Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Strong result including some one-off costs (from something to do with liver cancer????)

good to see the company finally producing a solid margin

props should continue to perform

gyros still an unknown if can continue the momentum, with multiple tenders pending. Would be good to see more talk of other interested ship builders other than strategic marine

Mark stepped down, new CEO Trevor Raman

Veem yesterday announced Sharrow had formally accepted the performance of the Sharrow by Veem inboard propellers on Veem's test boat. The move opens up the ability for Veem to now start building and selling Sharrow by Veem propellers for customers for inboard applications. They are off to good start with 280 customers already having put down an admittedly nominal (US$100) deposit on the revolutionary design. All of which prompted me to sell my remaining holding here and IRL...wait, what the...?

I might look back on the sale as a failed attempt to play 4D chess, but I need to put my thinking down to remind myself there was some thinking even if it was wrong. Basically, when I sold a portion of my holdings a few weeks ago I did so on two grounds: valuation and on the complexity that was becoming apparent in adapting Sharrow's design to an inboard application. Both of those factors were exacerbated yesterday, with the SP popping and the complexity confirmed.

When Veem originally announced the partnership in October they talked about testing taking place on their boat "in coming weeks", with acceptance implied soon after, sales in early 2024 and the full range offered by the end of 2024. That was probably always optimistic, but I think the timeframes now look wildly heroic. Management more or less conceded the engineering is a lot more complex for inboard motors, with solutions needing to be a lot more bespoke than the generic "one size fits most" approach Sharrow can take with outboard motors. Boat size, weight, propeller shaft angles, vibration and lots of factors I can't even imagine are much bigger issues for the props Veem will be producing, compared to Sharrow.

I'd still back them in to make it a success, but there's going to be a steep learning curve during the first couple of years, while Veem build up a catalogue of what attributes work in particular scenarios. I imagine there is a high likelihood of significant and expensive reworking of props. Further to that, the price of making it a success will be further significant investment required with a new manufacturing site being mooted for Europe or the United States.

My best guess is the next couple of years are a good opportunity to sit on the sidelines, wish them well and hope to get back in later with a better risk/reward tradeoff. The biggest risk I see to this thesis is Defense. I previously mooted that the characteristics of the Sharrow design (particularly quietness) would on face value have great appeal to world navies. Management called this out yesterday with upcoming underwater decibel testing to take place in coming months. If that testing confirms the more subjective and less relevant on deck experience, than it's hard to imagine how you send out a navy not equipped with Sharrow props, which Veem are in the box seat to build. In that scenario Defense are much more likely to fund development. Something to watch.

Updated Investor presentation. Nothing much new. Seem to be dragging their heels on the acceptance testing of the Sharrow props.

Sharrow by VEEM:

Subject to successful acceptance testing in the coming weeks, the SHARROW by VEEM product is expected to be introduced to customers in the fourth quarter of FY24.

Further design refinements expected to be generated as the different series are rolled out through FY25

General:

VEEM expects to be able to continue at the higher level of hours worked through the rest of FY24.

VEEM remains vigilant in terms of cost increases and availability of materials and components globally due to issues like the conflict in the middle east impacting global shipping. Mechanisms are in place to protect pricing and margins.

Liquidity adequate to fund current planned operations and capital expenditure.

Sold out in RL and SM recently after good run but up another 9% today.

Busy morning of results....

• VEEM’s revenue for the half-year was $37.5m up 37% on 1HFY23 with total activity (Sales + change in WIP) for 1HFY24 of $39.7m.

• EBITDA and NPAT were $6.9m and $3.5m, up 65% and 92% respectively on 1HFY23.

• Cashflow from operations was $4.4m, up 203% on 1HFY23.

• EPS of 2.58 cents per share, up 92% on the prior period.

• Gyro sales for the half-year were $5.0m, up 200% with orders in hand of $9.2m.

• Agreement signed with Sharrow Engineering for the exclusive worldwide licence to manufacture and sell Sharrow-designed propellers for inboard vessels.

Nice piece on 9 news promoting the company

Sharrow propeller in Time magazine's best inventions of 2023

Good news for the company that the Hunter class frigate is still going ahead. Veem was contracted to build prototype propellers back in 2022 due for completion Q2 24.

In short: Britain's BAE Systems will get the go ahead to build at least six new Hunter-class warships — costing around $4.5 billion each — for the Royal Australian Navy.

