Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

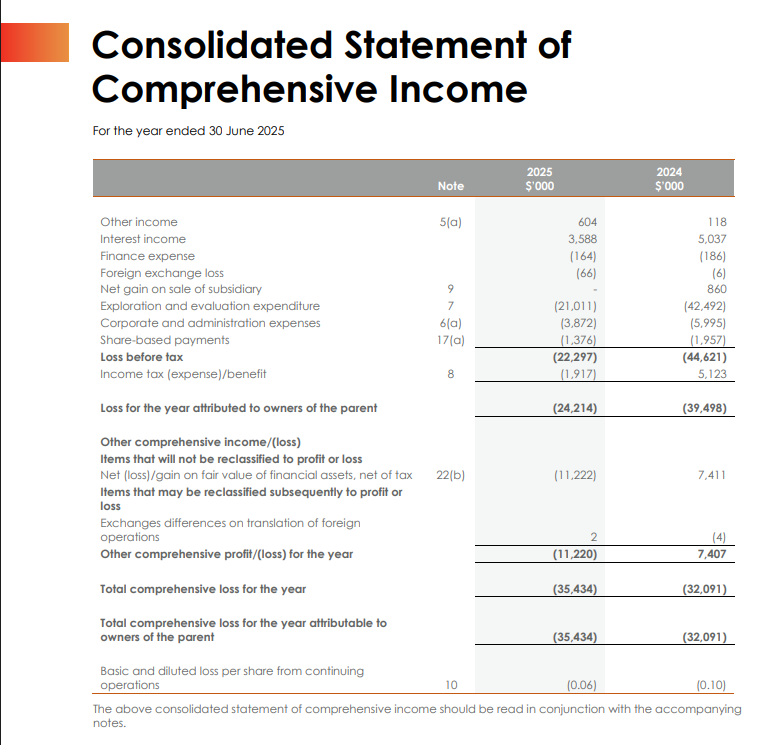

Statement of Cash Flows Cash and cash equivalents at 30 June 2025 were $70.8 million (2024: $88.9 million). Cash used in operating activities reduced from $44.1 million to $17.8 million, primarily due to a reduction in cash flows associated with exploration and evaluation expenses of $23.9 million and a reduction in cash paid to suppliers and employees of $1.6 million.

Net cash used in investing activities decreased significantly during the financial year, predominantly due to the acquisition of a private property and financial assets in the prior financial year.

On the corporate front, disciplined financial management saw FY25 operating cash outflows reduced to $18 million – the lowest level in six years

– adapting to lower commodity prices and preserving our strong cash and listed investment balance of $78 million. This strong position ensures we are well funded through to a Gonneville Final Investment Decision targeted for late CY27.

