Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Announcement today informing shareholders that topline have sold down a large portion of their stock. They do still hold ~19%.

I wonder if this is indication that it is unlikely another offer comes through and $5.90 is where things will end.

They may also be reducing the risk. With the market running pretty hot with good momentum there are likely easier ways to find a few extra % in other places.

wow what a morning.

just did one of its best ever quarters and then the next minute a takeover at $5.90 per share occurs.

Looks like it will go ahead, all major shareholders are in agreeance. I am certainly stoked this is my largest IRL position. But on the other hand the timing of it just as they release a set of results like this makes me feel a bit strange. Overall happy.

With the currency exchange between AUD/USD and the fact DSE earns most its dollars in US currency I did feel this was inevitable. I have been a very long term shareholder so it is great. Also happy for Cheriff who seems like a solid dude.

Hopefully a counter offer comes in just to add the icing.

Update from Ord Minnett. Increased P/T to $4.09.

https://www.asx.com.au/content/dam/asx/broker-reports/2024/dropsuite-limited-cr-221024.pdf

Positive Q3 update, but to be captain obvious, they're going to have to focus on controlling costs and ensuring ARPU doesn't stagnate, especially as competition grows.

Charif has to be one of my favourite guests.

- Consistent, clear and candid in his messaging.

- Significant shareholding, owning ~5% of all shares

- Despite being cashed up and with a stated intent of making some strategic bolt-on acquisitions, they have not yet progressed. Not because they didn't find things they liked, but because the prices were irrational

- Clear focus on their core strengths and resolve to stay within the circle of competence

- Culture and reputation are very much a focus, and is what helps underpin lead generation and retention.

- Approach to AI is sensible and without hype. Very much leveraging APIs and products from 3rd parties as opposed to building internally (an area they dont have expertise on).

- Expansion of the team is very much about enhancing the product offering, with huge potential to cross/up-sell to existing users

- Not dismissive of competition (including Syntex)

- No interest in emerging markets (not yet sophisticated enough, and a lower preparedness/ability to afford DSE solutions. And, besides, a lot of opportunity still within the OECD

- Expects the MSP space to continue growing strongly thanks to all manner of tailwinds. He expects 10%pa

- Is focusing on ease of use for MSPs (quick provisioning of services, simplified billing, and strong customer support). They aim to integrate backup with security solutions, as the lines between the two are becoming increasingly blurred.

- Drop Suite positions itself as a premium product in the market, allowing MSPs to make higher margins when using their services.

Expanding on the Syntax threat, while Charif acknowledged that Syntex has a "superpower" due to faster data restoration capability, he believes that Syntex lacks critical features, is costly, and doesn't adhere to best practices for disaster recovery, like keeping data in separate environments. Despite the initial market reaction, Syntex hasn't posed a significant threat to Drop Suite's business (which so far at least is supported by the numbers).

I do have some concerns over the valuation at >6x annualised sales (or the current ARR) there's a lot of growth priced in. (Given the heavy reinvestment and minimal NPAT, the PE is >400x)

But this could be somewhat deceptive.. a few more years of continued strong revenue growth at a decent margin could really bring those multiples down very quickly.

So, overall, very happy to keep holding.

Three things:

- Microsoft Announces General Availability of Microsoft 365 Backup on 31st July 2024

- It is available for customers only from 31st July 2024 - it was announced year or so ago

- Microsoft obviously recommend their backup solution but also provides partner solutions like AvePoint, Cohesity, Commvault, veeam, rubrik, veritas etc but no mention of Dropesuite : https://techcommunity.microsoft.com/t5/microsoft-365-backup-blog/microsoft-announces-general-availability-of-microsoft-365-backup/ba-p/4205300

- Microsoft published their Best practices whitepaper : https://adoption.microsoft.com/files/microsoft-365-backup/Microsoft-365-Backup_Best-practices-whitepaper.pdf

Ord Minnett maintains buy after latest quarterly -

https://www.asx.com.au/content/dam/asx/broker-reports/2024/dse-update-ordminnett-090824.pdf

Dropsuite announced the public preview of Dropshuite Entra ID Backup ( Entra ID is the new name of Azure AD ID)

https://dropsuite.com/blog/introducing-the-public-preview-of-dropsuite-entra-id-backup/

https://blocksandfiles.com/2024/05/14/google-cloud-unisuper/

good article on the importance of having a third party backup. Stories like this hopefully reduce the risk of Microsoft coming on scene.

disc held

Based on reaching $120m in FY28. Share count rising to 900,000,000. PE75 discounted at 20% due to big variables.

Inside Ownership Ordinary Shares % DSE Issued Net Value at $8.31

Charif El-Ansari 34,085,439 4.9% $8.862m

Theo Hnarakis 11,752,311 1.6% $3.055m

Bruce Tonkin 1,514,123 0.22% $393K

Eric Martorano 0 0 0

Kobe Lizheng 200,000 0.03% $52K

Total 47,551,873 6.83% $12.3M

*Note 27 May 2024 DSE share will be consolidated 10- 1 https://announcements.asx.com.au/asxpdf/20240419/pdf/062p5hdgxqkl78.pdf

Board of Directors

Charif El-Ansari - Chief Executive Officer & Director

Charif is the former head of sales and business development at Google Asia. He is a well-respected technology industry veteran with over 15 years of experience in various management positions at Google and Dell that required a strong entrepreneurial drive. Charif has held sales, marketing, operations and business development roles in the US and Asia.