From the Fy23 presentation

Currently manufacturing blades and hubs for the Hunter Class Frigate Program (HCFP) demonstrator program for BAE Systems Australia. The value of the demonstrator contract is $1.8 million, with successful completion of the task by Q2 2024 ensuring VEEM qualifies as a supplier to the HCFP. VEEM is one of only two suppliers globally to be able to produce this level of precision.

• Success with this project and subsequent high-level defence supplier qualification is expected to lead to further Australian defence work as well as the potential to export equipment for other naval shipbuilding programs around the world, including other Type 26 frigate programs.

A nice little announcement by Veem today that Strategic Marine are accelerating the purchase of gyros on their crew boats. Instead of purchasing 12 gyros over three years, they will now purchase all 12 by 30 June 2024.

On the one hand it's not new sales - just accelerated sales, but it's a nice validation of the technology. It's also a welcome cash boost given the likelihood the company will either have to raise capital or increase debt to fund expansion of its propellor manufacturing business and support the Sparrow partnership.

What's a little less certain is what the accelerated sales means for the Strategic Marine exclusivity agreement. Are Veem wholly reliant on Strategic Marine's onsale of gyros in FY25 and FY26? I think I'll ask.

Shares are up 10% today. I'm not sure the announcement below would suggest Veem is now a 10% better business but that's the fun of microcaps.

[Holding]

Time Magazine's Best Inventions of 2023 are out and the Sparrow new propeller design made the list. They are in some illustrious company with Chat GPT, Apple Vision Pro and the recently approved Alzheimer's drug Leqembi amongst those getting gongs.

Veem recently signed a 17-year agreement to be the exclusive manufacturer and seller of Sparrow-patented propellers for inboard applications, which I outlined in a recent straw.

One thing I didn't include in that straw was what that propeller might mean for worldwide navies. The fuel efficiency and speed benefits of the design would I'm sure have their own appeal, but the real benefit in this application would likely be the quietness of the new design. As an existing supplier to defense, VEEM could be well positioned to take advantage of this. With a decision about whether to set up a new manufacturing site likely in the next couple of years it will be interesting to see where they choose to go. Previously they have indicated Europe as a likely candidate, but a move to the United States (which Sparrow are also pushing VEEM to do) might suggest they are positioning to tender for U.S. Navy work.

[Held]

VEEM (VEE) Potential game-changer for propellers

- ADD (maintained) | Target price: A$0.84 (previous: A$0.84) | Current price: A$0.62We think VEE's partnership with Sharrow Engineering to jointly design and then VEE to exclusively manufacture and sell Sharrow designed propellers worldwide for the inboard motor market is a significant development that could accelerate propeller sales over the long term.

- While 'SHARROW by VEEM' propellers will likely cost more to produce than VEE's current propeller range, selling prices and margins are expected to be higher.

- Given the fuel savings and ESG benefits on offer, we think 'SHARROW by VEEM' propellers will be popular in the commercial retrofit market.

- We make no changes to earnings forecasts but see upside if things go to plan over the next 3-6 months. We have an Add rating and $0.84 target price on VEE.

VEE partners with Sharrow Engineering

- VEE's deal with Sharrow will see the parties jointly design and VEE exclusively manufacture and sell Sharrow propellers worldwide for inboard motor vessels.

- Sharrow has developed an award-winning propeller design for the outboard motor market with significant improvements in fuel efficiency, noise, vibration and handling compared to standard propellers.

- The agreement with VEE will target the inboard motor market with the total addressable market for inboard propellers estimated at US$2.6bn (of which US$338m pa will be new builds).

- VEE has exclusive rights to manufacture and sell Sharrow propellers worldwide for 17 years (or longer if the patents expire after that date) provided VEE meets minimum sales targets over the first 3-year period and annually thereafter. VEE will pay Sharrow a licence fee based on the sales of 'SHARROW by VEEM' propellers.

Opportunity for sales and margin improvement

- Progression with the project remains subject to VEE accepting the performance of the Sharrow design on VEE's test vessel. Testing is expected to be done over the coming weeks with the results due in December. If things go as planned, the first 'SHARROW by VEEM' propeller sales are due in early 2024.

- The 'SHARROW by VEEM' range will likely cost more to produce in both raw materials and manufacturing time. However, pricing for the propellers is expected to be substantially higher than current standard propellers (we estimate at least 2x higher) with Sharrow adoption rates for the outboard motor market showing customers are willing to pay a significant premium for the realised benefits. Even after factoring in the licence fee payable to Sharrow, management expects margins on 'SHARROW by VEEM' propellers to be above current VEE propeller margins.

