AVA has managed to scrape into it’s FY24 sales guidance of $30.2-34.2m (Core Revenue) with $30.2m… wow, some sweety palms around the board room on that number. Was it luck, skill or creativity on interpreting sales recognition, not sure, but the order back log lifted from $8.3m last quarter to $8.5m, which suggests that sales flow is solid even if there was some pull forward.

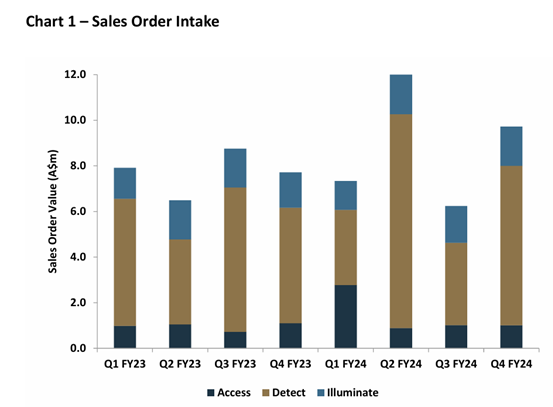

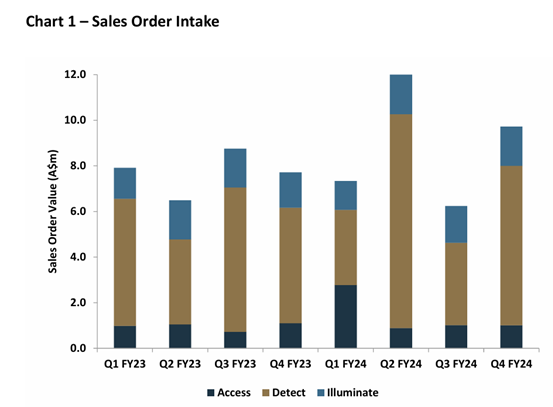

Order intake (the key KPI other than sales) bounced back to $9.0m for Q4 following the dismal Q3 of $6.8m which was probably the best news. Also good to see was that Detect made up a solid $6.5m of that, being the highest margin part of the business, it’s growth is the real driver of profitability.

On profitability, well not quite, positive EBITDA in H2 tells us that full year will be negative following -$1.1m EBITDA for H1 and I am sure that had the full year figure been positive Mal would have let that little factoid slip! The last item on the Strategy & Outlook is a nod to profitability “Scalable cost base generating positive EBITDA”, I just hope this isn’t in priority order.

Updates on the UGL contract suggest positive credential outcomes in receiving Safety Integrity Level 2 (SIL2) certification. Important for this customer and possibly opening up others.

The Telstra supply agreement was disrupted “slightly” by their restructuring (mass sackings), which has just plan killed deals in other companies I am connected with, so it’s nice to know that it’s still progressing.

So, in all, it’s a bit of a relief of a result from my point of view, if sales order intake had been under $8m and they hadn’t just scrapped into their FY target sales then I would have considered my investment to be under major threat. Jury is still out, but this is a step in the right direction.

The market will be voting on the result shortly so grab your popcorn…

Disc: I own RL+SM