Theo Hnarakis -Non-Executive Chairman

Theo brings a wealth of experience scaling Australian ASX-listed technology businesses as Melbourne IT’s Managing Director for more than a decade, along with senior roles at News Corp., Boral Group, PMP Communications Group. Currently, Theo is the Non-Executive Chairman of Dropsuite.

Bruce Tonkin - Non-Executive Director

Bruce is a respected authority on Internet business and technical infrastructure issues, and COO of .au Domain Administration Ltd (auDA). He has held senior roles at Melbourne IT (CTO 17+ years), ICANN (Board director 9+ years), and Monash University. Currently, Bruce is a Non-Executive Director at Dropsuite.

Eric Martorano -Non-Executive Director

Eric is currently the Chief Revenue Officer (CRO) for Simplilearn, one of the world’s leading online education providers,. Eric has previously held various leadership positions at Microsoft where he was ultimately General Manager of U.S. Channel Sales with responsibility for over $17 billion of revenue. Eric has also held a range of leadership positions, including CEO and CRO, across several fast-growing technology businesses.

Eric holds an MBA from Pepperdine University and a bachelor’s degree from California State University, Northridge and he has previously been nominated as CRN’s ‘Top 100 Executives’ and ‘50 Most Influential Channel Chiefs’.\

Capital Raise History

· Aug 2021 $20m placement at $0.21 per share

· Mar 2020 $2.96M, $2.7m Institutional , $286K SPP at $0.045 per share

· Oct 2017 Raised $4,722,321 via a share placement from institutional, professional & sophisticated investors at $0.059 per share.

What's wrong with this picture?

Well, nothing as far as I can see! Dropsuite just continues to get it done -- excellent top line growth while maintaining margins and delivering positive operating cash flows. Oh, and a balance sheet that is rock solid.

Ok, shares are trading at 5.5x ARR -- so it's not like the market isn't recognising what's going on. But there's good potential for operating leverage here, and a good acquisition (which appears likely at some stage) could help too.

Happy to keep holding.

Just to underline the point that it makes sense to outsource your backup and recovery... Microsoft a target of hacking...

https://www.theage.com.au/business/companies/microsoft-says-it-was-hacked-by-russian-state-sponsored-group-20240120-p5eysm.html

$DSE provided a qualterly business update, first out of the blocks in my RL and SM portfolios, ahead of an investor webinar tomorrow morning.

Their Highlights

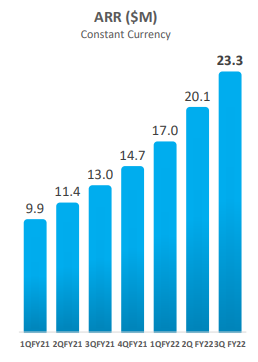

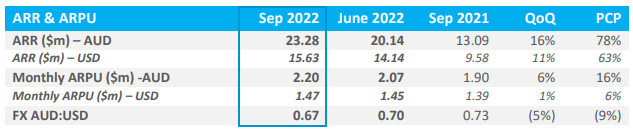

Annual Recurring Revenue (ARR1) of $34.3m, up 35% on the Previous Corresponding Period (PCP)

ARR was up 3% on prior quarter (QoQ), with momentum impacted by the stronger AUD:USD exchange rate. ARR was up 7% QoQ on a constant currency basis

Q4 FY23 operating cashflow of $0.27m and unaudited FY23 cashflow of $2.3m

Monthly ARPU of $2.46 down 2% QoQ due to AUD appreciating and up 9% on PCP

Product gross margin of 70%, up 2% QoQ and inline with PCP

Onboarded 26 new direct and 231 indirect transacting partners

Total users now exceed 1.16 million

Appointment of Eric Martorano as an independent non-executive director

DSE remains well-funded with $24.3m cash as at 31 December 2023.

My Analysis

$DSE is making good progress when viewed on a PCP basis; however, this was a softer Q-o-Q result which appears in part due to FX impacts. However, at the Q-o-Q cash level payments (+12%) expanded while receipts (-4%) contracted reflecting a significant reduction in cashflow from operations, tipping $DSE back into consuming a small amount of overall cash. (It is unclear that this is strictly a seasonal pattern, so I do need to go back to last year and have a look.)

We are of course always going to see q-on-q variability, however, the reason to hold these smaller cap companies at the inflection point is to see them blast through and generate stronger margins and operating leverage. So today's result does little to address this question over $DSE.

In summary, for me, there is no basis in today's result to take any action. Ideally, I'd like to be adding to my small RL and SM position. I'll attend tomorrow's webinar but for now, $DSE is a hold for me - albeit one towards the lower end of my conviction list.

Disc: Held in RL and SM

Dropsuites released 4th Quarter update to the market this morning.

It seems that growth has reduced compared to previous quarters and this will be FCF negative quarter.

