Consensus community valuation

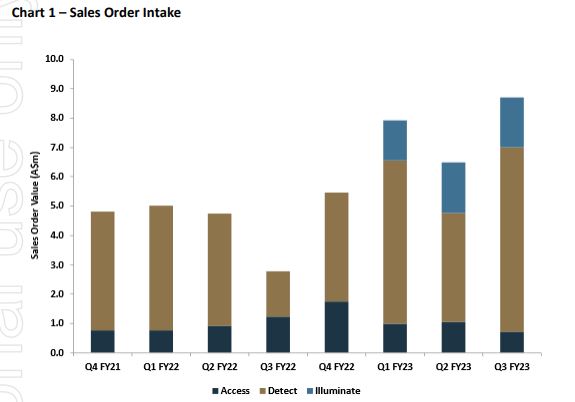

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

I no longer hold AVA, but today's announcement caught my eye.

AVA_ASX_AVA Secures Strategic Investment from Hale Capital_1767150000.pdf

The initial reaction in seeing the headline was "typical, some wizz bang new deal that will make my capitulation really sting.." so I opened with some trepidation..

Anyway, the tl;dr is it's an ok funding deal for AVA that will give them a bunch of cash and hopefully a partner that can help open a few doors. If it helps unlock a bunch of new sales it could be great for AVA and existing shareholders. But if they don't deliver they'll be in a worse position than they already are.. basically, having to pay back a bunch of debt after carrying it at at least 10% pa, plus a $1.4m repayment on some warrants

Hale are getting a really good deal. With a high interest loan on $7m and free warrants with a guaranteed floor of $1.4m. it's not risk free, if AVA goes bust they lose everything. But assuming AVA stay solvent, there's little downside for them.

Anyway, after having dissected the details of the announcement, I got a little ticked off about the way these things are communicated. They sure don't make it easy to understand the things that really matters for shareholders. They never do! So, after some back and forth with my AI PA, we rewrote the ASX announcement in a plain English way so you don't have to go through the pain of working it out.

****************************

ASX ANNOUNCEMENT

31 December 2025

AVA Secures US Strategic Partner & A$7m Growth Funding

The Bottom Line

AVA Risk Group has signed a deal with US-based investment firm Hale Capital to fund our expansion into the American market. Hale is providing up to A$7 million in funding.

This is not a simple placement of shares. It is a structured debt deal that gives Hale the option to become a major shareholder (owning ~26% of the company) if our share price rises significantly over the next 4-5 years.

Who is Hale Capital?

They are a US specialist investor focused on security and technology. They are not just passive money; they are taking a seat on our Board and will actively help us open doors to US federal and infrastructure clients—our biggest growth targets.

How the Deal Works

The funding is split into two parts: Convertible Notes (the loan) and Warrants (the sweetener).

1. The Loan (Convertible Notes)

* Amount: A2.98m immediately (Tranche 1), plus another A4.02m subject to your approval (Tranche 2).

* Interest: AVA pays Hale interest of at least 10% per year.

* The Conversion: Hale can choose to swap this debt for AVA shares at any time over the next 4 years.

* The Price: The swap happens at 12.34 cents per share. This is an 81% premium to our current price, meaning Hale only converts if they help us almost double the company's value.

2. The Sweetener (Warrants)

* What they are: We are giving Hale ~45.4 million "Warrants" for free. These are essentially options to buy more shares.

* The Price: Hale can exercise these to buy shares at the same price: 12.34 cents.

* The "Put Option" (Important Risk): If Hale doesn't use these warrants after 5 years (likely because the share price is low), AVA must buy them back for cash at ~3.15 cents each. This creates a strictly defined liability for AVA of approx. A$1.43m if the share price fails to perform.

The Scenarios: What This Means for Shareholders

There are two main outcomes for existing shareholders:

Scenario A: The Growth Success (Share Price > 12.34c)

* What happens: Hale converts their loan and exercises their warrants.

* Financial Impact: AVA becomes debt-free (the A7m loan vanishes) and receives an *additional* ~A5.6m in cash from the warrant exercise.

* Dilution: Hale would end up owning roughly 26% of the company. Existing shareholders own a smaller slice, but of a much larger, cash-rich, debt-free pie.

Scenario B: Stagnation (Share Price < 12.34c)

* What happens: Hale does not convert. They keep the deal as a loan.

* Financial Impact: AVA must repay the A7m principal in 4 years, pay the 10% annual interest, *and* pay the A1.43m penalty to buy back the unused warrants.

* Dilution: Zero dilution occurs, but the financing becomes expensive debt.

Why We Did This Deal

* US Expansion: We need capital and connections to crack the US market. Hale provides both.

* Less Dilution Now: Raising A$7m by selling shares at today's low price (~7c) would have been highly dilutive immediately. This structure pushes dilution into the future and only triggers if the share price rises substantially.

* Alignment: Hale only makes a significant profit if they help get the share price above 12 cents. They are incentivized to make the stock perform.

Next Steps

* Tranche 1: We receive A$2.98m immediately.

* Tranche 2: We will call a shareholder meeting (likely March 2026) to ask for your vote to approve the remaining A$4.02m funding and the issue of warrants.

Board of Directors

Ava Risk Group Limited

It's not often you see an announcement of a sudden CEO retirement met with a 12% jump in the share price!

See ya Mal.

tl;dr -- the first half will deliver essentially flat revenue growth.

Glad i'm out

I'm no longer an investor in AVA, but just making a note of their latest results to make sure I didnt make a mistake in bailing out.

It was good to see them swing back to profitability, and the gross margin bump was encouraging too, but the main issue remains -- sluggish top line growth (5%). On top of that, the sales opportunity pipeline is shrinking; they quote $88m for FY26, but it was $99m this time last year. Even the "high probability" pipeline shrank from $13.9m to $12.2. And most of the opportunities are all relatively small deals, with only 11 opportunities more than $1m in value.

Which hardly gives confidence that revenue is set to surge any time soon.

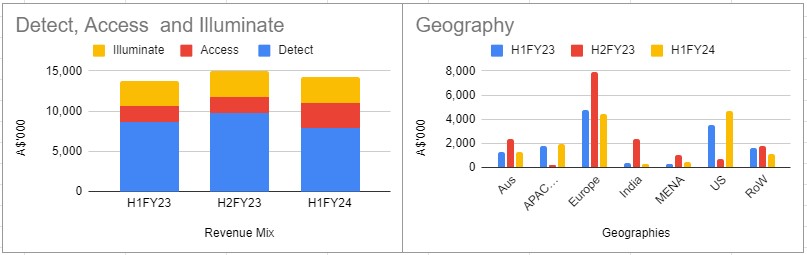

Digging deeper it seems that the Access and Illuminate segments are the main drag (Detect, which was always had the best potential and best margins) grew revenue by 17%. So potentially yet another case of acquisitions eroding shareholder value.

Not much point going into more detail. Show me the growth! and i'll start to get interested again.

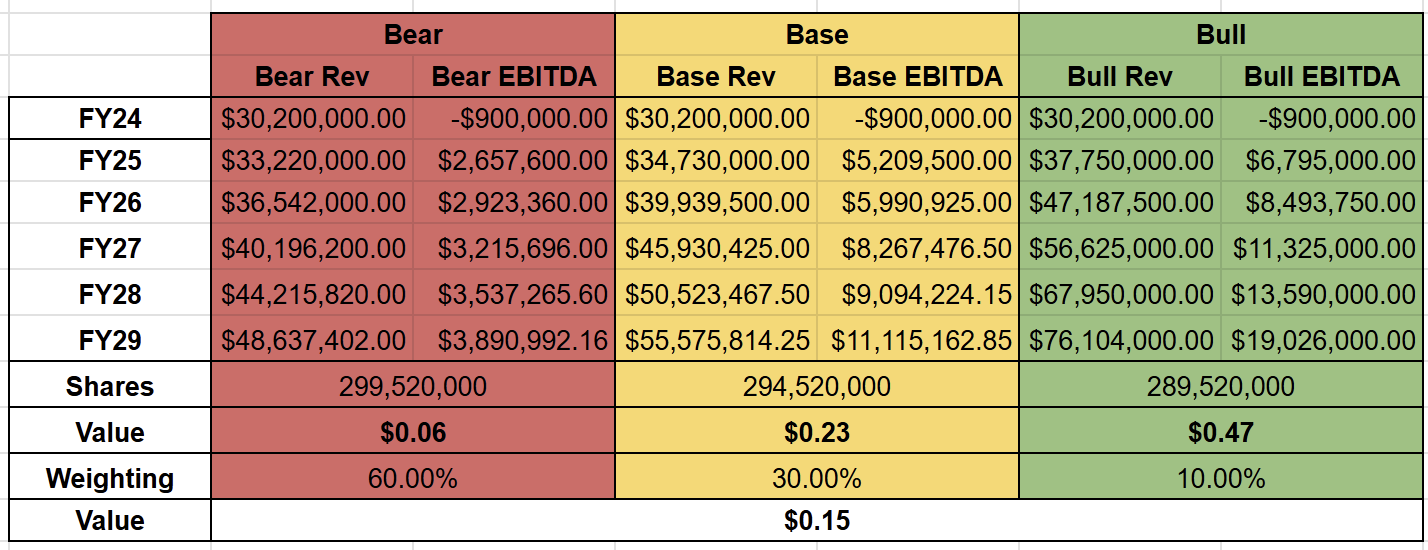

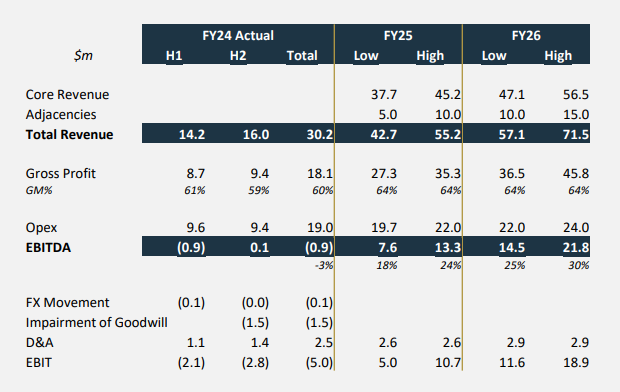

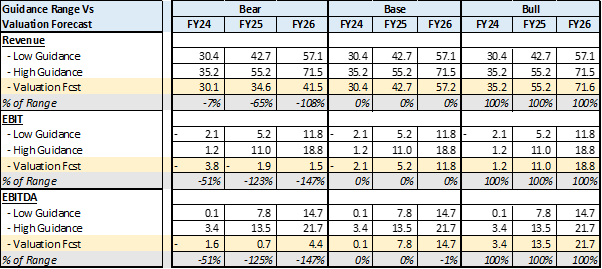

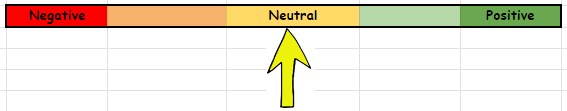

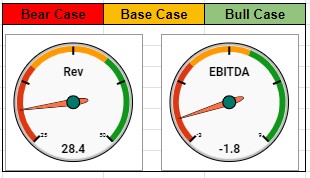

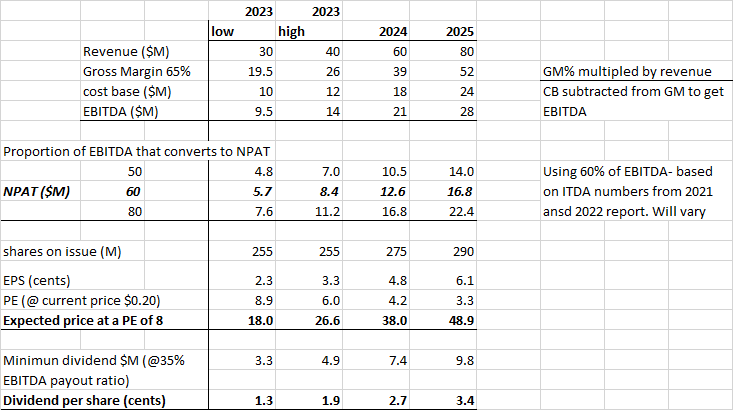

FY 25 results tracking well under all previous valuation forecasts.