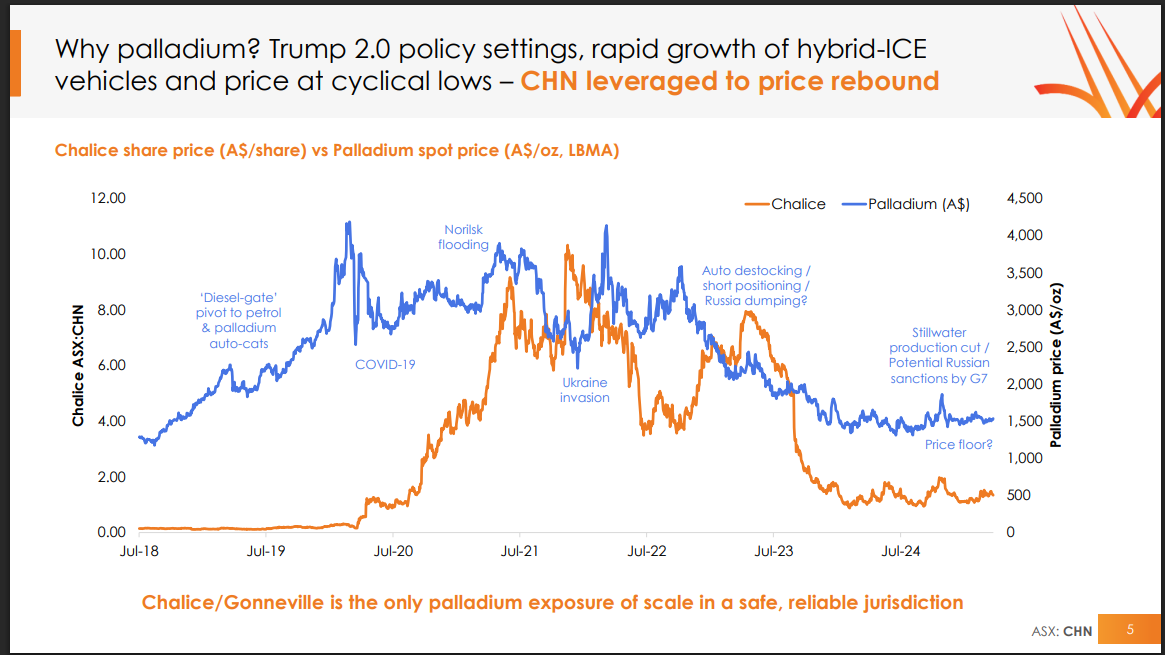

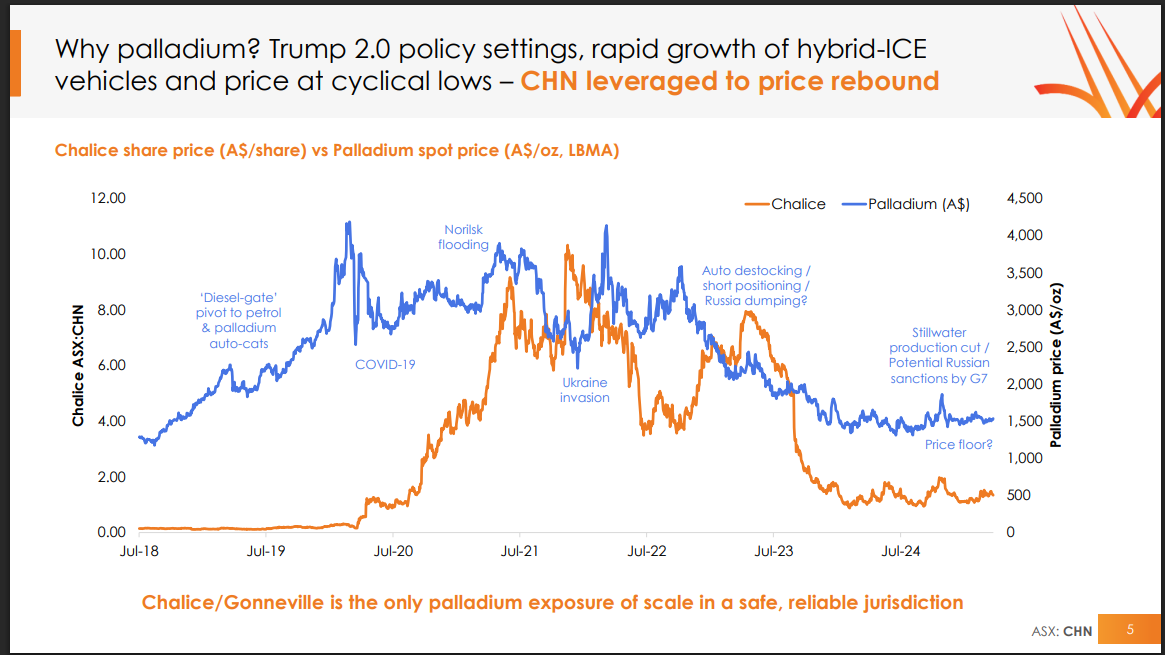

Gonneville is forecast to generate ~45-50% of its revenue from palladium,

The outlook for Chalice With a strong balance sheet, Chalice is well funded to advance Gonneville to a Final Investment Decision in late 2027, while continuing to explore priority targets. Anticipated milestones in FY26 include completion of the PFS, commencement of financing discussions, progression of offtake negotiations and submission of the Environmental Review Documents to regulators for major environmental approvals.