(cash balance at Q3 was 24.6m and at the end of Q4 reported cash balance is 24.3m )

Business isn't struggling by any means but these are weak numbers compared to a few previous quarters. incidentally, the Microsoft Backup solution is also in the preview and in the process of rolling out worldwide.

Following my Straw this morning, I thought I'd add some further detail from the investor call:

Cash Flow

CFO highlighted that the very strong receipts will not be repeated in the next Q ("next Q receipts will be lower"). The strong result was due to a focus in the last Q on collections. Charif, however, reiterated that $DSE will be both cashflow positive and EBITDA positive for the full year.

Churn Event

The large churn event was due to a Latin American hosting service de-platforming $DSE as part of going out of business due to competitive pressures. This was in part due to strength of $US in which $DSE products are priced (and presumably high inflation/decline of the national currency). Charif emphasised that this legagy customer was from 2018, has delivered a profitable contribution, but that $DSE focus is on developed countries, so that have no customer support in that country. A futher 40,000 customers will come off the next Q from this same event.

I asked about the definition of Partner Revenue Churn, and Charif confirmed that this is revenue from partners at the start of the year that is still in place at year end. He stated this is the appropriate metric because the MSPs are $DSE's customers, not the end customers. He further said that the underlying end customer churn rate is in the range 5-7% which is good.

Competition from MS Syntex

Charif said they are not seeing any change in customer behaviour. Material on the MS Syntex threat was included in the appendix. He reiterated the "single point of failure" key message and asserted that this is an important consideration for CIOs ("large and small"). While it is early days, Charif remains very bullish on this. He drew the comparison that Microsoft is active in cyber security offerings, but that there are a lot of very successful cyber security firms, continuing to grow strongly. "This is not our Netscape moment".

M&A

Charify highlighted that this is sbout identifying complementary product capability for cross-sell and not acquiring customers. He is adopting a disciplined approach.

My Key Takeaways

Overall, a good result with nothing of concern in the presentation or Q&A.

Just one thing to note, as I wondered in my initial straw, the quarter's receipts are unusually strong, and so we will see a softer result in the next Q more in line with the recent trend.

Disc: Held in RL and SM. Will be increasing my position in line with my investment strategy to build a position over time.

Another great set of results by Dropsuite and appears to be an acceleration on last quarter results which is great to see. One thing that has caught my eye is in the investor presentation they have two slides in the appendix on the Microsoft product Syntex and there own analysis of this. The key point that stood out to me was that DSE offers improved margins for the MSPs who then on-sell their product to their clients. This margin is higher even though DSE product price is lower compared to Syntex.

I do like the fact that management have not hidden from any possible threat rather they are addressing it and making slides for the investor webinar. I do believe there may be some impact but overall minimal impact given that they target MSPs.

DSE also had a low-margin partner churn but still grew overall subscriber numbers impressively. User take up was quite impressive this qtr compared to last qtr. I wonder if the launch with TD SYNNEX was a catalyst to this?

DSE also onboarded there first GovCloud client but no mention of the quickbooks product.

Overall happy with the results and happy to continue to hold.

$DSE issued their quarterly report this morning, with an investor call later this morning.

Their Highlights

- Annual Recurring Revenue (ARR1 ) of $33.4m, up 10% on prior quarter (QoQ) and 44% on the previous corresponding period (PCP)

- Q3 FY23 operating cashflow of $1.39m

- Monthly ARPU of $2.57 up 9% QoQ and 17% on PCP

- Product gross margin of 68%, stable with prior quarters

- Onboarded 35 new direct and 209 indirect transacting partners

- Gross paid user additions of 86k, offset by deactivation of 53k from a low ARPU, legacy partner, resulting in a net increase of 33k users

- Total paid users now exceeds 1.1 million

- DSE remains well-funded with $24.6m cash at 30 September 2023.

My Analysis

$DSE continues to advance steadily.

Pleasing to see is very decent cash generation, with closing cash up $1.6m on the previous Q, indicating good cost control meaning more of the strong receipts for the quarter staying put in the bank account. This is now the 6th consecutive quarter that the closing cash balance has increased,...we're up to $24.56m from the low point of $21.344m in 1QFY22, but this is the first time the cash balance has increased by more than a few hundred 000s.

The churn event is something to keep an eye on, although the report highlights that this is a legacy low ARPU customer. Certainly the strongly growing ARPU is consistent and an indication of the contribution of some of the higher value products launched over the last year or so.

On churn, Charif's preferred metric is Partner Revenue Churn, which is reported as <3%. I'm not sure what I think about this metric and keen to hear other StrawPeople views. Did we discuss it with Charif last meeting?

