Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

WAM now owns just under 10% of Stealth.

https://announcements.asx.com.au/asxpdf/20251204/pdf/06syn0fbfxwzw0.pdf

Given this is their first notice as substantial holder, they must have been in the most recent cap raise.

That's a heavy hitter in Stealth's corner. Should be able to offer more than just cash. They could open a few more doors.

[Correction note: I had incorrectly included reference to Sou Patts in this straw but have now edited out.]

Cap raise incoming..Never let a good share price pop go to waste, eh?

I suspect it'll be to strengthen the balance sheet. We'll see.

Thesis Review (17/11/25)

Original Thesis Review

Having spent most of my career in senior finance roles in import wholesale FMCG business’s, SGI was a business I felt I understood the fundamentals of if not the specific retail/product market, the key metrics for success and my thesis for SGI was centred on the delivery of these metrics and SGI as a founder business looking very long term and staying disciplined. It’s a game where very small % improvements make very big $ bottom line impacts.

Metrics & Thesis Focus:

· Inventory Management: ensure inventory turns are high to reduce WC and the need to write off or sell at a discount old inventory (Inv write downs are red flags).

· Margin Discipline: Avoid discounting and margin deterioration, slows top line growth but the benefits at the bottom line are significant (no margin, no mission). Find ways to grow or protect margin (exclusive product, tool hire).

· Operational Efficiency: Systems and process to manage hundreds of thousands or millions of inventory sku’s is critical and if done well is a point of difference/moat. It’s a commodity game for the most part so being the lowest cost supplier is the only place to be.

· Scale Economies: Small margins, fixed costs requires adding scale to create operating leverage. Profit doubles if you take a 2% NPAT, improve margins by 1% and reduce operating costs by 1%. Build the efficient machine then jam as much as you can through it (the point Mike made at the AGM).

· Leadership: Mike is a Founder, focused on his vision and long-term results driven plus a hard arse that only accepts the best outcomes for his business. Targets may not always be reached, but he isn’t going to undermine the long term to reach them for the sake of now.

· Asymmetric Bet: Initially with a market cap of 10-20m on 100m sales, the asymmetry was clear that only a small operating leverage would create value. Only a fraction of the targets presented ever had to be achieved to still offer very good returns. Valuation matters.

In tracking SGI, Mike has stayed disciplined and focused on a lean, profitable wholesaling machine in which he can add through put via acquisitions for scale economies and has been disciplined on cutting loose low margin or inefficient sales.

Value Review (17/11/25)

Is SGI still an asymmetric bet with the HBT acquisition? It was borderline at $0.70 prior, but now at $1.20 a week later with HBT is the question.

So, I looked at a set of scenarios (Now + FY28 sales) and value matrix (PE/Discount combos) based on those scenarios as outlined below they are (more dilution the more aggressive the target):

· Proforma FY25: Simply slap the businesses together what are they worth as is in combination. Would expect a low PE of 12, so $0.42 is the value I would take.

· Half HBT FY28: If only $100m in sales is added by FY28 (ie they fall short of the Pre-HBT target of $300m) but 5% NPAT% is achieved. Would also expect a low PE of 12 but discount range from 11% to 15%, so a value between $0.71 and $0.79.

· HBT Target: No organic or acquisition growth other than the $200m expected from HBT to come it at $342m by FY28, 5% NPAT. A PE of 16 and discount rate between 11% and 15% is my expectation of value from $1.27 to $1.42.

· SGI Target: Assumes the full $500m FY28 sales and 5% NPAT% is achieved. A five fold increase in NPAT in three years should command at least a PE of 20, with a value range somewhere between $2.19 and $2.44 based on 11-15% discount rates.

I have also looked at WC changes (orange) based on the same ratios as the business currently runs at, and while it obviously needs more cash to fund the WC, the increases by FY28 should be able to be funded out of operating profits even allowing for 1.5% Capex.

I have also factored in the increased cost of financing based on a 1x EBITDA target for Net Debt. To get to 5% NPAT I up’ed EBITDA to overcome this and this leaves EBITDA at around 10%, which is an improvement on current but not out of reach and in the middle of the companies target.

So, I am comfortable with that NPAT% and EBITDA% are achievable with increased sales, the ability to grow the top line is important to generate the operating leverage needed. However, even on a modest $242m sales target for FY28 these are reasonable.

Conclusion

Pre HBT, I saw value at between $0.70 and $0.90 with FY28 sales of $249m as my base scenario.

Post HBT, I am comfortable to add $100m so expect FY28 sales of $342m per the “HBT Target” scenario and take a base value of $1.27 to $1.42 as quite achievable.

I also see a reasonable amount of asymmetry remaining as I view the $500m FY28 target as achievable given the current opportunities HBT presents with existing and new ranges. If achieved the value is about double by base value, and I see downside a likely limited to half my base value (ie the Half HBT Target).

Value Check (13/4/25)

Stealth has up until late February has been way below my low-ball value estimate of $0.74 that I had been resting on for over a year now, so I hadn’t reviewed. At current prices I have had to trim just for portfolio balance reasons but need to do a hard assessment of value ranges because the asymmetry of value has changed radically at these prices and I need to be prepared for higher.

Below is a summary of values I have arrived at, the key factor is FY28 sales expectations, all of which sit at or below company minimum targets. I have a separate straw to analyse the sales bridge, note I use a more conservative set of assumptions in my valuation for EBITDA% and NPAT% than the sales bridge analysis for valuation purposes.

So my base case ($1.01) uses the expected sales growth generated from already executed or begun initiatives (Loyalty program + Exclusive brands) to get to around $250m sales by FY28 and margins around target.

The bull case ($1.45) lands just under the companies announced target of at least $300m with margins solidly above target.

The bear case ($0.56) sees about half the expected sales from those initiatives eventuating and no other growth and margins falling well short of target.

The EBITDA% and NPAT% targets I expect SGI will reach and likely exceed, the sales bridge analysis has them at these levels from the higher margin business additions, scale efficiencies have not been considered but will help. The focus on bottom line efficiency has been a constant and execution on this has been impressive even with acquisitions. If I didn’t have faith in this part of the business I would never have invested, because the operating leverage we are now seeing depended entirely on it.

So at the current price of $0.78 there is 30% downside to the Bear, 30% upside to the Base and 86% upside to the Bull case. Favourable asymmetry still exists, but it is now far less pronounced.

I will continue to hold and it will probably continue to be my largest position for a while (unless BOT or XRG re-rate), but I will continue to trim from mid-80’s and up.

Disc: I own RL & SM

I had to leave early, but a few tidbits from the AGM:

- Around half of HBT’s 490 suppliers already work with Stealth, which should help accelerate integration.

- They’re aiming to lift the number of HBT stores using Stealth’s wholesale channel from about 50 today to roughly 200 over the next two years.

- Key exclusive brands, such as CAT, can now be sold into a network of roughly 1,200 stores, up from just 32 previously.

- Management expects the first half of FY26 to be relatively flat, with a materially stronger second half.

- They drew a contrast with Bapcor’s issues, noting that Stealth’s model carries a far more variable cost base because independent operators carry much of the fixed load.

- Stealth’s real edge, in their view, is the efficiency of its stock and inventory management. They’ve been building Stealth as a platform from the very beginning.

- HBT is essentially a buying group with a technology layer; Stealth sees clear opportunity in plugging this into its broader platform.

- Mike said he has never sold shares, except for $200k worth to meet tax obligations, and doesnt intend on selling any more. The Chairman mentioned he may sell a small parcel to pay off his kid’s mortgage, but emphasised it would be “only a few shares.”

Valuation 12/11/25, with current price of $1.20, and fair price of $1.30

Bull case

- The bull case requires some faith that Mike can deliver at least a good chunk of his ambitious guidance. In recent years he has delivered solidly on revenue growth (albeit mostly via acquisition) and profitability. The last 4 years have seen 20% revenue CAGR, the company swing into profitability, and a clean balance sheet. And the latest acquisition seems strong. So Mike has earned some trust.

- Mike’s latest guidance of >$500m seems fanciful. But he got to 70% of his ambitious FY25 goals. So let’s say he get’s 70% of his latest revenue guidance, takes an extra 2 years to get there, and we take the low end of his profitability guidance. That’s $350m rev and 5% (about $18m) NPAT in FY30. With a PE of 25 and 10% dilution that’s a FY30 market cap around $440m and share price of $3.10. If you’re looking for a 10% return, factoring in some dividends along the way, that gives a current fair price around $2.05.

Bear case

- The recent acquisition takes Stealth to roughly $150m rev and $5m NPAT. In the absence of future acquisitions, past organic growth doesn’t inspire confidence in future organic growth. Mike’s plans for private/exclusive labels, tool hire, etc are all currently unproven. Let’s say Stealth can chug along a bit above inflation, say 5% pa revenue growth, and 10% pa profit growth.

- With about $190m revenue and $8m NPAT in FY30, with a PE of 12 and 10% dilution, that’s a market cap around $90m and share price of $0.64. For a 10% return, factoring in some dividends, I get current fair price around $0.45.

Base case

- If I weigh equally across the bull and bear cases, I get a current fair price around $1.30. So I think the recent pop and current price is pretty fair.