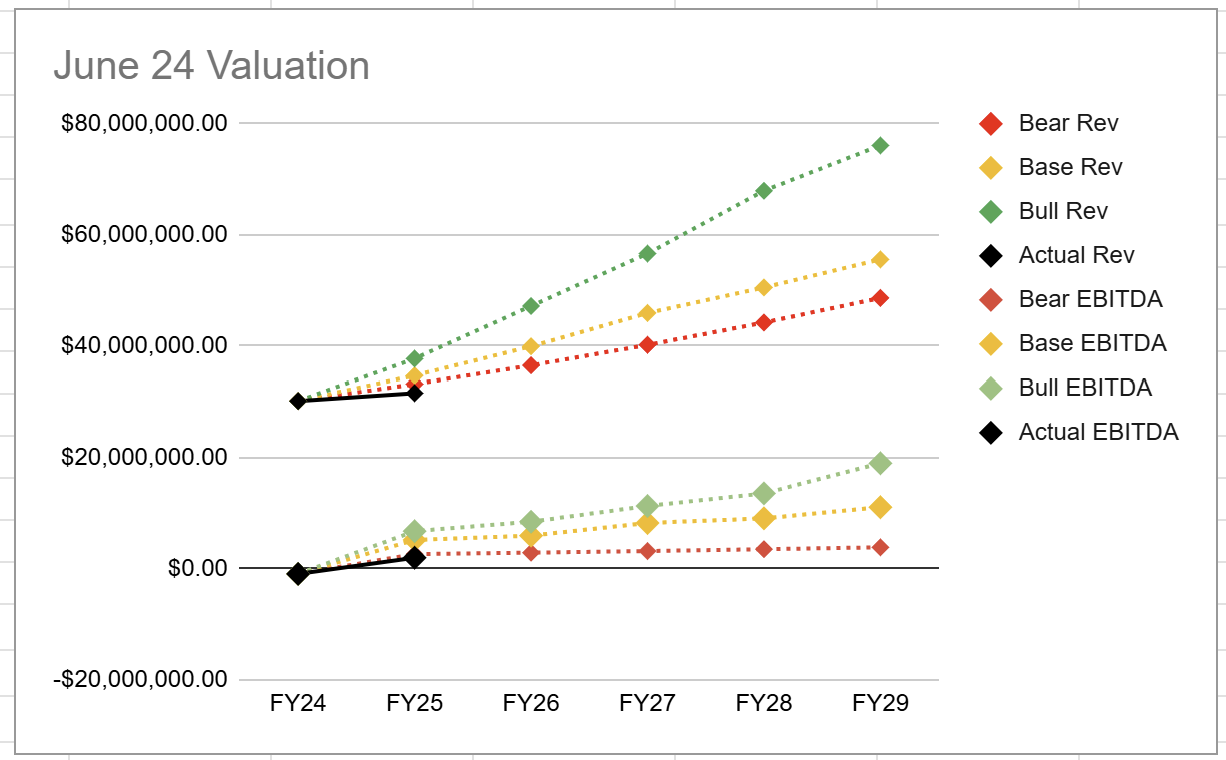

June 24 Scenarios

Revised down revenue growth and EBITDA %

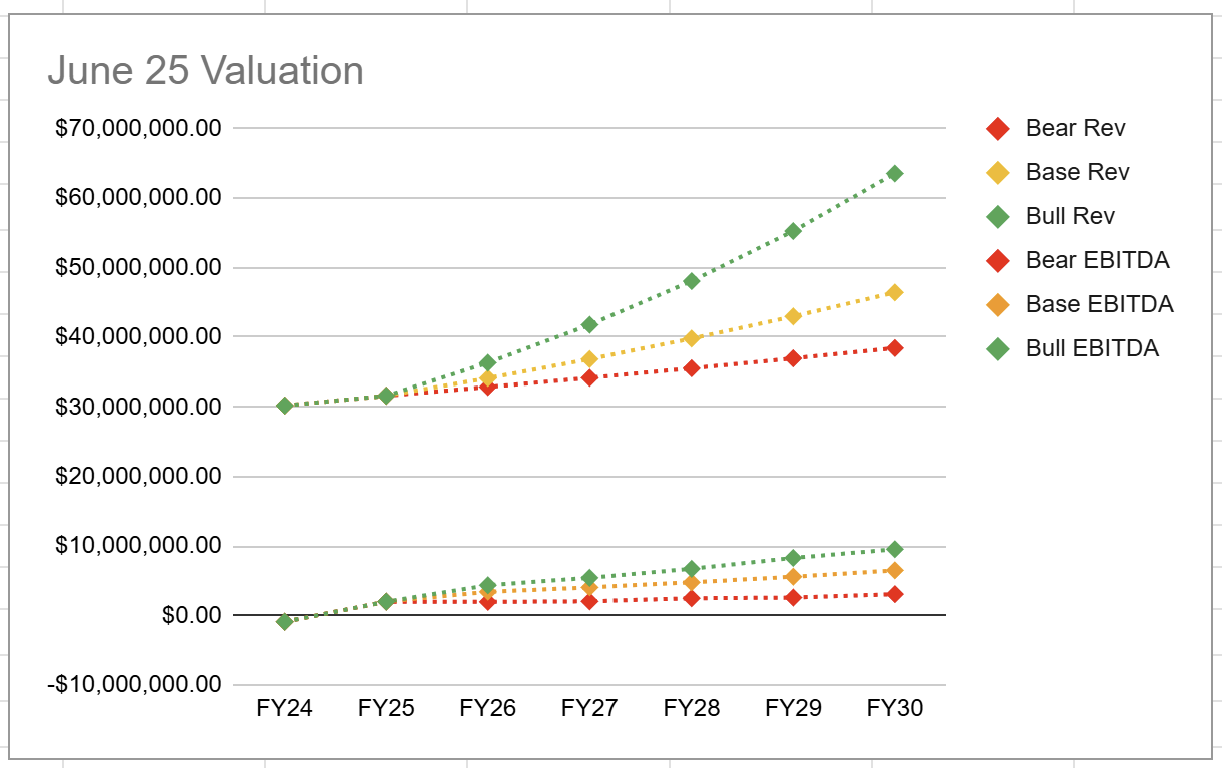

June 25 Scenarios

Revenue Growth Bear - 4%, Base 8%, Bull 15%

Updated valuation 15 Jul 2025

My thesis is busted for AVA. FY25 is coming below the path in my bear case in my Apr 2025 valuation (copied below).

Here are my notes from today's FY25 preliminary results:

- Revenue grew <5%, on back of 6% in previous year. This isn't fast enough to support my previous thesis.

- Mal's mis-guidance strikes again. In the latest update he confesses that FY25 will be "below guidance of $35m to $38m". But that guidance was only from Q3FY25 update. Back in Feb '25 the guidance was $37-41m; back in Aug '24 guidance was $43-55m. So not only is his guidance not useful, he is misleading about how bad his guidance has been.

- FY25 EBITDA around $2.0m is up thanks to some significant cost cutting. But statutory NPAT isn't offered. So there's a good chance the company is still running at a loss, which not much more to cut. The company has to grow its way into profit, but that's happening glacially.

- Sales orders for the year at $29.9m were below revenue, creating a headwind for FY26 growth. Also, pipeline of $88m is lower than the $100m at end of FY24 and H1FY25. Similarly, order backlog is now $6.4m compared to $7.4m at H1FY25 and $8.5m end of FY24. All these sales opportunity stats are heading in the wrong direction.

- So here's my revised valuation:

- Let's suppose a generous 8% revenue CAGR over next 5 years (last 2 years has averaged 5%), giving around $46m revenue in FY30.

- An NPAT of 5% gives $2.3m, with a PE of 15, gives a FY30 market cap of $35m.

- If I allow for 15% dilution over those 5 years, that's a FY30 share price of $0.105, giving essentially zero ROI between now and then.

- If I apply a required rate of return of 15% pa over the next 5 years (to compensate for size, risk, illiquidity) that gives a current fair price around $0.05.

As a wise man has written on his Strawman profile: "Hope is not an investment strategy". Maybe AVA has an exciting future, but for now I'll watch from the sidelines.

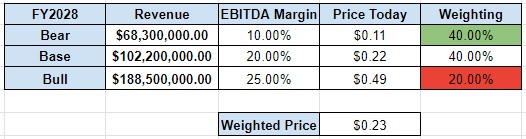

Valuation 16 Apr 2025

I’m a newbie to AVA. I know a lot of Strawpeople have invested in AVA over a number of years. The company has unfortunately not brought a lot of joy to our community. But I can see why folks have been optimistic. I was encouraged to dig into AVA from a recent chat with Strawman, and his ongoing investment in the company. Here’s a summary of my bull, bear and base cases. Apologies in advance for sometimes re-stating what many seasoned investors in AVA already know, these notes are my way of getting my head around the company.

Bull case

- AVA may be at the tipping point of substantial growth in profitability; last half revenue increased 20%, EBITDA was positive and NPAT essentially breakeven.

- Balance sheet is healthy with minimal debt of $2m; total liabilities around $8m are dwarfed by current assets of $21m.

- Operates in the security and detection market which has tailwinds from increased corporate and government focus on risk management.

- Delivers products, and in particular fibre detection, that have a broad range of applications across industries

- Major new products and capabilities have been released in last couple of years: Aura AI-X, Cobalt locks, LoRa wireless, safety certification for Metro applications.

- Offering customers ongoing software support for AVA’s hardware is a significant area to improve recurring revenue.

- The current competitive market is highly fragmented and AVA has the opportunity to become a market leader.

- Mal started in Jan 2023, only a little over 2 years ago, and has introduced some significant changes, in particular restructuring the sales team to sell integrated solutions across all three product lines, as well as moving from sales of bespoke solutions to scalable solutions.

- Valuation:

- I can’t take Mal’s communicated forecasts seriously (see reasons below in my bear case). But if I set a bull case around the low end of Mal’s forecast revenue ranges, I’ll assume 25% revenue growth in FY25 with 23% 5-year revenue CAGR, achieving $84m revenue in FY29.

- I’ll also assume a bullish FY29 NPAT of 12% and $10m, a PE of 30, 25% dilution.

- That gives a FY29 share price of $0.84, which will be >50% pa ROI from the current price around $0.11.

Bear case

- A lot of people have lost a lot of money investing in AVA. Momentum and reputation are headwinds.

- The security equipment sold in the Access and Illuminate product lines is a highly competitive business, one that is hard for a small player to succeed in.

- ARR is low, <10% of revenue, and only growing at the same rate as revenue growth; the business will be more attractive if it can grow ARR faster than overall revenue.

- Mal has consistently underachieved the financial targets he has announced to the market; even when he has given ranges, he has typically underperformed the low end of the range. My sense is that his targets are more like aspirational internal sales targets, rather than ones he should be sharing with shareholders.

- Mal can be a bit misleading at times; eg saying revenue was within guidance, which was only true for very recently released guidance, but was below guidance released only 6 months earlier; eg in a Strawman meeting saying Opex was “absolutely fixed” but later releases targets showing an increase in Opex; eg promoting the preferred supplier agreement with Telstra as a “contract” even though there was no guarantee of revenue (and still to-date it is not clear how much revenue, if any, has been achieved from this relationship).

- Mal has not achieved his internal management KPIs set by the Board, resulting in not being granted contingent compensation.

- Both the overly optimistic financial targets announced to the market and the internal KPIs not achieved by Mal, along with an impairment of goodwill, suggest a Board and executive that don’t have a firm understanding of their business OR a business that is unable to grow

- No Directors or executives (including the CEO) have significant skin in the game; one Director has 2% of shares, others own only tiny amounts

- Despite showing growth in revenue in the most recent half, sales orders were lower than revenue creating a headwind for further growth.

- No metrics for customer or employee engagement and retention are offered.

- No metrics are offered about customers such as number, avg order size, size of largest customer.

- Roughly 25% of current revenue, and perhaps a higher proportion in the pipeline, comes from the US which may be impacted by tariffs.

- Highly illiquid; hard to enter or exit; about $80k avg/wk traded over last couple of months; can be >10% difference in buy and sell offers for parcels >$10k.

- Although the $100m pipeline Mal promotes might initially sound attractive and might be useful for comparing one period to the next, if we apply success probabilities of 80%, 50% and 20% to the three tiers, it comes down to around $35m in possible revenue, and that will include multi-year deals; in which case the pipeline feels light for the growth targets that Mal has promoted.

- A cap raise was required in March 2024 to sustain the business.

- There may be a systemic reason why the competitive market is highly fragmented among many small players - it may simply be the market is not large and it is not easy to differentiate.

