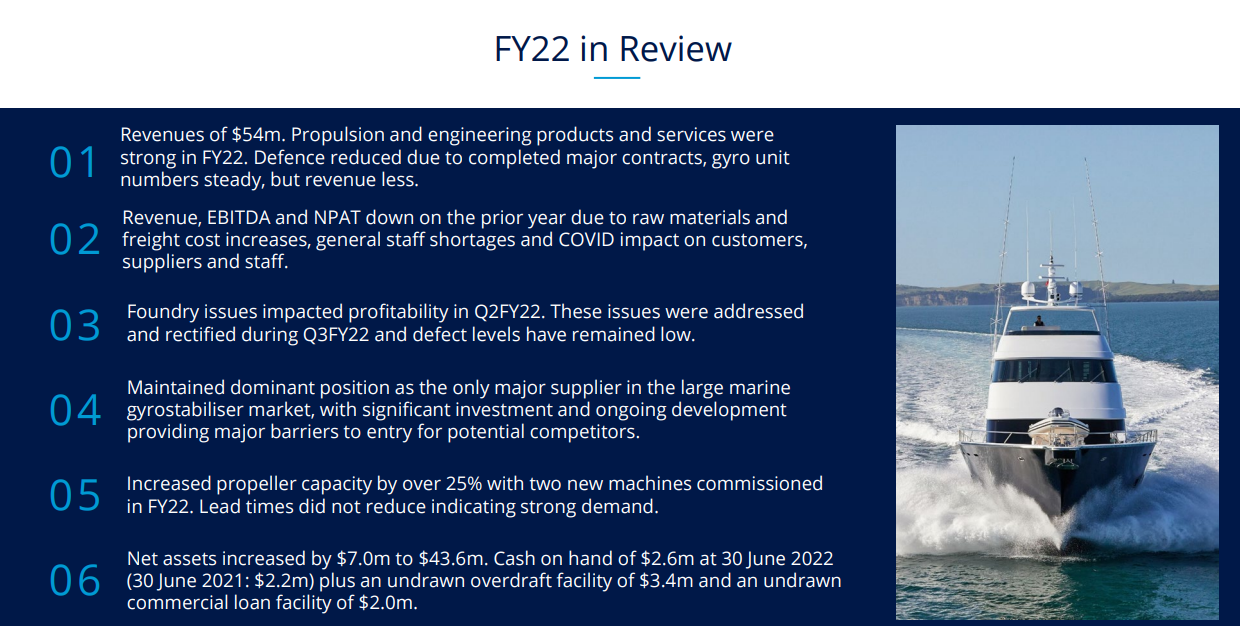

VEEM came out with their results today and as they'd indicated it was down on FY21, although bear in mind they are still consistently making money and have done so every year since 2014. The CEO opened by saying he was glad to see the back of FY22. I think some of the decline was due to factors beyond their control but some was due to some own goals on their part (the foundry issues in 1H and slowness in responding to cost pressures both appear to be due to flawed processes). Importantly they appear to have learnt from these and have implemented fixes to prevent repeats going forward.

Some notes from the investor call:

General

Impacted by copper price doubling over the past 12 months and freight costs quadrupling. Balance Sheet in good shape (I tend to think it's more ok than good). Employee costs up but hours down, showing impact of wage pressures. Maintained R&D spend and put what they can through EBITDA, which I always prefer to see

Gyros

This is the sexier part of the business with arguably the most potential for growth. However, at the moment the potential isn't being realized, which they state is due to not being able to leave the WA for two years, impacting ability to make sales and repair/maintain units.

Order on hand of $1.3m on 30 June and $2.4m now. They expect this business to run similar gross profit to other parts of the business but have some work to do on at least one of the units. They did say they haven't had to up the price of these units but sourcing parts from different counties. I thought it was interesting they stated they run a 'China-last' procurement policy.

When asked about the opportunity the Damen walk-to-work vehicle would create Mark hinted at some imminent developments around increases in load capacity.

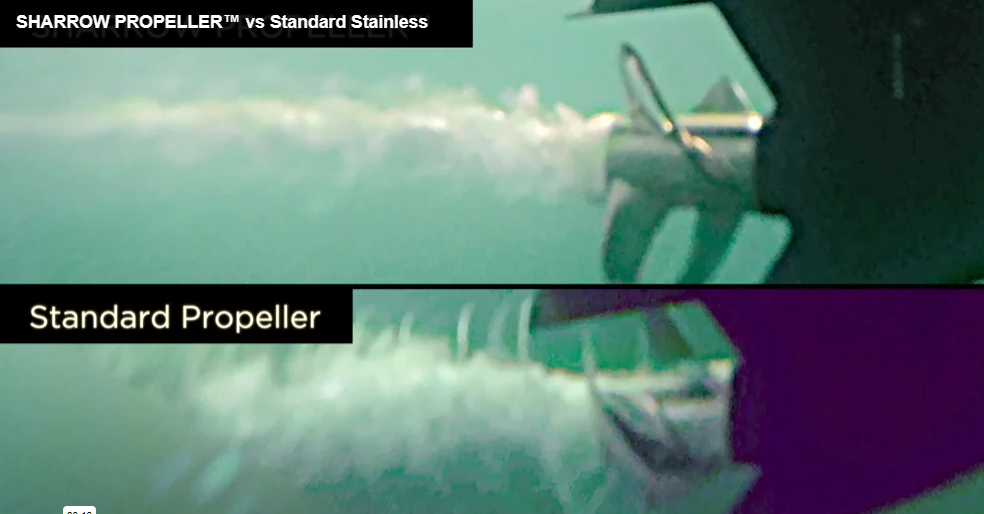

Propulsion

This is one of the largest businesses they run and was up 26% YoY with little sign of that slowing down. Capacity was increased by 25% in FY22 and will be increased by a further 25% later this year. They believe they have the most advanced propulsion facility in the world and are going further ahead, with plans to be able to run 24-hours 'lights off'. Gross profit has returned to usual levels after overcoming foundry issues and passing on price increases.

Defence

This was the big laggard for the year being down 39% YoY, mainly on the back of the end of Austal's littoral ship program for the US. It's a bit opaque what FY23 looks like here. They still have contracted programs going and are tendering for others. I've asked what was included in the FY22 result from the littoral ship program but am yet to get an answer.

Engineering

Probably the less exciting part of the business but it is growing on the back of strong mining conditions and is filling some of the gap from the Defence slowdown. A reasonably bullish outlook but growth will be steady, not parabolic.

Overall

This is a family-owned business that I've liked for a couple of years but never owned. The valuation has felt a bit full to me but at these levels it does feel a bit more of an opportunity. There's a little bit of bitterness that the family sold a part of their holding at $1.18 at the same time as doing a placement at the same price, and then revealed some operational issues in a subsequent update. The update did come a couple of months later and the family still own over 50% of the company, plus a placement at peak SP is when we want the company to do a placement. For me it's more something I'll note rather than put up a big red flag.

The thesis for me is fairly dependent of the Gyro business going big and the evidence of that isn't in...yet. I might have another look after earnings season and see if I can get a bit more comfortable with it after some more work.

@Strawman - maybe one we could meet with in a month or two?