- If wanting some margin of safety and looking for a 15% pa return, the buy price is around $1.00.

- There’s plenty of room for bulls and bears in forecasting Stealth’s future. FY26 will be an important year for Mike to demonstrate that Stealth is more than the sum of its acquisitions, and that his plans for private/exclusive labels, tool hire, etc, can be successful.

- For now I’m a HOLD. I’ll wait to see signs of organic growth in the H1 results.

Previous valuations (archived)

Valuation 1/10/25, based on FY25 results, current price $0.68, fair price $0.80

Bull case

- I don’t believe Mike will come anywhere near his stated ambition of $300m and 5% NPAT in FY28, which will require 27% revenue CAGR. But I see a realistic bull case of achieving maybe half that revenue growth rate, say 13% CAGR, over the next 5 years, reaching $260m in FY30. Combined with 4% NPAT, PE of 30 and 10% dilution, that gives a FY30 share price of $2.20. Discounting 10% pa, we get a fair current price around $1.45, and a 5-year ROI of 28% pa.

Bear case

- Putting aside Stealth’s many acquisitions, organic growth has been weak. Let’s say Stealth’s ongoing growth roughly matches inflation at 3% pa. We’d get a FY30 revenue of $165m. Mike has been strong at steadily improving profitability, so let’s say he can raise it a little to 3%. With a PE of 12 and 10% dilution, we get a FY30 share price of $0.42. Discounting 10%, we get a fair current price around $0.30, and a 5-year ROI of -6% pa.

Base case

- My base case sits between the above two scenarios, with 8% revenue CAGR, and hitting around $210m revenue in FY30 with 3.5% NPAT and PE of 18. Weighting equally across scenarios, I get a fair price around $0.80, and a 5-year ROI of 14% pa.

- Overall I see the current price of $0.68 as slightly underpriced. If requiring a 15% ROI, Stealth is a solid buy at $0.65 or below.

- FY26 will be an important year for Mike to demonstrate he can make some solid progress towards his ambitious FY28 goals. My base case doesn’t require him to hit those goals or even come close, but it does require solid organic growth of at least 8% arising from the many strategic initiatives Stealth has in place. If Mike can achieve even just half of his goal growth rate, then Stealth is a bargain. On the other hand, if organic growth doesn’t lift from current rates, it will be time to exit.

Valuation after H1FY25 results: $0.80

Stealth has been on a flyer recently. Awesome news for many of us in the Strawman community. And I have to say especially comforting for me given I’ve just retired (take that “sequencing risk”!). But it has also prompted me to dig back in and reassess my thesis. Big picture, I think Stealth is approaching fair value. There’s definitely a healthy chance of ongoing strong returns. But the bull case now requires solid ongoing execution. And the heightened share price has inevitably increased downside risk.

Bull case

- On most financial and operational performance measures Stealth has shown continued improvement over the last few years.

- H1FY25 revenue was up 27% vs pcp. Even assuming no organic growth, H2 and full year is likely to show similar growth vs pcp thanks to the Force acquisition. Revenue per customer, per order, and per employee have all shown impressive improvements.

- NPAT of $1.6m for the half exceed the full FY24 NPAT (admittedly, helped by a one-off currency gain of $0.5m from Force acquisition). Mike reiterated his guidance of 1.5%-3% NPAT for FY25, which appears very achievable given H1 NPAT of 2.2%.

- EBITDA was 7%, already close to Mike’s FY28 goal of 8%. Mike claimed that incremental EBITDA for the period was 15%.

- Debt has been reduced to essentially now reflect inventory; prior debt associated with acquisitions has now been paid off.

- Annual dividends have commenced.

- Opportunities for further growth include introduction of exclusive products, acting as bulk purchaser for the store network, introducing an equipment hire service, and cross-selling Force products with Industrial customers (and vice versa).

- Future acquisitions will be easier now with a strong share price.

- Mike’s blue sky goals (which I believe are unlikely to be achieved) of $300m revenue and 5% NPAT for FY28 would produce earnings of $15m. If achieved, that would be about 25% revenue CAGR and 70% earnings CAGR. Those numbers would warrant at least a PE of 30, giving a possible market cap around $450m, compared to around $80m cap at time of writing, giving around 75% pa ROI for shareholders. In which case a fair current share price, discounting at 10% pa and allowing for 30% dilution, is about $2.20.

- If you don’t believe the above scenario is likely (and I don’t), a more realistic bull case might see Mike achieve 75% of his FY28 targets (which is aligned with him likely achieving around 75% of his goal of $200m for FY25). In this scenario we have $225m in revenue in FY28 (about 15% CAGR), with 3.75% ($8.4m) NPAT (about 40% earnings CAGR). Warranting at least a PE of 20, this scenario gives a market cap in FY28 of $168m, more than double current market cap. Allowing for 20% dilution along the way, shareholders achieve 20% pa return. In which case a fair current share price, discounting at 10% pa, is about $0.90.

Bear case

- Revenue growth has been predominantly through acquisitions. Without the Force acquisition, revenue would have declined (admittedly, as a result of closures of unprofitable stores and accounts). Stealth hasn’t yet demonstrated a clear ability to organically win market share.

- The recent Force acquisition might not be a good fit, with added complexity and cost outweighing any synergies.

- The revenue growth that has been achieved has occurred alongside issuing 17% additional shares. A small percentage of this dilution came from dividend reinvestment and management incentives, but most of the increase was required to fund the Force acquisition.

- Stealth’s history of profitability is short, and can’t yet be confidently asserted as sustainable. Even though EBITDA has hit 7%, NPAT is only 2.2%, creating doubt in Mike’s ability to hit his FY28 goal of 5% NPAT on 8% EBITDA.

- A bear case could see revenue growth stumble along at 5% pa (higher than current organic growth) and NPAT plateauing around 2.5%. Despite Mike’s lofty ambitions, this would see FY28 revenue around $175m and NPAT around $4m. With a PE around 12, that gives a market cap of $48m, well below the current $80m. In which case a fair current share price, discounting at 10% pa, is about $0.30.

Thesis

- If I assign probabilities of 10%, 50% and 40% to the above three scenarios I get a risk adjusted current fair share price of $0.80, a little above the current price.

- The thesis for Stealth has changed substantially since I first pitched it to the Strawman community back in Oct 2021. Back then I saw it as a bargain at a stupidly low price, with not a lot that needed to go right to produce a healthy return. My base case back then suggested a 40% pa return over the next 5 years.

- With the share price moving from around $0.12 to now over $0.70, much of the untapped value in Stealth has been soaked up. Stealth is no longer a bargain, but instead is close to fair value. The thesis now depends on solid ongoing execution. To his credit, Mike has shown strong execution and capital management to-date, but that needs to continue for Stealth to continue to deliver good value to shareholders.

- The current share price around $0.70 assumes that Mike achieves roughly 75% of his financial guidance, but takes 5 years to get there (instead of his stated 3 years). Whereas if Mike can stay on track to achieve at least 75% of his goals, by end of FY28, then the current share price is still undervalued. If Mike manages to achieve his stated FY28 goals in full, then there remains enormous value.

- At current share price, my minimum expectations for FY25 are:

- Revenue of $140m to $155m (the lower end assumes ongoing economic headwinds and some more store/account closures)

- NPAT around 2% and $3m (Mike guided 1.5% to 3%, and was 2.2% for H1FY25)

- Assuming FCF roughly the same as NPAT, that would be a full year dividend roughly the same as last year of about $0.008 per share (roughly 1% yield).

Comforting to see from yesterday's ASX announcements that Mike, the Chairman and the other two Directors chose the Dividend Reinvestment Plan for their latest Stealth dividends. The Chairman Chris Wharton now owns over $3m in Stealth shares.

The HBT acquisition obviously changes things. As usual, i'm going to keep it simple and (hopefully) somewhat conservative.

They have guided for FY28 revenue of more than $500m, with an EBITDA margin of 8-12%, and a NPAT margin target of 5-8%.

Let's be conservative and assume $450m in FY28 revenue at a 5% net margin to get a profit of $22.5m.

Let's assume 3% annual growth in teh share count to get to 142m shares on issue, which gives us an EPS of 15.8c. To that, I'll apply a PE of 16 for a FY28 target price of $2.52.

If you discount that back by 10%pa you get a valuation of ~$1.90.

For comparison, if you take them at face value and use a revenue of $500m, a net margin of 6.5% and a terminal PE of 18 the valuation you get is ~$4.40.

For $22m Stealth are purchasing Australia's largest privately owned national buying group for the hardware and industrial sector. And are confident that it's a step up not only in 2028 revenue but also with better NPAT margin.

So when they say 'Australia'a largest alternative' they really have been talking about Bunnings and Metcash. I wasn't ever sure what they meant until now.

$SGI in a trading halt this morning pending an announcement about a "proposed acquisition".

My Assessment

Like many others here, I have done very well with $SGI. However, I am no longer a holder because I haven't seen any evidence of organic growth. The last thing I need is another acquisition to again muddy the waters. So, I fully expect to remain on the sidelines.

Disc: Not held

Just saw the $SGI annual report drop. With revenue at $141.7m (H1 was $71.5m) and H2 usually a bit stronger, does this indicate another weak organic revenue growth performance from the business?

