I'm just out of $CSL's capital markets day and, as ever, the deep dive into each of the three businesses and the R&D portfolio always leaves me in awe of what a tremendous business this is and the breadth and depth of talent on the management team. There are too many moving parts to summarise the day effectively and, I work on the basis that anyone who was so motivated would have been there anyway. So, instead, I'll pull a few selected slides from the deck with a brief explanation of what they said to me.

My Key Take Aways from the Day

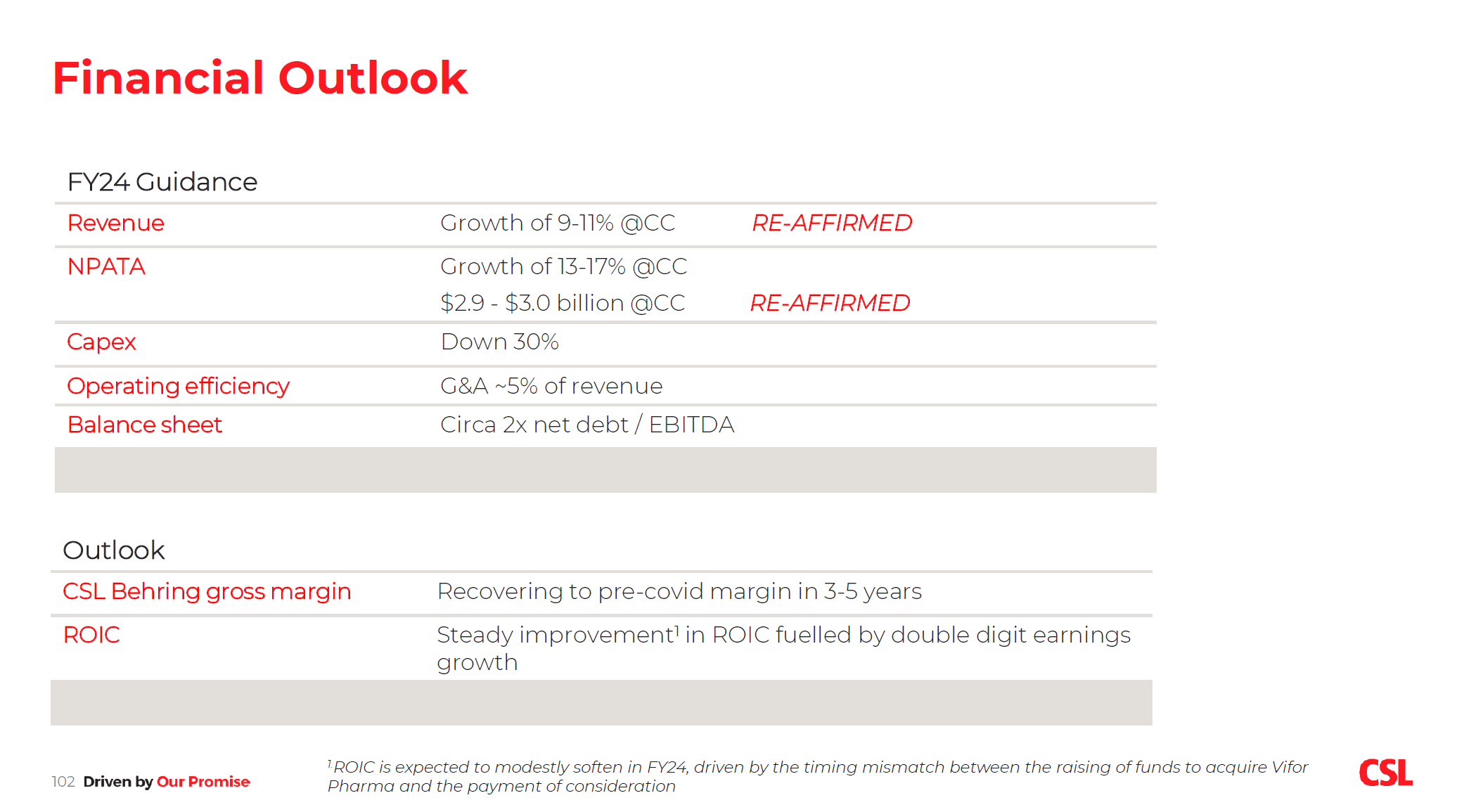

- $CSL will sustainably grow earnings at double digits annually for the foreseeable future. FY24 guidance was re-affirmed.

- It continues to sustain its R&D pipeline with new discoveries, with several exciting near-term, late-stage milestones for FY24

- Gross margin and ROIC will progressively improve year on year over the coming 3-5 years or so, driven by a program of efficiency improvements to drive plasma recovery, a period of 3-years of reduced capex and debt moving back to 2 x EBITDA by EOFY24.

- Overall, revenue will be driven by the tailwind of ageing populations in developed markets; label expansions of the existing portfolio; growth of recently launched products; and new approvals expected.

