Interesting announcement this morning by $LYL to acquire majority interest (60%) in South American engineer SAXUM.

ASX Announcement

SAXUM is a multi-disciplinary engineering and project management services company, founded in 1996, which provides services to the Mineral Processing, Cement & Lime, Manufacturing & Infrastructure and Oil & Gas sectors. It consists of four companies which are established in Argentina, Brazil, USA and Australia and operates from five offices around the globe – Tucumán and Buenos Aires, Argentina; Irving, Texas; Belo Horizonte, Brazil; and Perth, Western Australia.

No financial details offered, but more info promised when the deal is finalised in Q1 2025. Acquisition will be funded from cash reserves. SAXUM has no debt, consistent revenue growth and strong profit margins, and will contribute immediately to $LYL's revenue and profits.

Announcement was not even marked price senstive.

My Assessment

The move is intended to expand $LYL's global footprint, beefing up its presence in the Americas.

$LYL had cash at EOFY of $67m - so that should give some indication of the order or magnitude upper limit for the deal. However, it is clear that SAXUM is a lot smaller than this, as follows:

- SAXUM's total staff, including board, appears to number 34 - they are all listed on the SAXUM website.

- Given that $LYL has 1300 direct staff, it's almost 40x the scale of SAXUM. So, assuming comparable value per employee, that would indicate that SAXUM has a scale of $433m / 40 = $11m ... but perhaps anwhere from $5m to $20m.

- The method is OK for a ballpark, as SAXUM appears to perform similar work to $LYL

- The estimate also supports why the announcement wasn't marked price sensitive.

$LYL is a high-performing engineer with, from my earlier assessments, a stable core workforce. It will be interesting to see how this deal pans out. SAXUM looks like a South American mini-$LYL.

