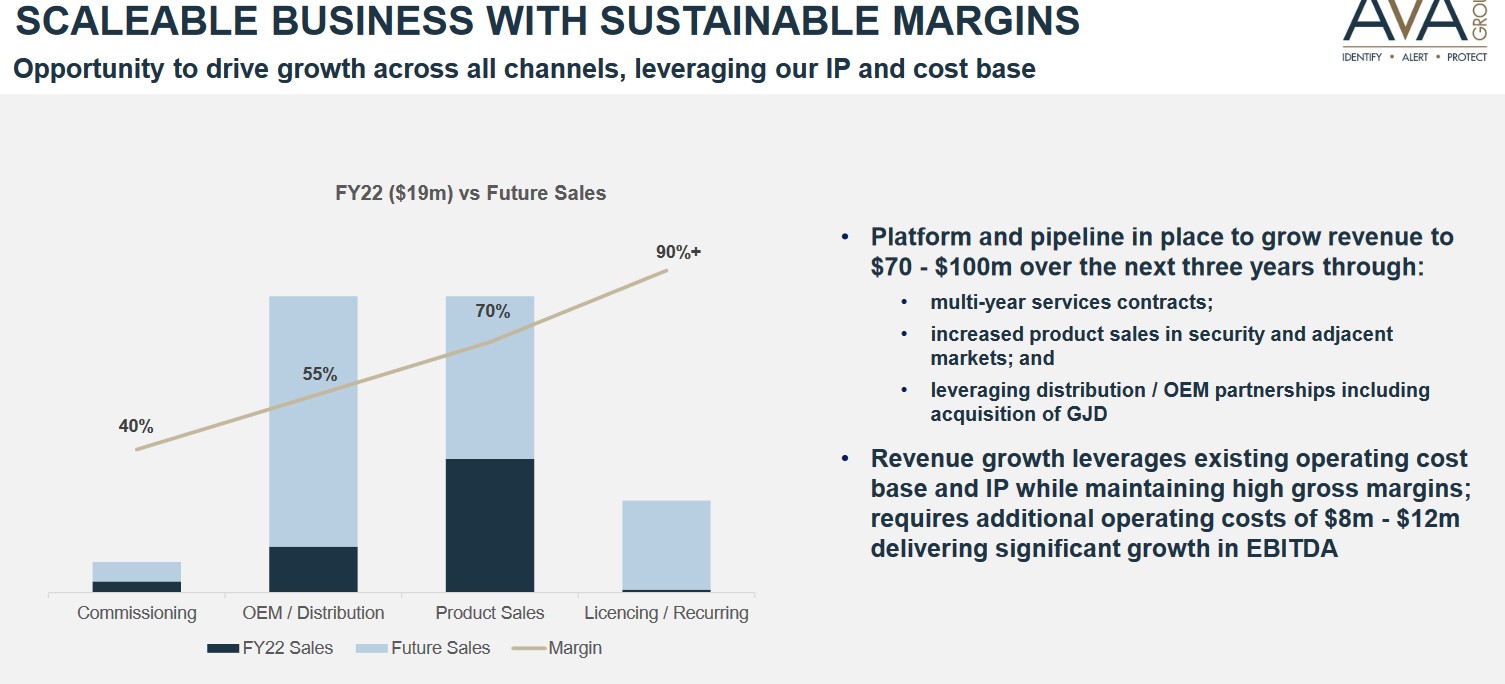

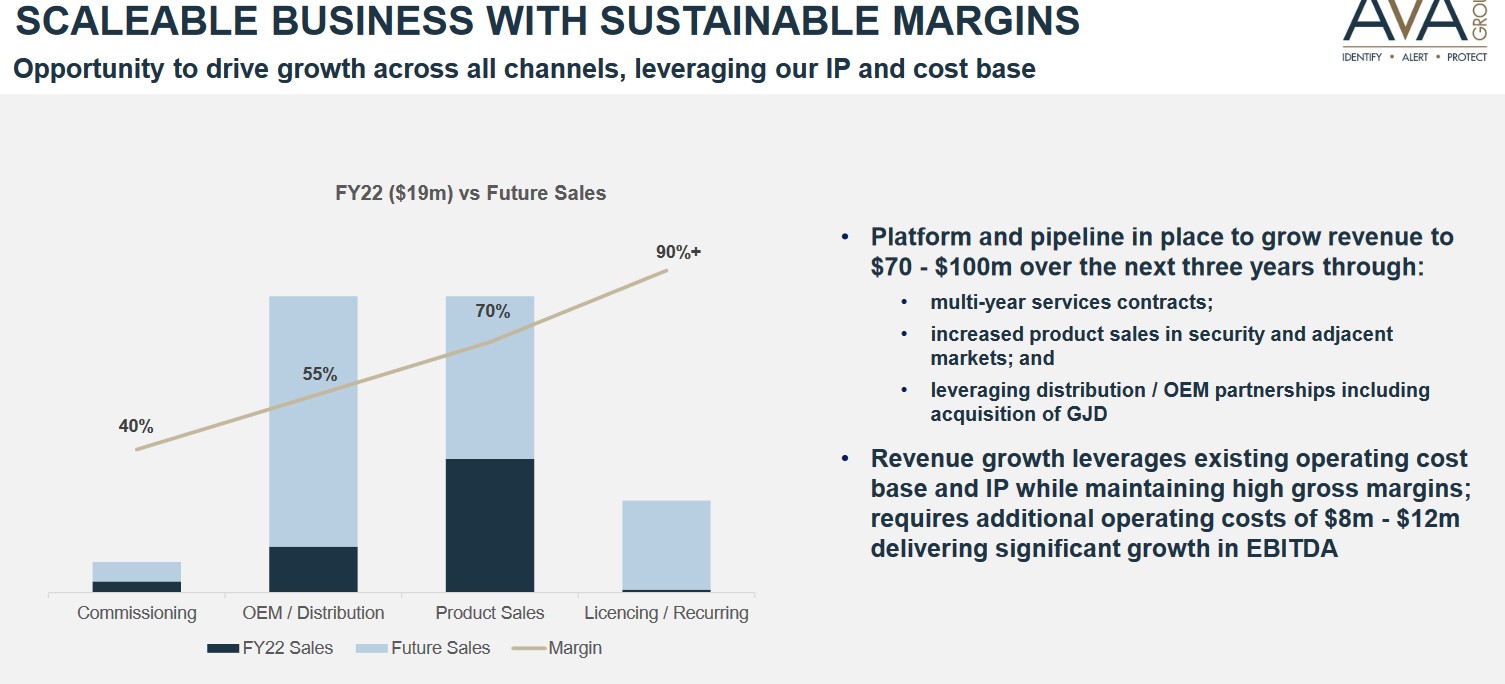

I first came across AVA through strawman, and really only got properly interested after the recent company meeting a month or so ago. My interest and valuation revolves around this slide and the associated commentary from management about their buisness units. They think they can increase revenue by 2-300% while only increasing the costbase by 50-70% over the next 3 years, if they can do that then they should be worth a lot more in the future than they are now. But the question is how much more!

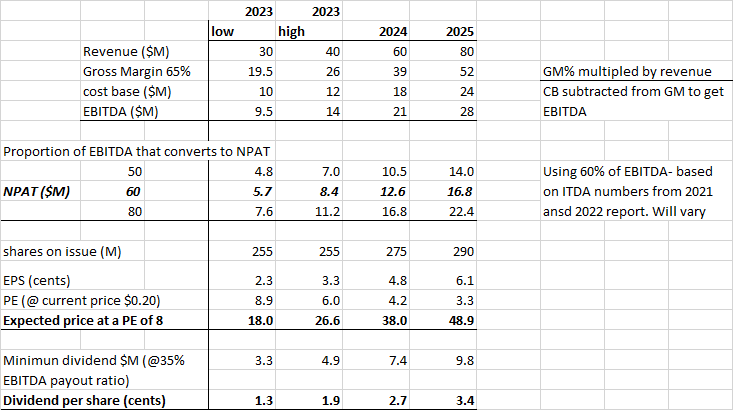

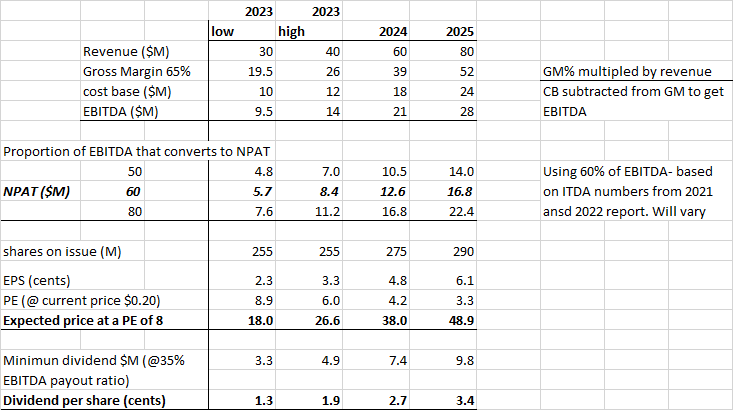

So far for FY23, they have upgraded guidance for H1 for revenue to be between $13-15M and have said that Q2 was better than Q1 and H2 is expected to be better than H1. So I am running a high and low scenario for FY23 - Low: $30M revenue and High $40M (probably a stretch but possible). Projecting further out I just guess $60M for FY24 and $80 for FY25 to be a bit conservative, but these are really just ballparks for now.

I am assumming a Gross margin of 65% (historically ranges between 65-75%) and their cost base to increase from $10-12M currently to $18M in FY24 and $24M in FY25. Closer to a 100% than the guided 50-70% increase to be conservative.

I have struggled to find what proportion of their EBITDA falls though to NPAT. From the 2022 annual report they have:

-$2.5M of debt and I am assumming 5% interest- so repayments come in at $125K/yr, largely immaterial to the calculation

-$17.5M unutilised tax losses are available for use. Based on them making $10-15M EBITDA then the tax bill will be around $3-4M, so will take a few years to use up the previous tax losses. They also have some foriegn tax credits ($10M) but I have ignored these for now.

-Depreciation and amortisation in 2021 and 2022 for the continuing operations was $1.8 and $1.7M respectively. I am assumming these will be similiar in FY23 and will scale at a similiar rate but will revisit this when the next report is released.

So from my best estimates in FY23 the ITDA should add up to be around $5M, based on what I think EBITDA will be means that to get from EBITDA to NPAT is between 50-70% conversion rate give or take, so I will just work with 60% for all years.

The numbers look pretty reasonable for 2023 and value really depedns on whether they hit the low or high side of revenue numbers. Going forward I don't have high confidence in these numbers but I think the ballpark they re in is about right and if they keep delivering in there day to day buisness units and also get a few more of the 90% margin licence deals to come in like they have spoken about then the 2025 numbers don't seem to crazy.

Maintaining costs and scaling revenue what a combo!

I would appreciate people tearing this apart and telling me why some of my assumptions or what I have done is garbage