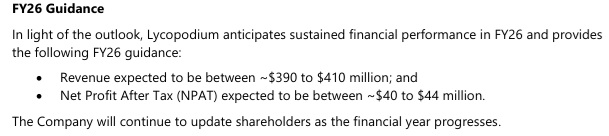

13-Nov-2025: Lycopodium held their 2025 AGM today and it gives shareholders a good chance to see how the company is progressing, and I'll break that down a bit in this straw.

LYL-FY26-Outlook--Guidance-(13Nov2025).PDF

Here's their FY26 Guidance from the announcement (link above):

And here's the guidance slide from the presentation today (link above):

Above, I've added the mid-points of those guidance ranges.

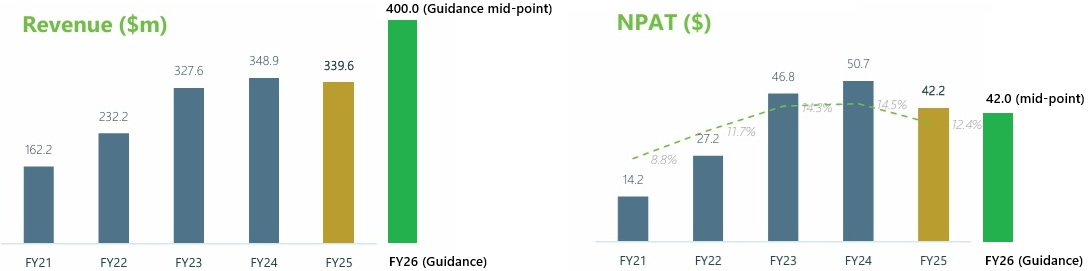

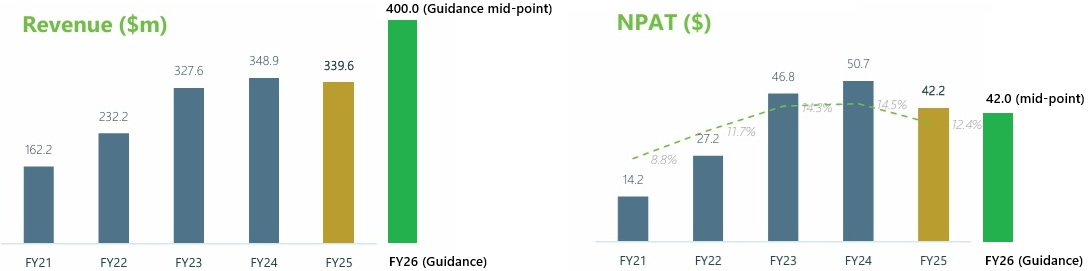

Here's how that guidance compares with their actual results over the past 5 years:

I've added the green guidance bars, as the graphed data in this slide only went up to FY25, as shown below:

It's probably a good idea to look at how the company has delivered on previous guidance. As a general rule, they have often provided guidance upgrades as the year progresses during prior years, and when they do report they usually hit the high end of or exceed their original guidance - in my experience - except for FY2025 when they walked away from two large projects for risk management reasons after spending significant money on those projects, one of those being Barrick's Reko Diq in Western Pakistan. I confirmed today that the other one was another Barrick project, the Lumwana copper mine in Zambia. More about Barrick in a bit, but I'm happy that Lycopodium pulled the plug on their involvement in those two projects.

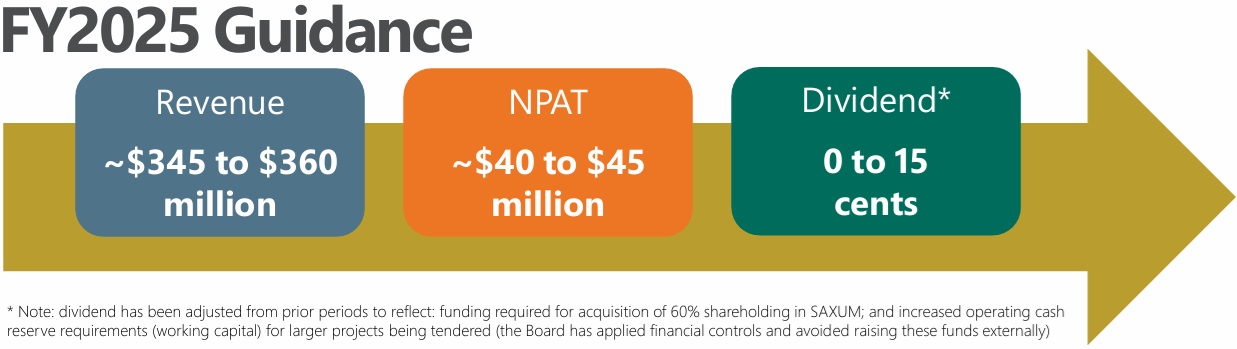

For example, here's their FY25 guidance from November 2024:

Source: FY2024 AGM Presentation.PDF [12-Nov-2024]

Their actual FY2025 results were $339.6m in Revenue and $42.2m in NPAT and a fully franked 10 cents/share dividend.

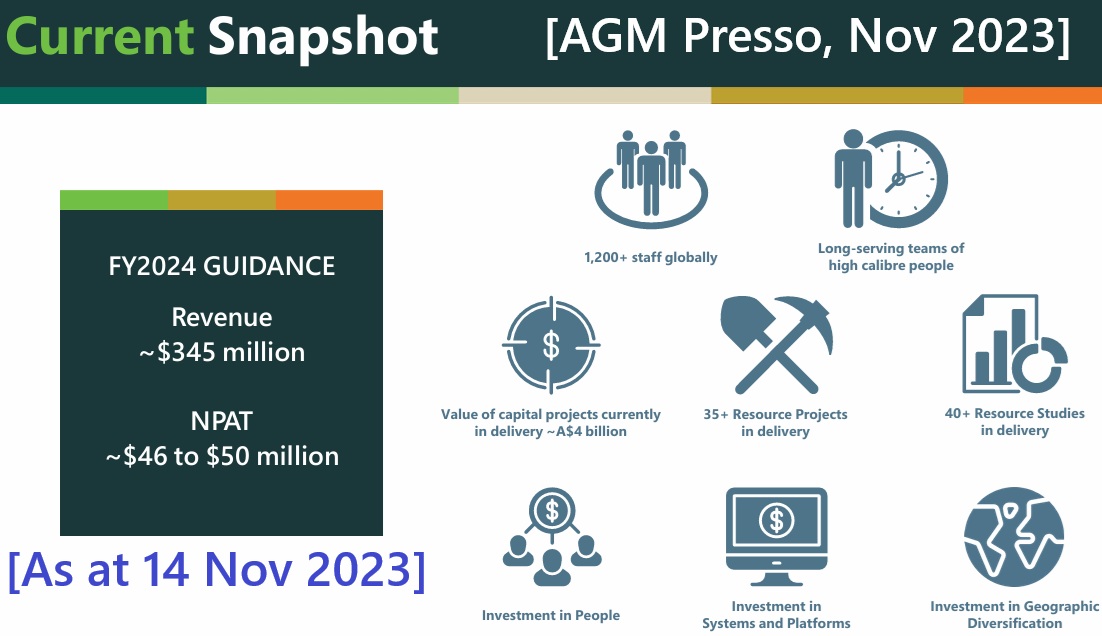

And below is their FY24 guidance from November 2023:

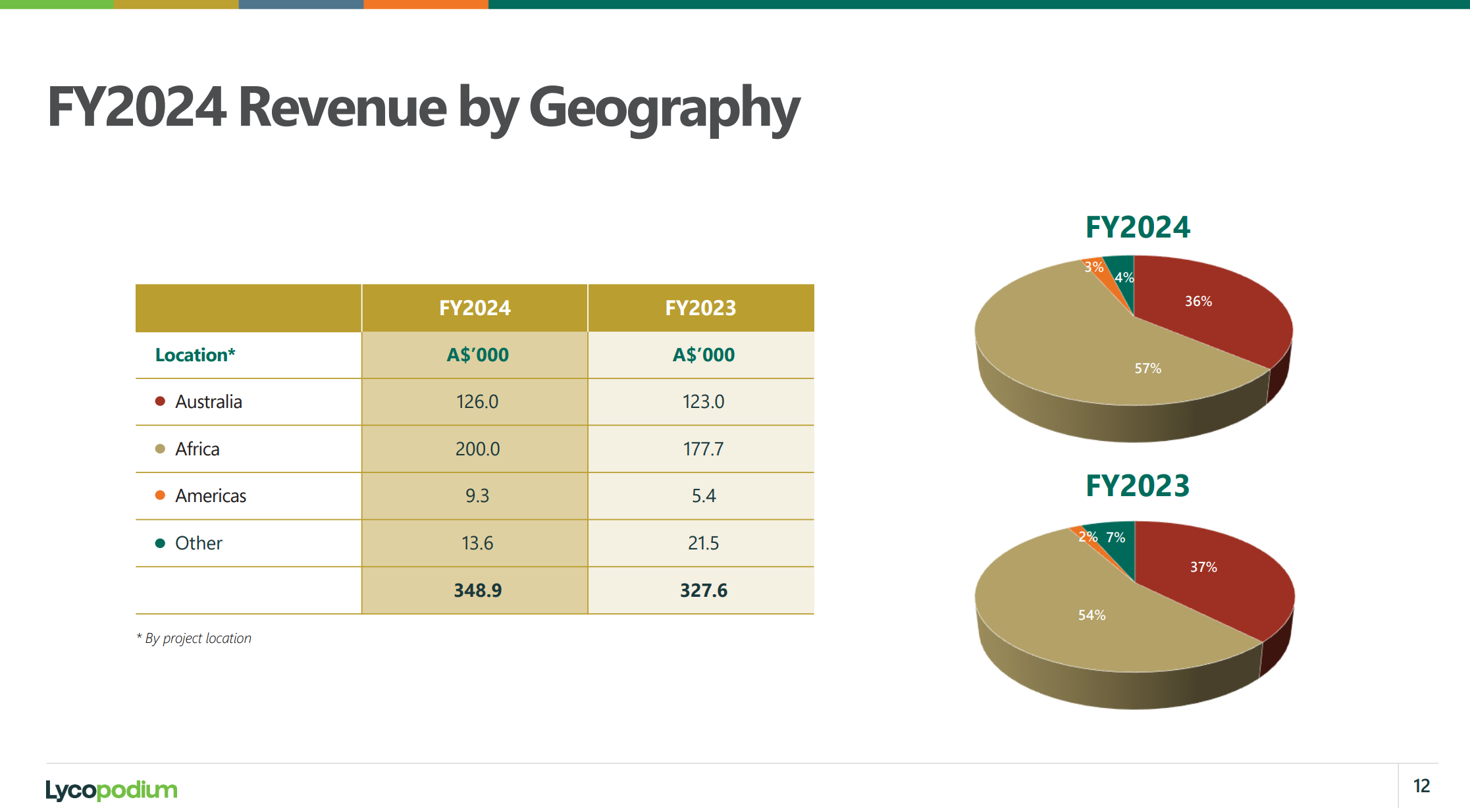

Their actual FY2024 results were Revenue of $348.9m and NPAT of $50.7m. FY2024 was typical of what I have observed with Lycopodium in terms of the company usually hitting the top end of their own guidance or exceeding guidance; they exceeded their revenue and NPAT guidance in FY24, as shown above.

So there's certainly scope for them to do the same in FY26. If they hit the top end of their FY26 NPAT guidance (being $44m), they will exceed their FY25 NPAT (of $42.2m), and they'll certainly well exceed their FY25 Revenue based on their current FY26 guidance of between $390m and $410m. And their dividends are almost certainly going to rise from FY25 levels when they were reduced to pay for the 60%-of-SAXUM acquisition (because they did not want to raise any capital or issue any new shares).

So, to recap:

There will be some margin compression this year, however they are still very profitable - their ROE has been over 30% for the past 3 years and over 25% for the past 4 years. They can afford to have some margin compression and still remain far more profitable than the majority of their peers, if not all of them.

Next, Growth:

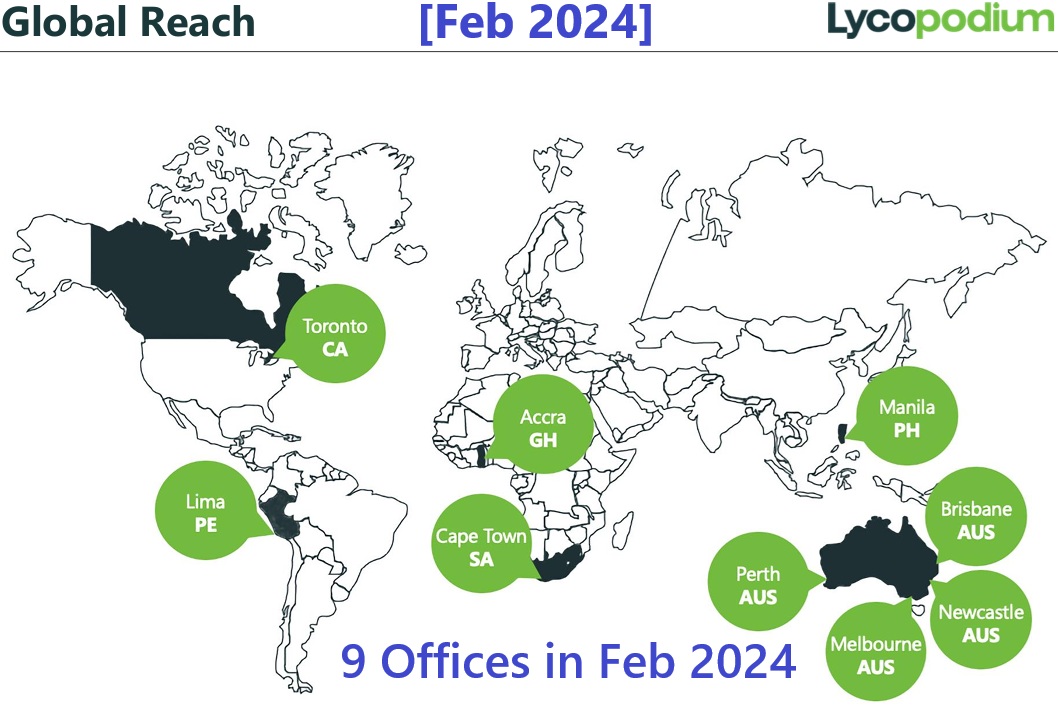

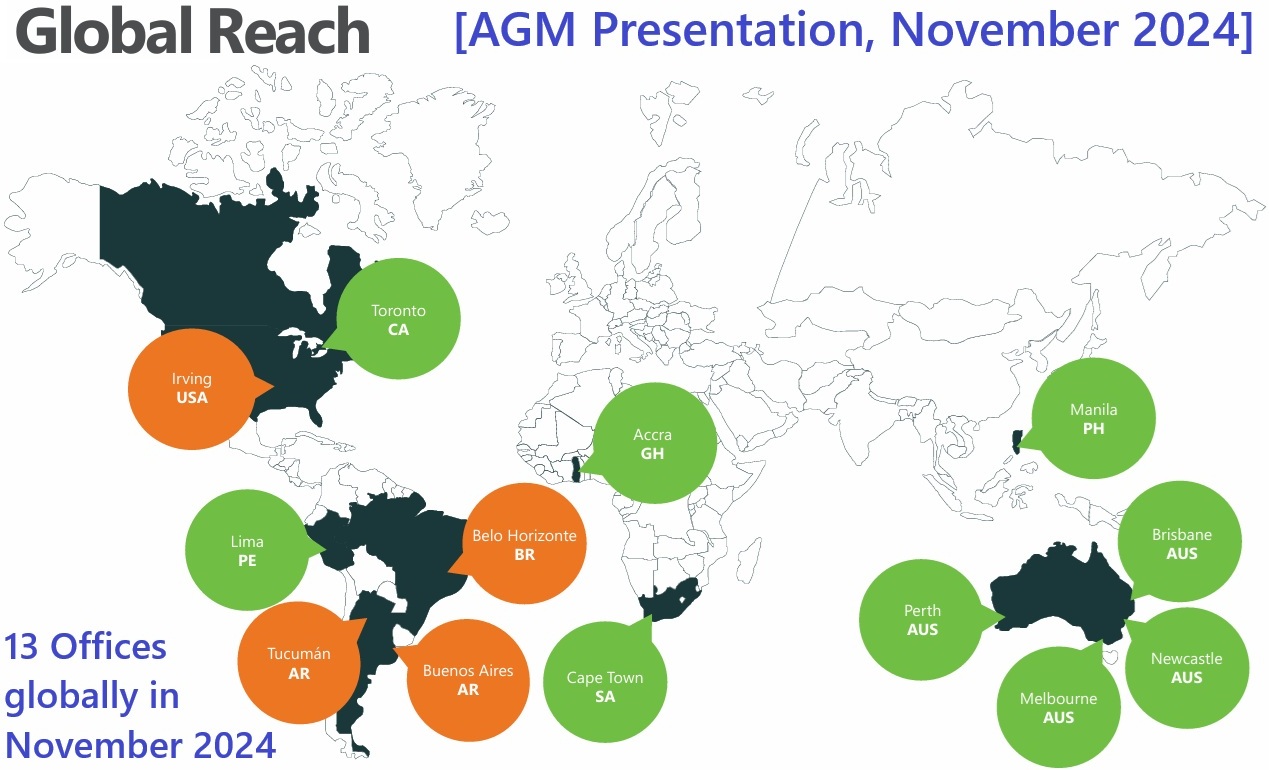

Let's look firstly at their global office count:

Source: Bell Potter Unearthed Conference Presentation.PDF [12-Feb-2024]

Source: FY2024 AGM Presentation.PDF [12-Nov-2024]