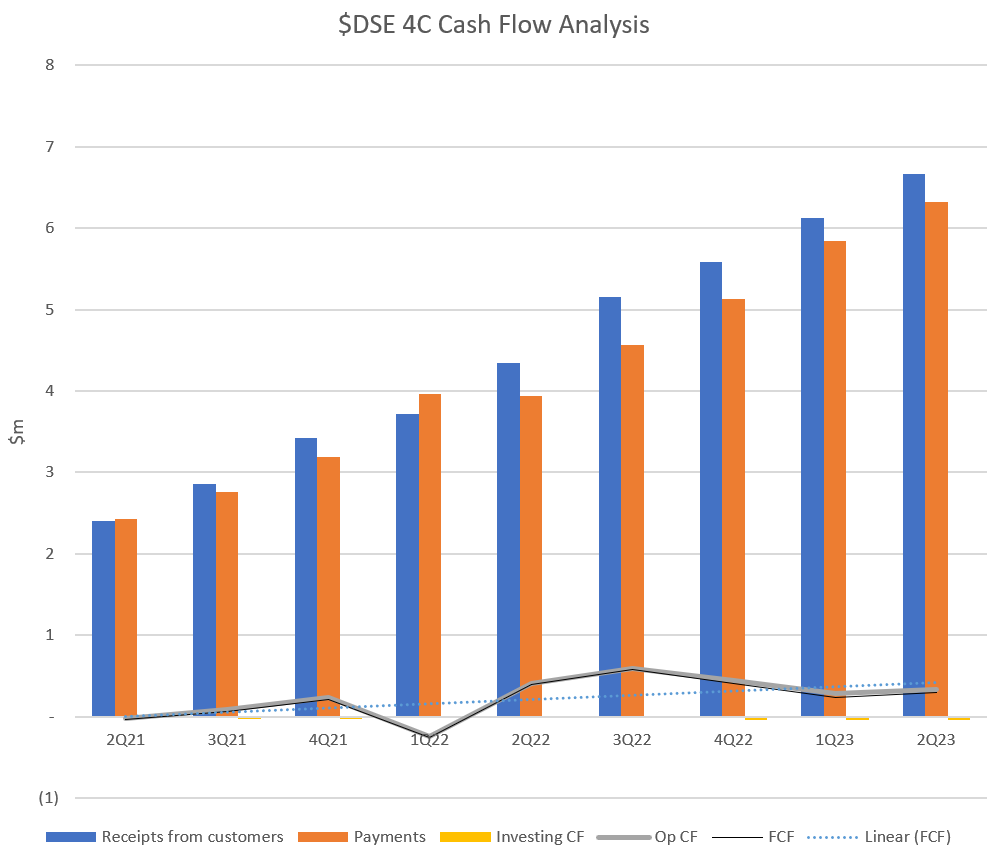

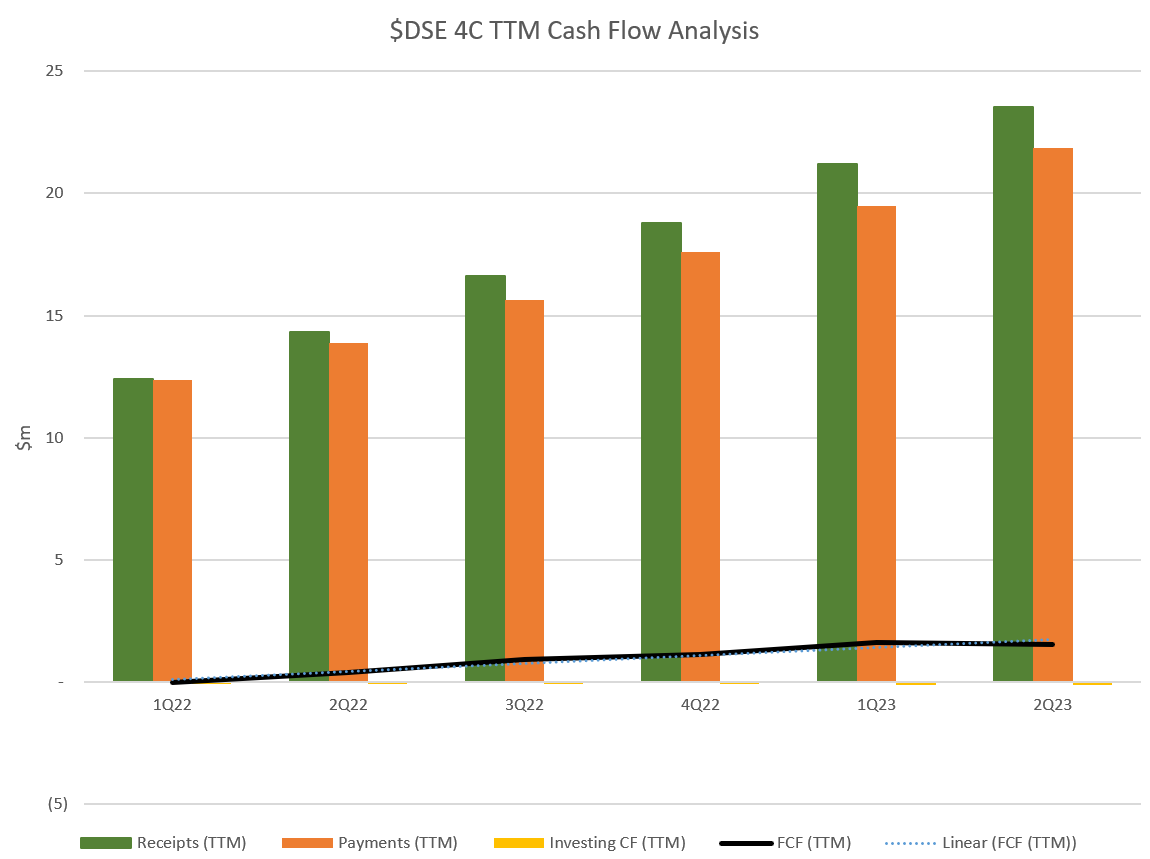

The strength of the result can be seen in the cash flow trend chart below, with the combined effect of strong receipts and control of costs driving a step up in cash flow.

