ASX Announcement

$DSE issued their quarterly report this morning, with an investor call later this morning.

Their Highlights

- Annual Recurring Revenue (ARR1 ) of $33.4m, up 10% on prior quarter (QoQ) and 44% on the previous corresponding period (PCP)

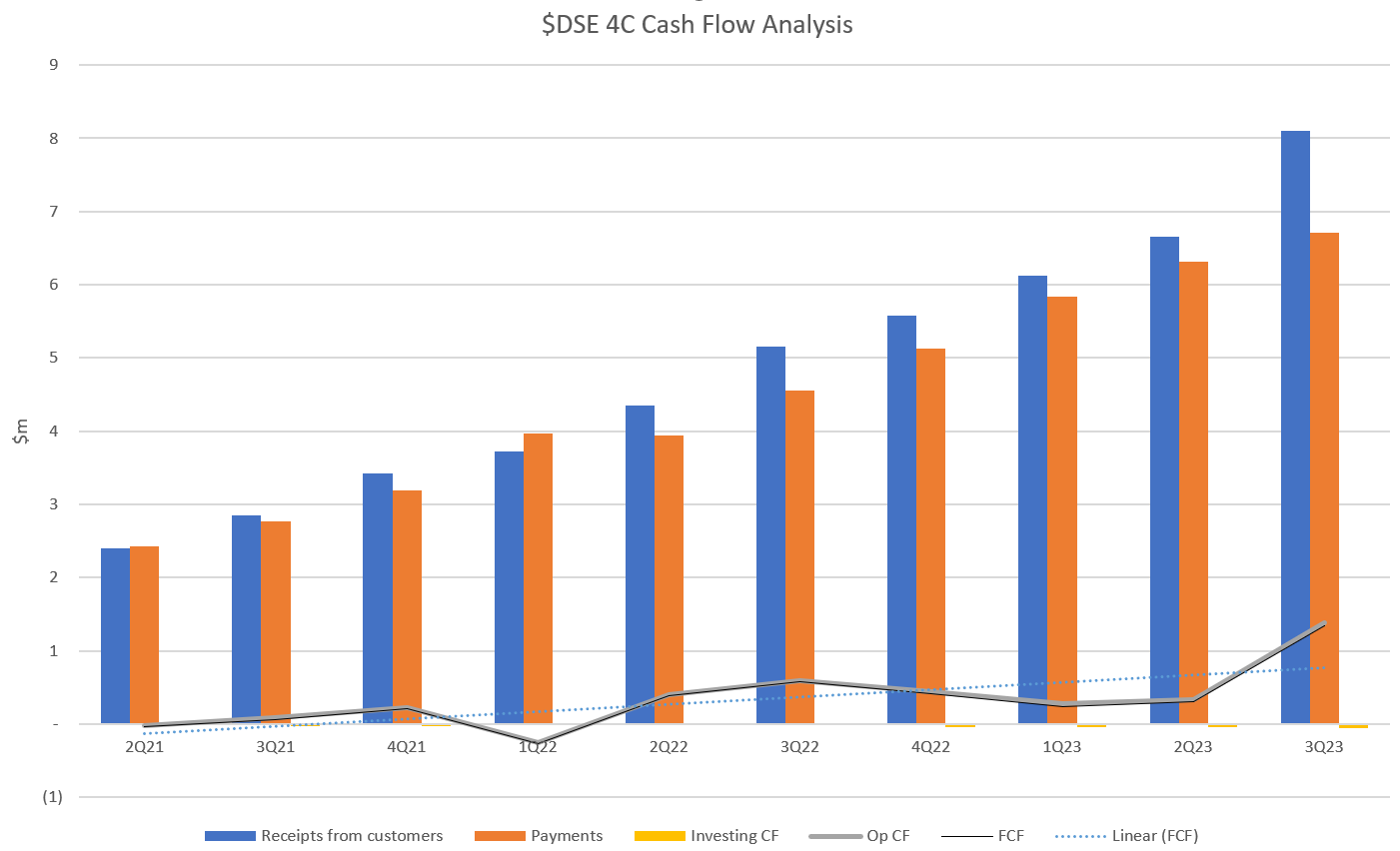

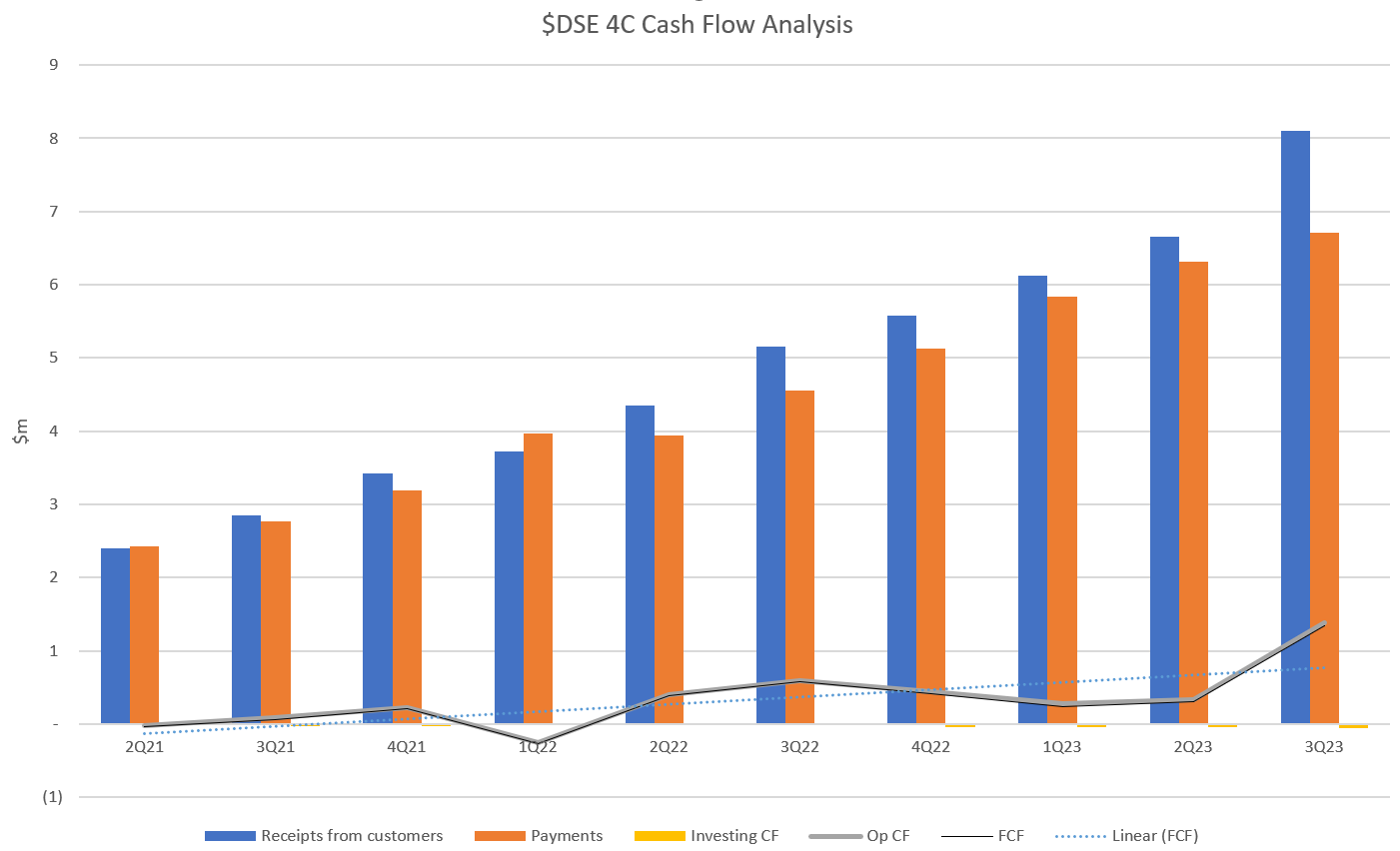

- Q3 FY23 operating cashflow of $1.39m

- Monthly ARPU of $2.57 up 9% QoQ and 17% on PCP

- Product gross margin of 68%, stable with prior quarters

- Onboarded 35 new direct and 209 indirect transacting partners

- Gross paid user additions of 86k, offset by deactivation of 53k from a low ARPU, legacy partner, resulting in a net increase of 33k users

- Total paid users now exceeds 1.1 million

- DSE remains well-funded with $24.6m cash at 30 September 2023.

My Analysis

$DSE continues to advance steadily.

Pleasing to see is very decent cash generation, with closing cash up $1.6m on the previous Q, indicating good cost control meaning more of the strong receipts for the quarter staying put in the bank account. This is now the 6th consecutive quarter that the closing cash balance has increased,...we're up to $24.56m from the low point of $21.344m in 1QFY22, but this is the first time the cash balance has increased by more than a few hundred 000s.

The churn event is something to keep an eye on, although the report highlights that this is a legacy low ARPU customer. Certainly the strongly growing ARPU is consistent and an indication of the contribution of some of the higher value products launched over the last year or so.

On churn, Charif's preferred metric is Partner Revenue Churn, which is reported as <3%. I'm not sure what I think about this metric and keen to hear other StrawPeople views. Did we discuss it with Charif last meeting?

The strength of the result can be seen in the cash flow trend chart below, with the combined effect of strong receipts and control of costs driving a step up in cash flow.

So I'm left wondering, is this just a good quarter given that there is noise in receipts and payments from Q to Q, or are we really now starting to see the business scale and the contribution of higer value products coming through? The next quarter or two are needed to confirm the trend, but this is looking positive.

Disc: Held in RL and SM