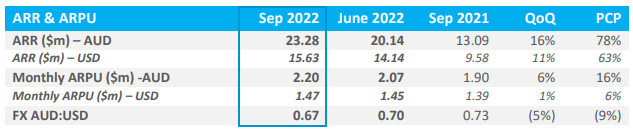

Dropsuite updated today and their main metrics all look positive. ARPU up strongly by 11% on prior quarter and 63% on pcp. Margin up, ARPU up, cashflow up, users up, churn low - all are what you want to see. The only proviso I can see is a lot of these metrics are being boosted by USD strength against AUD.

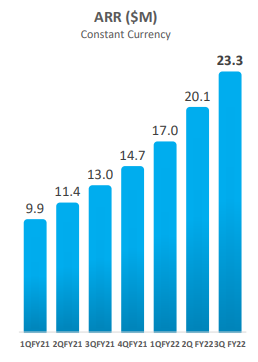

One thing I don't understand about how they report - and maybe I'm having a brain fart - is the fact they claim to report in constant currency (see below).

To me that means backing out currency movements usually by adjusting the prior period figures to the current exchange rate or occasionally adjusting current figures to the prior exchange rate. That doesn't seem to be what they are doing though. AUD ARR from previous quarters seems to be per previous disclosures i.e. not adjusted, and they include a table each time showing the exchange rate at each reporting date they using to translate.

It is true the headline percentages they quote are based off USD figures and thus are constant currency. I don't think it's nefarious and maybe my understanding of constant currency has been out of whack all these years but I don't quite get in.

Constant currency or not they're an impressive set of numbers. It's been on my watchlist for a while and a bit cheaper I might be keen but if it keeps showing this growth that may not ever happen.

[Not held but on watchlist]