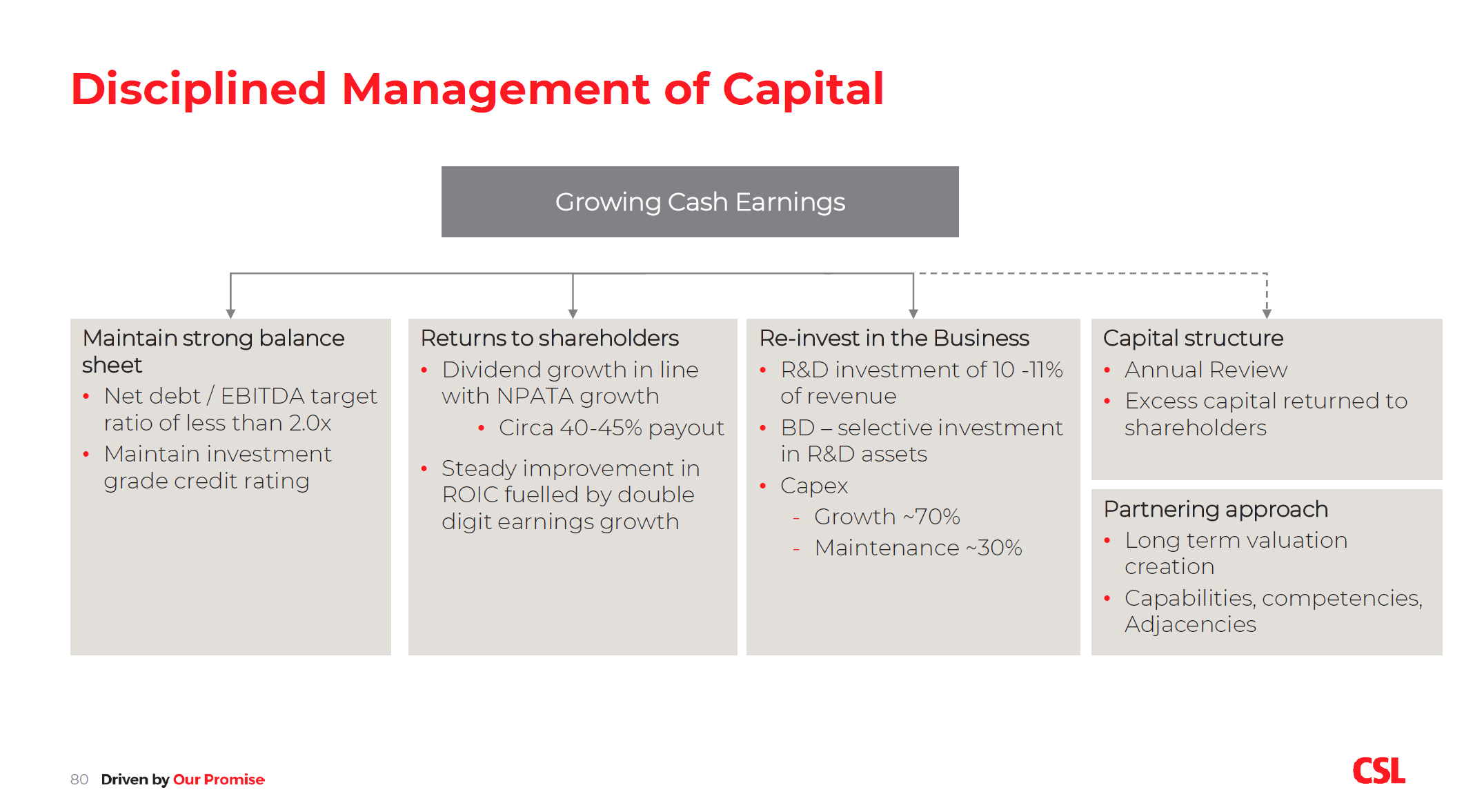

- The company has a framework for disciplined capital allocation, focused on sustaining growth while increasing shareholder returns over time

Today was Paul McKenzie's first outing as CEO for Capital Market's Day. He did a good job topping and tailing the day, supporting his team in the Q&A, and letting the team do the heavy lifting as you'd expect. As far as I am concerned, he did a good job and the first test will be meeting or beating FY24 guidance.

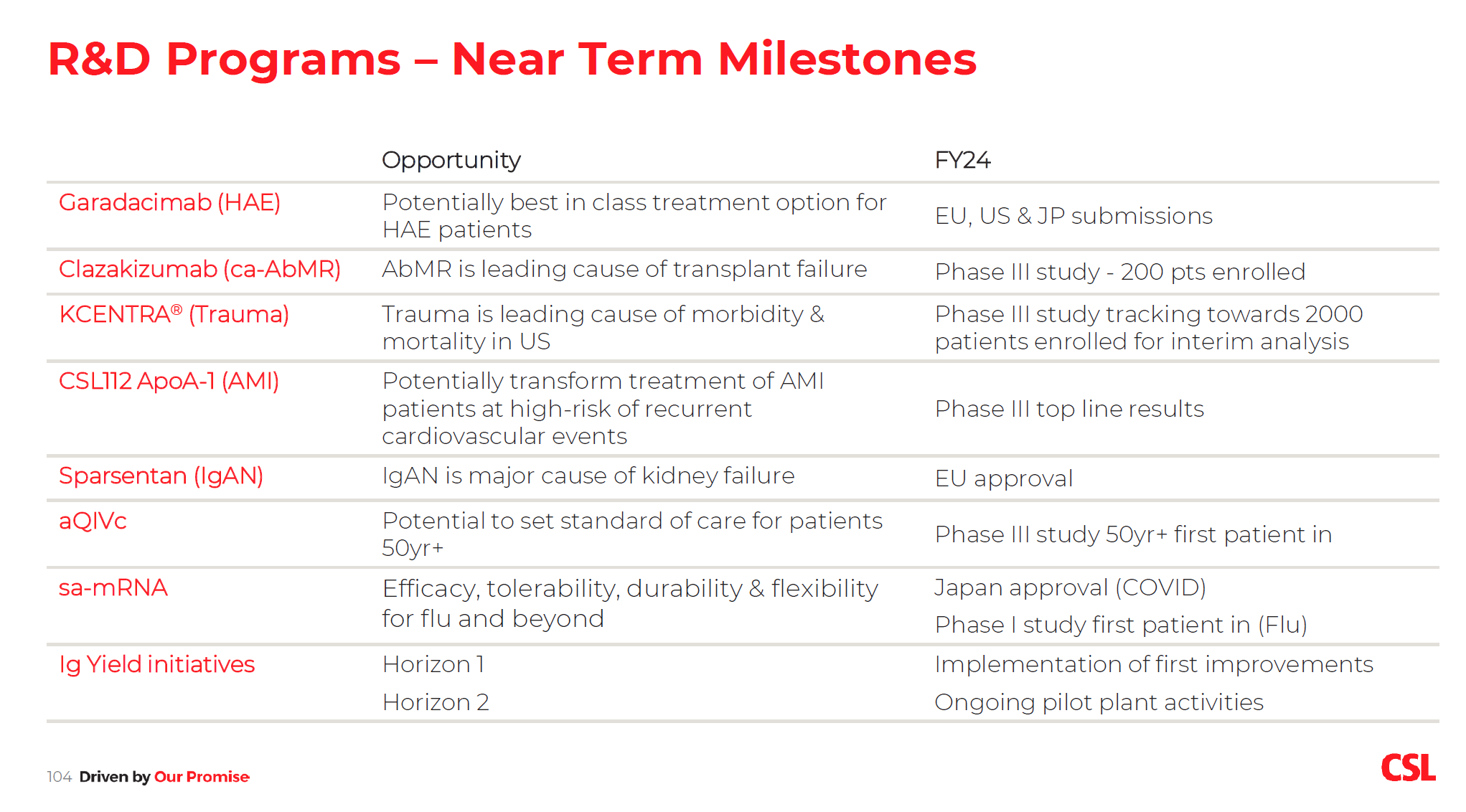

Capital Discipline

I start with Fig.1 the framework for capital discipline presented by CFO Joy Linton.

Figure 1

$CSL continues to invest strongly for growth. The next several years will be some transitionary points:

- A progressive return to pre-COVID %GM in the plasma business, with a promise to grow margins beyond these levels as a result of a range of investment in IT and manufacturing technology to reduce CPL (costs per litre) at the collection stage and increase plasma yield through manufactuing. This isn't something that just happens, and the team outlined some of the details of improvements being made in the collection centres and in the plasma extraction processes.