I'm focused elsewhere this morning, and will return to this later.

NPAT at $3.1m also a bit meh 1H was $1.58m.

Thoughts?

Disc: Held on SM

Registration link: https://zoom.us/webinar/register/WN_zEOOsKoxSWqznY9D0HLrPg This announcement was authorised to be given to the ASX by the Board of Directors of Stealth Group Holdings Ltd.

Announcement: John Boland has officially stepped down as the Secretary & CFO after 5 years with SGI. Replacing him is Anthony Benino as Secretary, and Matthew Green as CFO. Both seem to have extensive experience in these roles, so I hope both fit in and do well.

As i do a partial reset on my portfolio, i'm going to restate the investment thesis for each holding over the coming weeks. For Stealth it is as follows:

Big Picture

Stealth is basically a distribution engine. Its whole business is about moving industrial, workplace, and consumer products from suppliers to customers — faster, cheaper, and more efficiently than the next guy. The faster and cheaper they do it, the better the margins and cash flow. The bigger the volume, the bigger the revenue base.

The growth play here is simple (in theory):

- Sell more stuff.

- At better margins.

- Sweat the fixed assets harder (better warehouse/store use).

Every dollar invested (whether new capital, retained earnings, or debt) needs to push those levers and deliver a strong return.

Some Key Insights

Low-margin, high-turnover game

Half their assets are tied up in working capital (mainly receivables and inventory). If inventory turnover slows, it balloons working capital and tanks ROA. Worse, slow-moving stock usually ends up discounted, wrecking margins. They finance some inventory with debt at ~7% p.a., so if turnover isn’t tight, the carrying cost eats into profits fast.

Wide SKU base makes inventory tough

Tens of thousands of SKUs! Great for customers, brutal for management.

Managing such a wide and deep product catalog creates a constant balancing act: maintaining enough stock to meet customer expectations without tying up excessive capital or risking obsolescence. Every product line needs active oversight on turnover rates, gross margins, seasonality, and supplier terms.

Without disciplined inventory control — leveraging real-time data and predictive analytics — bloat creeps in fast, working capital balloons, and ultimately, margins and cashflow suffer. The operational complexity multiplies as Stealth expands into more categories and retail channels, making IT systems, demand forecasting, and inventory analytics absolutely critical to maintaining efficiency and profitability.

Non-discretionary core product offering

Most of what they sell (safety gear, tooling, automotive parts) isn’t optional for customers. Stealth Group states that over 90% of the products they sell are considered non-discretionary items.

Think things like safety gear, industrial supplies, automotive parts, and workplace essentials. The kind of stuff that customers need to keep operating day-to-day, even in tougher economic conditions. This gives them a resilience edge...to a point. If their customers (mining, construction, trades) go through a slowdown, and these are very cyclical sectors, volumes will absolutely still get hit and net margins could collapse.

IT and ERP systems are the secret sauce, hopefully

Good IT is non-negotiable here. Their ERP system needs to manage tens of thousands of SKUs across multiple divisions in real time — flagging aging stock, managing dynamic supplier pricing, and enabling better demand planning. In FY23 and FY24, Stealth invested around $2.8 million into technology, automation, ERP upgrades, and digital customer channels.

Specifically:

Consolidating ERP platforms across Heatleys and Skippers to centralise buying and improve inventory demand planning.

Launching AI-driven customer service platforms, now handling 95% of industrial support queries.

Expanding cybersecurity, e-commerce, and digital sales channels.

Automating distribution centre operations to improve order speed and accuracy.

Management views IT as a strategic weapon, not just a cost center, with a strong focus on "simplifying work" and "delivering superior customer experience through data, digital and automation." IT, data, and automation are now core pillars in their FY28 strategic plan, supporting a scalable, higher-margin business model. As they scale revenue and SKU complexity, these systems will be critical to protect margins, speed up cash conversion, and support future acquisitions.

ROE is modest and debt-aided

ROE sits at 6.1%, reflecting a business that is still sub-scale.

A DuPont analysis is helpful here, breaking ROE down into three drivers: profitability (net margins), efficiency (asset turnover), and leverage (equity multiplier).

For Stealth:

- Net Margin: 1.2% — extremely tight, highlighting limited pricing power today.

- Asset Turnover: 1.34x — solid but room to improve through better inventory and sales efficiency.

- Equity Multiplier: ~3.8x — moderate use of leverage to boost otherwise low returns.

So, at present, it’s primarily financial leverage doing the heavy lifting. To unlock the Bull Case ROE improvement, Stealth must:

- Expand gross margins through own-brand sales (like RIVO) and improved supplier terms.

- Accelerate asset turnover by increasing sales faster than growth in working capital.

- Maintain disciplined leverage to ensure operating gains — not debt — drive higher returns.

Basically: sustainable ROE improvement will need to come from capable operational execution, not just balance sheet engineering. Stealth has built the IT, logistics, and branding foundations...now it’s all about delivery.

Reason for optimism

Stealth has been more or less consistent in its messaging and we have started to see encouraging signs of unfolding operational leverage -- something that hopefully becomes more obvious now that underperforming stores have been closed down, the various business units have been streamlined and the new IT systems are delivering clearer insights.

The recent institutional raise, while annoying it bypassed retail shareholders, gives them cheaper capital, a stronger balance sheet and should also improve liquidity (which might open Stealth up to bigger capital managers). It also represents a sign of confidence, especially given the tough environment for capital markets at present.

A maiden dividend, improved cash flows and better inventory/revenue ratio are all encouraging. And management has an ambitious target -- even getting close to it should reveal a big uplift in profit (see below)

Risks

- Execution risk around inventory management, accounts receivable and general working capital.

- Margin pressure if own-brand products (like RIVO) underperform.

- Customer concentration in cyclical sectors. A downturn in customer activity could really knock the wind out of their sales

- Leverage risk if sales slow but debt obligations remain. Could force a costly cap raise.

- Poor acquisitions could really derail things -- not only in wasting capital in the purchase and integration, but also in management time and focus

What does growth look like?

Well, if we take management's targets at face value, you're looking at a FY28 revenue and EBITDA of $300m and $24m respectively. Ideally, that's be an NPAT of ~$14m or so. That compares to a pro-forma NPAT in FY24 (assuming a full year contribution from force) of roughly $3 - 3.5m or so.

But if we knock back the revenue target to $250m, and give it a 6% operating margin, and a 3.5% net margin, NPAT is closer to $8.8m. Still a big jump over three years, but could be further reduced by an increased share count.

Avoiding the specifics, the point remains that there is still an asymmetric upside if they execute well -- even if they fall short of these ambitious targets.

What to watch

Operating and net margins MUST trend higher:

Margins are tight today. Gross margin expansion through own-brand sales (like RIVO) and better sourcing deals must drive operating leverage. Watch quarterly gross margins carefully.

Organic top-line growth is key:

Acquisition growth is useful, but organic growth is the real acid test. Watch same-customer sales growth and contribution from online/digital channels (not just total revenue).

No bloat in working capital:

Monitor inventory days and receivables turnover closely. Bloating here would signal operational discipline slipping and would sap cash flow.

Improved ROE:

ROE must rise through higher margins and faster asset turnover — not just by leveraging up more debt. Look for rising returns on both invested capital (ROIC) and equity.

Sensible, bolt-on acquisitions:

Acquisitions must be disciplined: small, strategic, and margin-accretive. Watch for any large, high-risk bets (a red flag).

Successful Capital Raising and Completion of Trading Halt.

Stealth Group Holdings Ltd (ASX: SGI) (“Stealth” or “the Company”) advises that the trading halt requested on April 16, 2025, has now been lifted following the successful completion of a capital raising to institutional and sophisticated investors.

The amount raised was $7.5 million before capital raising costs. This is the Company’s first capital raise since listing on the ASX in October 2018 and marks a significant milestone in strengthening the shareholder register and positioning Stealth for its next phase of growth.

Capital Raise Overview

- The capital raising has attracted support from high-quality institutional investors, marking the first time in three years that institutional investors have joined the Stealth register.

- The raise also included participation from select sophisticated investors, further broadening and strengthening the Company’s shareholder base.

- Funds raised will be deployed to support growth-focused initiatives aligned to Stealth’s FY28 strategic target of $300 million in sales, including:

- – Expansion of exclusive and own-brand product ranges

- – Growth of Marketplaces and the store-in-store roll-out

- – Launch of Hire business including new In-Store Hire-rental openings

- – Investment in network expansion, digital infrastructure, and customer channels

- – Subscription & Loyalty programs enhancing customer retention and growing new revenue streams.

- – Strengthening the balance sheet to enhance financial flexibility and support margin accretive opportunities.

- Strategic Rationale

- This capital raising is a strategic initiative to support long-term value creation, improve register composition, increase liquidity, and provide the financial capacity to execute Stealth’s growth plans.

- Stealth is evolving into a scalable, higher-margin, multi-channel distribution platform servicing both B2B and B2C markets across industrial, safety, workplace, automotive, and consumer categories.