- Valuation:

- If we assume growth is modest, perhaps 8% 5-year revenue CAGR, we get FY29 revenue of $44m.

- I’ll also assume a modest FY29 NPAT of 4% = $2m, PE of 12, 15% dilution.

- That gives a FY29 share price of $0.06, about 45% lower than current share price.

Base case

- The investment thesis for AVA rests on Mal gaining sustainable traction from the changes he has introduced over the last 2 years. We’ve seen green shoots in H1FY25, these need to thrive.

- Valuation:

- Based on past performance, my base case assumes Mal will underachieve even the low end of his communicated forecasts of FY25F $37-41m and FY26F $52-$66m. Instead I’ll assume 20% growth in FY25 dropping to 15% in FY29, achieving FY29 revenue of $69m.

- For profitability, I will also assume that Mal does not achieve his EBITDA target of 25%. I’ll assume FY29 EBITDA around 15% and NPAT around 8%.

- With that growth and profitability a reasonable PE might be 25.

- With 20% dilution we get a FY29 share price of $0.39, which will be healthy 5-year ROI around 30% pa from current share price around $0.11.

- To come up with a fair current price, I’ll factor in the risk associated with the size and liquidity of the business (and hence use a higher discount rate), as well as the asymmetrical upside of the bull case compared to the bear cases. Applying a 15% discount rate, and equal probabilities to the bull and bear cases, the abacus spits reads a current fair price of $0.24.

- I know a lot Strawpeople apply a standard 10% discount to all opportunities. If I use a 10% discount rate, the fair price increases to $0.30.

- AVA is a high risk investment, so I won’t be betting the house. But I am willingly walking into this lobster pot and will slowly continue to build so long as my base case looks achievable.

AVA seems to be making a habit of falling short of guidance. Sure, those delays seem reasonable (territorial conflict in India, tariff related delays), but stop offering guidance that does not allow for such inevitabilities. It seems to happen a lot with AVA.

Also, revenue growth and sales order growth is positive, but not huge.

But it is good to see a lift in cash and a decent move into profitability.

As Mal said, there is (some) momentum in the business. And costs are very much contained. Which is great. But kinda sick of the over promising and failure to accelerate growth.

Part of the appeal has been that very little is assumed in the market price.. but perhaps the market is right to be sceptical.. I'm running out of patience.

Others here have called it well.

Anyway, this one is fast losing favour with me. Will have a deeper look when the full results are out.

Here's the transcript from today's session with Mal:

The big concern among most observers has been the slower than guided for pace of growth, so I asked chatGPT to highlight any comments from Mal that touched on this:

Summary: Mal Maginnis on Revenue Guidance Revisions and Early Expectations

1. Revenue timing slippage

- Mal acknowledged that while H1 FY25 was very strong, Q3 slowed, and some projects slipped into Q4.

- He noted that even small delays ($2–3M) have a substantial impact on a company of Ava’s size.

2. Overestimation of market adoption speed

- Mal believed the market would adopt Ava’s sensing technology faster than it did.

- He underestimated the lack of depth and readiness in many industries for this type of infrastructure sensing.

3. Historical baggage around fiber sensing

- He admitted not fully appreciating the skepticism in the market, caused by previous issues with high alarm rates and poor performance from older fiber sensing solutions.

- This created more resistance and longer sales cycles than anticipated.

4. Program sales cycles longer than expected

- Large project sales cycles are now expected to take 12–18 months (sometimes more), versus the 12 months or less initially assumed.

5. Macroeconomic and geopolitical impacts

- Global uncertainty caused major clients to delay capital spending.

- Some deals were pushed out by 3 to 6 months, affecting FY25 revenue recognition.

6. Pipeline disruption during team transition

- Mal acknowledged that changes in the commercial team led to parts of the pipeline falling away or being revealed as less real than initially believed.

7. Guidance was aspirational, not fixed

- He clarified that the original $42.7M–$55.2M FY25 range was not firm guidance, but a directional aspiration.

- He acknowledged that some investors may have treated it as a hard forecast.

8. Mitigation strategy going forward

- To address variability, Ava is now focused on:

- Growing recurring revenue

- Building a deeper pipeline

- Expanding backlog to smooth revenue over time

9. Nature of the business

- Ava is a program-based technology business, not a fast-moving consumer goods company.

- Sales are lumpy by nature, and even with strong products and execution, quarter-to-quarter predictability is limited.

For better or worse, I tend to think the technology is sound, the offering is compelling, and the opportunity remains significant. That said, management has clearly been too aggressive in setting expectations. Twenty-eight months in, Mal appears to have made a number of sensible but also highly material changes. He replaced more than 30 people in a team of around 40–45 non-manufacturing staff, effectively overhauling the commercial and client-facing parts of the business. He also shifted the development focus away from bespoke, one-off solutions and toward a more scalable, productised platform.

Those kinds of changes tend to disrupt a business before they improve it, and it takes time for their full impact — positive or negative — to become clear. When you layer on slow-moving customer decision cycles and capital deferrals in key sectors, it’s understandable why many of the early expectations haven’t been met. Still, there’s a meaningful distinction between underestimating timelines and being wrong about the opportunity itself.. and I think Mal’s misstep lies more with the former. The underlying opportunity hasn’t gone away. With much of the heavy lifting behind them, the next phase is about proving that the groundwork can now translate into consistent, tangible results.

But, as ive said, if we dont see decent traction emerge very soon, I'll have to admit there is not as much substance as I had initially hoped for.

Another contract announcement for AVA: 06jrxlmy2605nz.pdf

$1.1m for deployment of Aura Ai-X on an oil and gas filed for Abu Dhabi National Oil Company. Again they say deployment will occur this quarter.

Nice to get a 7-figure contract. And great names being added to client list.

Like the announcement 2 days ago for the India gas field, I'd like to know split of hardware/software, one-off vs ongoing revenue stream, how much revenue will be recognised this quarter.

Still, regardless of details, a strong couple of recent sales.

New contract for AVA in India monitoring a gas pipeline. Contract value A$0.9m.

They mark the announcement as price sensitive, which feels questionable, but reflects Mal's past tendency towards overstatement. Still, a nice win.

I'd like to know breakdown of contract between hardware and software deployment, and one-off vs ongoing revenue stream.

They say delivery is expected to occur in the current quarter. That seems ambitious for hardware deployment across > 1000km of pipeline. There are some details missing to be able to make full sense of this announcement.

Just as we speak/write . . . trading update from AVA:

https://announcements.asx.com.au/asxpdf/20250430/pdf/06j7sqqrsc9rnh.pdf

Ava Risk Group is in the business of protecting critical infrastructure and high-value sites from physical threats. It does this through smart fibre optic sensors, high-security access systems, and intelligent perimeter lighting and detection technologies. Its customers are governments, utilities, and large organisations that need to secure important assets.

The business has evolved a lot in recent years. It divested its logistics-focused services division (at a pretty incredible ROI, although the profits were essentially all paid out to investors rather than retained) and shifted focus to its in-house developed fibre-optic sensing tech.

This technology turns fibre optic cables into smart sensors that detect movement, digging, or climbing along a perimeter. It sends light through the cable and analyses microscopic changes in the reflected signal to classify activity in real time. (For the physics nerds: it uses Rayleigh backscatter and interferometry, with machine learning layered on top to turn raw signal data into actionable insights.)

The result is low power, high durability, and the ability to monitor long distances from a single system. Better yet, it can often be deployed over existing fibre infrastructure, avoiding the cost and disruption of new trenching.

That’s a big advantage over traditional perimeter security methods like fence-mounted vibration sensors, buried coaxial cables, or cameras, which usually require power at the sensing edge, have limited range, and are more prone to false alarms from weather or wildlife.

Alongside its core sensing business (Detect), Ava operates two other divisions: Access and Illuminate.

Access is all about high-security access control. Think biometric readers, encrypted smart locks, and secure systems for things like government buildings and prisons. Ava picked up this capability in 2014 through the acquisition of BQT Solutions. While Detect covers the perimeter, Access handles the internal entry points (doors, gates, restricted areas).

Then in 2022, Ava bought GJD Manufacturing, a UK-based business with expertise in perimeter lighting and detection. GJD makes things like motion sensors, ANPR cameras (for reading number plates), and IR and white-light illuminators -- hardware often used with CCTV to boost visibility and deterrence. Crucially, GJD tech allows you to trigger lighting or alarms in real time based on detection events, which ties in perfectly with Ava’s sensing capability. More recently, GJD released a LoRa-based wireless platform that can connect up to 500 devices without running cables, which is a big plus for complex sites.

Together, Detect, Access, and Illuminate make Ava a multi-layered security solutions provider. Think integrated systems that can detect, verify, and control access across some of the world’s highest-risk environments.

All of this sounds pretty compelling, but for a while Ava was really just a collection of standalone technologies. After the services divestment, it had some great IP but lacked cohesion. The segments operated more like parallel businesses. There wasn’t a unified go-to-market strategy. Internal systems and processes were a mess.

Then came Mal Maginnis. He joined as CEO in January 2023 and brought decades of defence and security experience. His job: get the machine working. That meant aligning products with customer use cases, building the sales and delivery backbone, and putting in place the systems needed to scale. Since then, Ava has become a much more focused business with a clearer strategy.

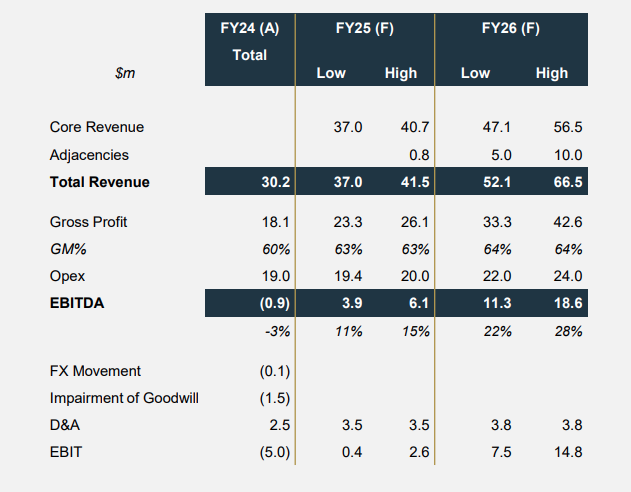

These changes take time. But it seems to be working. Revenue has grown steadily, hitting $30.2 million in FY24 (up from $28.6m in FY23) with FY25 forecast between $37 and $41 million.

More importantly, the quality of revenue is improving. Annual Recurring Revenue (ARR) hit $2.4 million in H1 FY25, up 20% year-on-year. The company returned to positive EBITDA in the latest half, with a $1.7 million profit (a $2.6 million turnaround). Cash flow has stabilised, and a $4.3 million equity raise has help strengthen up the balance sheet.

A key thing to note is that the internal systems have now been overhauled, commercial reporting sharpened, and the go-to-market model rebuilt. The sales team, especially in North America and EMEA, has been beefed up. The business is now focused on high-value verticals like border security, transportation, telecommunications, and energy infrastructure.

Cross-selling and bundling are now at the core of the strategy. The aim is to combine sensing, locking, and lighting into end-to-end solutions. That makes deployment easier and the value proposition stronger. Existing customers and distribution channels are being used to expand into Europe, North America, and the Middle East. The product set has been mapped to real use cases (eg borders, transport, utilities) allowing Ava to pitch for larger, more complex jobs.

In short, Ava’s shifted from clever tech to real-world commercially viable solutions. The product suite is far more integrated, and we’re beginning to see early signs of faster top line growth and expanding operating margins.

And that's the key part of the thesis -- after two years of investing in internal systems, commercial teams, and product dev (which did weigh on margins), Ava now has the foundations for scale. Management believes the current cost base can support much higher revenue and we’re seeing early signs of operating leverage. H1 FY25 revenue was up 20% year-on-year, margins improved, and the business returned to EBITDA positive. It's a start, but we need to see this continue.

The hope is that earnings growth begins to outpace revenue growth, especially as recurring revenue lifts and more big contracts land. That growth is underpinned by a stronger product offering, growing list of reference sites, and deeper enterprise and government relationships. Larger customers bring longer sales cycles, but once Ava gets in, the revenue is stickier and more repeatable.

Meanwhile, recurring revenue is building. Multi-year support, monitoring, and upgrade contracts are adding predictability and smoothing cash flow.

