Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Maxiparts released their latest update which I think is disappointing given they made a large acquisition recently

* Revenue for H1 FY24 of around $112m, a 13% increase compared to the prior comparative period.

* Operating Profit estimated to be around $10.6m EBITDA and $4.9m NPBT for the period,

So NPAT is probably 3*2m.=6m. Market cap is 130m. PE is 21 which is not cheap compared to revenue growth from previous period of 102m for 2HFY23.

In addition there is an ongoing legal dispute between MXI and ATSG regarding the divestment of the trailer business which means that MXI still won't receive their outstanding payment of 4m. In addition ATSG is making a counterclaim of 5m for breaches of warranties and deceptive conduct. Included in the sale was the Carole Park manufacturing facility that will now be closed and attached to that is a 1.1m liability to the QLD state govt that was aimed to keep the place running.

Given there is so much going on in not a good way, I've decided to exit. Bad call from me unfortunately

Maybe found the reason why MXI refused the @Strawman meeting request

There was a recent capital raise to acquire more of Forsch and another company IP

Placement was done to complete the transaction

Details below:

15 November 2023

New Shares under the Offer will be issued at a price of $2.46 per New Share (“Offer Price”), which represents a:

• 9.6% discount to the last traded price of $2.72 on 13 November 2023;

• 10.2% discount to 5-day VWAP of $2.74; and

• 9.2% discount to 10-day VWAP of $2.71.

Ord Minnett Limited and Canaccord Genuity (Australia) Limited are the Joint Lead Managers, Underwriters and Bookrunners to the Placement (“Joint Lead Managers”).

INSTITUTIONAL PLACEMENT

MaxiPARTS received strong support for the Placement from both existing and new shareholders, raising a total of approximately $17.2 million. Under the Placement, MaxiPARTS has agreed to issue approximately 7.0 million New Shares at the Offer Price to raise approximately $17.2 million. No shareholder approval is required for the Placement, as MaxiPARTS will utilise available placement capacity under Listing Rule 7.1.

Interestingly there was a announcement on the day before about the placement being fully underwritten

14 November 2023

Equity Raising

MaxiPARTS also announces a fully underwritten $17.2 million institutional placement launching today (“Placement”) utilising the Company’s Listing Rule 7.1 Placement Capacity.

Furthermore Ord Minnett came up with a new price target raising to $3.60 p/sh

Looks like there is some conflict of interest here.

My other hunch is the underwriters have been selling stock although I am not certain. But there is that feel that underwriters had some issue moving these 7m shares and didn't want to hold too much.

Not sure if I want to top up here. But if you think this has value, stock is going at a discount right now, possibly caused by the underwriters.

I haven't had time to look at the acquisition more closely as talking about the events leading up to the underwritten placement is more interesting.

On the other hand I could be reading too much into the placement and the share price fall today.

[held]

Calling it what it is

If you are going to sell, just sell and don't just sell 1 or 2 units.

Damn illiquid stock

[held]

As promised I will try and do a dive into Maxiparts

History

Maxiparts is a distributor of auto, truck and trailer parts for the commercial sector in Australia. Maxiparts main customer base are road transport operators, as well as commercial vehicle service and repair providers

In July 2021 they sold their underperforming trailer solutions business to Australian Trailer Solutions Group for 30m. Afterwards MXI issued a special div and 5 for 1 share consolidation. New CEO Peter Lorimanta also appointed.

On Feb 1st 2022 MXI acquired Truckzone

On May 31st 2023 MaxiPARTS completes Forch Australia acquisition of 80% for 9.7m or 7x normalised EBITDA. This was a significant acquisition which broadens their customer and product base into the mining, engineering and automotive repair sectors

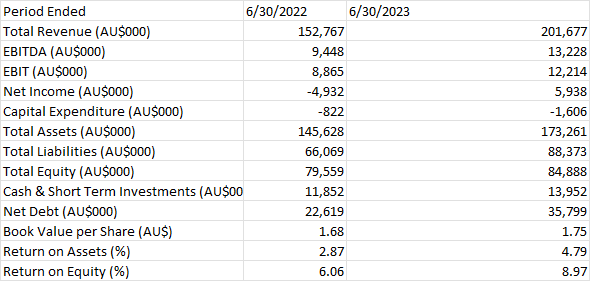

Financials (source capital IQ Pro)

While ROE has been low and negative previously periods, it is now hitting an uptrend after management changes and sale of Trailer Solutions business.