- CEO Mike Arnold said: “The strong support from institutional and sophisticated investors is a clear endorsement of our strategy and growth potential. This marks a new chapter for Stealth as we accelerate our ambitions and build a stronger, future-ready business.”

ASX: SGI

BOARD OF DIRECTORS

Chris Wharton AM Chairman

Michael Arnold

Group Managing Director & CEO

John Groppoli Non-Executive Director

Simon Poidevin Non-Executive Director

ISSUED CAPITAL

117.0 million Ordinary Shares

PRINCIPAL OFFICE

Level 2/43 Cedric Street Stirling, Western Australia 6021

CONTACT

Michael Arnold

Group Managing Director & CEO

Jessica Rich Investor Relations

P: +61 8 6465 7800

E: [email protected] W: www.stealthgi.com

ABN: 25 615 518 020

GROUP OPERATING BRANDS

› Heatleys Safety, Industrial & Automotive

› Force Technology International › United Supply Company

› Trade Member Direct

WEBSITES

› heatleys.com.au

› forcetechnology.com.au › cltoolcentre.com.au

› isgaus.com.au

› unitedtools.com.au

› toolspareparts.com.au

ASX: SGI

Next Steps

Settlement of the placement is expected on April 29, 2025, with 12.5 million new shares to be issued and commence trading on April 30, 2025.

The Company thanks all participating investors and MST Financial for their support and looks forward to delivering continued progress in line with its FY28 strategic targets.

This announcement was authorised to be given to the ASX by the Board of Directors of Stealth Group Holdings Ltd.

Investor enquiries:

Mike Arnold

Managing Director & CEO +61 (0) 8 6465 7800 [email protected]

About the Stealth Group

Jessica Rich

Investor Relations

+61 (0) 8 6465 7800 [email protected]

Chris Wharton

Chairman

+61 (0) 8 6465 7800 [email protected]

ASX NEWS RELEASE (CONT)

Stealth Group Holdings is a leading Australian multi-sector distribution company, providing a wide-range of industrial, safety, automotive, workplace and consumer products and solutions to businesses, trade-professionals and retail consumers through an omni-channel model incorporating a large sales force, contact centres, physical stores and online.

Stealth operates with two divisions, Industrial and Consumer, that collectively have over 200,000 products in-stock on sale in stores and distribution centres from hundreds of suppliers. In addition, it sources on customer demand, more than 300,000 non-stocked products from its suppliers.

The business also runs an innovative drop-shipping model whereby products are sent directly to customers by suppliers, enabling faster delivery times and reducing the need to hold inventory, allowing for a larger product range.

The large everyday product offer is complemented by an exclusive brand range and a private label range which is sourced directly by Stealth from overseas suppliers.

Stealth also offers various services and solutions to business and trade customers including bespoke product ranges, design-manufacturing-procurement, inventory management, hire-rental services, and onsite solutions by a dedicated support team.

Stealth Group’s registered office and principal place of business is Level 2, 43 Cedric Street, Stirling, Perth, Western Australia and is listed on the Australian Securities Exchange under the code SGI.

END OF RELEASE

Stealth is undertaking a cap raise. No details as yet.

Acquisition? Strengthen the balance sheet after a strong rally and with macro headwinds ahead? Something else?

I may have, for the first time ever, been lucky with a sell decision. Usually stocks rally after I sell! Although, that's still a possibility...

Ive just updated my valuation for Stealth and came up with a pretty bullish figure of $1.15 (at least compared to the current market price).

Still, i'm noting here that I will be selling down a large chunk today -- purely for portfolio weighting reasons and to free up some cash. I will still retain a very substantial holding, it's just a bit tough to justify the current 30% weighting!

Below is a bridge of sales based on announced programmes from FY25 expected to FY28. I have only added values where SGI has provided targets to the market. There is a gap of $51m to reach the FY28m target, but there are three areas to fill this we already know of or can expect. No allowance is made for organic growth, the new hire business or additional acquisitions, plus we may see additional exclusive brand agreements over the next 3 years.

Reaching at least $250m by FY28 looks likely and the 300m target looks achievable without any heroic assumptions beyond what the company has executed on in the past.

159m: FY25 Expected Sales

60m: Loyalty Returns Program (Dec24 start, in progress)

Xm: New Hire Business ($ unidentified, possibly cannibalise sales but higher margins)

30m: New Exclusive Brands (Agreement secured, locked in)

Xm: 3-5% Organic (like for like) but store closures may offset so treat as nil

Xm: Acquisitions

249m+3X: Total FY28 Sales Bridge

Loyalty Rewards Program

· Launched Dec24

· $60m annual new sales opportunity

· From question at FY23 AGM, they are targeting 12-15% NPBT, >30% GP%

New Hire business (Hire One):

· Target 4Q25 launch (in final testing phase).

· 20 new “store-in-stores” to open by Jun25

· 13 week payback period then 100% margin – expected to grow margin.

Own & Exclusive Brand Strategy:

· EFM range (Force Technology)

· H1FY25, exclusive products represented 5% of total revenue (>10% higher margins)

· DullCo own-label mobile accessories launched in late 2024 in select IGA WA stores.

· Distribution Agreements (CAT Power Tools, Wesco Power Tools & Harden Tools): Contract sell through arrangements for $30m in sales by 2028. Wholesale margins >40% and increase retail margins by 30-50%

· RIVO (Big W & 7-Eleven) Brand: Starting with RIVO SAFETY (Collaboration with PIP Global Safety) a range of head-to-toe light industrial essentials

Disc: I own RL & SM

Stealth announced launch of new own-label product line Rivo Safety:

https://announcements.asx.com.au/asxpdf/20250403/pdf/06hbcpmtphb5gk.pdf

Stealth-Secures-Exclusive-Distribution-Agreements.pdf

This is the cause of the price bump for Steal. Secured some reasonable looking exclusive brand deals. Seems they are high margin and will help push to the target revenue of $300M. They seem to be ticking the boxes regularly. Reasonable volume.

Nessy.

Held

After the strong H1 results on Tue, yesterday there was some more good news for Stealth and another share price pop. Stealth has announced exclusive distribution rights for three brands of power tools.

https://announcements.asx.com.au/asxpdf/20250227/pdf/06g1hbnlfr26vv.pdf

I don't have insight into how strong these brands are. Can anyone with more industry experience comment? I was aware of CAT for their heavy industrial machines, but wasn't aware of their power tools. I hadn't heard of Wesco or Harden. But Mike seems excited, describing this as a "game changer".

At the results presentation this week I asked a question about the $60m supplier pipeline revenue that Mike has previously indicated Stealth can tap into. He had gone quiet on this opportunity, and didn't answer my question on Tue. But I now assume this announcement is part of this capture. It's $30m instead of $60m. But nevertheless, a significant achievement for Stealth, and maybe (or not) the other $30m is still on the table with ongoing negotiations.

Another set of strong results from Stealth today. Again, most stats heading steadily in right direction. Share price pop at time of writing.

Announcement: https://announcements.asx.com.au/asxpdf/20250225/pdf/06fxf813gs3r9h.pdf

Presentation: https://announcements.asx.com.au/asxpdf/20250225/pdf/06fxglkjwvdbvw.pdf

$SGI has reported its results ahead of the investor call in half an hour's time.

Three observations from a quick analysis

Revenue

Of the total revenie of $71.5m, $21.8m was due to Force, leaving $49.7m due to legacy Stealth Group, which is down significantly from $56.5m in 1H FY24 - the impact no doubt of the store ratoinalisation program, but no doubt also a reflection of the macro-environment.

I can't see a clear reference to life-for-like sales. So this is something to pay attention to in the call.

Incremental EBITD Margin

One metric I am tracking for the group is the Incremental EBITDA Margin. In H1 FY24 this was 13.1%. In 1H FY25 this has increased to 14.5%. This is excellent news, as it means that this metric has continued to advance, even given the Force acquisition, and that we should expect to see the quality of the business continue to improve as it scales,

Cash Flows

Operating Cash Flow is weaker. Picking through the report this seem to be mainly due to higher working capital, acquisition integration costs, and increased investments in business expansion. While revenue and profit grew strongly, cash flow was impacted by inventory buildup and timing of receivables collections, which should normalize in the following periods.

OK - one to track in future reports. I can live with it given the changes the business has gone through, the important over time that this improves,

Summary Analysis of the HY Report

Stealth Group delivered record financial results, driven by strong revenue growth, improved profitability, and cost efficiencies. The successful integration of Force Technology enhanced the Consumer Division’s contribution. While net debt increased due to strategic investments, the balance sheet remained robust, supporting future expansion. The company’s return on capital and operational efficiencies improved significantly, positioning it well for continued growth.

Financial Performance

Stealth Group Holdings delivered a record half-year financial performance, with strong growth across all key financial metrics:

- Revenue increased 26.5% to $71.47 million (1H-FY24: $56.50 million).

- Gross profit grew 26.7% to $21.04 million (1H-FY24: $16.60 million), with a slight increase in gross profit margin to 29.44% (1H-FY24: 29.39%).

- EBITDA surged 78.1% to $4.97 million, achieving a 7.0% EBITDA margin for the first time.

- EBIT increased 89.0% to $3.29 million (1H-FY24: $1.38 million).