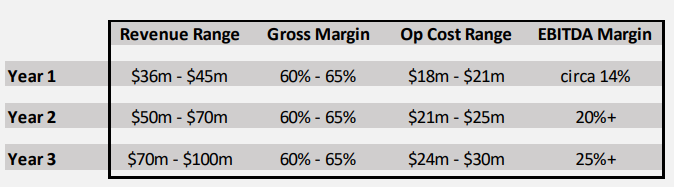

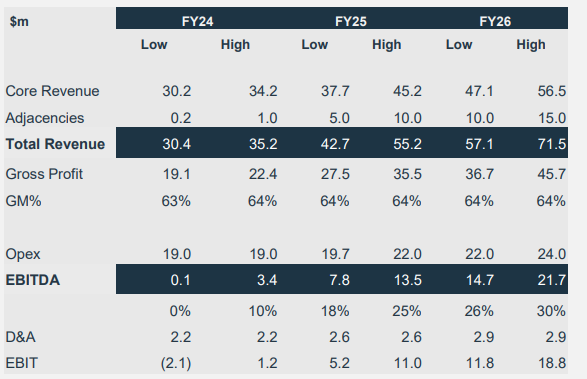

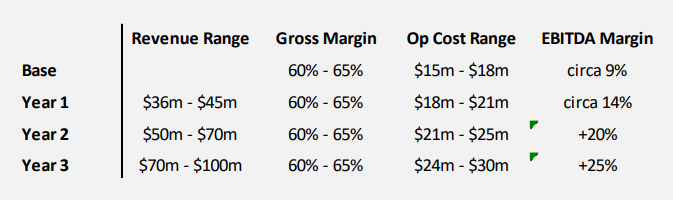

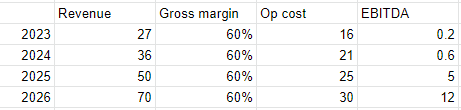

This is the latest management guesstimate from February 2025:

This shows the business moving from modest top-line growth in FY24 toward a more profitable, scalable model over the next 12–24 months.

At 10.5 cents per share, Ava has a diluted market cap of about $30.5 million and an enterprise value of ~$27.9 million. That puts it at around 7× forward EBITDA on the low end of FY25 guidance. But that’s a little misleading because the business is subscale and right on the edge of breakeven. The cost base has been engineered to handle a lot more revenue. If that growth materialises, operating margins should expand meaningfully. If not, well, the economics would remain pretty average..

At scale, this should be a business delivering 10–15% net margins (at least). And that’s the bet: that Ava can grow into its cost base and scale profitably. If that happens, the upside is big in percentage terms. Even more so from a stock price perspective if success brings multiple expansion.

In that case, the stock is ridiculously cheap.

Of course, the risks are real. If growth stalls or costs creep back in, shares will likely languish under 10cps. But there does seem to be real asymmetry here -- more upside than downside.

The market clearly isn’t pricing in much success. Which, i suppose, is the opportunity.

So why the ‘meh’ valuation by Mr Market? Part of it is liquidity. Ava trades under $100k a day, which limits institutional participation and depresses multiples. But also, there’s a fair bit of market fatigue. Ava’s been talking up its potential for a while, and while revenue has grown, earnings haven’t really followed through..yet. The unexpected capital raise in FY24 probably dented confidence in the company’s ability to fund itself.

That’s why the next 6 to 12 months matter. The hard stuff has largely been done; internal systems, sales capability, product integration. Now Ava needs to execute. That means growing revenue and lifting margins in a visible, sustained way.

If Ava even gets close to its FY26 targets, a 25 cent share price looks entirely reasonable. Maybe more, if there’s real revenue momentum. If it doesn’t deliver, the stock likely goes nowhere.

So why to a lean towards an optimistic stance? Because business transformation takes time, usually longer than markets are willing to wait. Ava’s spent the last two years doing the boring but important work. That phase looks done. Now we’re seeing early signs of execution: revenue is rising, margins are improving, and EBITDA is in the black.

I’m also patient (stubborn? naive?) But what I see is forward momentum. Contracts with Telstra and UGL aren’t speculative pilots, they’re commercial validation. Moreover, the order book is growing and ARR is rising. They seem to reliably convert the sales backlog into cash flows.

I think there’s also a tailwind here. Whether it’s border control, energy infrastructure, or general geopolitical instability, the need for scalable, intelligent perimeter protection is only going up. Ava’s well-positioned to benefit.

So yes, it’s a bit of a turnaround story. And one I was admittedly too early with. But it’s a turnaround that’s showing signs of working.

Strong IP. Streamlined and rebuilt operations. Improving fundamentals. Potential for meaningful operating leverage. And a valuation that barely reflects any of it.

That’s the setup.

AVA's H1 2025 Results were positive leading to positive valuetion based on share price of 11c as of 3rd March.

Taking the following assumptions

Revenue of 2026 52m

EBITDA margins 21.7%

EBITDA 11.28m

EBITDA Multiple * 7 = 79million Market Cap

Dilution 3% per year = 306.6million

Share Price = 26

Discounted back 10% per year = 21.87c

These estimates are on conservative end of forecasts outlined by Mal as is the 7x multiple.

Why the upside :

- Ability to flex sales at minimal cost increase a positive

- Revenue in the Detect segment growing well with a move to recurring revenue growing stronger than segment revenue.

- Pipeline looks well with in progress revenue 26.6m for the detect segment.

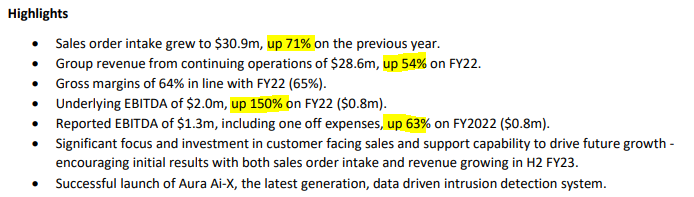

Some strong numbers from AVA, some of which were already revealed in the January trading update.

Still, 20% revenue growth to $17m at an EBITDA margin of 10% ($1.7m compared to a $0.9m loss in the previous first half) was nice to see. Gross margins improved 3% to 64% thanks to a favourable segment mix (Detect has the best margins by far). Contracted annual recurring revenue was up 20%, and represents around a third of all sales orders for the half.

AVA saw a sales intake (signed but not yet delivered) of $16.3m, which is below the $19.7m pace received in H1 FY24 (but part of that was a big order from the Access segment as distributors built inventory). The sales backlog more than doubled to $7.6m and they reckon there is a $100m sales opportunity with close dates in this calendar year. $8.5m of this is seen as high probability and there is $26.6m of sales opportunities in progress.

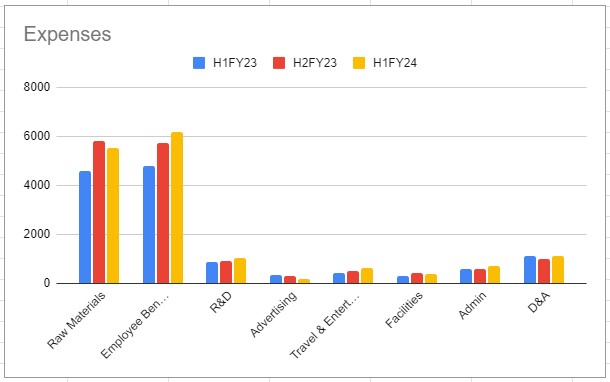

A big part of the thesis has always been the ability for the business to realise some good operating leverage, and after a lot of restructure after Mal arrived, it was good to see operating expenses dip $0.3m and still see strong revenue growth.

Detect was the star of the show -- and this has always been the most interesting segment -- where revenue rose by 57%, and represented 71% of all first half revenue.

Access segment actually saw a dip, but the comparable period including initial stocking by resellers. So that's not too concerning. Still, will need to see some growth from here. Illuminate was also slightly down, but good to see that there is increasing cross-sell/bundling with Detect sales.

FY guidance is for revenue between $37-41.7m -- which would be ~30% up on last year at the midpoint, and suggests H2 revenue growth of almost 40%. According to their outlook, they expect an 11-15% EBITDA margin on this revenue, which is expected to further improve in FY26

All in all, great to see good sales momentum and expectations for further growth, with a stable cost base and rising gross margins, not to mention being EBITDA positive with $4.7m in cash in the bank. They also broke even on a statutory basis, so hopefully they really are at an inflection point.

The market just cant get excited about AVA, but another half or two of continued progress like this and it will be very hard to ignore, and I suspect a decent re-rate would be likely. I mean, they are on an EV/EBITDA ratio of 5.3x, which strikes me as dirt cheap for a business that is growing the top line at 20-30%, and is breakeven with rapidly expanding operating margins.

Of course, we need a strong second half for this to be true, and maybe that falls short. But if not, you'd have to think AVA could command a share price somewhere in the 20-30c range.

It's certainly been one to test the patience, but I think Mal has done well to reposition the business and it remains somewhat of an asymmetric bet -- much more upside than downside.

[Held]

a

a

Q2FY25 Update

The Good

- Reiterated H1 revenue guidance of $17m which is right in the middle of the range previously provided along with being EBITDA positive.

The Not So Good

- No update on Telstra deals or products. Previously indicated trials to conclude and others to start within Q2. If the $5 to $10m of adjacencies revenue is to come through, then we will likely need to see some orders coming through in Q3.

- Although AVA is forecasting an uptick in revenue for H2, sales orders were down to $7.4m in Q2 which is concerning for the work in hand yet to be recognized as revenue which sits at $7.6m. As this is expected to be delivered in H2, a further $12m needs to be won and delivered within the next 6 months to hit the bottom end of the full year guidance range.

Watch Status

- Hold

Valuation Status

- Review at H1FY25

What To Watch

- Progress toward full year guidance

- Telstra Updates

- Detect subsea trial to start in Q2

- Illuminate pit trial to conclude in Q2

- Mobile Tower security

A promising update from AVA, who look like they are on track to hit stated guidance (something the market has seemed sceptical of).

Full update is here: AVA_ASX_Q2 FY2025 Trading Update_1737412500.pdf

H1 revenue: $17m (+20% YoY).

Positive H1 EBITDA expected.

Q2 sales orders: $7.4m (H1: $16.3M).

Order backlog: $7.6M, including $2.4M recurring revenue (+20%).

Gross margins: 60–65%.

Stable cost base.

(Held)

There are 2 items, not sure which is more significant:

- 3 little Aura Ai-X contracts, 2 with repeat customers (Dubai airport and an Eastern European border). The border was only a recent new customer who has asked for more so that seems good). New customer - San Diego airport.

- Also, a sales executive resigned and will not be replaced, instead regional leads will report directly to Mal.

Are there green shoots of growth?

Q1 Update and Presentations

https://cdn-api.markitdigital.com/apiman-gateway/ASX/asx-research/1.0/file/2924-02874837-3A654561

https://cdn-api.markitdigital.com/apiman-gateway/ASX/asx-research/1.0/file/2924-02875345-3A654645

The Good

- The business is really building itself around the Aura Ai-X technology with a decent pipeline of potential detect contracts for FY25. (Everyone loves a good pipeline graphic, just ask DRO). What is promising is the range of sectors that the sales are coming from.

- FY25 Guidance of $42.7m to $55.2m provided which is a solid jump on the $30.2m for FY24. What is a bit deceiving is breaking this into core revenue and adjacencies. (Telstra?) Given Telstra is likely a slow moving beast, guidance should be the core revenue range of $37.7m to $45.2m which is still an improvement of 25 to 50%

The Not So Good

- Ok sales order intake for Q1, with detect doing most of the heavy lifting again. Slight improvement in access with its best quarter since Q1FY24. However sales orders will need to increase to meet the revenue guidance. In previous years sales order intake has been lumpy.

Watch Status

- Slight improvement in sentiment due to guidance range and growth in the detect market.

Valuation Status

- Review at H1FY25

What To Watch

- H1 Revenue Guidance of $16.5m to $17.5m

- Telstra Update

- Detect subsea trial to start in Q2. Events like the recent damage to subsea cables in the Baltic are likely to provide tailwinds in this area.

- Illuminate pit trial to conclude in Q2.

- Mobile Tower security - TBC

- LoRA product line in illuminate launched in the quarter. Expected to contribute to improvement in sales orders for Illuminate.

- Would expect a high likelihood of winning the remaining Sydney Metro contracts given AVA were awarded the first one, unless they have had substantial issues during the commissioning, for this type of project, it is unlikely to have multiple technology providers installed across the same type of scope. SRL is also being delivered by the same groups of contractors.

