Combined my notes on the 30 Sep 2023 Quarterly Update and today's meeting with Vince Stazzonelli.

Discl: Held IRL and in SM, looking to top up IRL if the price falls closer to $0.90.

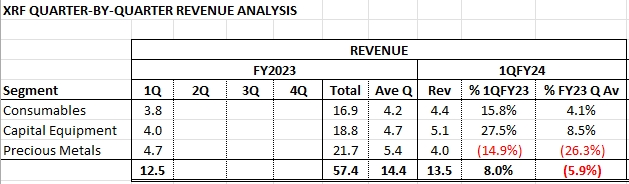

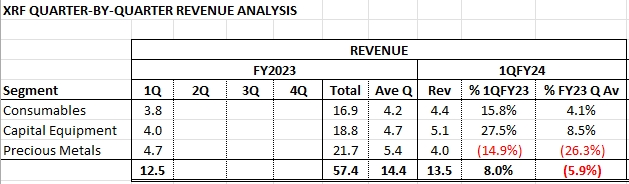

Built this simple revenue xls to get a better perspective of the 1QFY24 results against FY23, will add in subsequent quarters

- Solid result with PBT growing much more than Revenue

- Consumables was up 15.8%, Capital Equipment was up 27.5% but Precious Metals was down 14.9% over the PCP

- Revenue is 5.9% lower than the average FY23 quarterly revenue (average is annual revenue divided by 4)

- Not a concern given the large forward orders held for Precious Metals, but puts the 1Q result in better context, taking cue from concerns previously about the rate of growth from H-to-H

- All segments appear to be firing, with the order book for capital equipment at record levels, and production for some products is now being scheduled for the June 2024 quarter

TAKEAWAYS FROM VINCE MEETING

Industry Tests to test quality of a product which XRF Supports

- XRef Analysis - using X-Ray Fluorescence analytical technique to determine the major components of a sample

- ICP Analysis - ICP (Inductively Coupled Plasma) Spectroscopy is an analytical technique used to measure and identify elements within a sample matrix based on the ionization of the elements within the sample.

- Gold - FireAssay and PhotonAssay (C79’s technology)

- Platinum Labware - this is used in the sampling process. XRF manufactures Platinum Labware for all machines, not only XRF-specific machines

How the XRF Equipment Comes Into Play

- Orbis Mining Crushers - breaks down (crushes) big rocks to provide powder samples, which are then used as inputs to the various tests

- XRTGA Thermogravimetric Analyser - a high-temperature furnace, heats up the sample to run tests at different temperature points

- Market is dominated by key competitor: Leco

- XRF’s benefits over Leco units:

- 30 samples at a time vs 18

- Has heating and cooling cycles to speed up the process

- User friendly Touch Screen vs separate computer console

- Reputation of building reputable products

- Provides complementary data for XRF analysis

- XrTGA opens up access to new markets for XRF - Pharmaceuticals, Food, Agri-Products, Plastics etc

- Capital equipment should have at least 7-8 years of life through to 15 years

- Drives other products - spare parts, labware rework, consumables

Manufacturing Capacity

- Solved factory capacity issue for Capital Equipment this past quarter

- Can ramp up production across all 3 segments by adding more shifts - no further major spend to boost capacity is anticipated

International Expansion

- Already have presence in Europe (Germany and Belgium), North America (Montreal), Australia and parts of Asia

- Direct sales are fulfilled in Australia

- Large network of Distributors which are required to provide on-the-ground customer support

- Not in a position to open offices in many countries - driven by product line and the individual needs of the countries

Cost Pressures

- Cost pressures of the last 12-18M have eased in the last 3-6M - lead time blow outs

- Able to pass on price increases to customers who mostly pay based on the metal spot price at the time of invoice

- Employees were given good pay increases to retain them

Customer Demand

- Exploration activity mostly focused on Rare Earths, Lithium

- Exploration spend did not fall in Australia - Gold spend did fall, but Base Metals, Iron Ore continued to perform well

- Have not seen anything impacted by a slowing of Chinese demand

Capex Management Approach

- Dividend payout ratio is around 60% - this level of dividends is able to provide required capital for R&D, Inventory and Working Capital

- On the lookout for bolt on acquisitions - generally like to issue script to fund these acquisitions to incentivise vendors

- Ideal targets are (1) lab products which have business synergies with XRF’s products (2) used by existing customers (3) are under-developed in market potential

- Not interested in building business scale as XRF is at “about the right size” - focus is on value adding acquisitions

Key Investor Misunderstanding on XRF

- Investors misunderstand where XRF sits in the laboratory process

- High quality products

- Strong IP

- Essential in providing data to mines, industrials

- Critical to customers processes