Return (inc div) 1yr: 71.07% 3yr: -14.19% pa 5yr: 0.90% pa

CHN liquidity average traded daily : $3,000,000

Palladium

Gonneville is the largest palladium-nickel-copper resource in the Western world, a 17Moz 3E PGE, 960kt Ni, 540kt Cu, and 96kt Co open-pit project .

Early indications of price recovery but spot price still well below marginal cost of supply (~US$1450/oz)

https://hotcopper.com.au/threads/ann-presentation-diggers-and-dealers-mining-forum-2025.8696626/

The resource so supply and Demand:

Palladium fell to 1,187.50 USD/t.oz on August 5, 2025, down 2.10% from the previous day. Over the past month, Palladium's price has risen 5.74%, and is up 40.70% compared to the same time last year, according to trading on a contract for difference (CFD) that tracks the benchmark market for this commodity.

about:

Palladium is a soft silver-white metal used mostly in the production of catalytic converters for petrol cars, electronics, dentistry, medicine, hydrogen purification, chemical applications, groundwater treatment and jewelry. The biggest producers of palladium are by far Russia and South Africa (70-80% of world output) followed by United States, Canada and Zimbabwe. Palladium Futures are available for trading in London Platinum and Palladium Market and on the New York Mercantile Exchange. The standard contact weights 100 troy ounces.

asx CHN Return (inc div) 1yr: 53.85% 3yr: -30.66% pa 5yr: 8.50% pa

*The Charts - Palladium chart and the CHN have both declined

Cost of supply has a cost gap of (not profitable!) 23% = 1450 / 1182

$1450 IS COST OF SUPPLY AS ABOVE

30/07/25 08:25

This had a great run... on the back of the palladium price

CHN. Return (inc div) 1yr: 39.74% 3yr: -30.86% pa 5yr: 10.02% pa

Held RL

Palladium just needs to break through the year-long $1065 resistance level.

chart below at 7/6/2025:

Tuesday 10th market price up at open.

Last

$1.43

Change

0.150(11.8%)

Mkt cap !