- Net Profit After Tax (NPAT) rose 249.2% to $1.58 million (1H-FY24: $0.45 million).

- Earnings per share reached 1.36 cents, up 202.2% (1H-FY24: 0.45 cents per share).

Operational Performance

Stealth’s Industrial and Consumer Divisions contributed to the strong performance:

- Industrial Division: Maintained solid sales growth, with an 8.8% increase in average order value per active customer due to technology and productivity improvements.

- Consumer Division: Boosted by the acquisition of Force Technology (June 2024), contributing $21.8 million in sales, with major retail partners such as JB Hi-Fi, Officeworks, Coles, Vodafone, and Telstra.

Cost efficiencies were also achieved:

- The cost of doing business was reduced to 22.5% of revenue (1H-FY24: 24.4%).

- Operational restructuring led to the closure of 12 stores, reducing costs without impacting profitability.

Cash Flow and Balance Sheet Strength

Stealth's balance sheet remained strong, supporting future growth:

- Net assets grew 30.2% to $21.50 million (1H-FY24: $16.51 million).

- Cash reserves increased 17.8% to $10.40 million (1H-FY24: $8.83 million).

- Inventory levels increased to $22.05 million, reflecting higher sales and strategic stock management.

- Return on Capital Employed (ROCE) doubled to 18.8% (FY24: 9.6%).

- Net debt rose to $11.02 million, primarily due to investment in growth initiatives.

- Operating cash inflow was $2.83 million, slightly lower than 1H-FY24 ($2.92 million).

- Free cash flow declined to $1.56 million (1H-FY24: $2.40 million) due to increased investment in technology and operational efficiency projects.

Capital and Debt Management

- The final acquisition debt settlement of $1.02 million was completed.

- A maiden dividend of $971,879 (0.84 cents per share) was declared, with $621,547 paid in cash and the rest in shares via the Dividend Reinvestment Plan.

Overall Takeaway

A good result. Broadly on track to hit the $3.0 m NPAT for FY25 in my pro forma model I put together after the Force acquisition, but a miss on my modelled EBITDA. Excellent to see incremental EBITDA margin continues to improve.

Will see what Mike Arnold has to say on the call. (Just time to make my second coffee of the day, first!)

Disc: Held in RL and SM

The AGM recording is available: Stealth Group Holdings AGM 2024 - Webcast Recording on Vimeo

After market there are 35 buyers seeking 1.2m shares from 1 seller of 50k shares… gives you a feel for investor opinion on the results and AGM.

Mike focused on the FY25 to FY28 outlook and plan in his presentation, have a look.

My takeaway is the focus on efficiency and growth that improves margins and profitability is the story, the same one as when I initially invested 3 years ago. The $60m sell through is still in the plan, starting in next 90 days under a new business “United Supply Company”.

Disc: I own RL+SM

Mike Arnold sold 500k shares of his 10 mil (5%ish) for 200k ‘for tax purposes’

Unconcerned. Small amount of shares and Mike remains a very significant holder of ~10%

5-September-2024

Valuation = $0.53

Model updated following today's webinar.

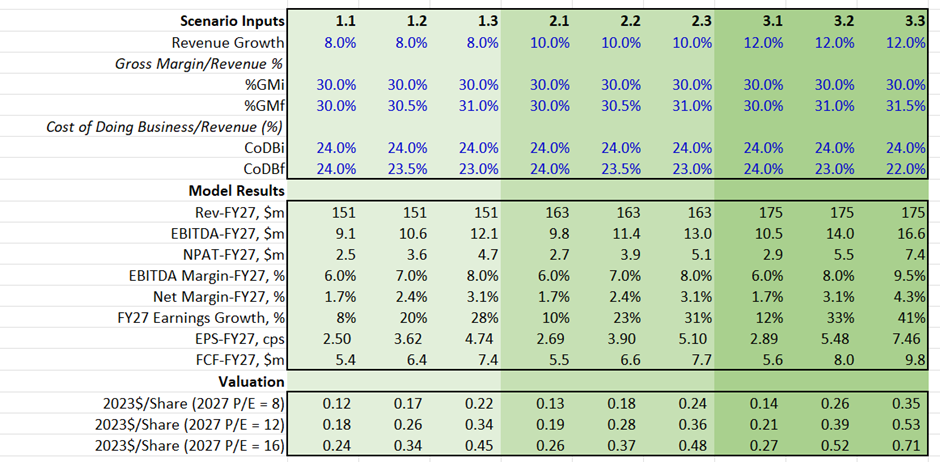

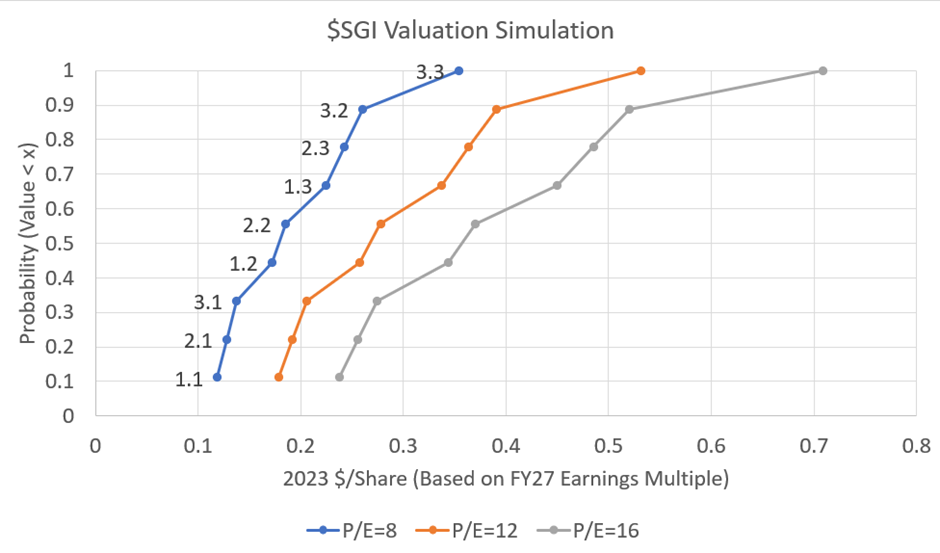

The detailed inputs and outputs are shown below. In essence the methodogy considers a wide range of scenarios for the business to be built by FY28, modelling a range of revenue growth and margin evolution scenarios.

On the Valuation Simulation graph below, I've plotted all the modelled values, with the pink rectangle showing my notional p10% - p90% range yielding a range of valuations from $0.33 up to $0.91. So pick your scenario or throw a dart!

The model assumes organic growth, although today Mike set out the assumption that 25% of the growth would come from M&A. To allow for the likely dilutive effect of future acquisitions, I've grown SOI by 5% p.a. from 2024 to 2028. So SOI in FY28 is 140 million.

And yes, I do have one scenario of c. $300m revenue and 8% EBITDA margin. However, in the lower revenue growth scenarios I find that higher EBITDA margins are very do-able! Prioritisation of margin over revenue from today should easily achieve a business with higher EBITDA margins, given the %GM and scaling of CoDB demonstrated to date.

Scenarios 3.1, 3.2, and 3,3 have the 17% revenue CAGR required to hit the FY28 $300m revenue target. However, most scenarios prioritise margin/ profitability over revenue growth, illustrating that Mike can come well short of $300m revenue and still achieve a lot of shareholder value creation. That's why I'm not bothered that the FY25 $200m target has gone by the wayside. Profit is more important!

Value per share in FY28 is discounted back at 11% (not 10% stated prior to edit).

Model retains capital light growth, scaling capex with Revenue. Working capital (incl. inventory) also scales with revenue.

Previously I modelled terminal P/Es of 8, 12 and 16. In this update, I've raised that to 10, 13, and 16. The big upside I've not modelled is that if $SGI can successfully execute this strategy, the EBITDA growth and earnings growth is going to be so high that the P/E will almost certainly be well north of 20. There is a massive premium here for successful execution. And I get a sense from today's webinar that the scale of the upside is apparent to Mike!

Of course, there is a big difference between modelling some scenarios and execution.

As ever, this is not advice and is intended for my own use only.

** Edit to original post ... discount rate used is actually 11% (I meant to use 10%, but left 11% in by error when I was doing some sensitivity analysis! ... all that means is the value is even higher than shown, So, I'll just leave it with 11%)

----------------------------------------------------------------------------

9-June-24

Valuation = $0.41

See straw for details.

Based on FY26 Proforma Project for Stealth+Force, discounted back to 2024 at a P/E = 10.

Taking stock of the release of Stealth Group results over the past 72hrs I sat back and listed why I bought a slice of this company.

This was over two years and the underlying basis / reason was VALUE.

Stealth was trading cheap across all metrics including share price. I found the Free cash Flow yield (FCF) over the past 2years as the most interesting. At 28mill market capitalisation and with FCF 4.7m yield is 16.7%. This presents itself at 3-5x higher than other retailers.

Stealth Group wasn't performing or delivering results with ROE of 20% + two years ago. The results were more like mid single digits ROE but on the pathway to be profitable and grow its margins and customer base.

Without needing to do much right, consensus (which is always scary) saw more upside than downside. A value play indeed. These factors still present themself in 2024 even though we have good appreciation in market capitalisation and share price.