So I'm left wondering, is this just a good quarter given that there is noise in receipts and payments from Q to Q, or are we really now starting to see the business scale and the contribution of higer value products coming through? The next quarter or two are needed to confirm the trend, but this is looking positive.

Disc: Held in RL and SM

I really like Dropsuite's CEO Charif, who comes across as a very straight shooter.

He strikes me as very customer focused, with their solutions aiming to solve genuine issues for customers. There appear to be genuine tailwinds for the sector too, and he seems to be thinking well beyond the next reporting period.

A few comments underscored the discipline in capital allocation decisions. There's a big pile of cash that is there waiting to be deployed, but they have walked away from a few opportunities (usually a good sign of a discerning buyer) and it's very much about building complimentary offerings aligned with the core value prop.

As he emphasised last year when we spoke with him, they were focused on viability and cash flows "before it was in vogue" and plan to remain self funded going forward.

I thought his response to the potential threat of Microsoft's backup solution was sound, and pretty much matched with the observations made by other Strawman members. It certainly doesn't strike me as an existential threat in any way.

There is, or at least was, a lot of hype around SaaS and the associated economics on the ASX, but this is a genuine SaaS business with all the characteristics you like to see. Not just sticky, high margin revenue, but excellent cash conversion.

And, of course, he's very aligned, with over 33m shares he's easily one of the largest individual shareholders, and is very long standing having been in the role for over ten years.

At 6x ARR, or roughly 80x EV/EBITDA, shares are hardly cheap in any traditional sense. But the growth is strong and consistent, and there's a long runway ahead.

Disc. Held (but not as much as i'd like)

This afternoon I had an interesting conversation with someone in my network who is co-owner/co-founder of a boutique cyber-security services firm. More generally, it was an eye-opening/jaw-dropping discussion. But my point here is to share key points regaring $DSE and the Microsoft back-up announcement.

My contact was not knowledgeable about $DSE (and is not an investor in it) as his focus is on larger enterprise clients and goverment agencies. However,he is very well-credentialled, sitting on the advisory board as a cyber-security expert to a highly respected Australian IT institution, so I attach some weight to his insights, as I would not normally write up opinions of non-expert acquaintances.

When I shared what was going on with MS-365 backups and the speculation about the impact on $DSE's value proposition, he did not hestiate and was unequivocal. He stated that the principal of "defence in depth" would mean that a completely independent back-up service would always be valuable from a business continuity/resilience perspective, for some of the reasons we have speculated about here. He believeds there would continue to be a large and growing market for such a service.

He went on to say that cyber attackers usually follow a dual strategy of seeking to defeat firewalls and go first of all for the back-up service. A back-up hosted in a completely separate environment, governed and controlled by a separate entity would be a more robust proposition. This would particurly the case if the service maintained compliance with the various global cyber-security standards. Such a service would also likely have advantages in terms of cyersecurity insurance premiums - a rapidly emerging area. He is also involved in this as a service line, as part of what his company does is assess cyber-risk of comapnies seeking insurance.

While he admitted that many clients might settle for a back-up service provided by the SaaS provider, he would always recommend his clients to view an appropriately-credentialled, completely indepedent service as superior, and this would be reflected in an actuarial assessment.

He fully agreed that $DSE may have a job of work to do to educate their MSP customers, as there is a high degree of variability in capability on security awareness across the MSP industry. This is in large part because of the limited availability of security talent. He cited that there is a shortage today of 30,000 IT securiy professionals across Australia, and one of his biggest areas of focus at the moment is defending his existing staff from poaching attacks my competitors.

Ironically, I have reduced by $DSE position in the last few days, simply because I wanted to increase some other positions, and it is lowest on my merit order for allocating capital (There being no cash in my SM position, and in RL I am "at weight" in my microcap / risky portfolio, so am unwilling to add more cash.) I'm not sure that today's conversation would have changed my decision, had it occurred a few days earlier, but it does strengthen my conviction somewhat regarding my remaining $DSE holding.

I regret I cannot give referenes to back this all up, as it was a private conversation. But this is someone with impeccable credentials whose opinion I trust.

So, when we meet with Charif, one question to ask in addition to understanding the MSP response to $MSFT Back-up, is to probe how security-savvy his MSP customers are, and what EXTRA effort he believes is required to educate them?

Largest shareholder Topline Capital partners LP continues to add post MSFT.

recent additions around 24/25c +3m shares.

now hold 27.4%, so havent been scared out

had an interesting conversation with my database lecturer last night at uni about backups…..

one of the core tenants of data integrity and disaster recovery is backing your databases up persistently in real time, in different physical locations, and for many with different organisations….

probably a bullish thought that there will always be space for competitors to the top dogs in this area.