Overall, pretty good I think. Not that you'd guess it based on the markets reaction (but you cant read much into that when there have so far only been 6 orders valued at <$7k in total!! In fact, looking at the recent trading history, one may well speculate there was a bit of leakage and the market has already reacted -- shares are up ~40%-plus in recent weeks. hmmm)

Anyway, Ava is saying to expect 16-23% growth in the current half (they grew only 4% or so in the pcp), and to expect a much stronger second half. In recent years the 2nd half has typically been 10-12% better off than the first.

If that pattern holds, they'd be looking at 18% top line growth for the FY. Q1 Sales orders are a good amount above prior first quarters, and the third highest on record despite what is typically a slower period. So there does seem to be a good amount of traction.

I thought the growth in sales orders for the detect segment were especially pleasing, and it sounds like Aura-Ai-X is seeing a bit of traction. And Access had its strongest order intake since the initial stocking by distributors, which gives some sign that there's been a decent (and growing) uptake.

Importantly, they expect to be EBITDA positive in the current half, continuing on from the preceding half. Given many reiterations for a stable costs base, which has largely been borne out, I dont see any big risk for a further raise (barring an acquisition), and in fact we should *hopefully* start to see a bit of a jump in operating cash, which tipped positive in H2 FY2024.

I'll let people read the latest announcements, but it looks to me like Mal has done well to reposition the business over the past 18 months and laid the foundations for growth, which are really starting to emerge. They are building up a lot of reference sites and expanding their customer base, the business appears to have passed breakeven on a sustainable basis, and there is plenty of opportunity to be captured.

It's on 1.1x sales, which is a super crude metric but if you assume they can build a 10% or so net margin in the next few years, which seems very doable, AND continue to grow at double digit rates in terms of revenue, well, it doesn't seem too expensive at all.

Happy to maintain my holding.

Latest presentation here

Bit of a long bow but who knows what comes of this. My understanding the trials with Telstra were underwater cables out of Darwin and urban fibre network in Melbourne. Maybe the 5G haters could provide an opportunity. Possibility? or clutching at straws? I’m unsure.

held IRL

09/09/2024

Given their capital rising and, again, not hitting their guidance I am significantly reducing my valuation.

Perhaps naively, I still see the potential here, however maybe it'll be a longer and bumpier road to get there.

So lets assume:

2028 Revenue (~13% CAGR): $50M

GP Margin of 60% and Opex of $24M (extrapolating the low end of their guidance)

=> 2028 EBITDA: $5M

Assuming 285M shares and a P.EBITDA of 10X

=> 2028 Share Price: 0.19

Discounting at 10%

=> 2024 SP: 0.13

So I only following their guidance for the Opex and assuming significantly less revenue growth

I'd consider adding more to my position at around 0.09c as I feel the risk/reward is good at that level. However, if the total revenue for FY25 is less and $35M I will sell and cut my losses on this one.

20/03/2024

Re-running the numbers to align with the lower end of their new multi-year guidance gives:

2028 Revenue: $70M

(effectively pushing the revenue out by another year, or alternatively as dropping their revenue CAGR to ~20% from 2023 results)

Dropping their GP margin to 63% and assuming 2028 OPEX of $29M gives:

2028 EBITDA: $15M

Assuming 274M shares and a P/EBITDA of 10 =>

2028 Share Price: 0.55

discounting at 10% =>

2024 Share Price: 0.38

Yet again, it seems cheap IF they can deliver what they say, however if they keep dropping their guidance, well... In addition, they are borderline on needing a capital raise.

If either of these (capital raise or lowering of guidance) happen in the next year I will no longer use their estimates as part of my valuation - instead will us more conservative assumptions, but for now I am prepared to give the new CEO the benefit of the doubt as he finds his feet.

Also - despite me giving them a lofty valuation - I am currently not buying. I will hold until I see how this next half plays out.

Older

Upon revisiting this - I don't see any reason to change. Will be interesting to see these year results to see how on track for this they are though. All signs seem positive, let's see if the numbers actually come in.

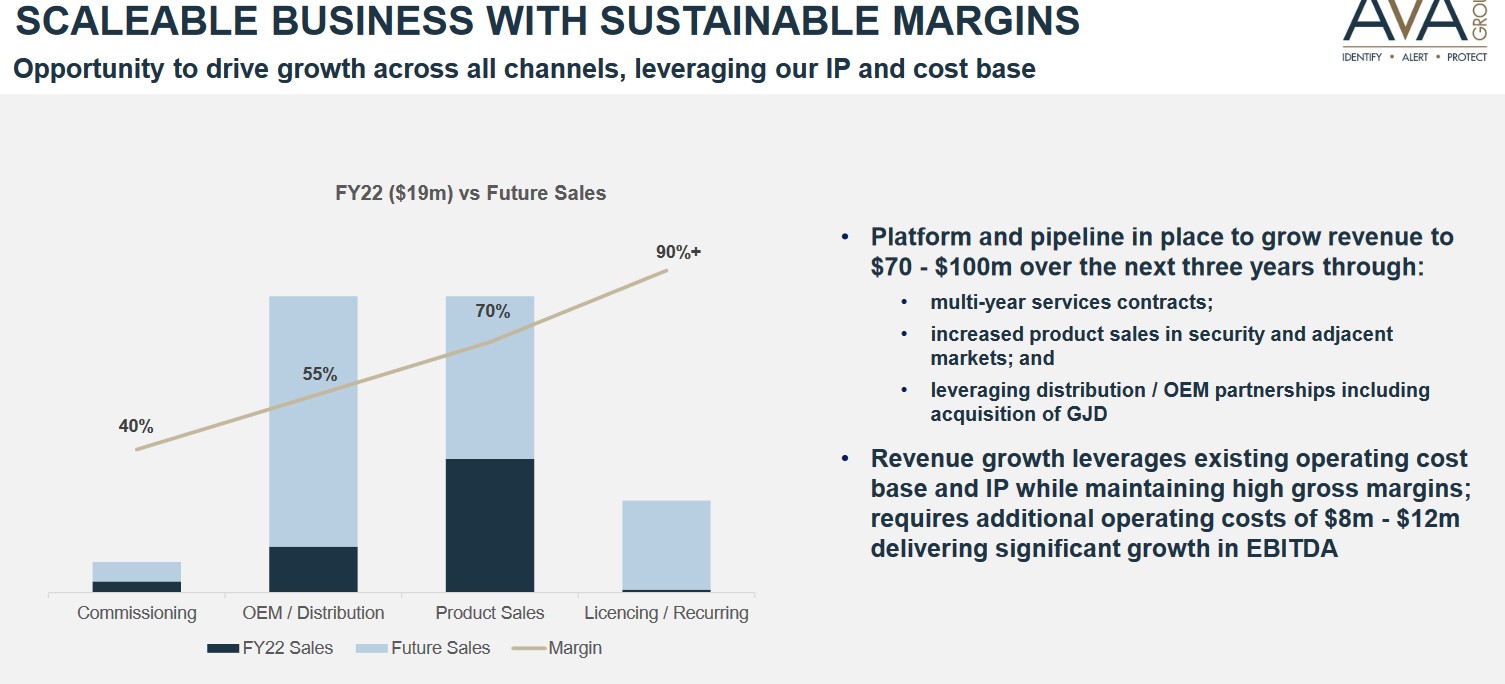

Based on their guidance of 70-100m revenue in 3 years I have assumed 70m revenue by 2027 so taking the lower end and giving them longer to get there (this corresponds to a CAGR of ~30%).

Assuming constant GP margin of 65% and a 20% CAGR in operation expenses (to 29m which is 50% higher than their estimate) gives $17m in EBITDA (works out to be 24% of revenue)

Applying a 10x multiple to EBITDA and assuming 270m shares in 2027 gives:

2027 share price: 0.63

Discounting back at 10% ->

2023 price: 0.43

So it is at a good price IF they can achieve what they say.

I just got off the AVA call.

Key takeaways:

Mal emphasized that FY24 was a transitional year, completing restructuring, launching new tech/products, and setting a firm foundation for FY25. It was a tale of two halves, with things accelerating in the final quarters.

Margin drop was due to a shift in segment mix -- Detect has the best margins, but strong growth in Access was why group margin eased back. Should normalise going forward.

Detect is really the core business, and Mal described this as a program or project based business, one that can have long lead times (3-12 months)

A $100 million pipeline, particularly strong in the Detect segment, is noteworthy. Mal repeatedly emphasised these leading indicators and you can see from the latest outlook table that they continue to expect high revenue growth against a relatively fixed costs base

At the mid point, you have ~62% revenue growth expected in FY25 and an EBITDA of ~$20m -- a 42% operating margin.

(interesting to hear Mal say "I know you've heard this before")

Aura AI-X has been transformational since its launch, contributing to improved detection and lower false alarms. The strong sales of over 100 units and Cobalt 2’s 48% growth in Access orders demonstrate successful product adoption and integration across segments

There was discussion about H1 traditionally being weaker than H2, with specific references to Q1 (northern summer) and Q3 (holiday season) slowdowns, aligns with their operational cycles.

Illuminate’s expected move to break-even or profitability in FY24

There was a noticeable shift toward emphasizing predictability in revenue, seen in their focus on bookings, pipeline, and backlog as core metrics.

Its a fractured and competitive market, and AVVA is trying to distinguish itself by focusing on the tech and aligning with bigger customers.

Company well funded, no expectations to raise capital. Board happy to commit to paying 30% of EBITDA as a dividend, which they think leaves ample room for growth investment.

Could FY25 finally be the year where things take off? Cost base and operating segments now set, good momentum in orders and sales.. Maybe. If they get anywhere near guidance you'd have to assume something of a rerate.

A do or die year for me.

Potential Competitor?

An ad for this product randomly appeared in my google feed (let's not get into why google thought I might be interested in buying fiber optic sensing equipment)

https://www.hawkfiber.com/

This is the main companies website https://www.hawkmeasurement.com/products/fiber-optic-sensing/ - looks like it is a new direction this company is foraying into.

Not sure if anyone else has looked into on this company or its product in comparison to Aura Ai. It is a private company unfortunately...

Curiously, they state the following:

I think the underlined has just been poorly worded - all systems will ignore false alarms PROVIDED they know they are false.

Anyway, I think would be good to get Mal's view on this company, and their claims next time we meet him.

