As promised I will try and do a dive into Maxiparts

History

Maxiparts is a distributor of auto, truck and trailer parts for the commercial sector in Australia. Maxiparts main customer base are road transport operators, as well as commercial vehicle service and repair providers

In July 2021 they sold their underperforming trailer solutions business to Australian Trailer Solutions Group for 30m. Afterwards MXI issued a special div and 5 for 1 share consolidation. New CEO Peter Lorimanta also appointed.

On Feb 1st 2022 MXI acquired Truckzone

On May 31st 2023 MaxiPARTS completes Forch Australia acquisition of 80% for 9.7m or 7x normalised EBITDA. This was a significant acquisition which broadens their customer and product base into the mining, engineering and automotive repair sectors

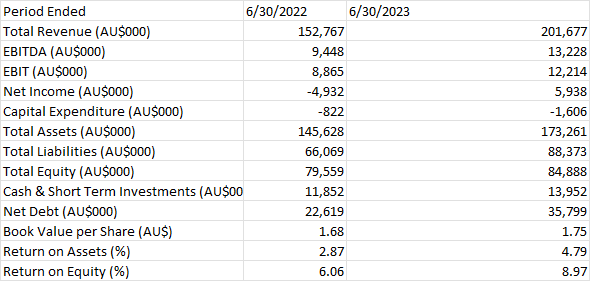

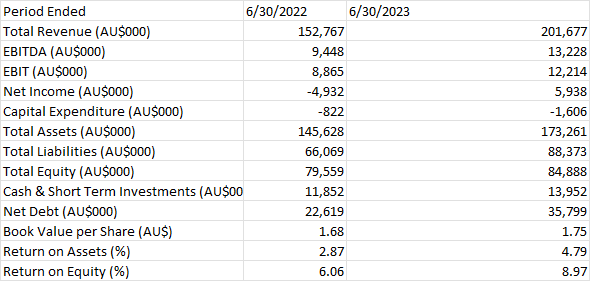

Financials (source capital IQ Pro)

While ROE has been low and negative previously periods, it is now hitting an uptrend after management changes and sale of Trailer Solutions business.

