Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

One more thing that was really interesting, and I didn't get around to posting about. Here's their most recent 4C:

I read it and thought: "huh, either something's missing, or I don't understand the conditional IF statement in item 8.6". But then the next day they provided an update with, let's say clarification, of what they will do now that they have less than 2 Qtrs of funding left:

Another red flag. Although, you want an even more alarming colour for the flag that this 4C raises.

I'd already sold out of this business, so it was just a funny occurrence.

So it finally happened, Livetiles in now in receivership: ASX announcement.

I feel like I'm getting better at this investing stuff. For the first time I've been able to avoid riding a business into the ground. I usually bag-hold until after the receivers are brought in. That's not to say that I didn't lose a lot of money, but at least I'm moving in the right direction.

Here's some notes for myself to remember for the future (not all of these are from LiveTiles):

- Do not, DO NOT, trust management when they say that things are about to get better. If it looks like they are going to run out of cash, they probably are.

- A business restructure is bad, but two restructures is a definite sign to get out (if I haven't already)

- Any attempts to change the way the shares are bought and sold (moving to a new exchange, voluntarily delisting, actively seeking to sell the company in a hurry).

I've been meaning to write something about LVT for a while, and I want to get my thoughts down before the new 4C in the next week or two. I also want to keep track of my evolving thinking on this company for my own reference in future.

This new announcement is a good kick up the backside to get on with it: Restructure and Cost Reduction Program to Achieve Cashflow

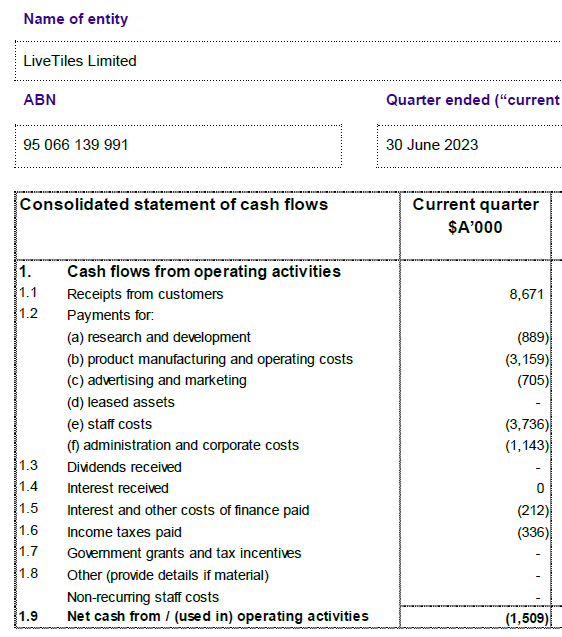

The latest is yet more restructure and cost reductions. The new one is to save $16.2M/year, which is about a third of their total operating expenses based on their June quarter 4C. This seems optimistic, to put it lightly.

At any rate, it's of academic interest to me now, as I sold out after that June quarter 4C. This was based on this set of data:

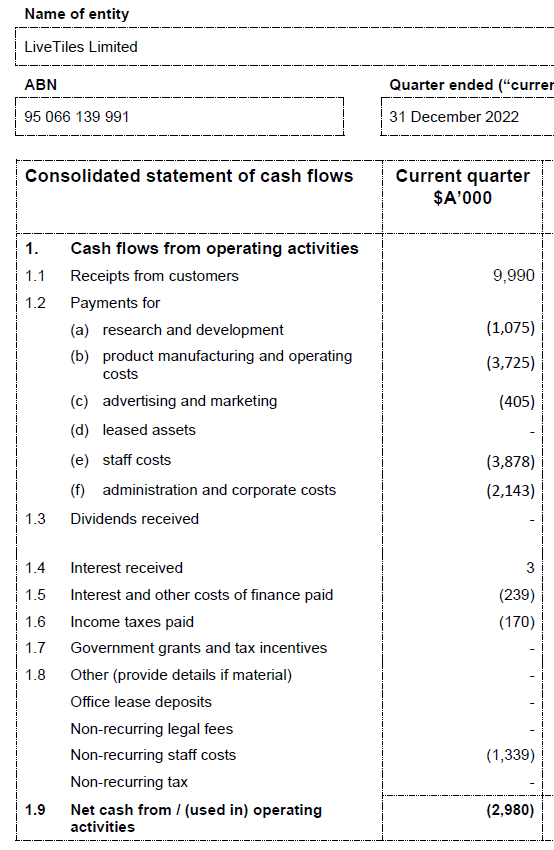

Post Dec 4C thesis:

"Well, they've got the new cost-saving measures in place, even though I can't see it in the data yet. Hold on and see what the Mar 4C brings."

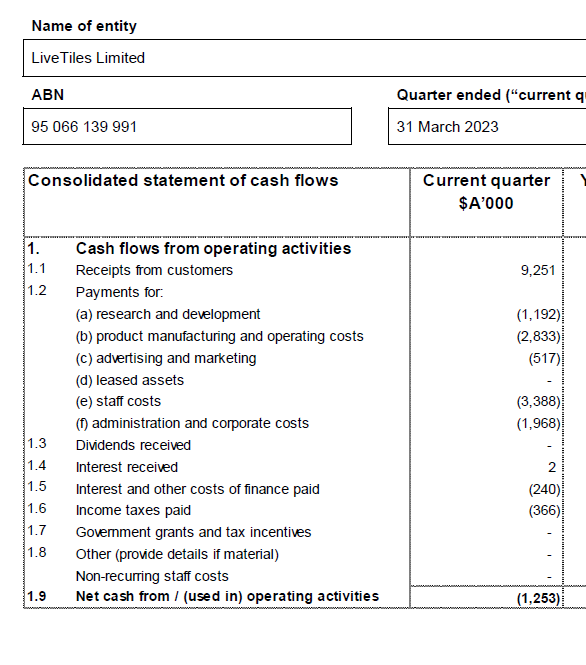

Post Mar 4C thesis:

"Well, costs seem to be decreasing faster than revenue decreasing, so maybe there's something there. Hold on and see what the Jun 4C brings. With the EOFY maybe the company can get a buyout offer."

Post Jun 4C thesis:

"Costs up, in particular, the staff costs that were supposedly part of their cost reduction program. Revenue down, while marketing is up a lot! Losses getting worse. Share price trending down and still no buyout offer. Sell."

After all that, I'm dubious that the new structure will change the direction.

It's taken a while to get around to looking at some 4Cs, but now's the time and I see @PinchOfSalt has already given a rundown for LVT, so this is just a quick follow up.

The 4C announcement doesn't explicitly say that the improvement in cash outflow is the result of the Operational Review that they published in October last year, but they hint at it. (See my straw about the review below).

This is a bit confusing as @PinchOfSalt suggested. The October review identified about $6.5M/year in savings of which about $5.5M/year is from reduced staff costs. Quote:

``To this end, the Company has reduced overall headcount globally by 32 employees across executive, senior management and general staff, representing annual savings of AUD$5.48M.''

But they identify only $1.4M of non-recurring staff costs in this quarter, while their (presumably) on-going staff costs have actually increased to $3.9M from $3.1M. Maybe some of that is also costs associated with getting rid of people and will not show up in future, but they don't seem to have made an effort to explain it. In fact, they seem to confuse it further since in the ``Highlights'' statement they say that $2.66M of the cash outflow is non-recurring, although I can't see it in the details of the cash flow statement itself.

The main areas where they did save money is in R&D ($1.1M down from $3.5M) and manufacturing & operating costs ($3.7M down from $4.5M). Also some savings in marketing and admin. This is in-line with their Review, so nothing surprising there.

My takeaway is that this MAY indicate that the company is finally on track to start getting some positive cash flow, and the next quarterly is all important.

If we go with their estimate of on-going cash outflow (ie. $2.98M-$2.66M= $320,000) then they should have plenty of quarters left to get things moving in the right direction. But the confusion about the ``non-recurring'' expenses leads me to temper my expectations.

(Disc: held in RL)

A comment on their latest 4C.