- Given the fuel savings and ESG benefits on offer, we think 'SHARROW by VEEM' propellers will be popular in the commercial retrofit market. We estimate the propellers could be up to 10% more fuel efficient than standard propellers, providing a compelling economic argument for operators to switch.

Changes to earnings forecasts

- Our earnings forecasts remain unchanged given VEE continues to test the Sharrow design and customer take-up and pricing is to be determined. These should become clearer over the next 3-6 months as more data becomes available and VEE speaks to its customer base about their interest in the new product. Nonetheless, due to the higher selling price and margins on offer, any incremental sales of 'SHARROW by VEEM' propellers will be positive for the earnings mix.

Investment view

- We see the Sharrow agreement as positive and could accelerate propeller sales over the long term. In addition, the global gyro market is worth ~US$14.6bn with VEE currently the only proven player operating in the large gyro segment. While gyro sales will be lumpy in the short term, if the company executes well, we believe there is significant growth potential in this segment. We have an Add rating and blended (DCF 50%, EV/EBITDA 25%, PE 25%) target price of $0.84 on VEE.

Price catalysts

- Sharrow testing results are due in December with the potential for VEE to also provide a general trading update.

I've been reflecting on the opportunities and risks associated with Veem's recent signing of a partnership with Sharrow.

A bit of background; Sharrow are a U.S. startup who have designed, patented and commercialised a toroidal propeller design that some (i.e. Sharrow) regard as the biggest single advance in propeller design since the 1830s. The design reduces the significant propeller tip vortices and makes boats equipped with their propellers significantly faster, quieter and - importantly - more fuel efficient. The differences are most prevalent at mid-range rpms but to some extent exist throughout the rev range. Fairly typical review here. A still from the video below shows the relatively dramatic difference.

The advancement Sharrow has made makes them a disrupter and a threat to Veem and other traditional propeller manufacturers. About the only thing that is stopping Sharrow from world domination is the fact they are selling them for five times the price of traditional props. That won't forever be the case. I think Veem management should be congratulated on doing the deal to become the exclusive manufacturer and seller of Sharrow-designed inboard props. It gets them back in the game.

We don't know a few things. Veem will pay a licensing fee on each propeller sold. We don't know how much. I did ask the Managing Director what he expects the gross margin (including licensing fee) to be relative to traditional props. To be honest his answer was a bit rambly, but I think that reflects the fact that they haven't settled on the cost multiple as this will be influenced by the performance they get from an inboard installation on their test boat (they have stated they will report back to the market on this by year end). He did say they wouldn't sell them at the same premium Sharrow is selling outboard props (5x versus traditional prop), but if they work as well as expected on an inboard installation they would sell them at a significant premium to their usual props. In the end he said "margins will certainly increase" - so take that as you will.

We don't know at what point they're going to want to add to their existing capacity. They say they have capacity to build 450-500 props a month. I take that to mean either traditional props or a mix of traditional and Sharrow props, but I've asked for clarification of that i.e. that it's not excess capacity. Assuming it's existing capacity I've asked what the rough excess capacity is - they probably won't tell me but if I don't ask they definitely won't tell me.

Either way they're talking about building a new facility. That adds execution risk and also puts some immediate stress on the balance sheet. The MD suggested an investment of $5-7m would result in a factory that could produce 200-250 props/month. Sharrow is selling their generic props for US$5-12k a pop. Veem props are custom made and typically for bigger boats. Although they only have one operating segment they did disclose propulsion and gyro sales combined as $33m in FY23. Subtract gyro sales of $5m and divide by an average build of 300 props/month (2/3rds of their end of year capacity) and you get an average sale price of around $8k. The MD has said they wouldn't be going with Sharrow's 5x multiple versus traditional props, but let's say it was 2x - $16k/prop. Assuming they build at the lower end of the MDs thumbsuck capacity and you get annual revenue of $38.4m. Is that a good payback? Stunning. But if they're saying $5-7m capex, they probably mean $10m. Plus we don't know the margins they'll make but if you conservatively use the FY23 whole of business margin (63%) it brings annual return back closer to $24.2m (still excellent). But I made so many assumptions in there that I wouldn't trust it to be within cooee of reality. Interesting exercise though.

The other thing we don't know is how they're going to fund it. They already have net debt (manageable but it's there), they're already capital intensive and didn't generate free cash flow last year, and they did a partial sell down during a cap raise a couple of years ago, then soon thereafter disclosed some operational issues, leaving a bad taste in the mouth of some investors. So all that needs to be taken into account.