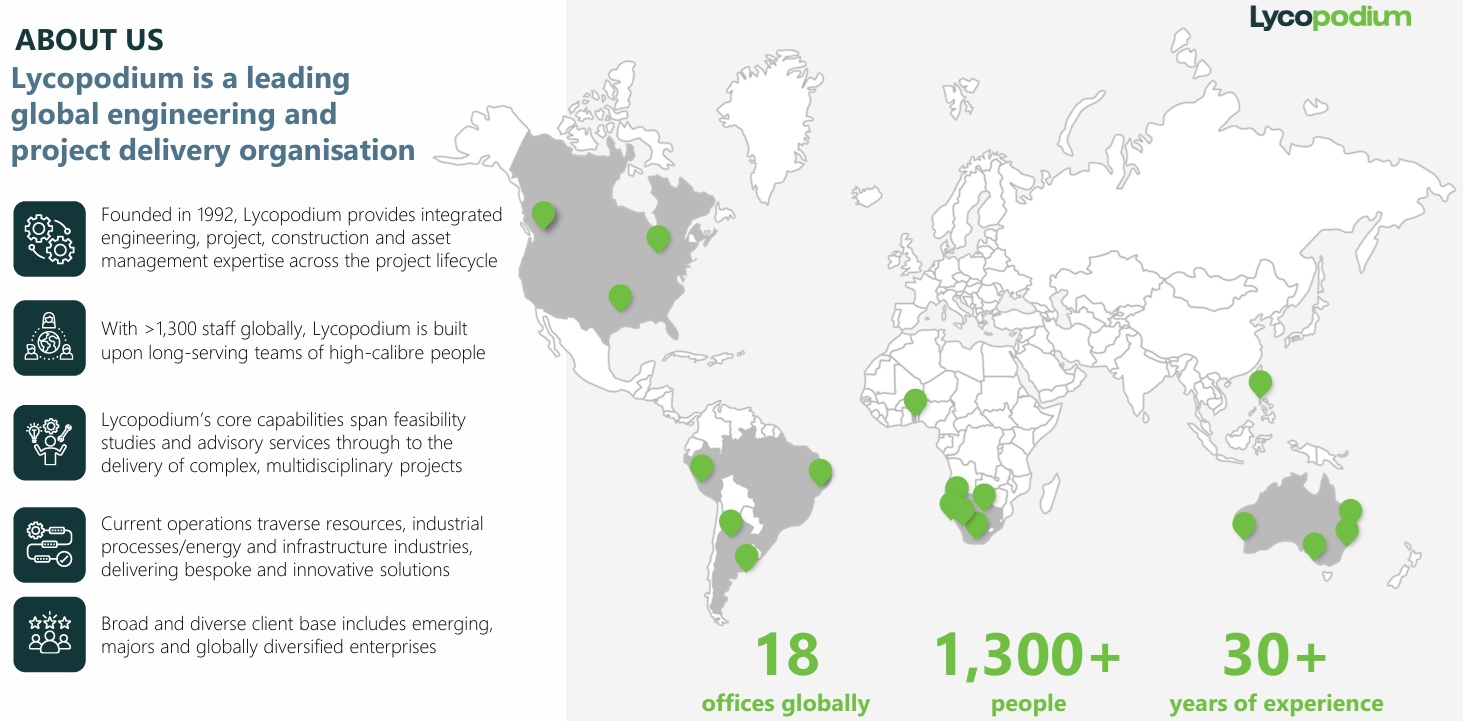

Source: Today's Presentation: FY25 AGM Presentation.PDF [13-Nov-2025]

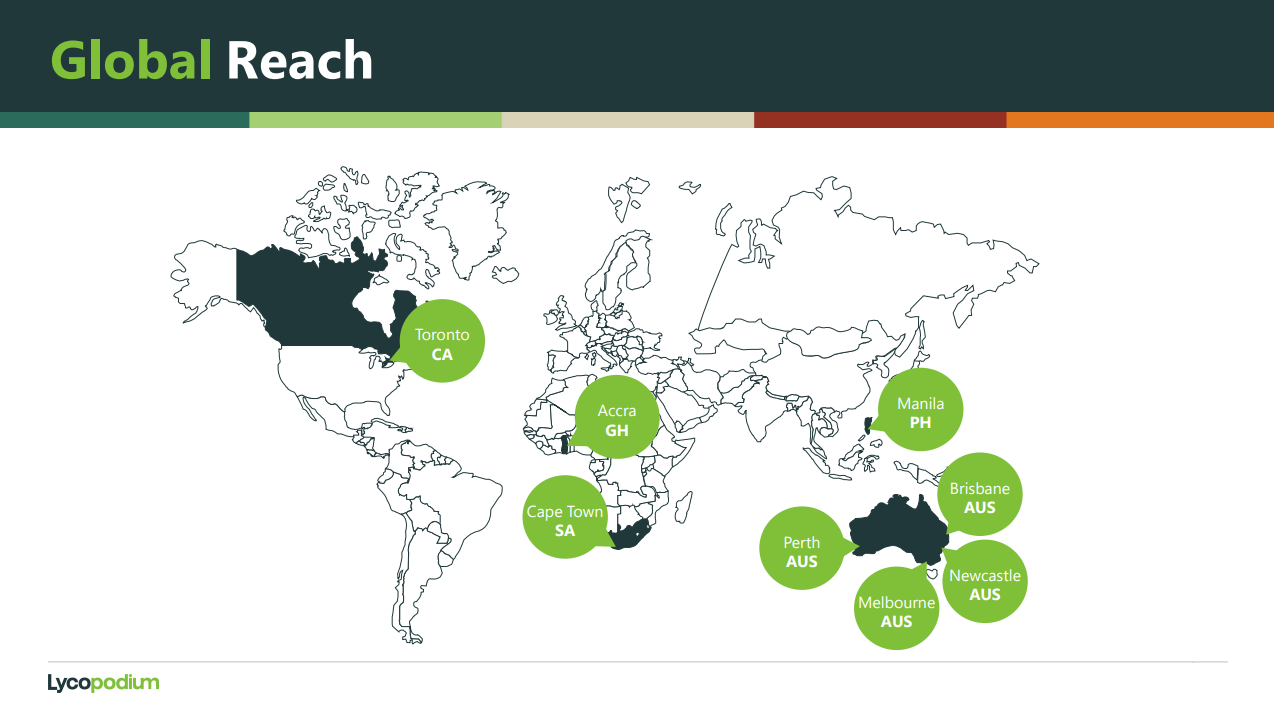

So, from 9 offices in Feb last year to 18 offices today, and only one of those offices is in West Africa (in Accra, Ghana), and 5 offices in Southern Africa. This is important because while the majority of Lycopodium's revenue is still derived from Africa, much more of it is now coming from the South, and less from the West. There are a number of countries in West Africa where it is very dangerous to try to build or operate mines, especially gold mines, and that list of risky West African countries is growing. For instance, Burkina Faso is now on that list while Mali has been on it for a few years.

LYL included a slide in today's presentation titled "Disciplined Risk Management" and that is certainly one of their greatest strengths:

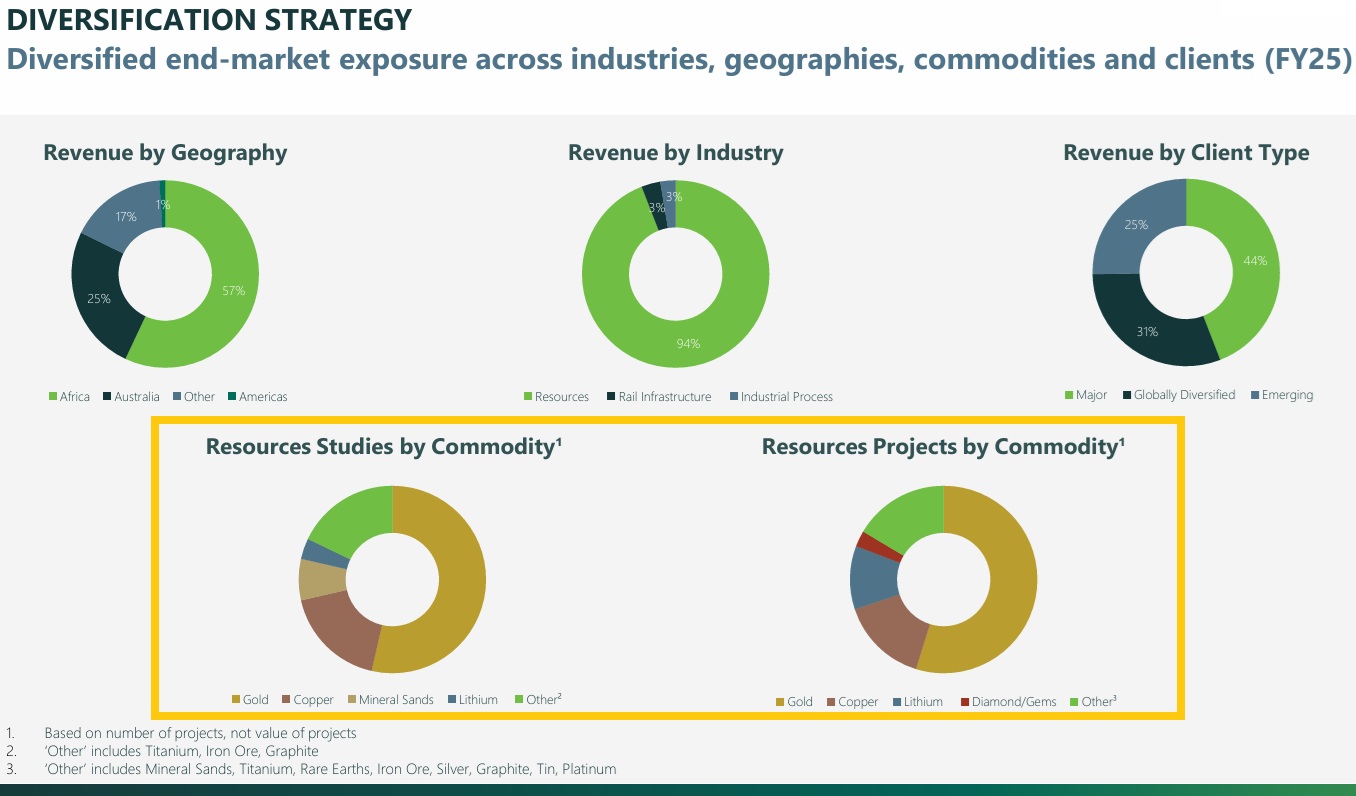

The top three charts below show their Revenue by Geography, Industry and Client Type. 94% of their revenue comes from Resources (mining) and 57% of their revenue is from Africa, but that is less than a few year ago when they were even more reliant on West African Gold Miners, and now/lately they have been gaining more work in Southern Africa and less in West Africa.