$496.0M

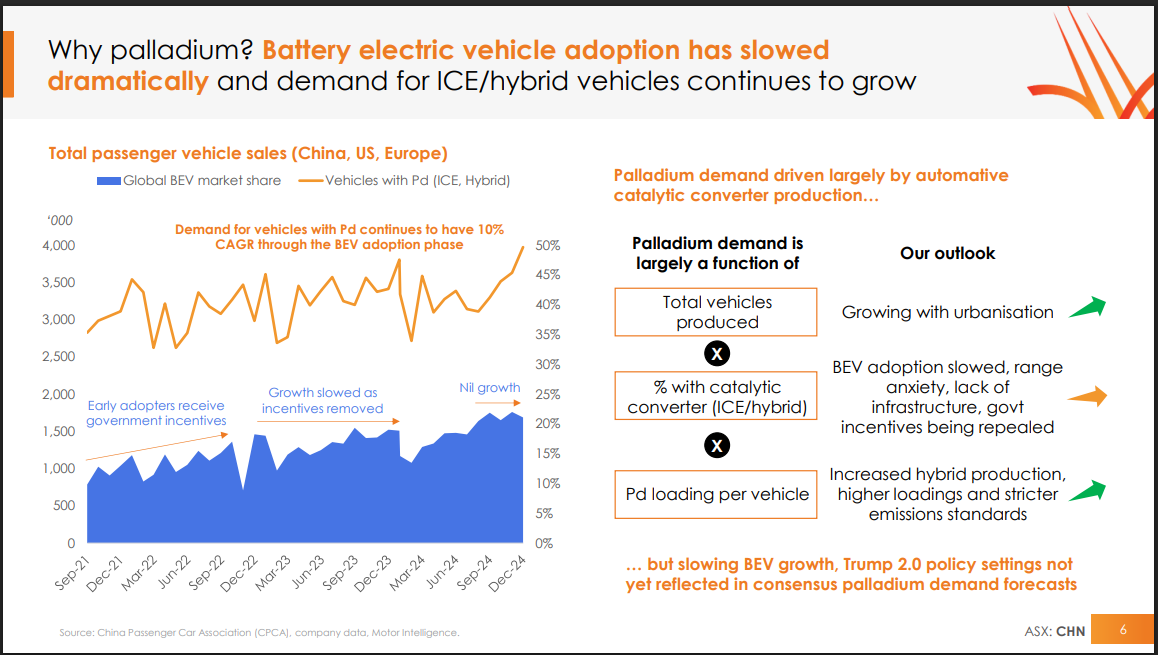

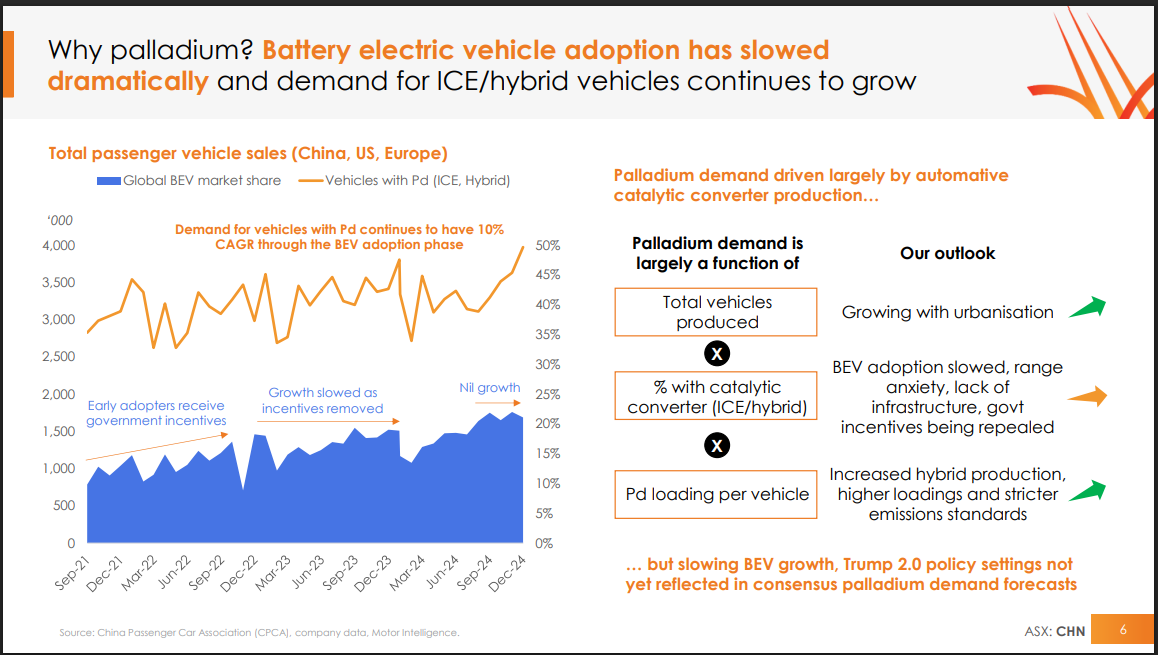

And the 'bias' is that hybrids (PHEV) are the go to now vs Battery (BEV), Gov policy 'belief' ..

