As mentioned yesterday, @Strawman's and @DrPete's enthusiasm for $SGI spurred me into a deep dive into the numbers of the business. In this straw I outline the potential earnings and cash flow leverage the business has to modest organic growth and margin improvement. It’s not a valuation, as such, but more like a sensitivity analysis that indicates the very material upside potential of the business.

After reviewing the SM meeting recordings and recent company presentations, some key facts stand out:

- Revenue has grown steadily at a c. 15% CAGR over the last 4 years through a mix of organic and inorganic growth;

- Consistently profitable at Statutory NPAT level;

- Broadly cash neutral over 2019-2022, with 2023 a breakout with FCF of >$5m (although partly due to a higher than normal level of payables);

- Lean IT-system investments enabling adoption of best practice inventory management and (in future) dynamic price management; and

- Capital light model as majority of stores are partner-owned-and-operated.

However, what stood out most of all (and in fact really piqued my attention) was CEO Mike Arnold's assertion that their existing partners purchase some $60m of sales from the top 5 current $SGI suppliers but currently outside of the $SGI umbrella.

In valuing any business, I try to understand the quality of the organic revenue engine - particularly that which is accessible without significant new investments. So, I present below a set of scenarios out to 2027, to estimate the 2027 earnings, calculate value/share based on p/e ratios of 8, 12 and 16, and then discount these at 11%p.a. back to today to get some sense of the current value.

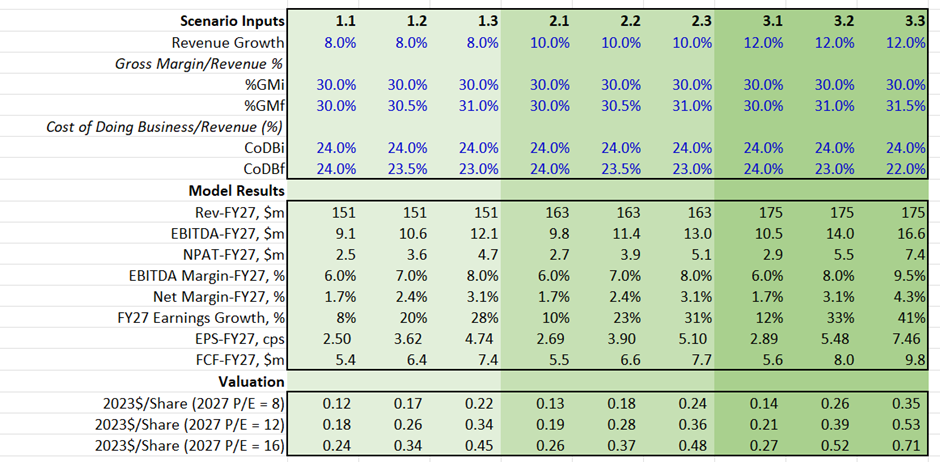

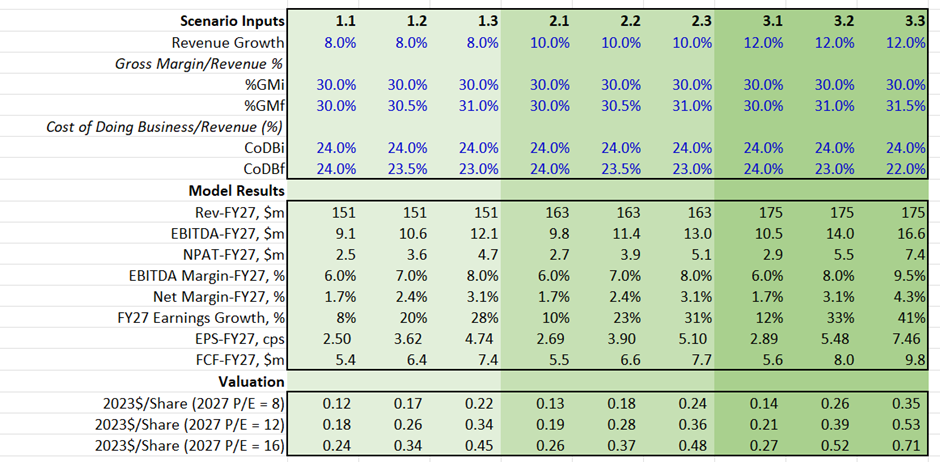

While about it, I consider a larger set of scenarios as follows, with further comments below on why I have chosen these:

- Annual revenue growth of 8%, 10% and 12% FY23 out to FY27

- %GM at 30% in F24 increasing progressively to 31% by 2027 (and 31.5% in the 12% revenue growth scenario)

- % Cost of Doing Business starting at 24% and falling progressively to 23% in FY27 (22% in the 12% revenue growth scenario)

Comments on values selected:

- Revenue: even in the highest 12% p.a. growth, this only takes 2027 revenue to $175m, so the lion's share of revenue growth could potentially be achieved by progressively capturing more of the potential partner volume from existing top 5 suppliers. This is an organic scenario and doesn't assume any network expansion.

- Gross Margin: with increasing volumes, better deals will be struck with suppliers. In addition, Mike has said they are going to add higher margin (albeit lower value) white label lines. Finally, the benefit of recent price increases initiated part way during FY23 are yet to show through, albeit they will be eroded by price and cost increases. So, the %GM margins are modest, and might even be improved upon. The table below shows the %GM in FY24 ("%GMi") and this improves incrementally and linearly to achieve with "%GMf" in FY27.

- Cost of Doing Business (CoDB): this assumes good cost control and it picks up on Mike's target that they can get from 24% to 19% over time, and that now incremental volumes are attracting a <10% incremenal CoDB. So, again, the range of scenarios is modest. The table below shows CoDB/Revenue(%) starting at "CoDBi" in FY24 (which is 24%) and reducing progressively and linearly each year to reach "CoDBf" in FY27. I assume there is greater leverage potential in the high revenue growth assumption.

I assume receivables, payables and inventory all scale with revenue (actually they should scale more slowly for a given network), and that other P&L, cashflow and balance sheet items scale with increasing Cost of Doing Business. However, I do assume a significant ongoing investment in systems, with FY24 (PPE+Intangibles) of $6.2m and scaling annually with CoDB. Mike will need to continue to make prudent systems investments to maintain an efficient, scalable operation.

With long term debt falling to zero, I assume the financing continues to be a revolving facility to fund progressively increasing inventory - the major balance sheet item. Interest rate of 7% is charged on Leases and Short-Term Financing.

I don't model any accumulation of free cash, so as far as the model is concerned all free cash is paid out and does not earn interest, but I have not tested this against the potential payout goal to achieve 5% yield, although the FY27 FCF looks pretty healthy and is lower than you might expect because I have a fair chunk going into Intangibles (IT Systems).

In essence, therefore, the modelling indicates the earnings and free-cashflow leverage over the next 4 years as $SGI passes through its inflection point.

