Preamble

A really interesting business with interesting technology and run by managers who put shareholder interest first. To top it off it is a small-cap with a market cap of around $100M. Very unusual behaviour from a small-cap to not sacrifice capital for all outgrowth. In fact, they are doing the opposite by returning capital back to shareholders via share buybacks & special; dividends.

What do they do?

Actually surprised no one articulated their offering but what they actually do depends on which industry their customers operate. They provide solutions to protect high-value assets and critical infrastructure. The business is currently structured under 2 divisions: Future Fibre technologies and BQT Solutions.

Future Fibre (Perimeter Security)

- perimeter intrusions (Military, Energy)

- pipeline intrusion (Oil & Gas)

- condition monitoring (not sure)

- data network protection (Energy & Telcom)

BQT Solutions (Access control solutions)

- Access control readers, high-security locking, custom encryption, biometric solutions (These would be industrial-like office buildings)

- Smart door lock companies like Dormaka & Assa Abloy signed the contract with Ava Risk for US and European markets.

Can you predict revenues with confidence?

Very hard to predict, I would say impossible. That is a concern as revenues are contract dependant and unlike SaaS businesses where you can track ARR with a high degree of confidence where churn rate < revenue growth rate, Ava's revenues are unpredictable. FFT is the main revenue driver for the business which means there is potential upside in the BQT division not reflected in current financials.

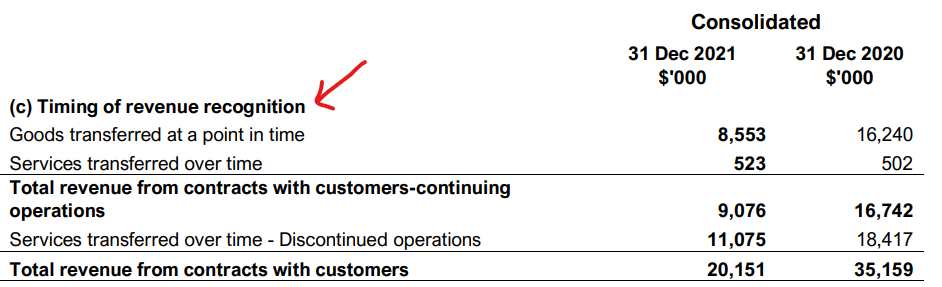

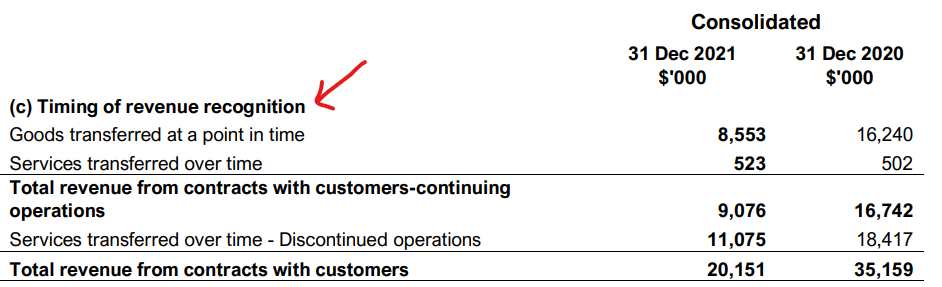

Speaking of financials, you have to dig deep in the Appendix to see the revenue breakdown and how the accountants define revenue. In the previous half-yearly report, we saw nearly all of the revenue recognised at the point of time and not spread out like in a SaaS contract.

What would be the investment case?

Entrepreneurial management with a track record for generating shareholder wealth. They sold the services division at multiples of revenue after growing the business internally for many years.

They provide solutions to critical assets that are mandatory for operation. The business does not operate in demand cycles when they win the contract. However, the time to win the contract varies. Ava's customers do intensive QA & tests before deploying solutions to their operations. The contract is not signed until they can successfully integrate. The time for that to happen varies between customers. The thesis is that when Ava wins a contract they are in and very hard for the customer to say no as switching costs is inconvenient from an opportunity cost perspective.

The solution according to Ava is scalable, I can't see it in the financials so far but these guys are entrepreneurs, I don't doubt management. I believe Ava is saying from a hardware sense they are scalable but they could also say it from a software angle.

Their client base is impressive and we are talking about a small-cap company:

Concluding thoughts

Asymmetric upside but the financials look patchy from a YoY basis as some revenues are recognised while others get recognised in the subsequent financial years. In saying that, these guys are business builders and I don't think investors give them credit for what they do (growing from scratch). They could have rested with $55M of cash but they decided to return that capital to shareholders and start again. Entrepreneurial grit.