..............We need cars still !!! .. though Amazon deliverers our parcels ..jejeje

https://hotcopper.com.au/threads/ann-presentation-macquarie-australia-conference.8569029/

at 06/05/25 08:34

- Presentation - Macquarie Australia Conference

https://hotcopper.com.au/threads/ann-promising-early-stage-gold-results-in-the-west-yilgarn.8598987/

significant suture of the South West and Youanmi terranes, including 1m @ 6.6g/t Au:

Gold-copper focused exploration in the Province remains at an early stage, with targeting for goldcopper systems continuing, drawing upon all available datasets including high-quality airborne magnetics, gravity and EM survey data acquired by Chalice from 2021 to 2023 following the discovery of the tier-1 scale Gonneville PGE-Ni-Cu-Co deposit.

is there any cash in the bank? 18.24 quarters..

- March 2025 Quarterly Activities & Cashflow Report

Last

$1.21

Change

-0.035(2.82%)

Mkt cap !

$466.8M

Although Chalice has a significant discovery close to Perth, the delays in the scoping study and concerns some majors may not want a joint venture plus a declining macro picture prompted me to exit.

The only thing kept me going was skin in the game by management especially with the last CR.

Anyway from around 40c to now that is 1000% in 3 years including a small topup around 3. In hindsight should have sold earlier. Hard to see a large hole left by my chn holding showing that big figure needing to be filled

Will enjoy the winnings but also will still watch Chn as well.

Not held

Suitors Reportedly Prepare to Lob Bids for Chalice

Suitors lining up for $2.3 billion nickel explorer and developer Chalice Mining Limited (ASX:CHN) are preparing to lob their final offers by August 21, sources say. The company's main project is its Julimar nickel and copper project in Western Australia's Avon region, 70km northeast of Perth. The group's Gonneville deposit is one of the world's nickel sulphide discoveries. It reported a net loss of $33.7 million for the six months to December and is looking for a backer to fund its development through Standard Chartered. But some believe the process could result in an acquisition of the company as a whole. Sources say Chalice is open to several options including a partial sale of about 20% of the group, or 100%. The king maker is Founding Chairman Tim Goyder, who owns just over 8% of the business. He has proved a tough negotiator on price, based on the experience of Albemarle, which has been courting Liontown. Mr. Goyder, who stepped down as the Chairman of Chalice Mining in 2021, also owns 15% of Liontown. Albemarle, the world's lithium producer, offered $5.5 billion for that company, currently worth $6 billion, but that was rejected. Anglo American plc (LSE:AAL), South32 Limited (ASX:S32), BHP Group Limited (ASX:BHP) and Rio Tinto Limited are expected to be lining up for Chalice's platinum metals assets. Some experts say the big players will be obliged to look at the asset, simply given the size of the resource, but the project is not yet in production and will take a long time from an environment point of view. The world's platinum producer, Sibanye Stillwater Limited (JSE:SSW), could also be in the mix.

Surprised IGO isn't on the list. Anglo seems a logical fit given their ground is nearby.

[held]

Continually impressed by Capital IQ Pro. Only found out tonight how to overlay claims between 2 companies Western Yilgarn and Chalice which is very useful.

Bit of competition here. Chalice in Red. Western Yilgarn in Blue

While Western Yilgarn has applied for E70/5111, Chalice has applied for E70/6255 which overlaps the former when I remove Western.

Western Yilgarn claims that E70/5111 has some lithium but won't know until they drill also implying E70/6255 has that too. Even then the application is still pending so a risk there for Western Yilgarn than Chalice.

Another note is I think Chalice is delaying the study because they know the resource can only get bigger. I think releasing a study now will undervalue the project. On the other hand it is disappointing we don't know the economics yet.

[held]

Capital raising for retail fell short of target.

But good to see directors including the CEO Alex Dorsch putting some money into the raising. That is better than some of the other recent raisings where the CEO did not subscribe to any shares (but will not mention any names here for now).

