I've been meaning to write something about LVT for a while, and I want to get my thoughts down before the new 4C in the next week or two. I also want to keep track of my evolving thinking on this company for my own reference in future.

This new announcement is a good kick up the backside to get on with it: Restructure and Cost Reduction Program to Achieve Cashflow

The latest is yet more restructure and cost reductions. The new one is to save $16.2M/year, which is about a third of their total operating expenses based on their June quarter 4C. This seems optimistic, to put it lightly.

At any rate, it's of academic interest to me now, as I sold out after that June quarter 4C. This was based on this set of data:

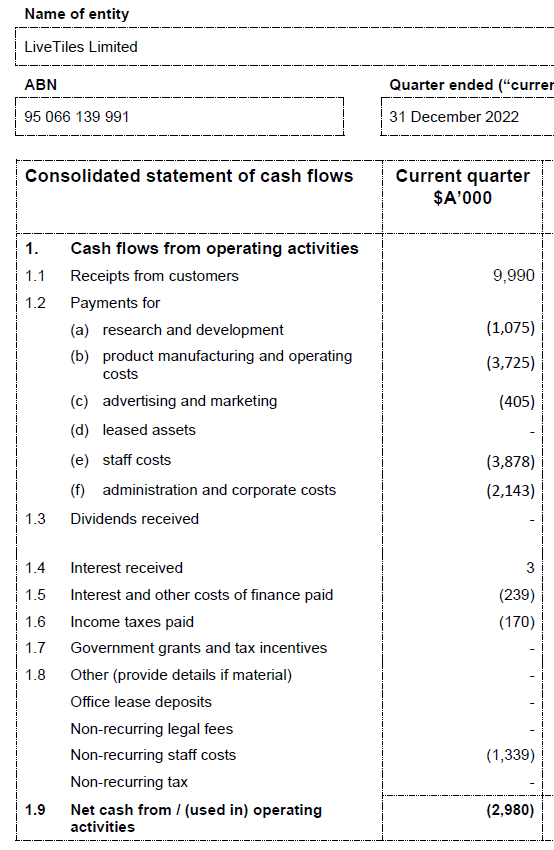

Post Dec 4C thesis:

"Well, they've got the new cost-saving measures in place, even though I can't see it in the data yet. Hold on and see what the Mar 4C brings."

