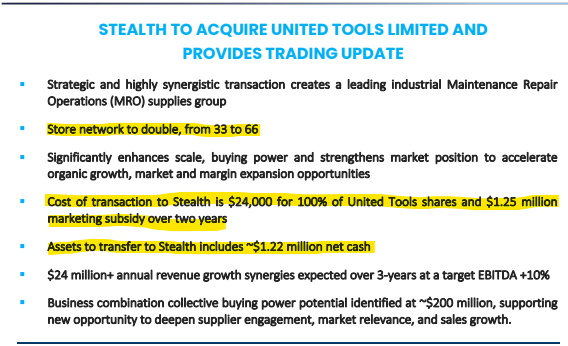

I posted on Stealth's acquisition, and then deleted it because it seemed too good to be true, and am now re-posting:

Effectively it looks like they are buying a sizable business, largely deferred, using the money they're acquiring on settlement. It seems too good to be true. Having said that they later disclose United is only marginally EBITDA positive in FY21, we don't know to what extent that result was propped up by COVID subsidies, nor how recent COVID lockdowns have impacted them, nor how the rest of their balance sheet looks. United's stores are geographically skewed to the east cost, which makes strategic sense for Stealth but does expose them more to current COVID concerns. Based on what they've given us it's really hard to tell if this is highly opportunistic or a massive risk (or a bit of both). Interesting though...

[Not held]