I am updating my valuation based on the release of DSE financial results for Q2 2023 and the risks to future growth posed by the upcoming release of Microsoft 365 Back-up and Archiving Products. The key "known-unknown" is how many MSPs will be motivated to promote and sell Dropsuite's solution in addition to or instead of Microsoft's back-up / restore option.

I have in the last few days reduced my DSE holding by about 50% in my Strawman portfolio as it had become my largest holding by some margin.

I am cautiously optimistic that Dropsuite's business can continue to grow at a decent rate with the rollout of product offerings outside the Office 365 Ecosystem such as Quickbooks Online Backup and the Government Cloud Offering.

Also encouraged that Dropsuite announced on July 18th, a new partnership with TD SYNNEX, a leading global distributor and solutions aggregator for the IT ecosystem.

I do acknowledge the very strong Bear Case that has been so well articulated on the SM Platform since the release of the Microsoft 365 Backup and Archive Announcement this week

Overview of the CY 23 Q2 results and Appendix 4C for the period ending 30 June 2023.

Highlights

Annual Recurring Revenue (ARR) of $30.4m, up 8% on prior quarter (QoQ) and 51% on the previous corresponding period (PCP)

Q2 FY23 operating cashflow of $0.34m

Monthly ARPU of $2.35 up 2% QoQ and 13% on PCP

Product gross margin of 69%, stable with prior quarter

Investment in expanded global sales staff in 1H FY23 anticipated to accelerate growth

Well-funded with $23.0m cash at 30 June 2023

Just off the $DSE call.

CEO Charif El-Ansari stated up front that they'd received a lot of investor questions following the $MSFT Inspire Partner Conference and that he'd address those questions at the end of the presentation before moving to Q&A.

The main body of the presentation tracked per the slides with nothing exceptional,other than a remark about continued churn of about 15,000 seats of a low ARPU legacy customer/partner, who still has an undefined number of users to "offboard". It doesn't sound material, although there was a reference to it slightly flattening the receipts growth curve. (Every little helps!)

To $MSFT

Charif made clear that this has been in the public domain for around 18 months, although it is being given profile at this year's partner conference because Syntex is being showcased. Syntex facilitates extraction of data from $MSFT products for use by AI, and 365 Backup is linked to that.

He stated that he does not consider that 365 Backup impacts the core proposition of $DSE. This is because 365 Backup still uses $MSFT Azure infrastructure, and the distinctive point of $DSE is that it is completely independent of $MSFT, being hosted on AWS.

He made some secondary points including that $DSE is advantaged at a price point of $3/seat versus $5-8/seat for Syntex.

Regarding the ability of partners to also access 365 Backup for their non $MSFT aps and data that connect via $MSFT APIs, this would only be the case if this was done on the Azure platform, so he reiterated the importance of the indepedence of $DSE.

Overall, it was a confident and articulate response dealing with the matter head-on.

Other Items

- Sales and marketing for balance of FY23 to focus on 365, Gov Cloud and QBO products

- Highlight that these new products have been thoroughly developed with partners and are high ARPU products

- Expects staff costs in H2FY23 to be below H1FY23

- Expects solids positive EBITDA and FCF for the Full Year, highlighting the reinvestment of cash into sales and marketing

- Expect FY margins to be ahead of FY22, and to sustain and improve these over the medium to long term

- Continues to look at M&A, however, the opportunities to date have been too highly priced and they've not been willing to pay.

The Usual Cash Flow Trends

Herewith my usual CF trends for Quaterly and Trailing Twelve Month (TTM) views.

Update on My Key Takeaways from this morning

It will be interesting to see how the new products drive ARPU, particularly Gov Cloud in the US and QBO backup.

Regarding $MSFT, only time will tell how much stock customers place on having a true independent back up. If the risk you are seeking to avoid is a cyber attack, then as a layman (and not an IT security expert), true independence has some value. I have no way of assessing this further, and ultimately the voice of the customer will decide. I'd imagine some customers might be comfortable with the $MSFT solution on its own, in which case it will be interesting to see if Charif's assertion about the advantaged $DSE price point holds up as a second line of defence in partner marketing and, indeep, if it matters enough to partners. The partner impact is an area that wasn't really explored.

I did - after all that has transpired in the day - increase my RL position to a total of 1%. I'll leave my SM holding where it is, as its already 5.8%, and I usually run at between 3-5 to 1 ratio between SM and RL weightings for most holdings.

With Microsoft entering the fray, growth outlook is highly uncertain. With Microsoft encroaching into their space, & if growth rates may fall back to a "Zoom inc" like rate - perhaps stabilising at 5% pa, and perhaps a 5% profit margin. I really haven't scratched the surface - There is an argument that backup with a non-Microsoft provider provides better redundancy - there may well be customers that wish to segregate backup form providers....

With a P/E of 20, & $23 M in cash, I come up with 5c/share for business, and 3 c/share for cash.

Really hard to value DSE atm, but the left tail risk does not appear to be priced in.

