I've been reflecting on the opportunities and risks associated with Veem's recent signing of a partnership with Sharrow.

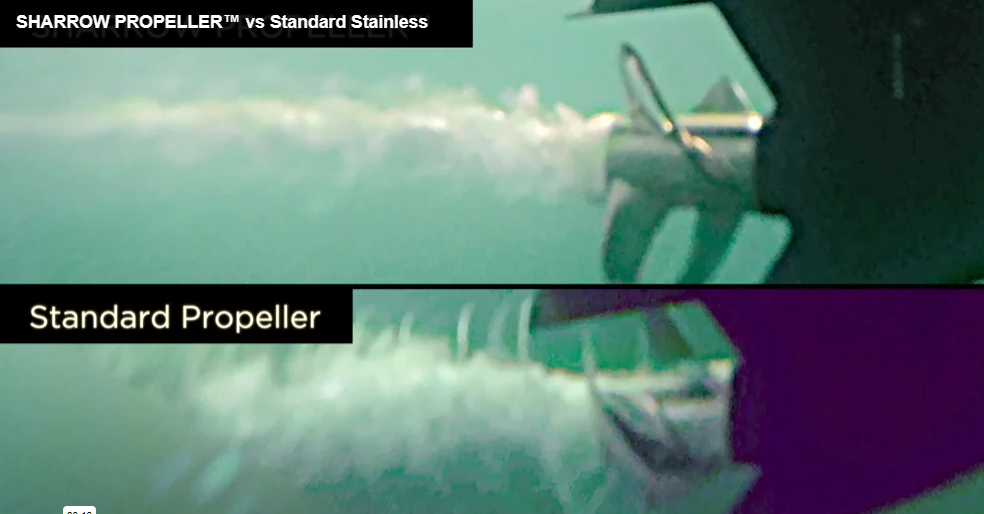

A bit of background; Sharrow are a U.S. startup who have designed, patented and commercialised a toroidal propeller design that some (i.e. Sharrow) regard as the biggest single advance in propeller design since the 1830s. The design reduces the significant propeller tip vortices and makes boats equipped with their propellers significantly faster, quieter and - importantly - more fuel efficient. The differences are most prevalent at mid-range rpms but to some extent exist throughout the rev range. Fairly typical review here. A still from the video below shows the relatively dramatic difference.

The advancement Sharrow has made makes them a disrupter and a threat to Veem and other traditional propeller manufacturers. About the only thing that is stopping Sharrow from world domination is the fact they are selling them for five times the price of traditional props. That won't forever be the case. I think Veem management should be congratulated on doing the deal to become the exclusive manufacturer and seller of Sharrow-designed inboard props. It gets them back in the game.

We don't know a few things. Veem will pay a licensing fee on each propeller sold. We don't know how much. I did ask the Managing Director what he expects the gross margin (including licensing fee) to be relative to traditional props. To be honest his answer was a bit rambly, but I think that reflects the fact that they haven't settled on the cost multiple as this will be influenced by the performance they get from an inboard installation on their test boat (they have stated they will report back to the market on this by year end). He did say they wouldn't sell them at the same premium Sharrow is selling outboard props (5x versus traditional prop), but if they work as well as expected on an inboard installation they would sell them at a significant premium to their usual props. In the end he said "margins will certainly increase" - so take that as you will.

We don't know at what point they're going to want to add to their existing capacity. They say they have capacity to build 450-500 props a month. I take that to mean either traditional props or a mix of traditional and Sharrow props, but I've asked for clarification of that i.e. that it's not excess capacity. Assuming it's existing capacity I've asked what the rough excess capacity is - they probably won't tell me but if I don't ask they definitely won't tell me.

Either way they're talking about building a new facility. That adds execution risk and also puts some immediate stress on the balance sheet. The MD suggested an investment of $5-7m would result in a factory that could produce 200-250 props/month. Sharrow is selling their generic props for US$5-12k a pop. Veem props are custom made and typically for bigger boats. Although they only have one operating segment they did disclose propulsion and gyro sales combined as $33m in FY23. Subtract gyro sales of $5m and divide by an average build of 300 props/month (2/3rds of their end of year capacity) and you get an average sale price of around $8k. The MD has said they wouldn't be going with Sharrow's 5x multiple versus traditional props, but let's say it was 2x - $16k/prop. Assuming they build at the lower end of the MDs thumbsuck capacity and you get annual revenue of $38.4m. Is that a good payback? Stunning. But if they're saying $5-7m capex, they probably mean $10m. Plus we don't know the margins they'll make but if you conservatively use the FY23 whole of business margin (63%) it brings annual return back closer to $24.2m (still excellent). But I made so many assumptions in there that I wouldn't trust it to be within cooee of reality. Interesting exercise though.

The other thing we don't know is how they're going to fund it. They already have net debt (manageable but it's there), they're already capital intensive and didn't generate free cash flow last year, and they did a partial sell down during a cap raise a couple of years ago, then soon thereafter disclosed some operational issues, leaving a bad taste in the mouth of some investors. So all that needs to be taken into account.

I think the opportunity is significant. The payback for commercial boats (ferries etc.) in terms of fuel savings is said to be just months. If the takeup of these props on inboard installations replicates Sharrow's experience with outboard props then the MD is saying it won't just be one new factory required but multiple in different parts of the globe. But the risks are also significant and I think that's why the share price hasn't really moved since the announcement. I'm happy to sit on my (under-sized) position for now and see what happens.

They do look cool though.

(updated the maths)