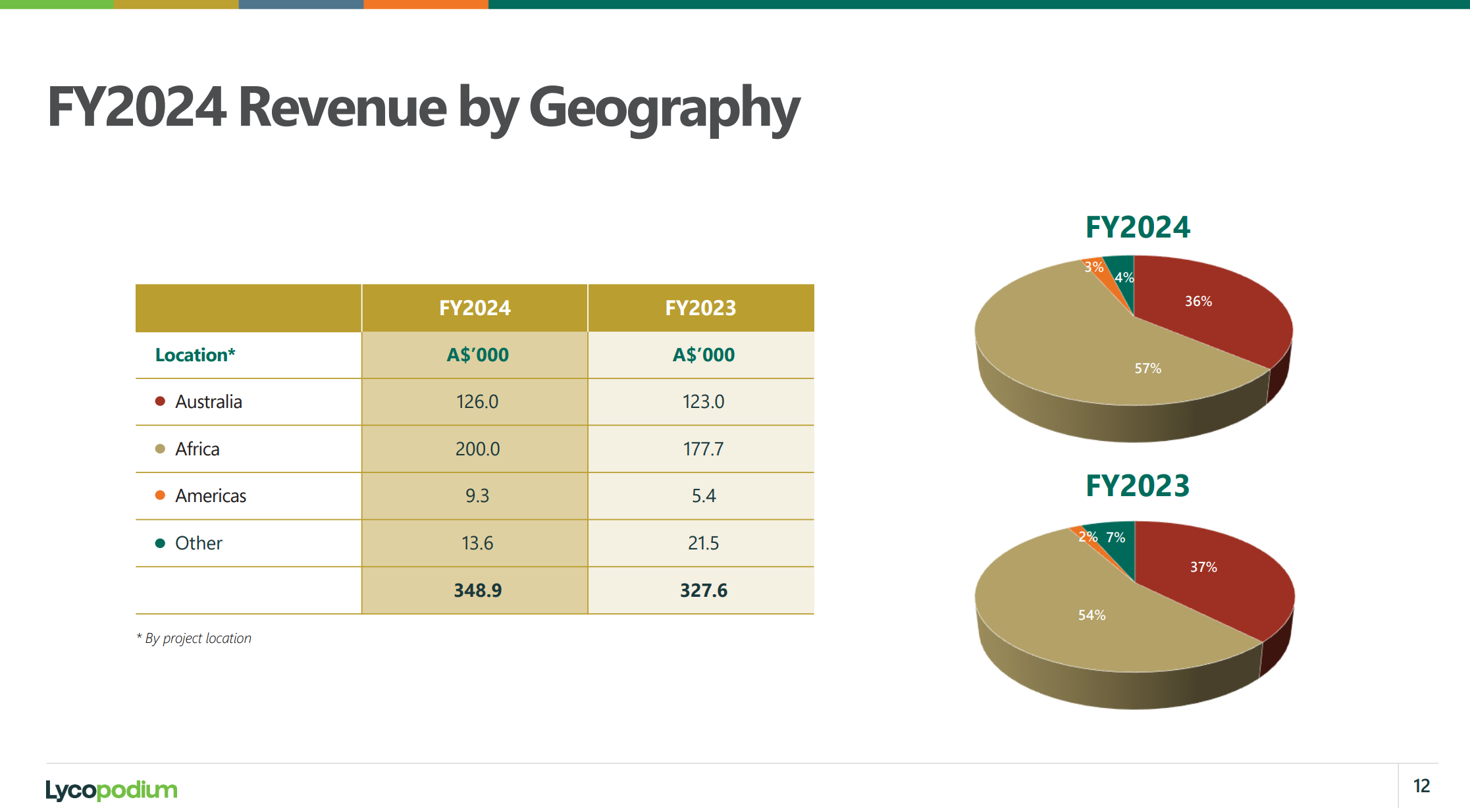

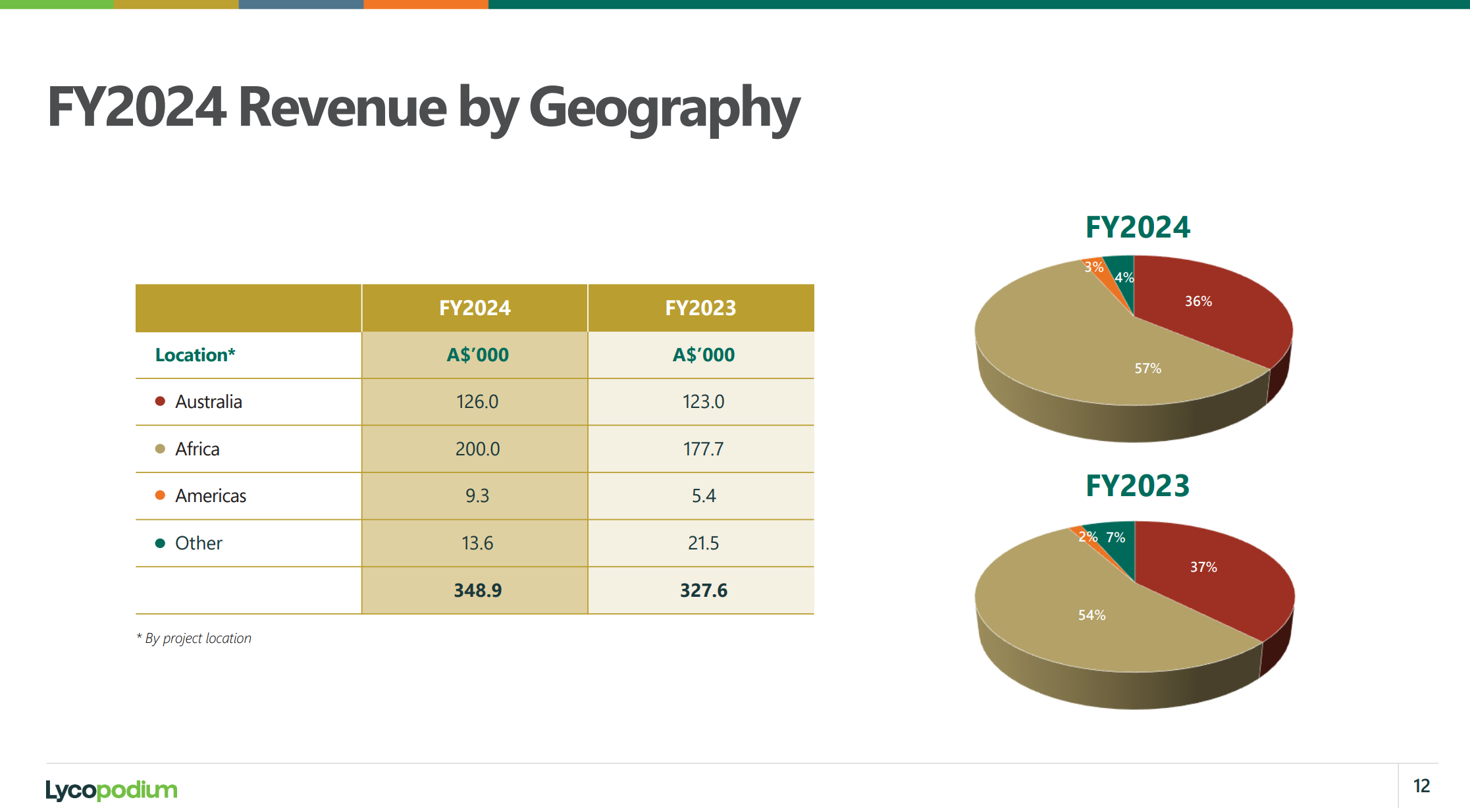

$LYL already operates in a global market with a concentration on projects in Africa. The bolt-on will help with staffing projects in the Americas - an area $LYL wants to do more work in, and which will give it greater geopolitcal diversification. See the chart below showing $LYL's curent geographic concentration. SAXUM will create a significant step up in American Revenue, taking it from 3% of total to probably (I'm guesstimating here) 5-6%. I guess the point is, at 3% of revenue that indicates to me it would be challenging to staff project from the region. Of course, people in this industry tend to move where the projects are and a lot of engineering design work is done remotely, but if the vision is to be a global company, it makes sense to have a more material regional capacity.

There are some small office overlaps in South America and WA, so perhaps some small real estate rationalisation opportunities. Limited synergy opportunity as the entities will continue to run as separate businesses.

Not knowing anything about SAXUM or much about the deal, it's hard to assess the deal, and I'm trusting management on this one.

Leadership alignment will be important for this, and so it will be interesting to learn more about how much the management teams know each other, for example, have they collaborated before on projects?

Superficially, the industrial logic makes sense.

Disc: Held in RL only