- A reduction in capex of c. 30% over the next three years. This follows the completion of a major program of new facility investments over recent years

- NPATA growth allowing the debit required for the Vifor acquisition to be reduced back to the target level of < 2 x EBITDA - a conservative position that should retain investment grade credit rating.

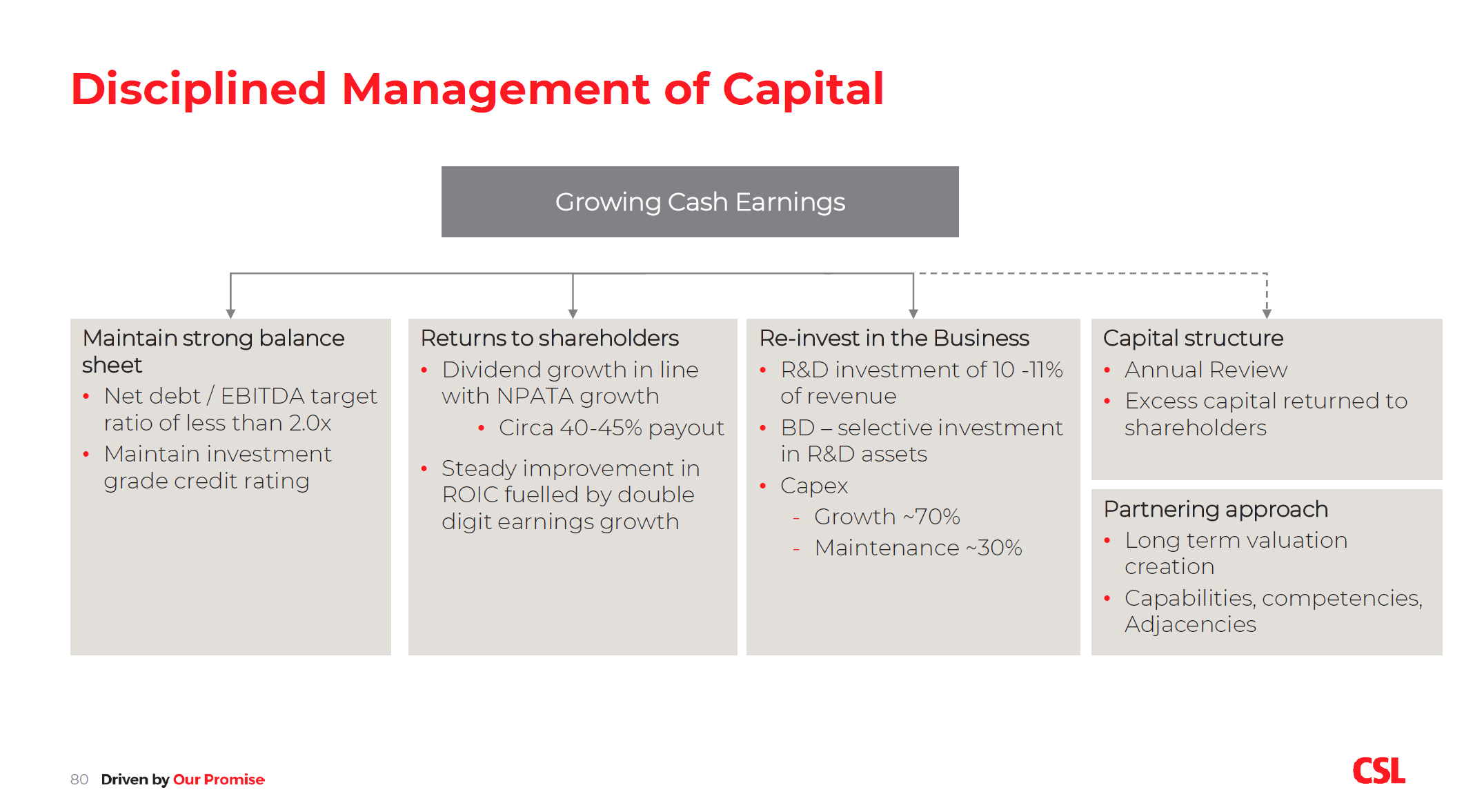

Revenue Growth

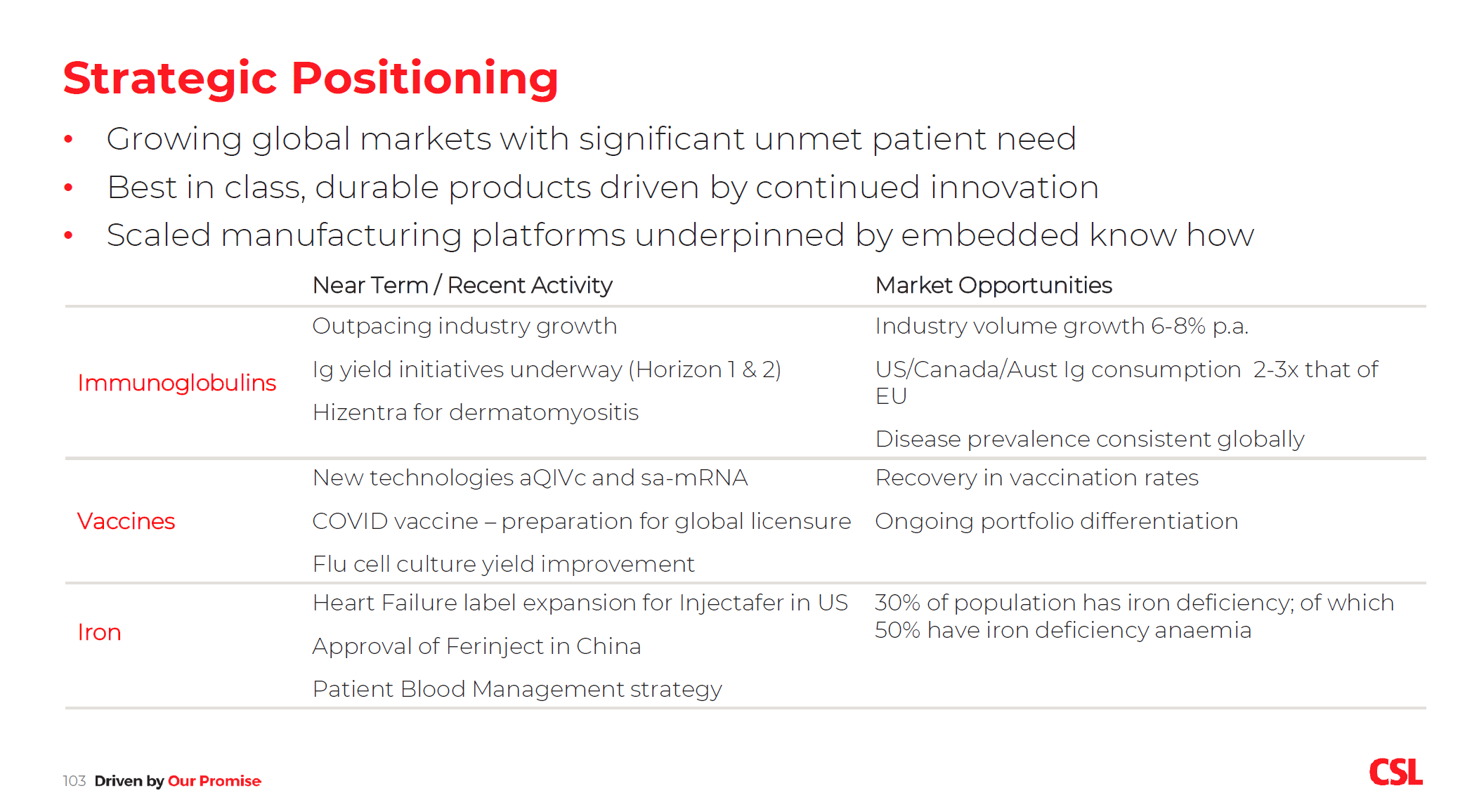

$CSL expects to grow strongly across all its businesses. The positioning of each of the three businesses and the market opportunities are summarised in Fig. 2.

Importantly, many of the conditions for $CSLs treatments are related to ageing, so there remains a long-term trend of ageing over the coming decades in developed markets, then to be followed in the future in the middle income countries. Even in developed markets, there is a significant variation in uptake of $CSL products, so there is significant opportunity in driving product use to a more uniform adoption of the standard of care in the most advanced markets. New indications for existing products come on top of that.

In summary, there are many levers for growth offset of course by competition and new tharapies, of which GLP-1s are just one of many.

Figure 2

Although the story for Iron (i.e. Vifor) was perhaps less confident (from my perspective) with indications that progress may be lumpy, this is more down to the uncertainty of how rapidly the growth of Injectafer will take off following approval for Heart Failure in the US and the approval of Ferinject in China, offset by the launch of generic competition from Sandoz (CEO Paul McKenzie emphasised that generic competition was in the acquisition case, but I sense that with the manufacturing challenges of the drug, Sandoz has perhaps been a bit faster out of the blocks than expected).