I think the opportunity is significant. The payback for commercial boats (ferries etc.) in terms of fuel savings is said to be just months. If the takeup of these props on inboard installations replicates Sharrow's experience with outboard props then the MD is saying it won't just be one new factory required but multiple in different parts of the globe. But the risks are also significant and I think that's why the share price hasn't really moved since the announcement. I'm happy to sit on my (under-sized) position for now and see what happens.

They do look cool though.

(updated the maths)

Interesting tour of the factory and experience of the gyros on the water in a 50 min video from Nautistyles a YouTube channel with 374k subscribers. Already has 129k views and 700 comments in 3 days. Good PR for the company and raises the profile.

I first came across toroidal propellers in this YouTube video from Matt Ferrell. At the time I thought of Veem and this announcement confirms that VEE will be making the Sharrow marine propellers for inboard powered applications.

Agreement signed with Sharrow Engineering for VEEM and Sharrow to partner together to design and then VEEM to exclusively manufacture and sell Sharrow designed propellers worldwide for inboard powered vessels.

• Sharrow has developed an award-winning propeller design that has made a spectacular impact on the outboard motor market with outstanding improvements in fuel efficiency, noise, vibration and handling.

VEEM will now take this technology to the larger inboard propellers.

• Sharrow chose VEEM as VEEM is the only manufacturer globally producing a range of high-performance, fully CNC machined propellers, thereby guaranteeing the accuracy of the propeller every time.

• The total addressable market for inboard propellers is estimated to be US$2.6 billion with the annual new build market estimated at US$338 million.

• Progressing with the project is subject to VEEM’s acceptance of the performance of the Sharrow design on the VEEM test vessel with the testing to be done in the coming weeks.

• Design work has already commenced and the first SHARROW by VEEM propellers are expected to be available in early 2024 with the full range rolled out by the end of 2024.

• Initial production will be at VEEM’s facility in Western Australia with the early adoption rates to determine potential demand and resultant capacity expansion opportunities

I thought Veem released one of the stronger reports I've seen thus far this reporting season. Both the looking backwards result and the looking forwards 'nuggets' lined up to present a very bullish proposition.

Revenue was 'only' up 10% but improved margins and cost discipline saw them flow most of that into profit (and cashflow).

The Outlook was full of bullish sentiment and light on specifics but a couple of disclosures stood out.

Gyro sales taking off like a frog in a sock was the main reason I had this company on my watchlist but it just never seemed to happen for them. Suddenly with $11m orders on hand and the Strategic Marine exclusivity agreement in place it might be a case of slowly, slowly and then all at once.

As @Wini and others have noted significant focused investment can suppress a company's results for a period of time but for right company the backback in the years following the investment can be significant. The key is finding the company who aren't selling perpetual capex requirements as 'Growth'. Veem are yet to prove that's what they are but I think there's enough in this result to suggest they may well be.

Kicking myself I didn't do more than look at it when the SP dropped below 40 cents just a month ago.

[Took a starter position yesterday IRL. Will look to add in SM]

A positive report for VEE. Looks like the worst of the pandemic is behind them. Costs, stabilising/ reducing, work in progress increasing. Propeller sales drove the increase in revenue and with three new machines operating from the end of March driving further sales as they are automated and not constrained by staffing. Smaller Gyro being developed. Gyro sales still not meeting expectations despite the Head of Sales and Business Development - Europe now in the job for a year, looks like the growth is in the smaller recreational market not currently supplied by Veem. Cash flows from operations was $1.4m, up 23%. During the period VEEM drew down an additional $2m from its commercial facilities to fund capital equipment and product development. Capital intensive work with only $1.4M cash at hand. 1.35cps dividend

Highlights from the Director's report

Customer Work in Progress increased by $2.5m to $9.2m during the period, highlighting that activity levels increased far more than demonstrated only by the increase in sales.

VEEM successfully managed a tightening labour market and resultant rising costs (overtime and higher wages). Chargeable hours were up compared to the second half of FY22 and were slightly down on the corresponding first half of FY22. Propeller and gyro manufacturing are less susceptible to local labour constraints due to automation in the case of propellers and by the global supply chain that the gyro division utilises.

Raw materials prices were mixed over the period with some rising and some relatively stable after several periods of significant rises. Air freight costs have recently stabilised with sea freight costs reducing, significantly in some cases. Where there were rises in input costs, VEEM was able to pass these through to customers preserving margins. VEEM has continued actively looking for sources of supply globally in order to improve margins and lower the risks of its supply chain.