The bottom two charts show how much Lycopodium is exposed to the gold sector - a LOT! And that's a good thing because the sector has a very strong tailwind from the elevated gold price.

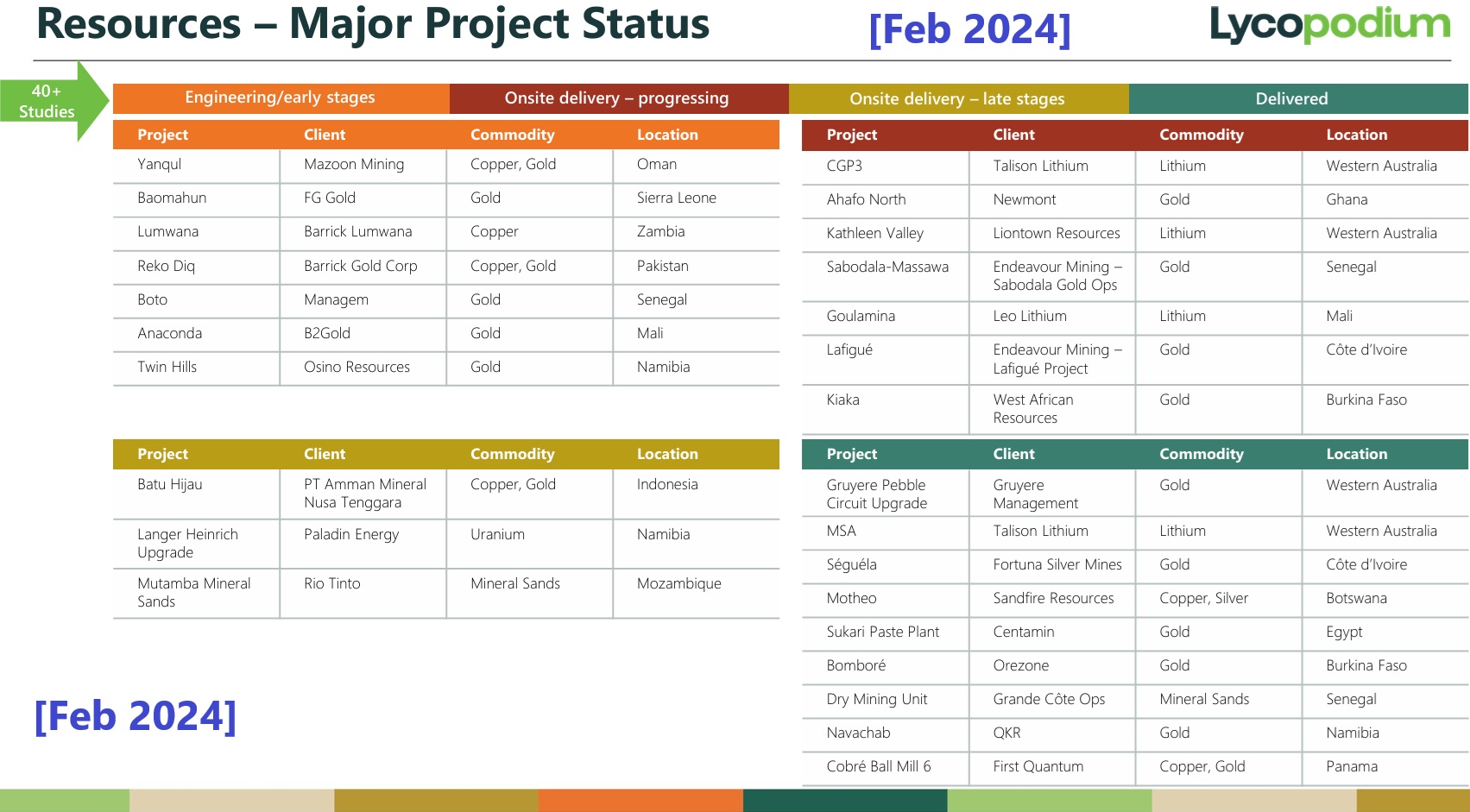

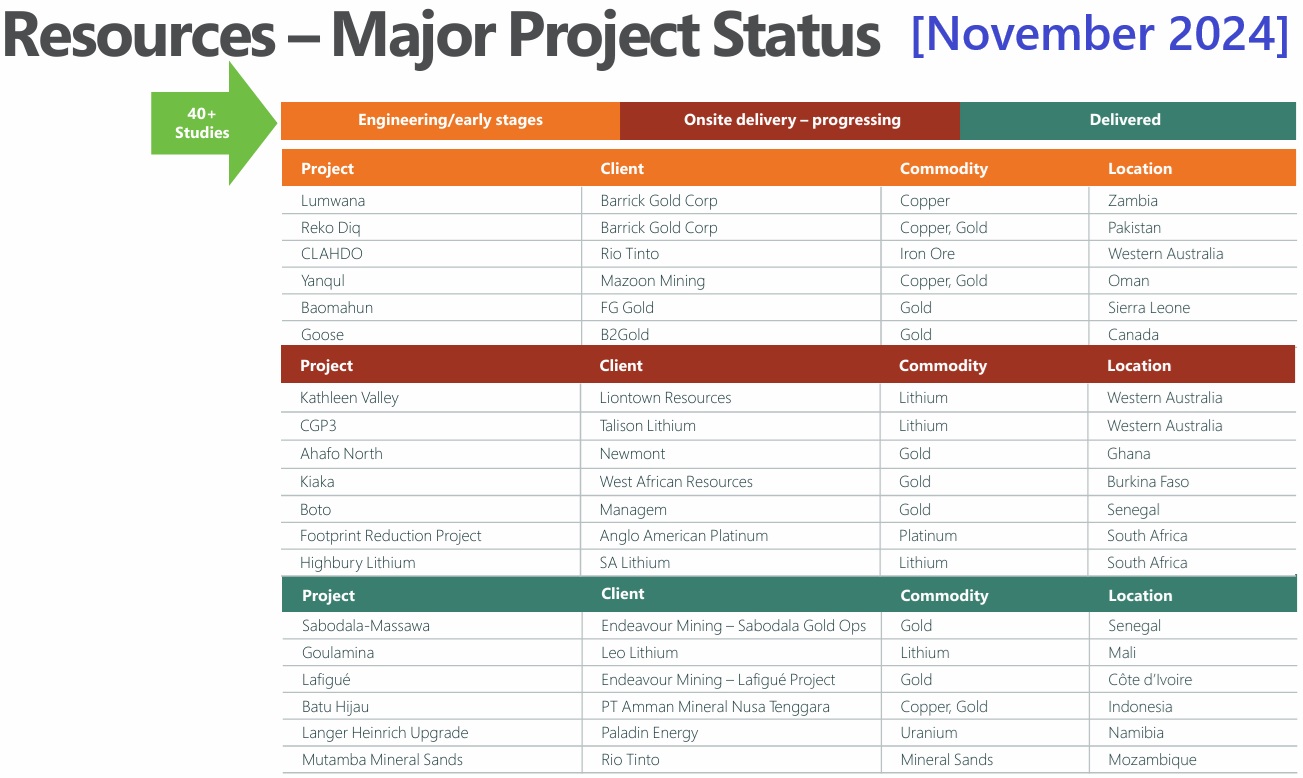

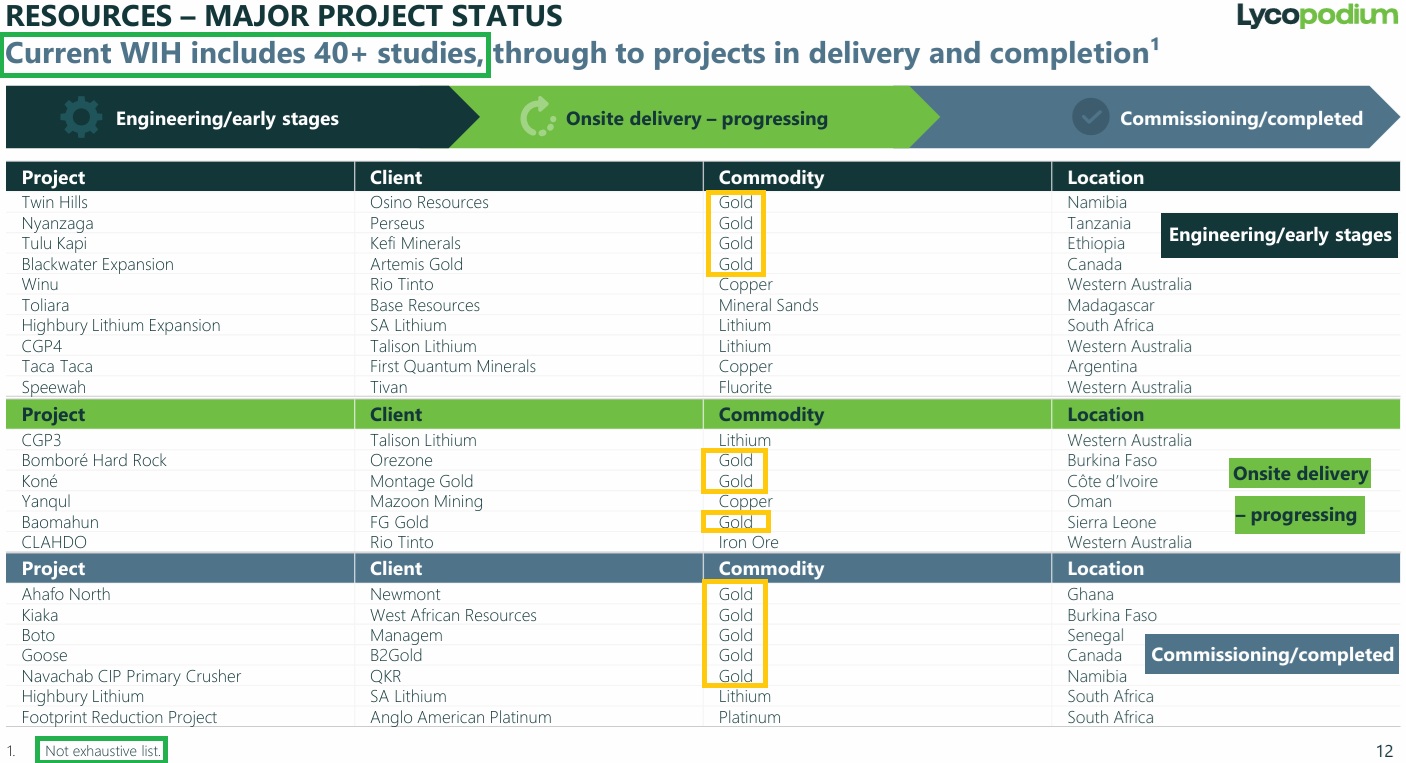

In terms of how busy Lycopodium are today, compared to how busy they have been recently, I'll include three slides below, the first from Feb last year, the next from November last year (2024) and the third one from today (November 2025):

Source: Bell Potter Unearthed Conference Presentation.PDF [12-Feb-2024]

Source: FY2024 AGM Presentation.PDF [12-Nov-2024]

Source: Today's Presentation: FY25 AGM Presentation.PDF [13-Nov-2025]

Compared to one year ago, they have one less project in the Delivery phase, one more project in the Commissioning/Completed phase, and they have 4 more major projects in the "Engineering" stage, and that's after walking away from Reko Diq and Lumwana, both Barrick projects. You can google Barrick if you're interested, however for today I'll just say that it was announced in late September that Mark Bristow has stepped down as president and CEO of Barrick Gold after nearly seven years in the role. In recent times it appears that he has embraced much riskier projects such as Reko Diq in Western Pakistan (Ballochistan), and diversified the company away from gold and more into copper and other metals.

One of his biggest moves recently was to refuse to negotiate with the military rulers of Mali where Barrick had some operating gold mines and as a result Barrick appears to have lost control of those mines and has now been shut out of the country. In fact the Malian authorities issued an arrest warrant for Mark Bristow so he can expect to be detained and/or locked up if he ever again sets foot in Mali.

There have been a number of allegations of human rights abuses during the period that Bristow has been in charge of Barrick Gold, and he got the company's name changed from Barrick Gold Corp to Barrick Mining Corp in May before quitting the company without any disclosed reason in September.

I had heard through the MoM podcast that there had been shareholder activism to either force Bristow out or to get the company to change direction or to split into two companies, the gold side and the rest. It appears that some large institutional shareholders were not pleased with Bristow's pursuit of copper projects in riskier locations and especially with the outcome of Barrick's gold assets in Mali which Barrick appears to have lost control of entirely.

Sources:

- https://mining.com.au/executive-exodus-hits-global-miners-barrick-mining/

- https://www.reuters.com/world/africa/mali-issues-arrest-warrant-barrick-gold-ceo-document-shows-2024-12-05/

- https://www.aljazeera.com/news/2022/11/23/tanzanians-sue-barrick-gold-in-canada-over-alleged-mine-abuses

- https://earthworks.org/blog/communities-call-for-respect-barrick-responds-with-aggression/

- https://www.proactiveinvestors.com.au/companies/news/1081743/newmont-barrick-gold-giants-circle-as-m-a-mood-returns-1081743.html

- https://discoveryalert.com.au/barrick-gold-leadership-dynamics-2025-market-impact/

- https://www.barrick.com/English/news/news-details/2025/barrick-announces-name-change-to-barrick-mining-corporation-and-election-of-directors/default.aspx

- https://www.streetwisereports.com/article/2025/10/13/whats-behind-shock-barrick-ceo-departure.html

Plenty of reading there if anybody is interested in one of the world's most stubborn (former) gold company executives, and the various perceptions of his performance and why he stepped down.

I have nothing but respect for Peter De Leo and his team at Lycopodium for declining to proceed with the bidding process for those big contracts at Barrick's Reko Diq and Lumwana copper projects in Western Pakistan and Zambia respectively. Barrick does not appear in Lycopodium's current "Major Projects" slide above, and that's a good thing in my opinion.

So Lycopodium is travelling OK in my opinion for a small Perth-based $500 million engineering company. They are really one of the quiet achievers in the Australian E&C (engineering and construction) sector who does most of their work overseas.