Stealth Group continues to craft its niche to be an alternative to the majors and in doing so there will be questionable acquisitions and moments in its trading results to but what was attractive over 2 years continues to hold true in 2024 in terms of of a value play.

WHY?

Time enables us to watch and assess the credibility and quality of the CEO and management group and although we have seen slips in the revenue forecasts what i ascertain is that this has been done with the profitability lens (see below in the Individual Business Highlights). This has and is more critical for stealth being in a low margin highly competitive market.

Comparing with other retailers for FY24 we have seen revenue fall for HVN (8.9%), ADH (4.3%) but NPAT fall significantly higher HVN (34.7%) ADH (17.8%). This has not been the case for Stealth infact we have seen rise in revnue but significantly higher rise in profitability and EPS.

Its fair to say that the environment is tough in retail.This is not only reflected in Stealth commentary but was also a feature in Wesfarmers results re Bunnings and Blackwoods last week . CEO Rob Scott and divisional lead for Bunnings were put under much pressure on the conference call last Thursday re Bunnings flat growth and outlook.

I find Mike's approach refreshing especially in delivering shareholder value (self interest plays a major role)

There were question marks over two years ago and there are question marks today which i look forward to the upcoming conference call on Thursday 5th September to have them answered.

What must be recognised is the improved business results over the past 2 years . This in turn has seen share price appreciation well over any index and most small cap stocks.

This does not gaurantee success going forward but as we all recognise past behaviour is a good predictor for the future.

Taking a detail look into Stealth Results i would rate 7/10.

The areas of watch :

- Force acquisition and outlook in terms of revenue and profitability

- Revenue growth especially organic 2025 - 2028

- 60mil plus in revenue flagged in new organic at AGM in 2023

Metric focused organisation - Highlight and strength and hard to fault . Keen to see the next two years in terms of these trends evolving especially in light of the Target 300m in revenue and 8% EBITDA margin call out by 2028.

Impressive is the 28.1 % growth in EBITDA in light of 19.4% revenue growth. Highlights focus on profitable customers.

Also important to call out the improvement made in inventory as a % of sales which has fallen from 16.1% to 13% or 19.25%.

Mike and the team clearly understand the importance adjusting as conditions change and improved inventory management.

Ability to pivot - In H2 when revenue fell away its clear Mike and team pulled back accordingly on costs reflected in personnel costs as a % of revenue falling from 18.2% in H1 to 17.4% in H2. This resulted in total expenses as a % of revenue falling from 24.5% in H1 to 24.1% in H2.

As sales with Force acquisition kick in this will be a key watch in terms of maintaining this downward trend for costs.

Clear in guidance - Mike and the leadership team haven't hesitated to put on the table the aspirations in seeking to gain share of the fragmented industry of industrial maintenance, repairs and operations and now with Force consumer technologies products and services. Albeit having to adjust as conditions alter Stealth North Star of 300million and 8% EBITDA by 2028 is set and clear.

Taking the outlook and guidance numbers provided above the range of the results may evolve to be

Rev - $159m

GP - $46m-55.65m

NPAT - $2.38m - 5.565m

EPS 2c- 4.78c

Div - 1.2c - 2.86c (60% payout ratio assumed).

Held

I'll never understand why companies release their results just ahead of market open or, worse, during market hours. For me, the gold standard is after market close on a Friday (although i know not everyone agrees). My reasoning is that it gives investors the most time possible to digest the results before trade resumes. In other words, it helps ensure 'the market' is as informed as possible. At least do it after 4pm.

Stealth decided to do it at 3:30pm.

It really isn't a big deal, but one of those small things that irks me.

Aaaanyway..

My initial thoughts in regard to the results were 'ok'. Although things seem to be more or less on track.

The revenue growth was a bit 'meh' at just 2.4%. In fact, comparing H2 last year to the most recent 6 months, revenue slipped 2.4%. All the growth came from H1.

Actually, it's a bit worse when you strip out the $1.9m revenue contributed by Force, which provided one month's worth of sales due to the timing of the acquisition. FY organic revenue growth was just 0.7% when you factor that in.

Stealth put this down to inflation and higher rates, which they say dampened demand. Fair enough, but they have previously talked up how non-discretionary their products are.. hmmm

The gross margins did improve slightly, 29.6% vs 29.4% supported by "operational initiatives focused on margin protection, inventory velocity, product profiling, and rebate uplifts, collaboratively with both customers and suppliers." Good to see.

Importantly, the EBITDA margin improved to 5.3% from 4.8% (in fact, slightly better on an underlying basis if you strip out one-off growth related investments). Also good to see a big jump in the return on funds improved, and an uptick in the ROE. Cost of doing business likewise improved.

This is all evidence of sound operational performance and gives credence to what Mike and the team have been saying for some time.

The cash balance increased 31%, but part of that was a drawdown on their facility. And while debt was reduced by 33%, that's only if you exclude Force (which had $5.9m in working capital debt). Still, they seem to have been able to reduce leverage associated with the existing part of the business and still paid a maiden dividend (although, as others have said, i'd prefer they keep the cash at this stage of their development).

So all told, we saw a 50% boost to NPAT, but there are more shares on issue post Force. So we need to look on a EPS basis. And we should also consider things pro-forma.

If we assume Force was held for a FY, we could thumb suck a pro-forma EBITDA of closer to $8m and an EPS of closer to 2cps (very rough estimate). But that's a good improvement on FY23's 0.9cps and puts shares on a PE of ~12

And they have again reiterated expectations for FY28 revenue of $300 million at an 8% EBITDA margin. That'd be something in the order of 7-8 cps in EPS, which is obviously a lot of growth from here (IF they can deliver). Acquisitions are clearly a part of this -- they say about a quarter of the extra $141m in revenue will come from acquisitions. So that's something to be mindful of (acquisitions dont always work out!), but good to see that organic growth is expected to do much of the heavy lifting.

I'm still a bit uncertain about Force, and the lack of any organic revenue growth is a bit concerning. But shares remain cheap (if you assume no further deterioration in earnings from cont. operations) and they have made measurable progress on their efficiency initiatives.

Happy to hold for the time being.

(I'd welcome a sanity check on any of this -- i did this in a bit of a hurry)

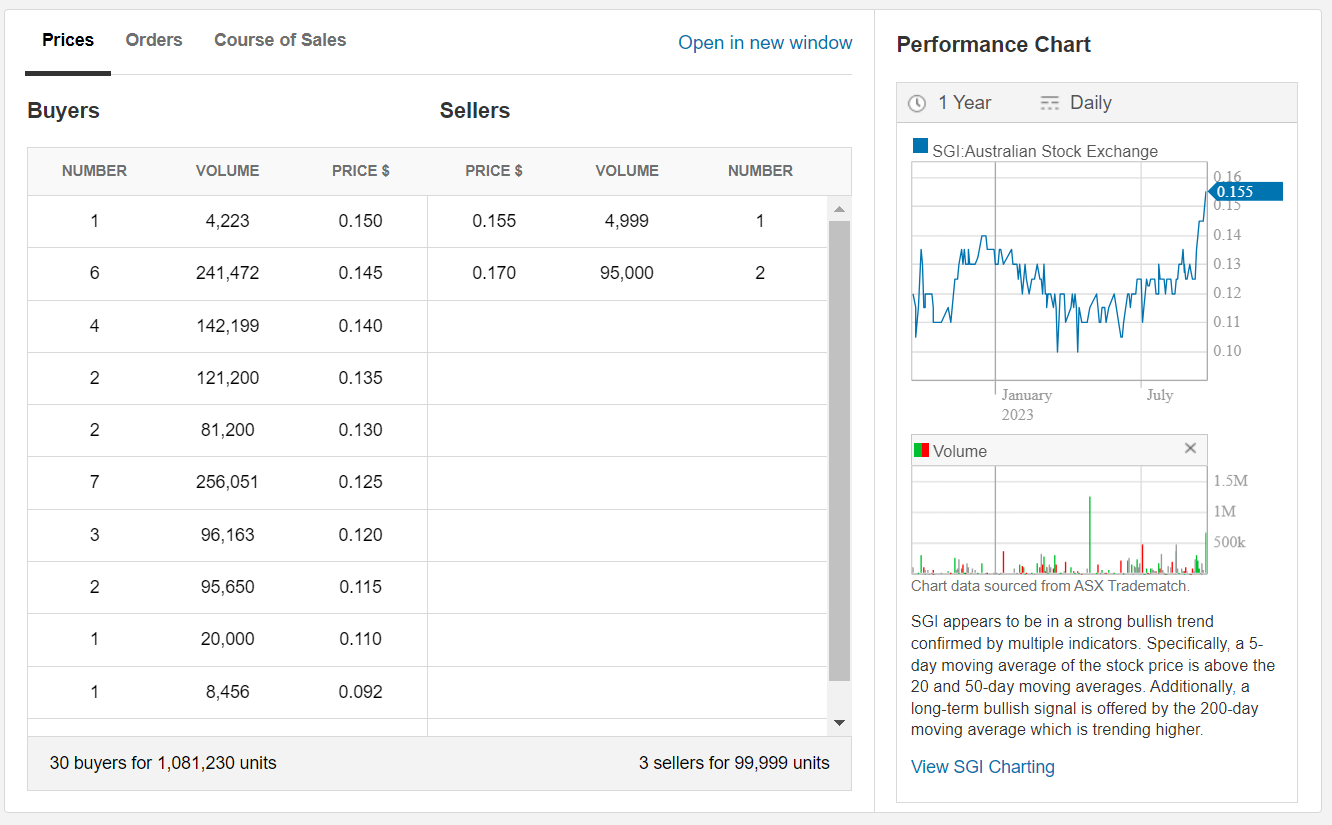

Buyer have dropped off significantly this morning:

I just want to give a huge thanks to @mikebrisy, @Tom73 and @Strawman for your recent thoughts on Stealth's acquisition.