Propulsion sales increased 19% to $11.7m for the half-year and work in progress also increased $0.8m over the same period. The two new machining centres installed in FY22 were at full availability for the period with sales of VEEM propellers alone (excludes shaftlines and Conquest) being a record $10.4m, up 23% on the prior comparative period. Despite this increase, lead times did not reduce indicating continued strong demand. Three new machines have now arrived and are all expected to be fully available by the end of March 2023 providing a platform for further increases in sales over the next six month period.

VEEM expects sales of propellers to continue to increase in line with capacity with margins protected against cost increases by regular pricing reviews. VEEM also continues to drive improvements to its processes through R&D with the goal of improving margins and reducing exposure to labour constraints.

VEEM continued to invest in research and development during the period with a number of staff involved in generating a smaller gyro model and further development of the current gyro range as well as projects related to the engineering and propulsion businesses.

Demand for the traditional engineering products and services is expected to continue with skilled labour shortages being the main inhibitor of revenue growth in this area. VEEM is working on a number of initiatives to minimise the labour constraints.

VEEM’s defence revenue is expected to remain strong with the deliveries under the upcoming Collins Class submarine full cycle docking to continue for at least the next quarter. Other defence work for a number of different prime contractors, including Austal, is also expected to continue with the building of patrol boats and other platforms.

Concerns

Revenue from gyrostabilisers was $1.7m for the period, up very slightly on the prior corresponding period. Orders on hand totalled $4.8m at 31 December 2022. Head of Sales and Business Development - Europe now in the job for a year, qualified leads are higher than ever, both in number of units and probable value. Commercial projects such as offshore support vessels continue to be very engaged with the technology once the economic, comfort and safety aspects are understood. The high rates of qualified leads, the evidence of take-up in the small boat recreational market (smaller than VEEM’s products) and the continued product improvements that have been made continue to give the Board confidence that the wide adoption of the technology is well on the way and VEEM is the only manufacturer with the products to capitalise on this.

Engineering products and services revenue, excluding defence and hollow bar, was down $1.4m to $3.6m.

The working capital position remained steady with progress payments from customers covering part of the significant increase in WIP at 31 December 2022.

The Company drew down an additional $2m from its commercial facilities to fund part of the capital equipment and the ongoing product development (intangible assets). The balance of the capital equipment was financed by HP agreements.

Veem notes AGM

Mark said one of their competitors in Italy went broke, and their main engineer is working down south. Mark was very pissed off when talking about a Chinese company he said Veem was competing with for a decent gyro contract where 12 Coast liners needed gryo’s and the Chinese government said Veem where the best candidate, but they decided to go with this chinse company that copied Veem. Smallest gyros Mark was pissed off and said they installed the wrong gyro’s for that boat, and they can’t sell those gyros anywhere else because of the patient. Mark said Veem sent a representative to china to see what they were doing, and the chinse company wanted Veem to buy them.

Mark said that they have employed one engineer in India to try and get products cheaper but make sure the quality is good because most chinse products they buy are not good he said it’s “ part of their ESG moving away from China movement.

Mark said they will eventually open a facility in Poland so they can be closer to their target market. This will help them with the freight cost. Mark said they might need to raise capital for this, or the family might rent it out to Veem. He said they’re not keen on moving into Poland at the moment because of the cost of energy in Europe, and he could see an energy crisis unfolding.

There are no plans to become just a Gryo company. They want to keep all revenue streams. They’re going to try and take all the excess steal out of the gyro this will help them cut costs and push forward innovation by creating a lighter product that can also be accessed more easily. Mark said most of the time, when they install Gyro’s. They leak straight away because the hydraulic fluid pipes are weaved in and out of the gyro and joint into the steel. He likened the leak to being like when you get a new car, you drive it home, and tiny drops of coolant come out. He said it’s not a problem, but it is just annoying, and they usually always have to look at the new Gyro’s once they have been installed.

They’re trying to carve out a competitive advantage in the gyro field by cutting costs everywhere and ensuring they still have great product quality. He ran me through how they were going to save money on every bolt, so I will leave that out.

He talked a lot about the labour shortage and how it’s annoying. He said they’re trying to work out ways to get people off the mines and into their factors. He said they’re offering engineers a base wage of $50 an hour, but they start at 3 PM and finish at 2 AM, which means they get double time or over time which in turn means they match the miners on 150,000 a year, and they only need to work four days a week.