Not looking good.

- Receipts down $3.5 million

- Operating costs down $1.5 million

- So Op CF went from -$2.3 million to -$4.3 million

Now:

- Cash on hand $12.5 million

- They have a $10 million loan facility which is already fully drawn (at 9.5% interest)

At the current rate, they have 3 quarters of funding left.

I'm not sure what their plan is now. According to Big Tin Can $BTH:

``To date, Bigtincan has received very limited engagement from the Board of Livetiles, beyond acknowledgement of our proposal.''

So it seems $LVT is not that interested in the buy out, and I guess they're planning another capital raise. I'm still hanging on to see what happens, but the sun is very quickly setting.

(Disc: Held in SM and IRL.)

An announcement about their latest review, this one called an ``Operational Review'', which follows on from the ``Strategic Review'' in 2021. They say that this new review has resulted in annual savings of $6.48 million, although I'm pretty sure these are projected savings as at least some of the recommended changes haven't happened yet.

It mostly involves getting rid of 32 staff (saving $5.48M), at all levels, including the co-founder Peter Nguyen-Brown, although it's not clear if he'll have some other role at the company as they include the obtuse statement that he will remain ``an ally to the business for years to come''. So both the CXO (the X stands for experience) and the SVP of People and Experience (Vanessa Ferguson) are leaving, which given the buzzword-y job titles, I think is probably a positive. This company really needs to focus on the business and less on self-promotion. At any rate, I'm not sure how soon the savings from these sackings can be realised given notice periods and contract termination clauses --- in my own field of academia people can be given 6 months or even a year to leave a university (so they can finish teaching courses or wrapping up research projects). I don't know what the protocol in tech businesses is. Then there's potential morale problems with the staff who remain.

The rest of the savings ($1M) will come from moving offices, renegotiating the prices they pay to suppliers and reviewing marketing expenses. Again, these seem like aspirational savings so it remains to be seen how they eventuate.

At any rate, they claim that they are on track for free cash flow positivity in CY2023. If I've correctly read their full year statement from 2021--2022 (happy to be corrected) then it says that they had cash outflow of about $10M (excluding a $6M loan they took out). It seems like they want to roll these new savings ($6.48M) in with the savings from the 2021 Strategic Review ($3.5M), giving a total of $9.98M in reduced spendings, making it seem that +ive FCF is pretty close, but at the beginning of the current announcement they say that those savings from the 2021 review have already been incorporated into last year's results. So ignoring that $3.5M I think +ive FCF next year is optimistic, and it requires significant increase in revenue.

They also took a swipe at shareholders' vote against the delisting, saying that this prevented them from an additional $1.5M in savings, although, again, this doesn't seem like enough to convert to cash-flow positivity.

Lastly, they mention the proposed buy-out by Big Tin Can at 7c/share. They're still weighing it up and talking to ``other parties that have expressed interest in LiveTiles'' presumably to drive up the price, but nothing to report yet.

Disc: Held IRL and SM. (Hanging on to see what happens with any buy-outs.)

Livetiles had their Extraordinary General Meeting today to vote on the delisting proposal, and shareholders voted against it. Here's the table of votes.

You can find the announcement here.

I've been holding a small portion of shares for a while, since Claude recommended them at MF, and being a bit of a dolt I didn't sell them when he told us to (I think it was about 70c at that point). I don't want to keep holding a delisted company but I wanted to see how the vote went before I sold out. I guess I'll keep holding on.

No comment yet from the company, but if it's truly undervalued as the management team claim, then I presume they'll try to find someone to buy the whole thing.

