Just off the $DSE call.

CEO Charif El-Ansari stated up front that they'd received a lot of investor questions following the $MSFT Inspire Partner Conference and that he'd address those questions at the end of the presentation before moving to Q&A.

The main body of the presentation tracked per the slides with nothing exceptional,other than a remark about continued churn of about 15,000 seats of a low ARPU legacy customer/partner, who still has an undefined number of users to "offboard". It doesn't sound material, although there was a reference to it slightly flattening the receipts growth curve. (Every little helps!)

To $MSFT

Charif made clear that this has been in the public domain for around 18 months, although it is being given profile at this year's partner conference because Syntex is being showcased. Syntex facilitates extraction of data from $MSFT products for use by AI, and 365 Backup is linked to that.

He stated that he does not consider that 365 Backup impacts the core proposition of $DSE. This is because 365 Backup still uses $MSFT Azure infrastructure, and the distinctive point of $DSE is that it is completely independent of $MSFT, being hosted on AWS.

He made some secondary points including that $DSE is advantaged at a price point of $3/seat versus $5-8/seat for Syntex.

Regarding the ability of partners to also access 365 Backup for their non $MSFT aps and data that connect via $MSFT APIs, this would only be the case if this was done on the Azure platform, so he reiterated the importance of the indepedence of $DSE.

Overall, it was a confident and articulate response dealing with the matter head-on.

Other Items

- Sales and marketing for balance of FY23 to focus on 365, Gov Cloud and QBO products

- Highlight that these new products have been thoroughly developed with partners and are high ARPU products

- Expects staff costs in H2FY23 to be below H1FY23

- Expects solids positive EBITDA and FCF for the Full Year, highlighting the reinvestment of cash into sales and marketing

- Expect FY margins to be ahead of FY22, and to sustain and improve these over the medium to long term

- Continues to look at M&A, however, the opportunities to date have been too highly priced and they've not been willing to pay.