Mark said that most people don’t understand that freighting companies have gouged consumers with this inflation narrative. That will return to normal as he expects the earnings to be significantly helped if freight costs revert to the mean.

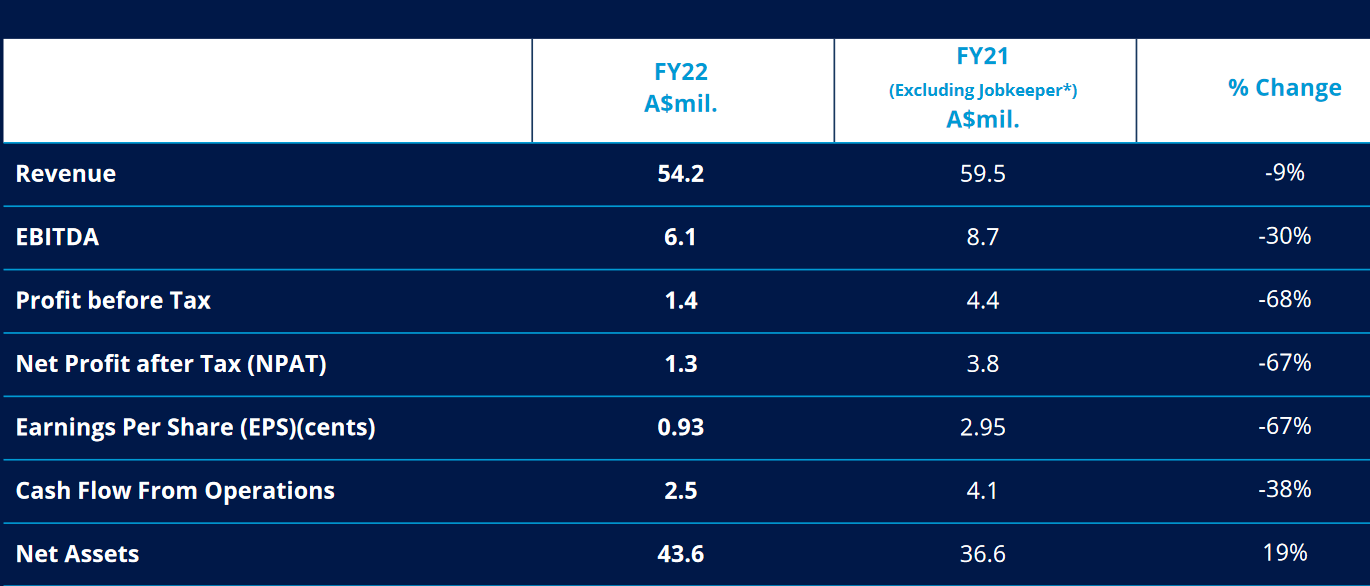

VEEM came out with their results today and as they'd indicated it was down on FY21, although bear in mind they are still consistently making money and have done so every year since 2014. The CEO opened by saying he was glad to see the back of FY22. I think some of the decline was due to factors beyond their control but some was due to some own goals on their part (the foundry issues in 1H and slowness in responding to cost pressures both appear to be due to flawed processes). Importantly they appear to have learnt from these and have implemented fixes to prevent repeats going forward.

Some notes from the investor call:

General

Impacted by copper price doubling over the past 12 months and freight costs quadrupling. Balance Sheet in good shape (I tend to think it's more ok than good). Employee costs up but hours down, showing impact of wage pressures. Maintained R&D spend and put what they can through EBITDA, which I always prefer to see

Gyros

This is the sexier part of the business with arguably the most potential for growth. However, at the moment the potential isn't being realized, which they state is due to not being able to leave the WA for two years, impacting ability to make sales and repair/maintain units.

Order on hand of $1.3m on 30 June and $2.4m now. They expect this business to run similar gross profit to other parts of the business but have some work to do on at least one of the units. They did say they haven't had to up the price of these units but sourcing parts from different counties. I thought it was interesting they stated they run a 'China-last' procurement policy.

When asked about the opportunity the Damen walk-to-work vehicle would create Mark hinted at some imminent developments around increases in load capacity.

Propulsion

This is one of the largest businesses they run and was up 26% YoY with little sign of that slowing down. Capacity was increased by 25% in FY22 and will be increased by a further 25% later this year. They believe they have the most advanced propulsion facility in the world and are going further ahead, with plans to be able to run 24-hours 'lights off'. Gross profit has returned to usual levels after overcoming foundry issues and passing on price increases.