Microsoft currently has a Tech conference : Inspire going on and the following is announced overnight

Welcome to Microsoft Inspire 2023: Introducing Microsoft 365 Backup and Microsoft 365 Archive

Microsoft 365 Backup provides recovery of your OneDrive, SharePoint, and Exchange data at unprecedented speeds for large volumes of data with a restore service level agreement (SLA) -- while keeping it all within the Microsoft 365 security boundary.

• Backup all or select SharePoint sites, OneDrive accounts, and Exchange mailboxes in your tenant.

• Restore files, sites, and mailbox items in your tenant in parallel to a prior point-in-time in a granular manner or at massive scale.

• Search or filter content in your backups using key metadata such as item or site names, owners, or event types within specific restore point date ranges.

You’ll be able to access Microsoft 365 Backup directly in the Microsoft 365 admin center.

You can also get the benefits of this technology by adopting a partner’s application built on top of our Backup APIs. You may choose to do this if you have a preferred partner or if you have non-Microsoft 365 data you also want to back up. Our partners can provide unique and powerful experiences within a single pane of glass for your Microsoft 365 and non-Microsoft 365 data sources. By leveraging the Backup APIs, partner apps can deliver the same unprecedented backup and restore speeds backed by Microsoft assurances – all while keeping that Microsoft 365 data within the trusted Microsoft security and compliance domain.

Get peace of mind that your content is securely and efficiently backed up and restorable in hours rather than months. Microsoft 365 Backup will be available in public preview in Q4 of this year.

Ahead of this afternoon's call, $DSE have issued their 2Q report.

Their highlights

Annual Recurring Revenue (ARR1 ) of $30.4m, up 8% on prior quarter (QoQ) and 51% on the Previous Corresponding Period (PCP)

Q2 FY23 operating cashflow of $0.34m

Monthly ARPU of $2.35 up 2% QoQ and 13% on PCP

Product gross margin of 69%, stable with prior quarter

Investment in expanded global sales staff in 1H FY23 anticipated to accelerate growth

Well-funded with $23.0m cash at 30 June 2023

My KeyTakeaways

Solid results across the board with an increased closing cash balance.

$DSE is now in a position where it can reinvest operating cash to drive growth. It will be interesting to see if the "anticipated" acceleration pans out.

$DSE SP has run hard over recent months. Should there be a significant pull back, I'd like to increase my small position, but I'm in no hurry.

Disc: Held in RL (0.75%) and SM

Good to see the Strawman himself showing the love for Dropsuite (DSE) on Ausbiz yesterday: (from 7:40)

https://ausbiz.com.au/media/strawmans-aussie-picks-wilsons-ai-plays-patriot-lithium-update?videoId=30360

Claude Walker has also been very keen on Dropsuite (BUY alert at 23c in mid-April), as have some other canny investors such as Pie Funds and 'madamswer' at HotCopper, so obviously on a lot of radar screens at the moment.

- USD ARR up 9.7% qoq and 50.4% yoy. All metrics heading in the right direction.

- Very strong cashflows considering the backdrop. Q1 is traditionally weak due to the payment of subscriptions, insurance, and staff bonuses. There was also a record number of new hires during the period as the company invest in growth. Staffing costs has been front loaded to make an impact in 2023, and is expected to stabilise for the rest of the year.

- Gross margins will remain strong for the year is expected to be around the area of 2H 2022 which was 69%.

- Quickbooks Online backup started monetising in early April, and take up is above internal expectations.

- Government version of Microsoft 365 backups launching soon.

- Running with a heap of tail winds at the moment. Cybersecurity, regulation, tight labour market (companies asking more from MSPs, and MSPs wanting to leverage more easy products that are not staff intensive).

What stands out to me is Charif’s clarity on what the company is trying to achieve. That is, expanding existing and building out new product offerings to leverage the existing distribution networks (MSPs), sales and support teams. They’re not really doing anything new, just feeding and building out the existing business model. All things are firing at the moment.

While I don't have anything against performance rights per-se, the risk is the propensity of employees selling on market after receiving the rights at any price.

They are free shares after all earned by performance milestones.

If the employees (which I will also consider as insiders) resist in selling shares then that's a good thing, but I can't see that from the price being capped at this level.

Loved to be proven wrong though.

i have no issue with this personally and Chariff has spoken about this previously. He speaks of the importance of staff feeling part of the company and owning a small amount of it improves productivity and care in their work.

you could also argue it helps maintaining staff and not losing valued staff members if they feel they own a part of the business.

although it may seem a lot of shares if they hit those targets for staff who have hung around for 12-24-36 months then I am a happy shareholder. DSE have had these performance rights issued previously and have hit those targets specified.

disc - held

On FY22 page 32, the Performance Rights number seems too high.

https://neke86.substack.com/p/dropsuite-asxdse?r=25g74b&utm_campaign=post&utm_medium=web

worth a read. Neke86 on twitter is worth the follow.

I hold IRL and SM

Shaws initiated buy 30 cents.

Hasn't done much to the share price. Current price 20 cents after a pop to 22 cents (good time for Shaw clients to exit?)

Despite all the positive straws here,frustrating to hold

held]

DSE provided another positive update today:

A bit larger than I would have preferred but hey!

