An announcement about their latest review, this one called an ``Operational Review'', which follows on from the ``Strategic Review'' in 2021. They say that this new review has resulted in annual savings of $6.48 million, although I'm pretty sure these are projected savings as at least some of the recommended changes haven't happened yet.

Announcement here.

It mostly involves getting rid of 32 staff (saving $5.48M), at all levels, including the co-founder Peter Nguyen-Brown, although it's not clear if he'll have some other role at the company as they include the obtuse statement that he will remain ``an ally to the business for years to come''. So both the CXO (the X stands for experience) and the SVP of People and Experience (Vanessa Ferguson) are leaving, which given the buzzword-y job titles, I think is probably a positive. This company really needs to focus on the business and less on self-promotion. At any rate, I'm not sure how soon the savings from these sackings can be realised given notice periods and contract termination clauses --- in my own field of academia people can be given 6 months or even a year to leave a university (so they can finish teaching courses or wrapping up research projects). I don't know what the protocol in tech businesses is. Then there's potential morale problems with the staff who remain.

The rest of the savings ($1M) will come from moving offices, renegotiating the prices they pay to suppliers and reviewing marketing expenses. Again, these seem like aspirational savings so it remains to be seen how they eventuate.

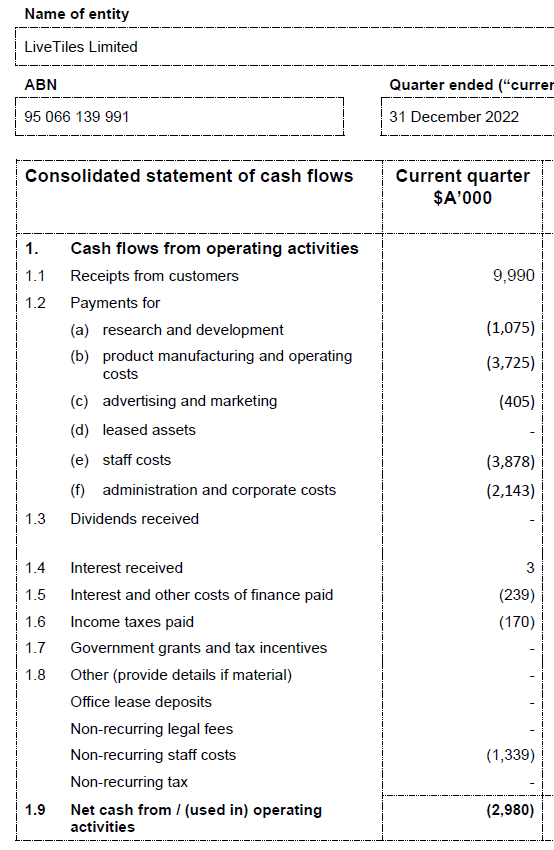

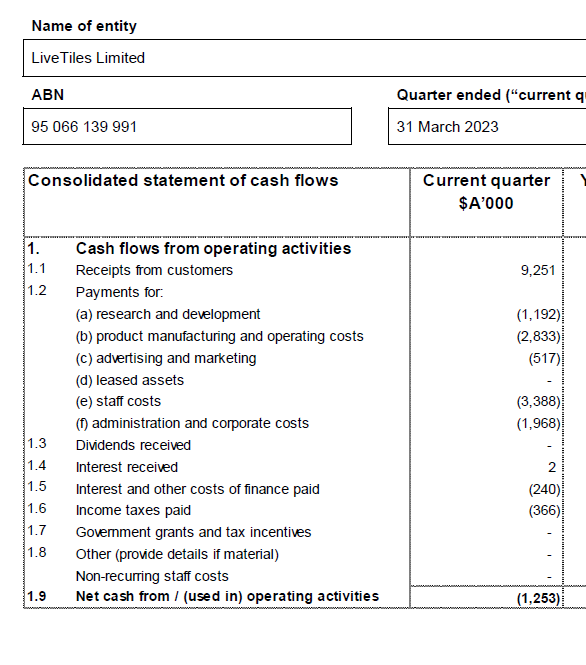

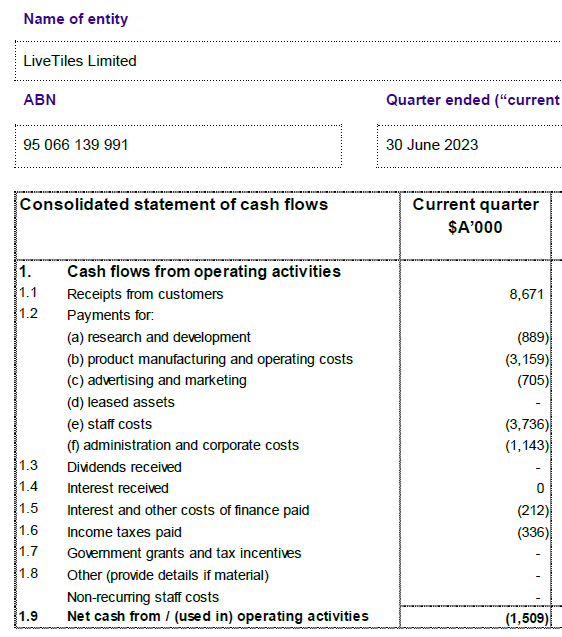

At any rate, they claim that they are on track for free cash flow positivity in CY2023. If I've correctly read their full year statement from 2021--2022 (happy to be corrected) then it says that they had cash outflow of about $10M (excluding a $6M loan they took out). It seems like they want to roll these new savings ($6.48M) in with the savings from the 2021 Strategic Review ($3.5M), giving a total of $9.98M in reduced spendings, making it seem that +ive FCF is pretty close, but at the beginning of the current announcement they say that those savings from the 2021 review have already been incorporated into last year's results. So ignoring that $3.5M I think +ive FCF next year is optimistic, and it requires significant increase in revenue.

They also took a swipe at shareholders' vote against the delisting, saying that this prevented them from an additional $1.5M in savings, although, again, this doesn't seem like enough to convert to cash-flow positivity.

Lastly, they mention the proposed buy-out by Big Tin Can at 7c/share. They're still weighing it up and talking to ``other parties that have expressed interest in LiveTiles'' presumably to drive up the price, but nothing to report yet.

Disc: Held IRL and SM. (Hanging on to see what happens with any buy-outs.)