(Disc: held in RL and SM)

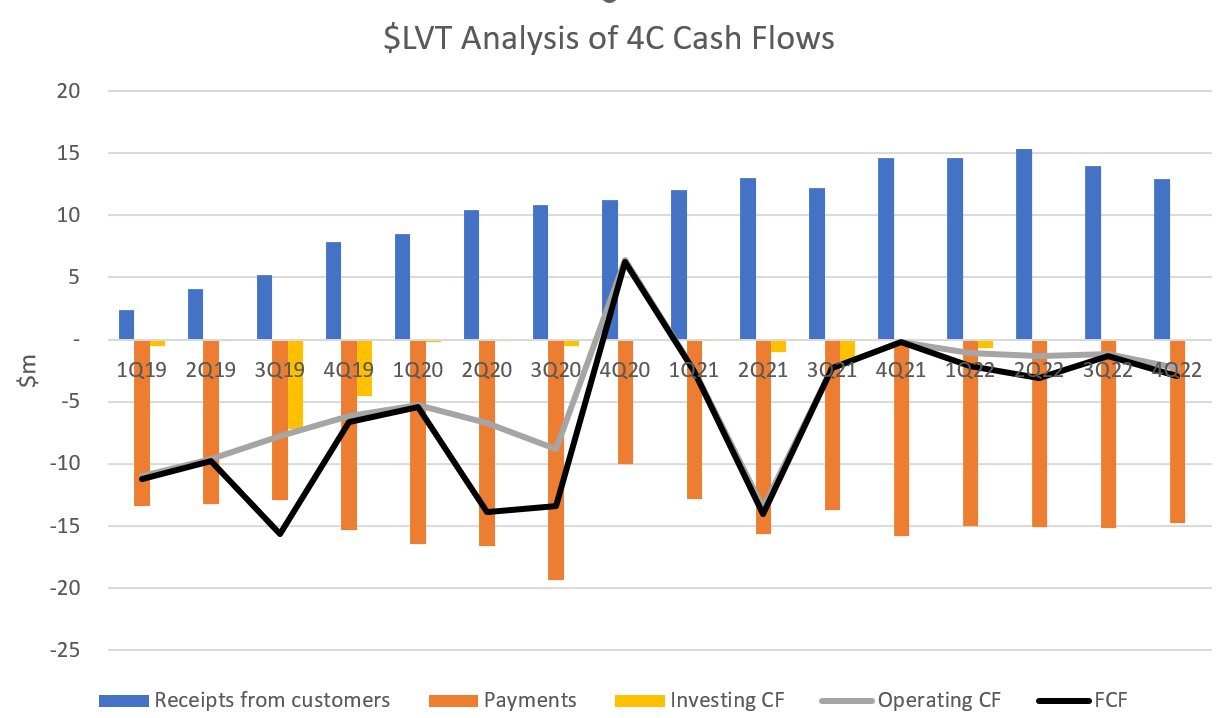

No longer on my watch list (exited IRL on 28-June-2021 at a 50% loss,.... boy was I lucky), I have updated my 4C analysis below to see if the recent strategy review, cost control, and focus on enterprise clients and user base (versus historial approach of focussing on LTV and number of customers) is yielding results.

You might read the ASX results release and conclude that there are propsects ahead for this business.

My conclusion is quite different. This is another business that hasn't figured out how to make money, is managing costs (barely) but now facing falling receipts. If I held it, I'd sell to salvage what I could.

Personal Action: look at the Board membership and exit any other companies in my portfolio where any of these people are on the Board.

Note: This is not advice - just sharing personal lessons learned on my own investing activities.

My Valuation: $0

Disc: Not held. on SM or IRL

Exhibit: 4C Analysis

Valuation based on 1H 2022 Announcement made on 25th Jan 2022

1H 2022 Operating Revenues (unaudited) of $26.7m, a 32% increase compared to 1H 2021.

• Contracted license base of 2.7m at 31 December 2021 grew 15% from 2.3m at 30 June 2021.

• Cash receipts quarter of $15.3m, 18% higher than pcp of $13m.

• $65.2m Annualised Recurring Revenue (ARR) at 31 December 2021 grew 12% versus the prior corresponding period (pcp); ARR on a Constant Currency basis was $64.3m.

• An operating cashflow break-even quarter when excluding one-off items; a +$0.5m improvement on Q1FY22 and +$2.7m on pcp.

• A cash position of $17.6m at 31 December 2021. With an additional $4m available to draw from the OneVentures debt facility, taking total cash available to $21.6m.