Defence

This was the big laggard for the year being down 39% YoY, mainly on the back of the end of Austal's littoral ship program for the US. It's a bit opaque what FY23 looks like here. They still have contracted programs going and are tendering for others. I've asked what was included in the FY22 result from the littoral ship program but am yet to get an answer.

Engineering

Probably the less exciting part of the business but it is growing on the back of strong mining conditions and is filling some of the gap from the Defence slowdown. A reasonably bullish outlook but growth will be steady, not parabolic.

Overall

This is a family-owned business that I've liked for a couple of years but never owned. The valuation has felt a bit full to me but at these levels it does feel a bit more of an opportunity. There's a little bit of bitterness that the family sold a part of their holding at $1.18 at the same time as doing a placement at the same price, and then revealed some operational issues in a subsequent update. The update did come a couple of months later and the family still own over 50% of the company, plus a placement at peak SP is when we want the company to do a placement. For me it's more something I'll note rather than put up a big red flag.

The thesis for me is fairly dependent of the Gyro business going big and the evidence of that isn't in...yet. I might have another look after earnings season and see if I can get a bit more comfortable with it after some more work.

@Strawman - maybe one we could meet with in a month or two?

Veem is one I have kept an eye on as I thought they were onto a good thing with their Gyro's, but have not owned previously. I just listened to their conference call and their was palpabel relief that 2022 FY is over. They seemed overjoyed to have come through the other side of the covid impacts in as good of a condition as they have. They also seemed very optimistic for FY23 and how they are a better company for the 2022 experience.

The numbers for 2022 are woeful, but the perfect storm of closed borders, cost increases in freight, material, and labor and manufacturing problems leading to rework all impacted them so even making a 1.4m profit is pretty good all things considering.

- Non-performance issues rectified through a technical group that have improved foundry processes. Highlighted how the company culture is to really fix the root cause of these issues and now non-performance is back to historical lows.

- Freight costs airfright (up 2x) seafreight (up 3x), now working closely with freight operators to forecast where it will be and are adjusting prices every month vs quarterly previously.

- Labor cost being managed Gyro and propulsion largely automated and relies on semi-skilled labor that can be trained in house. Commented that they have the most advanced manufactering facilities for propulsion worldwide and see this as a competitive advantage.

- Engineering relies on highly skilled labor and is a problem but they managing this as best they can in regrds to overtime etc.

- They have moved away from China and have a company policy for China last supply and through this have gotten efficiences in their supply of materials for Gyros. Has enabled them to maintain GP margins without passing price rises as efficincies gained in supply lines.

Propulsion has been a surprise and they have ramped up to respond, demand will be strong out to Fy24 and expect a slow decline from then not a steep drop off. Commented that is still a lot of money out there and demand for superyachts is still very strong. I expect really good numbers from this division in FY23.

Gyros- commented that Covid has really impacted the speed of uptake in this market but they think this year will be back to solid growth in sales. They sold 12 in 2022 but they were smaller units so revenue was lower than 2021. The Damon walk to work boat has been launched and they said they have recieved strong enquiries from this. They have Gyros instock so sales orders can be met quickly if the orders arrive.

Overall they were pretty excited about about he coming year and I think they are starting to look pretty good and I think I will look to buy into Veem over the coming weeks, especially if we get some weakness.

Market reaction to the AGM presentation has been very negative. Forecast for 1H22 below FY21 and various headwinds including staff shortages and shipping costs.

FY22 has had some early challenges in some areas which have impacted productivity, costs and the financial results. Confident that these specific issues have been rectified and the productivity and financial performance is back on track.

• Strong order book and global market for VEEM’s propellers. Confident propeller sales and margins will be stronger than FY21 going forward. The first of two new machines has been installed with the second due Jan 2022. Commodity price increases led to some margin erosion on propellers. Price rises have been implemented and are now starting to flow through to revenue.

• The very tight labour market has also meant that we have been unable to recruit as many skilled trades as we desire, constraining capacity. We are working to solve this.

• Delays in installations and commissioning of gyros has led to delays in repeat business. This has meant that sales for the first half are only expected to be $1.5m. The volume and quality of leads and recent orders provides confidence to expect 2H FY22 orders and sales to be significantly up on FY21 sales. As VEEM continues to build gyros to a plan, it will be able to sell from inventory in the 2H and beyond.

• Sea and air freight costs and duration have risen over the period since Jan 2019 as has been well reported.