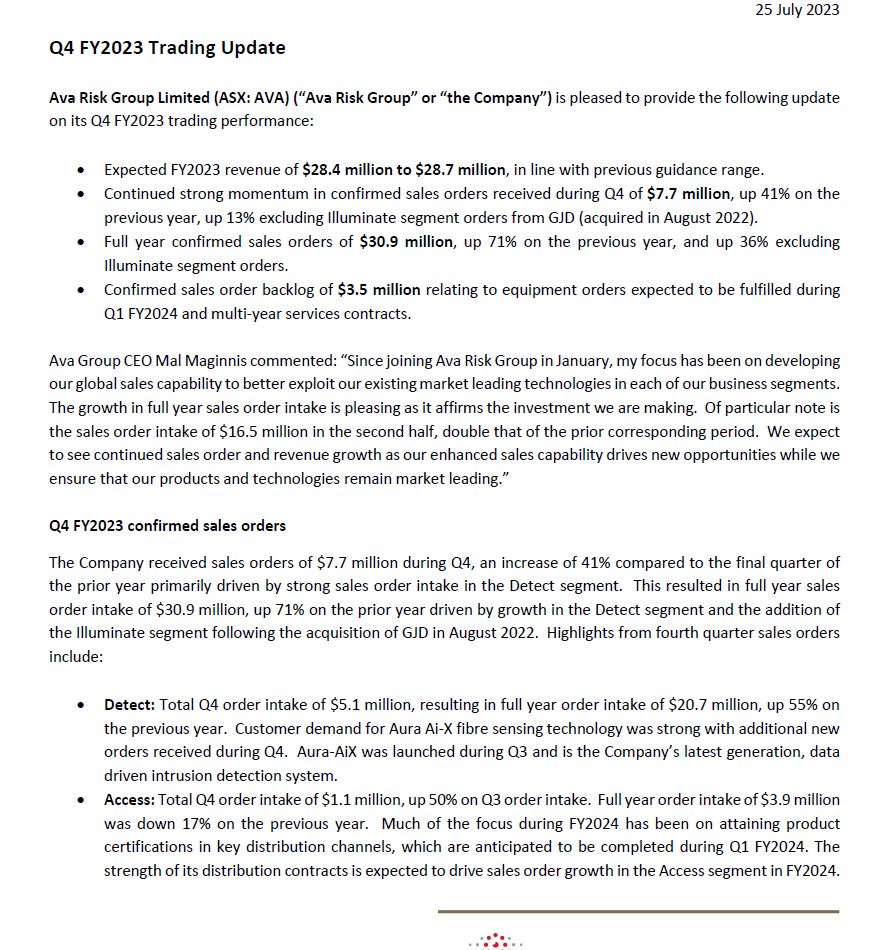

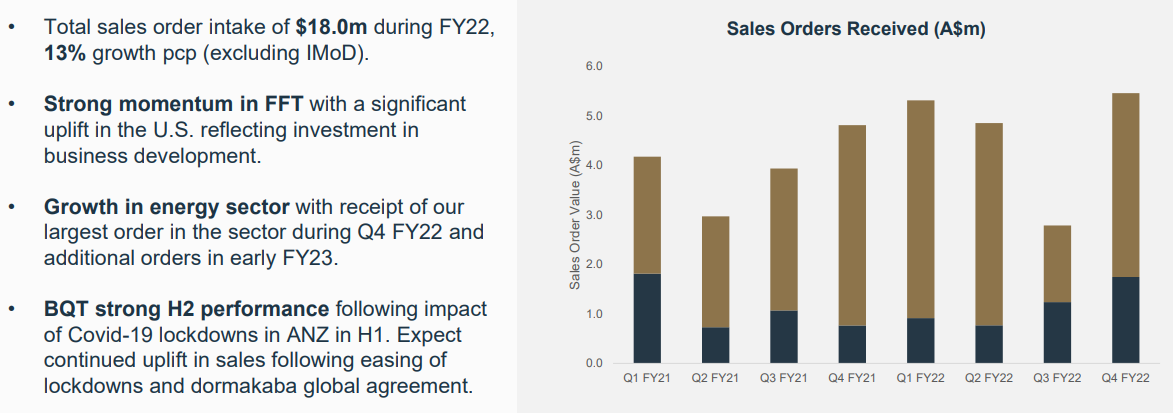

tl;dr -- It was a good final quarter, but H2 revenue was at the very bottom of guidance issued in April and FY revenue was up only 5.6% for the full year. EBITDA was positive (but unquantified) in H2, compared with -$900k in H1. Positioned well for accelerating growth -- according to the company -- but no guidance given at this stage.

Here's the key figures:

- Q4 sales order intake of $9m, second highest on record (pro forma), 50% above preceding quarter and 17% above previous 4th quarter

- The company brought in $35.3m in sales across the full year -- 14% up on last year

- The sales order backlog of $8.5m compares with $3.5m a year ago.

- FY24 revenue of $30.2m compared to $28.6m in FY23, representing growth of 5.6%

- At the end of Q3 in April, they said they were expecting $16-20m in revenue for the second half. Given they did $14.2m in H1 revenue, the result was at the very bottom of the range

- Telstra supply agreement disrupted a bit by restructuring within Telstra

My view: good to see a decent lift in sales orders and the partnerships with some big clients seem to be progressing well. Nice to see some cross-sell wins, and extensions to previous contracts. But material growth remains elusive.. Still, at 1x revenue (pre market open) it's not exactly priced for much growth. With the *potential* for good operating leverage, and some major trials in the pipeline, FY25 could be the year we finally see some good earnings growth.

If not, I'll concede defeat and move on.

AVA has managed to scrape into it’s FY24 sales guidance of $30.2-34.2m (Core Revenue) with $30.2m… wow, some sweety palms around the board room on that number. Was it luck, skill or creativity on interpreting sales recognition, not sure, but the order back log lifted from $8.3m last quarter to $8.5m, which suggests that sales flow is solid even if there was some pull forward.

Order intake (the key KPI other than sales) bounced back to $9.0m for Q4 following the dismal Q3 of $6.8m which was probably the best news. Also good to see was that Detect made up a solid $6.5m of that, being the highest margin part of the business, it’s growth is the real driver of profitability.

On profitability, well not quite, positive EBITDA in H2 tells us that full year will be negative following -$1.1m EBITDA for H1 and I am sure that had the full year figure been positive Mal would have let that little factoid slip! The last item on the Strategy & Outlook is a nod to profitability “Scalable cost base generating positive EBITDA”, I just hope this isn’t in priority order.

Updates on the UGL contract suggest positive credential outcomes in receiving Safety Integrity Level 2 (SIL2) certification. Important for this customer and possibly opening up others.

The Telstra supply agreement was disrupted “slightly” by their restructuring (mass sackings), which has just plan killed deals in other companies I am connected with, so it’s nice to know that it’s still progressing.

So, in all, it’s a bit of a relief of a result from my point of view, if sales order intake had been under $8m and they hadn’t just scrapped into their FY target sales then I would have considered my investment to be under major threat. Jury is still out, but this is a step in the right direction.

The market will be voting on the result shortly so grab your popcorn…

Disc: I own RL+SM

A new contract win. Not a lot of detail, but the ASX announcement is here

AUD$700k isn't huge, but not insignificant either. The more interesting thing is that the counterparty -- Johnson Controls Inc -- is quite a big company. It's listed on the New York Stock Exchange under the ticker symbol JCI, and valued at $45 billion.

From what I can see, it is extensively involved in the management and security of various types of critical infrastructure, including electricity substations. But I cant find an exact number. The related segment generated around $2.8b in revenue in FY23, so I assume it's a lot more than the number of sites associated with the AVA contract. Moreover, it looks like they manage a significant portfolio of infrastructure assets and buildings.

Johnson Controls manages a large portfolio of buildings and infrastructure, with a substantial focus on security. The Building Solutions segments contribute significantly to the company's revenue, driven by a wide range of security and building management products and services.

If they like what AVA provides, there is potential to substantially broaden their use of the Aura tech. And it seems there's an increase in intrusion and vandalism at sites across the US.

I wont extrapolate too much, maybe this is just a bespoke, one-off type deal. But it's encouraging.

The market, of course, is like "meh" :)

@Strawman personally I think the SP is loss of confidence in management although tax loss selling might be part of it… what would help is management loading up on cheap as chips shares to show a bit of confidence and skin in the game! If they don’t buy in at 1 x sales, why should anyone else?

Blimey -- AVA really can't catch a bid.

It's very thinly traded, so maybe I shouldn't put too much weight on the drop today, especially in the absence of any news (at least any that is ASX disclosed).

Anyway, shares are basically trading on 1x sales! And that's with the business reaffirming guidance at the latest quarter for a 20% lift in H2 sales (at the midpoint) and positive EBITDA. Not to mention the much touted operating margin expansion Mal reckons he can deliver.

This thing is either super cheap, or management's grand plans are built on nothing but unfounded hopium..

Time will tell, but I'm continuing to hold for now.

The SPP has closed oversubscribed ($1.34m Vs $1.0m) and the board has decided to allow for that oversubscription rather than scale back, which is good.

However, they only needed 34 shareholders taking up the maximum $30k for the SPP to be fully subscribed, so while I welcome the fact AVA got the cash they need, it's not a massive vote of confidence. It also helped that trade in shares bottomed at the $0.13 price (only a few trades below this), they would have struggled if the share price fell below it for even a few days while the SPP was open.

Conclusion - ok support at $0.13, company has a little more cash than they say they need and now the market can get back to thinking about the real value of the company rather than anchor on the SPP price.

Disc: I own RL+SM

Agree @Strawman, it’s a mixed result.

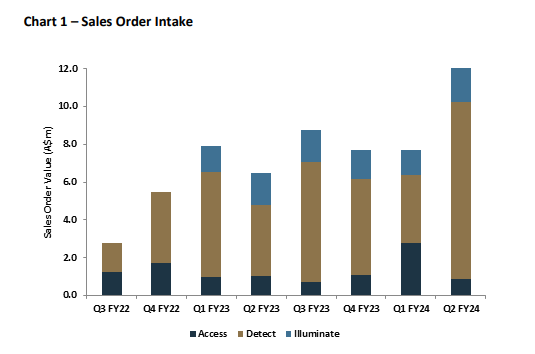

I was very disappointed at the sales order intake which is the guide we have been told they use and should use. The emphasis on YTD order intake is a disturbing attempt to distract from the quarter on quarter drop from 12.0 to 6.8m or -46% and on a 12 month rolling basis the growth is 11.4% which is below the YTD comparative of 15% but I will note that previous quarterly updates have focused on YTD, so it is at least consistent.

After I got over the initial shock in the drop in order intake I checked the chances of them reaching the target $16-$20m in sales for the half and hence reach their FY24 $30-$35m target range and it looks possible. Given order backlog only dropped $0.6m in the quarter ($8.9 to $8.3) then Q3 sales should be $7.4m (0.6 order drop plus 6.8 new orders), leaving $8.7m in sales required to hit the $30.4m bottom of the guidance range.

If the estimated $5.3m of open orders expected to land in Q4 happens this leaves $3.4m of new orders required in Q4 that are filled in Q4. This seems reasonable and the $8.7m sales in the quarter is not much above the previous 2 quarters of $8.3m (Q2) and $7.4m (Q3). Its a step up from $6.0m in Q1, but if they have the momentum they say they do then it’s not an unreasonable expectation.

It’s going to be lumpy, no illusions on that but the play book seems to be in tacked and as such will participate in the SPP.

Disc: I own RL+SM

Not a terrible Q3 update from AVA, but not great either.

Sales orders are up 15% comparted to the same time a year ago, and they have $8.6m in order backlogs (2/3rds will be converted to revenue this financial year).

The company still reckons it will do $16-20m in H2 revenue (the wide range due to the timing of project delivery). They did $14.2m in the first half of FY24, which means the full year figure will be between $30.2m-$34.2m. That's exactly what their 3 year outlook calls for, and the outlook is unchanged from what they said in March.

