Thank you @Slideup and @Strawman for your notes on the H1 presentation, very helpful addition to what I got out of it. I will only add the impression I got that Mike (CEO) was very much in sell mode to drive the share price up (eg FY24 dividend…maybe). Not an all together bad thing but I think he over embellished on a few points. In particular I do not agree that Operating Cash flow or FCF are in a good spot, if you factor in lease principal payments (which for their business is a significant opex) FCF is +0.1, not +1.2m as shown on slide 11 and Op Cash is +0.7 not +1.7 as shown on slide 19.

Also, I am taking with a grain of salt that 95% of items sold are non-discretionary until we go through a downturn and that is proven. A global recession and pull back in business investment and commodity prices may test this theory for their customer base. I am sure they won’t be too badly impacted, but they will not be 95% immune.

Probably not big points to make, but I would prefer a more objective/frank view from the CEO which to my mind still has more than enough positive and avoids them feeling the need to focus on short term expectations to meet the hyperbole. As a shareholder I sympathies with his frustration at the markets indifference to valuing the business, but the numbers will do the talking when they start delivering them!

Outlook

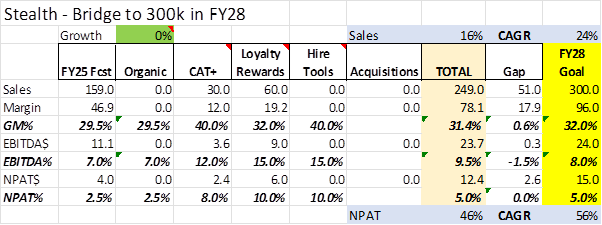

None the less the company looks like it is pivoting from around break-even top line growth into what could be very rapid operational profit growth if it can deliver the margin expansion. However that also seemed imminent when @DrPete123 introduced it to the SM community – and I agreed with him and bought a small position. I note they still have the 8% EBITDA target for 2025 and sales have gone from 70m in 2021 to a likely 110m for 2023, mostly due to acquisition. So, I retain my faith in them and acknowledge they are very well positioned to reach that target especially if they can get the margin expansion talked about from acquisition integration, synergies, consolidation and leveraging their buying scale.

A lot can go wrong with all that they are doing, and a recession will provide a headwind, but all the ingredients are there and their new scale should provide economies to expand margins one way or another as they absorb the acquisitions. So, let’s look at what happens if they meet there target or even get close:

Valuation

I have valued using a two methods, DCF at 10% and discounted PE of 15 from FY28 forecasted EPS figures to get the values. Assumptions for each noted.

Bull Case ($1.30-$1.37): They meet guidance of 25% sales growth and 8% EBITDA by 2025, then 10% pa Sales growth to 2028 terminal year and terminal EBITDA% of 10%. I doubt this will be possible without acquisitions which may require dilutive capital raises and impact on this valuation.

Base Case($0.60-$0.72): 10% Sales Growth to 2028, EBITDA% 6% by 2025 and 8.4% by 2028 terminal year. They have talked to a target of 10% organic growth, so assuming that they can do this and find margin efficiencies they have highlighted then I think this is achievable. For this scenario I assume capital rases to fund acquisition have a net zero benefit on a per share (ie dilution offset by additional growth)

Bear Case ($0.12-$0.23): Assume that sales grow at 10% still but efficiencies are minimal and EBITDA% only get to 4% by 2028.

There is of course a case where it’s worth zero, where operational complexities add cost and recession or other external factors keep profits from growing or send them negative. The debt levels could also be a cause of business failure for reasons that may not be clear currently.

That said, I see SGI currently at a price of $0.12 as undervalued on a large range of possible outcomes and an asymmetric bet on the future. Not a lot needs to get better (only small margin growth and modest sales growth) to justify much higher values.

Disc: I own SGI, having bought in Oct 2021 and have topped up recently following the H1 result, but that took 2 weeks given the lack of liquidity!!!

Side Notes on Reporting Matters

Inventory: I agree this is improving, but I don’t like it reported as a % of Sales, it should be a % of COS, that way movements in margins don’t impact your stock turn figures. Example is FY20 Vs FY22, Inventory measured as % of Sales was unfavorable 18% (11.6% to 14.2%) but as a % of COS was unfavorable 22% (15.8% to 20.3%)

Debt: I like the detail of the debt brake out, also the articulation of its use and management in the call. They are clearly and appropriately managing this closely which is great to see, and I think debt levels are reasonable currently, but I would be concerned if they grew from here. The splitting out of acquisition debt is informative but I don’t want to see an emphasis of debt excluding acquisition (inc WC support) as something that is highlighted as though the debt isn’t real debt (what is with Capital Risk Ratios that exclude acquisition debt – p22 of the H1 FY23 rep – maybe loan covenants metrics)!