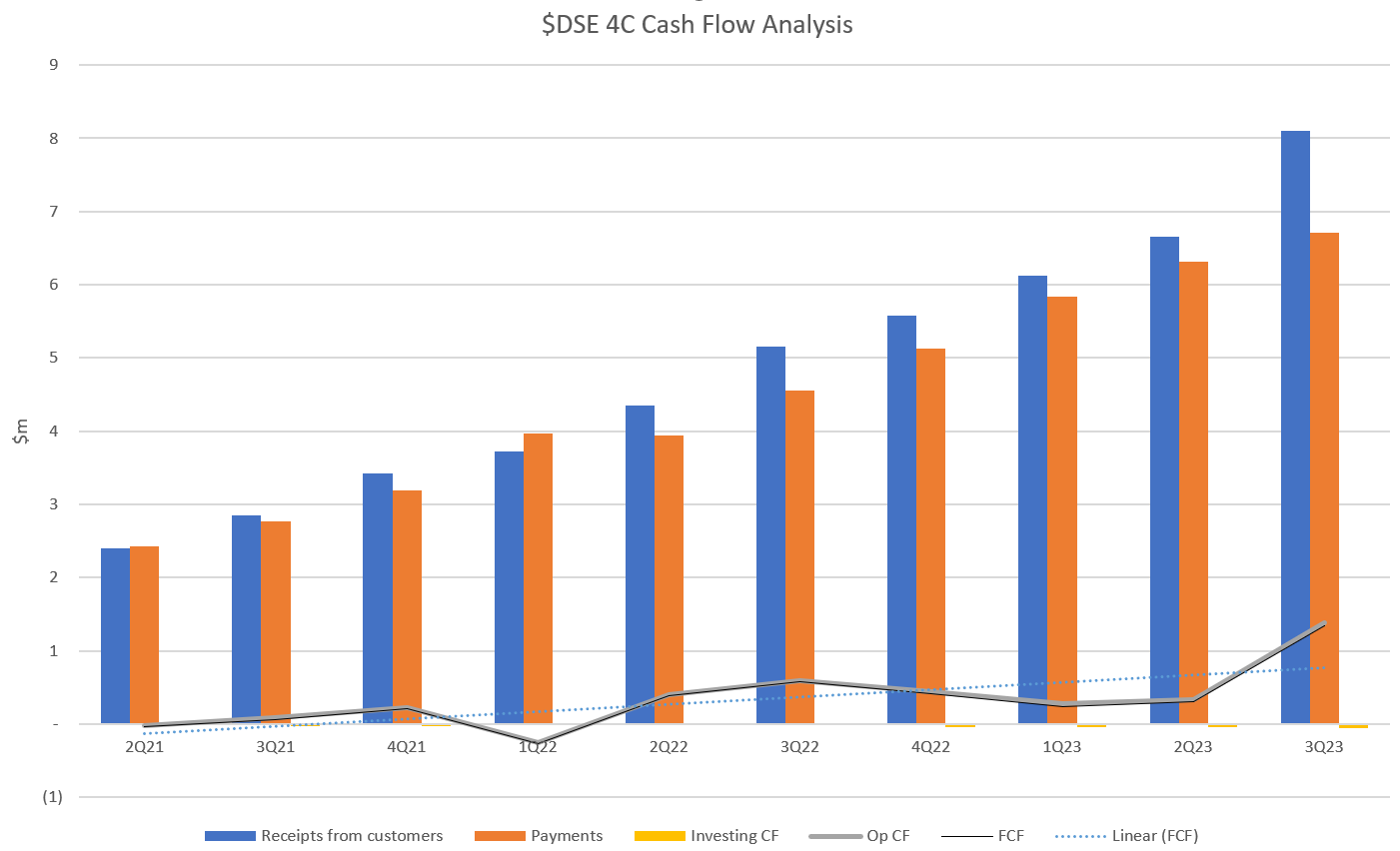

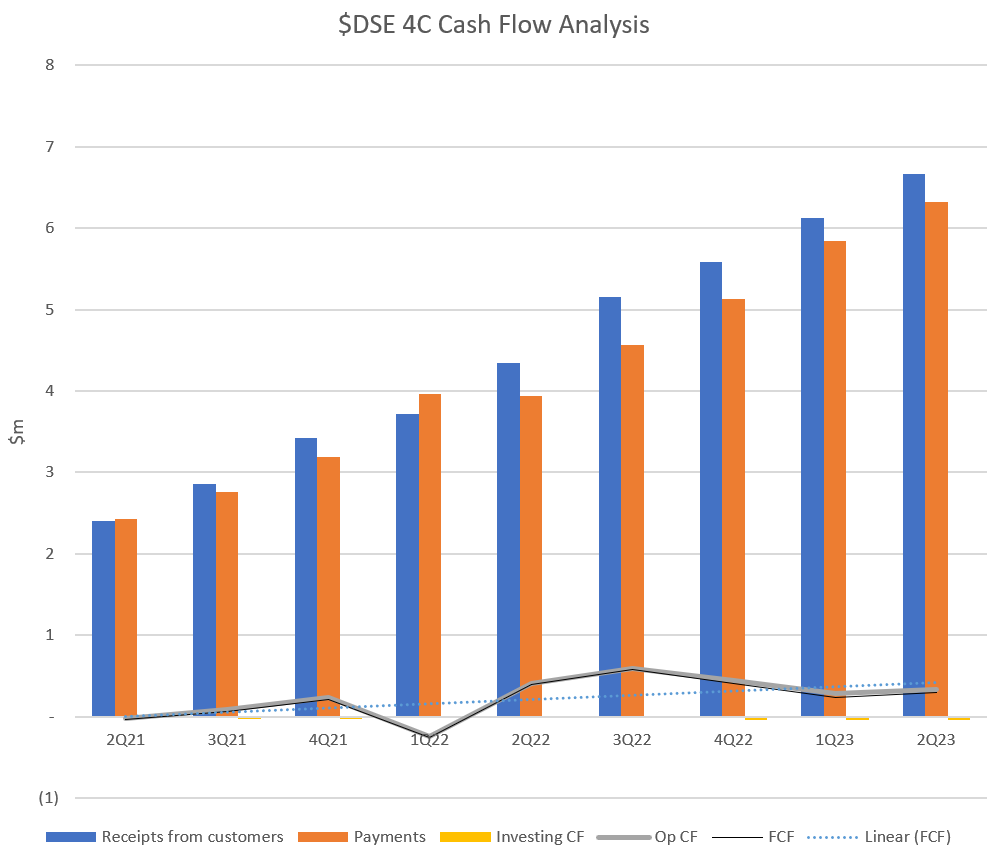

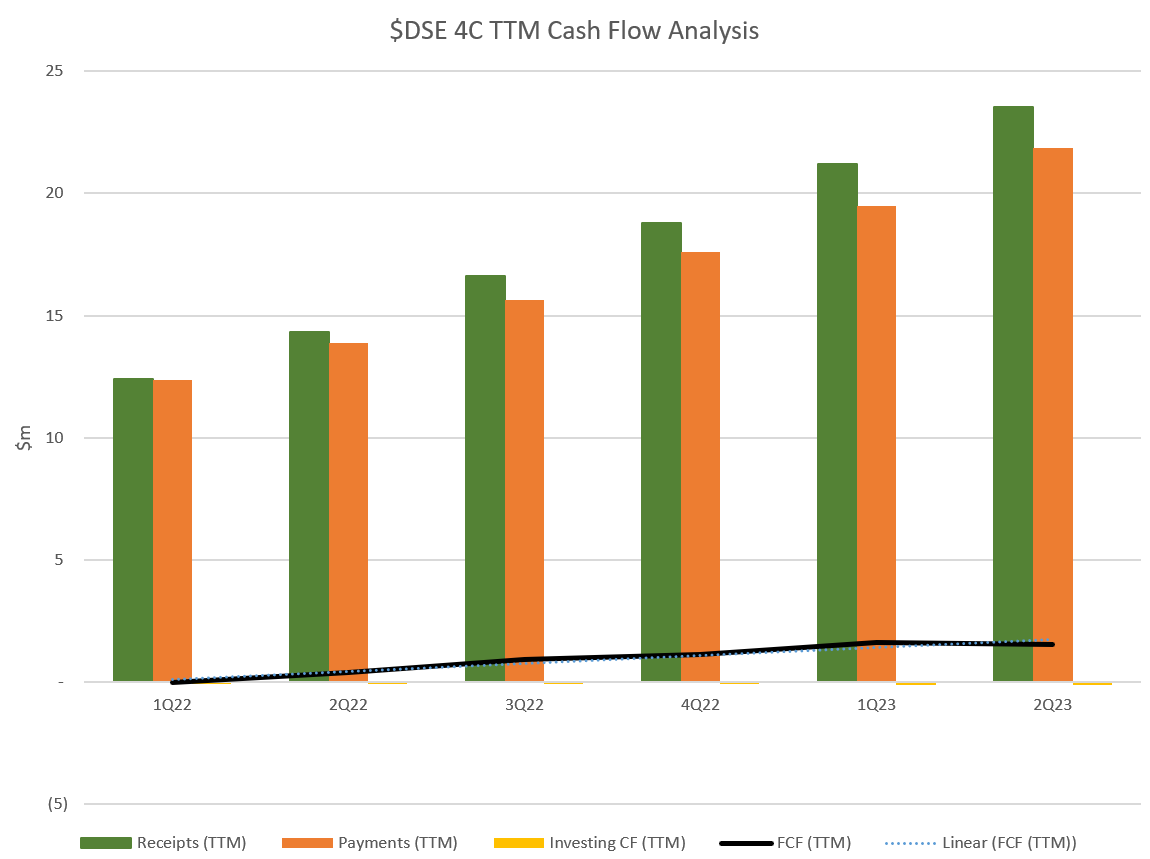

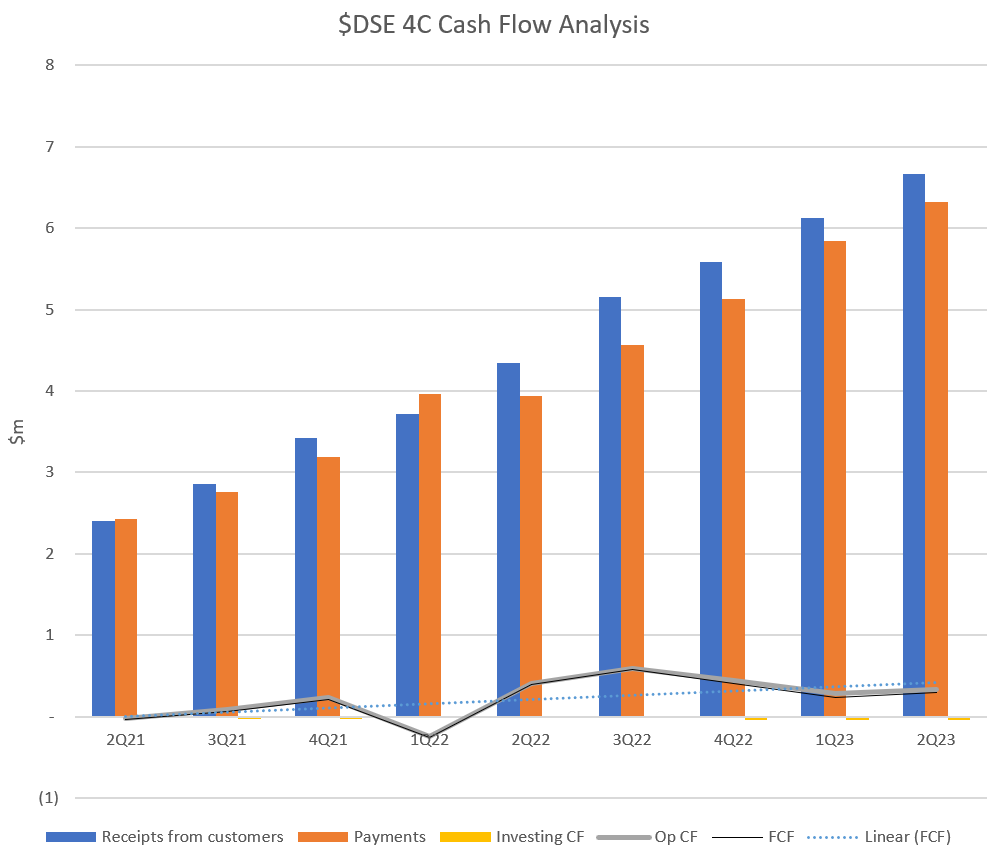

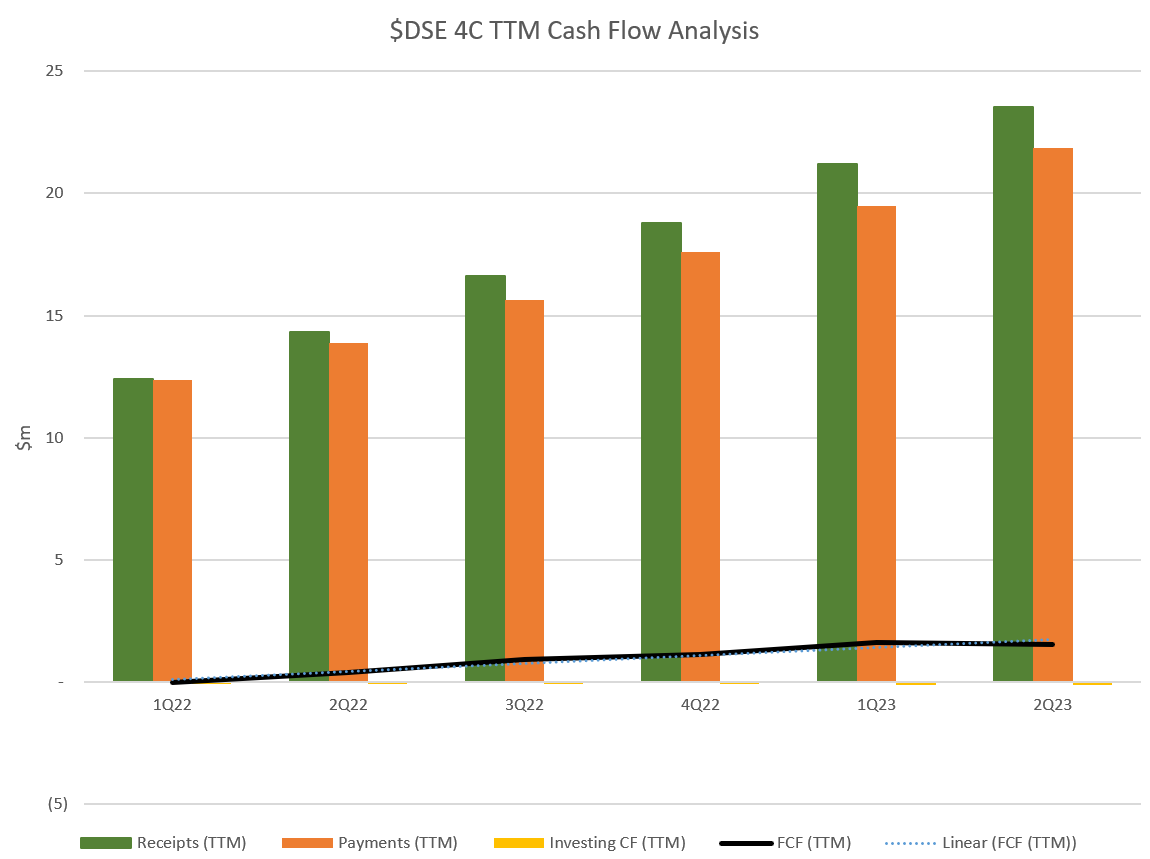

The Usual Cash Flow Trends

Herewith my usual CF trends for Quaterly and Trailing Twelve Month (TTM) views.

Update on My Key Takeaways from this morning

It will be interesting to see how the new products drive ARPU, particularly Gov Cloud in the US and QBO backup.

Regarding $MSFT, only time will tell how much stock customers place on having a true independent back up. If the risk you are seeking to avoid is a cyber attack, then as a layman (and not an IT security expert), true independence has some value. I have no way of assessing this further, and ultimately the voice of the customer will decide. I'd imagine some customers might be comfortable with the $MSFT solution on its own, in which case it will be interesting to see if Charif's assertion about the advantaged $DSE price point holds up as a second line of defence in partner marketing and, indeep, if it matters enough to partners. The partner impact is an area that wasn't really explored.

I did - after all that has transpired in the day - increase my RL position to a total of 1%. I'll leave my SM holding where it is, as its already 5.8%, and I usually run at between 3-5 to 1 ratio between SM and RL weightings for most holdings.