Veem is one I have kept an eye on as I thought they were onto a good thing with their Gyro's, but have not owned previously. I just listened to their conference call and their was palpabel relief that 2022 FY is over. They seemed overjoyed to have come through the other side of the covid impacts in as good of a condition as they have. They also seemed very optimistic for FY23 and how they are a better company for the 2022 experience.

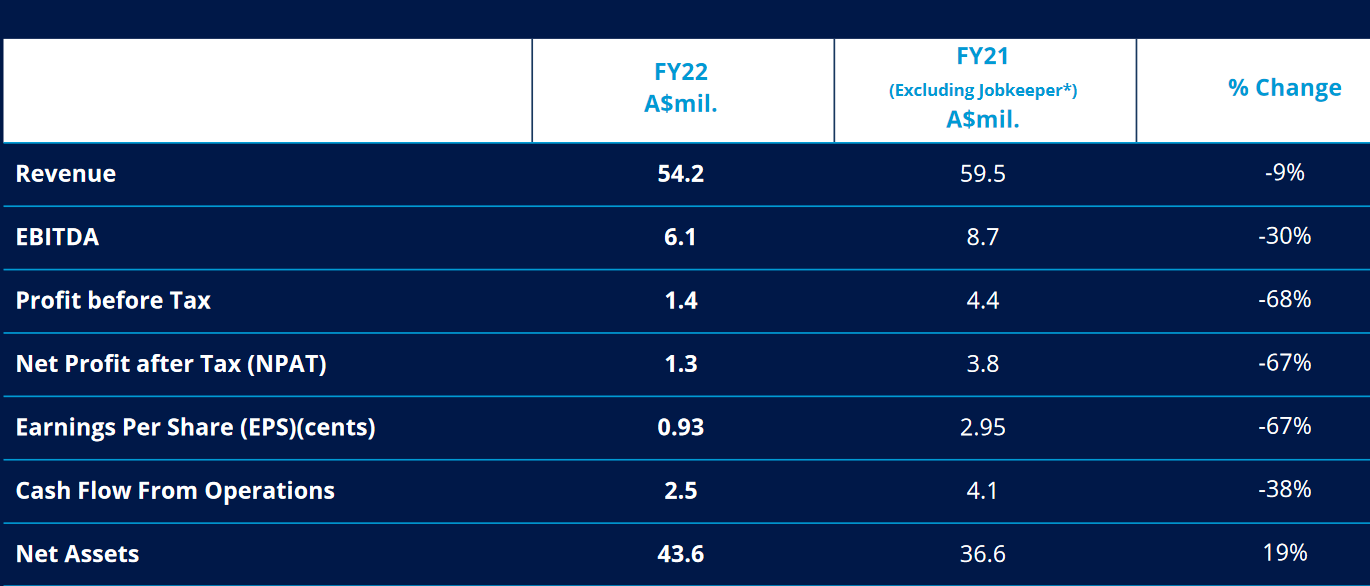

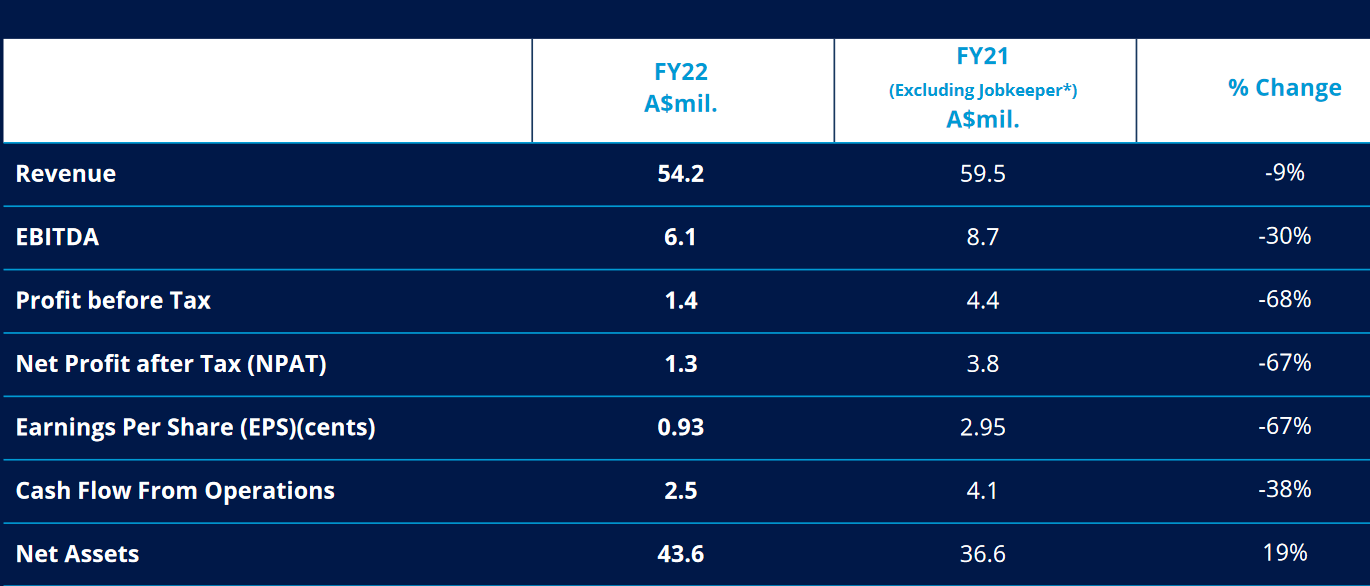

The numbers for 2022 are woeful, but the perfect storm of closed borders, cost increases in freight, material, and labor and manufacturing problems leading to rework all impacted them so even making a 1.4m profit is pretty good all things considering.

- Non-performance issues rectified through a technical group that have improved foundry processes. Highlighted how the company culture is to really fix the root cause of these issues and now non-performance is back to historical lows.

- Freight costs airfright (up 2x) seafreight (up 3x), now working closely with freight operators to forecast where it will be and are adjusting prices every month vs quarterly previously.

- Labor cost being managed Gyro and propulsion largely automated and relies on semi-skilled labor that can be trained in house. Commented that they have the most advanced manufactering facilities for propulsion worldwide and see this as a competitive advantage.

- Engineering relies on highly skilled labor and is a problem but they managing this as best they can in regrds to overtime etc.

- They have moved away from China and have a company policy for China last supply and through this have gotten efficiences in their supply of materials for Gyros. Has enabled them to maintain GP margins without passing price rises as efficincies gained in supply lines.

Propulsion has been a surprise and they have ramped up to respond, demand will be strong out to Fy24 and expect a slow decline from then not a steep drop off. Commented that is still a lot of money out there and demand for superyachts is still very strong. I expect really good numbers from this division in FY23.

Gyros- commented that Covid has really impacted the speed of uptake in this market but they think this year will be back to solid growth in sales. They sold 12 in 2022 but they were smaller units so revenue was lower than 2021. The Damon walk to work boat has been launched and they said they have recieved strong enquiries from this. They have Gyros instock so sales orders can be met quickly if the orders arrive.

Overall they were pretty excited about about he coming year and I think they are starting to look pretty good and I think I will look to buy into Veem over the coming weeks, especially if we get some weakness.