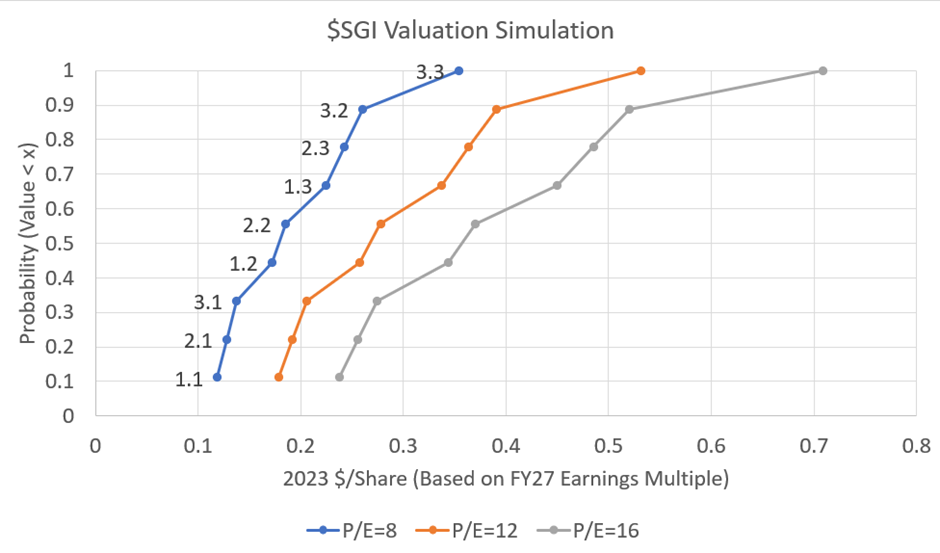

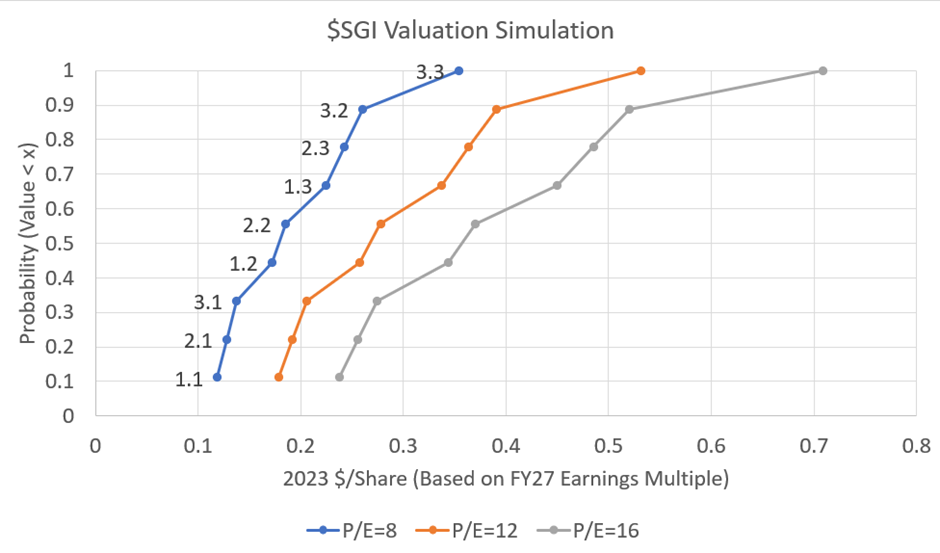

Model inputs and results are presented in Table 1. I've then plotted the calculated $/share in three curves in Figure 1. Each curve lists the 9 scenario results for each P/E ratio. Assuming each scenario has an equal likelihood, results are plotted as an implied probability function.

TABLE 1: Scenario Inputs and Summary Results

To get your eye in on the graph below, the three results, 1.1, 2.1, and 3.1, show the effect of revenue growth and P/E expansion only, without any margin improvements.

FIGURE 1: Modelled Valuations for Each Scenario at a Range of Assumed P/Es

(Note: labels on blue line relate to scenario number; labels read across horizontally for orange and grey P/E curves)

Discussion of Results

First, I am not pretending to have properly modelled the value of $SGI. For sure, I have no doubt that Mike will continue to pursue both organic and inorganic growth, with the prospect that over the next 4 years revenue growth will be higher than I have considered. After all, the current target is to get to $200m revenue by FY25! (Good luck) Because of that, I don't think margins and cost of doing business will advance in the smooth way that I have assumed. If $SGI try to acquire their way to their targets, CoDB will likely go backwards before it improves.

However, I still believe the analysis is instructive because it confirms the following:

- Material growth in value does not rely on driving revenue to achieve the FY25 "target"

- There is a lot of leverage to modest improvements in margins and control of costs

- Investments in technology to continue to support business scalability can yield significat returns, particularly if $SGI can continue to achieve a lean off-the-shelf approach to adoption of systems

- The existing partner volumes that currently lie outside the $SGI supply chain are a very valuable prize.

Remember, all of this assumes that most of the growth will come from bringing much of the current $60m of purchases by $SGI’s partners from $SGI’s top 5 suppliers that is currently outside $SGI’s scope. Of course just because Mike is targeting this doesn’t mean they’ll get it. For example, perhaps current partners are obtaining these supplies via one of the category-focused market leaders (think workwear and PPE, autoparts etc.). These suppliers may already have a scale that means $SGI cannot offer better value. Time will tell. But this is one reason to consider this analysis a sensitivity analysis and not a valuation or prediction.

Key Takeaway

While my methodology and assumptions are very different to @DrPete's, the conclusion is the same. If $SGI continues to be well-managed driving a balanced approach to revenue growth, returns and operational efficiency, there is a very significant multi-bagger upside.