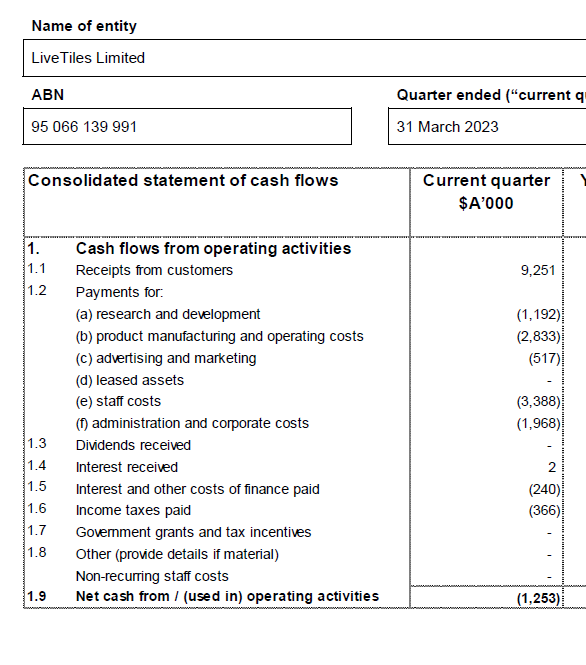

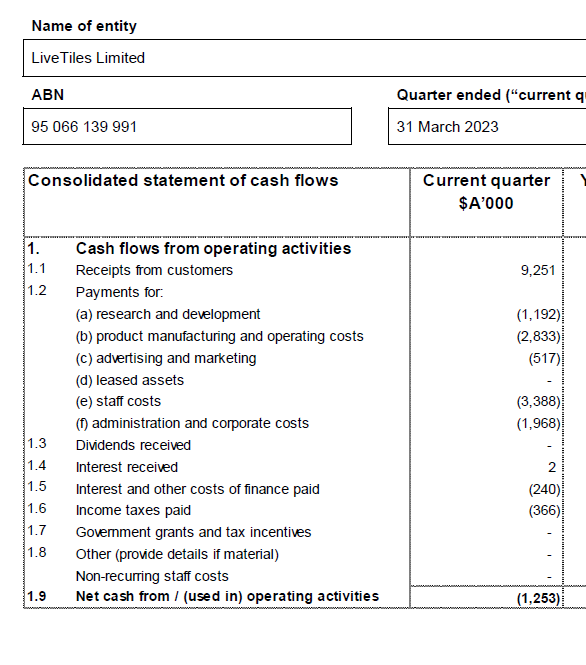

Post Mar 4C thesis:

"Well, costs seem to be decreasing faster than revenue decreasing, so maybe there's something there. Hold on and see what the Jun 4C brings. With the EOFY maybe the company can get a buyout offer."

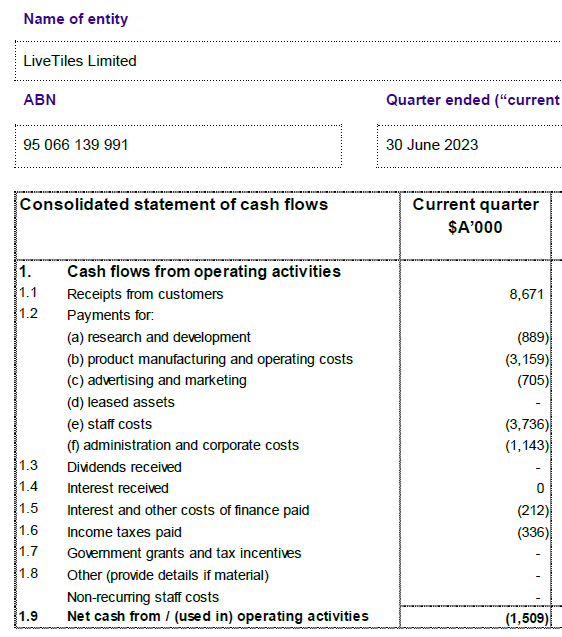

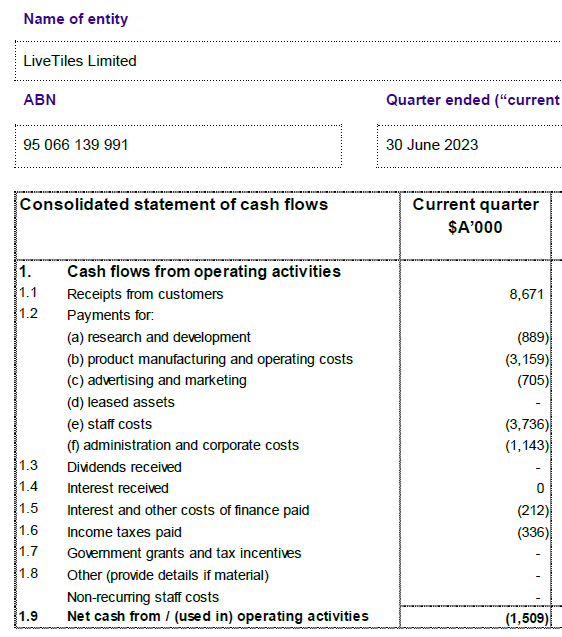

Post Jun 4C thesis:

"Costs up, in particular, the staff costs that were supposedly part of their cost reduction program. Revenue down, while marketing is up a lot! Losses getting worse. Share price trending down and still no buyout offer. Sell."

After all that, I'm dubious that the new structure will change the direction.