• Strategic investment in December 2021 to acquire BindTuning, a Digital Workplace software company helping to accelerate the development of the LiveTiles Marketplace for Employee Experience solutions.

"Positive cashflow" at least for now. A higher rate of sustained organic growth is needed for a re-rate by the market. A lot of well-justified market skepticism needs to be overcome by management trying to under-promise and over-deliver.

Dec-21 update - Updating my valuation, which is really just following the share price down rather than coming up with a new bear case. Still not profitable. Their market cap is getting close to 1x ARR (dodgy as their ARR is!), which does make you wonder if there is a good price to pay for an ordinary company. I contemplated that for almost a nanosecond before deciding the answer was no. Having said that if they actually get to cashflow positive for consecutive quarters they have the capacity to rerate quickly. I just don't trust this management though...

***

What they do This is harder than I thought it would be to figure out but essentially what they do is provide add ins to Microsoft products like SharePoint and Teams to enhance their functionality and UX. It enables an enterprise to, for instance, build an employee homepage on the SharePoint platform that is bespoked for that company. It looks kind of slick, you don’t necessarily notice that it’s SharePoint and companies can define what elements individual users can configure for themselves. What I like • They look kind of cheap given their market cap is about 2x ARR. If they can get back to pre-COVID growth rates they look really cheap. • Pre COVID they were not only growing ARR quickly but they were also growing average revenue per user at a very fast clip. • They have some really quality companies as customers, including recent large contracts with Nestle and United Healthcare (Fortune 100) • They’ve been cutting back on spend to the point that if you squint really hard you can almost imagine them getting to break even some time in the foreseeable future • The co-founders own about 25% of the company, which is nice number that implies plenty of alignment with shareholder interests but leaves plenty of liquidity for the rest of us. • There’s been some recent insider buying at slightly higher levels but this appears to be from directors who didn’t previously have a stake. What I don’t like • The thesis went that they could benefit from COVID with the need for enterprises to try to enable employees to collaborate better while working from home/remotely. This doesn’t appear to have played out as hoped with growth slowing significantly since COVID hit. Either the thesis is wrong and instead this is seen as a discretionary spend that companies are going to be more likely to shell out for once they have more economic certainty OR the thesis is right but LiveTiles isn’t that solution… • They don’t have a great history of hitting targets. I haven’t been following this company closely but a couple of years ago their stated aim was to achieve $100m ARR in FY21. They recently disclosed it was $62.8m. Even allowing for COVID that’s a big miss. Last year – during COVID – their stated objective was to reach cashflow breakeven during CY 2020. We’re now two quarters beyond that and they’re still not there. • Customer churn has increased to a worrying level. Customer growth was vertical until FY19. Since then it has slowed considerably and went backwards in the last half. To be fair they have stated their focus is on enterprise customers and ARR and ARPU are up so there is some evidence that is what is playing out. • I’m a sceptic when it comes to ARR generally. It has a place but not all companies calculate it the same way. One check is to compare the stated ARR at year end to reported revenue the following year. For a growing company if all else stays equal I expect revenue to exceed the previous year’s ARR. That has not been the case for LVT in either FY20 or – I expect – in FY21. Now FX hasn’t been kind but I don’t think that accounts for enough of the miss. Something else is going on there – maybe Storge or HugoWally could explain it. • You can view Storge and HugoWally’s recent posts in regards to LVT restating metrics to make themselves look better. I am less wound up about this one. I thought they were reasonably transparent about what they were doing and given FX movements they had some justification for it, but it’s something to watch going forward. • There was also a matter of legal proceedings between one of the founders and his brother in the past year that shareholders ended up having to fork out a significant amount to settle. It felt ‘icky’. • I’m not loving the balance sheet. Their recent 4C showed a fairly healthy $16.7m in cash, but as I said they’re still not cashflow positive. They also have $12.3m in contingent consideration they may need to pay in CYCL acquisition. Also, 70% of their net assets is in the form of intangibles and more than 50% of their net assets is Goodwill – that suggests their acquisitions owe them a fair bit. • I kind of hesitate to suggest this because you could argue the mutual benefit between Microsoft and them is an opportunity as much as a risk but the reality is they need Microsoft a lot more than Microsoft needs them. The probability of that risk being realised may be low but the impact if it did would be catastrophic. I wanted to like this one as a beaten up tech company, with a well-regarded product, adopted by an impressive customer list, who could grow as quickly as they previously were, is worth a good look. Unfortunately I think the market may have this one right.