• Much of the business continues to do well and overall we expect the above impacts to mean that 1H FY22 revenue is in the order of $26m with EBITDA of around $3m. We expect a strong 2H FY22 noting this may be impacted by labour shortages..

Disc : bought today in RL and added to SM

Highlights:

- Two highly prestigious Italian superyacht builders, Rossinavi and Overmarine, have ordered their first VEEM Gyros

- VEEM now has orders in hand of $5m for VEEM Gyros with $3.5m expected to be included in sales in FY2021

- The global superyacht construction order book as at 1 January 2021 is 710 vessels which alone represents an addressable market segment of over US$260m for sales of VEEM Gyros

VEEM Limited (ASX: VEE) (‘VEEM’ or ‘the Company’), a designer and manufacturer of disruptive, high-technology marine propulsion and stabilization systems for the global luxury motor yacht, fast ferry, commercial workboat and defence industries, is pleased to announce that it has received orders for VEEM Gyros from Rossinavi and Overmarine taking the Company’s order book for VEEM Gyros to $5 million.

Overmarine, designer and builder of the famous Mangusta range of superyachts, have ordered two VEEM Gyros for a new Mangusta 165. The new Mangusta 165 is a part of the “Maxi Open” range and is 50m in length.

Rossinavi have ordered a VEEM Gyro for a new superyacht design.

Disc~Another small holding

Highlights

• 36% increase in revenue to $28.4 million on previous corresponding period (“PCP”)

• EBITDA up 111% to $5.7 million on the PCP (includes JobKeeper of $1.5 million)

• Net profit after tax of $3.0 million – 233% increase on PCP

• Revenue increase includes gyrostabilizer sales of $3.6 million - up 33% from the six months to 30 June 2020 and 73% on PCP, continuing strong upward trend since 2018

03-Dec-2020: CCZ Equities Research: VEEM Limited (VEE): World class products to lead new industry

Analyst: Daniel Ireland, [email protected], +61 2 9238 8239

- Recommendation: BUY

- Target Price: 107cps ($1.07)

- Share Price: 70.5cps (03-Dec-2020, 70cps on 04-Dec-2020)

- Market Capitalization: $92m

- Index: None

- Sector: Industrials

Initiating coverage:

- VEEM (VEE) is a longstanding marine technology and propulsion business specialising in components for industrial/mining & defence applications, propellers and marine stabilization. Its marine products are both necessary for, and enhance the functionality of defence, crew transportation, commercial workboats and recreational vessels (superyachts). VEE’s latest disruptive product, the gyrostabilizer (for vessels from ~24m to 90m), reduces the rolling motion experienced by boats due to wind and waves by up to 95%. Gyrostabilizers are set to change marine stabilization, replacing stabilization fins which have been industry standard for many years. VEE Gyros have gained international recognition, validated by orders from the world’s largest shipyards including Damen Shipyards, Van Der Valk, Westport, Feadship and Heesen Yachts.

- Marine stabilization industry experiencing exponential growth: Superyachts alone are an estimated circa ˜$400M (p.a.) market in new build and ˜$1BN-$2BN AUD in retrofit. Fishing vessels, ferries, defence boats, commercial and offshore supply vessels multiply this addressable market. VEE will continue to demonstrate attractive economics (circa ˜16% EBITDA margins by Fy22) enabling the business to compound earnings by expanding operating margins. Facilitated by the new 4,000m2 assembly plant opened in March 2020, CCZ forecasts gyrostabilization revenue to increase materially each year for the next 5 years, reaching 10x 2020 revenues by 2025 (circa $50M).

- Accelerating gyro orders: Orders for VEEM Gyros accelerated in the first 4 weeks of FY21, with an order book of $4.2M USD ($5.9M AUD) by August 2020, exceeding FY20 gyro sales ($4.8M AUD). In late October, the company announced a 3- year supply deal with Damen Shipyards, signalling an inflection point toward full scale production. We expect a step up to 1 large gyro sale per quarter (RRP $1.65M AUD per unit) by FY22, with capacity increases by the end of the FY22 year.

- Substantial revenue growth and PE expansion: We are forecasting VEE to hit +$100M revenue (Up from $44M 2020) by 2025, as manufacturing reaches critical scale. We initiate with a BUY, with the building blocks in place for VEE to have a materially stronger year in 2021, the beginning of a long runway of accelerating revenue and expanding margins. After years of research and development the company has reached an inflection point, with significant increases in revenue expected from the company’s stabilization products.

--- click on the link at the top for the full CCZ initiating coverage report on Veem (VEE) ---