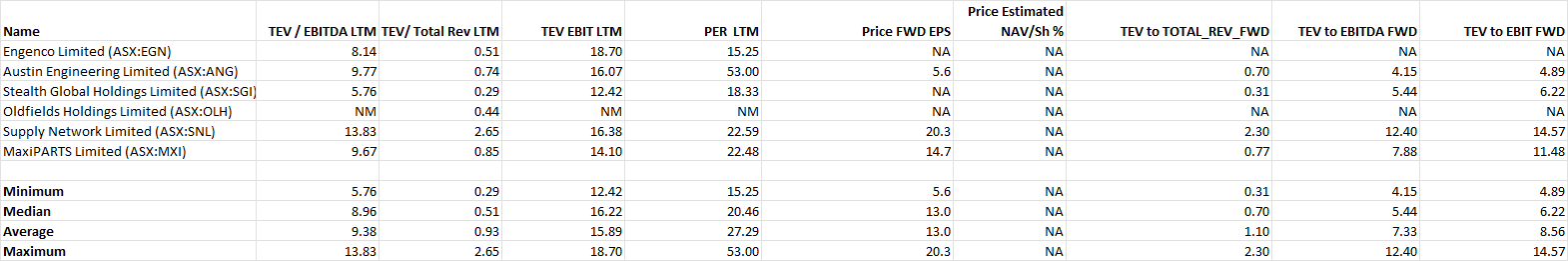

Multiples comparison (IQ Pro)

So expensive vs SGI (Strawman favourite) but cheap against SNL

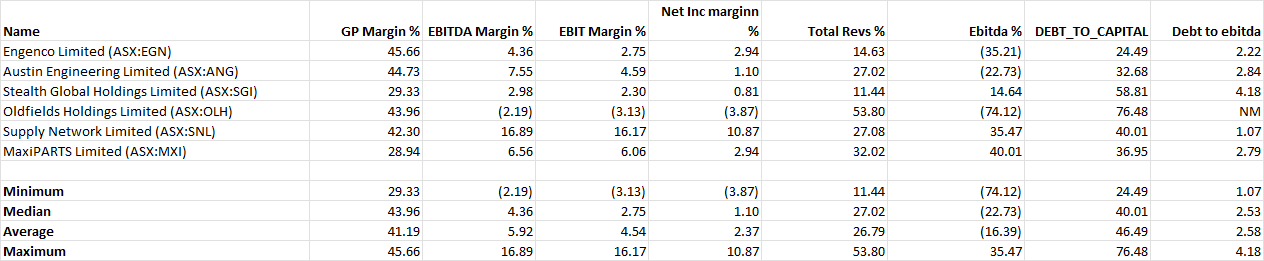

Margins comparison (IQ Pro)

A good idea on margins versus the comp. Seems reasonable buffer of growth and margin.

Some positives

Recent buying from Perpetual

3.30 price target from Ord Minnett, 25 Aug 23

Concerns

Outstanding $4m payment still to be paid from ATSG (Australian Trailer Solutions Group) after sale of Tralier solutions business. See ann 5 September 2023. Previously there was some dispute on remaining payments that was settled in court. I think this is what is holding the share price back.

Not sure what the big picture is for automotive/truck aftermarket with the advent of NEVs and automated driving. Would there be less need for this sort of parts/service or more. Still an evolving market so hard to value any potential disruption from NEVs and self driving/AI.

[held]

Have started doing a dive into Maxitrans after seeing Perpetual become substantial

Interesting little company that supply truck and trailer parts and components to the commercial and industrial sectors. And so has a few similarities to Supply network.