[Not held]

Ever been to the Berkshire website? If you haven’t, do yourself a favour and see how a USD600B company presents themselves. While there is no ‘About’ link, it doesn’t take you long to work out what they do.

Live Tiles on the other hand, I get it, they make apps. But working out what those apps do, how they are used and what value they add, well that is a completely different proposition.

Our friend Google didn’t return much when looking for reviews, or configuration guides, so I went to YouTube (GoogleTube). There were shameless self-promotional videos showing off their seriously swish office space. For a company that lost 30M, they are possibly focusing their expenditure in the wrong place.

Following the Google experience, I downloaded Reach and spent about 30 minutes going through it with the Get Started assistant. While the world is moving toward mobile everywhere, but this to me is a solution looking for a problem. Maybe it’s just me, but I avoid Yammer, Pulse Surveys, Slack chatter

It is also acknowledged it’s the content that matters. To use a George Fuechsel-ism, Garbage in Garbage Out. If your company was dedicated to the cause and adopted Reach as the source of truth for events, news, etc it could be valuable. I wonder though how much content curation would be required.

There must be some who are taking to Reach specifically as contracted revenue in the last year grew circa 50%, with Reach up over 1000%.

All the metrics seem to be heading the right direction, it’s just that pesky profitability issue. Above I mentioned the smick office space, however, it could also be the workforce balance with 40% of the team in “corporate” or “sales”.

For me at least, this one is in the too hard basket.

I thought I’d update my Straw on culture for LVT.

I don’t own LVT. It appears like it has a lot of positives going for it but I thought I’d point out what I came across regarding company culture and management. Poor company culture in particular is why I think LVT is going to have more difficulty succeeding.

Since first posting 11 months ago, LVT had 43 Glassdoor reviews, they now have 62. Overall score has improved from 3.1/5 to 3.6/5, CEO approval has improved from 45% to 68% and “recommend to a friend” from 49% to 67%.

Culture

62 Glassdoor reviews – 3.6/5

•67% would recommend to a friend

•68% approve of CEO Karl Redenbach

•While Livetiles is trending in a positive direction I’m still not overly optimistic about company culture and my suspicions management may be encouraging the posting of positive reviews was supported (in bold below).

Poor reviews:

<1 year: “The CEO was so disrespectful in words, tones, actions and deeds. He had absolutely no respect or regard for people, their personal lives or their time. He was known to throw things at employees, whatever he may get his hands on to.”

<1 year: “Company initiatives to flood glassdoor with fake ratings because the real ones are so bad. Remember that Karl didn't forego his cost of living allowance when he cleared $1.5m while everyone else was working a partial week. That is your leader. Anyone in leadership still working at LiveTiles knows their behavior wouldn't be tolerated in another company. Enjoy it while you can, because the money can't last forever. How are those options treating you?”

23/03/21 “…A highly dysfunctional startup with no clear vision It could be a great company with better leadership.”

18/01/2021 “Open bar…. Favoritism leaning towards young, attractive, and/or Australian staff.”

30/10/20 “Things at LiveTiles are not OK. Copious amounts of money are spent on social events in the name of ‘team building’ and ‘culture’. Work environments lack any formal HR or leave management and most higher-ranked staff easily get away with perpetuating toxic environments. Diversity is an illusion and plays directly into tokenism, particularly when it suits "outreach" agendas. Money comes from seemingly nowhere, but is generally from sales of products that don't even exist. "Opportunities for career growth" are just as nonexistent and the performance management process is dangerously stacked against the employee. You will be pushed to your breaking point and told that it's all ok because "that's just our culture".

