Pinned straw:

I too thought this was a solid result for AVA. I know andrew recently mentioned on the podcast machine that doing your own analysis is key and ignore what the market does- this might then present buying opprtunities. In the past ive always been scared to buy when the market goes down on a result that i personally thought was decent- however i have taken the plunge and added today in RL. Not quite a back up the truck moment but progress none the less. In no small part thanks to the honest open lessons learnt from the strawman community! #strongertogether

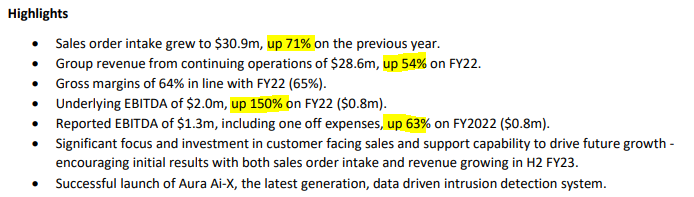

@Strawman I agree - pretty decent result.

I've had $AVA on my watchlist since joining SM over two years ago, including following your commentaries and the meetings. It was on my shopping list for this results season if a) result was good and b) price stayed good. So both were achieved this morning, and I have taken my 1% RL position (although I don't think the entire order has gone through at my price limit, although I have moved the market a litte back up ;-), you're welcome. ).

Will also add to SM.

Disc: Held in RL (yay) and later on SM.