Source: marketindex

On another note, UBS put a sell rating on CHN citing concerns on palladium demand forecasts

[held]

Has a few projects going including the Julimar Nickel PGM project in WA and Pyramid Hill in the Victorian Goldfields.

Update 3/4/2023 - As we don't have a reserve estimate I am using the last raise to all shareholders at $3.75. There was also more recent raise at $6 around May 2022

Update 10/10/2020 - Increased valuation based on latest developments including airborne survey, the Gonneville Intrusion discovery, and further news around the Julimar Complex.

After an anticlimax with environmental groups, Chalice secured approvals for drilling of Hartog in the Julimar State forest

https://www.afr.com/companies/mining/chalice-wins-permission-to-drill-in-wa-state-forest-20220519-p5amvy

Shares rallied 19%

For those that want background information on the opposition groups and a map of Hartog, there is a great article in AFR (behind a paywall)

https://www.afr.com/companies/mining/chalice-asks-opponents-to-see-the-forest-for-the-trees-20220502-p5ahop

Further drilling on the farmland since November has suggested the resource contains even more platinum, palladium, nickel and copper than was understood in November.

But the big hope for Chalice shareholders – and the big concern for opponents such as Kinsella – lies in what a helicopter found just six kilometres north of Gonneville in September 2020.

As it surveyed terrain inside the forest boundary for the type of magnetic signals that bounce off underground metal deposits, the helicopter received signals from several spots inside the forest boundary.

One of those signals was “significantly stronger” than Gonneville had produced when it was the subject of aerial surveys, and the location of that signal has since been dubbed “Hartog”.

The magnetic signals picked up by aerial surveys do not guarantee the presence of valuable minerals, but where there is smoke there is often fire, and Hartog is now one of Australia’s most eagerly anticipated exploration targets.

The investment community swiftly formed the view that if Chalice could get inside the forest to drill Hartog, it would likely prove that Gonneville was the tip of an iceberg whose richest parts were buried inside the forest boundary.

It’s a hypothesis that has turned pre-revenue Chalice into a $2.5 billion company and elevated its managing director Alex Dorsch onto the Financial Review Young Rich List.

But it’s also a hypothesis that will remain unproven until Hartog is drilled.

“We don’t know if anything is there yet.” stressed Dorsch, when asked about Hartog.

“I know the public is quick to associate exploration effort with mining and typically the mind goes straight to big, open-cut type of mining.

“We are many years away from knowing what sort of mineralisation is there, if any, as well as what style of mining it would be.”

The WA government has given Chalice permission to drill on the existing dirt tracks that firefighters and recreational users have carved through the forest.

But those tracks are nowhere near Hartog, nor the other targets identified by the helicopter surveys.

Permission to leave the tracks and push through the forest vegetation to drill the centre of the Hartog target looked to have been secured by Chalice in January, but the WA government permit has since been held up by five appeals from members of the public.

Community appeals

One of those five appeals was lodged by the Avon and Hills Mining Awareness Group, a community activist group that was formed to fight bauxite mining proponents in the region long before Chalice found Gonneville.

Kinsella was not one of the five, preferring to fight the project through other means.

Dorsch says it is not yet possible to judge whether the economic and environmental benefits of mining within the forest would justify the environmental impacts of the project, because the size and contents of the geology remains a mystery.

Held

Following from Naga's straw below, Alan Kohler and Tim Treadgold at Eureka just released an interview with CHN CEO Alex Dorsch. Behind a paywall at https://www.eurekareport.com.au/investment-news/chalices-platinum-find-may-promise-more-excitement/150713. A few highlights:

AK: Alex, at the end of September quarter you had $81 million in the bank, cash but you’re chomping through the money at a ferocious rate, $17 million in the quarter. How long is that $81 million going to last?

It should last us at least 12 months. Our run rate is sort of between $5 and $6 million a month, which is high for an exploration company. Six rigs basically have been working for us for the last 18 months – I should say, anywhere from six to nine rigs working for us at any one time, as well as obviously a big support contingent and a lot of geologists chasing those rigs around. We think that’s at least 12 months, it’s a fairly comfortable cash balance to do what we want to do for the next 12 months.