Of course it is important to remember that adding treatments for renal failure and CKD complements $CSL's other therapy areas, so Vifor is as much about building capability as it is about buying a portfolio of drugs. CFO Joy Linton summed it up when she pointed out that CSL's prior acquisitions have usually taken several years before their promise has materialised, pointing to the 3 years it took for the value of Sequirus (acquired from Novartis) to show through.

We've recently heard how $CSL has been in the gun sights from analysts and commentators from GLP-1 FLOW clinical trial. Head of R&D Bill Mazzanotte addressed this in his opening remarks. He pointed out that cardi-vascular diseases are of a "multi-dimensional and complex nature". By this, he means that there are many diseases within the category, and for each disease there are many indications according to patient profile, disease type and stage of advancement. Reflecting on the hype around GLP-1s, Bill pointed out that 25 years ago Statins were emerging and commentators were saying that would be the end of cardiovascular disease and the existing drugs that treated them. "It didn't happen," he said. He further added that there are many drivers of renal disease, and that weight is not an independent driver (a bit like we've debated here on OSA). While he accepted there will be an impact he considered it to be a small impact on a small part of the portfolio. He summarised by saying "I am proud of the scientists who have done the work. I am grateful that patients have a new opportunity. But I am confident of our product and R&D portfolio."

From that respect, today was good for my general well-being. Having a day immersed in the CSL portfolio reminded me (as a non-clinician) just how complex and multi-faceted disease is, and how vast the array of treatments and modes of action are. It is highly, highly unlikley that any one mode of therapeutic action is going to be a "silver bullet."