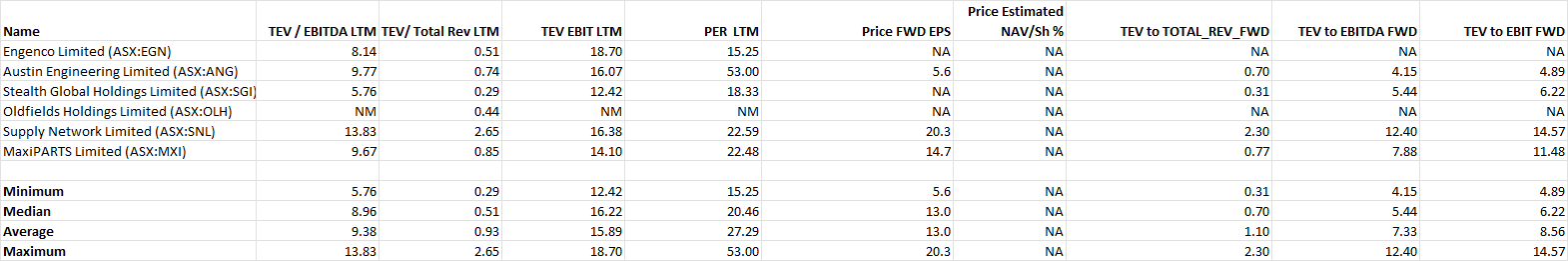

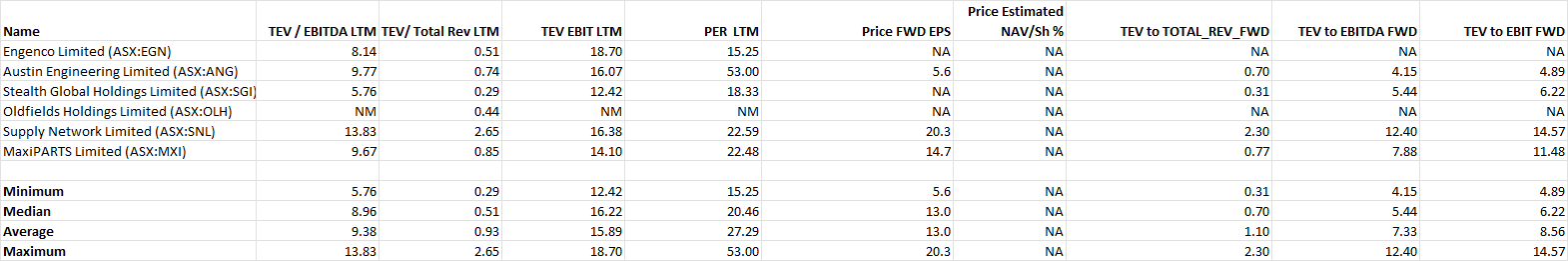

Multiples comparison (IQ Pro)

So expensive vs SGI (Strawman favourite) but cheap against SNL

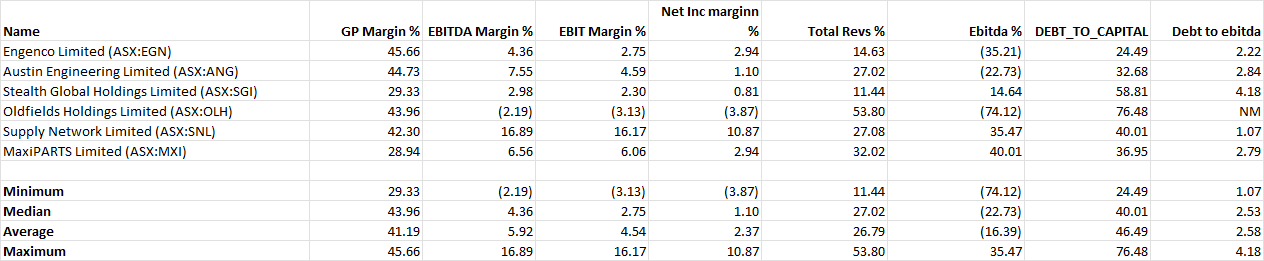

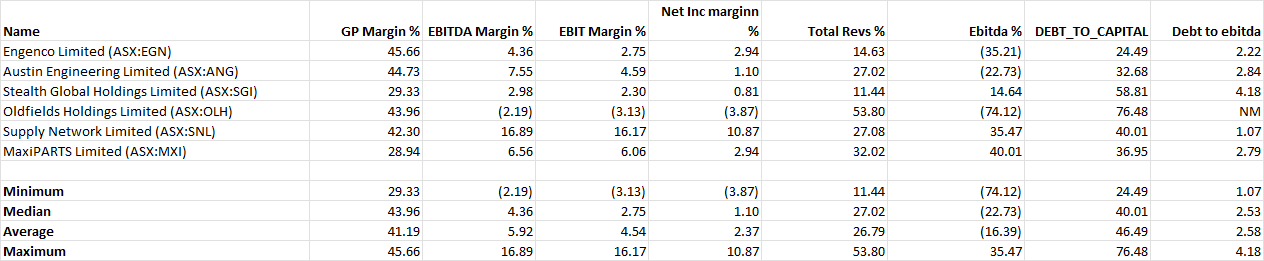

Margins comparison (IQ Pro)

A good idea on margins versus the comp. Seems reasonable buffer of growth and margin.

Some positives

Recent buying from Perpetual

3.30 price target from Ord Minnett, 25 Aug 23

Concerns

Outstanding $4m payment still to be paid from ATSG (Australian Trailer Solutions Group) after sale of Tralier solutions business. See ann 5 September 2023. Previously there was some dispute on remaining payments that was settled in court. I think this is what is holding the share price back.

Not sure what the big picture is for automotive/truck aftermarket with the advent of NEVs and automated driving. Would there be less need for this sort of parts/service or more. Still an evolving market so hard to value any potential disruption from NEVs and self driving/AI.

[held]