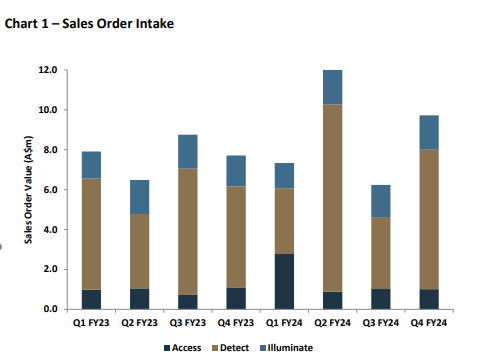

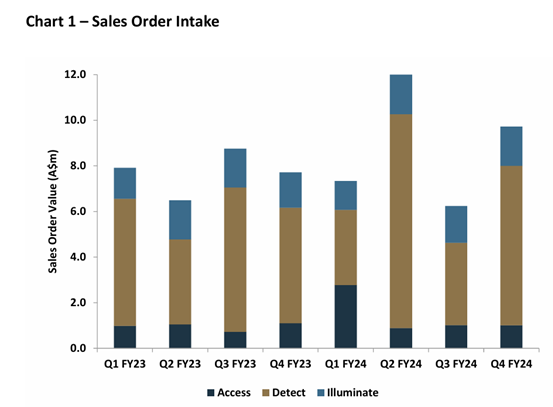

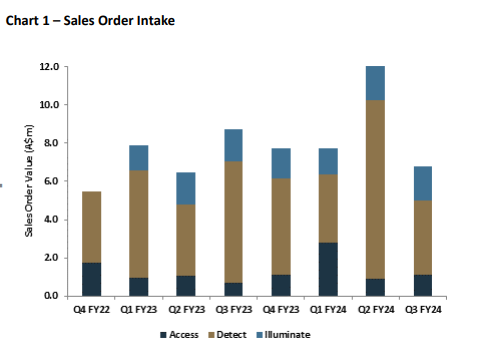

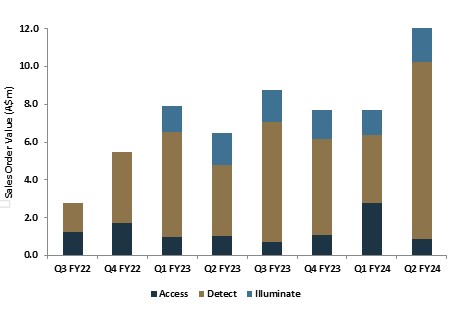

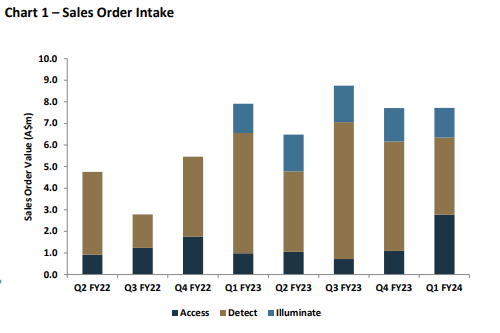

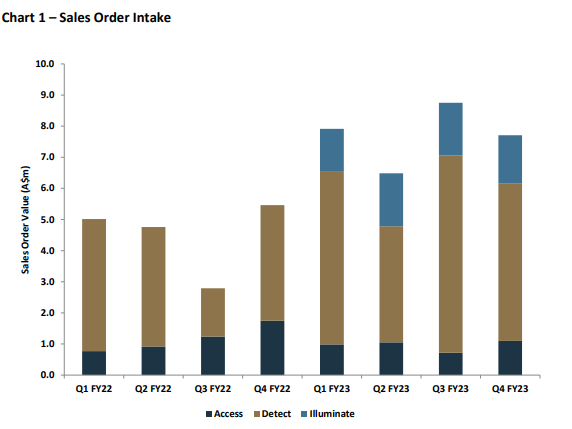

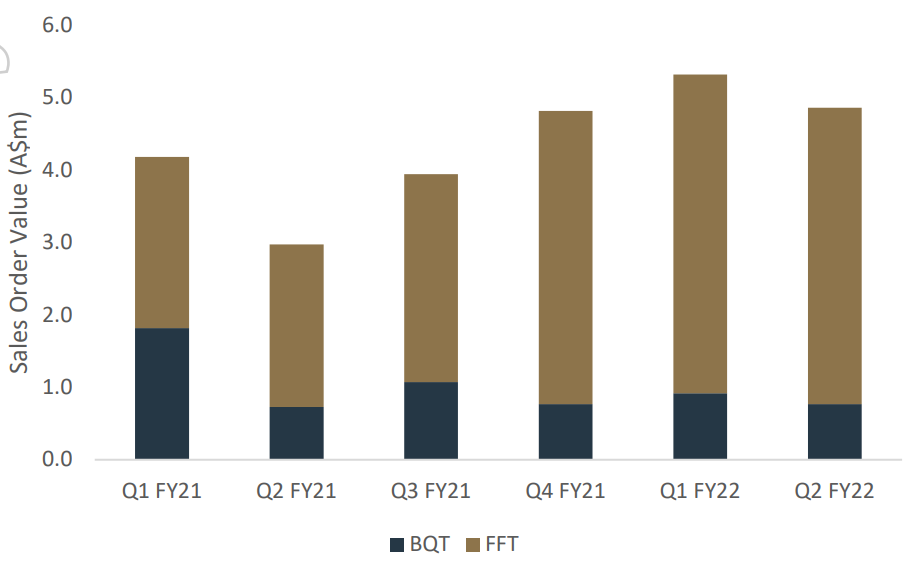

Still, this picture is worth a thousand words:

Growth may be 15% for the FY-to-date in sales orders, but it was Q2 that did all the heavy lifting, and the most recent quarter is down on what they did in the previous corresponding period. Detect was underwhelming due to project timing, and Mal said he expects to finalise various opportunities in the last quarter.

So, it's great to see they are on track to hit their guidance, but what we really need here is an acceleration in sales. You have to give some slack for the variability of revenues, but the market probably wont move much until there is some very clear evidence of growing traction.

[HELD]

Investment Thesis

AVA Risk Group is a tiny Australian company selling leading security solutions globally, with three product segments that offer integration and cross selling it has a highly scalable business opportunity of the existing operating base and with a new sales-oriented CEO and structure that is starting to see traction as it enters a growth phase on a global scale. The Detect segment presents the outstanding opportunity, with high margins and SAAS like flow on revenue component and possible licencing options, the growth opportunity and leading AI tech allows for rapid capital light scaling of the business and significant operating leverage if the go to market execution is done well.

The current value doesn’t factor in the growth and operating leverage opportunities with the market highly sceptical of planned growth. If the company executes at the low end of expectations a value 3.1x current price ($0.13) and 5x at the high end offers an asymmetric outcome as diversified sales channels and ability to scale down operating costs provides downside protection.

Factors in thesis:

· Sales Restructure: Move into a focus on sale of the products developed, integration of sales channels from 3 product focused businesses to a single business in 4 regional groups. Focus on sales numbers and results to promote. Opportunities in Australia and UK where presence is soft, US large opportunity (Jim Viscardi), Europe opportunities.

· Product scalability: Sell what we make – don’t bespoke, Rod Wilson (CTO) – integration platform the three business solutions, commercial team working on integration with external products also. R&D spend is ongoing, but focus on scalable products.

· Technology: solid, Machine Learning (AI) continuing, the Aura Ai-X solution provides a market leading solution and is based of internal data for ML/AI continued improvement in ability to detect with minimal false alarms.

· Capital Raise: 3-4m raise to provide working capital for growth is needed given the high growth rates targeted. Low net debt (400k) is preferred, but access to debt at reasonable rates is limited due to the geographically dispersed nature of the business operations and sales. Working capital management will need to improve even with the additional capital.

· Management: Good pedigree but relatively new and only just starting to show some wins in terms of contracts. Projected sales targets have slipped (walked back) – taking this as a reflection of new management enthusiasm and implemented changes taking more time to flow through to results than expected, but further slippage will be an orange or red flag depending on circumstances.

· Metric: Growing sales order intake and ultimately revenue will tell me if things are on track and is what management are focused on. Provided margins hold up and opex only increases in low single digit %, then things are working as planned. Working capital and cash are important, but from a capital management point of view, so I am giving them some rope in the short term and wouldn’t freak out if another small cap raising occurred next year if it was just to support WC for rapid sales growth.

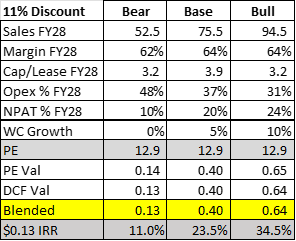

Valuation ($0.40)

The bear case ($0.13 & 11.0% IRR) valuation looks at what justifies the current price, with the business significantly underperforming it’s FY24 to FY26 financial targets to provide an 11% IRR which is equal to the discount rate used.

The base case ($0.40 & 23.5% IRR) assumes the FY24 to FY26 financial targets are meet at the low end of guidance while the bull case ($0.64 & 34.5% IRR) assumes they are meet at the high end of guidance.

Management expect GM% to be able to reach 65%, which if the Detect segment continues to dominate sales is quite reasonable, but the valuation is based on 62-64% margins.

Management also anticipate operating expenses to remain relatively flat for a few years until they need to step up again to support additional growth. This is included with Opex as a % of sales dropping sharply from 77% in H1 FY24, operating leverage is a key value driver with sales growth.

The vast amount of capex is for intangible assets, this along with working capital requirements will have a significant impact on free cash flows for the next few years until operating leverage is able to outweigh them with sales growth. Due to this and currently being in losses, the value is based on cashflows several years out, so interest rates movements will amplify market valuation ranges for the next few years.

Comment

I have held AVA since 2021, attracted to the FFT product (now Aura Ai-X) and the opportunity it offered as a high margin and scalable business, which only now seems to be getting the traction needed and under a new CEO. The delayed sale of the service division and it’s gross windfall for management at the expense of shareholders was a disappointment, but it’s low margin and ability to use the sale to focus on and further develop the Aura product was, in my view, a good strategy. The services business was security transport, not asset protection, so didn’t fit into the product portfolio like the current products do and offer cross selling opportunities.

No one likes a capital raise, but this one is needed and it has given me the time to think deeply about the business and not rush a decision. I have done a small top up at $0.13 in case the share price is well up on close of the SPP and it’s over subscribed. I intend to subscribe, but will keep my mind open and consider other opinions until the close, plus buy if the price drops below the offer.

Disc: I own IRL & SM

Cap raise inbound!

Let's wait until we see the details, but i suspect the cost of capital could be up there. And if it's just for 'working capital purposes it's more difficult to swallow. Perhaps another situation where a line of credit would be more appropriate? Anyway, getting ahead of myself.

We will see.

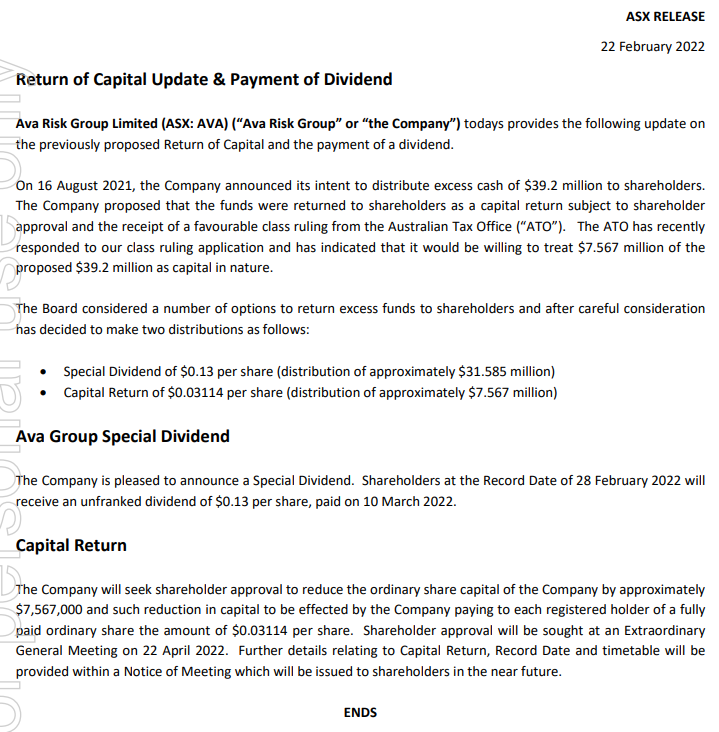

AVA in a trading halt prior to cap raise, it is absolutely absurd capital allocation to pay a meaningless dividend and then raise a couple of months later....will be very interested in the purpose....it better be a good one or this will go on the exit list for me (despite all the promise of a really good product offering)

The Good

- Sales orders up substantially on prior quarters to $12m. This annualises out to $48m which indicates that if sales can be maintained then revenue forecasts for FY25 are achievable.

- Wide range of projects signed over the quarter which is a positive for the technology base, in particular, Aura Ai-X.

The Not So Good

- Illuminate unit still struggling to show growth, Q2 slightly up which is potentially showing signs of turning.

- H1 revenue of $14.2m is flat over the last several periods, however, it was within the guidance range provided.

- Costs increased against this, which has resulted in a $2.3m loss for the half.

- The cash position at the end of December was precarious with only $1.78m and a negative free cash flow of $3.5m for the half. Unless there are some payments coming in, money will be running out very quickly.

Watch Status

- Neutral - Negative financial offset by slight improved outlook

Valuation Status

- Increased chance of Bear Case. Need to review forward revenue projections to better align with management forecasts

What To Watch

- Further details on sales commitments from the Telstra Agreement. Telstra has a large network of assets that could be protected by AVA products and this is AVA’s first with a telecommunications provider.

- New LoRa product to be launched in H2FY4 which may provide a boost to sales orders.

- H2 revenue guidance of $16m to $20m. Order backlog of $8.9m with $6.8m set to be delivered over CY24.

- Management is confident of improvement in the Illuminate division in H2FY24. (This has been reported previously)

A good part of today's results were known, following the company's Q2 update less than a month ago.

The best parts being strong sales order growth of $12m in Q2. (And I guess the company reckons this is a pace they can maintain given they thought to annualise this in today's preso..) This has been underpinned by some large value contract wins, and there's a healthy sales back log to give some confidence in a decent second half.

The recent Telstra deal was highlighted, and although it was a botched announcement, it's clearly a deal with some interesting potential (albeit one that the company isn't able to quantify).

Still, the detect segment saw a decline in revenue of 8%, following a weak first quarter. As AVA said at the time, that was mainly due to some timing issues with bigger contracts in Q1, and we did see a very strong Q2 in this segment, but overall it was a weaker half compared to the pcp. AVA reiterated it expects a strong second half here. I hope so.

