Historically LYL have proven themselves to be a prudent and conservative allocator of cash through the cycles - though perhaps over lenient in the terms it offers on receivables. (Memo: take a leaf out of the GNG book where they collect in advance).

Strategically, the SAXUM acquisition makes some sense.

Various podcasts and information by LYL suggests they are grappling with staff shortages and this move to acquire SAXUM gives them access to an additional 34 high profile engineering staff (see their (SAXUM) website) and just as importantly exposure to the Americas and their ongoing workflows.

BUT…is it worth it?

Here’s my take on what might be the likely acquisition cost of SAXUM and why it will not only torpedo the dividend, but chew into cash balances as well.

Background Facts (all figures rounded):

Dividends paid in FY24 circa $33m

FY25 div – 0c to 15c on 39m shares- zero or $6m

Assuming a historically prudent business might be using the available surplus cash (from not paying the dividend) for the SAXUM purchase - then they have ponied up between $27m and $33m to acquire 60%

This would value 100% at between $45m and $55m

So, what might they be buying – and is it in our interests to forgo the dividend?

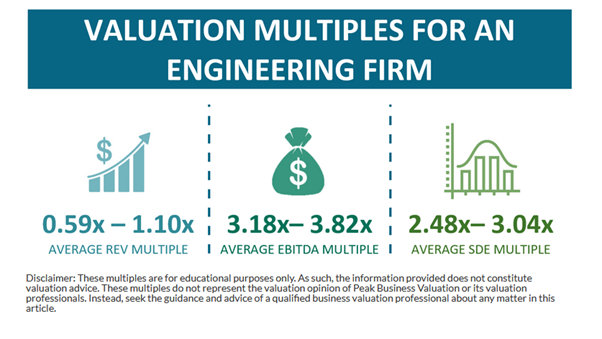

Rule of thumb valuation methodologies for a professional engineering business – courtesy of Peak Business Valuation is as follows:

Given the tight labour market presently, I’d be sure there will be a premium over and above the above multiples.

This might suggest revenue at around $50m to $60m

EBITDA at between (say a 4x) of $11m to $14m (roughly in line with what LYL are presently generating)

I wouldn’t assume D&A of a straight-out professional engineering biz would be all that high.

Note the terminology ‘SDE’ refers to “Sellers Discretionary Excess”. I’m presuming it is the equivalent of NPAT and after paying the owner a wage for his labour (and many private businesses don’t include this figure).

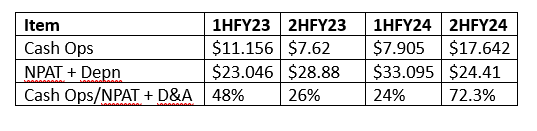

Yes, I keep looking at LYL, at face value it looks the goods, but follow the cash and there is something to be concerned about.

You can diddle the profit, but not the cash, and the following has been occurring for some time (at least for 3 halves and 2HFY24 was just a pass.

One would expect in an orderly world that the ratio of cash ops/NPAT + D&A would be around 100% - hopefully a tad more. This is certainly the case for fellow miner GNG and that company can do so because they collect cash in advance of doing the work – smart move.

So, LYL can report a decent NPAT, but the cash is getting soaked up in the biz.

Where is the leakage in LYL?

If they are making profits, how come it is not translating into cash? And how can they possibly pay some $33m in dividends (FY24) over the same time?

The answer (roughly) will be found in 2 areas:

- Cash balances have been depleting from $101m at FY22 to $67m at FY24

- Receivables less payables have swelled from $41m to $60m at FY24

I understand that the bloated receivables are possibly part of their ‘modus operandi’ of winning business in Africa where they get higher margins than say GNG operating is Australia.

Sure, this is okay when you have no debt, but eventually the cash balances will work themselves down to Zero and in pretty quick time when you make an acquisition – like SAXUM.

Should the FY25 outlook figures follow past history and assume the midpoint NPAT of $43m + D&A of say $6m is recouped as cash at the same rate as FY24 (45%) = $22m in operational cash - short of what they will require for SAXUM

My Conclusions:

Yes, the SAXUM acquisition looks strategically a good move and I don’t think it will deter much from the present high ROE

BUT, the SAXUM acquisition will not only kybosh the dividend, but will be a draw on the cash balance to boot and this, at a time when we are entering the cyclical downside when a healthy cash balance is required for survival.

Whilst respecting the quality if management, this cash issue, plus attendant risks of operating in Africa and some softness in director resolve to hold their shares will keep me on the sidelines.