AK: What do you think you’ll do next year, raise more money or farm it out?

It’s a good question. We’re sort of open to both avenues. Obviously, the equity market is very strong at the moment, I guess the demand is there, we feel, from large institutional investors to contribute at the equity level. If we got the right party inbound, yeah, we would consider a farm-in or strategic sort of partnership.

TT: So everything you’re looking at points to this not being a one-deposit-wonder, but a true PGM province on the doorstep of Perth?

Yeah, that’s the way we’ve been thinking about it for some time and I think what we see is potentially Julimar is a district or a camp of deposits. We found obviously the first one at the very southern end, but we only really drilled that southern end because of access constraints. In theory, if we had been allowed to drill all the way along that anomaly to begin with, we may already have two or three discoveries or two or three separate deposits along the Julimar district. But the province as a whole, we feel, is actually much, much larger than Julimar. We think that really, the entire sort of western half of WA could be a new nickel province just by the fact that that western half of Western Australia has a fraction of the exploration effort when compared to the gold fields or the Pilbara or even the Kimberley.

TT: Alex, if I can take you back to a question Alan asked at the start and that was funding, either more cash or a JV partner. There are two standout companies which really ought to be involved with you. One is Anglo American which controls South Africa’s platinum industry and must be looking at what you’re doing with great interest. The other is BHP which has gone off exploring for nickel in Canada when it’s got an enormous nickel division in Western Australia and doesn’t appear to have recognised what you’ve got. Are Anglo American and BHP knocking on your door?

Look, they’ve both been very positive about our discovery basically since the day we announced the discovery hole all the way back in March of last year. They’ve both made themselves aware to us and they’ve showed some interest since then. At this stage, we don’t really have any interest in pursuing any transaction with them. We’ve got 100 per cent control… I think we’ve found a very, very interesting discovery on the global scale, so we’re not limited to just going to corporates as partners or for sources of capital. We’ll continue to engage with them but at this stage we want to know what we have first and I think obviously we owe that to shareholders to determine what is the true scale of this -- is this just a single deposit or is this just a series of deposits or is this a new mineral province of which we own 100 per cent of.

TT: Have you worked out what the copper equivalent or nickel equivalent cost of production is? I assume it’s very low?

Not a cost of production, obviously, we’re just in the resource stage at the moment. We’re working as fast as we can on studies which will start to highlight what sort of net smelter return and costs we’re likely to see. At this stage, the resource grades, we’ve reported those in both nickel equivalent and palladium equivalent. Palladium is currently the most valuable metal out of the six on spot basis, but nickel does drive the recovery into concentrate, so the nickel-sulphide content is an important factor and this is a nickel-copper-PGE deposit, so that is the orthomagmatic – nickel, copper, PGE is the family of deposits, if you like, so we’ve reported in nickel-equivalent terms as well and obviously the contained metal numbers in terms of metal equivalent values are pretty impressive and almost two million tonnes of nickel equivalent or about 17 million ounces of palladium equivalent.

AK: So you could be 10 years off earning some money from this?

Yeah, I think the average sort of time period that you see quoted is anywhere from six to 13 years, I think is the time periods between discovery through to cash flow, and the average is around about 10 for Western Australia. Given the discovery was only 18 months ago, we do have some work to be done and do have a number of years ahead of us to be ready for actually studying, making an investment decision and then actually building a mining operation.

Just a quick note on Chalice. I was lucky enough to be a shareholder at the time they discovered Julimar in March 2020 so I have followed the story from the beginning.