30/10/20 “Started out good, now heading downhill” “…all our suggestions are ignored” “We were asked to accept a decrease in salary during coronavirus (which I thought was reasonable) but I've just seen the annual report and the CEO kept 100% of his Cost of Living Allowance.”

23/04/20 “No loyalty” “One such layoff being right before Christmas - super classy” “Also a super fratty culture”

25/02/20 “Vaporware distributors. AVOID!!” “There are no real products. Terms like "AI" are used incessantly yet none exists in any product made or acquired by LiveTiles. The "leadership" team is usually in some exotic part of the world, far away from wherever actual work is being done. Various departments of the business are left selling watered down solutions (at best) because most of the VC money goes into sales and leadership "off-sites". Just look at the stock over the past 2 years. Mergers & acquisitions cover up a lack of organic revenue because no one wants LiveTiles products.”

07/02/2020 “Lay off’s right before Christmas!”

01/03/20 “If you aren’t in the circle you go nowhere” “They will always take a senior employees word over yours even if you have proof to back it up. None of the little people are listened to. You could sacrifice alot to get the job done and get not so much as a thanks.”

27/03/19 “Not as it appears to be” lack of management, “lots of acquisitions but no structure”, bonuses taken away from employees, “favoratism is ever apparent”

21/03/19 “Company needs to treat their stuff with respect and follow their own values.”

13/12/18 “It was like working for the Australian Trump Family” “Leadership. From the C-Suite to the VP level, there is no clear, consistent communication, or actual leadership. Passive-aggressive is the best way to describe the overall style. If you're not part of the small inner circle, you're screwed. Blatant lies about bonus and stock plans. Cooked books to make numbers.”

04/12/18 “No structure, and I mean absolutely none internally. The product is half baked but sold as full baked. Pricing is literally whatever the customer will pay. If you’re offered a sales position, you MUST understand you’re selling an unproven, untested, zero case study concept of possibilities, it’s a stretch to even call it a real product.”

03/12/18 “Making quarterly layoffs to boost the balance sheet and hide poor sales and business decisions cannot be the long term solution.”

24/09/18 “it's completely lost its form, rushing half baked software into the market and forcing people to sell it to unhappy and frustrated customers”

27/10/17 “Avoid at all costs” “People get away with sitting on a couch all day with your feet up and surf insta while pretending to work since management is never around and no one seems to be running the company!”

Reviews also mention a fully stocked bar in the office. https://www.youtube.com/watch?v=6V_sHlVQkbs

LVT has a $12.4M “litigation cost” on their income statement

LiveTiles sued for $33m by employee alleging he was sacked for being old, having cancer

"which in reality was a culture of discrimination against individuals who were older, disabled, and United States citizens…prevented him from participating in the culture, marked by excessive drinking and raucous public behaviour.”

“building a fully stocked bar with hard liquor and two [tapped] kegs in the lunch area which was ‘always open’”

https://www.glassdoor.com.au/Reviews/LiveTiles-Reviews-E1390234.htm

https://www.arnnet.com.au/article/630285/aussie-software-vendor-faces-down-legal-challenge-us/

Management

Karl Redenbach CEO (Co-founder) $977,160 + discretionary cash bonus capped at 100% of base salary subject to meeting performance targets

Peter Nguyen-Brown (Co-founder) $700,000 + discretionary cash bonus capped at 100% of base salary subject to meeting performance targets

These salaries seem high considering the company had a net loss of $17M (excluding litigation costs) for FY21 and a cash outflow of $11M (excluding litigation costs).

On a positive note, both achieved their STIs but offered to forego their bonuses for FY21

Hey HugoWally, you're probably sick of me by now but I don't think anyone else has replied yet. Nice graph again. In my mind revenue lagging receipts makes sense and is what I would expect for a growing subscription model business. I'm not sure of their trading terms but typically a customer pays a 12 month subscription upfront. That is a cash receipt straight up but generally they wouldn't be entitled to show that all as revenue at the same time. Usually this sort of business would park the subscription on the balance sheet and then amortise the release of it to the P&L over 12 months. If you look at LiveTiles half year accounts you'll see they showed Other Liabilities on the balance sheet of $15m (current and non-current combined). Of that $13.5m is disclosed as Unearned Revenue, which are receipts that are yet to be released to the P&L. There's more analysis you could do here such as analyse the growth of Unearned Revenue over time and sense checking unearned revenue against ARR. There's no guarantee that all the Unearned Revenue in relation to subscriptions but they might tell you if you ask nicely!