Part of the issue with AVA in recent periods is that one segment seems to always zig when another zags. And it was the Access segment that did all the heavy lifting this half, and that was largely an stocking event associated with the distribution deal with dormakaba.

But Detect is the biggest segment and that meant total EBITDA dipped back below neutral and continued R&D and inventory expansion saw a $1.8m drop in cash -- there's now only $1.8m in cash left. They said the cost base will stabilise at the current level, but the risks of a capital raise are perhaps higher than I first expected.

The biggest new news for me was a revised 'outlook' scenario, which they have now aligned with financial years.

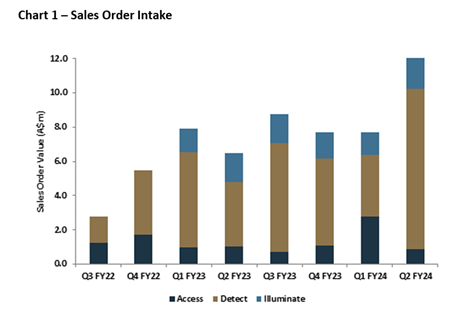

Before it was this:

Now it is this:

So essentially the same, but clearly the real expansion in operating margins is not expected to start showing up until FY25.

Using the mid-points above, you get only a 5% EBITDA margin for FY24, and basically nothing at the lower end. Yes, things start to look very good after that, but they're basically saying to not expect much this FY. Beyond that, you just need faith these targets are somewhat reasonable.

Maybe they are, and I'm sure they're put forward in good faith, but until we see good evidence in the financials there's a good amount of faith that is required.

Later in the deck they again reiterate the target for $70-100m in revenue over the next 3 calendar years, with minimal cost increases. And given what they have above for FY26 ($57 -- 71m), and with a good chunk labelled as 'adjacencies' (ie. currently untapped applications of their products), I'm a bit nervous there's a fair amount of "hopium" in managements outlook.

Maybe they're right to be optimistic, and there really is good growth in sales orders, but we're yet to see this translate into anything exciting in the statutory numbers.

There is potential for some acquisitions to help the company reach it's goals, and that can be good cover for a capital raise, but this type of growth isn't always accretive to shareholders and has all kinds of risks. I don't think their GJD purchase is doing much for them yet.

There's clearly some big potential for AVA, and I know that building the foundations for growth always take longer than you think to build, and for that to deliver accelerating sales traction, but this one really is testing my patience. Especially with some recent communication blunders.

Hopefully we can get a better picture of things when we speak with the CEO next month.

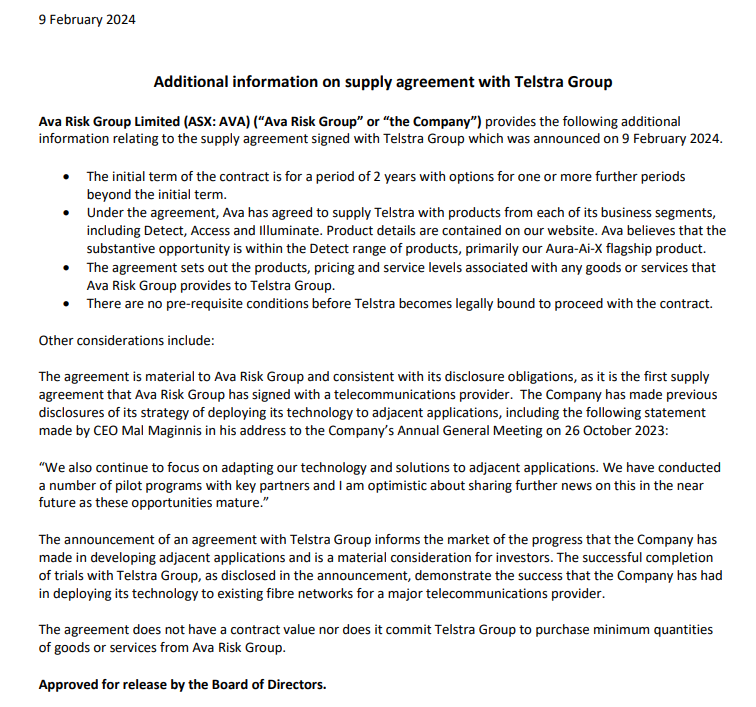

Not a lot of extra info here:

All we can surmise is that the contract is "significant". But it seems there is no minimum spend, and AVA are at pains to avoid mentioning any specific financials.

Maybe there are some commercially sensitive aspects to the deal, but this is frustratingly vague...

AVA has signed a major supply agreement with Telstra, where it will provide its tech to monitor the group's fibre optic network.

AVA will connect its tech to parts of Telstra existing fibre optic network -- effectively making the cable one giant sensor that can be used to monitor and protect the network.

No financials given, other than Telstra has 650,000km of cable. It seems installation should be reasonably easy and low cost -- you're basically adding some detectors to existing cable nodes.

The deal comes after a 10 month of collaboration and trials, and open up a new and significant market for AVA (there is 5 billion km of fibre cabling globally).

So it feels like this is big news, but can't really say for sure without knowing much about the commercial terms. We have a meeting with the CEO in March, so hopefully get some more detail then.

[HELD]

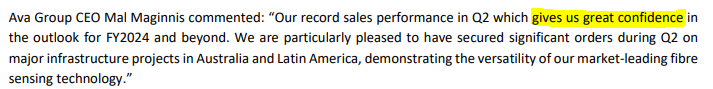

You beat me to it @Bear77 -- agree the update is generally positive, and while we need a solid second half for the company to land in its targeted revenue range ($36-45m), they seem to be suggesting that is very much in play with a "substantively stronger" second half. In Mal's words:

They'll need second half revenue of $22m to hit the lower end of their target range.

In the first half they have secured just shy of $20m in new sales orders (37% growth), with the second quarter representing 61% of the first half total and representing yoy growth of 39%. There's $8.9m in backlog to be fulfilled this calendar year, most of which is project delivery work -- this compares to a $5.2m backlog at the end of FY23.

This suggests (i think) that most of the sales order intake is converted to revenue relatively quickly (ie they added $19.7m in new sales orders in the 6 months to Dec 31, but the order backlog only increased by $3.7m. (someone please sanity check this assertion!).

Still, the reality is that H1 revenue is only 10% higher than H1 FY23, and is at the very bottom of the guidance they issued in October ($14.2-15.2m). The access segment had a great half but this was helped by stocking orders from their channel partners -- we'll need to see some good end-customer sales before we really know how their new Cobalt locks are being received by the market. And Illuminate was flat, albeit with a good improvement between the first and second quarters.

For me, the main game is with Access and Aura Ai-X, which has accounted for roughly 2/3rds of new sales orders. And they really do seem to be seeing some good sales traction there. Group targets aside, even if they 'only' get $18m in H2 revenue, that'll still be annual growth of 15% at the top line. (the previous second half did $15m in revenue, so I dont think that's too much of a stretch target)

Holding gross margins and fixed costs steady -- which is what management have essentially said to expect -- under that scenario you should still get an EBITDA figure that is more than double what we saw in FY23 (from cont. operations) and an operating margin expansion from 7% to ~12%.

The market obviously remains somewhat sceptical (if it wasn't the share price should be easily above 20c imo). But for me I consider the thesis still on track and shares good value. The next 6 months will be telling.

AVA today announced, after market close, that they had won a number of important contracts relating to its fibre sensing business.

In aggregate, it says it is expecting more than $10m in sales orders for Q2, which would be a record for the company and a big improvement on the $8m-odd generated in Q1.

Maybe this will help shake shares out of their malaise when trade resumes tomorrow?

ASX announcement here:

multiple contracts won for ava risk groups aix fibre tech1703050260pdf.pdf

Valuation purely numbers based - upside here could be 15%+ growth in sales over the long term. I think worse case scenario would be at least half that, my numbers saying 6.5%. Split the difference at 11% gives my current valuation on P/S.

52-week low today.

I think it's pretty indicative of the current small-cap space sentiment that any neutral or mildly positive news is taken as negative and incredibly suspicious by the market.

That other "though shall not be named" investing forum that rhymes with "big bopper" seems like it's going to spontaneously self-combust any second due to other-worldly level negative vibes.

Management of a lot of my portfolio such as AVA are desperately awkward trying to navigate announcements through this sentiment/minefield and are cocking up communication strategies compounding the whole vibe.

Maybe they should all just release quarterlies and nothing else.

Takes about one second for any announcement to be turned toxic by the mob.....lol.

#merrychristmas

This is a bit better -- a $2-3m contract with UGL Ltd for the groups Aura Ai-x product. It includes a 2 year support services agreement and is for a Sydney transportation project.

ASX announcement link here

Barely warrants a post, but AVA have announced a 5 year support agreement with Sydney Trains valued at $500k.

It's associated with their perimeter detection product, which Sydney trains have been using for some time already.

So it's good they extended the agreement, it's nice to have recurring revenue locked in (and I'm sure it doesn't take much work/cost to deliver on given the nature of the product) but it's very small in the grand scheme of things. Will need a lot of these kind of deals if they are to get close to their aspirational targets.

The announcement was marked as market sensitive, which I thought was a bit odd. It feels too small a contract to be sensitive, and if it is, I'd have hoped to have seen a lot more of these sized deals announced!

Have been away from me desk all morning, but I got an alert while I was on the go that Ava's first quarter update was out. A quick check of the price (as you do) and saw it was about 5% higher -- "must be good news", I thought!

Anyway, just got back in the saddle to have a look at the update and noticed the price is now down 7%.

Not sure how many times I need to be reminded how irrelevant the market price signal can be for small, illiquid stocks. In this instance (at the time of writing) we're talking about a price move that has been affected by less than $50k worth of trades, and where the high and low of the day ranges from 19c to 21.5c

Anyway, having now read the actual update, and thought for myself (as opposed to letting the market tell me what to think), I think the news is respectable.

I'll let you read the finer details yourself, but the big picture takeaway for me is that although sales order intake was basically flat ($7.7m vs $7.8m in the pcp, and $7.7m in Q4 FY2023), the Access segment (locks) finally saw a good bump as product certification was received for their Cobalt Lock range and Ava's partner Dormakaba stocked up, and the contraction in the Detect segment (fibre optic perimeter detection) was seemingly a timing issue with new orders expected to close in the current quarter.

(The illuminate segment was again disappointing with AVA again citing difficult economic conditions in the UK. The expectation is for FTY growth here -- we'll see i guess)

So adding that all together, the revenue outlook for the first half is for $14.2-$15.2m, an 8% lift on H1FY23 at the midpoint.

What we really need here is for all the segments to fire at the same time -- But it seems one always seems to zig when the others zag. As Mal told us earlier this year, this is a lumpy business.

Nevertheless, Ava seems to be winning new customers in the detect segment, they now have new products and distribution in America and Europe and, for what it's worth, management remain very optimistic for the full year:

"..management expects that second half revenue will substantively exceed the first half."

Take from that what you will, but given the margin assumptions AVA have previously released, it looks very likely that they will at least double FY23's EBITDA. Frankly, with FY revenue of $35m and a 14% operating margin, EBITDA could grow by 150% or so.

Anyway, thesis seems to still be on track.

HELD.

Another contract announcement for Aura Ai-X

Relatively small (A$1m), like the one announced recently, but great to see some traction for the product since its launch 6 months ago.

Held.

I went to update this valuation too but on re-reading it, I don't think my view has changed much, other than the recent results acting to strengthen my conviction a little.

Normally, I'd be tempted to increase some of the estimates, but given the current price (18.5c!!), the fact is shares are already well below what I think is fair value.

So I'm basically going to hit 'update' and leave it at 30c, again.

Original text from Feb '23:

>

11 months ago i gave AVA a valuation of 30cps, which assumed FY25 revenue of $40m and a 20% EBITDA margin as key inputs.

Last month AVA provided this as a "pathway" for the next three years

.. aspirations are great and all, but it's worth remembering that things don't always go to plan. But, as an exercise, I took the lower end of all assumptions (and the higher end of cost estimates) to get this:

Note that this gets you to only a 17% EBITDA margin, vs their target of 25%.

Still, IF they do that, you'll get a 15% annualised annual return from current prices (20.5c) so long as shares trade on at least an EBITDA multiple of 7x (that'd roughly be a PE of 15 or so) in 3 year's time.

(If you wanted to take the upper end of their forecasts, you get a FY26 EBITDA of $41m -- but I wouldn't be comfortable basing any valuation on that)