Sorry for going quiet on Strawman in the last year. After selling my tech/consulting business early 2023 I'm working through my earn out period. It's all gone pretty smoothly. But now that I'm "working for the man" I have a lot less flexibility with my workload during the week. I'll be back (said with an Arnie accent).

My quick take on Stealth's acquisition aligns with comments here on SM. My concerns: uncertainty about strategic fit (and Mike calling Stealth a "diversified conglomerate" didn't help); slow organic FY24 growth well below 10% expectations set by Mike; delay in the start of the additional $60m from bulk distribution model; continued glacial progress on profitability.

The positives: I can see how 1 + 1 might be a bit more than 2; all profitability and efficiency metrics continue to move in the right direction; only a small $ increase in NPAT is needed for PE to plummet; a modest dividend is on the way (I personally don't need the dividend, but it could be a catalyst for widening the shareholder pool).

I'm largely on track with @mikebrisy's valuation, although I'd use a more conservative discount rate of 20% given microcap status and current razor thin margin. Still, that puts a valuation somewhere around $0.30+ using a very conservative discount rate. Like everyone else, before I draw too many conclusions I'll wait a couple of months for FY24 report.

Stealth just issued another slide deck, as part of a presentation to ShareCafe.

I'll highlight what i see as the new information in a minute, but boy, this really hasn't been a smooth process.. As others have noted, you have weird (nonsensical?) performance calculations & inaccurate charts, and less than 24 hours after your own investor briefing, you do another with a 3rd party that includes new information..!

Probably a reflection of a small team, and maybe it's a good thing they aren't engaging some IR firm to manage things (and exaggerate them). But still.. it's a bit amateurish!

Anyway, here's the latest presentation -- Stealth-Investor-Webinar-Presentation2.PDF

The key differences to yesterday's presentation i saw were:

- The most important difference is Slide 18 which provides specific financial guidance for FY24, including expected year-on-year growth ranges for sales, gross profit, EBITDA, EPS, and capex. This forward-looking information may have been discussed verbally yesterday? But I don't believe so.

- Slide 10 provides updated "Key Numbers" after the acquisition, such as the $159.0m pro forma FY24f revenue, 250 team members, and over 3,310 retail reseller stores. The first presentation had slightly different figures.

So if NPAT is 25% higher, that gives us a FY24 value of $1.125m (last year was $0.9m)

Of course, post acquisition there will be an extra 14.4m shares on issue, or let's call it ~115m in total. So that's an EPS of 0.98cps. Last year they did 0.91cps, so that's growth of 7.7%.

SGI is right that EPS growth will be 25% if you exclude the Force acquisition (about 3 weeks contribution and extra shares). Maybe it's too late on a Friday, but I'm struggling to work out what the EPS will be in FY25 based on what has been said.

Here's my thought process (someone please correct me if needed!):

- FY24 NPAT (ex-Force) = 0.9m x 1.25 = 1.125 million

- On a per share basis, accounting for dilution, that's 0.98c

- FY25 EPS including the accretive impact of Force (expected to be ~26%) = 0.98 * 1.26 = 1.23 cents (this is before any new revenue contribution)

- So that puts SGI on a forward PE (using FY25 forecast as FY24 is essentially over) of 22.5c (current market price) / 1.23c = ~18.3x

I'm just not sure if i'm interpreting what they are saying correctly...? Still, that's a higher PE than I was expecting, but if I'm understanding things right that doesn't include any organic growth from the legacy business or the new one. And you'd like to think we get some of that!

As has been noted, Mike suggested $300m in revenue by FY28. Let's assume a EBITDA margin of 6% by then (it should be 5.7% this year, compared to 4.7% last year, and they have suggested previously 8% is reasonable at more scale). That'd be a FY28 EBITDA of $18m, which is almost 3x what they should do this year.

Let's thumb suck a net margin of 3% to get a FY28 NPAT of $9m, or 7.8cps

That's certainly a lot of growth, and even if you do use a forward PE of 18, that'd be more than justified if true. But it comes down to a lot of revenue growth (around 20%pa, and continued margin expansion).

It seems possible, but the expected sales growth for FY24 isnt huge (and why is there such a range given there's only 3 weeks left in the financial year)..

Anyway, too much thinking out loud for me. I need to ponder this a lot more..

Just looking at what the announcement says about the likely FY24 PE outcomes on both a pre acquisition and post acquisition proforma basis at the current 25c share price.

Note “transaction costs” are excluded – so this is based on the dreaded NORMALISED results

Vanila SGI (Pre-acquisition)

Sales of $159m less $44m expected for Force gives $115m (I was expecting $122m so a little off)

EBITDA of $8.5m less $2.64 (6% EBITDA) for Force gives $5.86m (I expected $5.94 so close)

Less Depreciation $3.2m and Tax $0.75m (my estimates)

NPAT = $1.91m (I had estimated $1.98m so confirmation bias is locked in Eddy)

PE = 12.5 (before dilution), 14.6 (post dilution)

Full Year Proforma (fully of both)

Assuming the same NPAT to EBITDA ratio as SGI has above: NPAT is 1/3 of EBITDA

Full year proforma EBITDA = $8.5m

NPAT = $2.83m (proforma full year estimate)

PE = 10.2 (post dilution)

The acquisition was a surprise at first – mobile accessories was the last thing on the mind, BUT – Stealth is a wholesale and logistics business for retail… so could make sense – will wait for tomorrows presentation to come to any real conclusions beyond the numbers look good and value is added on a proforma accounting basis.

Disc: I own RL+SM (largest positions for both…)

Mike and the team have a good track record of acquisitions, but I was a bit surprised to see them move into the mobile and tablet accessories market. Seems like a bit of a departure from the current product set (although, that's quite diverse in itself)

Full details here, but some early thoughts from me are:

- 4x EBITDA multiple seems reasonable

- New shares represent ~14.5% of current shares on issue.

- Pro-rata H1 EBITDA for stealth (pre-acquisition) gives $5.6m in FY24 EBITDA. Force should add ~$2.6m (pre-synergy), which is a 47% lift (ie. it is certainly accretive, and tracks what Stealth says about the deal being 43% EPS accretive before synergies)

- The vendors will have a 12.5% ownership stake in Stealth post acquisition. Combined with the earn out bonus there should be some good alignment. ie. the vendors will have some incentive to stay engaged and ensure a successful integration.

- Not sure how high the hurdle is for the earn out payment -- Force is already exceed the threshold in the current year.

- Synergies are always talked up with acquisitions, but it does seem reasonable to assume there will be some degree of opportunity here given SGI's investment into logistics and warehousing.

- Debt wont be too onerous after the deal -- they'll have $11.2m in debt, and Stealth said they will use cash flows to help deleverage things in the coming years.

I'll try and tune into the investor call tomorrow. But overall this looks like a positive.

STEALTH GROUP HOLDINGS LTD

Security Code: SGI

Pause in Trading

Trading in the securities of the entity will be temporarily paused pending a further announcement.

Wonder what this is about ?

Big seller on the market the last few days. I took a nibble. Does anyone have an idea who it is?

Sorry, I've been focused elsewhere today, but does anyone know what happened to:

"The Company will release its first-half investor presentation on Thursday 29 February 2024"

which was promised,...errr.... only yesterday?

[Draft advice to CEO - forget about Share F******* Cafe - and focus on delivery of communications via ASX]

$SGI has officially released their 1H FY24 Results.

Results identical to those presented on the 16th. So no new commentary required.

The funny thing is, this announcement was tagged "Price Sensitive". Its funny because this time there isn't any new information. Whereas, last time there was new information and it wasn't tagged. In fact, it wasn't even released before the presentation.

Oh dear .... more Hanlon at play, I fear.

Overall - a good result, nonetheless. Investor presentation tomorrow.

Disc: Held in RL and SM

Stealth copped a "please explain" from the ASX today, following the spike in share price after the presentation they gave for ShareCafe.

You can read their response here, but honestly this was an obvious and easily avoided mistake.

An investor presentation the day before results were out, in which unaudited numbers were disclosed is, frankly, bizarre.

They reckon this information was already out there, referencing guidance and progress made in November, but some guidance in November is hardly the same as pre-audit numbers after the period end.

It doesn't really change the thesis for me, but it's a mark against them.

I hope they learn from this and take better care in the future.