I wouldn't say that it's a conservative treatment. It's true that sometimes companies will try to argue that once they have invoiced the subscription the work has effectively been done and they can recognise it as revenue upfront. But I would argue that's a particularly aggressive interpretation and most auditors would be highly sceptical.

Investors seemed to have lost faith in this company, after relatively good news a few weeks ago the share price hasn't lifted the way investors had hoped.

They need to get there growth story back on track. If they can we may see a strong upward movement.

I think many may think they should be doing better in these times of working from home.

Record multi-million dollar deal with US-based Fortune 100 Healthcare company

• LiveTiles signs record deal with a three year multi-million dollar agreement.

• The healthcare company employs over 300,000 employees and signals strong acceleration in digital transformation needs in the healthcare industry.

• The deal includes many of the core LiveTiles products and validates the strong growth in the Employee Experience Platform category that LiveTiles pioneered.

• This is the second record breaking deal for LiveTiles in less than four months.

Disc: I hold

Shares in LiveTiles were earlier placed into a trading halt at the companies request, as it prepared a statement in regard to media speculation that an overseas buyout fund had approached it in regard to a control transaction.

While the company acknowledged that it does receive approaches from time to time, it was NOT in any current discussions with any parties.

Trade resumed after the announcement was issued, and shares have shot up over 14% (at time of posting) despite the company denying any talks with potential suitors. Go figure!

The article in question appears to be from the AFR (here for those with a subscription). The key part of the article in StreetTalk was:

"Street Talk understands small-cap Livetiles has called in Credit Suisse’s investment bankers as defence advisers, after fielding approaches from some specialist software buyout types offshore.

While interest was said to be early-stage and there was no formal process under way, Livetiles is understood to be keen to explore its options."

Who knows what is really going on, but i wouldnt personally be buying shares on this rumour/speculation alone.

ARR grows to $64.7m and record cash receipts of $13m

• Annualised recurring revenue (ARR) has grown to $64.7m on a Constant Currency basis; a 23% growth over the same quarter from last year and up 200% in 2 years. On a reported currency basis ARR has grown to $58.1m.

• Another record cash receipts quarter of $13m and 25% higher than prior corresponding period (Dec Qtr FY20). Net operating cash outflow (excluding grants and non-recurring items) of $2.7m; a 56% improvement on the corresponding period last year.

• LiveTiles Customer Lifetime Value reaches $403m, a 3x increase over 2 years.

• Cash on hand as at 31 December 2020 of $19.2m

• With increased pipeline growth in recent quarters and the successes of recently won customer deals, the business has strategically invested in expanding its Sales and Customer Success team capacity by 43% to capitalise on these opportunities.

DISC:I have a small holding

LiveTiles has reported another quarter of strong growth.

ARR has hit $52.7m, up 22% from the preceeding quarter and 130% over the past year.

Worth noting that close to half of this was acquired growth from the CYCL purchase.

Average copntract value also increased, but so did churn amongst smaller customers.

There was no detail on cash burn, though that will be released prior to the end of January when it posts its next 4C.

In terms of outlook, LiveTiles said only that it "expects to deliver another year of strong customer and revenue growth"

More detail here

Some initial thoughts:

Develops intranets for corporates, which gives an employee "homepage" that integrates all business functions and intel in the one place

Targeting $100m in ARR by end of FY2021. It has been growing very stringly to date, in part driven by acquisitions.

Annual costs of ~$65m at present

$56m in cash as of last quarter, but operating cash burn was $5.2m in the same quarter (Sept 2019).

Appears to have some substantial counterparty risks; Microsoft partnership is the basis of their business.

Has a very large addressable market, and claims to be the market leader