I am an exploration geologist by trade and my real world investing is skewed heavily to the resources sector. My intention in joining strawman was/is to apply some rigour to my portfolio in understanding in more detail what and how I value the companies I hold, and then to diversify my investments into other areas using the strawman philosophy to put in the time and effort to understand what I'm investing in. I have been successful in buying explorers and miners helped by a generous dose of luck but using certain heuristics that I have not before sat down and detailed. Call it a gut feel based on having worked on and seen many different ore deposits, and buying at the right time of the cycles that resources follow. However I am out in the field most of the time and have not made a lot of progress to date in putting this in place.

So back to Chalice, they have lucked upon a deposit of size and characteristic that rarely comes along. I believe it could be comparable to deposits such as Oyu Tolgoi, Olympic Dam, Grassberg as some random examples of giant ore deposits in our timezone. It has been difficult to put any valuation on it before this week when they released their first Resource Estimate. So I've now used this weeks market reaction as an initial case valuation. $10. They have demonstrated a near surface deposit of a collection of metals that are very much in the spotlight. At the very least they have a decent sized mining project which is on a fast track. I have been extremely impressed at how it has been managed, since the discovery drill hole they have completed 650 further holes, managed to get results out of Assay labs that are swamped, completed initial metallurgy, social license, etc. This is an impressive team.

So $10 for now but I would expect that they have already had interest from the big companies, BHP, RIO and if I had to guess I would say FMG will make a move first.

Not sure if this is appropriate as a straw? As I said I do intend to work through my portfolio and document valuations (I have only done BHP other than this to date) just need to find the time.

edit: a link to an AFR story on Chalice from the week - https://www.afr.com/companies/mining/chalice-strikes-the-holy-grail-of-a-greener-world-20211110-p597lp

160 km drilling program continues, with 7 drill rigs in operation. The initial drilling program is 55% complete. 165 new high grade drill intersections reported.

94 assay results pending.

The expansion of the mineralised footprint will neccessitate an expansion of the drilling program, and delay the maiden resource estimate to late Q3 2021.

Jullimar initial drilling targeted for Q3, 2021.

Chalice Managing Director, Alex Dorsch, said: “Even after 87,000m over more than 13 months of continuous drilling, we continue to expand on the footprint of our major Julimar discovery; a quite remarkable result that demonstrates the potential world-class nature of the discovery.

“The new intersections at the north-east extension of Gonneville are promising, as the previously identified discrete pods of high-grade mineralisation appear to be associated with a newly identified pyroxenite host unit. This new ultramafic unit appears to continue further to the north-east, and the recently secured property acquisitions will allow us to test this potential shortly.

“Given the continued expansion of the Gonneville deposit, in particular the growth of the high-grade zones, the quantum of drilling required to define the maiden Mineral Resource is likely to grow. We are now anticipating resource definition drilling will continue into Q3 2021 and the maiden Mineral Resource will be released in late Q3 2021.

“Concurrently with the 7-rig resource drill-out, we are continuing our comprehensive metallurgical testwork program on both the sulphide and oxide mineralisation, and we have commenced several other preliminary studies that will guide the scoping and feasibility stages.

“We are also nearing completion of initial on-ground activities within the Julimar State Forest to the north of Gonneville. Flora and fauna surveys are currently underway in the area, ahead of proposed initial drilling, which is targeted for Q3 2021, subject to access approval.”

Chalice reported today they have acquired 723 hectares of privately owned land, bringing the combined total land acquired to 1668 hectares, which covers the known mineralisation of the Gonneville Intrusion, athough the resource remains open to the West.

12-Oct-2020: Presentation - Diggers and Dealers Mining Forum

CHN rose +17% today on the back of that presso at D&D. Below is a link to the same presentation WITHOUT that annoying "FOR PERSONAL USE ONLY" watermark that the ASX is adding to everything - and making everything hard to read...

https://chalicegold.com/sites/default/files/asx-announcements/61000581.pdf

12-May-2020: Corporate Presentation - 12 May 2020

Also: 14-May-2020: Chalice Raises A$30 million to Fund Next Phase at Julimar

Been in trading halt since last week pending drill results for their Julimar project.