Risks? Of course there are several. Industrial MRO is a mature market and although $SGI highlight the huge market scale, there are existing players with 10-20x SGI's scale, including category specialists. It is easy to code incremental margin improvements in a spreadsheet, but not so easy to do deliver margin improvements in practice in such a market.

Moves by competitors to grow or defend share or existing partners defecting from the "$SGI consortium" cannot be ruled out. In fact, this potentially becomes more likely as $SGI continues to scale and improve its own margins. In my sensitivity analysis these downsides are not considered. So beware.

As ever, anything but the most modest of acquisitions would also be likely to muddy the waters, even if it expands the network and volumes which will ultimately deliver returns if $SGI continues to execute well.

So What? After All This Analysis!

If pushed, I’d venture that $SGI is fairly worth anywhere between $0.20 and $0.30 today. Over time, however, if it sustains a strong earnings growth trajectory, there is significant further upside if it re-rates to achieve growth stock P/E ratios. (A good comparator case study would be $SNL.)

So, I have voted up @Strawman 's valuation of $0.23 from 4 months ago.

-------------------------------------------------------------------------------

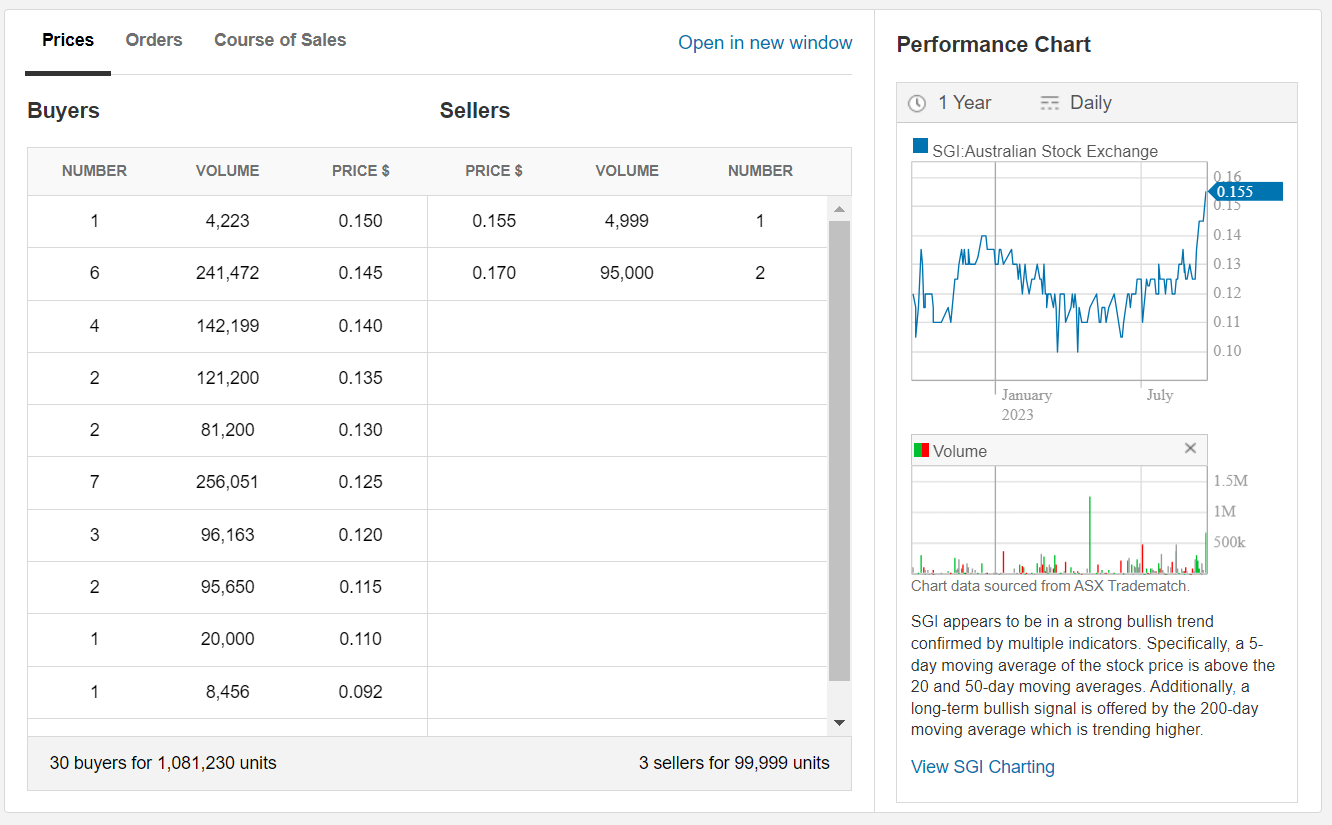

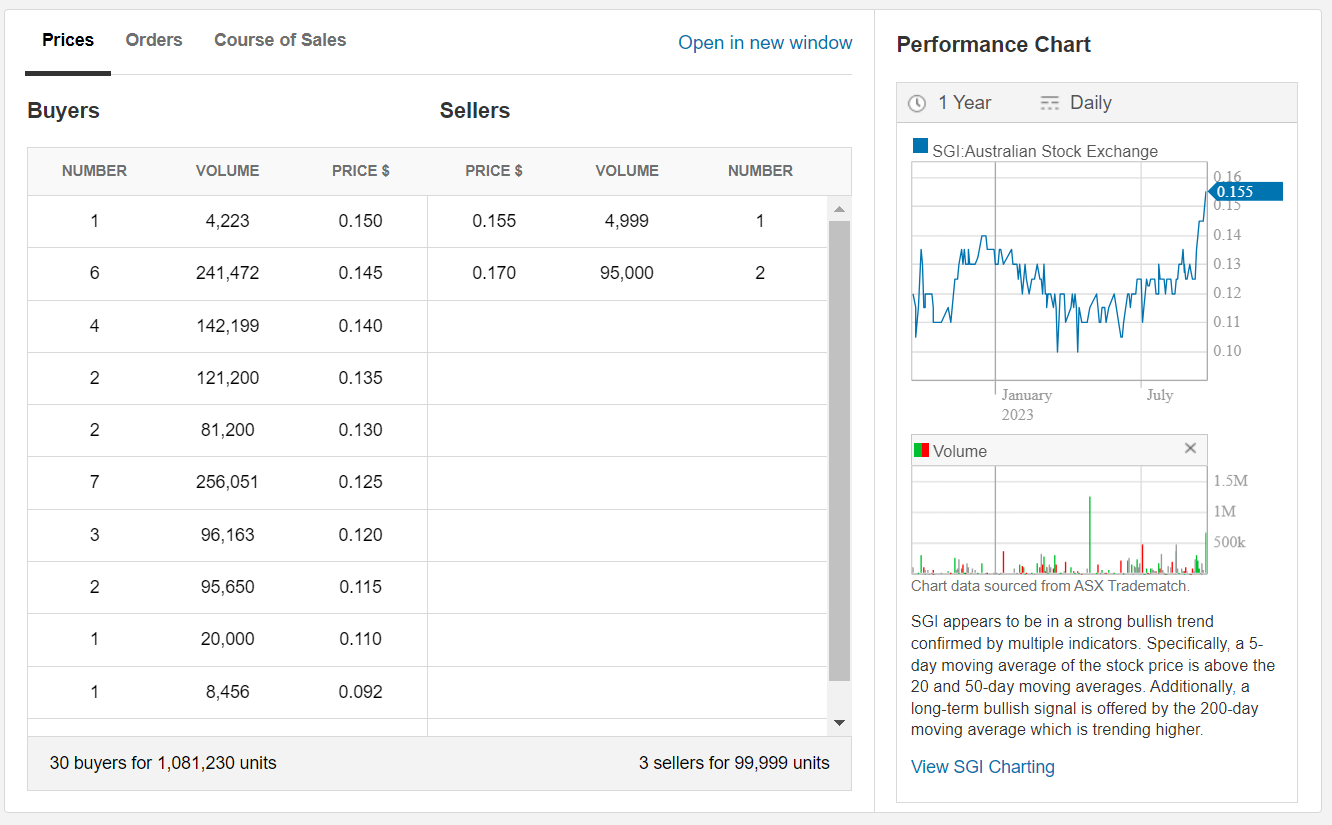

P.S. This morning, I pushed my order up to $0.155, and it cleared. Now looking a wee bit thin on the sell side!