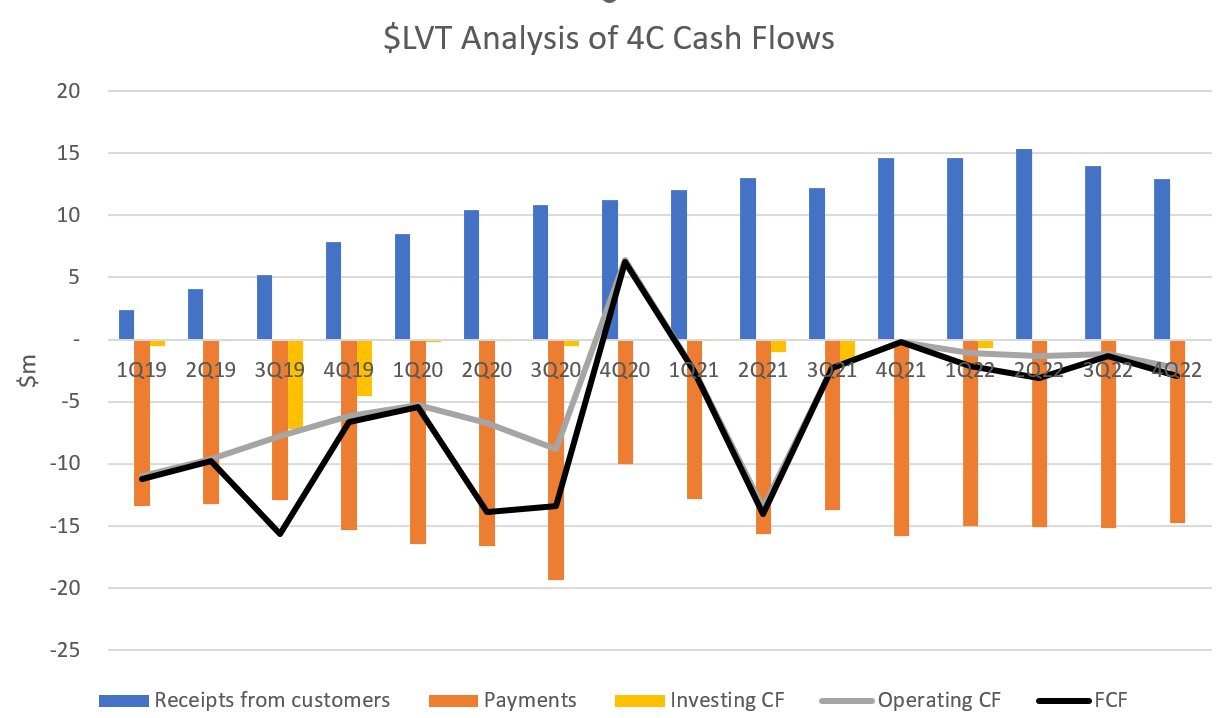

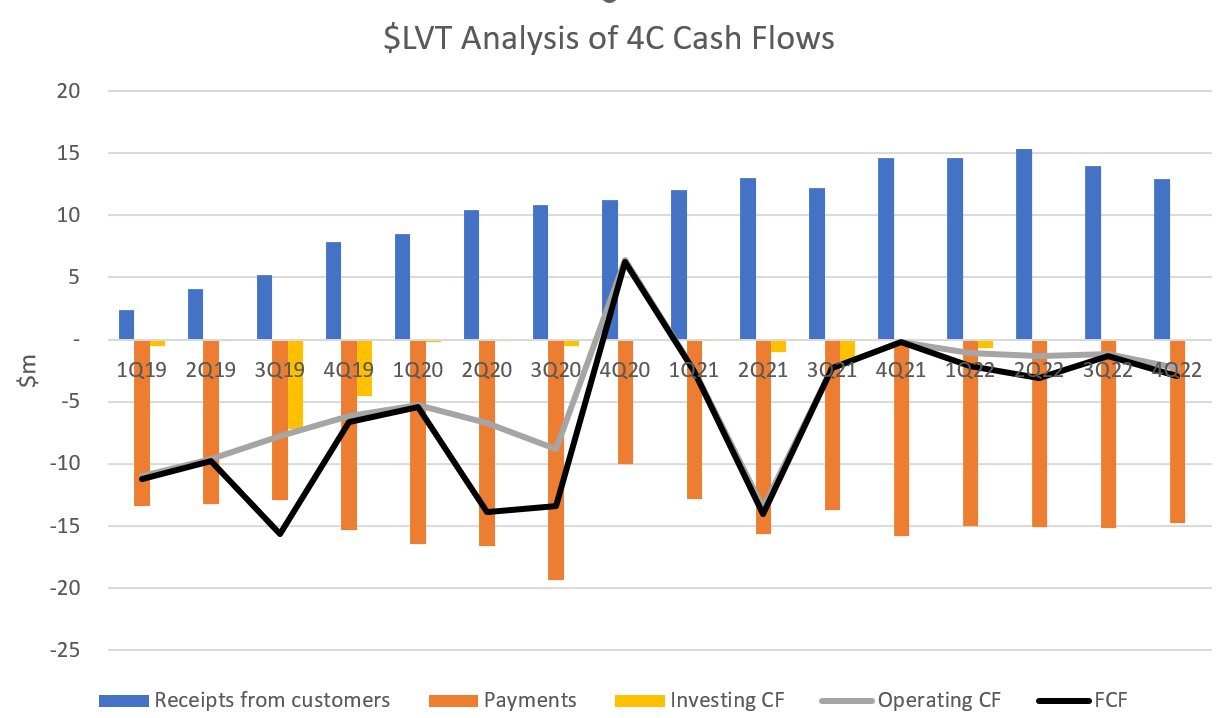

No longer on my watch list (exited IRL on 28-June-2021 at a 50% loss,.... boy was I lucky), I have updated my 4C analysis below to see if the recent strategy review, cost control, and focus on enterprise clients and user base (versus historial approach of focussing on LTV and number of customers) is yielding results.

You might read the ASX results release and conclude that there are propsects ahead for this business.

My conclusion is quite different. This is another business that hasn't figured out how to make money, is managing costs (barely) but now facing falling receipts. If I held it, I'd sell to salvage what I could.

Personal Action: look at the Board membership and exit any other companies in my portfolio where any of these people are on the Board.

Note: This is not advice - just sharing personal lessons learned on my own investing activities.

My Valuation: $0

Disc: Not held. on SM or IRL

Exhibit: 4C Analysis