If anyone is interested Mike Arnold is appearing tomorrow in the ShareCafe Small Cap “Hidden Gems” Webinar at 12:30pm AEDT.

https://stealthgi.com/wp-content/uploads/2024/02/2681574.pdf

Being my largest position on SM and RL (outside Bitcoin) sharing some thoughts on Stealth Group upcoming H1 and for the full year.

Overall to keep the thesis in check looking for positive momentum in respect to

- Revenue, 10%+ growth

- Growth in gross profit from 29.3%,

- EBITDA expansion 5% or higher,

- NPAT over 1%

- Inventory held looking for this to further reduce to 13.0% or lower as a % of revenue

- From a cost of doing business (CODB) similarly looking for this remain or fall beneath 24.3% as a % of revenue

- Free Cash flow growth of 10% to 6.6million or higher

- Debt to be reduced from 7.2m paving the way for a

- Dividend to be paid in H2 , 20% of H2 FCF or 0.65c

What to watch :

- Acquisition, which may be needed to propel revenues to the 2025 target of 200m . If announced looking to be purchased for 2x EBITDA .

Operationally, will be keen to see the continued positive trend in

- daily transaction volume ,

- average sales per order

- average sales per employee

- private label sales growth to 2.5% or higher of total revenue

- update on the price reset process and check in re any loss of customer

Specifically these results would be strong pass for the H1

- Revenue 59m, 12% up on LY

- Gross Profit Margin 31% = 18.3m

- EBITDA 6% = 3.54m

- NPAT - 1.5% = 885k

- Debt to be reduced from 7.2m

- Confirming a dividend to be paid in H2

Similarly strong results for the full year 2024 would look as follows :

- Revenue 125m

- Gross Profit 32% = 40million

- EBITDA 6% = 7.5m

- NPAT 1.5% = 1.875m

- Dividend 30% of H2 FCF 990k or 0.98c per share

- Debt below 5 million

- Shares on Issue 103.5m

Any insight or thoughts would be appreciated

Thanks for your updates and insights @mikebrisy, @Tom73 and @wtsimis. Sounds like a strong meeting with quite a detailed trading update from Mike. Some AGMs are dry. Mike’s openness perhaps reflects his confidence in progress and comfort in share price increase.

Stealth has now more than doubled in value for me. I built to a large position and I’m now pondering my outsized holding. I’m also contemplating @Strawman’s frequent reflection that some of his bigger regrets are decreasing holding too early. Stealth is now around the fair value that I’ve posted on Strawman for the last couple of years. That fair value was based on a discount rate of 20% that I used because of razor thin profit and illiquidity.

I’ll continue to hold. My 20% discount rate implies a forecast 20% return at current share price. The assumptions behind my valuation are starting to seem conservative with the continued positive and open updates from Mike. I’ll resist the fear, trust in the process, and continue to stay the course!

Another reflection and lesson for me with Stealth … In an odd way I’ve been lucky that Stealth has taken so long to see a significant share price increase. I started accumulating 3 years ago. I presented my stock pitch for Stealth on Strawman a couple of years ago soon after I joined in late 2021. My conviction just continued to grow with the support of all of you in the Strawman community who have debated the pros and cons of Stealth. Up until about a year ago I continued to build my holding until it was my largest holding and I wasn’t comfortable putting more in. All up it was about 3 years between first investment and significant increase in share price. Our natural desire is for price to increase as soon as we start to invest, that provides immediate validation of how smart we are. But quick price increase deprives the opportunity to steadily dollar cost average into a large holding.

So, note to future self; be content when the share price DOESN’T increase soon after you spot an opportunity, it’s better to be slowly right than quickly right.

Further to @Tom73's straw, here are the notes I took at the AGM today.

I won't summarise Chairman Chris Warton's address, which you can read here.

Mike gave up an update presentation which had some usefuly information. I'll focus on two elements:

- FY24 Trading Update

- Update on Strategic Initiatives

Overall, he was his usual matter-of-fact delivery style, although at the start he indicated his delight at the recent share price progression, and clearly sounded more upbeat that the progress they are making is getting recognised.

1. FY24 Trading Update

The Trading Update gave information on the 1st four months of 2024.

The chart below shows how the segmental split of sales has evolved, with two views presented: product segment and customer segment. The shares of workplace, safety and automotive segments have all increased slightly at the expense of industrial. On the right of the chart, Mike noted that declining share of Retail and Trade and Other (“small end of town”) customer segements is consistent with the overall trend they are seeing in other businesses.

In the next slide below from Mike’s presentation, it is titled “Highlights - year in review” but it has some relevant current year insights, which I will explain below.

Mike noted that on sales revenue in 1H FY24 vs FY23, they achieved 15% EBITDA “received on additional sales” – this is a key metric Mike has referred to in the FY23 results and, also, I think in his Strawman meeting. Given their statutory EBITDA Margin in FY23 was 4.8%, this would indicate that operating leverage is coming through as Mike has indicated it would. Should this trend continue, it will drive ongoing margin expansion over time. And Mike discussed this in terms of their target to achieve 8% in FY25, and also its significance in terms of their target range of achieving 10%-15% EBITDA margin on all incremental sales into the future. Good to see the evidence showing through.

On scale benefits, Mike described how the centralised purchasing office is achieving scale benefits. This is achieving a 2% to 4% uplift in margin, equating to $1.3m NET, with most of the benefits starting to flow in January / February.

Of the 8 new contracts signed last year with customers, 2 will start in March and 1 in May, with pre-determined order values with purchase orders supplied. One is for $6m for a supply over a two-year period. Mike said “We’re getting invited for big tenders, we’re winning those big tenders. And the investment we’ve made in technology has allowed us to onboard large customers now that we have an EDI linkage … which means that every order they supply to us comes automated instead of via email or via phone and then we manually have to key that in.” So, he said this is driving the people efficiency metrics, which I’ll show below, 2 slides down.

The trading update is shown in the next slide.

Against the 1H revenue target range of $55-$59m, they are at $39.0m after 4 months.

So, by my maths that's 68.4% of the mid-range with 67% of the time elapsed. (But I have no idea what the seasonality is towards the year end, so I can't read anything into that.)

Looking back at the same time last year, their 4 month result of $36.0m ended up being 68.7% of their 1H FY23 result of $52.4m. So they are pretty consistent.

The $39.0m represents +8.3% over the PCP.

So, overall, they appear on track for revenue to be within the 1H guidance range.

On costs, Mike spoke about some of the wage inflation challenges and said “our costs have increased roughly 7.4% since 1st July.” The are clawing this back in the "pricing reset program", mentioned at the FY23 results, however they are only 17% of the way through this, so there is still margin “uptake” still to come. Mike said “we are receiving more gross profit per order and that will obviously benefit us as well when our results come out.”

Mike noted that 1H represents about 42% to 45% of the FY result so, from his perspective, he considers that they are “sitting ahead of plan, which is encouraging.”

Mike then showed the comparable per day metrics over the 1st 4 months FY24 compared with FY23, slide shown below.

I note the daily sales are higher than I calculated in the pcp comparison in my analysis above. Overall, these metrics are encouraging.

I haven’t tried to calculate the potential EPS – slightly tricky with the FY23 result coming off a small base. But they should be making decent progress off these operating metrics.

Encouragingly, the overall business progress appears to be holding consistent with the “non-discretionary” banner that both the Chairman and MD tout.

2. Update on Strategic Initiatives

Mike called several strategic initiatives:

Loyalty Rewards Club, which gets rolled out in March. They hired a couple of people with experience doing this elsewhere, and expect it to drive both revenue and profit.

Launch of a Superstore format, coming first with a redesign of the Brisbane facility, and then will be replicated elsewhere. They are getting support in merchandising and fitouts from suppliers, so not having to bear the full cost. Four other locations have been identified for refurbishment and fit out.

Consolidating Skipper Transport into Heatleys to create a new category format of “Safety, Industrial, Automotive”, something Mike says he saw in the US, and where he perceives there to be a gap in the Australian market. By December the two current ERPs will be integrated onto one system – “quite a significant investment that we’ve made”.

Launch of a Hire Business operation, already operating in Queensland, but to be rolled out across the network focused on the “smaller end of town”. It covers tool, equipment, and lighting, and has alongside it the sale of all the consumables, PPE etc. that are needs for any hired equipment operation. Mike spoke about the attractive metrics, with payback on investment in the first 13 weeks, whereafter revenue drops straight to 100% gross profit, and then items are sold after a further period to recover value.

My Overall Takeaways

Good progress showing through on a range of metrics and very consistent where Mike indicated the business would be heading at FY results and at the SM meeting.

I have only a small position, which I am minded to increase, but will wait to see if there are opportunities to do better than today's SP.

Disc. Held in RL and SM

Mike was clearly pumped by the recent share price performance so spoke with conviction and pride of the business's operating performance. Someone else will have to cover the detail and the Chair speech, I missed parts due to an annoying phone call.

The key take away for me was the 60m organic sales growth opportunity that will get them to the 200m sales target. I asked Mike about how they expected GP% to change as they took this up because I wanted to understand the quality of the opportunity. His answer was far better than the question and said with confidence and clarity that gave me an appreciation of the depth of work they have done in analysing the opportunity and understanding how their business will change in taking it up.