Source of slide above and the ones below: Today's Presentation: FY25 AGM Presentation.PDF [13-Nov-2025]

That slide a little larger:

Source: Today's Lycopodium AGM Presentation: FY25 AGM Presentation.PDF [13-Nov-2025]

So, yeah, all good. Nothing of concern. Happy to have this as one of my top two positions IRL and my largest position here on Strawman.com. Currently my GNG position IRL has a higher market value than my LYL position because GNG's SP has risen more in recent days than LYL's has, however I like them both equally (a lot!) and happy for them to be my top positions. I hold both in my income portfolio (outside of my SMSF because my SMSF is limited to ASX300 companies and neither LYL or GNG are in the ASX300 index).

GNG is a very similar company but GNG do most of their work here in Australia and LYL do most of theirs overseas. Both of them specialise in the design and construction of gold mills, and both have a strong gold price tailwind.

Disclosure: Held, LYL has a 12.1% weighting in my real money portfolios, GNG is 12.4%. Those are my top two positions and together they represent 24.5% of my real money sharemarket investments at current share prices (13-Nov-2025).

19-Sep-2025: Lycopodium (LYL), my largest real life position, went ex-div yesterday (18th Sept) for a 25 cent fully franked dividend, however their SP actually rose +13 cents after rising +16 cents the previous day (Wednesday 17th) - and then they fell today (the day AFTER they went ex-div) by -28 cents, closing at $12.01.

Their trading range today was as low as $11.96 up to a day high of $12.29. So, two points - one is that the new baseline downside resistance level seems to have moved up from $10/share to $12/share, or that's how it looks to be shaping up to me anyway - and they held that level today (closing at $12.01 despite going ex-div yesterday), and secondly we now have their two lower dividends behind us (the FY25 half and full year divs) and if I'm right in my interpretation of Peter De Leo's guidance, it should now be back to their higher dividend payout ratio going forwards.

So we should get the continued growth plus the higher dividend income aspect back as well. Income + Growth.

Unless there's another self-funded acquisition of course. And that would just delay the income bit and assist the longer term growth, so either way I'm happy.

Remember:

- Stable share count for over a decade;

- Zero Debt;

- Conservative Management;

- Tailwinds - they design and build gold processing plants - yeah, they do other things too but that's what they specialise in, and;

- Excellent M&A history, and superb capital management in every other respect also.

And I reckon we're back to higher-than-market-average dividends as well now.

Disclosure: Held.

20-Aug-2025: Nothing alarming in this report, but the market clearly would have preferred a better set of numbers based on LYL being sold down a little on the results after a decent run-up over the past few weeks, so trading right now - @ $11.76 - at the same levels they were on August 8th and also through the second half of July, and still above where they were trading throughout the majority of the 8 month period from mid-November through to mid-July.

There was a fair bit to unpack, so I'll try to cover off the more important stuff. Firstly, I'm happy with the report, and the dividend. I would have preferred a higher dividend, as in a return to the circa-36 to 45 cps final dividends we have seen over the past three financial years (prior to FY25), but this slide from their presentation makes it clear that their dividends will return to normal levels in FY26:

The bit I've highlighted there in green (above) is why I think the lower dividends are now done (after the 25c FF one they just declared). Importantly, they still have a super-strong balance sheet and have accumulated an even higher cash balance:

And they have a growing pipeline of work:

They have more than 40 studies ongoing plus 10 major projects in Engineering/early stages, another 6 major projects being delivered currently, and another 7 that have either been recently completed and/or are in the commissioning phase currently, as shown above. While that table only covers their Resources division, that's the one that matters most, as shown below:

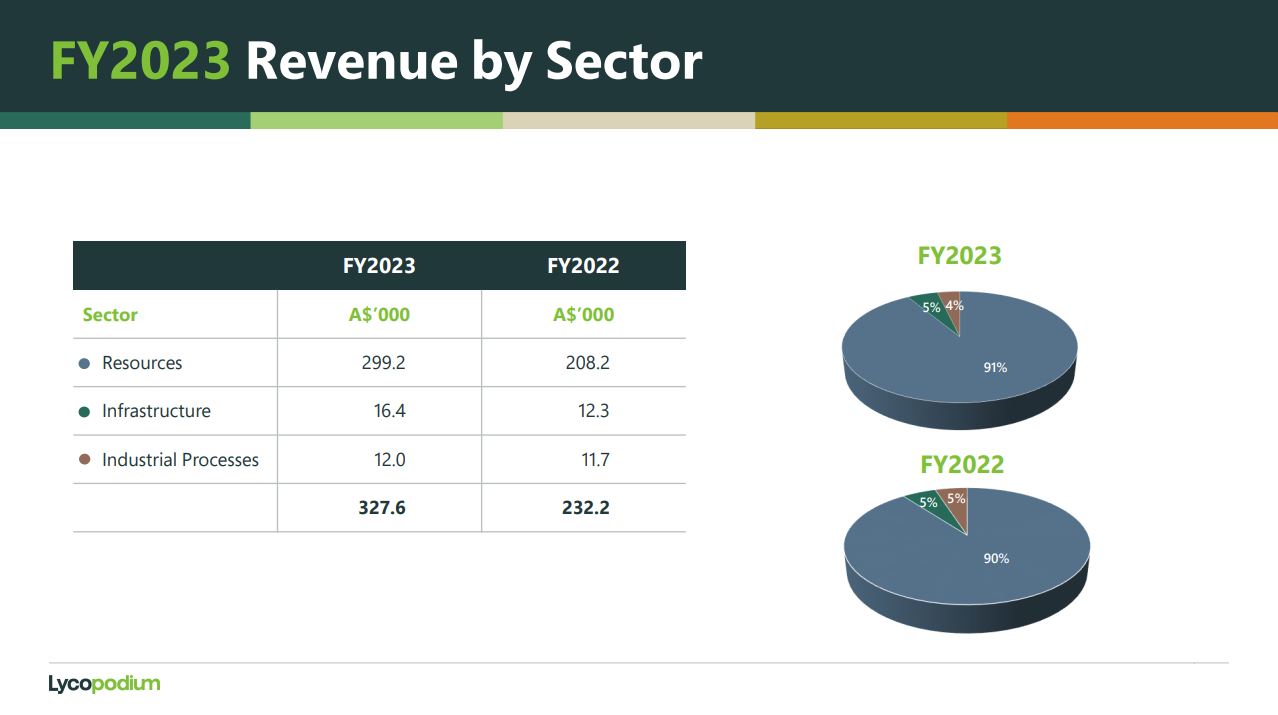

Around 94% of LYL's revenue is derived from that Resources division, and only 6% from Industrial Processes and Rail Infrastructure combined (circa 3% from each of those).

Here's what Peter De Leo, their MD & CEO had to say in today's report to shareholders for FY25:

I'm going to skip now to what he said about their Resources division:

They remain busy!

Here's what he had to say about their outlook:

It's fairly positive, remembering that Peter and his team are one of the most conservative management teams I've come across in terms of being careful to never overpromise and risk underdelivering later. The SAXUM majority acquisition - with an option to buy the remaining 40% later - should not be underestimated in terms of LYL getting a solid foothold in South America and the work that's going to bring in for them in future years.

Here are their historical results against FY25:

Sure, FY25 was down on FY24, but we knew that, it was flagged at their AGM last year (in November) and again in February with their H1 results; Both revenue and NPAT achieved in FY25 are at the top end of the guidance they provided in February (Full Year Guidance: Revenue $320m - $340m, NPAT $37m - $43m).

They're in good shape - and the nature of their E&C work is that revenue and earnings will be lumpy, but they're growing over time, you have to zoom out a little with these sorts of companies and look at their overall trajectory rather than just a single year.

Importantly, they're set up for a good couple of years from here by the looks of that.

Sources: LYL-Full-Year-Results-Announcement.PDF plus FY2025 Investor Presentation.PDF plus FY2025 Shareholder Report.PDF plus FY2025 Financial Report.PDF.

My investment thesis remains intact for Lycopodium. Still my largest real money position and one of my largest positions here on SM as well.

12-August-2025: MoM Podcast: Booms, Busts & Billion-Dollar Builds (Zimi Meka) (Ausenco)

Zimi is the founder of Ausenco which was ASX-listed but was taken private in 2016. They are a serious competitor of Lycopodium (LYL) because they love working in the world's more dangerous locations. Zimi even mentioned that he was recently asked to look at a project in Western Pakistan (Reko Diq) which he said they would be willing to take on with the appropriate controls - that's one that LYL recently passed on after doing all of the feasibility studies and FEED work.

Very interesting interview.

Ausenco continues to operate as a private global consulting, engineering, and project delivery company after its delisting from the Australian Stock Exchange in 2016 and subsequent sale to U.S. investment firms in September 2023. The company was acquired by Resource Capital Fund VI (RCF) in 2016, taking it private, and was then sold by RCF to a consortium of Eldridge, Brightstar Capital Partners, and Claure Group in 2023.

They are not listed on any stock exchange now, but they are a competitor of Lycopodium.

Worth noting however that Ausenco's specialty is copper, while Lycopodium's is gold, however they both work on a variety of minerals and metals processing plants including base and precious metals.

Disc: Holding LYL.

30th July 2025: Nyanzaga-Gold-EPCM-Contract-Award.PDF

More work for LYL in Africa, but not Western Africa this time. It pays to note that this is the 3rd time Perseus Mining (PRU) have contracted Lycopodium to deliver an EPCM contract (build a gold mill) for them in Africa, so clearly Perseus is happy with LYL's work.

LYL is after all the very best at what they do, in Africa in particular. Their mills get built on time and on budget and those gold mills work as planned, and Lycopodium know how to manage risk in some of the world's riskier locations.

Disc: Holding (my largest position in real life and one of my top two largest positions here on Strawman.com).

P.S. Looking forward to their full year report in August! And what they do with their full year dividend.

Further Reading:

Thursday 10th July 2025:

Looking like a good setup to me. We just need a good report from Lycopodium next month and a resumption of their higher-than-market-average dividends, and we're away. Context: LYL is my largest position both here and across my real money portfolios, so I'm clearly biased towards the company.

Their only announcement during the past 6 weeks has been a Change-of-Director's-Interest-Notice.PDF showing that Bruno Ruggiero sold 650,000 LYL shares on June 17th for $6,750,705 being @ around $10.39 each in an off-market transaction.

Bruno is an Executive Director at Lycopodium and also their Technical Director, overseeing the company's technical knowledge base, capabilities, and direction, alongside their MD, Peter De Leo. Bruno's responsibilities include extensive project involvement, strategy development, and the delivery of technical solutions in its EPC (Engineering, Procurement, and Construction) business.

Bruno is also a Non-Executive Director at ECG Pty Ltd and is the Board Chairman at Quantum Graphite Ltd (ASX:QGL). Bruno is also a director of Sherwood Utilities Pty Ltd and has interests in two companies (Luala Pty Ltd & Ziziphus Pty Ltd) that between them hold all of his 1,000,520 remaining LYL shares. One or both of those two (Luala & Ziziphus) are probably corporate trustees for family trusts or similar. Bruno also holds 52,047 Class A Performance Rights.

It was a big sell down ($6.8 mill), but he still owns over $11 million worth of LYL shares plus the performance rights. He also holds more than $10 million worth of QGL shares (where he is their Chairman).

The market doesn't seem overly worried about it. Peter De Leo (their MD) still holds 920,200 LYL shares, so Bruno is still ahead of Peter with his remaining 1,000,520 LYL shares. Their Board Chairman, Rod Leonard, owns 902,930 LYL shares.

There's plenty of skin in the game at both Board and C-suite level.

Here's LYL's graph for the past 5 years:

I believe that part of the reason for the SP fall in the latter half of last year was that a couple of microcap fund managers who held LYL may have reduced or exited their LYL positions when they realised that the company had gone cold on the massive Reko Diq Copper-Gold Project in western Pakistan (Ballochistan) and that LYL were not going to bid for the big EPC/EPCM/EPM contract to build Reko Diq. With LYL having done the feasibility studies and then the early works at Reko Diq, it was assumed by many that Barrick Gold would award the contract to build the plant to LYL in early 2025, and that would have been Lycopodium's largest contract ever if that had ocurred.

Peter De Leo confirming during their February half year results conference call that they had withdrawn from the bidding process for two large projects on the basis of a poor risk/reward trade off - basically the projects were just too high risk and the project owners were not prepared to adequately compensate LYL for taking on that very high risk - and we know that Reko Diq was one of those two projects, and that Reko Diq is likely to be a very dangerous and challenging build for whoever ends up with that contract.

We commented here at that time that this was actually a really good move and demonstrated why LYL continue to be so highly profitable - they don't take on projects that end up being loss making, they are disciplined with their tendering, and are very switched on across their risk management.

They don't lower their prices to fill their order book. Margins are maintained.

They then reduced their half year dividend (in Feb) to allow them to fully fund their part-acquisition (60%) of SAXUM using their own cash reserves rather than having to take on any debt or issue more shares.

LYL remain in a net cash position with a share count that has been stable for over a decade, so they have not issued shares to fund acquisitions OR used debt.

The purchase of 60% of SAXUM (announced in October and completed in February) only cost them US$7.1 million, so I am assuming they can and will (or are likely to) resume their previous high dividend payout ratio now, which should be confirmed with their full year results next month. If not in Feb, then I would expect it to be in August at the latest.

It pays to remember however that Lycopodium holds options over the remaining 40% of SAXUM which they can elect to purchase in future years, being 25% on the fifth anniversary of the completion date (i.e. in Feb, 2030) and the remaining 15% in Feb, 2032, on the seventh anniversary of the completion date. The completion date was in February this year - see here: https://www.listcorp.com/asx/lyl/lycopodium-limited/news/lycopodium-acquires-majority-interest-in-saxum-3152623.html

However, that's five and seven years away and the amounts will be lower (25% and 15% instead of 60% of SAXUM) if LYL choose to exercise those options at that time.