In addition, the ARPU increased as well, as legacy customers rolled onto new contracts and others upgraded.

This also improved margins which are now up to 70%; an increase of 4% on prior quarter.. Pleasingly they flagged that they are confident of maintaining these kinds of margins.

Whilst cash receipts were higher ($5.58m), Operating cashflow was once again positive, at $0.45m, which was their 3rd +ve quarter in a row. This was a reduction on the previous quarter which was attributed to timing issues and currency movements, but also higher wages and advertising spend. They have also said that next quarter is likely to be lower - due to other vagaries such as staff bonuses, annual insurance premiums etc. (see below). It seems the advertising spend is worth it, as they added a net 53k new users bringing the total user count up to 935k which is 6% higher than prior quarter and 44$ higher than pcp. Churn remains low at sub 3%.

They have heaps of cash left - $22.3m

The drivers for future growth remain much the same - continued increasing awareness by individuals and companies for the need for better back up facilities. They are also releasing the Quickbooks back up in March with fees being generated from April onwards. This may well be a significant product.

So, in summary a good update. Pretty much all metrics heading in the right direction. OCF could well be weaker and indeed -ve next quarter, before resuming an ever-increasing upswing as operating leverage and unit economics do their marvellous thing. They are at one of those much discussed inflection points (its getting a bit tired, but that's what it is)

Overlaid onto this is the possibility of an acquisition.

I have build a reasonable position in DSE over the years. I am looking to add more. The window of opportunity is likely to be after the next 4C when they update OCF, which I anticipate to be weak due to the reasons outlined above, plus a fair bit of FUD from the macro.

Reasons to be doubtful would be dumb acquisitions (unlikely on the evidence to date), spiralling wage costs or a loss in a major re-distrbutor.

Here's the link to the announcement

Dropsuite updated today and their main metrics all look positive. ARPU up strongly by 11% on prior quarter and 63% on pcp. Margin up, ARPU up, cashflow up, users up, churn low - all are what you want to see. The only proviso I can see is a lot of these metrics are being boosted by USD strength against AUD.

One thing I don't understand about how they report - and maybe I'm having a brain fart - is the fact they claim to report in constant currency (see below).

To me that means backing out currency movements usually by adjusting the prior period figures to the current exchange rate or occasionally adjusting current figures to the prior exchange rate. That doesn't seem to be what they are doing though. AUD ARR from previous quarters seems to be per previous disclosures i.e. not adjusted, and they include a table each time showing the exchange rate at each reporting date they using to translate.

It is true the headline percentages they quote are based off USD figures and thus are constant currency. I don't think it's nefarious and maybe my understanding of constant currency has been out of whack all these years but I don't quite get in.

Constant currency or not they're an impressive set of numbers. It's been on my watchlist for a while and a bit cheaper I might be keen but if it keeps showing this growth that may not ever happen.

[Not held but on watchlist]

Yesterday at 3:09pm DSE put a 'Change of Substantial holding' notice on the ASX from Topline Capital Partners LP. Their voting power increased from 19.8% to 20.9%.

Here is a link to 'Th Allens Handbook on takeover in Australia~ the 20% Rule...

https://content.allens.com.au/the-allens-handbook-on-takeovers-in-australia/the-20-rule/

I look forward to what happens next, if anything.?

Disc~ Held

Quarterly activities report and Appendix 4CRecord Quarter Across All Key Metrics

Highlights

? Annual Recurring Revenue (ARR1 ) of $8.46m, a 20% increase on the prior quarter and a 78% increase on previous corresponding period (pcp) on a constant currency basis

? Users increased to 431k up 14% quarter on quarter and 49% on pcp

? Monthly APRU of $1.64 up 5% quarter on quarter on a constant currency basis

? Normalised Cash used in Operations2 decreased 22% quarter on quarter to ($0.20m)

? DSE ended the quarter with $2.48m cash and is well funded ($2.89m September 2020) ? Decreasing cash burn rate, and expansion of product offerings and growing ARR, anticipated over the course of 2021 as DSE moves steadily towards profitability and cashflow breakeven

*Includes NO Govt grants or Tax incentives

Disc; I hold

Solid progress. Key takeaways:

1) Reported $6.74M on a constant currency basis. It reported this to be a 13% uncrease on Q1 2020.

2) Cash receipts of $1.46 M - increase of 28% on Q1 2020.

3) Gross margin improvement, now at 69%.

4) ARPU increase of 4% on Q1 2020.

5) Cashflow margin running at -44%, a slight improvement on Q2 2019.

Management claim cashflow will improve meaningfully over Q3 & Q4 - It needs to as they have 12 months of cash left in the bank.

At a froward EV/S of around 6, and negative cashflow margin above 40%, DSE is not cheap by any measure, and needs to really reign in the costs to avoid another CR around Christmas.

DISC. - I hold.

Key take aways:

1) ARR up 28% (17% constant currency) on prior quarter to $6.65 M.

2) 9% growth in paid users over quarter.

3) Bash burn of $632k with cash balance of $3.69m

4) top 10 partners account for 71% or revneue down from 75% prior quarter.

5) ARPU grew 7% over the quarter.

6) customer churn fell to 3.2%.