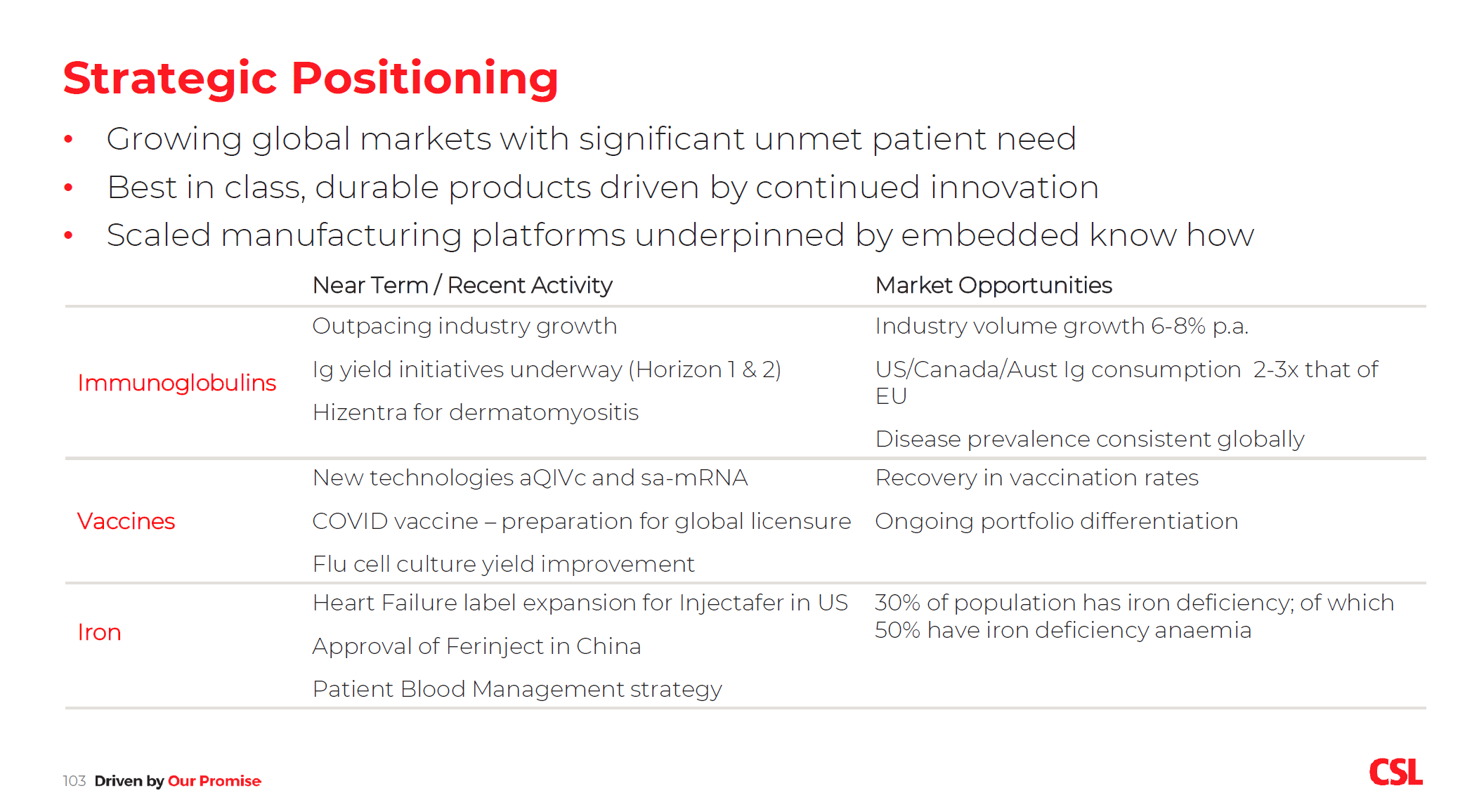

R&D Portfolio

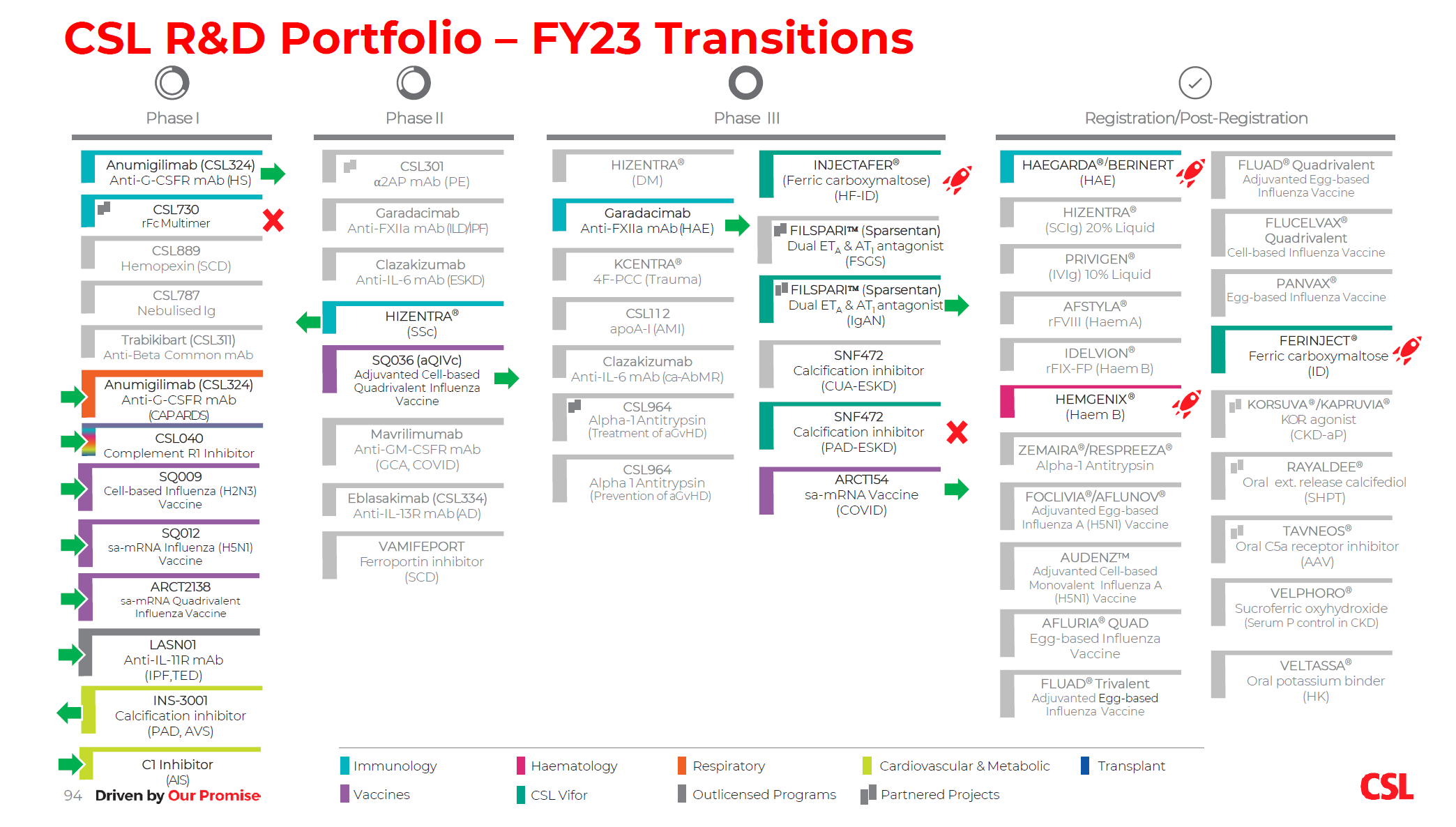

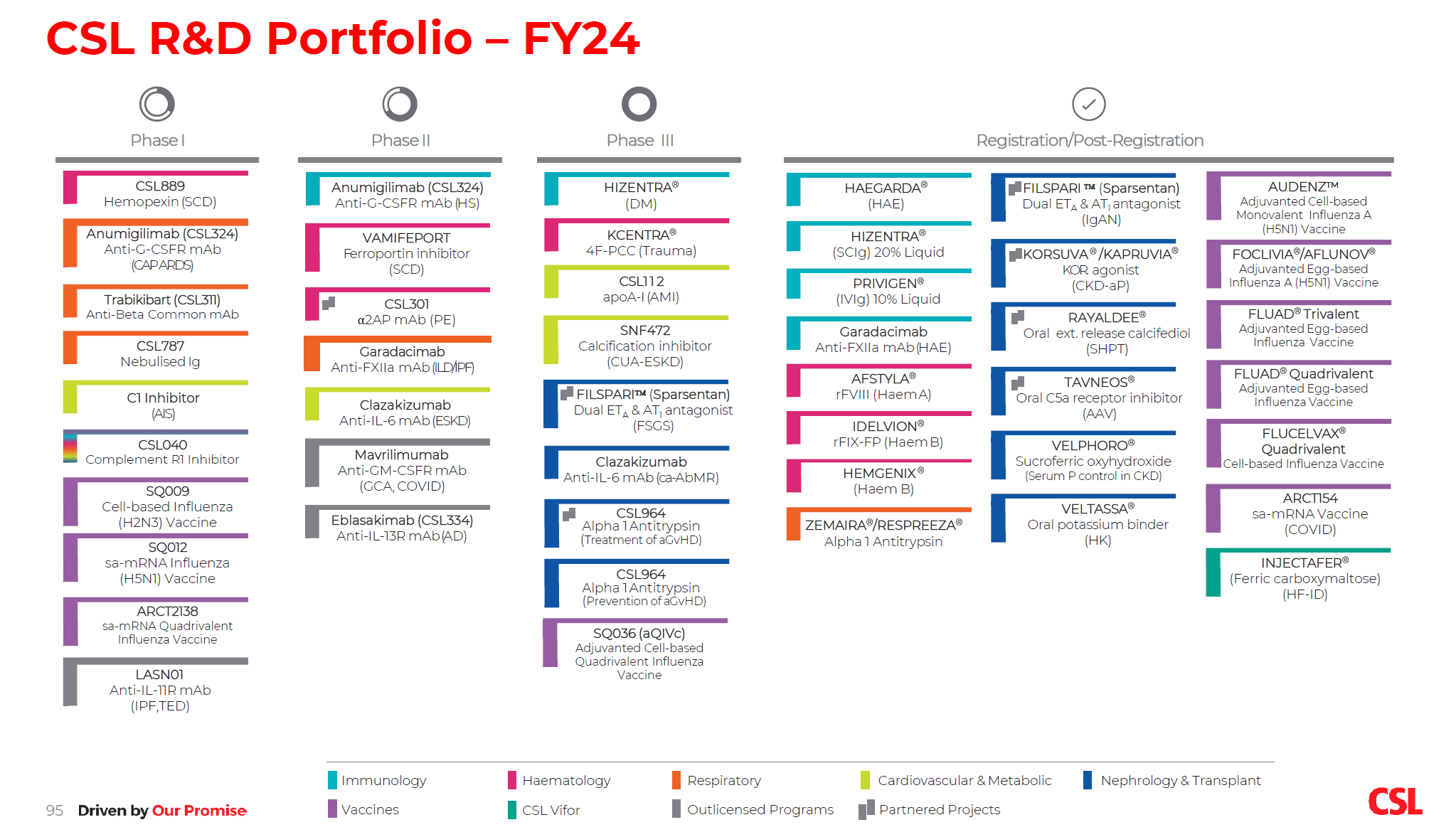

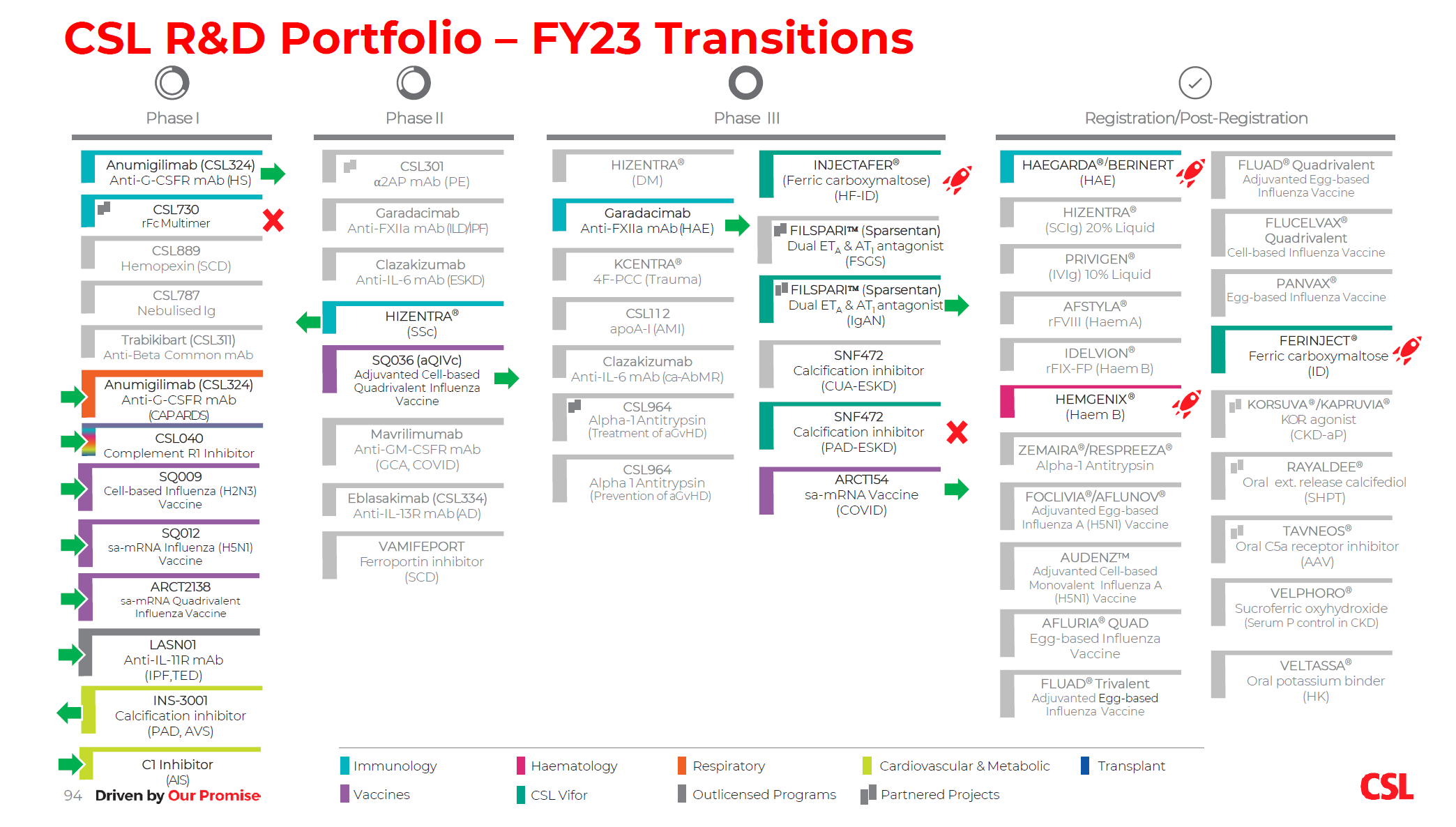

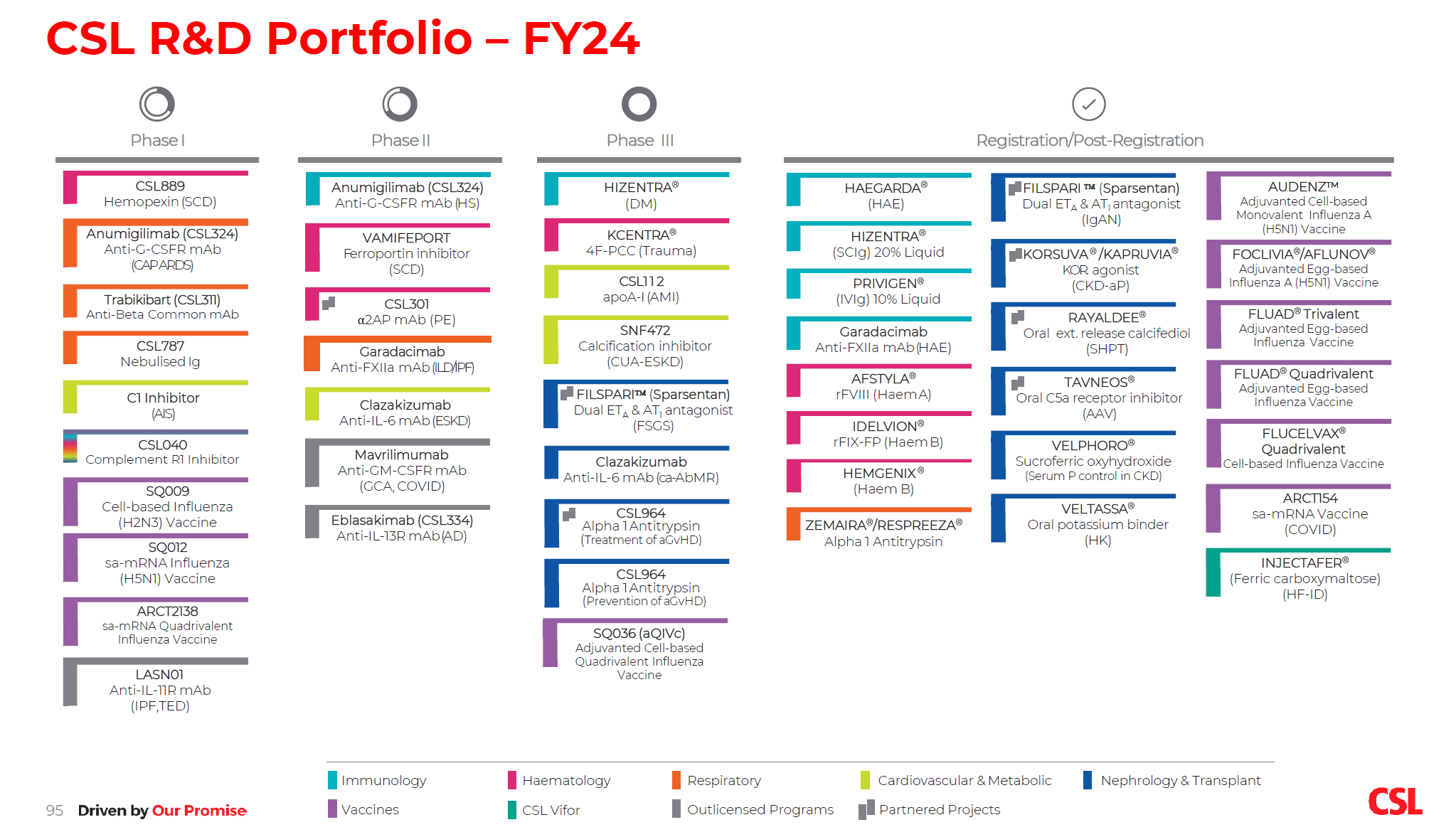

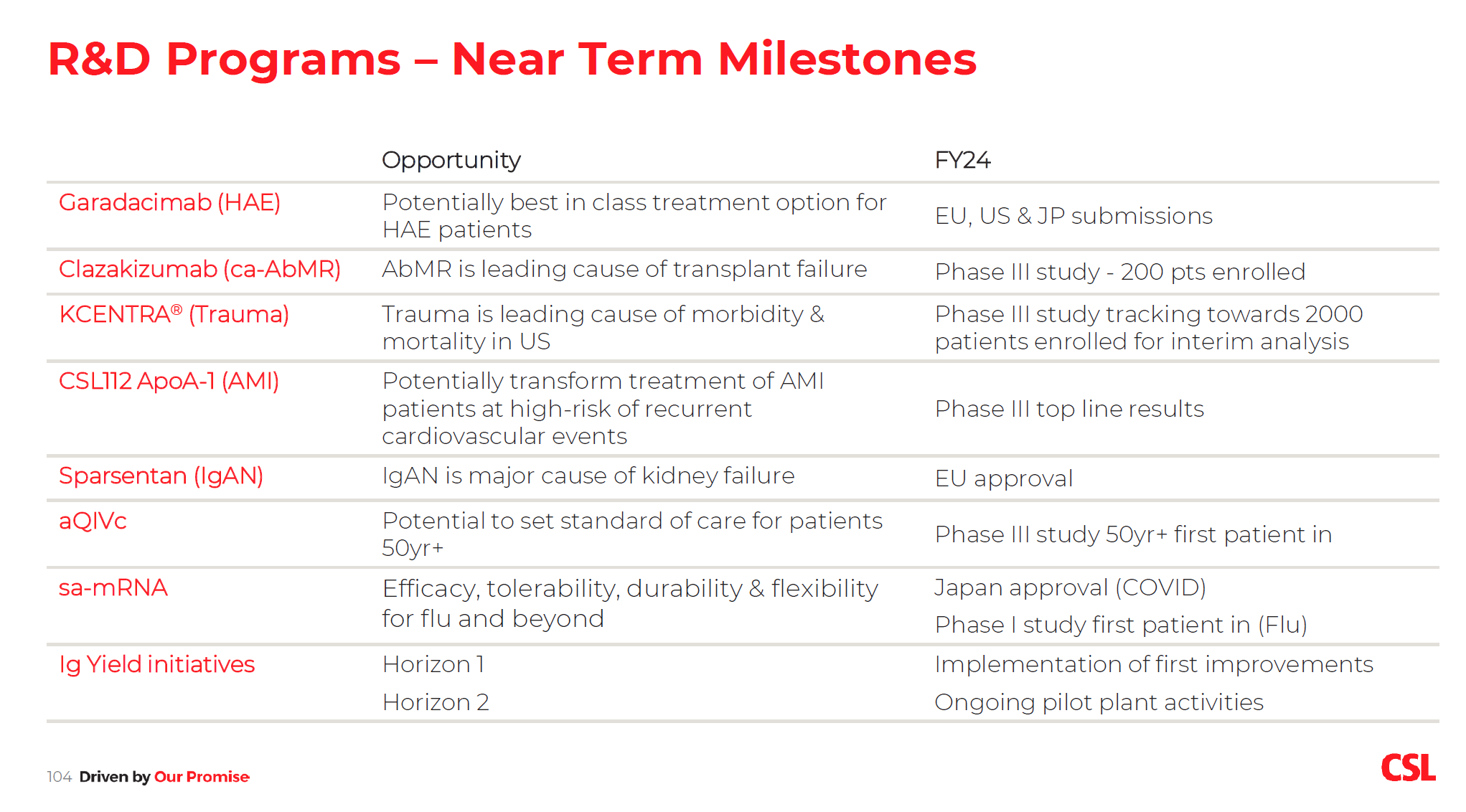

Bill Mazzanotte gave an update on R&D. At the headline level, several new candiates were added to the Phase 1 pipeline from different CSL "platforms" across the therapy areas; several drugs advanced throught the pipeline; and several candidates were dropped. Fig 3 shows the FY23 progress in the R&D portfolio and Fig 4 shows the updated portfolio and fig. 5 shows the key expected milestones for the next three years. (I'll be interested to read some of the broker notes on this, particularly GS, whose global healthcare desk will no doubt do a detailed analysis, considering similar developments across the competition. That's more than I can ever do! Chris Cooper asked several questions during the day, so I am sure there will be an update.)