Meanwhile, the share price graph indicates a good setup to me. Happy to be holding, and expecting a continued recovery in Lycopodium's share price from here. I'm not buying any more of their shares because I'm already full to the gills, having loaded up at lower prices; I'm now holding and waiting for this investment thesis to play out.

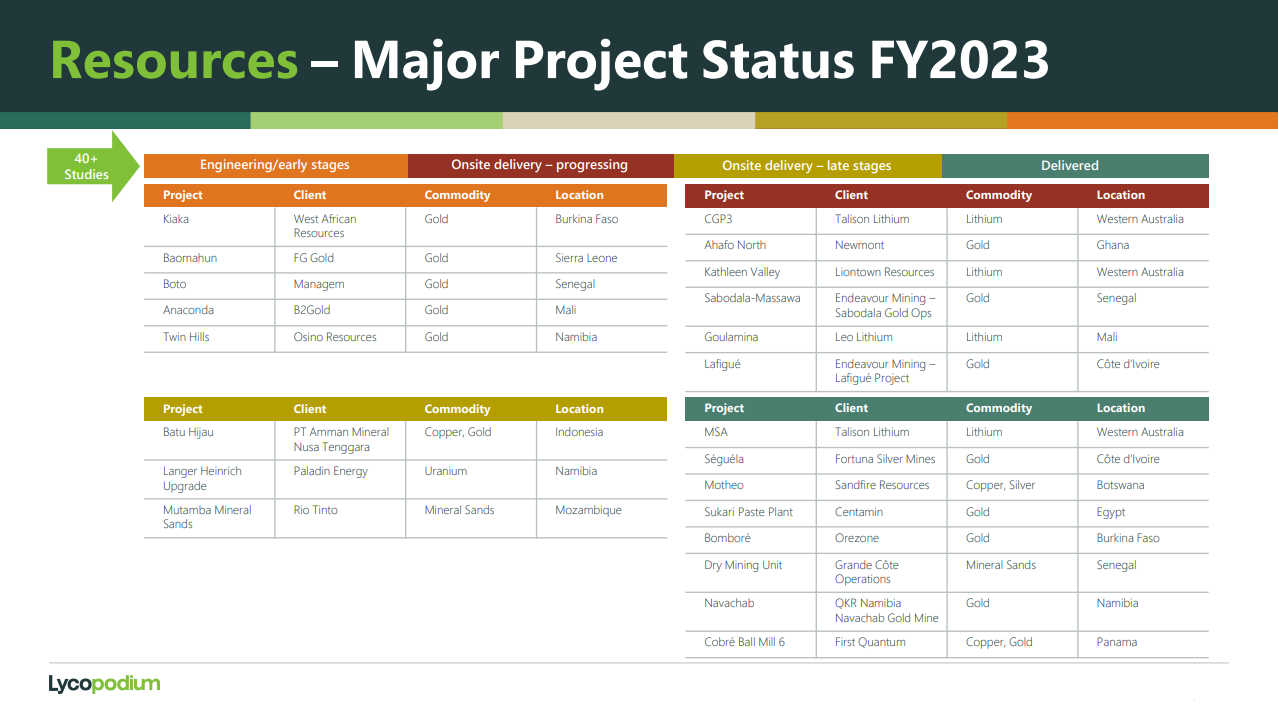

22nd May 2025: Today's Lycopodium-awarded-EPCM-contract-for-Twin-Hills-Gold-Project.PDF announcement from LYL is another positive of course (another $40m contract, with work starting immediately), however it also shows how Lycopodium are busy behind the scenes on multiple studies for dozens of companies, and how one study usually leads to the next study, if the previous study showed the project was economically viable, and eventually, once a positive FID (final investment decision) is made by the project owner, the company that has done these studies (LYL) if they have the appropriate capacity and experience (they do) are very well positioned to be awarded the big contract, in this case an EPCM contract, because they are intimately involved in the project already and know it inside out, having looked at a plethora of possibilities and worked with the project owners to come up with the very best design and specifications for the plant that they could to achieve what the project owners want to achieve (i.e. within their budget, best bang for their bucks).

--- end of excerpt ---

Source: Lycopodium-awarded-EPCM-contract-for-Twin-Hills-Gold-Project.PDF

The two paragraphs I have highlighted there in the green rectangle show how Lycopodium did the PEA for the project in 2021, then the PFS in 2022, then the DFS in 2023, plus the FEED work in the past 12 months (2024/2025), and have now been awarded the EPCM contract that will run through to 2027.

First Gold from Twin Hills in Namibia is expected in Q1 of 2027, so at that point Lycopodium will have worked on the project for 6 years - i.e. from 2021, having completed a PEA, a PFS, a DFS, FEED, and then an EPCM contract.

That's the sort of work flow that both LYL and GNG tend to have.

Sometimes those flows don't get so far down the line, as a number of things can stop a project at any one of those first 4 stages, such as poor economics (the project can't make money because the costs of production would be too high compared to a conservative estimate of the relevant commodity price at the expected time of production), the commodity price heading the wrong way and making previous assumptions less relevant and no longer reliable, issues with funding, company structure, ownership or management changes resulting in a project getting shelved or divested due to a change of strategy or focus, geopolitical risks (such as what has happened in Mali), and other factors. However, there are a few that go all the way through from PEA to construction and production, and this Twin Hills project is an example of that.

It is worth mentioning however that there are always studies going on in the background that both GNG and LYL are doing, and while not all of them do lead to these big E&C (engineering and construction) contracts, they are still revenue generating.

Because these studies are worth substantially less than the larger E&C contracts, the studies usually do not get announced to us by LYL or GNG as they are awarded, because they'd be making announcements all the time if that was the case; in short, the award of most DFS, PFS and PEA studies, and most FEED work, are deemed to not be price sensitive information that needs to be announced because it's BAU (business as usual), nothing out of the ordinary, it's just what these companies do all the time.

I should note that they do occasionally announce a DFS or other study but usually only when the expected revenue from the study is larger than usual, and/or the study shows that they are expanding into a new area or are gaining traction in a new sector, and therefore the study award could be regarded as price sensitive. An example is the Kalgoorlie-Nickel-Project-Award.PDF announcement in February this year where LYL were awarded the Definitive Feasibility Study (DFS) for the Design Engineering of the Hydrogen Sulphide Plant for the development of the Kalgoorlie Nickel Project (KNP) – Goongarrie Hub – owned by Kalgoorlie Nickel Pty Ltd (KNPL), a wholly-owned subsidiary of Ardea Resources.

While that was only a DFS rather than a higher value construction contract, the value of that DFS and associated engineering and design work for that Hydrogen Suphide plant was A$5.4 million and was in the nickel sector rather than being a gold and/or copper project (gold and copper being LYL's main bread and butter work). The hydrogen sulphide gas will be utilised to precipitate a high purity nickel and cobalt sulphide product called Mixed Sulphide Precipitate (MSP). MSP is a precursor for the production of electrolytic nickel and cobalt, nickel powder and nickel sulphate for lithium-ion battery production, and this was in an environment where nickel projects around the globe were being shut down and mothballed and new nickel projects were being shelved because of low nickel prices.

The largest example of that was when BHP's Nickel West division (their WA nickel production and new nickel project development) was shut down in March last year and with it their West Musgrave Nickel/Copper project where that plant was being built by GR Engineering (GNG), a very similar company to LYL (I hold both). I have no doubt that project (West Musgrave) will get built one day in a higher nickel price environment, but I have no idea when.

Meanwhile Ardea Resources were paying LYL over $5m in February to do a DFS with engineering and design for a new nickel hydrogen sulphide plant, so there were a couple of reasons (value and commodity) why LYL being awarded that DFS was worth announcing. But those types of studies are rarely announced by LYL or GNG. They usually just get awarded and the company gets on with it as BAU.

So there's always more going on in the background than what they tell us. For example, in LYL's 2024 AGM presentation on 12th November, LYL included the following slide:

I've added some extra lines to make it more obvious which projects were early stage engineering (FEED) (orange rectangle), or in delivery (dark red/brown), or completed (delivered) (dark green).

The main thing to note is that while there were 6 or 7 major projects in each of those 3 categories, they also had another 40+ studies being done at that time - as indicated by the green arrow (top left) which feeds into that pipeline of work.

Here's another slide from that same AGM presso that highlights current and recent Lycopodium clients:

Source: https://www.lycopodium.com/wp-content/uploads/2024/11/FY2024-AGM-Presentation-3.pdf

There's some big names there and many of them are repeat clients.

Finally, below is a slide from LYL's February 19th H1 of FY25 results presentation that shows a similar breakdown, however they have split it out into three segments, being Copper (Cu), Gold (Au) and Lithium (Li) and Others, plus they do not give us any indication of how many studies they have going on; the following are major E&C projects, not studies:

Source: https://www.lycopodium.com/wp-content/uploads/2025/02/Investor-Presentation-1H-FY2025_FINAL-1.pdf

I have highlighted the "Horizon" projects in blue, which other companies call their "pipeline"; it basically means projects they believe they have a better than even chance of securing but that have not yet been awarded to them. I have also highlighted "Twin Hills" in yellow, the project that they today announced they'd been awarded the EPCM contract for.

