31-August-2023: Money of Mine podcast: Why is the Chalice Share Price Down 30% in 2 Days?! | Daily Mining Show - YouTube

Show Notes: "Two big stories for us to pull apart today, Chalice and 29 Metals! We had Emanuel Datt of Datt Capital on for our Chalice segment, helping us get into the weeds on a range of aspects we found of interest. We also couldn’t help but discuss troubled copper miner 29 Metals, who have finally pulled the pin on a capital raise, 13 long days after denying the media speculation that a raise was imminent. "

CHAPTERS

0:00 Preview

0:58 Intro

3:37 Emmanual Datt & the Much-Anticipated Chalice Scoping Study

5:53 Breaking Down the Financial Assumptions

24:09 CHN being Western Aligned

27:43 What to look out for in Metal Equivalents

33:57 Top Tweets about Chalice

46:43 29M Raising $151m from Existing Holders

52:25 Analyst Questions from the 29M Investor Call

-------------------------------

DISCLAIMER

All Money of Mine episodes are for informational purposes only and may contain forward-looking statements that may not eventuate. The co-hosts are not financial advisers and any views expressed are their opinion only. Please do your own research before making any investment decision or alternatively seek advice from a registered financial professional.

-------------------------------

Source: https://www.youtube.com/@MoneyofMine

Disclosure: I do not hold CHN shares.

Further Reading:

Chalice Mining shares to move on PGE scoping study (afr.com) [Peter Ker, Resources Reporter, AFR, Aug 29, 2023 – 6.27pm]

CHN ASX: Tim Goyder says slump in Chalice Mining shares is an over reaction and the market needs to ‘get real’ (afr.com) [Peter Ker, AFR, Aug 30, 2023 – 12.58pm]

Tim Goyder, Chalice Mining’s largest shareholder, says a slump in the critical minerals explorer’s share price is an overreaction by a market that wants “a bed of roses” and needs to “get real” about long-term value.

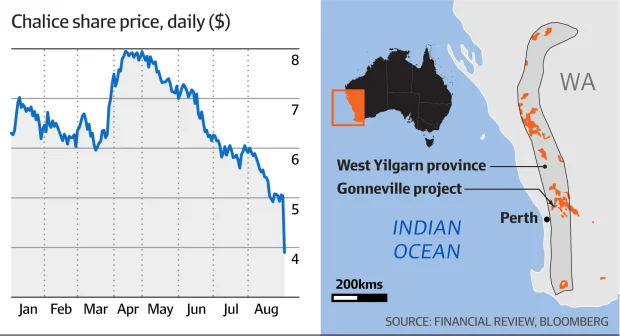

Chalice shares fell more than 25 per cent to $3.77 on Wednesday – the price has more than halved in four months – after investors were disappointed at the results of a long-awaited scoping study into its Gonneville project.

Tim Goyder is a major Chalice Mining shareholder, and a large investor in lithium hopeful Liontown Resources. [Photo: Trevor Collens]

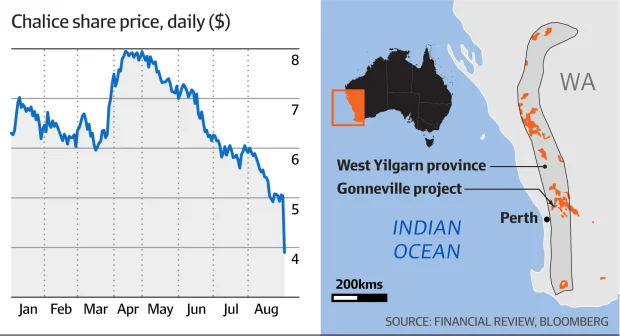

Gonneville has been touted as one of Australia’s best critical minerals discoveries for its platinum group elements, nickel and copper, but investors were underwhelmed by Chalice’s promise of a two-year payback on a mine costing between $1.6 billion and $2.3 billion.

Investor concerns were focused on the lower-than-expected rate of nickel recovery forecast by the study, capital spending that was higher than some estimates, and the fact Chalice has based its economic forecasts on commodity prices well above current levels.

But Mr Goyder, who is also chairman of lithium hopeful Liontown Resources, said he expected Chalice shares to recover within six months.

Chalice does not expect to be selling metals from Gonneville until 2029, and Mr Goyder said in that context, the company’s adoption of high commodity price assumptions was a case of “damned if you do, damned if you don’t”.

“If you believed consensus everywhere, you wouldn’t start anything. You wouldn’t even start exploration,” he said, adding that like Liontown, Chalice shares endured extreme volatility every time there was a market update.

Chalice has a market capitalisation of $1.5 billion; Liontown, where Mr Goyder is a 15 per cent shareholder, is valued at $6 billion.

“With a longer-term lens on, I believe the short-term aberrations of the market are really overdone,” he said.

“In the clear light of day any of these projects are so hard to find and the true value will come through. Everyone has gone very short term on their views on capex. They want a bed of roses with everything they touch, it is short-termism. The market has just got to get a bit real.”

Palladium is expected to provide about 55 per cent of revenue from the mine, and Chalice’s study assumed the metal would fetch $US2000 an ounce over the life of the mine. Palladium was fetching $US1218 an ounce on Wednesday; the price is down 30 per cent since January 1.

Chalice’s study assumed nickel – the metal that would provide 24 per cent of revenue from the mine – would fetch $US24,000 a tonne over the life of the mine; the current price is just below $US21,000 a tonne.

The study assumed copper would fetch $US11,000 a tonne during the mine’s life, rather than the $US8300 a tonne on offer this week.

Chalice’s forecast for platinum prices to average $US1000 an ounce were closer to Wednesday’s price of $US976 an ounce.

A 20-year operation

Chalice managing director Alex Dorsch was repeatedly asked about those commodity price assumptions on Wednesday, but told investors it was hard to know where they would be in 2029.

“There is about seven-plus years until we are actually producing any metal, so we are not talking about producing in the current commodity price environment, nor have we designed our operation in the current spot price, commodity price environment,” he said.

“We are designing a 20-year operation ... we are trying to understand those long-term dynamics as best as possible. We believe this project is robust under a number of scenarios.”

The critical minerals in the Gonneville deposit are increasingly sought by governments to ensure non-Chinese and non-Russian supply chains exist for the metals needed for decarbonisation.

Mr Dorsch said the decarbonisation megatrend and the geopolitical overlay were likely to “transform” demand for the metals discovered at Gonneville, and therefore future commodity prices were “very hard to predict”.

He said Chalice had relied on AME Group for the supply and demand models that underpinned the commodity price assumptions.

He added that prices for platinum and palladium were probably near a floor.

“We find it incredibly hard to believe a lower [platinum group element] price than what we are seeing today,” he said, adding that the study reflected only one portion of the geological opportunity in the Julimar province, which is 70 kilometres north-east of Perth.

The company continues to drill prospects close to Gonneville in the Julimar State Forest and those targets were not included in this week’s study.

--- end of excerpt ---

CHN ASX: Chalice questions critical minerals tie with Indonesia (afr.com) [Brad Thompson, reporter, AFR, Aug 7, 2023 – 6.22pm]

Chalice Mining's blowout: How a high-profile scoping study went so wrong (marketindex.com.au) [Kerry Sun, Aug 30, 2023 – 3:51pm]