Figure 3 FY23 Progress

Figure 4

Figure 5 FY24 R&D Milestones

Key milestones are Garadacimab approvals decisions, and Phase III results of CSL112.

Articificial Intelligence and IT Generally

Chief Information and Digital Officer Mark Hill gave a short and interesting presentation of how $CSL is using IT to drive value both in R&D and Operations.

Mark who is a IT veteran of four decades in industry made the following remarks which stood out. First "AI is here to stay, and it is bigger than the internet" and second, it is "difficult to harness because the speed of innovation is faster than anything we have seen."

However, this wasn't a buzzword-hype presentation. On the contrary, Mark gave practical examples of the kind of things that $CSL are applying generative AI to, and they have even built an internal accelerator to innovate, test and then deploy useful applications. ("No one need write meeting minutes again")

I'm calling out this segment because I think across industries, AI - like digital before it and ongoing - will lead to capabilities that the best companies will figure out how to use, and then gain benefits from so doing. Some will succeed, others will be left behind.

And as @Strawman said in the last episode of Baby Giants podcast, if I recall correctly, in quoting Warren Buffet, AI will be like attending a parade, where some stand on a box to get a better view. But eventually, everyone is standing on a box, so no-one has a better view.

From a competitive perspective, however, some get on taller boxes and they get up earlier. From today's presentation it looks like CSL is taking this seriously and is unlikely to be left behind.

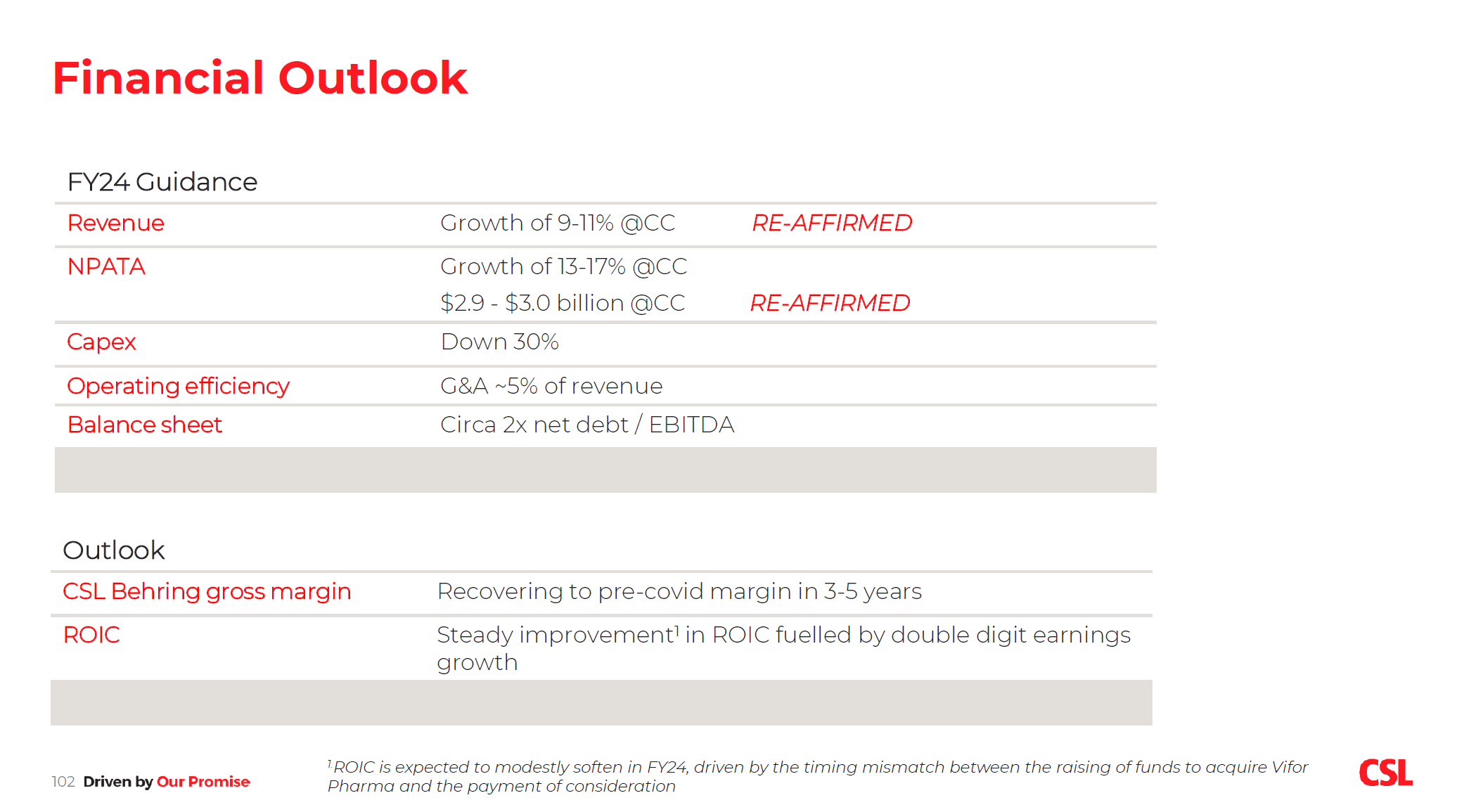

Guidance Re-Affirmed

I guess the good news about today is that there was no bad news. Guidance is intact, and the team sounds like they have clear plans in place to drive forward on the margin improvements that are under their control.

Figure 6; Guidance Re-Affirmed

I started my career in industry working in big pharma over 30 years ago, and attended many management updates on the progress of the commercial and R&D portfolios. Today felt strangely familiar. $CSL is a global leader taking stock of where it stands, and laying out its plans to continue to grow more strongly than the industry. I'm pretty confident they will continue to succeed and was impressed by each of the presenters today. This is a business that doesn't depend on single CEO and I've no doubt that anyone of the key executives presenting today could take the ship forward if they needed to. That said, Paul McKenzie did a good job, and came across as a very competent team captain.

Disc: Held in RL and SM