I can also confidently suggest that LYL will be awarded Perseus' Nyanzaga GP (gold project) located in northwestern Tanzania, south of Lake Victoria, because Perseus have been using Lycopodium exclusively for all of their gold projects for over 10 years now. It's just a matter of timing, i.e. when PRU want to pull the trigger on Nyanzaga; Perseus Mining (PRU) have a number of development projects at various stages in addition to their producing mines in West Africa.

Some of those projects in the slide above in the Horizon sections might struggle to achieve a positive FID given current commodity prices, mainly the lithium projects or plant expansions, such as CGP4 at Talison Lithium (the last project listed there in the bottom right corner of the slide), but most of those copper and gold projects (first two columns) are likely to proceed in the near-to-mid-term, and LYL are in the box seat to be awarded those E&C contracts given that they have done the studies for those projects for those projects' owners.

Hopefully this post gives a little colour around how the work flows through from early stage studies right through to E&C contracts for companies like LYL and GNG, and why the newsflow in terms of announcements can be fairly slow/scarce at times even though there is plenty going on in the background.

Because of the one-off nature of the majority of the work that they do, Lycopodium can have lumpy revenue and profits and while they ALWAYS have net cash (never any net debt), their cash balance moves up and down from period to period because of the timing of initial payments, milestone payments and project completion payments that are dependent on the structures of different contracts and the periods of time that each project takes to complete. I therefore don't get too fussed over cash balance movements and the lumpy revenue and earnings as long as the overall trajectory is upward (positive) and they maintain a high ROE and margins hold up. In short, given a rolling 5 year timeframe, the overall direction of everything that matters is up and the company is growing and very profitable.

The main risks are:

- Where they work, so most of their work has traditionally been in Africa, and most of that in West Africa;

- The lumpiness of their revenue, due to the one-off nature of most of their work; and

- Commodity prices. For instance, if gold and copper prices tank and the outlook for both is poor, then less gold and copper projects are going to be progressed, which would mean less work for LYL.

I'm comfortable with those risks because:

- Lycopodium have a strong history of superb risk management that has meant that I can not remember ever hearing about a single significant cost blowout on any of their major E&C projects;

- The lumpiness of their revenue and earnings on a year-on-year basis doesn't matter to me if both are heading north at a decent clip over any rolling five year period, and their ROE remains nice and high and they maintain good margins; and

- I have a positive outlook for both gold and copper, and I'm also comforted that LYL are diversified across sectors and commodities, as I have explained in other straws and forum posts.

Disc: I hold.

24-March-2025: LYL went ex-div today and their share price rose!

The ASX 200 rose 6 points to 7937 (0.1%) in quiet trade ahead of the Budget. The All Ords index fell 0.8% to 8,157.90. Banks were firm. Tariff proof fenced perhaps. CBA up 1.4% and insurers better too, QBE up 0.3%. REITs were a little mixed, GMG down 0.6% and SCG rising 0.6%. RPL was smashed 14.8% on news from OPT that it had missed Phase III end point. RPL owns 32% of OPT. WOW and COL both gave back some of the optimism from Friday’s ACCC report. Tech stocks were under pressure, WTC down 2.9% and 360 falling 4.4%. The All-Tech Index down 0.5%. Retail weaker, with PMV down 2.9%, NCK off 2.0% and MYR down 2.1%. WES rose 1.7%.

Resources were mixed. BHP fell 0.6% with FMG up 3.2% on some broker upgrades. Gold miners were mixed, with VAU down 3.2%, NST off 1.3% and BGL dropping 12.8% on a change in substantial holding from ETF provider Van Eck (9.06% down to 7.59%). There were some positive moves at the small end of the gold sector with NMG, LSA and MDX all rising by between 6% and 7%, and PLC was up +15.38% (shout out to @BkrDzn for his top work on that one shared here recently: Sub 2c Stocks - The Punters Forum - I bought some PLC and NMG recently after doing a bit of digging myself).

MIN bounced 6.9% as the haul road reopened. Oil and gas was flat, coal eased, NHC down 4.4% and WHC off also, and uranium sellers were back with BOE down 3.5% and DYL falling 1.8%. In corporate news, JHX announced a huge US merger and dropped 14.5% on the news. HLI fell 25.6% as CBA said it may not renew its contract. SM1 curdled 12.0% on unimpressive results.

Nothing on the economic front. Asian markets flat. 10-year yields back up to 4.42%.

And here's what LYL did:

Sure it's a smaller dividend than last year, due to the SAXUM acquisition (60% of), however it's still a little strange that they went up on an ex-div day. As I explained over the weekend, they are a low liquidity microcap, so they can move a fair bit on low volume, but there were 595 trades today, and 87,372 LYL shares changed hands, worth just over $940K, so the volume was decent - for Lycopodium. [Because they're a low liquidity company that trades lightly most of the time]

I have a half-baked theory, which is that some buyers were waiting to see if they did get sold down today as they went ex-div, as is usually the case, coz when a company does drop by more than the grossed up value of the dividend, that can present a good buying area, however that didn't happen, because there were likely no holders left who were in them for the income yield alone (due to that reduced dividend), so the prospective buyers decided to buy anyway.

Maybe...

No matter. Watching. But inactive. I didn't buy or sell anything today, except a tiny SPR top-up here on SM.

Disclosure: Holding LYL. They are my largest position both here and across my real money portfolios.

21-March-2025: The following slides were sourced from Lycopodium's 19th February 2025 Investor Presentation - for 1H FY2025

Plain text link - https://www.lycopodium.com/wp-content/uploads/2025/02/Investor-Presentation-1H-FY2025_FINAL-1.pdf

Who are they? What do they do?

Who do they do that for?

Where do they do it?

[above slide was added to by me to explain the two colours - green and orange]

What's the pitch? Why Invest?

[above slide was added to by me - the blue bit]

[above slide was added to by me]

'nuff said?

Well, I like them. A Lot. Lycopodium is my largest holding both here and in real life, so anything I say would just be talking up my own book...

Here's FNArena's summary - none of the analysts that FNArena follow cover LYL, so there are zero broker calls available, just this data from FactSet UK which FNArena have used:

And here are some of the key metrics according to Commsec:

Notes:

- Stable share count for a decade - no dilution; LYL have used their own cash for M&A, not issued new shares or taken on debt;

- Outstanding above-market TSRs (Total Shareholder Returns);

- Cheap - P/E ratio has been single digit (below 10) for the past 3 years and is currently 8.10 according to Commsec and 8.94 according to the ASX;

- Always very low debt, with much more cash than debt, so always zero net debt, hence all interest cover and gearing numbers being negative numbers;

- The following have all been rising: Sales, Earnings, Dividends - although their div dipped in the last half due to the SAXUM acquisition - that temporary dip in their dividend growth will show up in the next set of numbers, BV (book value) and NTA (net tangible assets per share) all on the up;

- Both ROE (Return on Equity) and ROC (Return on Capital) have been around 38 to 40 for the past two full financial years, which is very good; and

- It's not shown here in these metrics, but LYL is a relatively capital light business, because most of what they do (in revenue generation terms) is engineering and management. Most of the actual construction is contracted or sub-contracted out to other companies either by LYL or their clients. They certainly do plenty of hands-on stuff themselves, but with their larger projects they have high margins and they don't need to tie up a lot of capital in those projects because the majority of the labour-intensive work is done by others, not LYL, and the client is paying for all of the on-site equipment and costs, and for the other contractors.

Two more things that you don't find in their metrics are their superb industry position and reputation that sees them win heaps of repeat work from their clients, especially their larger clients, and secondly their top shelf risk-management procedures and attitude to risk, which allows them to take on work in some of the riskier locations around the world, like West Africa, and make plenty of money without any significant cost blowouts or project losses. I have only used the word "significant" there because while I have never heard of ANY cost blowouts or loss-making projects with Lycopodium, they may have had some, but they may not have been significant enough to report to us.

@mikebrisy tuned in to their most recent earnings call last month and reported here that Peter De Leo, LYL's MD, mentioned that they had declined to take on a couple of projects recently because they didn't like the risk/reward equation. I am fairly sure that one of those projects was Barrick's Reko Diq Copper/Gold project in Balochistan, western Pakistan, where LYL had been working on the Feasibility Study and FEED (Front End Engineering Design, a crucial phase that follows conceptual design, focusing on defining the project's technical and project-specific requirements before detailed engineering and construction). That project would have been LYL's largest project ever, if they'd tendered for it and won the contract and gone ahead with it, and Reko Diq would have taken years to build, but in some of the remotest arid desert in Pakistan, a long way from anywhere, except for Iran and Afghanistan which are uncomfortably close to the project.

The local militia and other groups in the Balochistan area have also been quite hostile over the years because they believe they have received next to nothing from Islamabad and they likely see this massive mine development by Barrick, a US-based gold miner (and the world's second largest gold miner), as another case of all take and no give, despite an agreement that they may not even be aware of that would have seen part of the project owned by Balochistan and millions of dollars being spent in the area on infrastructure, and not just for the mine but to benefit the local people also; although there aren't a huge amount of local people there because of how hard the area is to live in - they tend to be nomadic, not staying too long in the same place. But I digress. Point is, it shows a lot of discipline for LYL to walk away from negotiations over a contract that big because they considered the risks were too high.

I am almost certain that Reko Diq is one of the two projects Lycopodium have walked away from, not sure what the other one was, but it could have been in Mali where Barrick own some gold mines and had been planning to expand at least one of those before everything in Mali went pear-shaped last year after the latest military coup there. Again, I'd rather see LYL steer clear of Mali as well to be honest.